iCoreConnect Inc. Reports Strong Revenue and Subscriber Growth in Q2 2024 With a 66% Revenue Increase

17 August 2024 - 6:30AM

iCoreConnect Inc. (NASDAQ: ICCT) ("iCore" or the "Company"), a

leading provider of cloud-based software and technology solutions

designed to enhance workflow productivity and customer

profitability, is pleased to announce its financial results for the

three and six months ended June 30, 2024.

Q2 2024 Financial Highlights

- Revenue Growth: The Company reported a significant 66% increase

in revenue, rising from $1.6 million in Q2 2023 to $3.1 million in

Q2 2024. For the six months ending June 30, 2024, revenue grew from

$3.7 million to $5.8 million compared to the same period in 2023.

This growth was driven by strong performance across all active

products and services.

- Gross Profit Margins: iCoreConnect saw an improvement in gross

profit margins, increasing from 74% to 80% for both the three and

six months ending June 30, 2024 compared to the three and six

months ending June 30, 2023 respectively.

- Customer Demand: For the first time in the company's history,

it has signed agreements with customers waiting for installation

reflecting high demand for iCore’s solutions, including the newly

launched Fintech product, iCorePay.

Operational and Strategic Developments

- Operating Expenses: Operating expenses increased due to a

one-time, non-recurring charge of $4.8 million. This charge is

related to stock-based compensation awarded to certain officers and

employees in recognition of the Company's Nasdaq listing and merger

with FG Merger Corp in 2023.

- Artificial Intelligence Integration: The Company has

implemented artificial intelligence (AI) in its support division

and is testing AI across various solutions. Notably, iCoreConnect

sees significant potential in leveraging AI for its ICD-10 coding

and insurance verification software, promising exciting

developments soon.

- Channel Relationships: iCoreConnect continued to expand its

relationships with companies such as mConsent, Arthur/Marshall,

independent HIPAA consultants, and various state associations,

including the California Association of Orthodontists and Tennessee

Dental Associations. These relationships enhance value for end

users by enabling them to access multiple solutions with a single

sign-on through the iCoreEnterprise platform, seamlessly

integrating with existing practice management software.

Debt Restructuring

As part of its strategy to improve cash flow management,

iCoreConnect has successfully reached restructuring agreements with

certain of its convertible noteholders. These agreements cover

approximately $3.6 million in combined principal and accrued

interest, originally due in 2024. The majority of maturities have

now been extended to August 1, 2027, with all principal and

interest payable at that time. Upon shareholder approval,

noteholders will have the option to convert their notes into common

stock at a conversion price of $0.80 per share, with mandatory

conversion required if the common stock price exceeds $1.04.

This debt restructuring provides the Company with an additional

runway to preserve cash and support ongoing growth initiatives.

About iCoreConnect, Inc. (NASDAQ: ICCT)

iCoreConnect Inc. is a market leading, cloud-based software and

technology company focused on increasing workflow productivity and

practice profitability through its enterprise and healthcare

workflow platform of applications and services. iCoreConnect is

most notably known for its innovation in solving healthcare

business problems. iCoreConnect’s philosophy places a high value on

customer feedback, positioning iCoreConnect to respond to the

market’s needs. iCoreConnect touts a platform of 16 SaaS enterprise

solutions and more than 130 product endorsements with state or

regional healthcare associations across the United States.

Forward-Looking Statements

Some of the statements in this release are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, Section 21E of the Securities Exchange Act of 1934 and the

Private Securities Litigation Reform Act of 1995, which involve

risks and uncertainties. Although the Company believes that the

expectations reflected in such forward-looking statements are

reasonable as of the date made, expectations may prove to have been

materially different from the results expressed or implied by such

forward-looking statements. The Company has attempted to identify

forward-looking statements by terminology including ‘believes,’

‘estimates,’ ‘anticipates,’ ‘expects,’ ‘plans,’ ‘projects,’

‘intends,’ ‘potential,’ ‘may,’ ‘could,’ ‘might,’ ‘will,’ ‘should,’

‘approximately’ or other words that convey uncertainty of future

events or outcomes to identify these forward-looking statements.

These statements are only predictions and involve known and unknown

risks, uncertainties, and other factors, including those discussed

under Item 1A. “Risk Factors” in the Company’s most recently filed

Form 10-K filed with the Securities and Exchange Commission (“SEC”)

and updated from time to time in its Form 10-Q filings and in its

other public filings with the SEC. Any forward-looking statements

contained in this release speak only as of its date. The Company

undertakes no obligation to update any forward-looking statements

contained in this release to reflect events or circumstances

occurring after its date or to reflect the occurrence of

unanticipated events.

Investor Contacts:IR@icoreconnect.com888.810.7706, ext

5

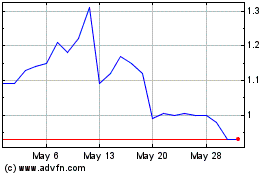

iCoreConnect (NASDAQ:ICCT)

Historical Stock Chart

From Jan 2025 to Feb 2025

iCoreConnect (NASDAQ:ICCT)

Historical Stock Chart

From Feb 2024 to Feb 2025