FlexShopper Updates Status of Rights Offering

31 January 2025 - 12:00AM

FlexShopper, Inc. (Nasdaq: FPAY), a prominent

national online lease-to-own retailer and payment solutions

provider, today announced an update to its previously disclosed

rights offering. FlexShopper shareholders who participated in the

unit subscription that closed on January 10, 2025, are now eligible

to participate in the Series A, B, and C rights. Details of which

can be found in the body of this press release.

As a result of the initial unit subscription,

FlexShopper raised approximately $12 million of proceeds,

consisting of $9.4 million in gross proceeds from the subscription

and the conversion of $2.5 million of the Company’s subordinated

debt with NRNS Capital Holdings LLC. The $9.4 million in gross

proceeds was used to pay down borrowings under FlexShopper’s credit

agreement with Waterfall Asset Management, LLC. As a result of

these actions, FlexShopper estimates that the initial unit

subscription would have been approximately 15% accretive to

pro-forma earnings per share for the 2024 third quarter.

“The outcome of the initial unit subscription

demonstrates the accretive nature of our efforts to equitize our

balance sheet,” said Russ Heiser, CEO of FlexShopper. “We are

approaching the Series A, B, and C rights offerings from a position

of strength and I am excited to provide investors with an update on

our financial performance.”

Overview of Upcoming Rights

|

Rights: |

Expiration Dates: |

Exercise Pricing of Rights: |

|

Series A |

February 15, 2025 |

Exercise price equal to the higher

of: 1) $1.70 or

2) 90.0% of

the VWAP of our common stock over the last three trading days prior

to the expiration date of the Series A Rights, but in any event not

to exceed $2.55. |

|

Series B |

March 17, 2025 |

Exercise price equal to the higher

of: 1) $1.70 or

2) 87.5% of

the VWAP of our common stock over the last three trading days prior

to the expiration date of the Series A Rights, but in any event not

to exceed $3.40. |

|

Series C |

April 16, 2025 |

Exercise price equal to the higher

of: 1) $1.70 or

2) 85.0% of

the VWAP of our common stock over the last three trading days prior

to the expiration date of the Series A Rights, but in any event not

to exceed $4.25. |

|

|

|

|

It is important to note that many broker-dealers

ask for rights subscription submissions prior to the expiration

dates of the respective rights. As a result, FlexShopper encourages

rightsholders to submit their submissions by February 13, 2025,

March 14, 2025, and April 14, 2025.

FlexShopper encourages holders of the Series A,

B, and C Rights to contact their broker or financial advisor’s

Corporate Actions Department to participate in these subsequent

rights. Rights offering information can be found at

https://www.sec.gov and https://investors.flexshopper.com, or by

calling the rights offer information agent, MacKenzie Partners at

800-322-2885.

Moody Capital Solutions, Inc. (Moody Capital) is

acting as dealer-manager for the rights offering and can be

contacted at info@moodycapital.com.

The offering was made pursuant to the

Corporation’s registration statement on Form S-1 (File No.

333-282857), which was declared effective by the U.S. Securities

and Exchange Commission on November 29, 2024. The prospectus

relating to and describing the terms of the rights offering has

been filed with the SEC on December 2, 2024, and is available on

the SEC’s website at www.sec.gov. This announcement shall not

constitute an offer to sell, or the solicitation of an offer to

buy, any securities, nor shall there be any sale of these

securities in any state in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under

the securities laws of any such state.

About FlexShopper, Inc.:

FlexShopper, Inc. (Nasdaq: FPAY) is a leading national financial

technology company that provides payment options to consumers.

FlexShopper provides a variety of flexible funding options for

underserved consumers through its online direct to consumer

marketplace at flexshopper.com and in partnership with partner

merchants both online as well as at brick and mortar locations.

FlexShopper’s solutions are designed to meet the needs of a wide

range of consumer segments via lease-to-own and lending

products.

Forward-Looking StatementsAll

statements in this release that are not based on historical fact

are “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements, which are based

on certain assumptions and describe our future plans, strategies

and expectations, can generally be identified by the use of

forward-looking terms such as “believe,” “expect,” “may,” “will,”

“should,” “could,” “seek,” “intend,” “plan,” “goal,” “estimate,”

“anticipate,” or other comparable terms. Examples of

forward-looking statements include, among others, statements we

make regarding expectations of lease originations, the expansion of

our lease-to-own program; expectations concerning our partnerships

with retail partners; investments in, and the success of, our

underwriting technology and risk analytics platform; our ability to

collect payments due from customers; expected future operating

results and expectations concerning our business strategy.

Forward-looking statements involve inherent risks and uncertainties

which could cause actual results to differ materially from those in

the forward-looking statements, as a result of various factors

including, among others, the following: our ability to obtain

adequate financing to fund our business operations in the future;

the failure to successfully manage and grow

our FlexShopper.com e-commerce platform; our ability to

maintain compliance with financial covenants under our credit

agreement; our dependence on the success of our third-party retail

partners and our continued relationships with them; our compliance

with various federal, state and local laws and regulations,

including those related to consumer protection; the failure to

protect the integrity and security of customer and employee

information; and the other risks and uncertainties described in the

Risk Factors and in Management’s Discussion and Analysis of

Financial Condition and Results of Operations sections of our

Annual Report on Form 10-K and subsequently filed Quarterly Reports

on Form 10-Q. The forward-looking statements made in this release

speak only as of the date of this release,

and FlexShopper assumes no obligation to update any such

forward-looking statements to reflect actual results or changes in

expectations, except as otherwise required by law.

Company Contact:FlexShopper,

Inc.Investor Relationsir@flexshopper.com

Investor and Media

ContactAndrew BergerManaging DirectorSM Berger &

Company, Inc.Tel (216) 464-6400andrew@smberger.com

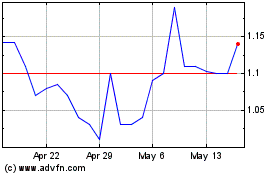

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Feb 2024 to Feb 2025