UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Amendment No. 1)

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

| x |

|

Preliminary Proxy Statement |

| ¨ |

|

Confidential, for Use of the SEC Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

|

Definitive Proxy

Statement |

| ¨ |

|

Definitive Additional Materials |

| ¨ |

|

Soliciting Material Pursuant to 14a-12 |

ENTERO THERAPEUTICS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x |

|

No fee required. |

| ¨ |

|

Fee paid previously with preliminary materials |

| ¨ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY PROXY MATERIALS –

SUBJECT TO COMPLETION, DATED JUNE 17, 2024

Entero Therapeutics, Inc.

777 Yamato Road, Suite 502

Boca Raton, Florida 33431

(561) 589-7020

| Dear Fellow Stockholder, |

|

|

[●], 2024 |

On behalf of the Board of Directors and management

of Entero Therapeutics, Inc. (“we”, “us” and “our”), a Delaware corporation, you are invited to attend

our 2024 Annual Meeting of Stockholders including any adjournment or postponement thereof (the “Annual Meeting”) to be held

on [●], 2024 at 9:00 A.M. Eastern Time at our corporate headquarters at 777 Yamato Rd., Suite 502, Boca Raton, FL 33431.

Details of the business to be conducted at the

Annual Meeting are described in this proxy statement. We have also made available a copy of our Annual Report on Form 10-K for the year

ended December 31, 2023 (filed with the Securities Exchange Commission on March 29, 2024) (the “Annual Report”) with this

proxy statement. We encourage you to read our Annual Report. It includes our audited financial statements and provides information about

our business and services.

Your

vote is important. Regardless of whether you plan to attend the Annual Meeting in person, please read the accompanying proxy

statement and then submit your proxy to vote by Internet, telephone or mail as promptly as possible. Returning your proxy will help

us assure that a quorum will be present at the Annual Meeting and avoid the additional expense of duplicate proxy solicitations. Any stockholder

attending the Annual Meeting may vote in person, even if he or she has previously voted. Please refer to your proxy card for voting instructions.

Submitting your proxy promptly may save us additional expense in soliciting proxies and will ensure that your shares are represented at

the Annual Meeting.

Our Board of Directors has approved the proposals

set forth in the proxy statement and recommends that you vote in favor of each such proposal.

| |

Sincerely, |

| |

|

| |

|

| |

JAMES SAPIRSTEIN |

| |

Chief Executive Officer and

Chairman of the Board of Directors |

If you have any questions or require any assistance

in voting your shares, please call:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ

07003

866-407-1875

NOTICE OF THE ENTERO THERAPEUTICS, INC.

ANNUAL MEETING OF STOCKHOLDERS

| Date and Time |

|

|

[●], 2024 at [●], Eastern Time. |

| |

|

|

|

|

|

|

| Place |

|

|

The offices

of Entero Therapeutics, Inc. (“we”, “us”, “our”, “Entero”,

or the “Company”) at 777 Yamato Rd., Suite 502, Boca Raton, FL 33431. |

| |

|

|

|

|

|

|

| Items of Business |

|

|

1. |

|

|

Election of seven director nominees named in this proxy statement, each for a term of one year expiring at our 2025 annual meeting of stockholders or until their respective successors are duly elected and qualified (the "Director Election Proposal”); |

| |

|

|

|

|

|

|

| |

|

|

2. |

|

|

Approval of an amendment to our 2020 Omnibus Equity Incentive Plan to: (1) increase the number of shares of Common Stock authorized for issuance thereunder from 58,374 shares to 1,500,000 shares and to increase the number of shares that otherwise become available under the plan for grants as incentive stock options (“ISOs”) from 250,000 to 750,000, and (2) to increase the number of shares that may be granted to any one non-employee director of the Board from 5 to 250,000 (the “Equity Plan Amendment Proposal”); |

| |

|

|

|

|

|

|

| |

|

|

3. |

|

|

To

approve, in accordance with Nasdaq Listing Rule 5635, the issuance of: (i) up to 12,373,226 shares of Common Stock, subject to adjustment,

upon conversion of the Company’s Series G Non-Voting Convertible Preferred Stock, par value $0.0001 per share, (ii) the issuance

of shares upon exercise of certain assumed ImmunogenX, Inc. (“ImmunogenX” or “IMGX”) stock options exercisable

for an aggregate of 200,652 shares of Common Stock (the “Assumed Options”), (iii) the issuance of shares upon exercise

of certain assumed ImmunogenX warrants exercisable for an aggregate of 127,680 shares of Common Stock (the “Assumed Warrants”),

and (iv) the prior issuance of 36,830 shares of Common Stock to the stockholders of ImmunogenX (the “Nasdaq Proposal”).

Entero agreed to all of such issuances in connection with its acquisition of ImmunogenX (the “IMGX Transaction”) pursuant

to that certain Agreement and Plan of Merger, dated March 13, 2024 (the “Merger Agreement”), by and among Entero, IMMUNO

Merger Sub I, Inc., IMMUNO Merger Sub II, LLC, and ImmunogenX, all as described in further detail herein; |

| |

|

|

|

|

|

|

| |

|

|

4. |

|

|

Adoption and approval of an amendment to our Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to effect a reverse stock split of our issued and outstanding shares of Common Stock, as a specific ratio, ranging from [●] to [●], at any time prior to the one-year anniversary date of the Annual Meeting, with the exact ratio to be determined by the Board without further approval or authorization of our stockholders (the “Reverse Split Proposal”); |

| |

|

|

|

|

|

|

| |

|

|

5. |

|

|

Approval, on an advisory basis, of the executive compensation of the Company’s named executive officers as described in this proxy statement (the “Say on Pay Proposal”); |

| |

|

|

|

|

|

|

| |

|

|

6. |

|

|

Ratification

of Forvis Mazars, LLP, as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (the “Auditor

Ratification Proposal”); and |

| |

|

|

|

|

|

|

| |

|

|

7. |

|

|

Approval of the adjournment of the annual meeting to the extent there are insufficient proxies at the annual meeting to approve any one or more of the foregoing proposals (the “Adjournment Proposal”). |

| |

|

|

|

|

|

|

| Adjournments and Postponements |

|

|

Any action on the items of business described above may be considered at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. |

| |

|

|

|

|

|

|

| Record Date |

|

|

[●] 2024 (the “Record Date”). Only stockholders of record holding shares of our Common Stock, par value $0.0001 per share (the “Common Stock”) as of the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting. |

| |

|

|

|

|

|

|

| Meeting Admission |

|

|

You are invited to attend the Annual Meeting if you are a stockholder of record or a beneficial owner of shares of our Common Stock as of the Record Date. |

| |

|

|

|

|

|

|

| Availability of Proxy

Materials |

|

|

This

proxy statement is dated [●], 2024 and is first being mailed to the stockholders of Entero on or about [●], 2024. Our proxy

materials and the Annual Report for the year ended December 31, 2023 are also available on the internet at: www.viewproxy.com/ENTO/2024. |

| |

|

|

|

|

|

|

| Voting |

|

|

If your shares are held in the name of a bank, broker or other fiduciary, please follow the instructions on the proxy card. Whether or not you expect to attend the Annual Meeting, we urge you to submit your proxy to vote your shares as promptly as possible by following the instructions on your proxy card so that your shares may be represented and voted at the Annual Meeting. Your vote is very important. |

The

Proposals are described in the accompanying proxy statement, which we encourage you to read in its entirety before voting.

Only holders of record of Common Stock at the close of business on [●], 2024 are entitled

to notice of the Annual Meeting and to vote and have their votes counted at the Annual Meeting and any adjournments or postponements

of the Annual Meeting. A complete list of Entero stockholders of record entitled to vote at the Annual Meeting will be available for

ten days before the Annual Meeting at the principal executive offices of Entero for inspection by stockholders during ordinary business hours

for any purpose germane to the Annual Meeting.

