0001476840False00014768402024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 21, 2024

Expensify, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-41043 | | 27-0239450 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

401 SW 5th Ave

Portland, Oregon 97204

(Address of Principal Executive Offices) (Zip Code)

(971) 365-3939

(Registrant’s telephone number, including area code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

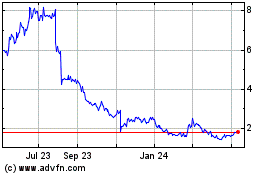

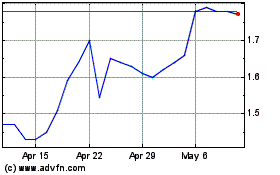

| Class A Common Stock, par value $0.0001 per share | | EXFY | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On February 21, 2024, Expensify, Inc.(“Expensify” or the “Company”) as borrower, the lenders party thereto and Canadian Imperial Bank of Commerce (“CIBC”), as administrative agent, entered into a Second Amended and Restated Loan and Security Agreement (the “Second Amended and Restated Loan and Security Agreement”). The Second Amended and Restated Loan and Security Agreement amends and restates that certain Amended and Restated Loan and Security Agreement, dated as of September 21, 2021, by and among the Company, the lenders party thereto and CIBC, to, among other things, extend the maturity date of the revolving line of credit by one year to September 21, 2025, remove certain provisions related to the term loan that was repaid in full in October 2023, and make certain changes to the positive and negative covenants intended to better align with the operations of the Company. The Second Amended and Restated Loan and Security Agreement continues to provide for a $25.0 million revolving credit facility, and interest on borrowings continues to accrue at CIBC’s reference rate plus 1.00%

As of February 21, 2024, $15.0 million was outstanding under the Loan and Security Agreement.

The foregoing description of the Second Amended and Restated Loan and Security Agreement does not purport to be complete and is qualified in its entirety by reference to the complete terms of the Second Amended and Restated Loan and Security Agreement, a copy of which is attached as Exhibit 10.1 to this current report on Form 8-K and is incorporated herein by reference. The Second Amended and Restated Loan and Security Agreement has been included as an exhibit to this filing to provide investors and security holders with information regarding its terms and is not intended to provide any other factual information about Expensify or any of its subsidiaries. The representations and warranties in the Second Amended and Restated Loan and Security Agreement were made only for the purposes of the Second Amended and Restated Loan and Security Agreement, as of a specified date, and may be subject to a contractual standard of materiality different from what might be viewed as material to stockholders, or may have been used for the purpose of allocating risk between the parties. Accordingly, the representations and warranties in the Second Amended and Restated Loan and Security Agreement are not necessarily characterizations of the actual state of facts concerning Expensify or any of its subsidiaries at the time they were made or otherwise and should only be read in conjunction with the other information that Expensify makes publicly available in reports, statements and other documents filed with the SEC.

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, the Company issued a press release announcing its financial results for the year and quarter ended December 31, 2023. A copy of this press release is furnished as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 of this current report on Form 8-K is incorporated into this Item 2.03 by reference.

Item 7.01 Regulation FD Disclosure.

On February 22, 2024, the Company posted an investor presentation to its website at https://ir.expensify.com (the “Investor Presentation”). A copy of the Investor Presentation is attached as Exhibit 99.2 to this current report on Form 8-K and is incorporated herein by reference. The Company expects to use the Investor Presentation, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts and others.

The information contained in the Investor Presentation is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Investor Presentation speaks only as of the date of this current report on Form 8-K. The Company undertakes no duty or obligation to publicly update or revise the information included in the Investor Presentation, although it may do so from time to time. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or other public disclosure. In addition, the exhibit furnished herewith contains statements intended as “forward-looking statements” that are subject to the cautionary statements about forward-looking statements set forth in such exhibit. By furnishing the information contained in the Investor Presentation, the Company makes no admission as to the materiality of any information in the Investor Presentation that is required to be disclosed solely by reason of Regulation FD.

The information contained in Item 2.02 and this Item 7.01, including Exhibit 99.1 and 99.2, is being furnished and shall not be deemed “filed” for the purposed of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by Expensify under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Expensify, Inc. |

| | |

| By: | | /s/ Ryan Schaffer |

| Name: | | Ryan Schaffer |

| Title: | | Chief Financial Officer |

Date: February 22, 2024

SECOND AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

This SECOND AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT (as amended, restated, supplemented or otherwise modified from time to time, this “Agreement”) dated as of February 21, 2024 (the “Effective Date”) is entered into among EXPENSIFY, INC., a Delaware corporation (in its capacity as borrower representative, “Borrower Representative”, and together with each Person party hereto as a borrower from time to time, collectively, “Borrowers”, and each, a “Borrower”), the several banks and financial institutions or entities from time to time party hereto (each, a “Lender”, and collectively, “Lenders”), Canadian Imperial Bank of Commerce (in its individual capacity, “CIBC”, and in its capacity as administrative agent and collateral agent for the lenders party hereto “Agent”). This Agreement amends and restates in its entirety that certain Amended and Restated Loan and Security Agreement, dated as of September 21, 2021, by and among Borrower Representative and CIBC, as amended through the Effective Date.

AGREEMENT

The parties hereto hereby agree as follows:

1.ACCOUNTING AND OTHER TERMS

Accounting terms not defined in this Agreement shall be construed in accordance with GAAP, and calculations and determinations shall be made following GAAP, consistently applied . For purposes of calculations made pursuant to the terms hereof, or otherwise for purposes of compliance herewith, GAAP shall be deemed to treat operating leases and capital lease obligations in a manner consistent with the treatment thereof under GAAP as in effect on December 31, 2021, notwithstanding any modifications or interpretive changes thereto that have occurred. Capitalized terms not otherwise defined in this Agreement shall have the meanings set forth on Exhibit A. All other terms contained in this Agreement, unless otherwise indicated, shall have the meaning provided by the Code to the extent such terms are defined therein. As used in the Loan Documents, the word “shall” is mandatory, the word “may” is permissive, the word “or” is not exclusive, the words “includes” and “including” are not limiting, the singular includes the plural, and numbers denoting amounts that are set off in brackets are negative. Unless otherwise specified, all references in this Agreement or any Annex or Schedule hereto to a “Section,” “subsection,” “Exhibit,” “Annex,” or “Schedule” shall refer to the corresponding Section, subsection, Exhibit, Annex, or Schedule in or to this Agreement. For purposes of the Loan Documents, whenever a representation or warranty is made to a Person’s knowledge or awareness, knowledge or awareness means the actual knowledge, after reasonable investigation, of any Responsible Officer of such Person.

2.LOAN AND TERMS OF PAYMENT

1.aPromise to Pay. Each Borrower hereby unconditionally promises to pay to Agent, for the ratable benefit of Lenders, the outstanding principal amount of all Credit Extensions, accrued and unpaid interest, fees and charges thereon and all other amounts owing hereunder as and when due in accordance with this Agreement.

1.bRevolving Loan Facility.

(1)Availability. Subject to the terms and conditions of this Agreement, each Revolving Lender severally agrees to make to Borrowers, Revolving Loans from time to time in an aggregate amount outstanding at any time outstanding which, when added to the applicable aggregate Bank Services Utilization Amount, does not exceed such Lender’s Revolving Loan Commitment. The aggregate outstanding Revolving Loans together with the aggregate Bank Services Utilization Amount shall not exceed the Total Revolving Loan Commitments. To request a Revolving Loan, Borrower Representative shall submit a Loan Request to Agent by email not later than 1:00 p.m., Toronto, Ontario time, one (1) Business Day before the date of the proposed Revolving Loan. Revolving Loans shall be made no more frequently than three times per month and in increments of One Hundred Thousand Dollars ($100,000). As part of the Revolving Loan Facility, Borrower Representative may request, and any Revolving Lender that is a Bank Services Provider may provide, Bank Services, as a sublimit under such Revolving Lender’s Revolving Loan Commitment, provided that the availability under the Revolving Loan Commitment with respect to such Revolving Lender shall be deemed reduced by the applicable Bank Services Utilization Amount, from time to time.

