SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

June 2024

Commission File Number: 001-37925

GDS Holdings Limited

(Registrant’s name)

F4/F5, Building C, Sunland

International

No. 999 Zhouhai Road

Pudong, Shanghai 200137

People’s Republic

of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F x Form

40-F ¨

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GDS Holdings Limited |

| |

|

| Date: June 7, 2024 |

By: |

/s/

William Wei Huang |

| |

Name: |

William Wei Huang |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Execution Version

DEED OF ADHERENCE AND AMENDMENT

TO SERIES A PREFERRED SHARE SUBSCRIPTION AGREEMENT

THIS

DEED OF ADHERENCE AND AMENDMENT TO SERIES A PREFERRED SHARE SUBSCRIPTION AGREEMENT (this “Deed”) is made and entered

into as of [•], 2024 (the “Effective Date”) by and among each investor identified on Schedule 2.01

of this Deed under the heading “Investor” (each, an “Investor” and, collectively, the “Investors”),

DigitalLand Holdings Limited, an exempted company incorporated under the laws of the Cayman Islands with limited liability (the “Company”),

and, solely for purposes of Section 4.02, Section 4.04 and Article V of the Share Subscription Agreement

(as defined below) and with respect to its obligations therein, GDS Holdings Limited, an exempted company incorporated under the laws

of the Cayman Islands with limited liability (“GDSH” and, together with the Investors and the Company, the “Parties”).

WHEREAS,

the Company, each investor identified on Schedule 2.01 thereof under the heading “Investor” (each, an “Original

Investor” and, collectively, the “Original Investors”, which, together with SBCVC Fund VI, L.P., a limited

partnership incorporated under the laws of the Cayman Islands, and Harvest Dall Pte Ltd, a private limited company incorporated under

the laws of Singapore (the “New Investors”), comprise all of the Investors), and, solely for purposes of Section 4.02,

Section 4.04 and Article V thereof and with respect to its obligations therein, GDSH, entered into that certain

Series A Preferred Share Subscription Agreement, dated as of [•], 2024 (the “Share Subscription Agreement”);

WHEREAS,

Section 8.05 of the Share Subscription Agreement provides that any amendment of any provision of the Share Subscription Agreement

shall be in writing and executed by each of the parties thereto;

WHEREAS,

the parties to the Share Subscription Agreement desire, and hereby agree, by execution and delivery of this Deed to effect certain changes

to the provisions contained in the Share Subscription Agreement as set forth herein, including the adherence to the Share Subscription

Agreement, as amended and supplemented herein, by each New Investor, on the terms and subject to the conditions set forth in this Deed;

WHEREAS, each New Investor

desires, and hereby agrees, by execution and delivery of this Deed to adhere to the Share Subscription Agreement, as amended and supplemented

herein, as a party thereto and be bound by and comply with the terms and conditions set forth therein as an Investor;

WHEREAS, simultaneously with

the execution and delivery of this Deed, as a condition and inducement to the willingness of the Company to enter into this Deed, certain

Investors (as specified in Schedule 3.02(f)(ii)(B)) are delivering amended and restated equity commitment letters (each, an “A&R

Equity Commitment Letter” and, collectively, the “A&R Equity Commitment Letters”) to the Company, which

will amend and restate their respective Original Equity Commitment Letters in each case in its entirety;

WHEREAS, the Company and GDSH

have entered into that certain Project Transfer Agreement dated as of March 26, 2024 (the “Project Transfer Agreement”);

WHEREAS, the Company and GDSH

desire to terminate the Project Transfer Agreement in its entirety and agree to certain undertakings in connection therewith;

WHEREAS, in connection with

the termination of the Project Transfer Agreement, the parties to the Share Subscription Agreement desire to amend Section 6.03(e) of

the Share Subscription Agreement by removing the condition set forth therein; and

WHEREAS, the Company has promptly

notified each Investor of the relevant matters set forth in this Deed in compliance with Section 4.05 of the Share Subscription

Agreement.

NOW THEREFORE, in consideration

of the premises and mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, the Parties hereby agree as follows. Subject to the last sentence of Section 2.1 of this Deed, capitalized

terms used and not defined in this Deed shall have the meanings ascribed to such terms in the Share Subscription Agreement.

1. AMENDMENT

OF SHARE SUBSCRIPTION AGREEMENT.

1.1 Amendment

to Section 1.01. Section 1.01 of the Share Subscription Agreement is hereby amended as follows:

1.1.1 by

inserting the following defined terms in alphabetical order in such Section:

“A&R

Equity Commitment Letters” means the amended and restated equity commitment letters delivered on the Effective Date by certain

Investors to the Company as specified in Schedule 3.02(f)(ii)(B).

“Effective

Date” is [•], 2024.