The Entero Board unanimously recommends

that Entero stockholders vote “FOR” each of the foregoing proposals.

The existence of any financial and personal

interests of one or more of Entero’s directors may be argued to result in a conflict of interest on the part of such director(s) between

what he, she or they may believe is in the best interests of Entero and its stockholders and what he, she or they may believe is best

for himself, herself or themselves in determining to recommend that stockholders vote for the proposals. See the section entitled “Interests

of Entero’s Directors and Executive Officers in the Proposals” in the accompanying proxy statement for a further discussion

of this issue.

Assuming a quorum is present at the Annual

Meeting, the proposals require the affirmative vote of the majority of the votes cast by stockholders present or represented by proxy

and entitled to vote on the matter at the Annual Meeting. Please vote by proxy over the internet or telephone using the instructions

included with the accompanying proxy card, or promptly complete your proxy card and return it in the enclosed postage-paid envelope,

in order to authorize the individuals named on your proxy card to vote your shares of Entero common stock at the Annual Meeting. If you

hold your shares through a broker, bank or other nominee in “street name” (instead of as a registered holder) please follow

the instructions on the voting instruction form provided by your bank, broker or nominee to vote your shares. The list of Entero stockholders

entitled to vote at the Annual meeting will be available at Entero’s headquarters during regular business hours for examination

by any Entero stockholder for any purpose germane to the Annual Meeting for a period of at least ten days prior to the Annual Meeting.

PLEASE

VOTE AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. IF YOU LATER DESIRE TO REVOKE OR CHANGE YOUR PROXY

FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. FOR FURTHER INFORMATION CONCERNING THE

PROPOSALS BEING VOTED UPON, THE MERGER AGREEMENT, THE IMGX TRANSACTION, USE OF THE PROXY AND OTHER RELATED MATTERS, YOU ARE URGED TO READ

THE ACCOMPANYING PROXY STATEMENT.

| |

BY ORDER OF THE BOARD OF DIRECTORS, |

| |

|

| |

|

| Boca Raton, Florida |

JAMES SAPIRSTEIN |

| [●], 2024 |

President, Chief Executive Officer and

Chairman of the Board of Directors |

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION

OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS.

This proxy statement is dated [●], 2024

and is first being mailed to the stockholders of Entero on or about [●], 2024.

TABLE OF CONTENTS

REFERENCES TO ADDITIONAL INFORMATION

The

accompanying proxy statement incorporates important business and financial information about Entero Therapeutics, Inc. (“we”,

“us”, “our”, “Entero”, or the “Company”) from other documents

that Entero has filed with the U.S. Securities and Exchange Commission (“SEC”) and that are not contained in and are

instead incorporated by reference in the accompanying proxy statement. For a list of documents incorporated by reference in the accompanying

proxy statement, see “Where You Can Find More Information.” This information is available for you, without charge,

to review through the SEC’s website at www.sec.gov.

You may request a copy of the accompanying

proxy statement, any of the documents incorporated by reference in the accompanying proxy statement or other information filed with the

SEC by Entero, without charge, by written request directed to the following contact:

Entero Therapeutics, Inc.

Attention: Chief Financial Officer

777 Yamato Road, Suite 502

Boca Raton, FL 33431

(561) 589-7020

In order for you to receive timely delivery

of the documents in advance of the annual meeting of Entero stockholders to be held on [●], 2024, which is referred to as the “Annual

Meeting,” you must request the information no later than [●], 2024.

If you have any questions about the Annual

Meeting or need to obtain a proxy card or other information, please contact Entero’s proxy solicitor at:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield,

NJ 07003

866-407-1875

The

contents of the websites of the SEC, Entero, ImmunogenX or any other entity are not incorporated in the accompanying proxy statement.

The information about how you can obtain certain documents that are incorporated by reference in the accompanying proxy statement

at these websites is being provided only for your convenience.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This proxy statement, and the documents incorporated

by reference into this proxy statement, includes certain “forward-looking statements” within the meaning of, and subject

to the safe harbor created by, Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities

Litigation Reform Act of 1995, which are referred to as the “safe harbor provisions.” Statements contained or incorporated

by reference in this proxy statement that are not historical facts are forward-looking statements, including statements regarding Entero’s

or ImmunogenX’s business and future financial and operating results, and other aspects of Entero’s or ImmunogenX’s

operations or operating results. Words such as “may,” “should,” “will,” “believe,” “expect,”

“anticipate,” “target,” “project,” and similar phrases that denote future expectations or intent

regarding Entero’s or ImmunogenX’s financial results, operations, and other matters are intended to identify forward-looking

statements that are intended to be covered by the safe harbor provisions. Investors are cautioned not to rely upon forward-looking statements

as predictions of future events. The outcome of the events described in these forward-looking statements is subject to known and unknown

risks, uncertainties, and other factors that may cause future events to differ materially from the forward-looking statements in this

proxy statement, including:

| |

● |

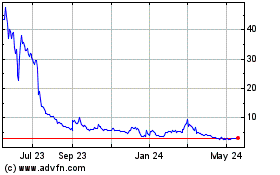

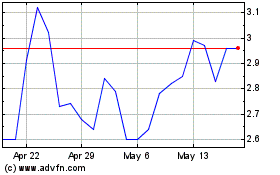

risks relating to fluctuations

of the market value of Entero Common Stock, including as a result of uncertainty as to the long-term

value of the common stock of Entero or as a result of broader stock market movements; |

| |

● |

Entero stockholders who receive

shares of Entero Common Stock as a result of the conversion of any Series G Preferred Stock will

have rights as Fist Wave common stockholders that differ from their current rights as preferred stockholders; |

| |

● |

our ability to commercialize Latiglutenase and integrate the assets and commercial operations

acquired into Entero’s business; |

| |

● |

failure to attract, motivate and retain executives and other key employees; |

| |

● |

disruptions in the business of Entero or ImmunogenX, which could have an adverse effect on their

respective businesses and financial results; and |

| |

● |

the unaudited pro forma condensed combined financial information in this proxy statement is presented

for illustrative purposes only and may not be reflective of the operating results and financial condition of the combination of Entero

and ImmunogenX. |

The forward-looking statements contained in

this proxy statement are also subject to additional risks, uncertainties, and factors, including those described in financial statements

of Fist Wave included in this proxy statement, as well as Entero’s most recent Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q and other documents filed by either of them from time to time with the SEC. See the section titled “Where

You Can Find More Information.”

The forward-looking statements included in proxy statement are

made only as of the date hereof. Entero does not undertake to update, alter or revise any forward-looking statements made in this proxy

statement to reflect events or circumstances after the date of this proxy statement or to reflect new information or the occurrence of

unanticipated events, except as required by law.

SUMMARY TERM SHEET

For your convenience, provided below is

a brief summary of certain information contained in this proxy statement. This summary highlights selected information from this proxy

statement and does not contain all of the information that may be important to you as an Entero stockholder. To understand the IMGX Transaction

fully and for a more complete description of the terms of the IMGX Transaction, you should read carefully this entire proxy statement,

its annexes and the other documents to which you are referred. You may obtain the information incorporated by reference in this proxy

statement, without charge, by following the instructions under “Where You Can Find More Information.”

The IMGX Transaction

On March 13, 2024, we

acquired ImmunogenX, Inc., a Delaware corporation (“IMGX” or “ImmunogenX”), in accordance with

the terms of an Agreement and Plan of Merger, dated March 13, 2024 (the “Merger Agreement”), by and among the Company, IMMUNO

Merger Sub I, Inc., a Delaware corporation (“First Merger Sub”), IMMUNO Merger Sub II, LLC, a Delaware limited liability

company (“Second Merger Sub”), and ImmunogenX. Pursuant to the Merger Agreement, On March 13, 2024, First Merger Sub

merged with and into ImmunogenX, pursuant to which ImmunogenX was the surviving corporation (the “First Merger”).

