UNITED STATES

Securities and Exchange Commission

Washington,

D.C. 20549

Form 40-F/A

(Amendment No. 1)

☐ Registration Statement

Pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒ Annual Report Pursuant to Section 13(a) or 15(d) of the Securities

Exchange Act of 1934

For the fiscal year ended December 31, 2023

Commission file number 001-36897

FirstService Corporation

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s

name into English (if applicable))

Ontario, Canada

(Province or other jurisdiction of incorporation or organization)

6500

(Primary Standard Industrial Classification Code Number (if applicable))

N/A

(I.R.S. Employer Identification Number (if applicable))

1255 Bay Street, Suite 600

Toronto, Ontario, Canada M5R 2A9

416-960-9566

(Address and telephone number of Registrant’s principal executive

offices)

Mr. Santino Ferrante, Ferrante & Associates

126 Prospect Street, Cambridge, MA 02139

617-868-5000

(Name, address (including zip code) and telephone number (including area

code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the

Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Shares |

FSV |

NASDAQ Stock Market

Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the

Act: None

Securities for which there is a reporting obligation pursuant to Section

15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this

Form:

| ☒ Annual information form | |

☒ Audited annual financial statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or

common stock as of the close of the period covered by the annual report:

44,682,427 Common Shares

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required

to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive

Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months

(or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth

company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to

Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting

standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after

April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s

assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections

are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive

officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY NOTE

FirstService Corporation (the “Registrant”) is filing this

Amendment No. 1 (this “Amendment”) to its original Annual Report on Form 40-F for the year ended December 31, 2023, which

was filed with the U.S. Securities and Exchange Commission on February 22, 2024 (the “Original 2023 Annual Report” and together

with this Amendment, the “Annual Report”), in order to file Exhibit 97 to the Annual Report. In addition, as required by Rule

12b-15 of the U.S. Securities and Exchange Act of 1934 (the “Exchange Act”), a new certification by the Registrant’s

principal executive officer and principal financial officer is filed herewith as Exhibit 31 to this Amendment, pursuant to Rule 13a-14(a)

of the Exchange Act. Because no financial statements have been included in this Amendment, paragraphs 3, 4 and 5 of the certification

has been omitted. The Registrant is also not including new certifications under Section 1350 of Chapter 63 of Title 18 of the United States

Code (18 U.S.C. 1350) (Section 906 of the Sarbanes-Oxley Act of 2002), as no financial statements are being filed with this Amendment.

This Amendment consists of a cover page, this explanatory note, the signature

page, the exhibit index, Exhibit 31 and Exhibit 97. Other than expressly set forth herein, this Amendment does not, and does not purport

to, amend or restate any other information contained in the Original 2023 Annual Report nor does this Amendment reflect any events that

have occurred after the Original 2023 Annual Report was filed.

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Registrant certifies

that it meets all of the requirements for filing on Form 40-F and has duly caused this Amendment to the Annual Report to be signed on

its behalf by the undersigned, thereto duly authorized.

| Date: March 11, 2024 |

|

FIRSTSERVICE CORPORATION |

| |

|

|

| |

|

|

By: |

/s/ Jeremy Rakusin |

| |

|

|

|

Name: Jeremy Rakusin

Title: Chief Financial Officer |

EXHIBIT INDEX

* Previously filed as an exhibit to the

Original 2023 Annual Report.

† Filed as an exhibit to this Amendment.

EXHIBIT 31

CERTIFICATION

PURSUANT TO RULE 13a-14(a) OR 15d-14(a) OF THE SECURITIES EXCHANGE ACT

OF 1934

I, D. Scott Patterson, certify that:

| 1. | I

have reviewed this annual report on Form 40-F/A of FirstService Corporation; and |

| 2. | Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make

the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered

by this report. |

March 11, 2024

| /s/ D. Scott Patterson |

|

|

| D. Scott Patterson |

|

|

| Chief Executive Officer |

|

|

CERTIFICATION

PURSUANT TO RULE 13a-14(a) OR 15d-14(a) OF THE SECURITIES EXCHANGE ACT

OF 1934

I, Jeremy Rakusin, certify that:

| 1. | I

have reviewed this annual report on Form 40-F/A of FirstService Corporation; and |

| 2. | Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make

the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered

by this report. |

March 11, 2024

| |

|

|

|

| /s/ Jeremy Rakusin |

|

|

|

| Jeremy Rakusin |

|

|

|

| Chief Financial Officer |

|

|

|

Exhibit 97

FIRSTSERVICE CORPORATION CLAWBACK POLICY

Effective as of December 1, 2023

Scope

This Clawback Policy (this “Policy”) applies to any

individual who is or was an Executive Officer (as defined below) of FirstService Corporation (“FirstService”) at the

relevant time. Should FirstService be required to prepare an Accounting Restatement (as defined below), FirstService will have the right

to claw back Incentive-Based Compensation (as defined below) from its Executive Officers, on and subject to the terms provided for in

this Policy.

Definitions

For the purposes of this Policy, the following terms will have the meanings set forth below:

| “Accounting Restatement” |

|

means any accounting restatement of FirstService’s financial statements due to material noncompliance with any financial reporting requirement under United States federal securities laws, including any required accounting restatement to correct a material error in FirstService’s previously-issued financial statements, or to avoid a material misstatement if the error were corrected in the current period or left uncorrected in the current period. |

| |

|

|

| “Erroneously Awarded Compensation” |

|

means the amount of Incentive-Based Compensation received that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the restated amounts in connection with an Accounting Restatement and must be computed without regard to any taxes paid and otherwise in accordance with the U.S. Clawback Rules. |

| |

|

|

| “Exchange Act” |

|

means the United States Securities Exchange Act of 1934, as amended. |

| |

|

|

| “Executive Officer” |

|

means any individual listed as, or holding the position designated as being, an executive officer in FirstService’s most recently filed annual information form, and any other person that would be considered an “executive officer” of FirstService within the meaning of the U.S. Clawback Rules. For clarity, in applying a Restatement Clawback, “Executive Officer” will include any person who served as an Executive Officer at any time during the performance period for the Incentive-Based Compensation subject to such Restatement Clawback. |

| |

|

|

| “Financial Reporting Measures” |

|

means measures that are determined and presented in accordance with the accounting principles used in preparing FirstService’s financial statements, and any measures that are derived wholly or in part from such measures, including stock price and total shareholder return. |

| |

|

|

| “Incentive-Based Compensation” |

|

means any compensation to any Executive Officer that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure. |

| |

|

|

| Clawback Policy – March 2024 | |

| “Restatement Clawback” |

|

means recovery and repayment of Erroneously Awarded Compensation from an Executive Officer when FirstService is required to prepare an Accounting Restatement. |

| |

|

|

| “Restatement Date” |

|

means the date on which FirstService is required to prepare an Accounting Restatement (such date as determined by the U.S. Clawback Rules). |

| |

|

|

| “U.S. Clawback Rules” |

|

means Section 10D of the Exchange Act, Rule 10D-1 issued thereunder, and the listing standards of the applicable U.S. Stock Exchange to implement Rule 10D-1 under the Exchange Act. |

| |

|

|

| “U.S. Stock Exchange” |

|

means the National Association of Securities Dealers Automated Quotations (NASDAQ) and/or any other U.S. national securities exchange(s) on which FirstService’s securities are listed. |

Accounting Restatements

In the event FirstService is required to prepare an Accounting Restatement,

the board of directors of FirstService (the “Board”) will review all Incentive-Based Compensation received by Executive

Officers (a) after beginning service as an Executive Officer, (b) who served as an Executive Officer at any time during the performance

period for such Incentive-Based Compensation, (c) during the three completed fiscal years immediately preceding the applicable Restatement

Date (as well as during any transition period specified in the U.S. Clawback Rules), (d) while FirstService had a class of securities

listed on a U.S. Stock Exchange and (e) after the U.S. Clawback Rules became effective. Incentive-Based Compensation is deemed “received”

in the fiscal period during which the Financial Reporting Measure specified in the Incentive-Based Compensation is attained, even if the

payment or grant of Incentive-Based Compensation occurs after the end of that period. If the Board determines that an Executive Officer

received any Erroneously Awarded Compensation in connection with such Accounting Restatement, the Board shall, reasonably promptly after

the Restatement Date, seek recoupment from such Executive Officer of all such Erroneously Awarded Compensation, subject to the exceptions

set forth below under “—Recoupment Exceptions”. The Board will determine, in its sole discretion, the method for recouping

Erroneously Awarded Compensation hereunder.