(2)Termination; Repayment. The Revolving Commitments terminate on the Revolving Loan Maturity Date, when the principal amount of all Revolving Loans, the unpaid interest thereon, and all other Obligations relating to the Revolving Loan Facility shall be immediately due and payable. Borrowers may repay and reborrow amounts under the Revolving Loan Facility from time to time through the Revolving Loan Maturity Date.

1.c[Reserved].

1.dFunding of Loans. Upon receipt of a Loan Request in accordance with Section 2.2 or 2.3, Agent shall promptly notify each appliable Lender thereof, and each Lender shall make the amount of its pro rata share of such borrowing available to Agent for the account of Borrowers in funds immediately available to Agent. Such borrowing will then be made available by Agent to Borrowers as specified in the Loan Request, by crediting such Collateral Account as is designated in writing to Agent in accordance with Section 2.7.

1.ePayment of Interest on the Loans.

(1)Interest Rate. Subject to Section 2.5(b), the outstanding principal amount of each Loan shall accrue interest from and after its Funding Date, at the Applicable Interest Rate.

(2)Default Rate. Immediately upon the occurrence and during the continuance of an Event of Default, the Obligations shall bear interest at a rate that is 5.0% higher than the Applicable Interest Rate (the “Default Rate”). Fees and expenses which are required to be paid by Borrowers pursuant to the Loan Documents (including, without limitation, Secured Party Expenses) but are not paid when due shall bear interest until paid at a rate equal to the highest rate applicable to the Obligations. Payment or acceptance of the increased interest rate provided in this Section 2.5(b) is not a permitted alternative to timely payment and shall not constitute a waiver of any Event of Default or otherwise prejudice or limit any rights or remedies of the Secured Parties hereunder.

(3)Payment; Interest Computation. Borrowers shall pay interest quarterly in arrears on each Payment Date, commencing with the first Payment Date after the applicable Funding Date with respect to each Loan. Interest shall be computed on the basis of a 365/366-day year for the actual number of days elapsed. In computing interest, (i) all payments received after 12:00 p.m. Ontario time on any day shall be deemed received at the opening of business on the next Business Day, and (ii) the date of the making of any Credit Extension shall be included and the date of payment shall be excluded.

(4)Maximum Interest. Notwithstanding any provision in this Agreement or any other Loan Document, it is the parties’ intent not to contract for, charge or receive interest at a rate that is greater than the maximum rate permissible by law that a court of competent jurisdiction shall deem applicable hereto (the “Maximum Rate”). If a court of competent jurisdiction shall finally determine that a Borrower has actually paid to any Secured Party an amount of interest in excess of the amount that would have been payable if all of the Obligations had at all times borne interest at the Maximum Rate, then such excess interest actually paid by Borrowers shall be applied to the reduction of outstanding principal, and thereafter to any other Obligations outstanding ratably (other than interest in excess of the Maximum Rate).

(5)Adjustment to Interest Rate. Changes to the interest rate applicable to the Loans based on changes to the Prime Rate shall be effective on the effective date of any change to the Prime Rate and to the extent of any such change.

1.fFees and Charges.

(1)Fees. Borrowers shall pay the following fees to Agent:

(a)Revolving Loan Facility Commitment Extension Fee. In respect of the Revolving Loan Commitments, a commitment extension fee to in an amount equal to 0.10% of the Total Revolving Loan Commitments, for the ratable benefit of the Revolving Lenders, due on the Effective Date;

(b)Unused Line Fee. An unused fee in an amount equal to 0.25% per annum of the Average Unused Revolving Loan Amount, payable quarterly in arrears on each Payment Date, provided that for any month in which the outstanding balance under the Revolving Loan Facility is equal to or greater than $5,000,000 at all times, the unused fee shall be waived with respect to such month;

(2)Secured Party Expenses. Borrowers shall pay to Secured Parties, all Secured Party Expenses (including reasonable attorneys’ fees and expenses for documentation and negotiation of this Agreement and the other Loan Documents) incurred through and after the Effective Date, when due (or, if no stated due date, within three (3) Business Days after written demand by Agent).

(3)Fees Fully Earned. Unless otherwise provided in this Agreement or any other Loan Document, the fees and charges specified in clause (b) above are fully earned as of the Effective Date, and in no event shall any Borrower be entitled to any credit, rebate, refund, reduction, proration or repayment of any fees or charges earned by any Secured Party pursuant to this Agreement or the other Loan Documents notwithstanding any termination of this Agreement or the suspension or termination of Commitments hereunder and notwithstanding the required payment date for such fees or charges.

1.gPayments; Application of Payments.

(1)All payments to be made by Borrowers under any Loan Document, including payments of principal and interest and all fees, charges, expenses, indemnities and reimbursements, shall be made in immediately available funds in Dollars, without setoff, recoupment or counterclaim, before 12:00 p.m. Pacific time on the date when due. Payments of principal and/or interest received after 12:00 p.m. Pacific time are considered received at the opening of business on the next Business Day. When a payment is due on a day that is not a Business Day, the payment shall be due the next Business Day, and additional fees or interest, as applicable, shall continue to accrue until paid. Unless otherwise notified by Agent in writing, Agent shall initiate debit entries to any Deposit Accounts as authorized on the Debit Authorization for principal and interest payments or any other amounts Borrowers owe Secured Parties when due, for the ratable benefit of Secured Parties. These debits shall not constitute a set-off. If the Debit Authorization arrangement is terminated for any reason, Borrowers shall promptly deliver a new Debit Authorization with respect to another Deposit Account of a Borrower and until such new Debit Authorization is effective, shall make all payments due to Agent at Agent’s address specified in Section 10, or as otherwise notified by Agent in writing. Except to the extent otherwise requested in writing by Borrower Representative, including pursuant to any disbursement letter or other Loan Request, any amounts to be funded by any Agent (including on behalf of any Lender) to a Borrower may be credited in accordance with the Credit Authorization.

(2)Unless Agent shall have been notified in writing by any Lender prior to the proposed date of any borrowing that such Lender will not make the amount that would constitute its share of such borrowing available to Agent, Agent may assume that such Lender has made such amount available to Agent on such date in accordance with Section 2.4, and Agent may, in reliance upon such assumption, make available to Borrowers a corresponding amount. If such amount is not in fact made available to Agent by the required time on the requested funding date, such Lender and each Borrower severally agree to pay to Agent forthwith, on written demand, such corresponding amount with interest thereon, for each day from and including the date on which such amount is made available to Borrowers but excluding the date of payment to Agent, at (i) in the case of a payment to be made by such Lender, a rate equal to the greater of (A) the federal funds effective rate and (B) a rate determined by Agent in accordance with banking industry rules on interbank compensation, and (ii) in the case of a payment to be made by a Borrower, the rate per annum applicable to Loans under the relevant facility. If a Borrower and such Lender shall pay such interest to Agent for the same or an overlapping period, Agent shall promptly remit to Borrower Representative the amount of such interest paid by a Borrower for such period. If such Lender pays its share of the applicable borrowing to Agent, then the amount so paid shall constitute such Lender’s Loan included in such borrowing. Any payment by a Borrower shall be without prejudice to any claim the Borrower may have against a Lender that shall have failed to make such payment to Agent.