Immediately following the First Merger, ImmunogenX merged with and into Second Merger Sub, pursuant to which Second Merger Sub was the

surviving entity and a wholly owned subsidiary of the Company (the “Second Merger” and together with the First Merger,

the “Merger”). The Second Merger Sub amended its certificate of formation concurrently with the Second Merger to change

its company name to ImmunogenX, LLC. The Merger closed on March 13, 2024.

For a more fulsome description

of the Merger, please see the section titled “Description of the IMGX Transaction”.

The Parties to the IMGX Transaction

| · | Entero

Therapeutics, Inc. |

Entero is engaged in the

research and development of targeted, non-systemic therapies for the treatment of patients with gastrointestinal (“GI”)

diseases. Non-systemic therapies are non-absorbable drugs that act locally, i.e., in the intestinal lumen, skin or mucosa, without reaching

an individual’s systemic circulation.

Entero is currently focused

on developing a therapeutic pipeline with multiple late-stage clinical programs built around four proprietary technologies: Latiglutenase

(which was acquired in the merger with ImmunogenX), a targeted oral biotherapeutic for celiac disease designed to breakdown gluten into

non-immunogenic peptides; the biologic Adrulipase, a recombinant lipase enzyme designed to enable the digestion of fats and other nutrients

in cystic fibrosis and chronic pancreatitis patients with exocrine pancreatic insufficiency; Capeserod, a selective 5-HT4 receptor partial

agonist which we are developing as a gastroparesis therapeutic; and Niclosamide, an oral small molecule with anti-inflammatory properties

for patients with inflammatory bowel diseases such as ulcerative colitis and Crohn’s disease.

Entero shares are listed

for trading on The Nasdaq Capital Market under the symbol “ENTO.” For more information, please visit Entero’s website

at http://www.enterothera.com. Entero’s principal executive offices are located at 777 Yamato Road, Suite 502, Boca Raton,

FL 33431, and its telephone number is (561) 589-7020.

| · | ImmunogenX,

Inc. (IMGX) |

Founded in 2013 as a California

LLC, ImmunogenX was a private, clinical stage, biotherapeutics company, headquartered in Newport Beach, California, with a research facility

in North Carolina, formed to address critical needs for individuals with suspected or diagnosed celiac disease. On January 1, 2021, ImmunogenX

converted to a corporation and incorporated in the state of Delaware. Research efforts are focused on therapy, disease management, and

food safety. ImmunogenX has patented formulations related to the use of Latiglutenase, a targeted oral biotherapeutic for celiac disease

designed to breakdown gluten into non-immunogenic peptides. Another key area of research involves a method of monitoring intestinal villi

atrophy by measuring the level of a drug metabolite that is strongly dependent on the villi heath.

ImmunogenX has been primarily

engaged in developing its biopharmaceutical products, research and development, and raising capital through equity and debt offerings.

ImmunogenX has not commenced principal revenue producing operations and has incurred significant expenditures for the research and development

of ImmunogenX’s biopharmaceutical products.

| · | IMMUNO

Merger Sub I, Inc. |

IMMUNO Merger Sub I, Inc. was formed by Entero

solely for the purpose of engaging in the transactions contemplated by the Merger Agreement and did not engage in any business activities

other than in connection with the transactions contemplated by the Merger Agreement.

| · | IMMUNO

Merger Sub II, LLC |

IMMUNO Merger Sub II,

Inc. was formed by Entero solely for the purpose of engaging in the transactions contemplated by the Merger Agreement and did not engage

in any business activities other than in connection with the transactions contemplated by the Merger Agreement.

The Merger Agreement

On March 13, 2024, Entero,

ImmunogenX, First Merger Sub, and Second Merger Sub entered into the Merger Agreement, a copy of which is attached as Annex B to this

proxy statement. The Entero Board of Directors has unanimously approved the Merger Agreement and declared the Merger Agreement advisable

and in the best interests of Entero. Entero encourages you to carefully read the Merger Agreement in its entirety because it is the primary

legal document governing the Merger. For a more detailed description of the Merger Agreement, please see the section titled “Description

of the IMGX Transaction”.

Merger Consideration

Pursuant to the Merger

Agreement, in exchange for the outstanding shares of capital stock of ImmunogenX immediately prior to the effective time of the First

Merger, on March 13, 2024 Entero issued to the stockholders of ImmunogenX an aggregate of (A) 36,830 shares of common stock of Entero,

par value $0.0001 per share (the “Common Stock”), and (B) 11,777.418 shares of Series G Preferred Stock (as defined

and described below), each share of which is convertible into 1,000 shares of Common Stock, subject to certain conditions described below.

In addition, Entero assumed (i) all ImmunogenX stock options immediately outstanding prior to the First Merger, each becoming an option

to purchase Common Stock subject to adjustment pursuant to the terms of the Merger Agreement (the “Assumed Options”)

and (ii) all ImmunogenX warrants immediately outstanding prior to the First Merger, each becoming a warrant to purchase Common Stock

subject to adjustment pursuant to the terms of the Merger Agreement (the “Assumed Warrants”). The Assumed Options

are exercisable for an aggregate of 200,652 shares of Common Stock, have an exercise price of $0.81 and expire between February 1, 2031

and June 6, 2033. The Assumed Warrants are exercisable for and aggregate of 127,682 shares of Common Stock, have exercise prices ranging

from $3.02 to $3.92 and expire between September 30, 2032 and September 6, 2033. For more information regarding the consideration paid

in the Merger, please see the sections titled “Description of the IMGX Transaction” and “Proposal 3: Nasdaq

Proposal”.

Closing Date

The Merger closed on March

13, 2024.

Entero’s Reasons for the IMGX

Transaction and Recommendation of the Entero Board

After careful consideration,

on March 13, 2024, the Entero Board of Directors deemed it advisable and in the best interests of Entero to approve and adopt the Merger

Agreement.

For a description of factors

considered by the Entero Board in reaching its decision to approve the Merger Agreement and the transactions contemplated thereby, including

the IMGX Transaction, and additional information on the recommendation of the Entero Board, see the section titled “Nasdaq Proposal

- Background of the IMGX Transaction” and “Nasdaq Proposal - Board Reasons for the Approval of the IMGX

Transaction”.

Risks Relating to the IMGX Transaction

You should carefully consider

all of the risk factors together with all of the other information in this proxy statement before deciding how to vote. The risks relating

to the IMGX Transaction and the Contemplated Transactions are described under the caption “Risk Factors” in this proxy

statement. The principal risks relating to the IMGX Transaction and the Contemplated Transactions include the following:

| |

● |

Company stockholders

may not realize a benefit from the Merger commensurate with the ownership dilution they will experience in connection with the transactions. |

| |

|

|

| |

● |

Pursuant to the terms

of the Merger Agreement, we are required to recommend that our stockholders approve the conversion of shares of our Series G Preferred

Stock into shares of our Common Stock. We cannot guarantee that our stockholders will approve this matter, and if they fail to do

so we may be required to settle such shares in cash and our operations may be materially harmed. |

| |

|

|

| |

● |

The failure to successfully

integrate the businesses of the Company and IMGX in the expected timeframe would adversely affect our future results. |

| |

|

|

| |

● |

The failure to successfully

integrate the businesses of the Company and IMGX in the expected timeframe would adversely affect our future results. |

| |

|

|

| |

● |

The issuance or conversion

of securities would result in significant dilution in the equity interest of existing stockholders and adversely affect the marketplace

of the securities. |

| |

|

|

| |

● |

In connection with the

Merger, we assumed significantly more indebtedness. Our level of indebtedness and our ability to make payments on or service our

indebtedness could adversely affect our business, financial condition, results of operations, cash flow and liquidity. |

