Combined Capabilities Will Set New Paradigm for

End-to-End Machine Identity Security

CyberArk (NASDAQ: CYBR), the identity security company, today

announced the successful completion of its acquisition of Venafi, a

leader in machine identity management, from Thoma Bravo. This

acquisition enables CyberArk to further deliver on its vision to

secure every identity – human and machine – with the right level of

privilege controls. Together, CyberArk and Venafi will build

end-to-end machine identity security solutions that help

organizations vastly improve security and stop costly outages.

Venafi adds complementary solutions that expand CyberArk’s total

addressable market by $10 billion to approximately $60 billion.

“We are thrilled to officially welcome the exceptional Venafi

team to CyberArk. Over the past months, every interaction has

further validated that this acquisition is a great fit from all

perspectives – technology, people, culture and spirit of

innovation,” said Matt Cohen, Chief Executive Officer, CyberArk.

“Machines are the fastest growing and most complex identity and

today, many organizations rely on manual processes and siloed tools

to secure and manage them. By joining forces, CyberArk and Venafi

will set a new paradigm, with the industry’s most comprehensive

platform for end-to-end machine identity security at enterprise

scale.”

Ongoing digital transformation, pervasive cloud computing and

the rise of AI are driving an exponential increase in the number of

machine identities, which can outnumber human identities by as much

as 45-to-1, many of which remain undetected. If left unprotected

and unmanaged, these identities can serve as a lucrative hunting

ground for cybercriminals who seek to exploit their

vulnerabilities. A new paradigm is required to keep pace with this

rapid proliferation – shifting from inefficient manual, siloed

approaches that create compliance and security risks to centralized

management of machine identities across all applications and

workloads for any cloud or IT environment at scale.

“CyberArk's acquisition of Venafi underscores the growing

recognition of the critical role machine identities play in

securing modern digital environments,” said Katie Norton, Research

Manager, DevSecOps and Software Supply Chain Security at IDC.

“While organizations have heavily invested in human identity

security, the automation and management of credentials for machine

identities has not historically received the same attention.

Together, the companies' complementary capabilities should enable

organizations to implement a more comprehensive machine identity

security strategy, reducing risk and enhancing operational

efficiency.”

All machine identities, including workloads, code, applications,

IoT devices and containers, must be discovered, managed, secured

and automated to keep their connections and communications safe.

The combination of Venafi’s certificate lifecycle management,

enterprise Public Key Infrastructure (PKI), workload identity

management, secure code signing and SSH security with CyberArk’s

secrets management capabilities, will empower organizations to

protect against misuse and compromise of machine identities at

scale.

Details Regarding the Acquisition

Under the terms of the agreement, CyberArk acquired Venafi for

approximately $1.54 billion in a combination of cash and CyberArk

ordinary shares (approximately $1 billion in cash and approximately

$540 million in ordinary shares).

Advisors

Morgan Stanley & Co. LLC served as exclusive financial

advisor to CyberArk, and Latham & Watkins LLP served as legal

counsel to CyberArk. Piper Sandler served as exclusive financial

advisor to Thoma Bravo and Venafi, and Kirkland & Ellis LLP

served as legal counsel to Thoma Bravo and Venafi.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in identity

security. Centered on intelligent privilege controls, CyberArk

provides the most comprehensive security offering for any identity

– human or machine – across business applications, distributed

workforces, hybrid cloud environments and throughout the DevOps

lifecycle. The world’s leading organizations trust CyberArk to help

secure their most critical assets. To learn more about CyberArk,

visit https://www.cyberark.com, read the CyberArk blogs or follow

on LinkedIn, X, Facebook or YouTube.

About Venafi

Venafi is a cybersecurity market leader and the category creator

of machine identity management, securing machine-to-machine

connections and communications. Venafi protects machine identity

types by orchestrating cryptographic keys and digital certificates

for SSL/TLS, SSH, code signing, mobile and IoT. Venafi provides

global visibility of machine identities and the risks associated

with them for the extended enterprise—on premises, mobile, virtual,

cloud and IoT—at machine speed and scale. Venafi puts this

intelligence into action with automated remediation that reduces

the security and availability risks connected with weak or

compromised machine identities while safeguarding the flow of

information to trusted machines and preventing communication with

machines that are not trusted.

