false000115846300011584632024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 1, 2024

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 000-49728 | 87-0617894 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

27-01 Queens Plaza North | Long Island City | New York | 11101 |

| (Address of principal executive offices) | (Zip Code) |

(718) 286-7900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | JBLU | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

The disclosure set forth below under Item 1.02 of this Current Report on Form 8-K is incorporated by reference herein.

Item 1.02 Termination of a Material Definitive Agreement.

As previously disclosed, on July 28, 2022, JetBlue Airways Corporation, (“JetBlue”), Sundown Acquisition Corp., a direct wholly owned subsidiary of JetBlue (“Merger Sub”) and Spirit Airlines, Inc. (“Spirit” and, together with JetBlue and Merger Sub, the “Parties”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which and subject to the terms and conditions therein, Merger Sub would be merged with and into Spirit, with Spirit continuing as the surviving corporation.

On March 1, 2024, the Parties entered into a Termination Agreement (the “Termination Agreement”), pursuant to which the Parties agreed that the Merger Agreement, including all schedules and exhibits thereto, was terminated, effective immediately, subject to limited exceptions related to JetBlue’s previously agreed indemnification obligations. Pursuant to the Termination Agreement, JetBlue agreed to pay Spirit $69 million in cash on March 5, 2024. The Parties also agreed to release each other from claims, demands, damages, actions, causes of action and liability relating to or arising out of the Merger Agreement and the transactions contemplated therein or thereby.

The foregoing descriptions of the Merger Agreement and the Termination Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Merger Agreement, which was filed as an exhibit to JetBlue’s Current Report on Form 8-K filed on July 28, 2022, and the Termination Agreement, which is attached hereto as Exhibit 10.1, each of which is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On March 4, 2024, JetBlue issued a press release announcing the termination of the Merger Agreement and the entry into the Termination Agreement. A copy of the press release is furnished herewith as Exhibit 99.1.

The information included under this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical facts contained in this Current Report on Form 8-K are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the risk associated with the execution of our strategic operating plans in the near-term and long-term; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to our Northeast Alliance with American Airlines Group Inc. and our wind-down of the Northeast Alliance; risks associated with cybersecurity and privacy, including information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs;

reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; restrictions as a result of our participation in governmental support programs under the CARES Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Current Report on Form 8-K, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue’s filings with the U.S. Securities and Exchange Commission, including but not limited to, in our Annual Report on Form 10-K for the year ended December 31, 2023. In light of these risks and uncertainties, the forward-looking events discussed in this Current Report on Form 8-K might not occur. Our forward-looking statements speak only as of the date of this Current Report on Form 8-K. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | JETBLUE AIRWAYS CORPORATION |

| | | (Registrant) |

| | | |

| Date: | March 4, 2024 | By: | /s/ Brandon Nelson |

| | | Brandon Nelson | |

| | | General Counsel and Corporate Secretary |

| | | |

Exhibit 10.1

Execution Copy

TERMINATION AGREEMENT

THIS TERMINATION AGREEMENT (this “Agreement”) is entered into effective as of March 1, 2024, by and among JetBlue Airways Corporation, a Delaware corporation (“Parent”), Sundown Acquisition Corp., a Delaware corporation and a direct wholly owned Subsidiary of Parent (“Merger Sub”), and Spirit Airlines, Inc., a Delaware corporation (the “Company” and, together with Parent and Merger Sub, the “Parties”).

All capitalized terms used but not otherwise defined herein shall have the respective meanings assigned to them in that certain Agreement and Plan of Merger, dated as of July 28, 2022 (the “Merger Agreement”), by and among the Parties.

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows:

1.Termination of Merger Agreement. Effective immediately upon the execution and delivery by the Parties of this Agreement, and in accordance with Section 7.1(a) of the Merger Agreement, the Parties hereby terminate the Merger Agreement, including all schedules and exhibits thereto, and agree to abandon the transactions contemplated thereby; provided that Sections 5.18(e) and 5.18(f), including any defined terms referred to therein, of the Merger Agreement (the “Surviving Provisions”) shall continue in effect in accordance with their terms.

