EUROPE MARKETS: European Markets Bounce As Investors Weigh Trade Fight Impact

30 May 2019 - 8:41PM

Dow Jones News

By Dave Morris

European markets gave back some of Wednesday's losses as

investors debated whether the U.S.-China trade skirmish could prove

long and intractable.

How did markets perform?

The Stoxx 600 rose 0.4% to 372.1, after plunging 1.4%

Wednesday.

The U.K.'s FTSE 100 also climbed 0.4% to 7,214. On Wednesday, it

fell 1.2%.

The pound edged up 0.1% to $1.2632, after moving downward

Wednesday by 0.3%.

In Germany, the DAX (DAX) was 0.6% higher at 11,912.5. It had

fallen 1.6% Wednesday.

France's CAC 40 rebounded 0.5% to 5,247.1, after sinking 1.7%

Wednesday.

Italy's FTSE MIB was up 0.4% to 20,079.9. It declined 1.3%

Wednesday.

What's moving the markets?

Another mixed bag of news provided little clarity on the future

of the U.S.-China trade dispute. Reuters reported on a request for

federal funding by the U.S. Defense Department

(https://www.reuters.com/article/us-china-usa-rareearth-pentagon/eyeing-china-pentagon-sends-report-on-rare-earth-minerals-to-congress-idUSKCN1SZ2C6)

to bolster production of rare earths minerals, which China is the

dominant player in and has threatened to withhold. Meanwhile, the

Chinese government is reportedly telling officials and state media

to tone down some of its rhetoric and to avoid referring to the

opposing camp as the "U.S. side".

The spotlight remained on Italian bond yields, which rose again

after Deputy Prime Minister Matteo Salvini demanded that the

European Central Bank intervene and back government debt. The ECB

is unlikely to accept Salvini's request, further raising the

temperature on an already-tense conflict over Europe's fiscal

rules.

In economic data, U.S. initial jobless claims for May will be

closely watched by investors, as economists expect an increase to

214,000 from 211,000. There is also U.S. first quarter gross

domestic product (GDP), and the consensus prediction is for no

change from the previous quarter's figure, 3.2%.

Which stocks are active?

Axel Springer SE (SPR.XE) leapt up 20.6% as the German media

group announced that it was in talks with private-equity firm KKR

(http://www.marketwatch.com/story/axel-springer-in-talks-to-sell-stake-to-kkr-2019-05-30-2485256),

which wants to take a stake in the company. The majority

shareholders would not give up control, however, and are instead

considering whether to take the company private. Shares had fallen

in recent months over concerns about the long-term profitability of

the company's online classified ad business.

U.K. transport operator FirstGroup PLC (FGP.LN) shares climbed

4.4% on the announcement that it planned to sell its Greyhound bus

operation in the U.S., to focus on its school and local bus units

there, and to mollify activist investor Coast Capital. The

statement was made in the course of announcing full-year earnings,

which narrowed the company's loss compared with the previous year.

AJ Bell investment director Russ Mould said: "It remains to be seen

if this will be enough to deflect calls from Coast Capital for a

change in management."

Johnson Matthey PLC (JMAT.LN) shares fell 3.1% as the British

chemical company reported full year earnings

(http://www.marketwatch.com/story/johnson-matthey-pretax-profit-rises-53-2019-05-30),

and guided lower for the coming year's figures. The company's

pretax profit was GBP488 million, significantly above 2018's GBP320

million figure.

(END) Dow Jones Newswires

May 30, 2019 06:26 ET (10:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

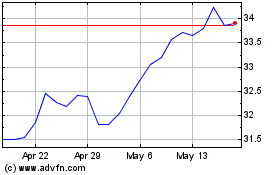

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

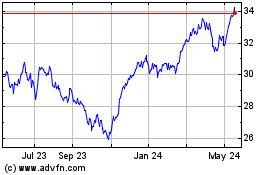

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024