false

0001633932

A1

0001633932

2024-06-05

2024-06-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest

event reported): June 5, 2024

ESSA

Pharma Inc.

(Exact name of registrant as

specified in its charter)

|

British Columbia, Canada

(State or other jurisdiction of incorporation) |

001-37410

(Commission File Number) |

98-1250703

(IRS Employer Identification No.) |

Suite 720, 999 West Broadway, Vancouver, British Columbia, Canada

(Address of principal executive offices) |

V5Z 1K5

(Zip Code) |

Registrant’s telephone

number, including area code: (778) 331-0962

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

☐Written communications pursuant to Rule

425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of

each class |

Trading

Symbol(s) |

Name of

each exchange on which registered |

| Common Shares, no par value |

EPIX |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

On June 5, 2024,

after a lengthy and thorough review process, the Board of Directors of ESSA Pharma Inc. (the “Company”) adopted

and approved the ESSA Pharma Inc. Severance Plan (the “Severance Plan”), which, for certain terminations of employment, replaces

the cash severance benefits previously provided under the employment agreements of certain executive officers. The

Company’s named executive officers and certain other executives will participate in the Severance Plan. Capitalized terms used but

not defined herein have the definitions ascribed to such terms in the Severance Plan.

In the event of a Qualifying

Termination, the Severance Plan provides for (i) cash severance ranging from 1 to 1.5 times of such officer’s base salary (and

in the case of the Chief Executive Officer, their target bonus in addition to base salary), with the larger multiple payable on a

Qualifying Termination in connection with a Change in Control of the Company and (ii) certain benefits continuation following termination.

Severance payments and benefits under the Severance Plan are subject to the executive’s execution of a release of claims in favor

of the Company.

The foregoing description

of the Severance Plan is qualified in its entirety by reference to the full text of the Severance Plan, a copy of which is filed as Exhibit

10.1 to this Current Report on Form 8-K and incorporated herein by reference.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

ESSA PHARMA INC.____________ |

| |

|

(Registrant) |

| Date: December 6, 2024 |

|

|

| |

By: |

/s/ David Wood |

| |

|

Name: David Wood |

| |

|

Title: Chief Financial Officer |

Exhibit 99.1

ESSA PHARMA INC.

SEVERANCE PLAN

Section

1. Purpose of the Plan

This ESSA Pharma Inc. Severance

Plan (the “Plan”) is intended to promote the interests of the Company by helping the Company retain qualified executives,

maintain a stable work environment and provide economic security to eligible executives in the event of certain qualifying terminations

of employment, including in connection with a Change in Control of the Company, and subject to the terms of the Plan. It is also contemplated

that the Plan will enhance the ability of the Company and its wholly-owned Subsidiaries to attract and retain the services of individuals

who are essential for the growth and profitability of the Company and to encourage them to devote their best efforts to the business of

the Company, thereby advancing the interests of the Company. Capitalized terms used but not otherwise defined herein have the meanings

set forth in Section 2.

The Plan is not intended

to be included in the definitions of “employee pension benefit plan” or “pension plan” set forth under Section

3(2) of ERISA. The Plan is intended to meet the descriptive requirements of a plan constituting a “severance pay plan” within

the meaning of regulations published by the Secretary of Labor at Title 29, Code of Federal Regulations, Section 2510.3-2(b). Notwithstanding

the foregoing, if and to the extent that the Plan is deemed to be an “employee pension benefit plan” or “pension plan”

as set forth under Section 3(2) of ERISA, then the Plan is intended, for all purposes under ERISA, to constitute a plan that is unfunded

and maintained by the Company primarily for the purposes of providing deferred compensation for a select group of management or highly

compensated employees.

Section

2. Definitions

As used in the Plan, the

following terms shall have the meanings set forth below:

(a) “Affiliate”

shall have the meaning set forth in the Omnibus Plan.

(b) “Base

Salary” means a Participant’s annual base salary as in effect immediately prior to the Qualifying Termination Date or,

if higher, as in effect immediately prior to the occurrence of an event or circumstance constituting Good Reason.

