0001817004

false

0001817004

2023-08-22

2023-08-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 22, 2023

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2999

NE 191st Street, Aventura, Florida 33180

(Address

of principal executive offices, including Zip Code)

305-791-1169

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

August 23, 2023, EzFill Holdings, Inc. (the “Company” or “Borrower”) and Next Charging, LLC (“Next”)

entered into a promissory note (the “Note”) for the sum of $110,000 (the “Loan”). The Note has an original issue

discount (“OID”) equal to $10,000, which is 10% of the aggregate original principal amount of the Loan. The unpaid principal

balance of the Note has a fixed rate of interest of 8% per annum for the first nine months, afterward, the Note will begin to accrue

interest on the entire balance at 18% per annum. Michael Farkas is the managing member of Next (the “Managing Member”).

The Managing Member is also the beneficial owner of approximately 24% of the Company’s issued and outstanding common stock. Additionally

and as previously reported on a Current Report on Form 8-K that was filed with he Securities and exchange Commission on August 16, 2023,

on August 10, 2023, the Company, the members (the “Members”) of Next and its Managing

Member, as an individual and also as the representative of the Members, entered into an Exchange Agreement (the “Exchange Agreement”),

pursuant to which the Company agreed to acquire from the Members 100% of the membership interests of Next Charging in exchange for

the issuance by the Company to the Members of shares of common stock, par value $0.0001 per share, of the Company. Upon consummation

of the transactions contemplated by the Exchange Agreement (the “Closing”), Next Charging will become a wholly-owned subsidiary

of the Company. As of the date of this Current Report on Form 8-K, the Closing has not occurred.

The

Note, along with accrued interest, will be due on October 23, 2023 (the “Maturity Date”). The Maturity Date will automatically

be extended for 2 month periods, unless Next sends 10 days written notice, prior to end of any two month period, that it does not wish

to extend the note, at which point the end of the then current two month period shall be the Maturity Date. Notwithstanding the forgoing,

upon the Company completing a capital raise of at least $3,000,000, then the entire outstanding principal and interest through the Maturity

Date will be immediately due.

Unless

this Note is otherwise accelerated, or extended in accordance with the terms and conditions hereof, the entire outstanding principal

balance of this Note plus all accrued interest shall be due and payable in full on October 23, 2023 (the “Maturity Date”).

The Maturity Date shall automatically be extended for 2-month periods, unless Lender sends 10 days written notice, prior to end of any

two month period, that it does not wish to extend the note at which point the end of the then current two month period shall be the Maturity

Date. Notwithstanding the above, upon Borrower completing a capital raise (debt or equity) of at least $3,000,000 the entire outstanding

principal and interest through the Maturity Date shall be immediately due and payable.

If

the Company defaults on the Note, (i) the unpaid principal and interest sums, along with all other amounts payable, multiplied by 150%

will be immediately due, and (ii) Next has the right to convert all or any part of the outstanding and unpaid principal, interest, penalties,

and all other amounts under the Note into fully paid and non-assessable shares of the Company’s common stock. The conversion price

will be the average closing price over the 10 trading days ending on the date of conversion.

The

information set forth above is qualified in its entirety by reference to the Note, which is incorporated herein by reference and attached

hereto as Exhibit 4.1.

Item

2.02 Results of Operations and Financial Condition

On

August 22, 2023, EzFill Holdings, Inc. (the “Company”), issued a press release announcing its financial results for the quarter

ended June 30, 2023. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

This

information is being furnished in this report and shall not be deemed to be “filed” for any purpose, including for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

To

the extent required by this Item 2.03, the information contained in Item 1.01 is incorporated herein by reference.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EZFILL

HOLDINGS, INC. |

| |

|

| Date:

August 24, 2023 |

By: |

/s/

Yehuda Levy |

| |

Name: |

Yehuda

Levy |

| |

Title: |

Interim

Chief Executive Officer |

Exhibit

4.1

PROMISSORY

NOTE

FOR

VALUE RECEIVED, EZFILL HOLDINGS, INC., a Delaware corporation having an address of 2999 NE 191st St, Ste 500, Aventura, Florida

33180 (the “Borrower”), hereby promises to pay to the order of, the Next Charging, LLC. a Florida company having an

address of 407 Lincoln Road, Ste 701, Miami Beach, Fl. 33139 (the “Lender”), at Lender’s offices, or such other

place as Lender shall designate in writing from time to time, the principal sum of $110,000.00 (the “Loan”), in US

Dollars, together with interest thereon as hereinafter provided.