(3)If any Lender makes available to Agent funds for any Loan to be made by such Lender as provided in the foregoing provisions of this Section 2.4, and such funds are not made available to Borrowers by Agent because the conditions to the applicable extension of credit set forth in Section 3.1 or 3.2 are not satisfied or waived in accordance with the terms hereof, Agent shall return such funds (in like funds as received from such Lender) to such Lender, without interest.

(4)The obligations of Lenders hereunder to fund their respective Commitments or make any other reimbursement or indemnity payments to Agent hereunder, are several and not joint. The failure of any Lender to make any such Loan, to fund any such participation or to make any such payment on any date required hereunder shall not relieve any other Lender of its corresponding obligation to do so on such date, and no Lender shall be responsible for the failure of any other Lender to so make its Loan or to make such payment.

(5)So long as no Application Event has occurred and is continuing and except as otherwise provided herein, all principal and interest payments received by Agent shall be apportioned ratably among Lenders (according to the unpaid principal balance of the Obligations to which such payments relate held by each Lender), to pay outstanding principal balance thereof, and all payments of fees and expenses received by Agent (other than fees or expenses that are for Agent’s separate account) shall be apportioned ratably among the Lenders according to each Lender’s pro rata share of the type of Commitment or Obligation to which a particular fee or expense relates.

(6)At any time that an Application Event has occurred and is continuing and except as otherwise provided herein, all payments remitted to Agent and all proceeds of Collateral received by Agent shall be applied as follows:

(a)to pay any Secured Party Expenses (including cost or expense reimbursements), indemnities, fees or other amounts then due to Agent, in its capacity as such, under the Loan Documents, until paid in full,

(b)to pay interest due in respect of any protective advances, until paid in full,

(c)to pay the principal of any protective advances, until paid in full,

(d)ratably, to pay any Secured Party Expenses (including cost or expense reimbursements) or indemnities then due to any Lenders under the Loan Documents, until paid in full,

(e)ratably, to pay any fees or premiums then due to any Lenders under the Loan Documents, until paid in full,

(f)ratably, to pay interest accrued in respect of the Revolving Loans, until paid in full,

(g)ratably

1)to pay the principal of all Revolving Loans until paid in full,

2)to pay or cash collateralize Bank Services provided under the Revolving Loan Facility,

(h)to pay any other Obligations other than Obligations owed to Defaulting Lender,

(i)ratably to pay any Obligations owed to Defaulting Lenders; and

(j)to Borrowers or such other Person entitled thereto under applicable law.

(7)Agent promptly shall distribute to each Lender, pursuant to the applicable wire instructions received from each Lender in writing, such funds as it may be entitled to receive.

(8)In each instance, so long as no Application Event has occurred and is continuing, Section 2.7(f)(ii) shall not apply to any payment made by Borrowers to Agent and specified by Borrowers to be for the payment of specific Obligations then due and payable (or prepayable) under any provision of this Agreement or any other Loan Document.

(9)For purposes of Section 2.7(f)(iii), “paid in full” of a type of Obligation means payment in cash or immediately available funds of all amounts owing on account of such type of Obligation, including interest accrued after the commencement of any Insolvency Proceeding, default interest, interest on interest, and expense reimbursements, irrespective of whether any of the foregoing would be or is allowed or disallowed in whole or in part in any Insolvency Proceeding.

(10)In the event of a direct conflict between the priority provisions of this Section 2.7 and any other provision contained in this Agreement or any other Loan Document, it is the intention of the parties hereto that such provisions be read together and construed, to the fullest extent possible, to be in concert with each other.

(11)If any Lender shall obtain any payment (whether voluntary, involuntary, through the exercise of any right of set-off, or otherwise) on account of the principal of or interest on any Loan made by it, such Lender shall (i) notify Agent of the receipt of such payment, and (ii) within five (5) Business Days of such receipt purchase (for cash at face value) from the other applicable Lenders (through Agent), without recourse, such participations in the Loans made by them or held by them, as applicable, or make such other adjustments as shall be equitable, as shall be necessary to cause such purchasing Lender to share the excess payment ratably with each of the other Lenders in accordance with their respective Applicable Percentages; provided, however, that if any such participations are purchased and all or any portion of the payment giving rise thereto is recovered, such participations shall be rescinded and the purchase price restored to the extent of such recovery, without interest. Each Borrower agrees that any Lender so purchasing a participation from another Lender pursuant to this subsection may exercise all its rights of payment (including the right of set-off) with respect to such participation as fully as if such Lender were the direct creditor of such Borrower in the amount of such participation. No documentation other than notices and the like referred to in this subsection shall be required to implement the terms hereof. Agent shall keep records (which shall be conclusive and binding in the absence of manifest error) of participations purchased pursuant hereto and shall in each case notify the applicable Lenders, following any such purchase.

1.hDefaulting Lenders.

(1)Defaulting Lender Adjustments. Notwithstanding anything to the contrary contained in this Agreement, if any Lender becomes a Defaulting Lender, then, until such time as such Lender is no longer a Defaulting Lender, to the extent permitted by applicable law:

(a)Waivers and Amendments. Such Defaulting Lender’s right to approve or disapprove any amendment, waiver or consent with respect to this Agreement shall be restricted as set forth in Section 12.8.

(b)Defaulting Lender Waterfall. Any payment of principal, interest, fees or other amounts received by Agent for the account of a Defaulting Lender shall be applied in accordance with Section 2.7.

(c)Certain Fees. Except as expressly set forth herein, no Defaulting Lender shall be entitled to any portion of any fees paid in accordance with Section 2.6.

(2)Defaulting Lender Cure. If Borrowers, Agent and Required Lenders agree in writing that a Lender is no longer a Defaulting Lender, Agent shall so notify the parties hereto, whereupon as of the effective date specified in such notice and subject to any conditions set forth therein, such Lender will, to the extent applicable, purchase at par that portion of outstanding Loans of the other Lenders or take such other actions as Agent may determine to be necessary to cause the Loans to be held on a pro rata basis by Lenders in accordance with their respective Applicable Percentages, whereupon such Lender will cease to be a Defaulting Lender; provided that no adjustments will be made retroactively with respect to fees accrued or payments made by or on behalf of the Borrower while such Lender was a Defaulting Lender; and provided further that, except to the extent otherwise expressly agreed by the affected parties, no change hereunder from Defaulting Lender to Lender will constitute a waiver or release of any claim of any party hereunder arising from such Lender having been a Defaulting Lender.

(3)Termination of Defaulting Lender. Borrower Representative may terminate the unused amount of any Commitment of any Lender that is a Defaulting Lender upon not less than ten (10) Business Days’ prior notice to Agent (which shall promptly notify Lenders thereof); provided that (i) no Event of Default shall have occurred and be continuing, and (ii) such termination shall not be deemed to be a waiver or release of any claim of Borrowers, Agent, or any other Lender may have against such Defaulting Lender.

3.CONDITIONS OF LOANS

1.aConditions Precedent to Effectiveness. The effectiveness of this Agreement and the Commitments hereunder are subject to the condition precedent that Agent shall have received, in form and substance satisfactory to Required Lenders, such agreements, documents and certificates, duly executed by the parties thereto, and in case of a Borrower; by a Responsible Officer, or as applicable, the conditions shall have been satisfied, in each case, as set forth on Schedule 2.

