Form 8-K - Current report

20 January 2024 - 3:14AM

Edgar (US Regulatory)

falseCullman Bancorp, Inc. /MD/0001845799316 SECOND AVENUE SWCULLMANNASDAQ00018457992024-01-182024-01-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 18, 2024

CULLMAN BANCORP, INC.

(Exact Name of Registrant as Specified in Charter)

|

Maryland

|

001-40607

|

61-1990996

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File No.)

|

(I.R.S. Employer

Identification No.)

|

|

316 Second Avenue, SW, Cullman, Alabama

|

35055

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (256) 734-1740

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, Par Value $0.01 Per Share

|

|

CULL

|

|

The Nasdaq Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On January 18, 2024, the Board of Directors of Cullman Bancorp, Inc. (the “Company”) approved a dividend of $0.12 per share, payable on

February 21, 2024 to stockholders of record on February 1, 2024. In addition, the Company issued a press release announcing the declaration of the dividend. The press release is attached to this Current Report as Exhibit 99.1.

| Item 9.01 |

Financial Statements and Exhibits

|

|

(d)

|

Exhibits

|

| |

|

| |

Exhibit No.

|

Exhibit

|

| |

|

|

| |

99.1

|

Press release dated January 18, 2024

|

| |

104

|

Cover Page Interactive Data File (embedded within Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned, hereunto duly authorized.

| |

|

CULLMAN BANCORP, INC.

|

| |

|

|

| |

|

|

|

DATE: January 19, 2024

|

By:

|

/s/ John A. Riley, III

|

| |

|

John A. Riley, III

|

| |

|

President and Chief Executive Officer

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

|

Contact:

|

John A. Riley, III

President and Chief Executive Officer

|

|

Telephone:

|

(256) 734-1740

|

CULLMAN BANCORP, INC.

ANNOUNCES PAYMENT OF ANNUAL CASH DIVIDEND OF $0.12 PER SHARE

Cullman, Alabama, January 18, 2024 — Cullman Bancorp, Inc. (the “Company”) (Nasdaq: CULL), the holding company for Cullman Savings Bank, announced that the Company has declared the payment of an annual cash

dividend. The dividend of $0.12 per share will be paid on February 21, 2024 to stockholders of record as of February 1, 2024.

John A. Riley, III, President and Chief Executive Officer of the Company, stated

“This dividend reflects our ongoing commitment to delivering stockholder value. We look forward to continuing to provide such value in the future.”

Forward-Looking Statements

Certain statements contained herein constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934 and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such

statements may be identified by words such as “may,” “will,” “would,” “intend,” “believe,” “expect,” “plan,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. These statements are based upon the current beliefs and expectations of Company management and are subject to significant risks and uncertainties. Actual results may differ materially from those

set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to: the effects of any pandemic disease, natural disaster, war, act of terrorism,

accident, or similar action or event; those related to the real estate and economic environment, particularly in the market areas in which the Company operates; inflation; fiscal and monetary policies of the U.S. Government; changes in government

regulations affecting financial institutions, including regulatory compliance costs and capital requirements; fluctuations in the adequacy of loan loss reserves; decreases

in deposit levels necessitating increased borrowing to fund loans and investments; operational risks including, but not limited to, cybersecurity, fraud and natural disasters; the risk that the Company may not be successful in the implementation of

its business strategy; changes in prevailing interest rates; credit risk management; asset-liability management; and other risks described in the Company’s filings with the Securities and Exchange Commission, which are available at the SEC’s website, www.sec.gov.

The Company wishes to caution readers not to place undue

reliance on any such forward looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above or other factors could affect the Company’s financial performance and could cause the

Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically disclaims any obligation

to publicly release the results of any revisions, which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

About Cullman Bancorp, Inc.

The Company is a Maryland corporation based in Cullman, Alabama. The Company’s banking subsidiary, Cullman Savings Bank, opened in 1887 and currently operates

three full-service offices in Cullman, Alabama and one full-service office in Hanceville, Alabama.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

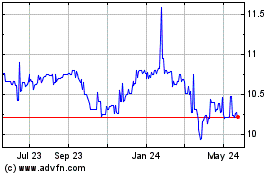

Cullman Bancorp (NASDAQ:CULL)

Historical Stock Chart

From Dec 2024 to Jan 2025

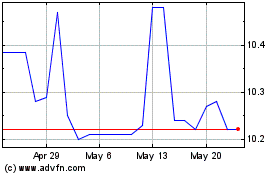

Cullman Bancorp (NASDAQ:CULL)

Historical Stock Chart

From Jan 2024 to Jan 2025