UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

(Check one): ¨ Form 10-K ¨ Form 20-F ¨ Form 11-K x Form 10-Q ¨ Form 10-D ¨ Form N-CEN ¨ Form N-CSR

For Period Ended: June 30, 2023

¨ Transition Report on Form 10-K

¨ Transition Report on Form 20-F

¨ Transition Report on Form 11-K

¨ Transition Report on Form 10-Q

For the Transition Period Ended: ____________

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type. Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I

REGISTRANT INFORMATION

IMPEL PHARMACEUTICALS INC.

Full Name of Registrant

N/A

Former Name if Applicable

201 Elliot Avenue West, Suite 260

Address of Principal Executive Office (Street and Number)

Seattle, Washington 98119

City, State and Zip Code

PART II

RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

(a) |

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense |

x |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

|

(c) |

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III

NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Impel Pharmaceuticals Inc. (the “Company”) will not be able to submit its Quarterly Report on Form 10-Q for the three months ended June 30, 2023 (the “Form 10-Q”) with the Securities and Exchange Commission (the “SEC”) within the prescribed time period for the reasons set forth below.

As previously disclosed, the Company estimated that it had sufficient capital to fund operations into the third quarter of 2023, and would need to raise additional capital to avoid defaulting under its senior credit agreement (the “Senior Credit Agreement”) with Oaktree Fund Administration, LLC as administrative agent and the lenders party thereto, or collectively Oaktree. As of the date hereof, the Company has been unsuccessful in identifying potential financing opportunities and is in breach of the covenant under the Senior Credit Agreement to maintain a minimum of $12.5 million in unrestricted cash and cash equivalents on hand. The Company is currently in negotiations with Oaktree regarding a potential forbearance and restructuring of the Senior Credit Agreement and with Oaktree and other investors regarding the terms of an approximately $20.0 million potential bridge financing facility. If the Company is unsuccessful in these negotiations, it expects to explore a range of strategic alternatives to maximize stakeholder value, which may include, withouth limitation, a sale of assets of the Company, or the initiation of bankruptcy proceedings under Chapter 11 of the U.S. Bankruptcy Code. The Company continues to negotiate these terms, and as such, requires additional time to finalize the required disclosures in its Form 10-Q.

For these reasons, the Company has determined that it is unable to file its Form 10-Q within the prescribed time period without unreasonable effort or expense. The Company anticipates that the Form 10-Q will be filed as soon as practicable and prior to or on the fifth calendar day following the prescribed due date.

Preliminary Financial Results for the Three Months ended June 30, 2023 and Update

The Company expects to report net product revenue of approximately $6.6 million for the three months ended June 30, 2023 compared to net product revenue of $2.8 million for the three months ended June 30, 2022. The increase of $3.8 million in net product revenue is due to both increased Trudhesa sales volume and improvements in net price realization due to decreases in the bridge and co-pay savings program discount during the three months ended June 30, 2023, compared to the three months ended June 30, 2022.

The Company expects to report Research and Development expenses of approximately $0.2 million for the three months ended June 30, 2023, compared to $4.0 million for the three months ended June 30, 2022. The decrease of $3.8 million is primarily due to decreased personnel costs and program costs as we redirected our resources from research and development activities and pivoted our focus to supporting our commercial operations rather than research and development in the first quarter of 2023.

The Company expects to report Selling, General & Administrative expense (SG&A) of approximately $19.3 million for the three months ended June 30, 2023 compared to SG&A expense of approximately $18.1 million for the three months ended June 30, 2022. The expected increase in SG&A expense versus last year is due to increased commercial operations and increased promotional and marketing spend.

While the Company continues to pursue actions and steps to improve its cash position and mitigate any potential liquidity shortfall, based on recurring losses and negative cash flow from operations for the six months ended June 30, 2023 as well as current cash and liquidity projections, the Company has concluded that there is substantial doubt about the Company’s ability to continue as a going concern. As of June 30, 2023, the Company had approximately $15.2 million in cash and cash equivalents.

The Company continues to consider all strategic alternatives including restructuring or refinancing its debt, seeking additional debt or equity capital, reducing or delaying the Company’s business activities and strategic initiatives, or selling assets, other strategic transactions and/or other measures, including obtaining relief under the U.S. Bankruptcy Code. These measures may not be successful.

The estimated results in this filing represent the Company’s preliminary estimates of certain financial results for the three months ended June 30, 2023, based on currently available information. The Company has not yet finalized its results for this period and its consolidated financial statements as of and for the three months ended June 30, 2023 are not currently available. The Company’s actual results remain subject to the completion by management of the quarter-end closing process, as well as a review by the Company’s board of directors, including the audit committee, and the Company’s independent auditors. While carrying out such procedures, the Company may identify items that require it to make adjustments to the preliminary estimates of its results set forth herein. As a result, the Company’s actual results could be different from those set forth herein and the differences could be material. Therefore, a reader should not place undue reliance on these preliminary estimates of the Company’s results. The preliminary estimates of the Company’s results included herein have been prepared by, and are the responsibility of, the Company’s management. The Company’s independent auditors have not audited, reviewed or compiled such preliminary estimates of the Company’s results. The preliminary estimates of certain financial results presented herein should not be considered a substitute for the information to be filed with the SEC in the Company’s Quarterly Report on Form 10-Q for the three months ended June 30, 2023 once it becomes available.

Cautionary Statement Regarding Forward-Looking Statements

This filing contains “forward-looking” statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the expected timing of filing of its periodic reports and the ability of the Company to obtain a forbearance and restructuring of its Senior Credit Agreement or a bridge financing facility. Forward-looking statements can be identified by words such as: “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” or the negative or plural of these words or similar expressions. These statements are subject to numerous risks and uncertainties that could cause actual results and events to differ materially from those anticipated by the forward-looking statements. Important factors that may cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, risk factors described in the Company’s filings with the SEC, a material delay in the Company’s financial reporting, including the possibility that the Company will not be able to file its Form 10-Q within the five-day extension permitted by the rules of the SEC, the outcome of the Company’s negotiations with Oaktree regarding its Senior Credit Agreement, the Company’s ability to explore strategic alternatives, and the risk of initiation of bankruptcy proceedings by the Company. The Company disclaims and does not undertake any obligation to update or revise any forward-looking statement in this report, except as required by applicable law or regulation.

PART IV

OTHER INFORMATION

|

|

(1) |

Name and telephone number of person to contact in regard to this notification |

|

|

|

|

|

|

|

Michael Kalb |

|

206 |

|

568-1466 |

|

(Name) |

|

(Area Code) |

|

(Telephone Number) |

|

|

(2) |

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). Yes x No ¨ |

|

|

(3) |

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? Yes x No ¨ |

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The Company has provided this information under Part III above “Preliminary Financial Results for the Three Months ended June 30, 2023 and Update.”

IMPEL PHARMACEUTICALS INC.

(Name of Registrant as Specified in its Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Dated: August 15, 2023 |

By: |

/s/ Michael Kalb |

|

|

Michael Kalb |

|

|

Chief Financial Officer |

Impel Pharmaceuticals (NASDAQ:IMPL)

Historical Stock Chart

From Apr 2024 to May 2024

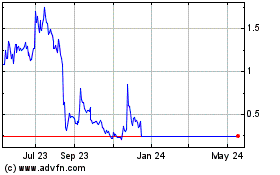

Impel Pharmaceuticals (NASDAQ:IMPL)

Historical Stock Chart

From May 2023 to May 2024