Jamf (NASDAQ: JAMF), the standard in managing and securing Apple at

work, today announced financial results for its fourth quarter and

fiscal year ended December 31, 2023.

“Jamf completed 2023 with solid results as

organizations choose Jamf to enable an Apple-first, modern approach

to managing and securing employee devices,” said John Strosahl,

Jamf CEO. “Our unique ability to deliver Trusted Access, where only

trusted users on trusted devices are able to access company

resources, has helped us navigate the recent headwinds related to

lower device expansion.”

Fourth Quarter 2023 Financial

Highlights

-

ARR: ARR of $588.6 million as of

December 31, 2023, an increase of 15% year-over-year.

- Revenue: Total

revenue of $150.6 million, an increase of 16% year-over-year.

- Gross Profit: GAAP

gross profit of $117.5 million, or 78% of total revenue, compared

to $99.9 million in the fourth quarter of 2022. Non-GAAP gross

profit of $124.1 million, or 82% of total revenue, compared to

$107.0 million in the fourth quarter of 2022.

- Operating

Loss/Income: GAAP operating loss of $20.3 million, or

(13)% of total revenue, compared to $24.7 million in the fourth

quarter of 2022. Non-GAAP operating income of $21.1 million, or 14%

of total revenue, compared to $8.7 million in the fourth quarter of

2022.

Fiscal Year 2023 Financial

Highlights

-

Revenue: Total revenue of $560.6 million, an

increase of 17% year-over-year.

- Gross Profit: GAAP

gross profit of $434.5 million, or 78% of total revenue, compared

to $359.5 million in fiscal year 2022. Non-GAAP gross profit of

$460.1 million, or 82% of total revenue, compared to $390.0 million

in fiscal year 2022.

- Operating

Loss/Income: GAAP operating loss of $115.2 million, or

(21)% of total revenue, compared to GAAP operating loss of $138.9

million in fiscal year 2022. Non-GAAP operating income of $45.4

million, or 8% of total revenue, compared to $25.9 million for

fiscal year 2022.

- Cash Flow: Cash

flow provided by operations of $36.0 million for fiscal year 2023,

or 6% of total revenue, compared to $90.0 million for fiscal year

2022. Unlevered free cash flow of $55.4 million for fiscal year

2023, or 10% of total revenue, compared to $87.5 million for fiscal

year 2022.

“We achieved significant margin improvement on

both on a GAAP and non-GAAP basis in 2023 as a result of revenue

outperformance and diligent cost management,” said Ian Goodkind,

Jamf CFO. “As we look to the next three years, we’ll ramp up our

efforts to increase profitability to align our cost structure with

the current revenue growth profile of Jamf, with the goal of

exceeding the Rule of 40 in 2026. I look forward to sharing more

during our Investor Day on March 13th.”

A reconciliation between historical GAAP and

non-GAAP information is contained in the tables below and the

section titled “Non-GAAP Financial Measures” below contains

descriptions of these reconciliations.

Recent Business Highlights

- Ended fiscal year

2023 serving more than 75,300 customers with 32.3 million

total devices on our platform.

- Achieved 33% year-over-year growth

in security ARR, to $133.8 million as of December 31, 2023,

representing 23% of Jamf’s total ARR.

- Launched first-to-market support

for Apple Vision Pro, adding this powerful new endpoint to Jamf’s

Apple-first, Apple-best security and access products, Jamf Protect

and Jamf Connect.

- Announced participation in the

Microsoft Security Copilot Partner Private Preview, working with

Microsoft product teams to help shape product development for the

first AI-powered security product that enables security

professionals to respond to threats quickly using an advanced large

language model (LLM) with a security-specific model that is

informed by Microsoft's unique global threat intelligence and more

than 65 trillion daily signals.

- Released Jamf’s annual Security

360: Annual Trends Report, analyzing the threats impacting devices

used in the modern workplace.

- Profiled in the Omdia Universe on

Digital Workspace Management / Unified Endpoint Management

Platforms, 2024 assessment.

For the first quarter of 2024, Jamf currently

expects:

- Total revenue of $148.0 to $150.0 million

- Non-GAAP operating income of $19.0 to $20.0 million

For the full year 2024, Jamf currently

expects:

- Total revenue of $614.5 to $619.5 million

- Non-GAAP operating income of $89.0 to $93.0 million

To assist with modeling, for the first quarter

of 2024 and full year 2024, amortization is expected to be

approximately $10.2 million and $40.3 million, respectively. In

addition, for the first quarter of 2024 and full year 2024,

stock-based compensation and related payroll taxes are expected to

be approximately $23.1 million and $110.8 million,

respectively.

Jamf is unable to provide a quantitative

reconciliation of forward-looking guidance of non-GAAP operating

income to GAAP operating income (loss) because certain items are

out of Jamf’s control or cannot be reasonably predicted.

Historically, these items have included, but are not limited to,

acquisition-related expense and acquisition-related earn-out,

offering costs, amortization, stock-based compensation and related

payroll taxes, and system transformation costs. Accordingly, a

reconciliation for forward-looking non-GAAP operating income is not

available without unreasonable effort. These items are uncertain,

depend on various factors, and could result in projected GAAP

operating income (loss) being materially less than is indicated by

currently estimated non-GAAP operating income.

