Gevo, Inc. (NASDAQ: GEVO), a leading developer of hydrocarbon fuels

and chemicals with net-zero greenhouse gas emissions, is pleased to

announce that it has acquired the ethanol production plant and

carbon capture and sequestration (“CCS”) assets of Red Trail

Energy, LLC (“Red Trail Energy”) for an aggregate purchase price of

$210 million, subject to customary adjustments, including a working

capital adjustment. The acquired assets include the plant, pore

space, and we are bringing on their experienced operational

personnel. In addition to creating another strategic option for

economic and competitively advantaged sustainable aviation fuel

(“SAF”) facilities, this acquisition is expected to contribute $30

million to $60 million of Adjusted EBITDA(1) to Gevo annually. The

acquired assets are being renamed “Net-Zero North.”

“This transformational acquisition marks the start of Net-Zero

North,” said Gevo Chief Executive Officer, Patrick Gruber. “Looking

forward, this is a great site to expand the plant to produce SAF,

along with other additional co-located projects. We like the

potential annual Adjusted EBITDA of $30 million to $60 million,

synergies with the existing Gevo platform of assets, and having CCS

assets in the Gevo portfolio as a risk mitigation tool for carbon

sequestration for our Net-Zero 1 (“NZ1”) plant under development in

South Dakota. The proven CCS site will allow us to permanently

sequester biogenic carbon dioxide to produce US products with the

highest quantity and quality of carbon abatement to address a

growing global market demand. Net-Zero North is a key step on our

path to becoming self-sustaining and profitable as a company in

advance of our NZ1 project coming online.”

The transaction was funded with a combination of Gevo equity

capital and a $105 million senior secured term loan facility from

Orion Infrastructure Capital (“OIC”), a U.S.-based private

investment firm. OIC has also indicated interest in providing up to

an additional $100 million in debt for future growth projects at

Net-Zero North that are mutually agreed upon. In addition, OIC is

investing $5 million in equity at Net-Zero North, which is in

addition to the equity contributed by Gevo. The investment comes

from OIC’s Infrastructure Credit Strategy, which provides

non-dilutive and flexible capital to middle market infrastructure

businesses in North America. The strategy seeks to capitalize on

the growing need for investment and innovation in sustainable

Infrastructure in North America.

“We are thrilled to partner with the Gevo team on this

acquisition,” said Ethan Shoemaker, Investment Partner and Head of

Infrastructure Credit at OIC. “The Net-Zero North assets bring

together operating carbon sequestration, a strong track record of

profitability, near-term upside from their industry-leading carbon

intensity score, a strong operating team, and room to grow. We are

also excited about the potential synergies and incremental value

that the Gevo team and platform of assets brings to the Net-Zero

North business.”

“North Dakota is a state that understands both energy and

agriculture, and that they are synergistic,” Gruber said. “We

expect to continue to partner with the community to grow the

business as they’re a resource that understands how oil and gas,

pipelines, carbon capture, and regenerative agriculture all fit

together. Net-Zero North provides the fundamental pieces of the

puzzle towards cost-effective energy production, such as SAF, while

addressing the market demand for cost effective,

lower-carbon-footprint products.”

“We’re taking on a first-class operation from the previous

owners, with an exemplary safety record and excellent people to

back it up,” said Chris Ryan, President and Chief Operating Officer

of Gevo. “The operations team have done a great job, and we’re

excited they’re continuing on with us. We are already in

engineering development for a Net-Zero alcohol-to-jet (“ATJ”) SAF

plant to be built at the site.”

“Net-Zero North is one of a select few ethanol plants in the

U.S., of which we are aware, that are expected to maximize value

from carbon abatement, including under Section 45Z,” explained

Ryan. “Net-Zero North, with its efficient operating profile and

CCS, is projected to achieve a carbon intensity (“CI”) score in the

low 20s (not including improved agricultural results that farmers

can achieve using regenerative agriculture practices) using the

variation of the GREET model proposed in the Section 45Z rule. We

believe that is about 30 CI points lower than the best plants that

are not connected to CCS. British Columbia previously scored the

Net-Zero North plant at a CI of 19. This is a great starting point

to expand Gevo’s business.”

AdvisorsOcean Park Securities, LLC acted as

exclusive financial advisor and sole lead arranger on the debt

financing for Gevo.

Acquisition Conference CallA conference call

will be held on Monday, February 3, 2025, at 10:00am ET to discuss

the acquisition.

To participate in the live call, please register through the

following event

weblink: https://register.vevent.com/register/BI174d9b6ef4074fed9db695b122abda12

After registering, participants will be provided with a dial-in

number and pin. To listen to the conference call (audio only),

please register through the following event

weblink: https://edge.media-server.com/mmc/p/7e4padot

A webcast replay will be available after the conference call

ends on February 3, 2025. The archived webcast will be available in

the Investor Relations section of Gevo's website

at www.gevo.com..

Further information regarding the acquisition and accompanying

debt financing is included in the Current Report on Form 8-K, which

Gevo will file with the U.S. Securities and Exchange Commission

(the “SEC”).