2.Termination Payment. Not later than 5:00 p.m. Eastern time on March 5, 2024, Parent will pay or cause to be paid to the Company the amount of $69,000,000 (sixty-nine million US dollars) (the “Termination Payment”) in cash by wire transfer of immediately available funds in accordance with Company’s wire instructions set forth on Section 7.2(g) of the Company Disclosure Schedule. The payment of the Termination Payment shall be the sole and exclusive remedy of the Company, its Affiliates and its Representatives against Parent and any of its Representatives and Affiliates for any loss or damage suffered as a result of the failure of the Merger or for a breach of, or failure to perform under, the Merger Agreement (including all schedules and exhibits thereto) or otherwise or in respect of any oral representation made or alleged to have been made in connection therewith, and upon payment of such amount, none of Parent, Merger Sub or their respective Representatives or Affiliates shall have any further liability or obligation relating to or arising out of the Merger Agreement (including all schedules and exhibits thereto), whether in equity or at law, in contract, in tort or otherwise, except in respect of the Surviving Provisions.

3.Mutual Release. Subject only to the payment of the amount contemplated by Section 2 of this Agreement, each of the Parties, on behalf of itself and each of its respective past, present or future assigns, officers, directors, affiliates, subsidiaries, members, managers, predecessors in interest and successors (the “Releasors”) does to the fullest extent permitted by Law, hereby fully release, quitclaim, discharge and hold harmless each other and their respective past, present or future assigns, officers, directors, employees, affiliates, subsidiaries, parents, shareholders, members, managers, attorneys, accountants, representatives, advisors, agents, predecessors in interest and successors (the “Releasees”) of and from any and all claims, demands, damages, actions, causes of action or liability of every kind or nature whatsoever for, on account of or growing out of any matters pertaining to, relating to or arising out of (a) the Merger Agreement (including all schedules and exhibits thereto) and the transactions contemplated therein or thereby (including, for the avoidance of doubt, the negotiation thereof and all due diligence activities undertaken in connection therewith) and (b) any public statements made prior to the date hereof relating to the foregoing (collectively, “Claims”). Nothing in this Section 3 shall (i) apply to any action by any Party to enforce the rights and obligations pursuant to this Agreement or the Surviving Provisions or (ii) constitute a release by any Party for any Claim arising under this Agreement or in respect of the Surviving Provisions.

4.Covenant Note to Sue. Each of Parent and the Company on behalf of itself and its Releasors covenants not to bring any Claim before any court, arbitrator, or other tribunal in any jurisdiction, whether as a claim, a cross claim, or counterclaim, in respect of the Merger Agreement (other than in respect of the Surviving Provisions). Any Releasee may plead this Agreement as a complete bar to any such Claim brought in

derogation of this covenant not to sue. The covenants contained in this Section 4 shall become effective on the date hereof and shall survive this Agreement indefinitely regardless of any statute of limitations.

5.Non-solicitation. For a period of six months following the date hereof, neither Parent nor the Company will, and each of them will cause its respective Affiliates not to, solicit or cause to be solicited for employment any officer, employee or consultant of the other Party (or any of its Affiliates) who was involved in the integration planning process engaged in by the Parties in respect of the proposed Merger; provided that this Section 5 shall not prevent either Party (or any of its Affiliates) from (x) soliciting for employment any person who has not been employed by the other Party (or any of its Affiliates) or, in the case of consultants, engaged as a consultant by the other Party, as the case may be, for at least six months prior to such solicitation or (y) engaging in any general solicitation of employment not specifically directed at employees of the other Party (or any of its Affiliates), or, in the case of consultants, consultant of the other Party. If any of the time or activity limitations set forth herein are determined to be unreasonable by a court or other tribunal of competent jurisdiction, the Parties agree to the modification and/or reduction of such time or activity limitations (including the imposition of such a limitation if it is missing) to such a period or scope of activity as said court or tribunal shall deem reasonable under the circumstances.

6.Non-Disparagement. For a period of six months following the date of this Agreement, except as required by applicable Law or the rules or regulations of any Governmental Entity or by the order of any court of competent jurisdiction, none of the Parties shall, directly or indirectly, make any public statements or any private statements to third parties (in each case, oral or written) in respect of the Merger Agreement or the transactions contemplated thereby that could reasonably be understood as disparaging the other Parties or their respective affiliates.