Stockholders Meeting

In

addition to the other matters to be considered at the Annual Meeting, pursuant to the terms of the Merger Agreement and in accordance

with Nasdaq Listing Rule 5635, we are recommending to our stockholders that they approve the issuance of: (i) up to 12,373,226

shares of Common Stock, subject to adjustment, upon conversion of the Company’s Series G Non-Voting Convertible Preferred Stock,

par value $0.0001 per share, (ii) the issuance of shares upon exercise of the Assumed Options, (iii) the issuance of shares upon exercise

of the Assumed Warrants, and (iv) the prior issuance of 36,830 shares of Common Stock to the stockholders of ImmunogenX (the “Nasdaq

Proposal”). See the section titled “Proposal 3: Nasdaq Proposal” for more information regarding the purpose

of the Nasdaq Propsal, a description of the Series G Preferred Stock and background of the IMGX Transaction.

| · | Stockholders

Entitled to Vote |

All holders of record

of shares of Entero Common Stock who held shares at the close of business on [●], 2024, the record date, are entitled to receive

notice of, and to vote at, the Annual Meeting. Attendance at the Annual Meeting is not required to vote. As of the record date, there

were [●] shares of Entero Common Stock issued and outstanding and entitled to vote at the Annual Meeting. Each share of Entero

Common Stock as of the record date is entitled to one vote on the Nasdaq Proposal.

At the Annual Meeting,

a quorum requires the presence of both (i) the holders of one-third of the voting power of the shares of the capital stock of the Company

issued and outstanding and entitled to vote at the Annual Meeting, and (ii) the holders of at least one-third of the shares of Common

Stock issued and outstanding and entitled to vote at the Annual Meeting must be represented at the Annual Meeting, either in person,

by means of remote communication in a manner, if any, authorized by the Board in its sole discretion, or represented by proxy. Abstentions

and broker non-votes, if any, will be included in determining whether a quorum is present at the Annual Meeting.

The approval of the Nasdaq

Proposal requires the affirmative vote of the majority of the votes cast by stockholders present or represented by proxy and entitled

to vote on the matter at the Annual Meeting.

See the section titled

“The Annual Meeting — Methods of Voting” for instructions on how to vote without attending the

Annual Meeting.

Interests of Entero’s Officers

and Directors in the IMGX Transaction

As of the date of this

proxy statement, Entero’s directors and executive officers do not have interests in the proposals that are different from, or in

addition to, the interests of other Entero stockholders generally, except that:

| |

● |

Dr. Jack Syage, our

President, Chief Scientific Officer, and Director, is a holder of 15,400 shares of Common Stock and 4,920.037 shares of Series G Preferred

Stock. |

| |

● |

Dr. Chaitan Khosla, a Director,

is a holder of 440 shares of Common Stock and 140.70 shares of Series G Preferred Stock. |

Stockholder Appraisal Rights

Our stockholders have no dissenter’s

or appraisal rights in connection with any of the proposals described herein.

Third Party Consents and Regulatory

Approvals

No third-party consents

or regulatory approvals were required prior to the consummation of the Merger other than the consent of Mattress Liquidators, Inc., which

was required under the Credit Agreement, dated October 3, 2022 (as amended by that certain Modification of Loan Documents, dated as of

September 6, 2023, the “Credit Agreement”), by and between ImmunogenX, Inc. and Mattress Liquidators, Inc. Such consent

was provided under the Second Modification of Loan Documents, dated March 13, 2024. See the section entitled “Description of

the IMGX Transaction – Debt of ImmunogenX” for information regarding the Credit Agreement.

Management of the Combined Company

Except for the change

in President as described herein, the officers and directors of Entero immediately prior to the Merger continued to be officers and directors

of the combined company immediately after the Merger, each to serve until the earlier of his or her resignation or removal or the due

election and qualification of his or her successor, in each case in accordance with the Entero Amended and Restated Certificate of Incorporation

and Amended and Restated Bylaws. On March 13, 2024, Jack Syage, former CEO of ImmunogenX, was appointed as Chief Operating Officer, President,

and Director of the combined company and Dr. Chaitan Khosla was appointed as a Director of the combined company. James

Sapirstein, the Company’s Chief Executive Officer and Chairman, had served as the Company’s President until the appointment

of Dr. Syage.

Material Federal Income Tax Consequences

of the Merger

The Merger is intended

to qualify as a tax-free reorganization for U.S. federal income tax purposes.

Opinion of Entero’s Financial

Advisor

Ladenburg Thalmann & Co. Inc. (“Ladenburg”) was retained by Entero

to render a fairness opinion (the “Opinion”) regarding the IMGX Transaction to the Entero Board of Directors. The

full text of the Opinion is attached to this proxy statement as Annex C. For more information regarding the Opinion of Ladenburg, including

details regarding the financial analyses Ladenburg performed, please see the section titled “Proposal 3: Nasdaq Proposal –

Opinion of Entero’s Financial Advisor”).

FREQUENTLY ASKED QUESTIONS

The following questions and answers briefly

address some questions that you, as an Entero stockholder, may have regarding the matters being considered at the Annual Meeting. You

are urged to carefully read this proxy statement and the other documents referred to in this proxy statement in their entirety because

this section may not provide all the information that is important to you regarding these matters. See “Summary Term Sheet”

for a summary of important information regarding the Annual Meeting. Additional important information is contained in the annexes to,

and the documents incorporated by reference in, this proxy statement. You may obtain the information incorporated by reference in this

proxy statement, without charge, by following the instructions in the section titled “Where You Can Find More Information.”

Why am I receiving this proxy statement?

We sent you this proxy statement because our

Board is soliciting your proxy to vote at the Annual Meeting that Entero is holding to seek stockholder approval on certain matters described

in further detail herein. This proxy statement summarizes the information you need to vote at the Annual Meeting. You do not need to

attend the Annual Meeting to vote your shares.

What is being voted on?

You are being asked to vote on seven proposals:

| 1. |

Election

of seven director nominees named in this proxy statement, each for a term of one year expiring at our 2025 annual meeting of stockholders

or until their respective successors are duly elected and qualified (the “Director Election Proposal”); |

| |

|

| 2. |

Approval

of an amendment to our 2020 Omnibus Equity Incentive Plan to: (1) increase the number of shares of Common Stock authorized for issuance

thereunder from 58,374 shares to 1,500,000 shares and to increase the number of shares that otherwise become available under the

plan for grants as incentive stock options (“ISOs”) from 250,000 to 750,000, and (2) to increase the number of shares

that may be granted to any one non-employee director of the Board from 5 to 250,000 (the “Equity Plan Amendment Proposal”);

|

| |

|

| 3. |

To

approve, in accordance with Nasdaq Listing Rule 5635, the issuance of: (i) up to 12,373,226 shares of Common Stock, subject to adjustment,

upon conversion of the Company’s Series G Non-Voting Convertible Preferred Stock, par value $0.0001 per share, (ii) the issuance

of shares upon exercise of certain assumed ImmunogenX, Inc. (“ImmunogenX” or “IMGX”) stock options exercisable

for an aggregate of 200,652 shares of Common Stock (the “Assumed Options”), (iii) the issuance of shares upon exercise

of certain assumed ImmunogenX warrants exercisable for an aggregate of 127,680 shares of Common Stock (the “Assumed Warrants”),

and (iv) the prior issuance of 36,830 shares of Common Stock to the stockholders of ImmunogenX (the “Nasdaq Proposal”).

