Glucotrack, Inc. Announces Closing of $10.0 Million Public Offering and Concurrent Private Placement Converting $4.0 in Outstanding Debt

15 November 2024 - 8:30AM

Glucotrack, Inc. (Nasdaq: GCTK), a medical technology company

focused on the design, development, and commercialization of novel

technologies for people with diabetes, announced the closing of a

“best efforts” public offering of 2,437,340 shares of common stock

and 4,756,900 pre-funded warrants, with each share of common stock

and each pre-funded warrant accompanied by (i) a series A common

warrant to purchase one (1) share of common stock at an exercise

price of $1.81 per share and (ii) a series B common warrant to

purchase one (1) share of common stock at an exercise price of

$1.81 per share. The combined offering price of each share of

common stock together with the accompanying series A and series B

common warrants is $1.39, and the combined offering price of each

pre-funded warrant together with the accompanying series A and

series B common warrants is $1.389. The gross proceeds of the

public offering were approximately $10 million before deducting

placement agent fees and offering expenses.

The closing of the public offering occurred on

November 14, 2024 and was made by the Company pursuant to a

registration statement on Form S-1 (File No. 333-282158), which was

declared effective by the United States Securities and Exchange

Commission (“SEC”) on November 12, 2024.

Dawson James Securities, Inc. acted as the sole

placement agent for the public offering.

In connection with the public offering,

Glucotrack was represent by Nelson Mullins Riley & Scarborough

LLP (Atlanta, Ga and Raleigh, NC), and Dawson James Securities,

Inc. was represented by ArentFox Schiff LLP (Washington, D.C.).

Concurrent with the closing of the public

offering, the Company closed a private placement pursuant to which

approximately $4.0 million in outstanding secured convertible notes

originally issued in July 2024 were converted into equity on

substantially the same terms as the public offering.

This press release shall not constitute

an offer to sell or the solicitation of an offer to buy these

securities, nor shall there be any sale of these securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction.

About Glucotrack, Inc.

Glucotrack, Inc. (NASDAQ: GCTK) is focused on

the design, development, and commercialization of novel

technologies for people with diabetes. The Company is currently

developing a long-term implantable continuous blood glucose

monitoring system for people living with diabetes.

Glucotrack’s CBGM is a long-term, implantable

system that continually measures blood glucose levels with a sensor

longevity of 3 years, no on-body wearable component and with

minimal calibration. For more information, please

visit http://www.glucotrack.com

Forward-Looking Statements

This press release may contain statements that

constitute “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are statements other than historical

facts and may include statements that address future operating,

financial or business performance, the anticipated use of proceeds

from the offering, and the exercise of the series A warrants and

series B warrants prior to their expiration. In some cases, you can

identify these statements by forward-looking words such as “may”,

“might”, “will”, “should”, “expects”, “plans”, “anticipates”,

“believes”, “estimates”, “predicts”, “projects”, “potential”,

“outlook” or “continue”, or the negative of these terms or other

comparable terminology. Forward-looking statements are based on

management’s current expectations and beliefs and involve

significant risks and uncertainties that could cause actual

results, developments and business decisions to differ materially

from those contemplated by these statements. These risks and

uncertainties include, but are not limited to, market and other

conditions, the ability of Glucotrack to raise additional capital

to finance its operations (whether through public or private equity

offerings, debt financings, strategic collaborations or otherwise);

risks relating to the receipt (and timing) of regulatory approvals

(including U.S. Food and Drug Administration approval); risks

relating to enrollment of patients in, and the conduct of, clinical

trials; risks relating to Glucotrack’s future distribution

agreements; and risks relating to its ability to hire and retain

qualified personnel, including sales and distribution personnel.

These risks and uncertainties also include, but are not limited to,

those described under the caption “Risk Factors” in Glucotrack’s

Annual Report on Form 10-K for the year ended December 31, 2023 as

filed with the SEC on March 28, 2024, and in Glucotrack’s other

filings with the SEC, which are available free of charge on the

SEC’s website at: www.sec.gov. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated. All forward-looking statements and all

subsequent written and oral forward-looking statements attributable

to Glucotrack or to persons acting on behalf of Glucotrack are

expressly qualified in their entirety by reference to these risks

and uncertainties. You should not place undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date they are made, and Glucotrack does not undertake any

obligation to update them in light of new information, future

developments or otherwise, except as may be required under

applicable law.

Investor Relations:investors@glucotrack.com

Media:GlucotrackPR@icrinc.com

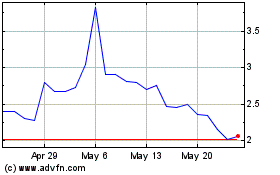

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Nov 2024 to Dec 2024

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Dec 2023 to Dec 2024