“Equity

Commitment Letters” means the A&R Equity Commitment Letters and the Original Equity Commitment Letters.

“New

Investors” means SBCVC Fund VI, L.P., a limited partnership incorporated under the laws of the Cayman Islands and Harvest

Dall Pte Ltd, a private limited company incorporated under the laws of Singapore.

“Original

Equity Commitment Letters” means the equity commitment letters delivered by certain Investors on [•], 2024 to the

Company as specified in Schedule 3.02(f)(ii)(A).

“Original

Investors” means all Investors other than the New Investors.

1.1.2 by

deleting the defined term “Project Transfer Agreement” in such Section; and

1.1.3 by

amending and restating the definition of “GDSH Services Agreements” in its entirety as follows:

“GDSH Services

Agreements” means the Services Agreement, the Corporate Guarantees Agreement and the IP License Agreement.

1.2 Amendment

to Section 3.01(c)(i). The second sentence of Section 3.01(c)(i) of the Share Subscription Agreement is

hereby amended and restated in its entirety as follows:

“Immediately

prior to the Closing, the authorized share capital of the Company will be US$50,000.0001, consisting of 932,800,002 Ordinary Shares, 75,000,000

of which will be issued and outstanding, and 67,200,000 Series A Preferred Shares, none of which will be issued and outstanding prior

to the Closing.”

1.3 Amendment

to Section 3.02. The first paragraph of Section 3.02 of the Share Subscription Agreement is hereby amended and

restated in its entirety as follows:

“Each

Original Investor, severally and not jointly, and with respect to itself only, hereby represents and warrants to the Company that, as

of the date hereof and as of the Closing Date, each of the following statements in this Section 3.02 is true and correct,

and each New Investor, severally and not jointly, and with respect to itself only, hereby represents and warrants to the Company

that, as of the Effective Date and as of the Closing Date, each of the following statements in this Section 3.02 is true and

correct:”

1.4 A&R

Equity Commitment Letters. Notwithstanding anything to the contrary in the Share Subscription Agreement or herein, with respect

to each Investor that has delivered an A&R Equity Commitment Letter, the representations and warranties set forth in Section 3.02(f)(ii) through

(v) of the Share Subscription Agreement shall be deemed to be given by such Investor to the Company solely with respect to

its A&R Equity Commitment Letter as of the date of this Deed and as of the Closing Date, and the covenants set forth in Section 4.07

of the Share Subscription Agreement shall be deemed to be made by such Investor solely with respect to its A&R Equity Commitment Letter.

1.5 Amendment

to Section 4.01, Section 4.03, Section 4.05, Section 4.08, and Section 6.02(a). Section 4.01,

Section 4.03, Section 4.05, Section 4.08, and Section 6.02(a) of the Share Subscription

Agreement are hereby amended by replacing each instance of “the date hereof” or “the date of this Agreement” therein

with the phrase “the date hereof (in respect of each Original Investor) or the Effective Date (in respect of each New Investor),

as applicable,”.

1.6 Amendment

to Section 6.03(e). Section 6.03(e) of the Share Subscription Agreement is hereby removed and replaced in

its entirety as follows:

“[reserved;].”

1.7 Amendment

to Schedule 2.01. Schedule 2.01 of the Share Subscription Agreement is hereby amended and restated in its entirety as set

forth in Schedule 2.01 to this Deed.

1.8 Amendment

to Schedule 3.01(c)(ii). Schedule 3.01(c)(ii) of the Share Subscription Agreement is hereby amended and restated in

its entirety as set forth in Schedule 3.01(c)(ii) to this Deed.

1.9 Amendment

to Schedule 3.01(k)(i). Schedule 3.01(k)(i) of the Share Subscription Agreement is hereby amended and restated in

its entirety as set forth in Schedule 3.01(k)(i) to this Deed.

1.10 Amendment

to Schedule 3.02(f)(ii). Schedule 3.02(f)(ii) of the Share Subscription Agreement is hereby amended and restated in

its entirety as set forth in Schedule 3.02(f)(ii) to this Deed.

2. Project

Transfer Agreement

2.1 Termination

of Project Transfer Agreement. Pursuant to Section 3.01(a) of the Project Transfer Agreement, the Company and

GDSH agree that the Project Transfer Agreement shall be terminated in its entirety with effect from the date hereof. Subject to Section 3.02

of the Project Transfer Agreement, the Project Transfer Agreement shall have no further force or effect from the date hereof and all of

the rights and obligations of the Company and GDSH under the Project Transfer Agreement shall terminate with immediate effect. Any capitalized

term used in this Section 2 but not otherwise defined in this Deed shall have the meaning ascribed to such term in Article I

of the Project Transfer Agreement.