Entero agreed to all of such issuances in connection with its acquisition of ImmunogenX (the “IMGX Transaction”) pursuant

to that certain Agreement and Plan of Merger, dated March 13, 2024 (the “Merger Agreement”), by and among Entero, IMMUNO

Merger Sub I, Inc., IMMUNO Merger Sub II, LLC, and ImmunogenX, all as described in further detail herein; |

| |

|

| 4. |

Adoption

and approval of an amendment to our Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to

effect a reverse stock split of our issued and outstanding shares of Common Stock, as a specific ratio, ranging from [●] to

[●], at any time prior to the one-year anniversary date of the Annual Meeting, with the exact ratio to be determined by the

Board without further approval or authorization of our stockholders (the “Reverse Split Proposal”); |

| |

|

| 5. |

Approval,

on an advisory basis, of the executive compensation of the Company’s named executive officers as described in this proxy statement

(the “Say on Pay Proposal”); |

| |

|

| 6. |

Ratification

of Forvis Mazars, LLP, as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (the “Auditor

Ratification Proposal”); and |

| |

|

| 7. |

Approval

of the adjournment of the annual meeting to the extent there are insufficient proxies at the annual meeting to approve any one or

more of the foregoing proposals (the “Adjournment Proposal”). |

When are this proxy statement and the accompanying

materials scheduled to be sent to stockholders?

On or about [●], 2024, we will begin mailing

our proxy materials, including the Notice of the Annual Meeting, this proxy statement, and the accompanying proxy card or, for shares

held in street name (i.e., shares held for your account by a broker or other nominee), a voting instruction form.

When and where will the Annual Meeting take

place?

The Annual Meeting will be held on [●],

2024 at [●] Eastern Time at our corporate headquarters at 777 Yamato Rd., Suite 502, Boca Raton, FL 33431.

When is the record date for the Annual Meeting?

The record date for determination of stockholders

entitled to vote at the Annual Meeting is the close of business on [●], 2024, which we refer to as the “record date.”

Who is entitled to vote at the Annual Meeting?

All holders of record of shares of Entero

Common Stock who held shares at the close of business on [●], 2024, the record date, are entitled to receive notice of, and to

vote at, the Annual Meeting. Attendance at the Annual Meeting is not required to vote. See below and the section titled “The Annual

Meeting — Methods of Voting” for instructions on how to vote without attending the Annual Meeting.

Does my vote matter?

Yes, your vote is very important, regardless of

the number of shares that you own.

How does the Entero Board recommend that I

vote at the Annual Meeting?

The Entero Board unanimously recommends that

Entero stockholders vote “FOR” each of the proposals.

Why should I vote for the Nasdaq Proposal?

We are subject to the Nasdaq Rules because our

Common Stock is currently listed on the Nasdaq Capital Market.

Pursuant to Nasdaq Rule 5635(a), stockholder approval

is required prior to the issuance by the Company of Common Stock (or securities convertible into or exercisable for Common Stock) in connection

with the acquisition of the stock or assets of another company if, due to the present or potential issuance of common stock, including

shares issued pursuant to an earn-out provision or similar type of provision, or securities convertible into or exercisable for common

stock, other than a public offering for cash: (A) the common stock has or will have upon issuance voting power equal to or in excess of

20% of the voting power outstanding before the issuance of stock or securities convertible into or exercisable for common stock; or (B)

the number of shares of common stock to be issued is or will be equal to or in excess of 20% of the number of shares of common stock outstanding

before the issuance of the stock or securities. Additionally, pursuant to Nasdaq Rule 5635(b), stockholder approval is required prior

to certain issuances with respect to Common Stock or securities convertible into Common Stock which could result in a change of control

of the issuer. Although Nasdaq has not adopted any rule on what constitutes a “change of control” for purposes of Rule 5635(b),

Nasdaq has previously indicated that the acquisition of, or right to acquire, by a single investor or affiliated investor group, as little

as 20% of the common stock (or securities convertible into or exercisable for common stock) or voting power of an issuer could constitute

a change of control.

Combined with the shares issued in the IMGX Transaction,

the shares issuable upon (i) conversion of the Series G Preferred Stock, (ii) exercise of the Assumed Warrants, and (iii) exercise of

the Assumed Options would result in the issuance of more than 20% of the voting power and the number of shares of Common Stock outstanding

as of the issuance of the Series G Preferred Stock. As a result of the foregoing, in accordance with Nasdaq Rule 5635(a) and (b), the

Series G Certificate of Designation provides that the Series G Preferred Stock will not be convertible into Common Stock until such time

as we obtain stockholder approval for their removal, as discussed in “Proposal 3: Nasdaq Proposal.”

If stockholders do not approve the Nasdaq Proposal,

the Company will not be able to honor any conversions of Series G Preferred Stock held by the former shareholders of ImmunogenX (see “Description

of the IMGX Transaction”).

Why should I vote for the Reverse Split Proposal?

Our Board has determined that it is advisable

and in the best interests of the Company and its stockholders, for us to amend our Charter to authorize our Board to effect a reverse

stock split (the “Charter Amendment”) of our issued and outstanding shares of Common Stock at a specific ratio, ranging from

[●] to [●] (the “Approved Split Ratios”), to be determined by the Board (the “Reverse Split”). A vote

for this Reverse Split Proposal will constitute approval of the Reverse Split that, once authorized by the Board and effected by filing

the Charter Amendment with the Secretary of State of the State of Delaware, will combine between [●] and [●] shares of our

Common Stock into one share of our Common Stock. If implemented, the Reverse Split will have the effect of decreasing the number of shares

of our Common Stock issued and outstanding.

Accordingly, stockholders are asked to adopt and

approve the Charter Amendment set forth in Annex D to effect the Reverse Split as set forth in the Charter Amendment, subject to the Board’s

determination, in its sole discretion, whether or not to implement the Reverse Split, as well as the specific ratio within the range of

the Approved Split Ratios, and provided that the Reverse Split must be effected on or prior to the one-year anniversary date of the Annual

Meeting. The text of Annex D remains subject to modification to include such changes as may be required by the Secretary of State of the

State of Delaware and as our Board deems necessary or advisable to implement the Reverse Split.

If adopted and approved by the holders of our

outstanding voting securities, the Reverse Split would be applied at an Approved Split Ratio approved by the Board prior to the one-year

anniversary date of the Annual Meeting. The Board reserves the right to elect to abandon the Reverse Split if it determines, in its sole

discretion, that the Reverse Split is no longer in the best interests of the Company and its stockholders.

Why should I vote for the Equity Plan Amendment

Proposal?

The general purpose of our 2020 Omnibus Equity

Incentive Plan (the “Plan”), is to benefit our Company and its shareholders by assisting the Company and its subsidiaries

to attract, retain and provide incentives to key management employees, officers, directors, and consultants of the Company and its affiliates,

and to align the interests of such service providers with those of the Company’s shareholders.

Our Board believes that the granting of stock

options, restricted stock awards, restricted stock units, stock appreciation rights and similar kinds of cash-based and equity-based compensation

promotes continuity of management and provides a critical incentive to align the interests of those who are primarily responsible for

shaping and carrying out our long range plans and securing our growth and financial success with the interests of our shareholders.

If the Company’s stockholders do not approve

the increase in the number of shares available for issuance under the Plan, the Company will continue to operate the Plan under its current

provisions, but will be limited in its ability to make future grants and incentives under the Plan to individuals we believe are, and

in the future, will be critical to the Company’s success.

Why should I vote for the Say on Pay Proposal?

The Board believes that the Company’s compensation

policies and practices are effective in achieving our goals of motivating and retaining executives by (i) rewarding excellence in leadership

and sustained financial performance, and (ii) aligning our executives’ interests with those of our stockholders to create long-term

value.

Why should I vote for the Auditor Ratification

Proposal?

Mazars USA LLP (“Mazars”)

has served as the Company’s independent registered public accounting firm since July, 2022. On June 1, 2024, Mazars entered into

a transaction with FORVIS, LLP (“FORVIS”) whereby substantially all of the partners and employees of Mazars joined

FORVIS. As a result, on the effective date of June 1, 2024, FORVIS changed its name to Forvis Mazars, LLP (“Forvis Mazars”)

and Mazars resigned as the Company’s independent public accounting firm. Our Audit Committee has appointed Forvis Mazars to serve

as the Company’s independent registered public accounting firm effective June 1, 2024, subject to ratification by the Company’s

stockholders. Our Audit Committee and Board believe that stability and continuity in the Company’s auditor is important as we advance

our business plan.