These statements are forward-looking and actual

results may differ materially. Refer to the Forward-Looking

Statements safe harbor below for information on the factors that

could cause our actual results to differ materially from these

forward-looking statements.

Jamf to Host Investor Day

Jamf will host an Investor Day for analysts and

investors to provide an update on the business, strategy and 3-year

financial expectations.

The event will begin at 9:00 a.m. Eastern Time

on March 13th, 2024 and will be hosted in person in New York, New

York and via live webcast.

The event will be webcast live on Jamf’s

Investor Relations website at https://ir.jamf.com. Those parties

interested in participating in person, please reach out to

investorevents@jamf.com. The presentation and related materials

provided in connection with this event will be available on Jamf’s

Investor Relations website.

A replay of the event will be available on the

Investor Relations website beginning on March 13th, 2024, at

approximately 6:00 p.m. Central Time (7:00 p.m. Eastern Time).

Webcast and Conference Call

Information

Jamf will host a conference call and live

webcast for analysts and investors at 3:30 p.m. Central Time (4:30

p.m. Eastern Time) on February 27, 2024.

The conference call will be webcast live on

Jamf’s Investor Relations website at https://ir.jamf.com. Those

parties interested in participating via telephone may register on

Jamf’s Investor Relations website. The financial tables, earnings

presentation, and investor presentation provided in connection with

this press release and the accompanying conference call will also

be available on Jamf’s Investor Relations website.

A replay of the call will be available on the

Investor Relations website beginning on February 27, 2024, at

approximately 6:00 p.m. Central Time (7:00 p.m. Eastern Time).

Please note that Jamf uses its

https://ir.jamf.com website as a means of disclosing material

non-public information, announcing upcoming investor conferences,

and for complying with its disclosure obligations under Regulation

FD. Accordingly, you should monitor our investor relations website

in addition to following our press releases, SEC filings, and

public conference calls and webcasts.

Non-GAAP Financial Measures

In addition to our results determined in

accordance with generally accepted accounting principles in the

United States (“GAAP”), we believe the non-GAAP measures of

non-GAAP operating expenses, non-GAAP gross profit, non-GAAP gross

profit margin, non-GAAP operating income (loss), non-GAAP operating

income (loss) margin, non-GAAP income before income taxes, non-GAAP

provision for income taxes as it relates to the calculation of

non-GAAP net income, non-GAAP net income, adjusted EBITDA, free

cash flow, free cash flow margin, unlevered free cash flow, and

unlevered free cash flow margin are useful in evaluating our

operating performance. Certain of these non-GAAP measures exclude

stock-based compensation, amortization expense, acquisition-related

expenses, acquisition-related earnout, offering costs, foreign

currency transaction (gain) loss, payroll taxes related to

stock-based compensation, extraordinary legal settlements and other

non-recurring litigation costs, loss on extinguishment of debt,

amortization of debt issuance costs, system transformation costs,

and restructuring charges. We believe that non-GAAP financial

information, when taken collectively, may be helpful to investors

because it provides consistency and comparability with past

financial performance and assists in comparisons with other

companies, some of which use similar non-GAAP information to

supplement their GAAP results. The non-GAAP financial information

is presented for supplemental informational purposes only, should

not be considered a substitute for financial information presented

in accordance with GAAP, and may be different from similarly-titled

non-GAAP measures used by other companies. The principal limitation

of these non-GAAP financial measures is that they exclude

significant expenses that are required by GAAP to be recorded in

our financial statements. In addition, they are subject to inherent

limitations as they reflect the exercise of judgment by our

management about which expenses are excluded or included in

determining these non-GAAP financial measures. Reconciliation

tables of the most comparable GAAP financial measures to the

non-GAAP financial measures used in this press release are included

with the financial tables at the end of this press release. We

strongly encourage investors to review our consolidated financial

statements included in our publicly filed reports in their entirety

and not rely solely on any single financial measurement or

communication.

Forward-Looking Statements

This press release and the accompanying

conference call contain “forward-looking statements” within the

meaning of federal securities laws, which statements involve

substantial risks and uncertainties. Forward-looking statements

generally relate to future events or our future financial or

operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“may,” “can,” “will,” “would,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “forecasts,”

“potential,” or “continue,” or other similar terms or expressions

that concern our expectations, strategy, plans, or intentions.

Forward-looking statements may involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

performance, or achievements to be materially different from those

expressed or implied by the forward-looking statements. These

statements include, but are not limited to, statements regarding

our future financial and operating performance (including our

outlook and guidance), the demand for our platform, anticipated

impacts of macroeconomic conditions on our business, our

expectations regarding business benefits and financial impacts from

our acquisitions, partnerships, and investments, and our ability to

deliver on our long-term strategy.

The forward-looking statements contained in this

press release and the accompanying conference call are also subject

to additional risks, uncertainties, and factors, including those

more fully described in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2023. Moreover, we operate in a

very competitive and rapidly changing environment, and new risks

and uncertainties may emerge that could have an impact on the

forward-looking statements contained in this press release and the

accompanying conference call.