1.bConditions Precedent to all Credit Extensions. Lenders’ obligations to make each Credit Extension is subject to the following conditions precedent:

(1)the representations and warranties in this Agreement and the other Loan Documents shall be true, accurate, and complete in all material respects on the date of each Credit Extension; provided, however, that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof; and provided, further that those representations and warranties expressly referring to a specific date shall be true, accurate and complete in all material respects as of such date,

(2)no Default or Event of Default shall have occurred and be continuing or result from the Credit Extension;

(3)Agent has received a duly executed Loan Request, including calculations in form satisfactory to Agent demonstrating pro forma compliance with applicable financial covenants after giving effect to the requested Loan; and

(4)there has not been any event or circumstance that has had or could reasonably be expected to have a Material Adverse Effect, or any material adverse deviation by Borrowers from the most recent business plan of Borrowers presented to and accepted by Required Lenders, as determined by Required Lenders in their discretion.

1.cCovenant to Deliver.

(1)Borrowers agree to deliver to Agent each item required to be delivered to Agent under this Agreement as a condition precedent to any Credit Extension. Borrowers expressly agree that a Credit Extension made prior to the receipt by Agent of any such item shall not constitute a waiver of a Borrower’s obligation to deliver such item, and the making of any Credit Extension in the absence of a required item shall be in the discretion of Required Lenders.

(2)Borrower agrees to deliver the items set forth on Schedule 3 hereto within the timeframe set forth therein (or by such other date as Required Lenders may approve in writing), in each case, in form and substance reasonably acceptable to Required Lenders.

4.CREATION OF SECURITY INTEREST

1.aGrant of Security Interest. Each Borrower hereby grants Agent, for the ratable benefit of Lenders, to secure the payment and performance in full of all of the Obligations, a continuing security interest in, and pledges to Agent, for the ratable benefit of Lenders, the Collateral, wherever located, whether now owned or hereafter acquired or arising, and all proceeds and products thereof. If this Agreement is terminated, Agent’s Lien in the Collateral shall continue until the Obligations (other than contingent indemnification obligations as to which no claim has been asserted or is known to exist) are repaid in full in cash. Upon payment in full in cash of the Obligations (other than contingent indemnification obligations as to which no claim has been asserted or is known to exist) and at such time as all Commitments have terminated, Agent shall, at Borrowers’ sole cost and expense, release its Liens in the Collateral and all rights therein shall revert to the applicable Borrower.

1.bPriority of Security Interest. Each Borrower represents, warrants, and covenants that the security interest granted herein is and shall at all times continue to be a first priority perfected security interest in the Collateral (subject only to Permitted Liens that are permitted pursuant to the terms of this Agreement to have superior priority to Agent’s Lien under this Agreement). If a Borrower shall acquire a commercial tort claim with a potential recovery in excess of One Hundred Thousand Dollars ($100,000), Borrowers shall promptly notify Agent in writing and deliver such other documents as Agent may require to grant Agent a perfected security interest in such commercial tort claim. If a Borrower shall acquire a certificate with respect to Shares or any instrument, such Borrower shall promptly notify Agent and deliver the same together with a stock power or instrument of transfer and any necessary endorsement, all in form satisfactory to Agent.

1.cAuthorization to File Financing Statements. Each Borrower hereby authorizes Agent to file at any time financing statements, continuation statements and amendments thereto with all appropriate jurisdictions to perfect or protect Agent’s interest or rights hereunder. Such financing statements may describe the Collateral as all assets of such Borrower.

1.dPledge of Collateral. Each Borrower hereby pledges, assigns and grants to Agent a security interest in all the Equity Interests in which such Borrower has any interest, including the Shares, together with all proceeds and substitutions thereof, all cash, stock and other moneys and property paid thereon, all rights to subscribe for securities declared or granted in connection therewith, and all other cash and noncash proceeds of the foregoing, as security for the performance of the Obligations. On the Effective Date or as required pursuant to Section 6.11, the certificate or certificates for such Equity Interests, to the extent certificated, will be delivered to Agent, accompanied by a stock power or other appropriate instrument of assignment duly executed in blank. To the extent required by the terms and conditions governing the Equity Interests in which a Borrower has an interest, such Borrower shall cause the books of each Person whose Equity Interests are part of the Collateral and any transfer agent to reflect the pledge of the Equity Interests. Upon the occurrence and during the continuance of an Event of Default hereunder, Agent may effect the transfer of any securities included in the Collateral (including but not limited to the Equity Interests) into the name of Agent and cause new certificates representing such securities to be issued in the name of Agent or its transferee. Each Borrower will execute and deliver such documents, and take or cause to be taken such actions, as Agent may reasonably request to perfect or continue the perfection of Agent’s security interest in the Equity Interests. Unless an Event of Default shall have occurred and be continuing, each Borrower shall be entitled to exercise any voting rights with respect to the Equity Interests in which it has an interest and to give consents, waivers and ratifications in respect thereof, provided that: no such notice shall be required if a Borrower has commenced an Insolvency Proceeding and, in any event, no vote shall be cast or consent, waiver or ratification given or action taken which would be inconsistent with any of the terms of this Agreement or which would constitute or create any violation of any of such terms. All such rights to vote and give consents, waivers and ratifications shall terminate upon the occurrence and during the continuance of an Event of Default.

5.REPRESENTATIONS AND WARRANTIES

Each Borrower represents and warrants as follows:

1.aDue Organization, Authorization; Power and Authority.

(1)Each Loan Party and each of its Subsidiaries are duly existing and in good standing as a Registered Organization in their respective jurisdictions of formation and are qualified and licensed to do business and are in good standing in any other jurisdiction in which the conduct of their respective business or ownership of property require that they be qualified except where the failure to do so could not reasonably be expected to have a Material Adverse Effect. In connection with this Agreement, Borrower Representative has delivered to Agent a completed certificate signed by Borrower Representative entitled “Perfection Certificate”. Except to the extent Borrower Representative has provided notice of a legal name change to Agent in accordance with Section 7.2, (i) each Loan Party’s exact legal name is that indicated on the Perfection Certificate and on the signature page hereof; (ii) each Loan Party is an organization of the type and is organized in the jurisdiction set forth in the Perfection Certificate; (iii) the Perfection Certificate accurately sets forth each Loan Party’s organizational identification number or accurately states that such Loan Party has none; (iv) the Perfection Certificate accurately sets forth each Loan Party’s place of business, or, if more than one, its chief executive office as well as such Loan Party’s mailing address (if different than its chief executive office); (v) except as set forth in the Perfection Certificate, each Loan Party (and each of its predecessors) has not, in the past five (5) years, changed its jurisdiction of formation, organizational structure or type, or any organizational number assigned by its jurisdiction; (vi) each Subsidiary that is an MSB Subsidiary is designated as such in the Perfection Certificate; and (vii) all other information set forth on the Perfection Certificate pertaining to each Loan Party and each of its Subsidiaries is accurate and complete in all material respects (it being understood and agreed that such Loan Party may from time to time update certain information in the Perfection Certificate after the Closing Date to the extent permitted by one or more specific provisions in this Agreement).

(2)The execution, delivery and performance by each Loan Party of the Loan Documents to which it is a party have been duly authorized, and do not (i) conflict with such Loan Party’s Operating Documents or other organizational documents, (ii) contravene, conflict with, constitute a default under or violate any material Requirement of Law, (iii) contravene, conflict or violate any applicable order, writ, judgment, injunction, decree, determination or award of any Governmental Authority by which such Loan Party or any of its Subsidiaries or any of their property or assets may be bound or affected, (iv) require any action by, filing, registration, or qualification with, or Governmental Approval from, any Governmental Authority (except such Governmental Approvals which have already been obtained and are in full force and effect) or (v) conflict with, contravene, constitute a default or breach under, or result in or permit the termination or acceleration of, any material agreement by which such Loan Party is bound. No Loan Party is in default under any agreement to which it is a party or by which it is bound in which the default could reasonably be expected to have a Material Adverse Effect. No Subsidiary which is not a Loan Party owns any material Intellectual Property.