Why should I vote for the Adjournment Proposal?

If the Adjournment Proposal is not approved,

the Entero Board may not be able to adjourn the Annual Meeting to another time and place if necessary or appropriate to permit the solicitation

of additional proxies if there are insufficient votes at the time of the Annual Meeting to approve the Director Election Proposal, the

Equity Plan Amendment Proposal, the Nasdaq Proposal, the Reverse Split Proposal, the Say on Pay Proposal, or the Auditor Ratification

Proposal.

Will stockholders have the ability to unwind

the IMGX Transaction if they do not approve the Nasdaq Proposal?

No, the IMGX Transaction closed on March 13,

2024, and stockholder approval of the Nasdaq Proposal was not a pre-condition to closing the IMGX Transaction. If stockholders have not

approved the conversion of the Series G Preferred Stock into Common Stock by September 13, 2024, at

the request of the holder setting forth such holder’s request to cash settle a number of shares of Series G Preferred Stock, the

Company shall pay to such holder an amount in cash equal to (i) the Fair Value (as defined below) of the shares of Common Stock underlying

the shares of Series G Preferred Stock set forth in such request multiplied by (ii) the Conversion Ratio (as defined in the Certificate

of Designation of the Series G Preferred Stock) in effect on the trading day on which the

request is delivered to Entero. The “Fair Value” of shares shall be fixed with

reference to the last reported closing stock price on the principal trading market of the Common Stock.

What is a proxy?

A proxy is a stockholder’s legal designation

of another person to vote shares owned by such stockholder on their behalf. If you are a stockholder of record, you can vote by proxy

over the internet or by mail by following the instructions provided in the enclosed proxy card, or, by telephone if you are an Entero

stockholder of record. If you hold shares beneficially through a broker, bank or other nominee in “street name,” you should

follow the voting instructions provided by your broker, bank or other nominee.

How many votes do I have at the Annual

Meeting?

Each Entero stockholder is entitled to one

vote on each proposal for each share of Common Stock held of record at the close of business on the record date. At the close of business

on the record date, there were [●] shares of Common Stock outstanding.

What constitutes a quorum for the Annual Meeting?

A quorum is the minimum number of shares required

to be represented, either through virtual attendance or through representation by proxy, to hold a valid meeting.

In order for any business to be conducted at the

Annual Meeting, both (i) the holders of one-third of the voting power of the shares of the capital stock of the Company issued and outstanding

and entitled to vote at the Annual Meeting, and (ii) the holders of at least one-third of the shares of Common Stock issued and outstanding

and entitled to vote at the Annual Meeting must be represented at the Annual Meeting, either in person, by means of remote communication

in a manner, if any, authorized by the Board in its sole discretion, or represented by proxy. If a quorum is not present at the scheduled

time of the Annual Meeting, the Board, the chairman of the meeting or, if directed to be voted on by the chairman of the meeting, the

stockholders present or represented at the Annual Meeting and entitled to vote thereon, although less than a quorum, may adjourn the Annual

Meeting until a quorum is present. The date, time and place and the means of remote communication, if any, of the adjourned Annual Meeting

will be announced at the time the adjournment is taken, and no other notice will be given unless the adjournment is for more than 30 days,

in which case a notice of the adjourned meeting will be given to each stockholder of record entitled to vote at the Annual Meeting. An

adjournment will have no effect on the business that may be conducted at the Annual Meeting.

Since the Auditor Ratification Proposal is considered

a routine matter, shares held in “street name” through a broker, bank or other nominee will be counted as present for the

purpose of determining the existence of a quorum if such broker, bank or other nominee does not have instructions to vote on such proposal.

How can I vote my shares at the Annual

Meeting?

Shares held directly in your name as an Entero

stockholder of record may be voted at the Annual Meeting.

If

you hold your shares through a stockbroker, nominee, fiduciary or other custodian you may also be able to vote through a program provided

through Alliance Advisors LLC (“Alliance”) that offers Internet voting options. If your shares are held in an account at a

brokerage firm or bank participating in the Alliance program, you are offered the opportunity to elect to vote via the Internet. Votes

submitted via the Internet through the Alliance program must be received by 11:59 p.m. the day before the Annual Meeting.

Even if you plan to attend the Annual Meeting,

Entero recommends that you vote by proxy in advance as described below so that your vote will be counted if you later decide not to or

become unable to attend the Annual Meeting.

For additional information on attending the Annual

Meeting, see the section titled “The Annual Meeting.”

How can I vote my shares without attending

the Annual Meeting?

Whether you hold your shares directly as a

stockholder of record of Entero or beneficially in “street name,” you may direct your vote by proxy without attending the

Annual Meeting.

If you are a stockholder of record, you can vote

by proxy:

| |

● |

by Internet 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on the day before the Annual Meeting (have your proxy card in hand when you visit the website); |

| |

● |

by telephone in accordance with the instructions on your proxy card, until 11:59 p.m. Eastern Time on the day before the Annual Meeting (have your proxy card in hand when you call); or |

| |

● |

by completing and mailing your proxy card in accordance with the instructions provided on the proxy card. |

If you hold shares beneficially in “street

name,” you should follow the voting instructions provided by your bank, broker, or other nominee. If you hold your shares through

a stockbroker, nominee, fiduciary or other custodian you may also be able to vote through a program provided through Alliance that offers

Internet voting options. If your shares are held in an account at a brokerage firm or bank participating in the Alliance program, you

are offered the opportunity to elect to vote via the Internet. Votes submitted via the Internet through the Alliance program must be received

by 11:59 p.m. Eastern Time on the day before the Annual Meeting.

For additional information on voting procedures,

see the section titled “The Annual Meeting.”

What stockholder vote is required for the approval

of each proposal at the Annual Meeting?

The Equity Plan Amendment Proposal, Nasdaq Proposal,

Reverse Split Proposal, the Say on Pay Proposal, the Auditor Ratification Proposal and the Adjournment Proposal require the affirmative

vote of the majority of the votes cast by stockholders present or represented by proxy and entitled to vote on the matter at the Annual

Meeting.

The Director Election Proposal requires the affirmative

vote of a plurality of votes cast by stockholders present or represented by proxy and entitled to vote on the matter at the Annual Meeting.

What is a “broker non-vote?”

Under Nasdaq rules, banks, brokers and other nominees

may use their discretion to vote “uninstructed” shares (i.e., shares of record held by banks, brokers or other nominees, but

with respect to which the beneficial owner of such shares has not provided instructions on how to vote on a particular proposal) with

respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. All proposals

other than the Auditor Ratification Proposal are “non-routine” matters.

A “broker non-vote” occurs on

a proposal when (i) a broker, bank or other nominee has discretionary authority to vote on one or more proposals to be voted on

at a meeting of stockholders, but is not permitted to vote on other proposals without instructions from the beneficial owner of the shares,

and (ii) the beneficial owner fails to provide the broker, bank or other nominee with such instructions. The Auditor Ratification

Proposal is the only matter for which Entero expects there to be broker non-votes.

What will happen if I fail to vote or

abstain from voting on each proposal at the Annual Meeting?

An abstention represents a stockholder’s

affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting

its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions to be recorded for

shares, these shares will be considered present and entitled to vote at the annual meeting. Under Delaware law and our Amended and Restated

Bylaws (our “Bylaws”), abstentions, if any, with respect to the Director Election Proposal, the Equity Plan Amendment Proposal,

the Nasdaq Proposal, the Reverse Split Proposal, the Say on Pay Proposal, the Auditor Ratification Proposal, and the Adjournment Proposal

are not counted as votes cast on the matter and therefore will not affect the outcome of such proposal. Abstentions will be counted for

purposes of determining the presence or absence of a quorum at the Annual Meeting.

