true

0001342958

0001342958

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K/A

(Amendment No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 6, 2024

DIGITAL

ALLY, INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-33899 |

|

20-0064269 |

| (State

or other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

14001

Marshall Drive, Lenexa, KS 66215

(Address

of Principal Executive Offices) (Zip Code)

(913)

814-7774

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

stock, $0.001 par value |

|

DGLY |

|

The

Nasdaq Capital Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

Digital

Ally, Inc. (the “Company”) is filing this Amendment No. 1 (this “Amendment”) to the Current Report on Form 8-K

originally filed by the Company with the Securities and Exchange Commission on November 7, 2024 (the “Original Form 8-K)”,

to disclose certain information with respect to subsidiary guarantees of the Company, and to incorporate by reference the applicable

information disclosed under Item 1.01 hereunder into Item 2.03, which disclosures were inadvertently omitted in the Original Form 8-K.

This Amendment makes no other changes to the Original Form 8-K.

Item

1.01 Entry Into a Material Definitive Agreement.

Securities

Purchase Agreement

On

November 6, 2024, Digital Ally, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Securities

Purchase Agreement”) with certain institutional investors (the “Purchasers”), pursuant to which the Company has agreed

to issue and sell to such Purchasers, in a private placement transaction, (i) senior secured promissory notes in aggregate principal

amount of $3,600,000 (the “Notes”), and (ii) 808,377 shares (the “Shares”) of the Company’s common stock,

par value $0.001 per share (the “Common Stock”), for aggregate gross proceeds of approximately $3.0 million, before deducting

placement agent fees and other offering expenses payable by the Company (such transaction, the “Private Placement”). The

Private Placement closed on November 7, 2024 (the “Closing Date”).

Pursuant

to the Securities Purchase Agreement, the Company is required to use approximately $2,015,623 of the net proceeds from the Private Placement

to pay, in full, all liabilities, obligations and indebtedness owing by the Company and its subsidiary, Kustom Entertainment, Inc. (the

“Borrowers”), to Mosh Man, LLC (the “Lender”), in respect of that certain promissory note and note purchase agreement

and related documents by and among the Borrowers and the Lender (collectively, the “Mosh Man Note”).

The

Company’s full repayment of the outstanding obligations under the Mosh Man Note will effectively terminate the public sale process

of the collateral securing the Borrowers’ obligations thereunder, which sale process was disclosed by the Company in a Current

Report on Form 8-K filed by the Company on October 28, 2024 and again November 4, 2024.

The

Company anticipates that the remaining net proceeds from the Private Placement after repayment of the Mosh Man Note, and after deducting

placement agent fees and other offering expenses, will meet the Company’s capital needs for approximately three months, subsequent

to which the Company anticipates that it will need to raise additional funds to implement its business plan and to service its ongoing

operations. The Company also anticipates pursuing the sale of its video solutions business in the short term.

Pursuant

to the Securities Purchase Agreement, the Company shall file within 30 days of the Closing Date a registration statement with the U.S.

Securities and Exchange Commission (“SEC”) for a public offering, and use its reasonable best efforts to pursue and consummate

a financing transaction within 90 days of the Closing Date. The proceeds of the public offering shall be used as set forth in the registration

statement, including the repayment of the principal amounts of the Notes. The Company shall also file within 30 days of the Closing Date

a registration statement on Form S-1 (or other appropriate form if the Company is not then S-1 eligible) providing for the resale by

the Purchasers of the Shares issued under the Securities Purchase Agreement. The Company shall use commercially reasonable efforts to

cause such registration statement to become effective within 60 days following the filing thereof and to keep such registration statement

effective at all times until no Purchaser owns any Shares.

Furthermore,

pursuant to the Securities Purchase Agreement, within five (5) days of the signing the Securities Purchase Agreement, (i) the Company’s

board of directors shall approve an amendment to the Company’s bylaws setting the quorum required for a special meeting of stockholders

to one-third of all stockholders entitled to vote at such special meeting and (ii) the Company shall file with the SEC a preliminary

proxy statement on Schedule 14A announcing a meeting of stockholders for the purpose of approving the Series A and Series B warrants

issued by the Company on June 25, 2024.

Furthermore,

in order to secure the Company’s obligations under the Notes, the Securities Purchase Agreement provides that the Company shall

cause its wholly owned subsidiaries, to the extent permitted under such subsidiaries’ existing obligations, to guarantee the payment

of and performance of obligations under the Notes. The Company agreed to use best efforts to enters into subsidiary guarantees to that

effect.

Senior

Secured Promissory Notes

The

Notes will mature ninety (90) days following their issuance date (the “Maturity Date”), and shall accrue no interest unless

and until an Event of Default (as defined in the Notes) has occurred, in which case interest shall accrue at a rate of 14% per annum

during the pendency of such Event of Default. In addition, upon customary Events of Default, the Purchasers may require the Company to

redeem all or any portion of the Notes in cash with 125% redemption premium. The Purchasers may also require the Company to redeem all

or any portion of the Notes in cash upon a Change of Control, as defined in the Notes, at the prices set forth therein. Upon a Bankruptcy

Event of Default (as defined in the Notes), the Company shall immediately pay to the Purchasers an amount in cash representing 100% of

all outstanding principal, accrued and unpaid interest, if any, in addition to any and all other amounts due under the Notes, without

the requirement for any notice or demand or other action by the Purchaser or any other person.