Given these factors, as well as other variables

that may affect our operating results, you should not rely on

forward-looking statements, assume that past financial performance

will be a reliable indicator of future performance, or use

historical trends to anticipate results or trends in future

periods. The forward-looking statements included in this press

release and the accompanying conference call relate only to events

as of the date hereof. We undertake no obligation to update or

revise any forward-looking statement as a result of new

information, future events, or otherwise, except as otherwise

required by law.

About Jamf

Jamf’s purpose is to simplify work by helping

organizations manage and secure an Apple experience that end users

love and organizations trust. Jamf is the only company in the world

that provides a complete management and security solution for an

Apple-first environment designed to be enterprise secure, consumer

simple and protect personal privacy. To learn more, visit

www.jamf.com.

Investor ContactJennifer

Gaumondir@jamf.com

Media ContactRachel

Nauenmedia@jamf.com

|

Jamf Holding Corp.Consolidated Balance Sheets(in

thousands)(unaudited) |

|

|

| |

December 31,2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

243,576 |

|

|

$ |

224,338 |

|

|

Trade accounts receivable, net of allowances of $444 and $445 |

|

108,240 |

|

|

|

88,163 |

|

|

Deferred contract costs |

|

23,508 |

|

|

|

17,652 |

|

|

Prepaid expenses |

|

14,255 |

|

|

|

14,331 |

|

|

Other current assets |

|

13,055 |

|

|

|

6,562 |

|

|

Total current assets |

|

402,634 |

|

|

|

351,046 |

|

| Equipment and leasehold

improvements, net |

|

15,184 |

|

|

|

19,421 |

|

| Goodwill |

|

887,121 |

|

|

|

856,925 |

|

| Other intangible assets,

net |

|

187,891 |

|

|

|

218,744 |

|

| Deferred contract costs,

non-current |

|

53,070 |

|

|

|

39,643 |

|

| Other assets |

|

43,752 |

|

|

|

43,763 |

|

|

Total assets |

$ |

1,589,652 |

|

|

$ |

1,529,542 |

|

| |

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

25,909 |

|

|

$ |

15,393 |

|

|

Accrued liabilities |

|

77,447 |

|

|

|

67,051 |

|

|

Income taxes payable |

|

1,248 |

|

|

|

486 |

|

|

Deferred revenue |

|

317,546 |

|

|

|

278,038 |

|

|

Total current liabilities |

|

422,150 |

|

|

|

360,968 |

|

| Deferred revenue,

non-current |

|

55,886 |

|

|

|

68,112 |

|

| Deferred tax liability,

net |

|

5,952 |

|

|

|

5,505 |

|

| Convertible senior notes,

net |

|

366,999 |

|

|

|

364,505 |

|

| Other liabilities |

|

21,118 |

|

|

|

29,114 |

|

|

Total liabilities |

|

872,105 |

|

|

|

828,204 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

126 |

|

|

|

123 |

|

|

Additional paid-in capital |

|

1,162,993 |

|

|

|

1,049,875 |

|

|

Accumulated other comprehensive loss |

|

(26,777 |

) |

|

|

(39,951 |

) |

|

Accumulated deficit |

|

(418,795 |

) |

|

|

(308,709 |

) |

|

Total stockholders’ equity |

|

717,547 |

|

|

|

701,338 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,589,652 |

|

|

$ |

1,529,542 |

|

|

Jamf Holding Corp.Consolidated Statements of

Operations(in thousands, except share and per share

amounts)(unaudited) |

| |

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

146,677 |

|

|

$ |

124,875 |

|

|

$ |

543,019 |

|

|

$ |

455,007 |

|

|

Services |

|

3,731 |

|

|

|

4,838 |

|

|

|

16,325 |

|

|

|

19,025 |

|

|

License |

|

237 |

|

|

|

610 |

|

|

|

1,227 |

|

|

|

4,744 |

|

|

Total revenue |

|

150,645 |

|

|

|

130,323 |

|

|

|

560,571 |

|

|

|

478,776 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Cost of subscription(1)(2)(3)(4)(5)(exclusive of amortization

expense shown below) |

|

26,200 |

|

|

|

22,609 |

|

|

|

98,554 |

|

|

|

85,479 |

|

|

Cost of services(1)(2)(3)(4)(exclusive of amortization expense

shown below) |

|

3,563 |

|

|

|

3,632 |

|

|

|

13,976 |

|

|

|

13,816 |

|

|

Amortization expense |

|

3,427 |

|

|

|

4,172 |

|

|

|

13,529 |

|

|

|

19,932 |

|

|

Total cost of revenue |

|

33,190 |

|

|

|

30,413 |

|

|

|

126,059 |

|

|

|

119,227 |

|

|

Gross profit |

|

117,455 |

|

|

|

99,910 |

|

|

|

434,512 |

|

|

|

359,549 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing(1)(2)(3)(4)(5) |