1.bCollateral.

(1)Each Loan Party has good title to, rights in, and the power to transfer each item of the Collateral upon which it purports to grant a Lien hereunder, free and clear of any and all Liens except Permitted Liens.

(2)Except for the Collateral Accounts described in the Perfection Certificate or in a notice timely delivered pursuant to Section 6.6, no Loan Party has any Collateral Accounts at or with any bank, broker or other financial institution, and each Loan Party has taken such actions as are necessary to give Agent a perfected security interest therein as required pursuant to the terms of Section 6.6(b). The Accounts are bona fide, existing obligations of the Account Debtors.

(3)The Collateral (other than mobile Equipment such as laptop computers in the possession of a Borrower’s employees or agents) is located only at the locations identified in the Perfection Certificate and other Permitted Locations. The Collateral is not in the possession of any third party bailee (such as a warehouse) except as otherwise provided in the Perfection Certificate or as disclosed in writing pursuant to Section 6.12.

(4)Each Loan Parties is the sole owners of the Intellectual Property which it owns or purports to own except for (i) licenses constituting “Permitted Transfers”, (ii) open-source software, (iii) over-the-counter software that is commercially available to the public, (iv) material Intellectual Property licensed to such Loan Party and noted on the Perfection Certificate or as disclosed pursuant to Section 6.7(b), and (v) immaterial Intellectual Property licensed to such Loan Party. Each Patent (other than patent applications) which it owns or purports to own and which is material to such Loan Party’s business is valid and enforceable, and no part of the Intellectual Property which a Loan Party owns or purports to own and which is material to the Loan Parties’ business has been judged invalid or unenforceable, in whole or in part. To the best of each Borrower’s knowledge,

no claim has been made that any part of the Intellectual Property violates the rights of any third party except to the extent such claim could not reasonably be expected to have a Material Adverse Effect. Except as noted on the Perfection Certificate or as disclosed pursuant to Section 6.7(b), no Loan Party is a party to, nor is it bound by, any Restricted License.

(5)As of the Effective Date, no Collateral consisting of promissory notes is evidenced by an original instrument, and except for the Shares of Subsidiaries, no Investments consisting of equity interests of a third person are evidenced by certificates. Except as permitted to be delivered post-closing in accordance with Section 3.3(b), all Collateral consisting of certificated securities or instruments has been delivered to Agent to be held as possessory collateral with such powers or allonges as Agent may require.

(6)All sales and other transactions underlying or giving rise to Recurring Revenue shall comply in all material respects with all applicable laws and governmental rules and regulations. To the best of Borrower’s knowledge, all signatures and endorsements on all documents, instruments, and agreements relating to all customer Accounts are genuine, and all such documents, instruments and agreements are legally enforceable in accordance with their terms. Borrower is the owner of and has the legal right to grant a security interest in each customer contract, and, there are no defenses, offsets, counterclaims or agreements for which the customer may claim any deduction or discount.

1.cAccounts; Material Agreements. The Accounts are bona fide existing obligations. The property or services giving rise to such Accounts have been delivered or rendered. No Borrower has received any written notice of actual or imminent insolvency of an account debtor. The material licenses and agreements to which any Loan Party or any of its Subsidiaries is a party is in good standing and in full force and effect and no Loan Party is in material breach with respect thereto. No material customer or supplier has terminated, significantly reduced or communicated its intent to do so to any Loan Party or any of its Subsidiaries.

1.dLitigation and Proceedings. Except as set forth in the Perfection Certificate or as disclosed in writing pursuant to Section 6.2, there are no actions, suits, litigations or proceedings, at law or in equity, pending, or, to the knowledge of any Responsible Officer, threatened in writing, by or against any Loan Party, any of its Subsidiaries or any officers or directors of the foregoing involving more than, individually or in the aggregate for all related proceedings, Two Hundred Fifty Thousand Dollars ($250,000) or in which any adverse decision has had or could reasonably be expected to have any Material Adverse Effect.

1.eFinancial Statements; Financial Condition. All consolidated and consolidating financial statements for the Loan Parties and each of their Subsidiaries delivered to Agent fairly present in all material respects the consolidated and consolidating financial condition and results of operations of the Loan Parties and each of their Subsidiaries as of the respective dates and for the respective periods then ended, and there are no material liabilities (including any contingent liabilities) which are not reflected in such financial statements. There has not been any material deterioration in the consolidated and consolidating financial condition of the Loan Parties and each of its Subsidiaries or the Collateral since the date of the most recent financial statements submitted to Agent.

1.fSolvency. The fair salable value of the assets (including goodwill minus disposition costs) of the Loan Parties and each of their Subsidiaries, on a consolidated basis, exceeds the fair value of liabilities of the Loan Parties’ and each of their Subsidiaries, on a consolidated basis; no Loan Party is left with unreasonably small capital after the transactions in this Agreement; and each Loan Party is able to pay its debts (including trade debts) as they mature.

1.gConsents; Approvals. Each Loan Party and each of its Subsidiaries have obtained all third party or governmental consents, licenses, approvals, waivers of any, made all declarations or filings with, and given all notices to, all Governmental Authorities that are necessary (i) to enter into the Loan Documents and consummate the transactions contemplated thereby, and (ii) to continue their respective businesses as currently conducted, except (with respect to this clause (ii)) where failure to do so could not reasonably be expected to result in a Material Adverse Effect.

1.hSubsidiaries; Investments. No Loan Party has any Subsidiaries, except as noted on the Perfection Certificate or as disclosed to Agent pursuant to Section 6.11 below. No Loan Party owns any stock, partnership, or other ownership interest or other Equity Interests except for Permitted Investments.

1.iTax Returns and Payments. Each Loan Party and each of its Subsidiaries have timely filed all required tax returns and reports (or appropriate extensions therefor), and such Loan Party and each of its Subsidiary has timely paid all foreign, federal, state and local taxes, assessments, deposits and contributions owed such Subsidiary or such Subsidiary, as applicable, except (a) to the extent such taxes are being contested in good faith by appropriate proceedings promptly instituted and diligently conducted, so long as such reserve or other appropriate provision, if any, as shall be required in conformity with GAAP shall have been made therefor, or (b) if such taxes, assessments, deposits and contributions do not, individually or in the aggregate, exceed Ten Thousand Dollars

($10,000). No Borrower is aware of any claims or adjustments proposed for any prior tax years of any Borrower or any of its Subsidiaries which could result in a material amount of additional taxes becoming due and payable by a Borrower or any of its Subsidiary.

1.jShares. Such Borrower has full power and authority to create a first lien on the Shares and no disability or contractual obligation exists that would prohibit such Borrower from pledging the Shares pursuant to this Agreement. There are no subscriptions, warrants, rights of first refusal or other restrictions on transfer relative to, or options exercisable with respect to the Shares. The Shares have been and will be duly authorized and validly issued, and are fully paid and non-assessable. The Shares are not the subject of any present or threatened suit, action, arbitration, administrative or other proceeding, and such Borrower knows of no reasonable grounds for the institution of any such proceedings.

1.kCompliance with Laws.

(1)No Loan Party or Subsidiary of Loan Party is an “investment company” or an “affiliated person” of, or “promoter” or “principal underwriter” for, an “investment company”, as such terms are defined in the Investment Company Act of 1940 as amended.