(c) “Benefit

Subsidy” means, to the extent a Participant employed in the United States shall have elected continuation coverage under the

Consolidated Budget Reconciliation Act of 1985, as amended, the Company’s provision of continued participation to the Participant

and his or her eligible dependents in the health, dental and vision benefit plans of the Company in which the Participant participated

immediately prior to the Participant’s Qualifying Termination (or, if more favorable, immediately before any circumstance giving

rise to Good Reason) on the same basis as similarly situated active employees from time to time or, if continued participation in such

plans is not possible, substantially equivalent coverage or, to the extent such Benefit Subsidy would result in a taxable event to the

Participant, the Company’s payment to the Participant of an amount equal to the lesser of (i) the amount that the Company determines

is sufficient to obtain substantially comparable insurance coverage, and (ii) the amount the Company would have contributed (or been deemed

to contribute) to coverage had continued participation in the applicable Company plan had such participation been possible. If a Participant

is not enrolled in a group health plan sponsored by the Company or an Affiliate as of the immediately prior to the Qualifying Termination

Date, the term Benefit Subsidy shall mean for such Participant a payment equal to the amount that the Company determines the Company would

have contributed to such coverage had the Participant participated in such a plan during the Continuation Period.

(d) “Board”

means the board of directors of the Company.

(e) “C-Level”

Executive means the Company’s Chief Financial Officer, Chief Operating Officer and Chief Medical Officer.

(f) “Cause”

shall have the meaning set forth in the Omnibus Plan.

(g) “Change

in Control” shall have the meaning set forth in the Omnibus Plan.

(h) “Code”

shall have the meaning set forth in the Omnibus Plan.

(i) “Company”

means ESSA Pharma Inc., a company incorporated under the laws of the Province of British Columbia, and, except as the context otherwise

requires, its wholly-owned Subsidiaries and any successor by merger, acquisition, consolidation or otherwise that assumes the obligations

of the Company under the Plan.

(j) “Continuation

Period” means:

(i) with

respect to a Participant who is a Vice President, the period beginning on his or her Qualifying Termination Date and ending three (3)

months following such date (or six (6) months in the event of a Qualifying Termination Date during the Covered Period) or (ii) if earlier,

the date on which the Participant becomes eligible to receive health, dental and vision coverage on substantially similar terms from another

employer;

(ii) with

respect to a Participant who is a Senior Vice President, the period beginning on his or her Qualifying Termination Date and ending six

(6) months following such date (or nine (9) months in the event of a Qualifying Termination Date during the Covered Period) or (ii) if

earlier, the date on which the Participant becomes eligible to receive health, dental and vision coverage on substantially similar terms

from another employer.

(iii) with

respect to a Participant who is a the Chief Executive Officer or a C-Level Executive, the period beginning on his or her Qualifying Termination

Date and ending one year following such date (or eighteen months in the event of a Qualifying Termination Date during the Covered Period)

or (ii) if earlier, the date on which the Participant becomes eligible to receive health, dental and vision coverage on substantially

similar terms from another employer.

(k) “Covered

Period” means the period of time beginning sixty (60) days immediately prior to the first occurrence of either a Change in Control

or, if earlier, the execution by the Company of an agreement, the consummation of which would result in a Change in Control, and lasting

through the first anniversary of the occurrence of the Change in Control.

(l) “Disability”

shall have the meaning set forth in the Omnibus Plan.

(m) “ERISA”

means the Employee Retirement Income Security Act of 1974, as amended. Any reference to a section of ERISA shall be deemed to include

a reference to any regulations promulgated thereunder.

(n) “Good

Reason” means the occurrence of any of the following conditions: (i) a material adverse change in the nature of the Participant’s

duties or responsibilities from those in effect at the time the individual becomes a Participant hereunder (as such duties or responsibilities

may be increased from time to time); (ii) a material reduction in the Participant’s base compensation or short-term cash incentive

compensation opportunities from those in effect at the time the individual becomes a Participant hereunder (as such base compensation

or short-term cash incentive compensation opportunities may be increased from time to time); or (iii) a mandatory relocation of Participant’s

principal place of work in excess of 50 miles.

Notwithstanding the foregoing, a condition shall

not constitute “Good Reason” for purposes of the Plan unless (a) within 30 days following the first occurrence of such condition,

the Participant delivers written notice to the Company of his or her intent to terminate employment for Good Reason based on such condition,

and (b) within 30 days following its receipt of such notice, the Company has not substantially cured such condition. For the avoidance

of doubt, the occurrence of a Change in Control (including a Change in Control in which the Company becomes a subsidiary of another entity)

shall not itself constitute Good Reason.

(o) “Omnibus

Plan” means the ESSA Pharma Inc. 2022 Omnibus Incentive Plan, as in effect on the Effective Date.

(p) “Participant”

means each officer of the Company or its wholly-owned Subsidiaries who may be designated by the Administrator as a Participant from time

to time pursuant to Section 4, as identified on Annex A attached hereto, as amended from time to time (subject to any written agreement

between a Participant and the Company). Changes to Annex A shall not be permitted during Covered Period, to the extent such changes would

be adverse to a Participant.

(q) “Person”

shall have the meaning set forth in the Omnibus Plan.