|

62,420 |

|

|

|

58,557 |

|

|

|

250,757 |

|

|

|

217,728 |

|

|

Research and development(1)(2)(3)(4)(5) |

|

32,921 |

|

|

|

30,322 |

|

|

|

134,422 |

|

|

|

119,906 |

|

|

General and administrative(1)(2)(3)(4)(5)(6) |

|

34,935 |

|

|

|

28,568 |

|

|

|

135,233 |

|

|

|

132,562 |

|

|

Amortization expense |

|

7,441 |

|

|

|

7,124 |

|

|

|

29,349 |

|

|

|

28,227 |

|

|

Total operating expenses |

|

137,717 |

|

|

|

124,571 |

|

|

|

549,761 |

|

|

|

498,423 |

|

|

Loss from operations |

|

(20,262 |

) |

|

|

(24,661 |

) |

|

|

(115,249 |

) |

|

|

(138,874 |

) |

| Interest income (expense),

net |

|

2,073 |

|

|

|

917 |

|

|

|

6,526 |

|

|

|

(538 |

) |

| Foreign currency transaction

gain (loss) |

|

1,911 |

|

|

|

1,279 |

|

|

|

916 |

|

|

|

(2,802 |

) |

|

Loss before income tax (provision) benefit |

|

(16,278 |

) |

|

|

(22,465 |

) |

|

|

(107,807 |

) |

|

|

(142,214 |

) |

| Income tax (provision)

benefit |

|

(1,132 |

) |

|

|

1,234 |

|

|

|

(2,279 |

) |

|

|

913 |

|

|

Net loss |

$ |

(17,410 |

) |

|

$ |

(21,231 |

) |

|

$ |

(110,086 |

) |

|

$ |

(141,301 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.14 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.88 |

) |

|

$ |

(1.17 |

) |

| Weighted‑average shares used

to compute net loss per share, basic and diluted |

|

126,361,484 |

|

|

|

122,300,221 |

|

|

|

124,935,620 |

|

|

|

120,720,972 |

|

(1) Includes stock-based compensation as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

2,594 |

|

$ |

2,359 |

|

$ |

10,229 |

|

$ |

8,854 |

|

Services |

|

392 |

|

|

338 |

|

|

1,386 |

|

|

1,299 |

| Sales and marketing |

|

8,059 |

|

|

6,934 |

|

|

33,127 |

|

|

33,559 |

| Research and development |

|

5,856 |

|

|

4,772 |

|

|

23,719 |

|

|

24,392 |

| General and

administrative |

|

6,017 |

|

|

5,243 |

|

|

32,539 |

|

|

41,066 |

| |

$ |

22,918 |

|

$ |

19,646 |

|

$ |

101,000 |

|

$ |

109,170 |

(2) Includes payroll taxes related to stock-based compensation

as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

143 |

|

$ |

160 |

|

$ |

318 |

|

$ |

293 |

|

Services |

|

32 |

|

|

30 |

|

|

57 |

|

|

54 |

| Sales and marketing |

|

451 |

|

|

367 |

|

|

1,162 |

|

|

810 |

| Research and development |

|

171 |

|

|

183 |

|

|

581 |

|

|

429 |

| General and

administrative |

|

137 |

|

|

153 |

|

|

490 |

|

|

428 |

| |

$ |

934 |

|

$ |

893 |

|

$ |

2,608 |

|

$ |

2,014 |

(3) Includes depreciation expense as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

296 |

|

$ |

310 |

|

$ |

1,219 |

|

$ |

1,201 |

|

Services |

|

44 |

|

|

44 |

|

|

168 |

|

|

170 |

| Sales and marketing |

|

777 |

|

|

739 |

|

|

3,155 |

|

|

2,725 |

| Research and development |

|

444 |

|

|

445 |

|

|

1,814 |

|

|

1,610 |

| General and

administrative |

|

266 |

|

|

258 |

|

|

1,064 |

|

|

965 |

| |

$ |

1,827 |

|

$ |

1,796 |

|

$ |

7,420 |

|

$ |

6,671 |

(4) Includes acquisition-related expense as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

61 |

|

Services |

|

34 |

|

|

— |

|

|

50 |

|

|

— |

| Sales and marketing |

|

152 |

|

|

— |

|

|

371 |

|

|

7 |

| Research and development |

|

299 |

|

|

120 |

|

|

807 |

|

|

912 |

| General and

administrative |

|

2,704 |

|

|

1,092 |

|

|

6,133 |

|

|

3,663 |

| |

$ |

3,189 |

|

$ |

1,212 |

|

$ |

7,361 |

|

$ |

4,643 |

(5) Includes system transformation costs as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

29 |

|

$ |

— |

|

$ |

51 |

|

$ |

— |

| Sales and marketing |

|

82 |

|

|

— |

|

|

174 |

|

|

— |

| Research and development |

|

— |

|

|

— |

|

|

12 |

|

|

— |

| General and

administrative |

|

1,569 |

|

|

— |

|

|

4,596 |

|

|

— |

| |

$ |

1,680 |

|

$ |

— |

|

$ |

4,833 |

|

$ |

— |

(6) General and administrative also includes the following:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