7.Governing Law; Consent to Jurisdiction; Waiver of Trial by Jury. This Agreement will be governed by, and construed in accordance with, the Laws of the State of Delaware, without regard to laws that may be applicable under conflicts of laws principles (whether of the State of Delaware or any other jurisdiction) that would cause the application of the Laws of any jurisdiction other than the State of Delaware. Each of the Parties hereby irrevocably and unconditionally submits, for itself and its property, to the exclusive jurisdiction of the Court of Chancery of the State of Delaware (the “Chancery Court”), or, if the Chancery Court lacks subject matter jurisdiction of the action or proceeding, any Federal court of the United States of America sitting in Delaware, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby or for recognition or enforcement of any judgment relating thereto, and each of Parties hereby irrevocably and unconditionally (i) agrees not to commence any such action or proceeding, except in such court, (ii) agrees that any claim in respect of any such action or proceeding may be heard and determined in such court, (iii) waives, to the fullest extent it may legally and effectively do so, any objection which it may now or hereafter have to the laying of venue of any such action or proceeding in any such court and (iv) waives, to the fullest extent permitted by Law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court. Each of the Parties agrees that a final judgment in any such action or proceeding will be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by Law. Each Party irrevocably consents to service of process in the manner provided for notices in Section 8.3 of the Merger Agreement. Nothing in this Agreement will affect the right of any party to this Agreement to serve process in any other manner permitted by Law. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES, AND THEREFORE IT HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT (I) NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE EITHER OF SUCH WAIVERS, (II) IT UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF SUCH WAIVERS, (III) IT MAKES SUCH WAIVERS VOLUNTARILY AND (IV)

IT HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 7.

8.Entire Agreement. This Agreement constitutes the entire agreement of the Parties and supersedes all prior agreements and undertakings, both written and oral, among the Parties, or any of them, with respect to the subject matter hereof.

9.Severability. Any term or provision of this Agreement that is deemed or determined by a court of competent jurisdiction to be invalid or unenforceable in any situation in any jurisdiction shall not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction. If a court of competent jurisdiction declares that any term or provision hereof is invalid or unenforceable, the Parties agree that the court making such determination shall have the power to limit the term or provision, to delete specific words or phrases, or to replace any invalid or unenforceable term or provision with a term or provision that is valid and enforceable and that comes closest to expressing the intention of the invalid or unenforceable term or provision, and this Agreement shall be enforceable as so modified. In the event such court does not exercise the power granted to it in the prior sentence, the Parties agree to replace such invalid or unenforceable term or provision with a valid and enforceable term or provision that will achieve, to the maximum extent possible, the economic, business and other purposes of such invalid or unenforceable term and the overall purpose of this Agreement as expressly described herein.

10.Notices. The provisions of Section 8.3 of the Merger Agreement are incorporated herein by reference.

11.Counterparts. This Agreement may be executed in one or more counterparts, and by the different Parties in separate counterparts, each of which when executed will be deemed to be an original but all of which taken together will constitute one and the same agreement.

12.Third-Party Beneficiaries. Except for the provisions of Section 3, with respect to which each Releasee is an expressly intended third-party beneficiary thereof, this Agreement is not intended to (and does not) confer on any Person other than the Parties any rights or remedies or impose on any Person other than the Parties any obligations.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

| | | | | |

| JETBLUE AIRWAYS CORPORATION |

|

|

| By: | /s/ Brandon Nelson |

| Name: | Brandon Nelson |

| Title: | General Counsel and Secretary |

| | | | | |

| SUNDOWN ACQUISITION CORPORATION |

|

|

| By: | /s/ Brandon Nelson |

| Name: | Brandon Nelson |

| Title: | General Counsel and Secretary |

[Signature Page to Termination Agreement]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

| | | | | |

| SPIRIT AIRLINES, INC. |

|

|

| By: | /s/ Edward Christie |

| Name: | Edward Christie |

| Title: | President & CEO |

[Signature Page to Termination Agreement]

JetBlue Announces Termination of Merger Agreement with Spirit

Positions JetBlue to focus on organic strategy and return to profitability

NEW YORK, March 4, 2024 – JetBlue (NASDAQ: JBLU) today announced that it has reached an agreement with Spirit Airlines (NYSE: SAVE) to terminate their July 2022 merger agreement.