(r) “Plan”

means this ESSA Pharma Inc. Severance Plan, as may be amended and/or restated from time to time in accordance with the terms hereof.

(s) “Qualifying

Termination” means the termination of a Participant’s employment either by the Company without Cause (at any time) or

during the Covered Period by the Participant for Good Reason.

(t) “Qualifying

Termination Date” means the date on which a Participant incurs a Qualifying Termination.

(u) The

“Severance Multiple” of any Participant shall be as set forth in the matrix below:

| Position |

Severance Multiple |

Severance Multiple for Qualifying Termination Date During Covered Period |

| Chief Executive Officer and C-Level Executives |

1 |

1.5 |

| Senior Vice President |

0.5 |

0.75 |

| Vice President |

0.25 |

0.5 |

(v) “Severance

Payment” means (A) for any Participant other than the Chief Executive Officer of the Company, a lump-sum cash payment equal

to the product of (i) such Participant’s Base Salary and (ii) the applicable Severance Multiple and (B) for the Chief Executive

Officer of the Company, a lump-sum cash payment equal to the product of (i) the sum of (x) such Participant’s Base Salary and (y)

such Participant’s target annual cash bonus (without giving effect to any action constituting Good Reason) and (ii) the applicable

Severance Multiple.

Section

3. Administration

(a) General

Authority. The Plan shall be administered by the Board or, as and to the extent designated by the Board from time to time, a committee

thereof, one or more employees of the Company, or one or more members of the Board together with one or more employees of the Company

(collectively, the “Administrator”), subject to such limitations on such delegated powers and duties as the Board may

impose.

(b) Determinations.

Subject to the terms of the Plan and applicable law, and in addition to other express powers and authorizations set forth in the Plan,

the Administrator shall have full power and authority to: (i) designate Participants; (ii) interpret and administer the Plan; (iii) establish,

amend, suspend, or waive such rules and regulations and appoint such agents as it shall deem appropriate for the proper administration

of the Plan; and (iv) make any other determination and take any other action that the Administrator deems necessary or desirable for the

administration of the Plan. The Administrator shall have full power and express discretionary authority to make factual determinations

and to adopt or amend such rules, regulations, agreements, and instruments for implementing the Plan and for the conduct of its business

as it deems necessary or advisable, in its sole discretion. Unless otherwise expressly provided in the Plan, all designations, determinations,

interpretations, and other decisions under or with respect to the Plan shall be within the sole discretion of the Administrator, may be

made at any time and shall be final, conclusive, and binding upon all Persons. Administration of the Plan need not be uniform as to similarly

situated Participants.

Section

4. Eligibility

Any officer of the Company

or its wholly-owned Subsidiaries shall be eligible to be designated a participant in the Plan. With respect to any individual who is identified

on Annex A as a Participant who is party to an agreement with the Company or an Affiliate which provides for severance payments or benefits,

participation in the Plan shall be conditioned on the execution by such individual of a waiver of the severance entitlements under such

agreement, in such form as shall be determined by the Administrator.

Section

5. Qualifying Termination

(a) Amount.

In the event a Participant incurs a Qualifying Termination, provided that the Participant executes and does not revoke a customary release

of claims in a form and manner reasonably satisfactory to the Company (the “Release”) within sixty (60) days following

the Qualifying Termination Date, the Company shall provide (or cause to be provided) to the Participant: (i) the Severance Payment, and

(ii) the Benefit Subsidy during the applicable Continuation Period, paid or provided as soon as practicable (but in any event within five

(5) days) after the Release becomes irrevocable, subject to Section 9(a) and Section 9(e). In the event that a Participant experiences

a Qualifying Termination and such Qualifying Termination is later determined to have occurred during the Covered Period, the Company shall

immediately pay to the Participant the additional amounts which would have been payable to the Participant had such Qualifying Termination

been initially determined to have occurred during the Covered Period.

(b) No

Transfer. No right under the Plan may be assigned, alienated, pledged, attached, sold, or otherwise transferred or encumbered by a

Participant and any such purported assignment, alienation, pledge, attachment, sale, transfer, or encumbrance shall be void and unenforceable

against the Company or any Affiliate.

Section

6. Term and Termination

(a) The

Plan shall be effective as of June 5, 2024, the date the Plan was approved by the Board (the “Effective Date”), and

shall continue in effect indefinitely; provided that the Plan may be amended or terminated subject to subsection 6(b) below.

(b) Except

to the extent prohibited by applicable law or specifically set forth in a written agreement between a Participant and the Company, the

Board may amend, alter, suspend, discontinue, or terminate the Plan, provided that during a Covered Period, no such amendment, alteration,

suspension, discontinuance or termination shall impair the rights of a Participant under the Plan.