1. ORIGINAL

ISSUE DISCOUNT. The Borrower agrees that the funding of the Loan shall be made by the Lender with original issue discount in

an amount equal to 10% of the aggregate original principal amount of the Loan (i.e. $10,000).

2. INTEREST

RATE. The unpaid principal balance of this Promissory Note (the “Note”) from day to day outstanding shall

bear a fixed rate of interest equal to 8% per annum for the first nine months and after the first nine months will begin to accrue interest

on the entire balance at 18% per annum.

3. PREVIOUS

NOTE. The disbursement of funds on the note entered into by the Borrower and Lender on August second has been completed. This

Note is for additional funds.

4. PAYMENT

OF PRINCIPAL AND INTEREST. Unless this Note is otherwise accelerated, or extended in accordance with the terms and conditions

hereof, the entire outstanding principal balance of this Note plus all accrued interest shall be due and payable in full on October 23,

2023 (the “Maturity Date”). The Maturity Date shall automatically be extended for 2 month periods, unless Lender sends

10 days written notice, prior to end of any two month period, that it does not wish to extend the note at which point the end of the

then current two month period shall be the Maturity Date. Notwithstanding the above, upon Borrower completing a capital raise (debt or

equity) of at least $3,000,000 the entire outstanding principal and interest through the Maturity Date shall be immediately due and payable.

5. APPLICATION

OF PAYMENTS. Except as otherwise specified herein, each payment or prepayment, if any, made under this Note shall be applied

to pay late charges, accrued and unpaid interest, principal, and any other fees, costs and expenses which Borrower is obligated to pay

under this Note.

6. TENDER

OF PAYMENT. Payment on this Note is payable on or before 5:00 p.m. on the due date thereof, at the office of Lender specified

above and shall be credited on the date the funds become available, in Lender’s account, in lawful money of the United States.

7. REPRESENTATIONS AND WARRANTIES. Borrower represents and warrants to Lender as follows:

7.2. Execution

of Loan Documents. This Note has been duly executed and delivered by Borrower. Execution, delivery and performance of this Note

will not: (i) violate any contracts previously entered into by Borrower, provision of law, order of any court, agency or other instrumentality

of government, or any provision of any indenture, agreement or other instrument to which he is a party or by which he is bound; (ii)

result in the creation or imposition of any lien, charge or encumbrance of any nature; and (iii) require any authorization, consent,

approval, license, exemption of, or filing or registration with, any court or governmental authority.

7.3. Obligations

of Borrower. This Note is a legal, valid and binding obligation of Borrower, enforceable against him in accordance with its terms,

except as the same may be limited by bankruptcy, insolvency, reorganization or other laws or equitable principles relating to or affecting

the enforcement of creditors’ rights generally.

7.4. Litigation. There

is no action, suit or proceeding at law or in equity or by or before any governmental authority, agency or other instrumentality now

pending or, to the knowledge of Borrower, threatened against or affecting Borrower or any of its properties or rights which, if

adversely determined, would materially impair or affect: (i) Borrower’s right to carry on its business substantially as now

conducted (and as now contemplated); (ii) its financial condition; or (iii) its capacity to consummate and perform its obligations

under this Note.

7.5. No

Defaults. Borrower is not in default in the performance, observance or fulfillment of any of the obligations, covenants or conditions

contained herein or in any material agreement or instrument to which he is a party or by which he is bound.

7.6. No

Untrue Statements. No document, certificate or statement furnished to Lender by or on behalf of Borrower contains any untrue

statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein and therein

not misleading. Borrower acknowledges that all such statements, representations and warranties shall be deemed to have been relied upon

by Lender as an inducement to make the Loan to Borrower.

7.7. Documentary

and Intangible Taxes. Borrower shall be liable for all documentary stamp and intangible taxes assessed at the closing of the

Loan or from time to time during the life of the Loan.

7.8. The loan funds shall be used solely for Borrower’s working capital needs.

8. EVENTS

OF DEFAULT. Each of the following shall constitute an event of default hereunder (an “Event of Default”):

(a) the failure of Borrower to pay any amount of principal or interest hereunder with three (3) business days from when it becomes due

and payable; (b) Borrower becoming insolvent or declaring bankruptcy; (c) the discovery that any of the Borrower representations were

untrue; or (d) the occurrence of any other default in any material term, covenant or condition hereunder, and the continuance of such

breach for a period of ten (10) days after written notice thereof shall have been given to Borrower. Borrower shall promptly notify Lender

of the occurrence of any default, Event of Default, adverse litigation or material adverse change in its financial condition.