(2)No Loan Party or Subsidiary of a Loan Party is engaged, nor will it engage, principally or as one of its important activities, in the business of extending credit for the purpose of “purchasing” or “carrying” any “margin security” as such terms are defined in Regulation U of the Federal Reserve Board as now and from time to time hereafter in effect (such securities being referred to herein as “Margin Stock”). None of the proceeds of the Credit Extensions or other extensions of credit under this Agreement have been (or will be) used, directly or indirectly, for the purpose of purchasing or carrying any Margin Stock, for the purpose of reducing or retiring any Indebtedness which was originally incurred to purchase or carry any Margin Stock or for any other purpose which might cause any of the Credit Extensions or other extensions of credit under this Agreement to be considered a “purpose credit” within the meaning of Regulation T, U or X of the Federal Reserve Board. None of the proceeds of the Credit Extensions or other extensions of credit under this Agreement have been (or will be) used to fund Investments in Expensify Payments.

(3)No Loan Party has taken or permitted to be taken any action which might cause any Loan Document to violate any regulation of the Federal Reserve Board. Neither the making of the Credit Extensions by the Lenders hereunder nor Borrowers’ use of the proceeds thereof will violate the Trading with the Enemy Act, as amended, or any of the foreign assets control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended) or any enabling legislation or executive order relating thereto. No Loan Party, nor any of its Subsidiaries, nor any Affiliate of any Loan Party or of any Subsidiary, nor any present holder of Equity Interests of any of the foregoing (i) is, or will become, a Person described or designated in the Specially Designated Nationals and Blocked Persons List of the Office of Foreign Assets Control of the United States Department of Treasury (“OFAC”) or in Section 1 of the Anti-Terrorism Order or similar sanctions laws of any other Governmental Authority (“Sanctions”), (ii) is, or will become, a citizen or resident of any country that is subject to embargo or trade sanctions enforced by OFAC, (iii) is, or will become, a Person whose property or interest in property is blocked or subject to blocking pursuant to applicable Sanctions, or (iv) engages or will engage in any dealings or transactions, or is or will be otherwise associated, with any such Person. Each Loan Party and its Subsidiaries are in compliance, in all material respects, with the USA Patriot Act, and any applicable laws or regulations in any jurisdiction in which any Loan Party or any of its Subsidiaries or Affiliates is located or is doing business that relates to money laundering, any predicate crime to money laundering, or any financial record keeping and reporting requirements related thereto (“Anti-Money Laundering Laws”). No part of the proceeds from the Credit Extensions made hereunder has been (or will be) used, directly or indirectly, for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of applicable Anti-Corruption Laws. Borrower Representative and each applicable Subsidiary has implemented policies and procedures (including know-your-customer verifications) reasonably designed to ensure compliance with applicable Sanctions, Anti-Money Laundering Laws and Anti-Corruption Laws.

(4)No Reportable Event or Prohibited Transaction, as defined in ERISA has occurred or is reasonably expected to occur, and no Loan Party has failed to meet the minimum funding requirements of ERISA. No Loan Party has violated any applicable environmental laws in any material respect, maintains any properties or assets which have been designated in any manner pursuant to any environmental protection statute as a hazardous materials disposal site, or has received any notice, summons, citation or directive from the Environmental Protection Agency or any other similar Governmental Authority.

1.lBroker. No Person has any agreement or option to provide financial advisory services to any Loan Party or any of its Subsidiaries or to receive any finder’s fee or similar fee with respect to this Agreement or any other debt or equity transaction entered into by a Loan Party.

1.mFull Disclosure. No written representation, warranty or other statement of a Loan Party or any of its Subsidiaries in any certificate or written statement given to Agent by or on behalf of a Loan Party or any of its Subsidiaries, as of the date such representation, warranty, or other statement was made, taken together with all such written certificates and written statements given to, contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements contained in the certificates or statements not misleading in light of the circumstances under which they were made (it being recognized that the projections and forecasts provided by any Loan Party in good faith and based upon reasonable assumptions are not viewed as facts and that actual results during the period or periods covered by such projections and forecasts may differ from the projected or forecasted results).

6.AFFIRMATIVE COVENANTS

Each Borrower shall, and shall cause each Loan Party to, do all of the following:

1.aGovernment Compliance. Maintain its and all its Subsidiaries’ legal existence and good standing in their respective jurisdictions of formation and maintain qualification in each jurisdiction in which the failure to so qualify could reasonably be expected to have a Material Adverse Effect; comply, and cause each Subsidiary to comply, with all laws, ordinances and regulations to which it is subject except where a failure to do so could not reasonably be expected to have a Material Adverse Effect; obtain all of the Governmental Approvals required in connection with such Loan Party’s business and for the performance by each Loan Party of its obligations under the Loan Documents to which it is a party and the grant of a security interest to Agent in all of its property, and comply with all terms and conditions with respect to such Governmental Approvals.

1.bFinancial Statements, Reports, Certificates. Provide Agent with the following:

(1)[Reserved]

(2)Quarterly Compliance Certificate. Within forty five (45) days after the last day of each fiscal quarter and together with the quarterly financial statements, a duly completed Compliance Certificate signed by a Responsible Officer, certifying that as of the end of such fiscal quarter, the Loan Parties were in full compliance with all of the terms and conditions of this Agreement, and, if applicable, setting forth calculations showing compliance with the financial covenants set forth in this Agreement and such other information as Agent may reasonably request (including at the direction of Required Lenders).

(3)Quarterly Financial Statements. Within forty-five (45) days after the last day of each fiscal quarter, a company prepared consolidated and consolidating balance sheet, income statement and statement of cash flows covering the Loan Parties and each of their Subsidiaries’ operations for such fiscal quarter, in form acceptable to Agent, certified by a Responsible Officer as having been prepared in accordance with GAAP, consistently applied, except for the absence of footnotes, and subject to normal year-end adjustments.

(4)Annual Operating Budget and Financial Projections. Within sixty (60) days after the end of each fiscal year of Borrower Representative (and promptly and within five (5) days of any material modification thereto), an annual operating budgets, on a consolidating basis (including income statements, balance sheets and cash flow statements, by month) for the upcoming fiscal year of Borrower Representative, as approved by Borrower Representative’s Board, together with any related business forecasts used in the preparation of such annual financial projections.

(5)Annual Audited Financial Statements. As soon as provided to Borrower Representative’s lead investor, but in no event later than one hundred twenty (120) days after the last day of Borrower Representative’s fiscal year, audited consolidated financial statements prepared in accordance with GAAP, consistently applied, together with an unqualified opinion on the financial statements from an independent certified public accounting firm reasonably acceptable to Agent, together with any management letter with respect thereto.

(6)Other Statements. Within five (5) days of delivery, copies of all statements, reports and notices generally made available to all Borrower Representative’s Equity Interest holders or to all holders of Borrower Representative’s preferred stock or to any holders of Subordinated Debt.

(7)SEC Filings. In the event that Borrower Representative becomes subject to the reporting requirements under the Exchange Act within five (5) days of filing, copies of all periodic and other reports, proxy statements and other materials filed by Borrower Representative with the Securities and Exchange Commission.

(8)Legal Action Notice and Updates. A prompt report of any legal actions pending or threatened in writing against any Loan Party or any of its Subsidiaries that could result in damages or costs to any Loan Party or any of its Subsidiaries of, individually or in the aggregate for all related proceedings, Two Hundred

Fifty Thousand Dollars ($250,000) or more, or of any Loan Party or any of its Subsidiaries taking or threatening legal action against any third person with respect to a material claim, and with respect to any pending action or threatened action, a prompt report of any material development with respect thereto.