Section

7. Effect on Other Plans, Agreements and Benefits

(a) It

shall be a condition to an individual’s eligibility to be a Participant that such individual agree that that the Plan constitutes

the sole source of any severance, termination or similar benefits and, to the extent applicable, supersedes and other contractual or other

severance or similar entitlements. Each Participant who incurs a Qualifying Termination shall remain entitled to any benefits to which

he or she would otherwise be entitled under the terms and conditions of the Company’s other compensation and benefit plans, programs

and arrangements (other than any severance or termination benefit plans, programs, policies or agreements), and nothing contained in the

Plan is intended to waive or relinquish the Participant’s rights thereunder.

(b) Any

severance benefits payable to a Participant under the Plan shall not be counted as compensation for purposes of determining benefits under

any other benefit policies or plans of the Company or its wholly-owned Subsidiaries, except to the extent expressly provided therein.

(c) Notwithstanding

anything set forth herein to the contrary, to the extent that any severance payable under a plan or agreement covering a Participant as

of the date such Participant becomes eligible to participate in this Plan constitutes deferred compensation under Section 409A of the

Code, then to the extent required to avoid accelerated taxation and/or tax penalties under Section 409A of the Code, the portion of the

benefits payable hereunder equal to such other amount shall instead be provided in the form set forth in such other plan or agreement.

Section

8. Section 280G

(a) Treatment

of Payments. Notwithstanding any other provision of the Plan to the contrary, in the event that any payment or benefit received or

to be received by a Participant (whether pursuant to the terms of the Plan or any other plan, arrangement or agreement) (all such payments

and benefits, including the severance benefits payable hereunder, being hereinafter referred to as the “Total Payments”)

would be subject (in whole or part) to any excise tax imposed on the Participant under Section 4999 of the Code (the “Excise

Tax”), then, after taking into account any reduction in the Total Payments provided by reason of Section 280G of the Code in

such other plan, arrangement or agreement, the severance benefits payable hereunder shall be reduced to the extent necessary so that no

portion of the Total Payments is subject to the Excise Tax but only if the net amount of such Total Payments, as so reduced (and after

subtracting the net amount of federal, state and local income taxes on such reduced Total Payments and after taking into account the phase

out of itemized deductions and personal exemptions attributable to such reduced Total Payments) is greater than or equal to the net amount

of such Total Payments without such reduction (but after subtracting the net amount of federal, state and local income taxes on such Total

Payments and the amount of Excise Tax to which the Participant would be subject in respect of such unreduced Total Payments and after

taking into account the phase out of itemized deductions and personal exemptions attributable to such unreduced Total Payments).

(b) Ordering

of Reduction. In the case of a reduction in the Total Payments pursuant to Section 8(a), the Total Payments shall be reduced in the

following order: (i) payments that are payable in cash the full amount of which are treated as parachute payments under Treasury Regulation

Section 1.280G-1, Q&A 24(a) shall be reduced (if necessary, to zero), with amounts that are payable last reduced first; (ii) payments

and benefits due in respect of any equity the full amount of which are treated as parachute payments under Treasury Regulation Section

1.280G-1, Q&A 24(a), with the highest values reduced first (as such values are determined under Treasury Regulation Section 1.280G-1,

Q&A 24), shall next be reduced; (iii) payments that are payable in cash that are valued at less than full value under Treasury Regulation

Section 1.280G-1, Q&A 24, with amounts that are payable last reduced first, shall next be reduced; (iv) payments and benefits due

in respect of any equity valued at less than full value under Treasury Regulation Section 1.280G-1, Q&A 24, with the highest values

reduced first (as such values are determined under Treasury Regulation Section 1.280G-1, Q&A 24), shall next be reduced; and (v) all

other non-cash benefits not otherwise described in clauses (ii) or (iv) shall be next reduced pro-rata.

(c) Additional

Payments. If a Participant receives reduced payments and benefits by reason of this Section 8 and it is established pursuant to a

determination of a court of competent jurisdiction, which determination is not subject to review or as to which the time to appeal such

determination has expired, or pursuant to an Internal Revenue Service proceeding, that the Participant could have received a greater amount

without resulting in any Excise Tax, then the Company shall thereafter pay the Participant the aggregate additional amount which could

have been paid without resulting in any Excise Tax as soon as reasonably practicable.

Section

9. General Provisions

(a) Withholding.

All payments and benefits hereunder shall be subject to applicable federal (including FICA), state, and local tax withholding requirements.

The Company may deduct from any payment made under the Plan the amount of any withholding taxes due with respect thereto, as determined

by the Administrator in its sole discretion.

