Current Report Filing (8-k)

11 December 2021 - 12:34AM

Edgar (US Regulatory)

0001798270false00017982702021-12-092021-12-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): December 9, 2021

Assure Holdings Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Nevada

|

|

001-40785

|

|

82-2726719

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

4600 South Ulster Street, Suite 1225

Denver, CO

|

|

80237

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 720-287-3093

_____________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

IONM

|

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07. Submission of Matters to a Vote of Security Holders

On December 9, 2021, Assure Holdings Corp. (the “Company”) held its 2021 annual meeting of stockholders (the “Meeting”). The matters submitted for a vote and the related results are set forth below. A more detailed description of each proposal is set forth in the Company’s proxy statement on Schedule 14A, as filed with the Commission on November 9, 2021. A total of 7,023,109 shares of common stock were present at the Meeting, representing approximately 59.32% of the issued and outstanding common stock.

Proposal One– Election of Directors

Each of the following individuals were elected as the directors of the Company to hold office until the next annual meeting of the stockholders of the Company or until their successors are elected or appointed:

Preston Parsons

Martin Burian

John Farlinger

Christopher Rumana

Steven Summer

John Flood

The detailed ballot voting in respect of the election of directors was as follows:

|

Nominee

|

Votes FOR

|

Votes WITHHELD

|

Broker Non-Votes

|

|

Preston Parsons

|

6,480,885

|

83,524

|

319,667

|

|

Martin Burian

|

6,499,934

|

64,475

|

319,667

|

|

John Farlinger

|

6,503,793

|

60,616

|

319,667

|

|

Christopher Rumana

|

6,500,534

|

63,875

|

319,667

|

|

Steven Summer

|

6,499,934

|

64,475

|

319,667

|

|

John Flood

|

6,500,534

|

63,875

|

319,667

|

Proposal Two – Appointment of Auditors

By a resolution passed, the stockholders ratified the appointment of Baker Tilly US, LLC as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021.

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

6,828,889

|

54,787

|

400

|

0

|

Proposal Three – Advisory Vote on Executive Compensation

By a resolution passed, the resolution regarding the advisory non-binding approval of executive compensation was approved.

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

6,449,228

|

114,752

|

429

|

319,667

|

Proposal Four – Advisory Vote on Frequency of Advisory Vote on Executive Compensation

By a resolution passed, the resolution regarding the non-binding frequency of advisory votes on executive compensation was approved with 3 years being the recommendation of stockholders. Based on the recommendation of the Board to the stockholders and the stockholders recommendation, the Board has determined that the Company will hold advisory votes on executive compensation every three years.

|

1 Year

|

2 Years

|

3 Years

|

Abstain

|

Broker Non-Votes

|

|

179,630

|

1,190

|

6,382,869

|

720

|

319,667

|

Proposal Five – Approval of 2021 Stock Incentive Plan

By a resolution passed, the resolution regarding the approval of the 2021 Stock Incentive Plan was approved, including the approval of the disinterested stockholders in accordance with the requirements of the TSX Venture Exchange (“Disinterested Stockholder Approval”).

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

6,420,358

|

123,034

|

21,017

|

319,667

|

Disinterested Stockholder Approval:

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

1,781,016

|

123,034

|

21,017

|

319,667

|

Proposal Six – Approval of 2021 Employee Stock Purchase Plan

By a resolution passed, the resolution regarding the approval of the 2021 Employee Stock Purchase Plan was approved, including the Disinterested Stockholder Approval.

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

6,470,855

|

72,537

|

21,017

|

319,667

|

Disinterested Stockholder Approval:

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

1,831,513

|

72,537

|

21,017

|

319,667

|

Proposal Seven – Approval of Amendments to Amended 2020 Stock Option Plan

By a resolution passed, the resolution regarding the approval of amendments to the Amended 2020 Stock Option Plan was approved, including the Disinterested Stockholder Approval.

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

6,418,530

|

124,762

|

21,117

|

319,667

|

Disinterested Stockholder Approval:

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

1,779,188

|

124,762

|

21,117

|

319,667

|

Proposal Eight – Approval of Amendments to 2020 Equity Incentive Plan

By a resolution passed, the resolution regarding the approval of amendments to the 2020 Equity Incentive Plan was approved, including the Disinterested Stockholder Approval.

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

6,418,530

|

79,337

|

66,542

|

319,667

|

Disinterested Stockholder Approval:

|

Votes FOR

|

Votes AGAINST

|

Votes ABSTAIN

|

Broker Non-Votes

|

|

1,779,188

|

79,337

|

66,542

|

319,667

|

Item 7.01 Regulation FD

On December 10, 2021, Assure Holdings Corp. issued a press release announcing results of the Meeting. A copy of the press release is attached to this report as Exhibit 99.1. In accordance with General Instruction B.2 of Form 8-K, the information set forth herein and in the press release is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended. The information set forth in Item 7.01 of this report shall not be deemed an admission as to the materiality of any information in this report on Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 9.01 Exhibits

Exhibit No.Name

99.1Press Release dated December 10, 2021

104Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101).

SIGNATURE

Pursuant to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

ASSURE HOLDINGS CORP.

|

|

|

|

|

|

Date: December 10, 2021

|

By:

|

/s/ John Price

|

|

|

Name:

|

John Price

|

|

|

Title:

|

Chief Financial Officer

|

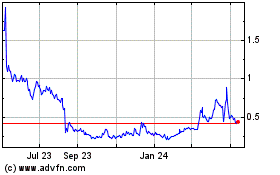

Assure (NASDAQ:IONM)

Historical Stock Chart

From Mar 2024 to Apr 2024

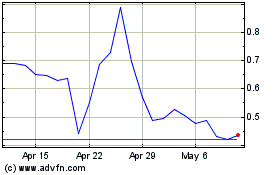

Assure (NASDAQ:IONM)

Historical Stock Chart

From Apr 2023 to Apr 2024