If

an Event of Default occurs, (i) all sums of Principal and Interest and all other amounts payable hereunder multiplied by 150% the then

remaining unpaid hereon shall be immediately due and payable, and (ii) The Lender shall have the right to convert all or any part of

the outstanding and unpaid principal, interest, penalties, and all other amounts under this Note into fully paid and non-assessable shares

of Common Stock. The conversion price shall be the average closing price over the 10 trading days ending on the date of conversion.

9. REMEDIES.

If an Event of Default exists, Lender may exercise any right, power or remedy permitted by law or as set forth herein, including, without

limitation, the right to declare the entire unpaid principal amount hereof and all interest accrued hereon, to be, and such principal,

interest and other sums shall thereupon become, immediately due and payable.

10. MISCELLANEOUS.

10.2. Disclosure

of Financial Information. Lender is hereby authorized to disclose any financial or other information about Borrower to any regulatory

body or agency having jurisdiction over Lender and to any present, future or prospective participant or successor in interest in any

loan or other financial accommodation made by Lender to Borrower, so long as there is a mandatory requirement to provide such disclosure.

The information provided may include, without limitation, amounts, terms, balances, payment history, return item history and any financial

or other information about Borrower.

10.3. Integration.

This Note constitutes the sole agreement of the parties with respect to the transaction contemplated hereby and supersede all oral negotiations

and prior writings with respect thereto.

10.4. Borrower’s

Obligations Absolute. The obligations of Borrower under this Note shall be absolute and unconditional and shall remain in full

force and effect without regard to, and shall not be released, suspended, discharged, terminated or otherwise affected by, any circumstance

or occurrence whatsoever, including, without limitation:

10.4.1. any

renewal, extension, amendment or modification of, or addition or supplement to or deletion from, this Note, or any other instrument or

agreement referred to therein, or any assignment or transfer of any thereof;

10.4.2. any

waiver, consent, extension, indulgence or other action or inaction under or in respect of any such agreement or instrument or this Note;

10.4.3. any

furnishing of any additional security to the Borrower or its assignee or any acceptance thereof or any release of any security by the

Lender or its assignee; or

10.4.4. any

limitation on any party’s liability or obligations under any such instrument or agreement or any invalidity or unenforceability,

in whole or in part, of any such instrument or agreement or any term thereof.

10.5. No

Implied Waiver. Lender shall not be deemed to have modified or waived any of its rights or remedies hereunder unless such modification

or waiver is in writing and signed by Lender, and then only to the extent specifically set forth therein. A waiver in one event shall

not be construed as continuing or as a waiver of or bar to such right or remedy in a subsequent event. After any acceleration of, or

the entry of any judgment on, this Note, the acceptance by Lender of any payments by or on behalf of Borrower on account of the indebtedness

evidenced by this Note shall not cure or be deemed to cure any Event of Default or reinstate or be deemed to reinstate the terms of this

Note absent an express written agreement duly executed by Lender and Borrower.

10.6. No

Usurious Amounts. Notwithstanding anything herein to the contrary, it is the intent of the parties that Borrower shall not be

obligated to pay interest hereunder at a rate which is in excess of the maximum rate permitted by law (the “Maximum Rate”).

If by the terms of this Note, Borrower is at any time required to pay interest at a rate in excess of the Maximum Rate, the rate of interest

under this Note shall be deemed to be immediately reduced to the Maximum Rate and the portion of all prior interest payments in excess

of the Maximum Rate shall be applied to and shall be deemed to have been payments in reduction of the outstanding principal balance,

unless Borrower shall notify Lender, in writing, that Borrower elects to have such excess sum returned to it forthwith. Borrower agrees

that in determining whether or not any interest payable under this Note exceeds the Maximum Rate, any non-principal payment, including,

without limitation, late charges, shall be deemed to the extent permitted by law to be an expense, fee or premium rather than interest.

10.7. Partial

Invalidity. The invalidity or unenforceability of any one or more provisions of this Note shall not render any other provision

invalid or unenforceable. In lieu of any invalid or unenforceable provision, there shall be automatically added hereto a valid and enforceable

provision as similar in terms to such invalid or unenforceable provision as may be possible.