If

the Company engages in one or more subsequent financings while the Notes are outstanding, the Company will be required to use at least

100% of the gross proceeds of such financing to redeem all or any portion of the Notes outstanding. The Company may also prepay the Notes

in whole or in part at any time or from time to time. The Notes also contain customary representations and warranties and covenants of

each of the parties. Subject to certain exceptions, the Notes are secured by a first lien and continuing security interest in and to

the Collateral (as defined in the Notes).

The

foregoing description of the Securities Purchase Agreement and the Notes is qualified in its entirety by reference to the full text of

the Form of Securities Purchase Agreement and Form of Note, a copy of each of which is filed as Exhibits 4.1, and 10.1, respectively,

to this Current Report on Form 8-K (the “Report”), and incorporated herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth above in Item 1.01 of this Report is incorporated by reference herein.

Item

3.02 Unregistered Sales of Equity Securities

The

information set forth above in Item 1.01 of this Report is incorporated by reference herein. The shares of Common Stock to be issued

in connection with the Securities Purchase Agreement and the transactions contemplated thereby will not be registered under the Securities

Act, in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated

thereunder.

Forward-Looking

Statements

This

report contains certain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1955. These forward-looking statements include, without limitation, the Company’s expectations with respect

to the anticipated need for future financing, and the anticipated sale of the video solutions business, including statements regarding

the timing and size of the financing, timing of the contemplated sale, the need to obtain additional financing to support ongoing operations,

the Company’s ability to properly assess ongoing capital needs, and the Company’s projected future results. Words such as

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar

expressions are intended to identify such forward-looking statements. Forward-looking statements are predictions, projections and other

statements about future events that are based on current expectations and assumptions and, as a result, are subject to significant risks

and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside

of the Company’s control and are difficult to predict. Factors that may cause actual future events to differ materially from the

expected results, include, but are not limited to: (i) the risk future financings may not be completed in a timely manner or at all,

which may adversely affect the price of the Company’s securities, (ii) the risk of downturns and the possibility of rapid change

in the highly competitive industry in which the Company operates, (iii) the risk that any adverse changes in the Company’s relationships

with buyer, sellers and distribution partners may adversely affect the business, financial condition and results of operations, (iv)

the risk that the Company is not able to maintain and enhance its brand and reputation in its marketplace, adversely affecting the Company’s

business, financial condition and results of operations, (v) the risk of the occurrence of extraordinary events, such as terrorist attacks,

disease epidemics or pandemics, severe weather events and natural disasters, (vi) the risk that the Company may need to raise additional

capital to execute its business plan, which many not be available on acceptable terms or at all, (vii) the risk that third-parties suppliers

and manufacturers are not able to fully and timely meet their obligations, (viii) the risk that the Company is unable to secure or protect

its intellectual property, (iv) the risk that the Company is not able to properly asses the ongoing capital needs, (x) the risk that

the Company is not able to properly estimate the timing and amount of expenses related to the future financing, and (xi) the risk the

Company is not able to find counterparty to purchase video solutions business. There may be additional risks that the Company presently

does not know or that the Company currently believes is immaterial that could also cause results to differ from those contained in any

forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and the Company assumes no obligation and do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 8, 2024

| |

Digital

Ally, Inc. |

| |

|

|

| |

By: |

/s/

Stanton E. Ross |

| |

Name:

|

Stanton

E. Ross |

v3.24.3

Cover

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

Digital

Ally, Inc. (the “Company”) is filing this Amendment No. 1 (this “Amendment”) to the Current Report on Form 8-K

originally filed by the Company with the Securities and Exchange Commission on November 7, 2024 (the “Original Form 8-K)”,

to disclose certain information with respect to subsidiary guarantees of the Company, and to incorporate by reference the applicable

information disclosed under Item 1.01 hereunder into Item 2.03, which disclosures were inadvertently omitted in the Original Form 8-K.

This Amendment makes no other changes to the Original Form 8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity File Number |

001-33899

|

| Entity Registrant Name |

DIGITAL

ALLY, INC.

|

| Entity Central Index Key |

0001342958

|

| Entity Tax Identification Number |

20-0064269

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

14001

Marshall Drive

|

| Entity Address, City or Town |

Lenexa

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66215

|

| City Area Code |

(913)

|

| Local Phone Number |

814-7774

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.001 par value

|

| Trading Symbol |

DGLY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

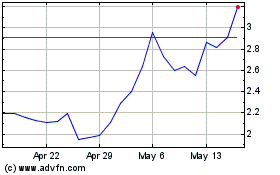

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Nov 2024 to Dec 2024

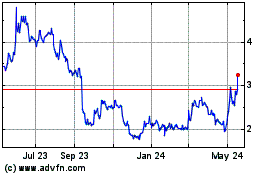

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Dec 2023 to Dec 2024