(in thousands) |

| Acquisition-related

earnout |

$ |

— |

|

$ |

306 |

|

$ |

— |

|

$ |

694 |

| Offering costs |

|

— |

|

|

— |

|

|

— |

|

|

124 |

| Restructuring charges |

|

1,393 |

|

|

— |

|

|

1,393 |

|

|

— |

| Legal settlements and other

non-recurring litigation costs |

|

359 |

|

|

— |

|

|

559 |

|

|

— |

|

Jamf Holding Corp.Consolidated Statements of Cash

Flows(in thousands)(unaudited) |

|

|

| |

Years Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating

activities |

|

|

|

|

Net loss |

$ |

(110,086 |

) |

|

$ |

(141,301 |

) |

|

Adjustments to reconcile net loss to cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization expense |

|

50,298 |

|

|

|

54,830 |

|

|

Amortization of deferred contract costs |

|

21,497 |

|

|

|

16,563 |

|

|

Amortization of debt issuance costs |

|

2,742 |

|

|

|

2,722 |

|

|

Non-cash lease expense |

|

5,935 |

|

|

|

5,869 |

|

|

Impairment of lease right-of-use assets |

|

1,077 |

|

|

|

— |

|

|

Provision for credit losses and returns |

|

472 |

|

|

|

328 |

|

|

Share‑based compensation |

|

101,000 |

|

|

|

109,170 |

|

|

Deferred tax benefit |

|

(1,976 |

) |

|

|

(2,955 |

) |

|

Adjustment to contingent consideration |

|

— |

|

|

|

694 |

|

|

Other |

|

(1,673 |

) |

|

|

3,333 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Trade accounts receivable |

|

(19,233 |

) |

|

|

(9,487 |

) |

|

Prepaid expenses and other assets |

|

(11,354 |

) |

|

|

1,888 |

|

|

Deferred contract costs |

|

(40,643 |

) |

|

|

(31,134 |

) |

|

Accounts payable |

|

9,352 |

|

|

|

5,891 |

|

|

Accrued liabilities |

|

2,690 |

|

|

|

10,017 |

|

|

Income taxes payable |

|

727 |

|

|

|

151 |

|

|

Deferred revenue |

|

23,939 |

|

|

|

63,426 |

|

|

Other liabilities |

|

1,200 |

|

|

|

— |

|

|

Net cash provided by operating activities |

|

35,964 |

|

|

|

90,005 |

|

| Investing

activities |

|

|

|

|

Acquisitions, net of cash acquired |

|

(18,797 |

) |

|

|

(23,816 |

) |

|

Purchases of equipment and leasehold improvements |

|

(2,934 |

) |

|

|

(7,727 |

) |

|

Purchase of investments |

|

(750 |

) |

|

|

(3,100 |

) |

|

Other |

|

5 |

|

|

|

(139 |

) |

|

Net cash used in investing activities |

|

(22,476 |

) |

|

|

(34,782 |

) |

| Financing

activities |

|

|

|

|

Debt issuance costs |

|

— |

|

|

|

(50 |

) |

|

Cash paid for offering costs |

|

— |

|

|

|

(104 |

) |

|

Cash paid for contingent consideration |

|

(206 |

) |

|

|

(4,588 |

) |

|

Payment of acquisition-related holdback |

|

(515 |

) |

|

|

(200 |

) |

|

Proceeds from the exercise of stock options |

|

6,042 |

|

|

|

5,203 |

|

|

Net cash provided by financing activities |

|

5,321 |

|

|

|

261 |

|

|

Effect of exchange rate changes on cash, cash equivalents, and

restricted cash |

|

79 |

|

|

|

(713 |

) |

|

Net increase in cash, cash equivalents, and restricted cash |

|

18,888 |

|

|

|

54,771 |

|

| Cash, cash equivalents, and

restricted cash, beginning of period |

|

231,921 |

|

|

|

177,150 |

|

| Cash, cash equivalents, and

restricted cash, end of period |

$ |

250,809 |

|

|

$ |

231,921 |

|

| |

|

|

|

| Reconciliation of

cash, cash equivalents, and restricted cash within the consolidated

balance sheets to the amounts shown in the consolidated statements

of cash flows above: |

|

|

|

|

Cash and cash equivalents |

$ |

243,576 |

|

|

$ |

224,338 |

|

|

Restricted cash included in other current assets |

|

3,633 |

|

|

|

383 |

|

|

Restricted cash included in other assets |

|

3,600 |

|

|

|

7,200 |

|

| Total cash, cash equivalents,

and restricted cash |

$ |

250,809 |

|

|

$ |

231,921 |

|

|

Jamf Holding Corp.Supplemental Financial

InformationDisaggregated Revenue(in

thousands)(unaudited) |

|

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| SaaS subscription and support