What is the difference between holding shares

as a stockholder of record and as a beneficial owner of shares held in “street name”?

If your shares of Common Stock are registered

directly in your name with the transfer agent of Entero, you are considered the stockholder of record with respect to those shares. As

the stockholder of record, you have the right to vote directly at the Annual Meeting. You may also grant a proxy directly to Entero,

or to a third party to vote your shares at the Annual Meeting.

If your shares of Common Stock are held by brokerage

firm, bank, dealer or other similar organization, trustee, or nominee, you are considered the beneficial owner of shares held in “street

name.” Your brokerage firm, bank, dealer or other similar organization, trustee, or nominee will send you, as the beneficial owner,

a package describing the procedures for voting your shares. You should follow the instructions provided by your brokerage firm, bank,

dealer or other similar organization, trustee, or nominee to vote your shares.

If you hold your shares of Common Stock through

a stockbroker, nominee, fiduciary or other custodian you may also be able to vote through a program provided through Alliance that offers

Internet voting options. If your shares of Common Stock are held in an account at a brokerage firm or bank participating in the Alliance

program, you are offered the opportunity to elect to vote via the Internet. Votes submitted via the Internet through the Alliance program

must be received by 11:59 p.m. Eastern Time on the day before the Annual Meeting.

If my shares of Common Stock are held in “street

name” by my brokerage firm, bank, dealer or other similar organization, trustee, or nominee, will my brokerage firm, bank, dealer

or other similar organization, trustee, or nominee automatically vote those shares for me?

No. Your bank, broker or other nominee will only

be permitted to vote your shares of Common Stock at the Annual Meeting if you instruct your bank, broker or other nominee. You should

follow the procedures provided by your bank, broker or other nominee regarding the voting of your shares. Banks, brokers and other nominees

who hold shares of Common Stock in “street name” for their customers have authority to vote on “routine” proposals

when they have not received instructions from beneficial owners. However, banks, brokers and other nominees are prohibited from exercising

their voting discretion with respect to non-routine matters, which includes all proposals other than the Auditor Ratification Proposal.

As a result, absent specific instructions from the beneficial owner of such shares, banks, brokers and other nominees are not empowered

to vote such shares on such proposals.

What should I do if I receive more

than one set of voting materials for the Annual Meeting?

If you hold shares of Common Stock in “street

name” and also directly in your name as a stockholder of record or otherwise, or if you hold shares of Common Stock in more than

one brokerage account, you may receive more than one set of voting materials relating to the Annual Meeting.

Record

Holders. For shares held directly, please vote by proxy over the internet or by telephone, using the instructions included

with the accompanying proxy card, or promptly complete your proxy card and return it in the enclosed postage-paid envelope, in order to

ensure that all of your shares of Common Stock are voted.

Shares

Held in “Street Name.” For shares held in “street name” through a bank, broker or other nominee,

you should follow the procedures provided by bank, broker or other nominee to submit a proxy or vote your shares.

If a stockholder gives a proxy, how are the

shares of Common Stock voted?

Regardless of the method you choose to vote, the

individuals named on the enclosed proxy card will vote your shares of Common Stock in the way that you indicate. For each item before

the Annual Meeting, you may specify whether your shares of Common Stock should be voted “for” or “against,” or

abstain from voting.

For more information regarding how your shares

will be voted if you properly sign, date and return a proxy card, but do not indicate how your Common Stock should be voted, see below

“— How will my shares be voted if I return a blank proxy?”

How will my shares be voted if I return

a blank proxy?

If you sign, date and return your proxy and

do not indicate how you want your shares of Common Stock to be voted, then your shares of Common Stock will be voted in accordance with

the recommendation of the Entero Board, “FOR” each of the proposals.

Can I change my vote after I have

submitted my proxy?

Any Entero stockholder giving a proxy has

the right to revoke the proxy and change their vote before the proxy is voted at the Annual Meeting by doing any of the following:

| |

● |

subsequently submitting a new proxy for the Annual Meeting that is received by the deadline specified on the accompanying proxy card; |

| |

● |

giving written notice

of your revocation to Entero’s Chief Financial Officer or |

| |

● |

attending and voting at the Annual Meeting. Note that a proxy will not be revoked if you attend, but do not vote at, the Annual Meeting. |

Execution or revocation of a proxy will not in

any way affect your right to attend and vote at the Annual Meeting. See the section titled “The Annual Meeting — Revocability

of Proxies.”

If I hold my shares in “street name,”

can I change my voting instructions after I have submitted voting instructions to my bank, broker or other nominee?

If your shares are held in the name of a bank,

broker or other nominee and you previously provided voting instructions to your bank, broker or other nominee, you should follow the instructions

provided by your bank, broker or other nominee to revoke or change your voting instructions.

Where can I find the voting results of

the Annual Meeting?

The preliminary voting results for the Annual

Meeting are expected to be announced at the Annual Meeting. In addition, within four Business Days following certification of the

final voting results, Entero will file the final voting results of the Annual Meeting (or, if the final voting results have not yet been

certified, the preliminary results) with the SEC on a Current Report on Form 8-K.

Do Entero stockholders have dissenters’

or appraisal rights?

The stockholders of Entero are not entitled

to appraisal rights in connection with the proposals at the Annual Meeting under Delaware law.

What happens if I sell my shares of Common

Stock after the record date but before the Annual Meeting?

The record date is earlier than the date of the

Annual Meeting. If you sell or otherwise transfer your shares of Common Stock after the record date but before the Annual Meeting, you

will, unless special arrangements are made, retain your right to vote at the Annual Meeting.

Who will solicit and pay the cost of soliciting

proxies?

Entero has engaged Alliance Advisors LLC,

which is referred to as “Alliance,” to assist in the solicitation of proxies for the Annual Meeting. Entero estimates that

it will pay Alliance a fee of approximately $32,400, plus reimbursement for certain out-of-pocket fees and expenses. Entero has agreed

to indemnify Alliance against various liabilities and expenses that relate to or arise out of its solicitation of proxies (subject to

certain exceptions).

Entero also may reimburse banks, brokers and

other custodians, nominees and fiduciaries or their respective agents for their expenses in forwarding proxy materials to beneficial

owners of Common Stock. Entero directors, officers and employees also may solicit proxies by telephone, by electronic means or in person.

They will not be paid any additional amounts for soliciting proxies.

What should I do now?

You should read this proxy statement carefully

and in its entirety, including the annexes. Then, you may vote by proxy over the internet or by telephone, using the instructions included

with the accompanying proxy card, or promptly complete your proxy card and return it in the enclosed postage-paid envelope, so that your

shares will be voted in accordance with your instructions.

How can I find more information about

Entero?

You can find more information about Entero

from various sources described in the section titled “Where You Can Find More Information.”

Whom do I call if I have questions

about the Annual Meeting?

If you have questions about the Annual Meeting,

or desire additional copies of this proxy statement or additional proxies, you may contact Entero’s proxy solicitor:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield,

NJ 07003

866-407-1875

The Annual Meeting

The Annual Meeting will be

held on [●], 2024, beginning at [●] a.m., Eastern Time at our corporate headquarters at 777 Yamato Rd., Suite 502, Boca Raton,

FL 33431.