(b) No

Right to Employment. Participation in the Plan shall not be construed as giving a Participant the right to be retained in the employ

or service of the Company or any Affiliate.

(c) Governing

Law. The validity, construction, and effect of the Plan and any rules and regulations relating to the Plan shall be determined in

accordance with the laws of the State of Texas (without regard to any choice of law provision that might refer interpretation of the Plan

to the substantive law of another jurisdiction) and applicable Canadian and United States federal law. Notwithstanding anything in the

Plan to the contrary, the provisions of the Plan shall be altered for participants who are employed by the Company or an Affiliate in

Canada in the manner set forth in Appendix A.

(d) Severability.

If any provision of the Plan is or becomes or is deemed to be invalid, illegal, or unenforceable in any jurisdiction or as to any Participant,

such provision shall be construed or deemed amended to conform to the applicable laws, or if it cannot be construed or deemed amended

without, in the determination of the Administrator, materially altering the intent of the Plan, such provision shall be stricken as to

such jurisdiction or Participant and the remainder of the Plan shall remain in full force and effect.

(e) Compliance

with Other Laws. It is intended that, to the extent applicable, payments and benefits under the Plan be exempt from or, if not so

exempt, comply with, the requirements of Section 409A of the Code and the regulations thereunder to the extent required to avoid accelerated

taxation and/or tax penalties under Section 409A of the Code, and the Plan shall be interpreted consistently with this intent. Notwithstanding

anything in the Plan to the contrary, any benefit under the Plan that is considered nonqualified deferred compensation under Section 409A

of the Code shall be payable only upon a Participant’s “separation from service” with the Company and its Affiliates

within the meaning of Section 409A of the Code. If a Participant is a “specified employee” (as defined in Section 409A of

the Code), then to the extent required to avoid accelerated taxation and/or tax penalties under Section 409A of the Code, such Participant

shall not be entitled to any payments upon a termination of his or her employment or service until the earlier of: (i) the expiration

of the six (6)-month period measured from the date of such Participant’s “separation from service” or (ii) the date

of such Participant’s death.

Notwithstanding anything in the Plan to the contrary,

in the event any payments hereunder could occur in one of two calendar years as a result of being dependent upon the Release becoming

irrevocable, then, to the extent required to avoid the imposition of taxes and penalties under Section 409A of the Code, such payments

shall commence on the first regularly scheduled payroll date of the Company, following the date the Release becomes irrevocable, that

occurs in the second of such two calendar years.

(f) No

Trust or Fund Created. Neither the Plan nor any right to a payment or benefit under the Plan shall create or be construed to create

a trust or separate fund of any kind or a fiduciary relationship between the Company or any Affiliate and a Participant.

(g) Headings.

Headings are given to the sections and subsections of the Plan solely as a convenience to facilitate reference. Such headings shall not

be deemed in any way material or relevant to the construction or interpretation of the Plan or any provision thereof.

(h) Applicable

Policies. All payments and benefits under the Plan shall be subject to the terms of the Company’s clawback policy, as may be

amended and/or restated from time to time and pursuant to the terms thereunder.

ANNEX A

PARTICIPANT LIST

David Parkinson, President

and Chief Executive Officer

Peter Virsik, Executive

Vice President and Chief Operating Officer

Alessandra Cesano, Executive

Vice President and Chief Medical Officer

David Wood, Chief Financial

Officer

Han-Jie Zhou,

Senior Vice President

Karen Villaluna,

Vice President

APPENDIX A

[Variation of Plan terms for Canadian Participants,

if any]

v3.24.3

Cover

|

Jun. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 05, 2024

|

| Entity File Number |

001-37410

|

| Entity Registrant Name |

ESSA

Pharma Inc.

|

| Entity Central Index Key |

0001633932

|

| Entity Tax Identification Number |

98-1250703

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

Suite 720

|

| Entity Address, Address Line Two |

999 West Broadway

|

| Entity Address, City or Town |

Vancouver

|

| Entity Address, State or Province |

BC

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

V5Z 1K5

|

| City Area Code |

778

|

| Local Phone Number |

331-0962

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, no par value

|

| Trading Symbol |

EPIX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

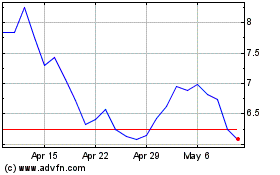

ESSA Pharma (NASDAQ:EPIX)

Historical Stock Chart

From Nov 2024 to Dec 2024

ESSA Pharma (NASDAQ:EPIX)

Historical Stock Chart

From Dec 2023 to Dec 2024