and maintenance |

$ |

140,315 |

|

$ |

117,621 |

|

$ |

521,269 |

|

$ |

430,613 |

| On‑premise subscription |

|

6,362 |

|

|

7,254 |

|

|

21,750 |

|

|

24,394 |

|

Subscription revenue |

|

146,677 |

|

|

124,875 |

|

|

543,019 |

|

|

455,007 |

| Professional services |

|

3,731 |

|

|

4,838 |

|

|

16,325 |

|

|

19,025 |

| Perpetual licenses |

|

237 |

|

|

610 |

|

|

1,227 |

|

|

4,744 |

|

Non‑subscription revenue |

|

3,968 |

|

|

5,448 |

|

|

17,552 |

|

|

23,769 |

|

Total revenue |

$ |

150,645 |

|

$ |

130,323 |

|

$ |

560,571 |

|

$ |

478,776 |

|

Jamf Holding Corp.Supplemental InformationKey

Business Metrics(in millions, except number of customers and

percentages)(unaudited) |

|

|

| |

December 31,2023 |

|

September 30,2023 |

|

June 30,2023 |

|

March 31,2023 |

|

December 31,2022 |

|

September 30,2022 |

|

June 30,2022 |

|

March 31,2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR |

$ |

588.6 |

|

|

$ |

566.3 |

|

|

$ |

547.8 |

|

|

$ |

526.6 |

|

|

$ |

512.5 |

|

|

$ |

490.5 |

|

|

$ |

466.0 |

|

|

$ |

436.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR from management solutions as a percent of total ARR |

|

77 |

% |

|

|

79 |

% |

|

|

79 |

% |

|

|

80 |

% |

|

|

80 |

% |

|

|

82 |

% |

|

|

82 |

% |

|

|

83 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ARR

from security solutions as a percent of total ARR |

|

23 |

% |

|

|

21 |

% |

|

|

21 |

% |

|

|

20 |

% |

|

|

20 |

% |

|

|

18 |

% |

|

|

18 |

% |

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR from commercial customers as a percent of total ARR |

|

74 |

% |

|

|

73 |

% |

|

|

73 |

% |

|

|

72 |

% |

|

|

72 |

% |

|

|

71 |

% |

|

|

71 |

% |

|

|

70 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ARR

from education customers as a percent of total ARR |

|

26 |

% |

|

|

27 |

% |

|

|

27 |

% |

|

|

28 |

% |

|

|

28 |

% |

|

|

29 |

% |

|

|

29 |

% |

|

|

30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dollar-based net retention

rate(1) |

|

108 |

% |

|

|

108 |

% |

|

|

109 |

% |

|

|

111 |

% |

|

|

113 |

% |

|

|

115 |

% |

|

|

117 |

% |

|

|

120 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Devices |

|

32.3 |

|

|

|

31.8 |

|

|

|

31.3 |

|

|

|

30.8 |

|

|

|

30.0 |

|

|

|

29.3 |

|

|

|

28.4 |

|

|

|

26.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Customers |

|

75,300 |

|

|

|

74,400 |

|

|

|

73,500 |

|

|

|

72,500 |

|

|

|

71,000 |

|

|

|

69,000 |

|

|

|

67,000 |

|

|

|

62,000 |

|

(1) The dollar-based net retention rate for March 31, 2022 was

based on our Jamf legacy business and does not include Wandera

since it had not been a part of our business for the full trailing

twelve months.