(9)[Reserved]

(10)[Reserved]

(11)Intellectual Property Report. Together with the Compliance Certificate delivered at the end of each calendar quarter, a report in form reasonably acceptable to Agent, listing any applications or registrations that any Loan Party or any of its Subsidiaries has made or filed in respect of any Patents, Copyrights or Trademarks and the status of any outstanding applications or registrations, as well as any material change in any Loan Party or any of its Subsidiaries’ Intellectual Property.

(12)Other Reports and Information. Together with the quarterly financial reports, reports as to the following, in form acceptable to Agent: accounts receivable and accounts payable aging, general ledger, and any other information related to the financial or business condition of any Loan Party as and when reasonably requested by Agent (including at the direction of Required Lenders).

(13)Bank Account Balances. At the end of each fiscal quarter, a report in form reasonably satisfactory to Agent, of all bank balances for each Collateral Account maintained by Borrower Representative and each of its Subsidiaries, which report shall indicate for each Collateral Account if an Account Control Agreement is in effect with respect thereto and for any Collateral Account of a Loan Party that is not subject to an Account Control Agreement, the basis for exemption, together with, at Agent’s request, a copy of associated account statements, with transaction detail.

1.cEquipment; Inventory; Returns. Keep all Equipment in good operating condition and in a state of good maintenance and repair subject to the usual wear and tear; and keep all Inventory in good marketable condition, free from material defects. Returns and allowances between a Loan Party and its Account Debtors shall follow such Loan Party’s customary practices as they exist at the Closing Date. Borrower Representative shall promptly notify Agent of all returns, recoveries, disputes and claims that involve more than Two Hundred Fifty Thousand Dollars ($250,000).

1.dTaxes; Pensions. Timely file, and cause each of its Subsidiaries to timely file, all required tax returns and reports and timely pay, and require each of its Subsidiaries to timely pay, all foreign, federal, state and local taxes, assessments, deposits and contributions owed by such Loan Party and each of its Subsidiaries, except for deferred payment of any taxes contested pursuant to the terms of Section 5.8, and shall deliver to Agent, on demand, appropriate certificates attesting to such payments, and pay all amounts necessary to fund all present pension, profit sharing and deferred compensation plans in accordance with their terms.

1.eInsurance.

(1)Keep, and cause each Subsidiary to keep, its business and the Collateral insured for risks and in amounts standard for companies in the Loan Parties’ industry and location and as Required Lenders may reasonably request. Insurance policies shall be in a form, with financially sound and reputable insurance companies that are not Affiliates of any Loan Party, and in amounts that are reasonably satisfactory to Required Lenders.

(2)Ensure that proceeds payable under any property policy with respect to Collateral or key man insurance are, at Agent’s option, payable to Agent, for the ratable benefit of Lenders, on account of the Obligations. To that end, all property policies shall have a lender’s loss payable endorsement showing Agent as lender loss payee, all liability policies shall show, or have endorsements showing, Agent as an additional insured, in each case, in form satisfactory to Agent and as set forth on Exhibit D.

(3)Notwithstanding the foregoing, (a) so long as no Default or Event of Default has occurred and is continuing, the Loan Parties shall have the option of applying the proceeds of any casualty policy up to Five Hundred Thousand Dollars ($500,000), in the aggregate per fiscal year, toward the prompt replacement or repair of destroyed or damaged property; provided that any such replaced or repaired property shall be deemed Collateral in which Agent has been granted a first priority security interest and (b) after the occurrence and during the continuance of an Event of Default, all such proceeds shall, at the option of Required Lenders, be payable to Agent, for the ratable benefit of Lenders, on account of the Obligations.

(4)At Agent’s request, Borrower Representative shall deliver certified copies of insurance policies and evidence of all premium payments. Each provider of any such insurance required under this Section 6.5 shall agree, by endorsement upon the policy or policies issued by it or by independent instruments furnished to

Agent, that it will give Agent thirty (30) days prior written notice before any such policy or policies shall be canceled (or ten (10) days’ notice for cancellation for non-payment of premiums).

(5)If any Loan Party fails to obtain insurance as required under this Section 6.5 or to pay any amount or furnish any required proof of payment to third persons and Agent, Agent may make all or part of such payment or obtain such insurance policies required in this Section 6.5, and take any action under the policies Agent deems prudent, or as Required Lenders may direct.

1.fDeposit and Securities Accounts.

(1)Maintain, and cause each Subsidiary to maintain, (i) at all times through and including June 29, 2024, 45%, and from June 30, 2024 and (ii) at all times thereafter, 65%, of all unrestricted cash and Cash Equivalents of Borrower Representative and its Subsidiaries, with CIBC or CIBC USA, and maintain Collateral Accounts only as set forth on the Perfection Certificate, or as disclosed pursuant to a notice timely delivered pursuant to subsection (b) below. Notwithstanding the foregoing, balances constituting funds held for the benefit of customers, and balances maintained in accordance with clauses (e)(i) and (ii) of the defined term “Permitted Investments” shall be disregarded for purposes of the above percentage calculation.

(2)For each Collateral Account that any Loan Party at any time maintains, Borrowers shall cause such Collateral Account to be subject to an Account Control Agreement, which Account Control Agreement may not be terminated without the prior written consent of Agent, provided that the Account Control Agreements specified on Schedule 3 hereto may be delivered following the Effective Date within the timeframe specified therein. Notwithstanding the foregoing, the requirement to maintain Account Control Agreements shall not apply to

(a)Collateral Accounts designated as excluded to Agent in writing from time to time, provided that the aggregate balance of such Collateral Accounts, (x) with respect to Collateral Accounts maintained in Australia or United Kingdom, shall not exceed $3,000,000, and (y) with respect to Collateral Accounts maintained in any other jurisdiction, shall not exceed $500,000, in each case, at any time;

(b)Collateral Accounts used exclusively to maintain Permitted Cash Collateral;

(c)Collateral Accounts used exclusively to maintain balances invested in accordance with clause (e) of the defined term “Permitted Investments; and

(d)Collateral Accounts used exclusively to maintain funds in trust for customers, including in connection with expense reimbursement processing services provided to customers, in each case, which accounts have been identified as such to Agent in writing as such,

(3)Notwithstanding anything to the contrary set forth herein, Borrowers shall not permit any CIBC Collateral Account to be used for third party payment processing activity or any other MSB Subsidiary activity, and to the extent necessary to comply with this clause (c), any MSB Subsidiary shall be permitted to maintain Collateral Accounts with other depository institutions.

1.gIntellectual Property.

(1)Protect, defend and maintain the validity and enforceability of its Intellectual Property material to its business; promptly advise Agent in writing of material infringements or any other event that could reasonably be expected to materially and adversely affect the value of its Intellectual Property material to its business; not suffer any material claim of infringement that could reasonably be expected to have a Material Adverse Effect unless such claim is dismissed within thirty days from initiation thereof or Borrowers have demonstrated to the satisfaction of Required Lenders that such proceedings are without merit and adequate reserves have been taken; and not allow any Intellectual Property material to the Loan Parties’ business to be abandoned, forfeited or dedicated to the public without written consent of Required Lenders.