10.8. Binding

Effect. The covenants, conditions, waivers, releases and agreements contained in this Note shall bind, and the benefits thereof

shall inure to, the parties hereto and their respective heirs, executors, administrators, successors and assigns; provided, however,

that this Note cannot be assigned by Borrower without the prior written consent of Lender, and any such assignment or attempted assignment

by Borrower shall be void and of no effect with respect to Lender.

10.9. Modifications.

This Note may not be supplemented, extended, modified or terminated except by an agreement in writing signed by the party against whom

enforcement of any such waiver, change, modification or discharge is sought.

10.10. Sales

or Participations. Lender may, from time to time, sell or assign, in whole or in part, or grant participations in, the Loan,

this Note and/or the obligations evidenced thereby. The holder of any such sale, assignment or participation, if the applicable agreement

between Lender and such holder so provides, shall be: (a) entitled to all of the rights, obligations and benefits of Lender; and (b)

deemed to hold and may exercise the rights of setoff or banker’s lien with respect to any and all obligations of such holder to

Borrower, in each case as fully as though Borrower were directly indebted to such holder. Lender may in its discretion give notice to

Borrower of such sale, assignment or participation; however, the failure to give such notice shall not affect any of Lender’s or

such holder’s rights hereunder.

10.11. Jurisdiction;

etc. Borrower hereby consents that any action or proceeding against him be commenced and maintained in any court in Miami-Dade

County Florida and Borrower agrees that the courts in Miami- Dade County Florida shall have jurisdiction with respect to the subject

matter hereof and the person of Borrower. Borrower agrees not to assert any defense to any action or proceeding initiated by Lender based

upon improper venue or inconvenient forum.

10.12. Notices.

All notices from the Borrower to Lender and Lender to Borrower required or permitted by an provision of this Note shall be in writing

and sent by registered or certified mail or nationally recognized overnight delivery service and addressed to the address set forth above.

Notice

given as hereinabove provided shall be deemed given on the date of its deposit in the United States Mail and, unless sooner actually

received, shall be deemed received by the party to whom it is address on the third (3rd) calendar day following the date on which said

notice is deposited in the mail, or if a courier system is used, on the date of delivery of the notice. The parties may add, deleted,

or alter any address to which notice is to be provided by providing written notice of such change pursuant to the terms of this section.

10.13. Governing

Law. This Note shall be governed by and construed in accordance with the substantive laws of the State of Florida without regard

to conflict of laws principles.

10.14. Waiver

of Jury Trial. BORROWER AND LENDER AGREE THAT, TO THE EXTENT PERMITTED BY APPLICABLE LAW,

ANY SUIT, ACTION OR PROCEEDING, WHETHER CLAIM OR COUNTERCLAIM, BROUGHT BY LENDER OR BORROWER, ON OR WITH RESPECT TO THIS NOTE OR ANY

OTHER LOAN DOCUMENT EXECUTED IN CONNECTION HEREWITH OR THE DEALINGS OF THE PARTIES WITH RESPECT HERETO OR THERETO, SHALL BE TRIED ONLY

BY A COURT AND NOT BY A JURY. LENDER AND BORROWER EACH HEREBY KNOWINGLY, VOLUNTARILY, INTENTIONALLY AND INTELLIGENTLY AND WITH THE ADVICE

OF THEIR RESPECTIVE COUNSEL, WAIVE, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO A TRIAL BY JURY IN ANY SUCH SUIT, ACTION

OR PROCEEDING. FURTHER, BORROWER WAIVES ANY RIGHT IT MAY HAVE TO CLAIM OR RECOVER, IN ANY SUCH SUIT, ACTION OR PROCEEDING, ANY SPECIAL,

EXEMPLARY, PUNITIVE, CONSEQUENTIAL OR OTHER DAMAGES OTHER THAN, OR IN ADDITION TO, ACTUAL DAMAGES. BORROWER ACKNOWLEDGES AND AGREES THAT

THIS SECTION IS A SPECIFIC AND MATERIAL ASPECT OF THIS NOTE AND THAT LENDER WOULD NOT EXTEND CREDIT TO BORROWER IF THE WAIVERS SET FORTH

IN THIS SECTION WERE NOT A PART OF THIS NOTE.

