Grom Social Enterprises, Inc. Announces Pricing of $3.0 Million Public Offering

08 September 2023 - 10:30PM

Grom Social Enterprises, Inc. (NASDAQ: GROM; GROMW) (the

“Company”), today announced the pricing of a public offering of

946,000 units (the “Units”) at a price to the public of $3.00 per

Unit and approximately 54,000 pre-funded units (the “Pre-Funded

Units”) at a price to the public of $2.999 per Pre-Funded Unit.

Each Unit consists of one share of common stock, one Series A

warrant to purchase one share of common stock and one Series B

warrant to purchase one share of common stock (the Series A and

Series B warrants together the “Warrants”). The Warrants will have

an exercise price of $3.00 per share, are exercisable immediately

upon issuance, and will expire five (5) years following the date of

issuance. Each Pre-Funded Unit consists of one pre-funded warrant

exercisable for one share of common stock (the “Pre-Funded

Warrants”), one Series A Warrant and one Series B Warrant,

identical to the Warrants in the Unit. The purchase price of each

Pre-Funded Unit is equal to the price per Unit being sold to the

public in this offering, minus $0.001, and the exercise price of

each Pre-Funded Warrant is $0.001 per share. The Pre-Funded

Warrants will be immediately exercisable and may be exercised at

any time until all of the Pre-Funded Warrants are exercised in

full. The closing of the offering is expected to occur on or about

September 12, 2023, subject to the satisfaction of customary

closing conditions.

EF Hutton, division of Benchmark Investments,

LLC (“EF Hutton”) is acting as the sole book running manager for

the offering. Lucosky Brookman LLP is acting as legal counsel to

the Company and Carmel, Milazzo & Feil LLP is acting as legal

counsel to EF Hutton.

The gross proceeds to the Company from the

offering are expected to be approximately $3.0 million, before

deducting underwriter fees and other offering expenses payable by

the Company. The Company intends to use the net proceeds from this

offering for general corporate purposes, which may include

acquisitions, research and development of original content and

technology, strategic partnerships, and for working capital,

capital expenditures, and other general corporate purposes.

The offering is being conducted pursuant to the

Company’s registration statement on Form S-1, as amended (File No.

333-273895), previously filed with the Securities and Exchange

Commission (“SEC”) that was declared effective by the SEC on

September 7, 2023. A final prospectus relating to the offering will

be filed with the SEC and will be available on the SEC’s website at

www.sec.gov. Electronic copies of the final prospectus relating to

this offering, when available, may be obtained from EF Hutton,

division of Benchmark Investments, LLC, 590 Madison Avenue, 39th

Floor, New York, NY 10022, Attention: Syndicate Department, or via

email at syndicate@efhuttongroup.com or telephone at (212)

404-7002.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Grom Social Enterprises,

Inc.

Grom Social Enterprises, Inc. (NASDAQ: GROM;

GROMW) is an emerging social media platform and original content

provider of entertainment for children under 13, which provides

safe and secure digital environments for kids that can be monitored

by their parents or guardians. The Company has several operating

subsidiaries, including Grom Social, which delivers its content

through mobile and desktop environments (web portal and apps) that

entertain children and lets them interact with friends, access

relevant news, and play proprietary games while teaching them about

being good digital citizens, and Curiosity Ink Media, a global

media company that develops, acquires, builds, grows, and maximizes

the short-, mid-, and long-term commercial potential of Kids &

Family entertainment properties and associated business

opportunities. The Company also owns and operates Top Draw

Animation, which produces award-winning animation content for some

of the largest international media companies in the world. The

Company also includes Grom Educational Services, which provides web

filtering for K-12 schools, government and private businesses. For

more information, please visit https://gromsocial.com or for

investor relations, please visit

http://investors.gromsocial.com.

Safe Harbor Statement

This press release may contain forward-looking

statements about Grom Social Enterprises, Inc. activities that are

based on current expectations, forecasts, and assumptions that

involve risks and uncertainties that could cause actual outcomes

and results to differ materially from those anticipated or

expected, including statements related to the amount and timing of

expected revenues and any payment of dividends on our common stock,

statements related to our financial performance, expected income,

distributions, and future growth for upcoming quarterly and annual

periods, and other risks set forth in the Company’s filings with

the U.S. Securities and Exchange Commission, including our Annual

Report on Form 10-K and our Quarterly Reports on Form 10-Q. Actual

results and the timing of certain events could differ materially

from those projected in or contemplated by the forward-looking

statements due to a number of factors. Among other matters, the

Company may not be able to sustain growth or achieve profitability

based upon many factors including, but not limited to general stock

market conditions. We have incurred and will continue to incur

significant expenses in the expansion of our existing and new

service lines, noting there is no assurance that we will generate

enough revenues to offset those costs in both the near and

long-term. Additional service offerings may expose us to additional

legal and regulatory costs and unknown exposure(s) based upon the

various geopolitical locations where we will be providing services,

the impact of which cannot be predicted at this time. All

forward-looking statements speak only as of the date of this press

release. We undertake no obligation to update any forward-looking

statements or other information contained herein. Stockholders and

potential investors should not place undue reliance on these

forward-looking statements. Although we believe that our plans,

intentions, and expectations reflected in or suggested by the

forward-looking statements in this report are reasonable, we cannot

assure stockholders and potential investors that these plans,

intentions, or expectations will be achieved. Except to the extent

required by law, we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, a change in events, conditions, circumstances, or

assumptions underlying such statements, or otherwise.

Media Contact for Grom Social Enterprises,

Inc.:

Paul Ward+1-917-593-6066Paul@gromsocial.com

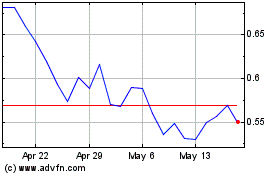

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Feb 2024 to Feb 2025