(2)If any Loan Party (i) obtains any Patent, registered Trademark, registered Copyright, registered mask work, or any pending application for any of the foregoing, whether as owner or licensee, or (ii) applies for any Patent or the registration of any Trademark, then Borrower Representative shall promptly provide written notice thereof to Agent and shall execute such intellectual property security agreements and other documents and take such other actions as Agent may request to perfect and maintain a first priority perfected security interest in favor of Agent in such property. If a Loan Party decides to register any Copyrights or mask works in the United States Copyright Office, Borrower Representative shall: (x) provide Agent with at least fifteen (15) days prior written notice of such Loan Party’s intent to register such Copyrights or mask works together with a copy of the application it intends to file with the United States Copyright Office (excluding exhibits thereto); (y) execute an

intellectual property security agreement and such other documents and take such other actions as Agent may request to perfect and maintain a first priority perfected security interest in favor of Agent in the Copyrights or mask works intended to be registered with the United States Copyright Office; and (z) record such intellectual property security agreement with the United States Copyright Office contemporaneously with filing the Copyright or mask work application(s) with the United States Copyright Office. Borrower Representative shall promptly provide to Agent copies of all applications that it files for Patents or for the registration of Trademarks, Copyrights or mask works, together with evidence of the recording of the intellectual property security agreement required for Agent to perfect and maintain a first priority perfected security interest in such property.

(2)Provide written notice to Agent within ten (10) days of any Loan Party entering or becoming bound by any Restricted License (other than off the shelf software and services that are commercially available to the public). Each Borrower shall, and shall cause each Loan Party to, take such steps as Agent requests to obtain the consent of, or waiver by, any person whose consent or waiver is necessary for (i) any Restricted License to be deemed “Collateral” and for Agent to have a security interest in it that might otherwise be restricted or prohibited by law or by the terms of any such Restricted License, whether now existing or entered into in the future, and (ii) Agent to have the ability in the event of a liquidation of any Collateral to dispose of such Collateral in accordance with Agent’s rights and remedies under this Agreement and the other Loan Documents.

1.hLitigation Cooperation. From the Closing Date and continuing through the termination of this Agreement, make available to any Secured Party, without expense to such Secured Party, each Loan Party and its officers, employees and agents and each Loan Party’s books and records, to the extent that such Secured Party may deem them reasonably necessary to prosecute or defend any third-party suit or proceeding instituted by or against such Secured Party with respect to any Collateral or relating to such Loan Party.

1.iAccess to Collateral; Books and Records. Allow Agent, or its agents, to inspect the Collateral and audit and copy such Loan Party’s Books in accordance with Section 6.13. Such inspections or audits shall occur during Borrower’s usual business hours and upon at least five (5) business days’ prior written notice and be conducted no more often than once every twelve (12) months, unless an Event of Default has occurred and is continuing in which case such inspections and audits shall occur as often and at such times as Agent shall determine is necessary. The foregoing inspections and audits shall be at Borrowers’ expense.

1.jFinancial Covenants.

(1)From the Effective Date to but excluding March 31, 2025, the following financial covenants shall apply: The Liquidity Coverage Ratio shall at all times be no less than (i) for the period commencing on the Effective Date through and including June 29, 2024, 1.10 to 1.00, and (ii) from June 30, 2024 through but excluding March 31, 2025, 1.20 to 1.00, in each case, tested on the last day of each fiscal quarter.

(a)From and including March 31, 2025 and at all times thereafter, the following financial covenants shall apply: Total EBITDA Net Leverage Ratio shall not exceed 2.50 to 1.00, tested on the last day of each fiscal quarter;

1.kSubsidiary Matters.

(1)No later than thirty (30) days after such time as (a) a Loan Party or any of its Subsidiaries forms or acquires any direct or indirect Subsidiary (other than an MSB Subsidiary), or if any Subsidiary ceases to qualify as an Excluded Subsidiary pursuant to clause (c) of the defined term “Excluded Subsidiary”, Borrower Representative shall notify Agent thereof, and shall provide such details as Agent may reasonably request, and at the request of Agent, shall cause such Subsidiary to (x) enter into a joinder to this Agreement to become a co-borrower hereunder, or enter into a Guaranty with respect to the Obligations, together with such collateral security documents and related filings, all in form and substance satisfactory to Agent and sufficient to grant Agent a first priority Lien (subject to Permitted Liens) in and to all assets of such Subsidiary, (y) promptly, and in any event within five (5) days of the formation or acquisition or Agent’s request, provide certified copies of the Operating Documents for such Subsidiary and (z) provide to Agent all other documentation in form and substance satisfactory to Agent, including one or more opinions of counsel satisfactory to Agent, which in its opinion is appropriate with respect to the execution and delivery of such joinder, guaranty or security documents. Any document, agreement, or instrument executed or issued pursuant to this Section 6.11 shall be a Loan Document. Notwithstanding the foregoing, any Excluded Subsidiary shall not be required to become a Loan Party pursuant to the foregoing, subject to any conditions applicable thereto set forth in the defined term “Excluded Subsidiary”.

(2)Not permit Subsidiaries which are not Loan Parties (including all MSB Subsidiaries), together, (i) to maintain cash and other assets having an aggregate value in excess of ten percent (10.0%) of consolidated assets of Borrower Representative, and its Subsidiaries, on a consolidated basis (provided that for the period through and including June 29, 2024, the foregoing limit shall be increased to twenty percent (20%)), and each such Subsidiary, individually, to maintain cash and other assets having an aggregate value in excess of five

percent (5.0%) of consolidated assets of Borrower Representative, and its Subsidiaries, on a consolidated basis (provided that for the period through and including June 29, 2024, the foregoing limit shall be increased, with respect to Expensify Ltd. to ten (10%)), in each case, tested as of the last day of each fiscal quarter, provided that, for purposes of the foregoing, (x) the assets of the Real Estate SPV, (y) with respect to MSB Subsidiaries, any customer held funds, funds held by FBO customers and any funds held in trust as required by banking partners shall be disregarded, and (z) any assets or liabilities constituting intercompany loans or balances shall be disregarded, (ii) to contribute more than ten percent (10.0%) to consolidated revenue of Borrower Representative and its Subsidiaries consolidated revenue or EBITDA, and each such Subsidiary, individually, not contribute more than five percent (5.0%) to consolidated revenue of Borrower Representative and its Subsidiaries consolidated revenue or EBITDA, in each case, tested on a quarterly basis for the then-most recent quarter, provided that for purposes of this clause (ii), revenue arising from intercompany transactions shall be disregarded, or (iii) to own any Intellectual Property that is material to the business of Borrower Representative and its Subsidiaries as a whole.

(3)Cause each MSB Subsidiary to (i) not conduct any business or have any operations except as necessary to maintain legal existence, maintain money transmitter licenses and other activities ancillary thereto (including, but not limited to, the transmission of funds on behalf of Borrower or its customers), (ii) have no material assets except for (x) proceeds from Investments made in accordance with Section 7.12 and clause (d) in the defined term “Permitted Investments”, which are maintained as restricted cash in connection with money transmitter licenses, or funds held in a trust account on behalf of customers, and (y) money transmitter licenses, (iv) not have any revenue, provided that the foregoing shall not restrict such MSB Subsidiary from contributing to revenue generation by a Borrower and (v) not have any Subsidiaries. No Loan Party shall guaranty or otherwise be liable for or provide collateral security or other credit support for Indebtedness of an MSB Subsidiary, and no MSB Subsidiary shall guaranty or otherwise be liable for or provide collateral security or other credit support for Indebtedness of a Loan Party, in each case, directly or indirectly. At Agent’s request, Borrower Representative shall provide evidence and supporting calculations satisfactory to Agent demonstrating compliance with the foregoing.

1.lProperty Locations.

(1)Provide to Agent at least ten (10) days’ prior written notice before adding any new offices or business or Collateral locations, including warehouses (unless such new offices or business or Collateral locations qualify as Excluded Locations).