|

Jamf Holding Corp.Supplemental Financial

InformationReconciliation of GAAP to non-GAAP Financial

Data(in thousands, except share and per share

amounts)(unaudited) |

|

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating expenses |

$ |

137,717 |

|

|

$ |

124,571 |

|

|

$ |

549,761 |

|

|

$ |

498,423 |

|

| Amortization expense |

|

(7,441 |

) |

|

|

(7,124 |

) |

|

|

(29,349 |

) |

|

|

(28,227 |

) |

| Stock-based compensation |

|

(19,932 |

) |

|

|

(16,949 |

) |

|

|

(89,385 |

) |

|

|

(99,017 |

) |

| Acquisition-related expense |

|

(3,155 |

) |

|

|

(1,212 |

) |

|

|

(7,311 |

) |

|

|

(4,582 |

) |

| Acquisition-related earnout |

|

— |

|

|

|

(306 |

) |

|

|

— |

|

|

|

(694 |

) |

| Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(124 |

) |

| Payroll taxes related to

stock-based compensation |

|

(759 |

) |

|

|

(703 |

) |

|

|

(2,233 |

) |

|

|

(1,667 |

) |

| System transformation costs |

|

(1,651 |

) |

|

|

— |

|

|

|

(4,782 |

) |

|

|

— |

|

| Restructuring charges |

|

(1,393 |

) |

|

|

— |

|

|

|

(1,393 |

) |

|

|

— |

|

| Legal settlements and other

non-recurring litigation costs |

|

(359 |

) |

|

|

— |

|

|

|

(559 |

) |

|

|

— |

|

| Non-GAAP operating expenses |

$ |

103,027 |

|

|

$ |

98,277 |

|

|

$ |

414,749 |

|

|

$ |

364,112 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

| |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Gross profit |

$ |

117,455 |

|

|

$ |

99,910 |

|

|

$ |

434,512 |

|

|

$ |

359,549 |

|

| Amortization expense |

|

3,427 |

|

|

|

4,172 |

|

|

|

13,529 |

|

|

|

19,932 |

|

| Stock-based compensation |

|

2,986 |

|

|

|

2,697 |

|

|

|

11,615 |

|

|

|

10,153 |

|

| Acquisition-related

expense |

|

34 |

|

|

|

— |

|

|

|

50 |

|

|

|

61 |

|

| Payroll taxes related to

stock-based compensation |

|

175 |

|

|

|

190 |

|

|

|

375 |

|

|

|

347 |

|

| System transformation

costs |

|

29 |

|

|

|

— |

|

|

|

51 |

|

|

|

— |

|

| Non-GAAP gross profit |

$ |

124,106 |

|

|

$ |

106,969 |

|

|

$ |

460,132 |

|

|

$ |

390,042 |

|

| Gross profit margin |

|

78% |

|

|

|

77% |

|

|

|

78% |

|

|

|

75% |

|

| Non-GAAP gross profit

margin |

|

82% |

|

|

|

82% |

|

|

|

82% |

|

|

|

81% |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

| |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating loss |

$ |

(20,262 |

) |

|

$ |

(24,661 |

) |

|

$ |

(115,249 |

) |

|

$ |

(138,874 |

) |

| Amortization expense |

|

10,868 |

|

|

|

11,296 |

|

|

|

42,878 |

|

|

|

48,159 |

|

| Stock-based compensation |

|

22,918 |

|

|

|

19,646 |

|

|

|

101,000 |

|

|

|

109,170 |

|

| Acquisition-related

expense |

|

3,189 |

|

|

|

1,212 |

|

|

|

7,361 |

|

|

|

4,643 |

|

| Acquisition-related

earnout |

|

— |

|

|

|

306 |

|

|

|

— |

|

|

|

694 |

|

| Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

124 |

|

| Payroll taxes related to

stock-based compensation |

|

934 |

|

|

|

893 |

|

|

|

2,608 |

|

|

|

2,014 |

|

| System transformation

costs |

|

1,680 |

|

|

|

— |

|

|

|

4,833 |

|

|

|

— |

|

| Restructuring charges |

|

1,393 |

|

|

|

— |

|

|

|

1,393 |

|

|

|

— |

|

| Legal settlements and other

non-recurring litigation costs |

|

359 |

|

|

|

— |

|

|

|

559 |

|

|

|

— |

|

| Non-GAAP operating income |

$ |

21,079 |

|

|

$ |

8,692 |

|

|

$ |

45,383 |

|

|

$ |

25,930 |

|

| Operating loss margin |

(13)% |

|

|

(19)% |

|

|

(21)% |

|

|

(29)% |

|

| Non-GAAP operating income

margin |

|

14% |

|

|

|

7% |

|

|

|

8% |

|

|

|

5% |

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss |

$ |

(17,410 |

) |

|

$ |

(21,231 |

) |

|

$ |

(110,086 |

) |

|

$ |

(141,301 |

) |

| Exclude: income tax

(provision) benefit |

|

(1,132 |

) |

|

|

1,234 |

|

|

|

(2,279 |

) |

|

|

913 |

|

| Loss before income tax

(provision) benefit |

|

(16,278 |

) |

|

|

(22,465 |

) |

|

|

(107,807 |

) |

|

|

(142,214 |

) |

| Amortization expense |

|

10,868 |

|

|

|

11,296 |

|

|

|

42,878 |

|

|

|

48,159 |

|

| Stock-based compensation |

|

22,918 |

|

|

|

19,646 |

|

|

|

101,000 |

|

|

|

109,170 |

|

| Foreign currency transaction

(gain) loss |

|

(1,911 |

) |

|

|

(1,279 |

) |

|

|

(916 |

) |

|

|

2,802 |

|

| Amortization of debt issuance

costs |

|

687 |

|

|

|

682 |

|

|

|

2,742 |

|

|

|

2,722 |

|

| Acquisition-related

expense |

|

3,189 |

|

|

|

1,212 |

|

|

|

7,361 |

|

|

|

4,643 |

|

| Acquisition-related

earnout |

|

— |

|

|

|

306 |

|

|

|

— |

|

|

|

694 |

|

| Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

124 |

|

| Payroll taxes related to

stock-based compensation |

|

934 |

|

|

|

893 |

|

|

|

2,608 |

|

|

|

2,014 |

|

| System transformation

costs |

|

1,680 |

|

|

|

— |

|

|

|

4,833 |

|

|

|

— |

|

| Restructuring charges |

|

1,393 |

|

|

|

— |

|

|

|

1,393 |

|

|

|

— |

|

| Legal settlements and other

non-recurring litigation costs |

|

359 |

|

|

|

— |

|

|

|

559 |

|

|

|

— |

|

| Non-GAAP income before income

taxes |

|

23,839 |

|

|

|

10,291 |

|

|

|

54,651 |

|

|

|

28,114 |

|

| Non-GAAP provision for income

taxes(1) |

|

(5,721 |

) |

|

|

(2,469 |

) |

|

|

(13,116 |

) |

|

|

(6,747 |

) |

| Non-GAAP net income |

$ |

18,118 |

|

|

$ |

7,822 |

|

|

$ |

41,535 |

|

|

$ |

21,367 |

|

| Net loss per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.14 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.88 |