2.2

[REDACTED]. It is acknowledged that [REDACTED] have entered into a [REDACTED] dated [REDACTED] relating to certain proposed

amendments to the [REDACTED], respectively, a copy of which is attached as [REDACTED].

2.3

[REDACTED]Amendment Agreements. Each of the Company and GDSH shall use its reasonable best efforts to expeditiously

negotiate, finalize and enter into, or cause its relevant Subsidiary to enter into, binding agreements (the “[REDACTED] Amendment

Agreements”) to give effect [REDACTED]; provided, that any amendment to the [REDACTED] shall require the prior written

consent (which consent shall not be unreasonably withheld, conditioned or delayed) of each of the Relevant Investors (as defined in the

Share Subscription Agreement) if such amendment contains (i) any material term that is contemplated under the [REDACTED] but is inconsistent

with or less favorable to the Company as compared to that set forth in the [REDACTED] or (ii) any other material term that is not contemplated

under the [REDACTED]. In the event the Company and GDSH fail to enter into the [REDACTED] Amendment Agreements by [REDACTED], the Company

and GDSH shall, as soon as possible, discuss in good faith and use their respective reasonable best efforts to agree on [REDACTED].

2.4

Confirmation. Each of GDSH and the Company hereby jointly and severally represents, warrants and covenants to each Investor

that none of GDSH, the Company and any of their respective Subsidiaries has as of the date hereof entered into or will enter into any

Contract with any person that would require the Company or any of its Subsidiaries to purchase or pay for, or otherwise have any other

obligation or liability in respect of, [REDACTED].

3. UNDERTAKINGS

BY NEW INVESTORs AND OTHER PARTIES

3.1 As

of the Effective Date, each New Investor shall accede to the Share Subscription Agreement, as amended and supplemented herein, as an Investor

and be bound by, and subject to, all of the terms and conditions set forth therein.

3.2 All

of the other Parties hereby agree and accept the accession of the New Investors to the Share Subscription Agreement, as amended and supplemented

herein, effective as of the Effective Date.

4. Miscellaneous.

4.1 Effectiveness.

The provisions of this Deed shall be effective as of the date first written above. Except as expressly amended and/or superseded by this

Deed, the Share Subscription Agreement remains as set forth therein and shall remain in full force and effect. Upon the execution and

delivery hereof, the Share Subscription Agreement shall thereupon be deemed to be amended and supplemented as hereinabove set forth as

fully and with the same effect as if the amendments and supplements set forth herein were originally set forth in the Share Subscription

Agreement. This Deed and the Share Subscription Agreement shall each henceforth be read, taken, and construed as one and the same instrument,

but such amendments and supplements shall not operate so as to render invalid or improper any action heretofore taken under the Share

Subscription Agreement. If and to the extent there are any inconsistencies between the Share Subscription Agreement and this Deed with

respect to the matters set forth herein, the terms of this Deed shall control.

4.2 References

to Share Subscription Agreement. All references to the Share Subscription Agreement in the Transaction Documents shall hereafter

refer to the Share Subscription Agreement as amended and supplemented by this Deed. Each reference in the Share Subscription Agreement

to “this Agreement”, “hereunder”, “hereof”, “herein”, or words of like import shall mean,

and be a reference to, the Share Subscription Agreement as amended and supplemented by this Deed. Notwithstanding the foregoing and except

as otherwise provided in this Deed, references to the date of the Share Subscription Agreement and references in the Share Subscription

Agreement, as amended and supplemented by this Deed, to “the date hereof”, “the date of this Agreement” and other

similar references shall in all instances continue to refer to [•], 2024 and references to the date of this Deed and “as of

the date of this Deed” shall refer to [•], 2024.

4.3 Other

Provisions. The provisions of Section 1.02 (Interpretation), Section 8.03 (Binding Effect; Assignability;

Benefit), Section 8.04 (Notices), Section 8.05 (Waiver; Amendment), Section 8.06

(Fees and Expenses), Section 8.07 (No Recourse), Section 8.08 (Governing Law), Section 8.09

(Jurisdiction), Section 8.10 (Specific Enforcement), Section 8.11 (Exercise of Rights and Remedies),

Section 8.12 (Counterparts; Effectiveness), Section 8.13 (Entire Agreement), and Section 8.14

(Severability) of the Share Subscription Agreement are incorporated herein by reference mutatis mutandis; provided

that, in each case, references to “this Agreement” in such Sections shall mean this Deed. Notwithstanding anything to the

contrary herein, any provision contained in Section 2 of this Deed may be (a) amended, modified or terminated by an instrument

in writing executed by the Company, GDSH and the Relevant Investors or (b) waived by an instrument in writing executed by the Company

and the Relevant Investors, in the case of any obligation of GDSH contained therein, or by GDSH, in the case of any obligation of the

Company contained therein.