Calculation of Erroneously Awarded Compensation

The amount of Erroneously Awarded Compensation shall be calculated in accordance

with the U.S. Clawback Rules. For Incentive-Based Compensation based on FirstService’s stock price or total shareholder return,

where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in an

Accounting Restatement: (i) the amount of Erroneously Awarded Compensation must be based on a reasonable estimate of the effect of the

Accounting Restatement on FirstService’s stock price or total shareholder return upon which the Incentive-Based Compensation was

received; and (ii) FirstService must maintain documentation of the determination of that reasonable estimate and provide such documentation

to the applicable U.S. Stock Exchange.

| Clawback Policy – March 2024 | |

Recoupment Exceptions

FirstService must recover any Erroneously Awarded Compensation unless the

committee of the Board making executive compensation decisions (or, in its absence, the majority of the independent directors serving

on the Board) determines that any of the impracticality exceptions set forth in the U.S. Clawback Rules are available.

FirstService’s obligation to recover Erroneously Awarded Compensation

is not dependent on if or when the restated financial statements for the Accounting Restatement have been filed.

Recoupment of Erroneously Awarded Compensation due to an Accounting Restatement

will be made on a “no fault” basis, without regard to whether any misconduct occurred or whether any Executive Officer is

responsible for the noncompliance that resulted in the Accounting Restatement.

No Indemnification

FirstService shall not indemnify any Executive Officer against the loss

of any Erroneously Awarded Compensation.

Indemnification of the Board

Any members of the Board who assist in the administration of this Policy

will not be personally liable for any action, determination or interpretation made with respect to this Policy and will be fully indemnified

by FirstService to the fullest extent under applicable law and FirstService policy with respect to any such action, determination or interpretation.

The foregoing sentence will not limit any other rights to indemnification of the members of the Board under applicable law or FirstService

policy.

Further Reference to Applicable SEC and U.S. Stock Exchange Rules

This Policy shall be qualified in all respects by reference to the U.S.

Clawback Rules. To the extent there is a conflict between this Policy and the U.S. Clawback Rules, or any interpretive question arises

hereunder, the U.S. Clawback Rules shall control.

Applicability

Each award agreement or other document setting forth the terms and conditions

of any Incentive-Based Compensation granted or paid to an Executive Officer will include (or will be deemed to include) a provision incorporating

this Policy or the requirements of this Policy. The remedies specified in this Policy shall not be exclusive and shall be in addition

to every other right or remedy at law or in equity that may be available to FirstService.

Other Recovery Obligations

To the extent that the application of this Policy would provide for recovery

of Incentive-Based Compensation that FirstService already recovered pursuant to Section 304 of the Sarbanes-Oxley Act or other recovery

obligations, the amount already recovered from the relevant Executive Officer will be credited to the required recovery under this Policy.

| Clawback Policy – March 2024 | |

Interpretation

The Board shall have full and final authority to make all determinations

under this Policy including, without limitation, whether this Policy applies and, if so, the amount of compensation to be repaid or forfeited

by an Executive Officer. All determinations and decisions made by the Board pursuant to the provisions of this Policy shall be final,

conclusive and binding on all parties.

Clawback Policy – March 2024

|

|

|

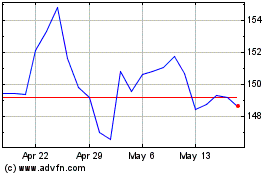

FirstService (NASDAQ:FSV)

Historical Stock Chart

From Mar 2024 to May 2024

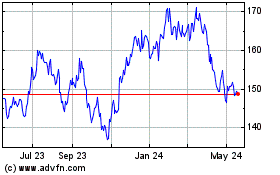

FirstService (NASDAQ:FSV)

Historical Stock Chart

From May 2023 to May 2024