Although both companies continue to believe in the procompetitive benefits of the combination, JetBlue and Spirit mutually agreed that terminating is the best path forward for both companies as required closing conditions, including receiving necessary legal and regulatory approvals, were unlikely to be met by the merger agreement’s outside date of July 24, 2024.

“We believed this merger was worth pursuing because it would have unleashed a national low-fare, high-value competitor to the Big Four airlines,” said Joanna Geraghty, chief executive officer, JetBlue. “We are proud of the work we did with Spirit to lay out a vision to challenge the status quo, but given the hurdles to closing that remain, we decided together that both airlines’ interests are better served by moving forward independently. We wish the very best going forward to the entire Spirit team.”

Under the agreement, JetBlue will pay Spirit $69 million and the termination resolves all outstanding matters related to the transaction and under which any claims between them will be mutually released.

“JetBlue has a strong organic plan and unique competitive advantages, including a beloved brand, a unique value proposition, and high-value geographies,” Geraghty continued. “We have already begun to advance our plan to restore profitability. We look forward to sharing more on our progress in the coming months.”

As outlined on the company’s fourth quarter earnings call, JetBlue is taking decisive action to return to sustained profitability and drive shareholder value. As part of this work, the company is refocusing on its core strengths – deepening its network relevance in proven geographies and better segmenting its product offerings to enhance its competitive position – while delivering meaningful cost savings.

To date, JetBlue has identified multiple near-term revenue initiatives for 2024, including increased distribution and partnerships, expanded loyalty program functionality, network initiatives, and ancillary initiatives, which will deliver over $300 million in revenue benefits. JetBlue also remains on track to deliver $175-200 million in cost savings from its structural cost program and $75 million in maintenance savings from its fleet modernization, as well as incremental savings from targeted fixed cost base reductions, positioning the company to approach breakeven operating margins in 2024. These initiatives are just the starting point as JetBlue rebuilds its long-term organic strategy with a renewed focus on driving sustained profitability for its crewmembers and investors.

JetBlue will hold an Investor Day on Thursday, May 30, 2024, to provide additional detail on its long-term strategy and ongoing revenue and cost initiatives. Further information regarding Investor Day will be shared with analysts and investors in the coming weeks.

About JetBlue

JetBlue is New York's Hometown Airline®, and a leading carrier in Boston, Fort Lauderdale-Hollywood, Los Angeles, Orlando, and San Juan. JetBlue carries customers to more than 100 destinations throughout the United States, Latin America, Caribbean, Canada, and Europe. For more information and the best fares, visit jetblue.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical facts contained in this press release are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured.

Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the risk associated with the execution of our strategic operating plans in the near-term and long-term; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to our Northeast Alliance with American Airlines Group Inc. and our wind-down of the Northeast Alliance; risks associated with cybersecurity and privacy, including information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; restrictions as a result of our participation in governmental support programs under the CARES Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this press release, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue’s filings with the U.S. Securities and Exchange Commission, including but not limited to, in our Annual Report on Form 10-K for the year ended December 31, 2023. In light of these risks and uncertainties, the forward-looking events discussed in this press release might not occur. Our forward-looking statements speak only as of the date of this press release. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Contacts:

JetBlue Corporate Communications

Tel: +1.718.709.3089

corpcomm@jetblue.com

JetBlue Investor Relations

Tel: +1.718.709.2202

ir@jetblue.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

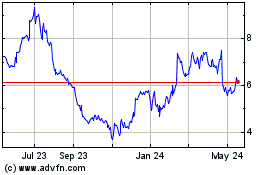

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

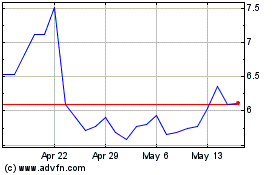

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Apr 2023 to Apr 2024