Gritstone bio Takes Action to Preserve Value and Strengthen Capital Structure

10 October 2024 - 8:50PM

Business Wire

Voluntarily Files for Chapter 11

Restructuring

Strategic Alternatives Process Continues with

Interest from Parties

Gritstone bio, Inc. (Nasdaq: GRTS) (“Gritstone” or the

“Company”), a clinical-stage biotechnology company working to

develop the world’s most potent vaccines, today announced it has

filed a voluntary petition under chapter 11 of the United States

Bankruptcy Code in the United States Bankruptcy Court for the

District of Delaware.

Gritstone intends to use the court-administered restructuring

process to preserve value and support its ongoing strategic

alternatives process. The Company is in discussions with a party to

act as a stalking horse bidder or plan sponsor and intends to

present an agreement to the Court as early as next week in order to

enter into a value-maximizing transaction and continue to research

and develop its next-generation vaccines and immunotherapies for

oncology and infectious diseases.

“Our world-class science and cutting-edge innovations have

positioned us at the forefront of oncology and medical

breakthroughs. We recently reported encouraging interim Phase 2

data from our ongoing study evaluating GRANITE, which continues to

demonstrate an emerging benefit for patients, however, additional

time is needed for the data to mature,” said Andrew Allen, MD, PhD,

Co-founder, President & CEO of Gritstone. “The decision to file

for chapter 11 relief allows us to stay focused on our mission of

bringing potentially life-saving treatments like GRANITE to

patients around the world.”

During its financial restructuring process, Gritstone intends to

operate in the ordinary course and remains committed to advancing

its clinical programs, including its ongoing neoantigen

immunotherapy and infectious disease programs, and driving

innovation in immunotherapy and vaccine development.

Gritstone is filing customary "first day" motions in its chapter

11 case with the intention of ensuring normal operations. Upon

court approval of these first day motions, Gritstone intends to

minimize the impact of the bankruptcy process on the Company's

vendors, employees, and other key stakeholders.

Additional information regarding Gritstone’s chapter 11 process

is available at https://www.veritaglobal.net/gritstone.

Stakeholders with questions may call the Company’s Claims Agent,

Verita Global, at 877-709-4754 or 424-236-7233 if calling from

outside the U.S. or Canada, or send an inquiry by visiting

https://www.veritaglobal.net/gritstone/inquiry.

Advisors

Pachulski Stang Ziehl & Jones LLP is serving as legal

counsel, Fenwick & West LLP is serving as general corporate

counsel, Raymond James & Associates, Inc. is serving as

investment banker, PwC is serving as financial advisor, and C

Street Advisory Group is serving as strategic communications

advisor to the Company.

About Gritstone

Gritstone bio, Inc. (Nasdaq: GRTS) is a clinical-stage

biotechnology company that aims to develop the world’s most potent

vaccines. We leverage our innovative vectors and payloads to train

multiple arms of the immune system to attack critical disease

targets. Independently and with our collaborators, we are advancing

a portfolio of product candidates to treat and prevent viral

diseases and solid tumors in pursuit of improving patient outcomes

and eliminating disease. www.gritstonebio.com

Gritstone Forward-Looking Statements

This press release contains forward-looking statements. These

forward-looking statements include, but are not limited to,

statements regarding the process and potential outcomes of

Gritstone’s chapter 11 case, Gritstone's ability to continue to

operate as usual during the chapter 11 case, Gritstone's ability to

enter into a transaction in the chapter 11 case and strengthen its

capital structure, and Gritstone's ability to present a stalking

horse bidder or plan sponsor to the Court. These statements are

based on management's current expectations, and actual results and

future events may differ materially due to risks and uncertainties,

including, without limitation, risks inherent in the bankruptcy

process, including the outcome of the chapter 11 case; Gritstone's

financial projections and cost estimates; Gritstone's ability to

raise additional funds or secure additional financing during the

chapter 11 case; Gritstone's ability to conduct asset sales; the

impact of the chapter 11 case on the listing of the Gritstone's

common stock on the Nasdaq Stock Market; and the effect of the

chapter 11 case on Gritstone's business prospects, financial

results and business operations. For a further description of the

risks and uncertainties that could cause actual results to differ

from those expressed in these forward-looking statements, as well

as risks relating to the business of the company in general, see

Gritstone’s most recent Quarterly Report on Form 10-Q filed on

August 13, 2024 and any current and periodic reports filed with the

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009836692/en/

Media C Street Advisory Group

gritstone@thecstreet.com

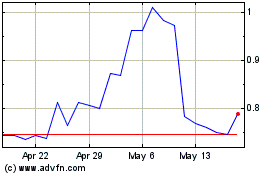

Gritstone bio (NASDAQ:GRTS)

Historical Stock Chart

From Jan 2025 to Feb 2025

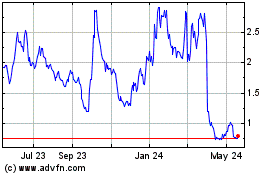

Gritstone bio (NASDAQ:GRTS)

Historical Stock Chart

From Feb 2024 to Feb 2025