Form 8-K - Current report

27 December 2023 - 11:45PM

Edgar (US Regulatory)

false

0001852407

0001852407

2023-12-21

2023-12-21

0001852407

FEXD:UnitsEachConsistingOfOneShareOfClassCommonStockOneRightAndOnehalfOfOneRedeemableWarrantMember

2023-12-21

2023-12-21

0001852407

FEXD:ClassCommonStockParValue0.0001PerShareMember

2023-12-21

2023-12-21

0001852407

FEXD:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-12-21

2023-12-21

0001852407

FEXD:RightsIncludedAsPartOfUnitsMember

2023-12-21

2023-12-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): December 21, 2023

FINTECH

ECOSYSTEM DEVELOPMENT CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40914 |

|

86-2438985 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 100

Springhouse Drive, Suite 204, Collegeville, PA |

|

19426 |

| (Address

of principal executive offices) |

|

(Zip Code) |

(610)

226-8101

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units,

each consisting of one share of Class A common stock, one right and one-half of one redeemable warrant |

|

FEXDU |

|

The

Nasdaq Capital Market |

| Class

A common stock, par value $0.0001 per share |

|

FEXD |

|

The

Nasdaq Capital Market |

| Redeemable

warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

FEXDW |

|

The

Nasdaq Capital Market |

| Rights

included as part of the units |

|

FEXDR |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

December 21, 2023, Fintech Ecosystem Development Corp., a Delaware corporation (the “Company”), received a written notice

(the “Notice”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) indicating

that since the Company has not yet filed its Form 10-Q for the period ended September 30, 2023 (the “Form 10-Q”), the Company

is no longer in compliance with Listing Rule 5250(c)(1) (the “Rule”), which requires the Company to timely file all required

periodic financial reports with the U.S. Securities and Exchange Commission (the “SEC”). The Notice is only a notification

of a deficiency and not a notification of imminent delisting. The Notice does not have a current effect on the listing or trading of

the Company’s securities on the Nasdaq Capital Market.

The

Notice states that the Company, pursuant to the listing rules, has 60 calendar days to submit a plan to regain compliance. If Nasdaq

accepts the Company’s plan, Nasdaq may grant the Company an extension of up to 180 calendar days from the Form 10-Q’s due

date, or until May 13, 2024 to regain compliance with the Rule. If Nasdaq does not accept the Company’s plan, the Company will

have the opportunity to appeal the decision in front of a Nasdaq Hearings Panel pursuant to Listing Rule 5815(a).

The

Company anticipates that it will file the Form 10-Q within the 60 calendar days, eliminating the applicability of submission of a plan

to regain compliance.

Item

7.01. Regulation FD Disclosure.

On

December 27, 2023, the Company issued a press release announcing the Notice. A copy of the press release is attached as Exhibit 99.1

to this Current Report on Form 8-K and is incorporated herein solely for purposes of this Item 7.01 disclosure.

The

furnishing of the press release is not an admission as to the materiality of any information therein. The information contained in the

press release is summary information that is intended to be considered in the context of more complete information included in the Company’s

filings with the SEC and other public announcements that the Company has made and may make from time to time by press release or otherwise.

The Company undertakes no duty or obligation to update or revise the information contained in this report, although it may do so from

time to time as its management believes is appropriate. Any such updating may be made through the filing of other reports or documents

with the SEC, through press releases or through other public disclosures.

The

information in this Item 7.01 of this Current Report on Form 8-K and the press release shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 7.01 and in the press release shall

not be incorporated by reference into any filing with the SEC made by the Company, whether made before or after the date hereof, regardless

of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FinTech ECOSYSTEM DEVELOPMENT Corp. |

| |

|

| |

By: |

/s/

Saiful Khandaker |

| |

Name: |

Saiful Khandaker |

| |

Title: |

Chairman and Chief Executive Officer |

Date:

December 27, 2023

2

Exhibit 99.1

Fintech Ecosystem Development Corp. Receives

Notice from Nasdaq

Collegeville, Pennsylvania, December 27, 2023

– On December 21, 2023, Fintech Ecosystem Development Corp. (the “Company”) received a written notice (the “Notice”)

from the Staff of the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”), indicating that since the

Company has not yet filed its Form 10-Q for the period ended September 30, 2023 (the “Form 10-Q”), the Company is no longer

in compliance with Listing Rule 5250(c)(1) (the “Rule”), which requires the Company to timely file all required periodic financial

reports with the Securities and Exchange Commission. The Notice states that the Company, pursuant to listing rules, has 60 calendar days

to submit a plan to regain compliance.

The Company anticipates that it will file the

Form 10-Q within the 60 calendar days, eliminating the applicability of submission of a plan to regain compliance.

Contacts:

For Media

Kirti Kirk

Email: kirti.kirk@fintechecosys.com

For Fintech Ecosystem Development Corp.

Dr. Saiful Khandaker

saiful@fintechecosys.com

v3.23.4

Cover

|

Dec. 21, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 21, 2023

|

| Entity File Number |

001-40914

|

| Entity Registrant Name |

FINTECH

ECOSYSTEM DEVELOPMENT CORP.

|

| Entity Central Index Key |

0001852407

|

| Entity Tax Identification Number |

86-2438985

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100

Springhouse Drive

|

| Entity Address, Address Line Two |

Suite 204

|

| Entity Address, City or Town |

Collegeville

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19426

|

| City Area Code |

610

|

| Local Phone Number |

226-8101

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A common stock, one right and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one share of Class A common stock, one right and one-half of one redeemable warrant

|

| Trading Symbol |

FEXDU

|

| Security Exchange Name |

NASDAQ

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A common stock, par value $0.0001 per share

|

| Trading Symbol |

FEXD

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable

warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

FEXDW

|

| Security Exchange Name |

NASDAQ

|

| Rights included as part of the units |

|

| Title of 12(b) Security |

Rights

included as part of the units

|

| Trading Symbol |

FEXDR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FEXD_UnitsEachConsistingOfOneShareOfClassCommonStockOneRightAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FEXD_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FEXD_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FEXD_RightsIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

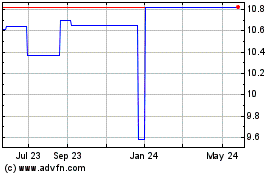

Fintech Ecosystem Develo... (NASDAQ:FEXDU)

Historical Stock Chart

From Apr 2024 to May 2024

Fintech Ecosystem Develo... (NASDAQ:FEXDU)

Historical Stock Chart

From May 2023 to May 2024