About Thoma Bravo

Thoma Bravo is one of the largest software-focused investors in

the world, with approximately US$160 billion in assets under

management as of June 30, 2024. Through its private equity, growth

equity and credit strategies, the firm invests in growth-oriented,

innovative companies operating in the software and technology

sectors. Leveraging Thoma Bravo’s deep sector knowledge and

strategic and operational expertise, the firm collaborates with its

portfolio companies to implement operating best practices and drive

growth initiatives. Over the past 20+ years, the firm has acquired

or invested in more than 490 companies representing approximately

US$265 billion in enterprise value (including control and

non-control investments). The firm has offices in Chicago, London,

Miami, New York and San Francisco. For more information, visit

Thoma Bravo’s website at thomabravo.com.

Copyright © 2024 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include risks relating, but not limited to: risks

related to the Company’s acquisition of Venafi Holdings, Inc.

(“Venafi”), including impacts of the acquisition on the Company’s

or Venafi’s operating results and business generally; the ability

of the Company or Venafi to retain and hire key personnel and

maintain relationships with customers, suppliers and others with

whom the Company or Venafi do business; risks that Venafi’s

business will not be integrated successfully into the Company’s

operations; risks relating to the Company’s ability to realize

anticipated benefits of the combined operations after the Venafi

acquisition; changes to the drivers of the Company’s growth and the

Company’s ability to adapt its solutions to the information

security market changes and demands, including artificial

intelligence (“AI”); the Company’s ability to acquire new customers

and maintain and expand the Company’s revenues from existing

customers; intense competition within the information security

market; real or perceived security vulnerabilities, gaps, or

cybersecurity breaches of the Company, or the Company’s customers’

or partners’ systems, solutions or services; risks related to the

Company’s compliance with privacy, data protection and AI laws and

regulations; the Company’s ability to successfully operate its

business as a subscription company and fluctuation in the quarterly

results of operations; the Company’s reliance on third-party cloud

providers for its operations and software-as-a-service (“SaaS”)

solutions; the Company’s ability to hire, train, retain and

motivate qualified personnel; the Company’s ability to effectively

execute its sales and marketing strategies; the Company’s ability

to find, complete, fully integrate or achieve the expected benefits

of additional strategic acquisitions; the Company’s ability to

maintain successful relationships with channel partners, or if the

Company’s channel partners fail to perform; risks related to sales

made to government entities; prolonged economic uncertainties or

downturns; the Company’s history of incurring net losses, the

Company’s ability to generate sufficient revenue to achieve and

sustain profitability and the Company’s ability to generate cash

flow from operating activities; regulatory and geopolitical risks

associated with the Company’s global sales and operations; risks

related to intellectual property claims; fluctuations in currency

exchange rates; the ability of the Company’s products to help

customers achieve and maintain compliance with government

regulations or industry standards; the Company’s ability to protect

its proprietary technology and intellectual property rights; risks

related to using third-party software, such as open-source

software; risks related to stock price volatility or activist

shareholders; any failure to retain the Company’s “foreign private

issuer” status or the risk that the Company may be classified, for

U.S. federal income tax purposes, as a “passive foreign investment

company”; risks related to the Company’s Convertible Senior Notes

due 2024 (the “Convertible Notes”), including the potential

dilution to existing shareholders and the Company’s ability to

raise the funds necessary to repurchase the Convertible Notes;

changes in tax laws; the Company’s expectation to not pay dividends

on the Company’s ordinary shares for the foreseeable future; risks

related to the Company’s incorporation and location in Israel,

including the ongoing war between Israel and Hamas and conflict in

the region; and other factors discussed under the heading “Risk

Factors” in the Company’s most recent annual report on Form 20-F

filed with the Securities and Exchange Commission. Forward-looking

statements in this release are made pursuant to the safe harbor

provisions contained in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements are made only

as of the date hereof, and the Company undertakes no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930990953/en/

Investor Relations: Srinivas Anantha, CFA CyberArk

617-558-2132 ir@cyberark.com Media: Nick Bowman CyberArk +44

(0) 7841 673378 press@cyberark.com

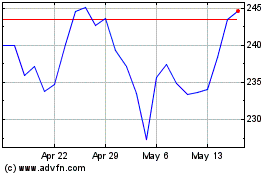

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

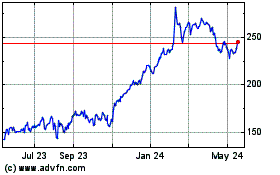

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Nov 2023 to Nov 2024