Borrower,

intending to be legally bound, has duly executed and delivered this Note as of the day and year first above written.

| BORROWER: |

|

| EzFill

Holdings, Inc. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name: |

Yehuda

Levy |

|

| Title: |

CEO |

|

Exhibit

99.1

August

22, 2023

EzFill

Announces 2023 Second Quarter Financial Results

—

Revenue Increased 63% year over year to $6.1 Million From $3.8 Million —

—

Approx. 1.6 Million Gallons Delivered, Up 102% From Prior Year –

—

20 New Fleet Customers Added in Quarter —

—

Net Loss Narrows by $1.4 Million or $0.47 per share —

MIAMI,

FL, Aug. 22, 2023 (GLOBE NEWSWIRE) — EzFill Holdings, Inc. (“EzFill” or the “Company”) (NASDAQ: EZFL),

a pioneer and emerging leader in the mobile fueling industry, announced today its financial results for the three-month period ended

June 30, 2023 (“2Q23” or “second quarter 2023”).

Q2

23 Highlights (in USD, except gallons delivered)

| |

Q2 2023 | | |

Q2 2022 | |

| Financial Highlights | |

| | | |

| | |

| Revenue | |

| 6,130,661 | | |

| 3,754,431 | |

| Net loss | |

| (2,468,811 | ) | |

| (3,872,670 | ) |

| Adjusted EBITDA* | |

| (1,545,807 | ) | |

| (3,005,630 | ) |

| Operating Highlights | |

| | | |

| | |

| Total Gallons Delivered | |

| 1,583,320 | | |

| 782,0367 | |

*

See end of this press release for reconciliation to US GAAP

Commenting

on the second quarter results, Interim CEO Yehuda Levy stated, “Our second quarter financial results reflect improvement in both

the comparison to the prior year second quarter, and sequentially from the first quarter of 2023. Of particular note is that we increased

our gallons delivered to another record in the second quarter of 2023, which was 102% higher year over year and we increased our margins

by $0.13 per gallon. We continue to grow our fleet business, adding 20 new fleet customers in the second quarter of 2023, bringing our

total to 54 new fleet customers for the year.

“We

continue to work on reducing our overall expenses and improving our operations. The team has helped achieve another quarterly record

for both gallons delivered and revenues. We hope to continue our momentum in the coming months.”

Second

Quarter 2023 Financial Results

During

the second quarter of 2023, the Company reported revenue of $6.1million, up from $3.8 million in the prior year period, a 63%

increase, primarily due to a 102% increase in gallons delivered. Total gallons delivered in the second quarter of 2023 were

1,583,320 compared to 782,037 in the prior year period, reflecting new customers in existing and new markets, as well as expansion

of certain existing customers to new markets. Average fuel margin per gallon was $0.60 for the quarter an increase of $0.13 per

gallon from the previous quarter.

Cost

of sales was $5.6 million for the second quarter of 2023 compared to $3.8 million for the prior year period. The increase from the prior

year reflects the increase in sales as well as the hiring of additional drivers, primarily in new markets and the cost of fuel.

Operating

expenses, excluding depreciation and amortization, were $2.4 million for the second quarter of 2023, compared to $3.4 million in the

prior year period. The decrease was primarily due to decreases in payroll, technology expenses, stock compensation and public company

expenses as we continue to achieve efficiencies in our operations.

Depreciation

and amortization decreased to $0.28 million in the second quarter of 2023 from $0.46 million in the prior year period due to the

write-off of intangibles in 2022.

Interest

expense increased in the current year due to increased borrowing for truck purchases during 2022.

The

net loss in the second quarter of 2023 was $(2.5) million, compared to $(3.9) million in the prior year period. Loss per share improved

in the quarter to $(0.71) from $(1.18) in the prior year period.

Adjusted

EBITDA loss in the second quarter of 2023 was $(1.5) million as compared to Adjusted EBITDA loss of $(3.0) million in the second quarter

of 2022. The improvement in adjusted EBITDA reflects both the improved margin and the operating cost efficiencies.

As

previously reported, on April 26, 2023, the Company effected a 1:8 reverse stock split of its common stock. All share related amounts

have been adjusted to reflect the reverse stock split.

Balance

Sheet

At

June 30, 2023, the Company had a cash position of $1.4 million, compared with $4.2 million at year end 2022. The Company had long-term

debt of $1.1 million and had outstanding borrowings under its line of credit of $1.0 million as of quarter end. Currently the Company

has limited cash and is relying on related party loans to fund its business operations.