The purposes of the Annual

Meeting are as follows:

| 1. |

Election of seven director nominees named in this proxy statement, each for a term of one year expiring at our 2025 annual meeting of stockholders or until their respective successors are duly elected and qualified; |

| |

|

| 2. |

Approval of an amendment to our 2020 Omnibus Equity Incentive Plan to: (1) increase the number of shares of Common Stock authorized for issuance thereunder from 58,374 shares to 1,500,000 shares and to increase the number of shares that otherwise become available under the plan for grants as incentive stock options (“ISOs”) from 250,000 to 750,000, and (2) to increase the number of shares that may be granted to any one non-employee director of the Board from 5 to 250,000 (the “Equity Plan Amendment Proposal”); |

| |

|

| 3. |

To

approve, in accordance with Nasdaq Listing Rule 5635, the issuance of: (i) up to 12,373,226 shares of Common Stock, subject to adjustment,

upon conversion of the Company’s Series G Non-Voting Convertible Preferred Stock, par value $0.0001 per share, (ii) the issuance

of shares upon exercise of certain assumed ImmunogenX, Inc. (“ImmunogenX” or “IMGX”) stock options exercisable

for an aggregate of 200,652 shares of Common Stock (the “Assumed Options”), (iii) the issuance of shares upon exercise

of certain assumed ImmunogenX warrants exercisable for an aggregate of 127,680 shares of Common Stock (the “Assumed Warrants”),

and (iv) the prior issuance of 36,830 shares of Common Stock to the stockholders of ImmunogenX (the “Nasdaq Proposal”).

Entero agreed to all of such issuances in connection with its acquisition of ImmunogenX (the “IMGX Transaction”) pursuant

to that certain Agreement and Plan of Merger, dated March 13, 2024 (the “Merger Agreement”), by and among Entero, IMMUNO

Merger Sub I, Inc., IMMUNO Merger Sub II, LLC, and ImmunogenX, all as described in further detail herein; |

| |

|

| 4. |

Adoption and approval of an amendment to our Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to effect a reverse stock split of our issued and outstanding shares of Common Stock, as a specific ratio, ranging from [●] to [●] at any time prior to the one-year anniversary date of the Annual Meeting, with the exact ratio to be determined by the Board without further approval or authorization of our stockholders (the “Reverse Split Proposal”); |

| |

|

| 5. |

Approval, on an advisory basis, of the executive compensation of the Company’s named executive officers as described in this proxy statement (the “Say on Pay Proposal”); |

| |

|

| 6. |

Ratification

of Forvis Mazars, LLP, as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (the

“Auditor Ratification Proposal”); and |

| |

|

| 7. |

Approval of the adjournment of the annual meeting to the extent there are insufficient proxies at the annual meeting to approve any one or more of the foregoing proposals (the “Adjournment Proposal”). |

A

quorum of Entero stockholders is necessary to conduct business at the Annual Meeting. The presence in person or by proxy of both (i)

the holders of one-third of the voting power of the shares of the capital stock of the Company issued and outstanding and entitled to

vote at the Annual Meeting, and (ii) the holders of at least one-third of the shares of Common Stock issued and outstanding and entitled

to vote at the Annual Meeting will constitute a quorum. Abstentions will count as votes present and entitled to vote for the purpose

of determining the presence of a quorum for the transaction of business at the Annual Meeting. Since the Auditor Ratification Proposal

is considered a routine matter, shares held in “street name” through a broker, bank or other nominee will be counted as present

for the purpose of determining the existence of a quorum if such broker, bank or other nominee does not have instructions to vote on

such proposal.

The Nasdaq Proposal, the Reverse

Split Proposal, the Equity Plan Amendment Proposal, the Say on Pay Proposal, the Auditor Ratification Proposal and the Adjournment Proposal

require the affirmative vote of the majority of the votes cast by stockholders present or represented by proxy and entitled to vote on

the matter at the Annual Meeting. The Director Election Proposal requires the affirmative vote of the plurality of the votes cast by stockholders

present or represented by proxy and entitled to vote on the matter at the Annual Meeting.

An abstention represents a

stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to

abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions

to be recorded for shares, these shares will be considered present and entitled to vote at the annual meeting. Under Delaware law and

our Bylaws, abstentions, if any, with respect to the Director Election Proposal, the Equity Plan Amendment Proposal, the Nasdaq Proposal,

the Reverse Split Proposal, the Say on Pay Proposal, the Auditor Ratification Proposal, and the Adjournment Proposal are not counted as

votes cast on the matter and therefore will not affect the outcome of such proposal. Abstentions will be counted for purposes of determining

the presence or absence of a quorum at the Annual Meeting.

Interests of Entero’s Directors and

Executive Officers in the IMGX Transaction

As of the date of this

proxy statement, Entero’s directors and executive officers do not have interests in the proposals that are different from, or in

addition to, the interests of other Entero stockholders generally, except that:

| |

● |

Dr. Jack Syage, our President, Chief Scientific Officer, and Director, is a holder of 15,400 shares of Common Stock and 4,920.037 shares of Series G Preferred Stock. |

| |

● |

Dr. Chaitan Khosla,

a Director, is a holder of 440 shares of Common Stock and 140.70 shares of Series G Preferred Stock. |

Certain Beneficial Owners of Entero Common

Stock

At the close of business

on June 12, 2024, the latest practicable date prior to the date of this proxy statement, Entero directors and executive officers and

their affiliates, as a group, owned and were entitled to vote approximately 2% of the shares of Entero common stock.

DESCRIPTION OF THE IMGX TRANSACTION

On March 13, 2024, we

acquired ImmunogenX, Inc., a Delaware corporation, in accordance with the terms of the Merger Agreement, by and among us, IMMUNO Merger

Sub I, Inc., a Delaware corporation (“First Merger Sub”), IMMUNO Merger Sub II, LLC, a Delaware limited liability

company (“Second Merger Sub”), and IMGX. Pursuant to the Merger Agreement, First Merger Sub merged with and into IMGX,

pursuant to which IMGX was the surviving corporation (the “First Merger”). Immediately following the First Merger,

IMGX merged with and into Second Merger Sub, pursuant to which Second Merger Sub was the surviving entity and a wholly owned subsidiary

of the Company (the “Second Merger” and, together with the First Merger, the “Merger”). The Second

Merger Sub amended its certificate of formation concurrently with the Second Merger to change its company name to ImmunogenX, LLC. The

Merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

Under the terms of the

Merger Agreement, following the consummation of the Merger on March 13, 2024 (the “Closing”), in exchange for the

outstanding shares of capital stock of IMGX immediately prior to the effective time of the First Merger, we issued to the stockholders

of IMGX an aggregate of (A) 36,830 shares of Common Stock, and (B) 11,777.418 shares of Series G Preferred Stock (as defined and described

below), each share of which is convertible into 1,000 shares of Common Stock, subject to certain conditions described below. In addition,

we assumed (i) all IMGX stock options immediately outstanding prior to the First Merger, each becoming an option to purchase Common Stock

subject to adjustment pursuant to the terms of the Merger Agreement (the “Assumed Options”) and (ii) all IMGX warrants

immediately outstanding prior to the First Merger, each becoming a warrant to purchase Common Stock subject to adjustment pursuant to

the terms of the Merger Agreement (the “Assumed Warrants”). The Assumed Options are exercisable for an aggregate of

200,652 shares of Common Stock, have an exercise price of $0.81 and expire between February 1, 2031 and June 6, 2033. The Assumed Warrants

are exercisable for an aggregate of 127,682 shares of Common Stock, have exercise prices ranging from $3.02 to $3.92 and expire between

September 30, 2032 and September 6, 2033.

The foregoing description

of the Assumed Warrants does not purport to be complete and is qualified in its entirety by reference to the form of Assumed Warrant,

which is incorporated by reference to this proxy statement as Exhibit 4.43 to the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, filed with the SEC on March 29, 2024.

Tungsten Partners LLC (“Tungsten”)

acted as our financial advisor in connection with the Merger. As partial compensation for services rendered by Tungsten, we issued to

Tungsten or its affiliates or designees an aggregate of 18,475 shares of Common Stock and 595.808 shares of Series G Preferred Stock.

Pursuant to the Merger