[Signature pages follow]

IN

WITNESS WHEREOF, the parties hereto have executed and delivered this Deed as a deed on the day and year first above written.

THE COMPANY:

| SIGNED, SEALED and DELIVERED as a deed by DigitalLand Holdings Limited acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| |

Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

SOLELY FOR PURPOSES OF SECTION 4.02, SECTION 4.04 AND

ARTICLE V OF THE SHARE SUBSCRIPTION AGREEMENT:

GDSH:

| SIGNED, SEALED and DELIVERED as a deed by GDS

Holdings Limited acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| |

Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by HGDC HOLDINGS LIMITED

acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| |

Title: |

| SIGNED, SEALED and DELIVERED as a deed by HGDK HOLDINGS LIMITED

acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| |

Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by LUMINOUS KNOWLEDGE LIMITED

acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| |

Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by CHAUSSON INTERNATIONAL

LIMITED acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| |

Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by TORAKEN LLC acting

by _______________________, who is duly authorised to sign on its behalf |

|

|

| |

Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by PRINCEVILLE GLOBAL DATACENTER

DEVELOPMENT INVESTMENTS acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| Title: |

| SIGNED, SEALED and DELIVERED as a deed by PRIVATUS NOMINEES PTY LTD (ACN 649 376 527) AS TRUSTEE FOR PRINCEVILLE GLOBAL III ANZ FUND acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by PUJIANG INTERNATIONAL

INVESTMENT HOLDING LIMITED acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by TEKNE PRIVATE VENTURES

XVI, LP acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by HARVEST DALL PTE LTD acting

by _______________________, who is duly authorised to sign on its behalf |

|

|

| Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

INVESTORS:

| SIGNED, SEALED and DELIVERED as a deed by SBCVC FUND VI, L.P.

acting by _______________________, who is duly authorised to sign on its behalf |

|

|

| Title: |

[Signature Page to Deed of Adherence and

Amendment

to Series A Preferred Share Subscription Agreement]

Schedule 2.01

Details of Investors

Schedule

2.01

Schedule 3.01(c)(ii)

Company Capitalization Immediately After

Closing

| Shareholder | |

Class of Shares | |

Number of Shares | | |

Shareholding

Percentages | |

| GDS Holdings Limited | |

Ordinary Shares | |

| 75,000,000 | | |

| 52.74 | % |

| HGDC Holdings Limited | |

Series A Preferred Shares | |

| 14,500,000 | | |

| 10.20 | % |

| HGDK Holdings Limited | |

Series A Preferred Shares | |

| 14,500,000 | | |

| 10.20 | % |

| Luminous Knowledge Limited | |

Series A Preferred Shares | |

| 21,000,000 | | |

| 14.77 | % |

| Chausson International Limited | |

Series A Preferred Shares | |

| 5,000,000 | | |

| 3.52 | % |

| Toraken LLC | |

Series A Preferred Shares | |

| 1,500,000 | | |

| 1.06 | % |

| Princeville Global Datacenter Development Investments | |

Series A Preferred Shares | |

| 2,817,727 | | |

| 1.98 | % |

| Privatus Nominees Pty Ltd (ACN 649 376 527) as trustee for Princeville Global III ANZ Fund | |

Series A Preferred Shares | |

| 332,273 | | |

| 0.23 | % |

| Pujiang International Investment Holding Limited | |

Series A Preferred Shares | |

| 2,650,000 | | |

| 1.86 | % |

| Tekne Private Ventures XVI, LP | |

Series A Preferred Shares | |

| 2,300,000 | | |

| 1.62 | % |

| Harvest Dall Pte Ltd | |

Series A Preferred Shares | |

| 1,500,000 | | |

| 1.06 | % |

| SBCVC Fund VI, L.P. | |

Series A Preferred Shares | |

| 1,100,000 | | |

| 0.77 | % |

Schedule 3.01(c)(ii)

Schedule 3.01(k)(i)

Material Contracts

Schedule 3.01(k)(i)

Schedule 3.02(f)(ii)

Investors Delivering Equity Commitment Letter

Schedule 3.02(f)(ii)

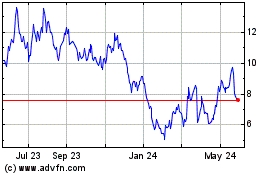

GDS (NASDAQ:GDS)

Historical Stock Chart

From May 2024 to Jun 2024

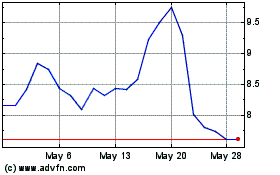

GDS (NASDAQ:GDS)

Historical Stock Chart

From Jun 2023 to Jun 2024