About

EzFill

With

the number of gas stations in the U.S. continuing to decline, corporate giants such as Shell, Exxon, GM, Bridgestone, Enterprise, and

Mitsubishi have recognized the increasing shift in consumer behavior and are investing in the fast growing on-demand mobile fueling industry.

As the only company to provide fuel delivery in three vertical segments - consumer, commercial, and specialty including marine, we believe

EzFill is well positioned to capitalize on the growing demand for convenient and cost-efficient mobile fueling options.

EzFill

is a leader in the fast-growing mobile fuel industry, with the largest market share in its home state of Florida. Its mission is to disrupt

the gas station fueling model by providing consumers and businesses with the convenience, safety, and touch-free benefits of on- demand

fueling services brought directly to their locations. For commercial and specialty customers, at-site delivery during downtimes enables

operators to begin their daily operations with fully fueled vehicles. For more information, visit www.ezfl.com.

Forward

Looking Statements

This

press release contains “forward-looking statements” Forward-looking statements reflect our current view about future events.

When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect,”

“future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate

to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained

in this press release relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking

statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because

forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances

that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They

are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying

on any of these forward- looking statements. Important factors that could cause actual results to differ materially from those in the

forward-looking statements include, without limitation, our ability to raise capital to fund continuing operations; our ability to protect

our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other

providers and products; our ability to develop and commercialize products and services; changes in government regulation; our ability

to complete capital raising transactions; and other factors relating to our industry, our operations and results of operations. Actual

results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors

or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of

them. We cannot guarantee future results, levels of activity, performance or achievements. The Company assumes no obligation to update

any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this release.

For

further information, please contact:

Investor

and Media Contact

Telx,

Inc.

Paula Luna

Paula@Telxcomputers.com

Note

Regarding Use of Non-GAAP Financial Measures

To

supplement our condensed consolidated financial statements, which are prepared in accordance with generally accepted accounting principles

in the United States (GAAP), we use non-GAAP measures. Adjusted EBITDA is a non-GAAP financial measure which we use in our financial

performance analyses. This measure should not be considered a substitute for GAAP-basis measures, nor should it be viewed as a substitute

for operating results determined in accordance with GAAP. We believe that the presentation of Adjusted EBITDA, a non-GAAP financial measure

that excludes the impact of net interest expense, taxes, depreciation, amortization and stock compensation expense, provides useful supplemental

information that is essential to a proper understanding of our financial results. Non-GAAP measures are not formally defined by GAAP,

and other entities may use calculation methods that differ from ours for the purposes of calculating Adjusted EBITDA. As a complement

to GAAP financial measures, we believe that Adjusted EBITDA assists investors who follow the practice of some investment analysts who

adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability.

The

following is a reconciliation of net loss to the non-GAAP financial measure referred to as Adjusted EBITDA for the three months ended