About Gevo Gevo is a next-generation

diversified energy company committed to fueling America’s future

with cost-effective, drop-in fuels that contribute to energy

security, abate carbon, and strengthen rural communities to drive

economic growth. Gevo’s innovative technology can be used to make a

variety of renewable products, including SAF, motor fuels,

chemicals, and other materials that provide U.S.-made solutions. By

investing in the backbone of rural America, Gevo’s business model

includes developing, financing, and operating production facilities

that create jobs and revitalize communities. Gevo owns and operates

one of the largest dairy-based renewable natural gas (“RNG”)

facilities in the United States, turning by-products into clean,

reliable energy. We also operate an ethanol plant with an adjacent

CCS facility, further solidifying America’s leadership in energy

innovation. Additionally, Gevo owns the world’s first production

facility for specialty ATJ fuels and chemicals. Gevo’s market

driven “pay for performance” approach regarding carbon and other

sustainability attributes, helps ensure value is delivered to our

local economy. Through its Verity subsidiary, Gevo provides

transparency, accountability and efficiency in tracking, measuring

and verifying various attributes throughout the supply chain. By

strengthening rural economies, Gevo is working to secure a

self-sufficient future and to make sure value is brought to the

market.

For more information, see

www.gevo.com.

About OICWith approximately $5 billion in

assets under management, OIC invests in North America and select

international markets. OIC’s unique partnership approach – for

entrepreneurs, by entrepreneurs – cultivates creative credit,

equity, and growth capital solutions to help middle market

businesses scale and deploy sustainable infrastructure. OIC’s

target investment sectors include energy efficiency, digital

infrastructure, sustainable power generation, renewable fuels,

waste & recycling, and transportation, storage & logistics.

OIC was founded in 2015 by a team of energy and sustainability

veterans, successful infrastructure investors, and former asset

owners and industry operators. Across OIC’s platform is a team of

approximately 45 professionals based in New York, Houston, and

London.

Forward Looking Statements This release

contains “forward-looking statements” within the meaning of the

federal securities laws. All statements other than statements of

historical fact are forward-looking statements, including

statements related to the expected operation of Net-Zero North, the

expected effect of the acquisition on Adjusted EBITDA, the expected

annual Adjusted EBITDA from Net-Zero North, and our future

prospects as a combined company, including our plans for the site

and synergies with our other projects. These statements relate to

analyses and other information, which are based on forecasts of

future results or events and estimates of amounts not yet

determinable. We claim the protection of The Private Securities

Litigation Reform Act of 1995 for all forward-looking statements in

this release.

These forward-looking statements are identified by the use of

terms and phrases such as “anticipate,” “assume,” “believe,”

“estimate,” “expect,” “goal,” “intend,” “plan,” “potential,”

“predict,” “project,” “target” and similar terms and phrases or

future or conditional verbs such as “could,” “may,” “should,”

“will,” and “would.” However, these words are not the exclusive

means of identifying such statements. Although we believe that our

plans, intentions and other expectations reflected in or suggested

by such forward-looking statements are reasonable, we cannot assure

you that we will achieve those plans, intentions or expectations.

All forward-looking statements are subject to risks and

uncertainties that may cause actual results or events to differ

materially from those that we expected.

Important factors that could cause actual results or events to

differ materially from our expectations, or cautionary statements,

include among others, the risk that anticipated benefits, including

synergies, from the acquisition may not be fully realized or may

take longer to realize than expected, including that the

transaction may not be accretive within the expected timeframe or

to the extent anticipated; failure to successfully integrate the

acquired assets and employees; changes in legislation or government

regulations affecting the future operations of the acquired assets;

and other risk factors or uncertainties identified from time to

time in Gevo’s filings with the SEC. All written and oral

forward-looking statements attributable to us, or persons acting on

our behalf, are expressly qualified in their entirety by the

cautionary statements identified above and in the section entitled

“Risk Factors” and elsewhere in our Annual Report on

Form 10-K for the year ended December 31, 2023 as

well as other cautionary statements that are made from time to time

in our other SEC filings and public communications. You should

evaluate all forward-looking statements made in this release in the

context of these risks and uncertainties.

We caution you that the important factors referenced above may

not reflect all of the factors that could cause actual results or

events to differ from our expectations. In addition, we cannot

assure you that we will realize the results or developments we

expect or anticipate or, even if substantially realized, that they

will result in the consequences or affect us or our operations in

the way we expect. The forward-looking statements included in this

release are made only as of the date hereof. We undertake no

obligation to publicly update or revise any forward-looking

statement as a result of new information, future events or

otherwise, except as otherwise required by law.

Media ContactHeather ManuelVice President,

Stakeholder Engagement & PartnershipsPR@gevo.com

IR ContactEric FreyVice President of Corporate

DevelopmentIR@Gevo.com

(1) Adjusted EBITDA is a non-GAAP measure calculated as

earnings before interest, taxes, depreciation and amortization,

inclusive of the value of monetizable tax credits such as Sections

45Q and 45Z and excluding project development costs.

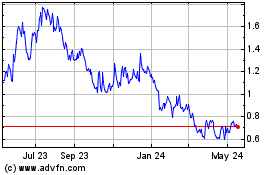

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jan 2025 to Feb 2025

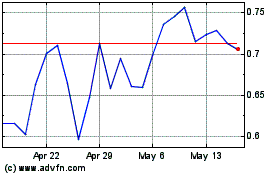

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Feb 2024 to Feb 2025