) |

|

$ |

(1.17 |

) |

|

Diluted |

$ |

(0.14 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.88 |

) |

|

$ |

(1.17 |

) |

| Weighted‑average shares used in

computing net loss per share: |

|

|

|

|

|

|

|

|

Basic |

|

126,361,484 |

|

|

|

122,300,221 |

|

|

|

124,935,620 |

|

|

|

120,720,972 |

|

|

Diluted |

|

126,361,484 |

|

|

|

122,300,221 |

|

|

|

124,935,620 |

|

|

|

120,720,972 |

|

| Non-GAAP net income per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.14 |

|

|

$ |

0.06 |

|

|

$ |

0.33 |

|

|

$ |

0.18 |

|

|

Diluted |

$ |

0.13 |

|

|

$ |

0.06 |

|

|

$ |

0.31 |

|

|

$ |

0.16 |

|

| Weighted-average shares used

in computing non-GAAP net income per share: |

|

|

|

|

|

|

|

|

Basic |

|

126,361,484 |

|

|

|

122,300,221 |

|

|

|

124,935,620 |

|

|

|

120,720,972 |

|

|

Diluted |

|

136,716,406 |

|

|

|

133,027,869 |

|

|

|

135,285,356 |

|

|

|

130,965,684 |

|

(1) In accordance with the SEC’s Non-GAAP Financial Measures

Compliance and Disclosure Interpretation, the Company’s blended

U.S. statutory rate of 24% is used as an estimate for the current

and deferred income tax expense associated with our non-GAAP income

before income taxes.

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss |

$ |

(17,410 |

) |

|

$ |

(21,231 |

) |

|

$ |

(110,086 |

) |

|

$ |

(141,301 |

) |

| Interest (income) expense,

net |

|

(2,073 |

) |

|

|

(917 |

) |

|

|

(6,526 |

) |

|

|

538 |

|

| Provision (benefit) for income

taxes |

|

1,132 |

|

|

|

(1,234 |

) |

|

|

2,279 |

|

|

|

(913 |

) |

| Depreciation expense |

|

1,827 |

|

|

|

1,796 |

|

|

|

7,420 |

|

|

|

6,671 |

|

| Amortization expense |

|

10,868 |

|

|

|

11,296 |

|

|

|

42,878 |

|

|

|

48,159 |

|

| Stock-based compensation |

|

22,918 |

|

|

|

19,646 |

|

|

|

101,000 |

|

|

|

109,170 |

|

| Foreign currency transaction

(gain) loss |

|

(1,911 |

) |

|

|

(1,279 |

) |

|

|

(916 |

) |

|

|

2,802 |

|

| Acquisition-related expense |

|

3,189 |

|

|

|

1,212 |

|

|

|

7,361 |

|

|

|

4,643 |

|

| Acquisition-related earnout |

|

— |

|

|

|

306 |

|

|

|

— |

|

|

|

694 |

|

| Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

124 |

|

| Payroll taxes related to

stock-based compensation |

|

934 |

|

|

|

893 |

|

|

|

2,608 |

|

|

|

2,014 |

|

| System transformation costs |

|

1,680 |

|

|

|

— |

|

|

|

4,833 |

|

|

|

— |

|

| Restructuring charges |

|

1,393 |

|

|

|

— |

|

|

|

1,393 |

|

|

|

— |

|

| Legal settlements and other

non-recurring litigation costs |

|

359 |

|

|

|

— |

|

|

|

559 |

|

|

|

— |

|

| Adjusted EBITDA |

$ |

22,906 |

|

|

$ |

10,488 |

|

|

$ |

52,803 |

|

|

$ |

32,601 |

|

| |

Years Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Net cash provided by operating

activities |

$ |

35,964 |

|

|

$ |

90,005 |

|

| Less: |

|

|

|

|

Purchases of equipment and leasehold improvements |

|

(2,934 |

) |

|

|

(7,727 |

) |

| Free cash flow |

|

33,030 |

|

|

|

82,278 |

|

| Add: |

|

|

|

|

Cash paid for interest |

|

784 |

|

|

|

763 |

|

|

Cash paid for acquisition-related expense |

|

2,975 |

|

|

|

4,480 |

|

|

Cash paid for system transformation costs |

|

12,493 |

|

|

|

— |

|

|

Cash paid for contingent consideration |

|

6,000 |

|

|

|

— |

|

|

Cash paid for legal settlements and other non-recurring litigation

costs |

|

132 |

|

|

|

— |

|

| Unlevered free cash flow |

$ |

55,414 |

|

|

$ |

87,521 |

|

| Total revenue |

$ |

560,571 |

|

|

$ |

478,776 |

|

| Net cash provided by operating

activities as a percentage of total revenue |

|

6% |

|

|

|

19% |

|

| Free cash flow margin |

|

6% |

|

|

|

17% |

|

| Unlevered free cash flow

margin |

|

10% |

|

|

|

18% |

|

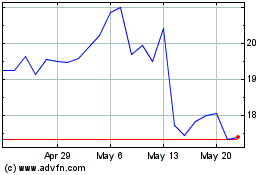

Jamf (NASDAQ:JAMF)

Historical Stock Chart

From Apr 2024 to May 2024

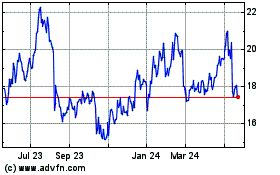

Jamf (NASDAQ:JAMF)

Historical Stock Chart

From May 2023 to May 2024