June 30, 2023 and 2022

| | |

Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Net loss | |

$ | (2,468,811 | ) | |

$ | (3,872,670 | ) |

| Interest expense | |

| 306,547 | | |

| 6,167 | |

| Depreciation and amortization | |

| 277,608 | | |

| 458,811 | |

| Stock compensation | |

| 338,849 | | |

| 402,061 | |

| Adjusted EBITDA | |

$ | (1,545,807 | ) | |

$ | (3,005,630 | ) |

| | |

For the Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

Sales – net | |

$ | 6,130,661 | | |

$ | 3,754,431 | |

Costs and Expenses | |

| | | |

| | |

| Cost of sales | |

| 5,646,291 | | |

| 3,755,861 | |

| General and administrative expenses | |

| 2,369,026 | | |

| 3,406,262 | |

| Depreciation and amortization | |

| 277,608 | | |

| 458,811 | |

| Total Costs and Expenses | |

| 8,292,925 | | |

| 7,620,934 | |

| Loss from operations | |

| (2,162,264 | ) | |

| (3,866,503 | ) |

Other income (expense) Interest income | |

| 14,461 | | |

| 19,754 | |

| Interest expense | |

| (308,189 | ) | |

| (25,921 | ) |

| Loss on sale of marketable debt securities | |

| (12,819 | ) | |

| - | |

| Total other income (expense) – net | |

| (306,547 | ) | |

| (6,167 | ) |

Net loss | |

$ | (2,468,811 | ) | |

$ | (3,872,670 | ) |

| Loss per share - basic and diluted | |

$ | (0.71 | ) | |

$ | (1.18 | ) |

| Weighted average number of shares - basic and diluted | |

| 3,469,490 | | |

| 3,294,252 | |

Comprehensive loss: Net loss | |

$ | (2,468,811 | ) | |

$ | (3,872,670 | ) |

| Change in fair value of debt securities | |

| - | | |

| (17,208 | ) |

| Total comprehensive loss: | |

$ | (2,468,811 | ) | |

$ | (3,889,878 | ) |

EzFill

Holdings, Inc. and Subsidiary

Consolidated Balance heets

| | |

June

30,

2023

| | |

December 31,

2022

| |

| | |

(Unaudited) | | |

(Audited) | |

| Assets | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 1,359,333 | | |

$ | 2,066,793 | |

| Investment in debt securities | |

| - | | |

| 2,120,082 | |

| Accounts receivable – net | |

| 1,004,114 | | |

| 766,692 | |

| Inventory | |

| 130,341 | | |

| 151,248 | |

| Prepaids and other | |

| 263,556 | | |

| 329,351 | |

| Total Current Assets | |

| 2,757,344 | | |

| 5,434,166 | |

| Property and equipment – net | |

| 3,994,302 | | |

| 4,589,159 | |

| Operating lease - right-of-use asset | |

| 411,025 | | |

| 521,782 | |

| Deposits | |

| 53,017 | | |

| 52,737 | |

| Total Assets | |

$ | 7,215,688 | | |

$ | 10,597,844 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 974,313 | | |

$ | 1,256,479 | |

| Line of credit | |

| 1,000,000 | | |

| 1,000,000 | |

| Notes payable – net | |

| 767,339 | | |

| 811,516 | |

| Notes payable – related party | |

| 1,171,800 | | |

| - | |

| Operating lease liability | |

| 238,042 | | |

| 230,014 | |

| Total Current Liabilities | |

| 4,151,494 | | |

| 3,298,009 | |

| Long Term Liabilities | |

| | | |

| | |

| Notes payable | |

| 1,062,827 | | |

| 1,198,380 | |

| Operating lease liability | |

| 202,002 | | |

| 316,008 | |

| Total Long Term Liabilities | |

| 1,264,829 | | |

| 1,514,388 | |

| Total Liabilities | |

| 5,416,323 | | |

| 4,812,397 | |

| Commitments and Contingencies | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred stock - $0.0001 par value; 5,000,000 shares authorized none issued and outstanding, respectively | |

| - | | |

| - | |

| Common stock - $0.0001 par value, 50,000,000 shares authorized 3,791,332 shares issued and 3,641,332 shares outstanding at June 30, 2023 and 3,335,674 shares issued and outstanding at December 31, 2022 | |

| 379 | | |

| 334 | |

| Additional paid-in capital | |

| 41,461,729 | | |

| 40,674,864 | |

| Accumulated deficit | |

| (39,662,743 | ) | |

| (34,845,161 | ) |

| Accumulated other comprehensive loss | |

| - | | |

| (44,590 | ) |

| Total Redeemable Common Stock and Stockholders’ Equity | |

| 1,799,365 | | |

| 5,785,447 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 7,215,688 | | |

$ | 10,597,844 | |

v3.23.2

Cover

|

Aug. 22, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 22, 2023

|

| Entity File Number |

001-40809

|

| Entity Registrant Name |

EZFILL

HOLDINGS, INC.

|

| Entity Central Index Key |

0001817004

|

| Entity Tax Identification Number |

84-4260623

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2999

NE 191

|

| Entity Address, Address Line Two |

st

|

| Entity Address, Address Line Three |

Street

|

| Entity Address, City or Town |

Aventura

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33180

|

| City Area Code |

305

|

| Local Phone Number |

791-1169

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

EZFL

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

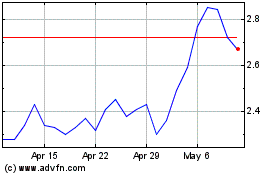

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Apr 2024 to May 2024

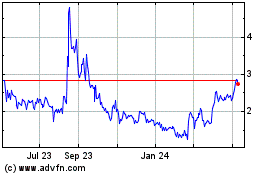

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From May 2023 to May 2024