Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

07 June 2021 - 10:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of June 2021

Commission

File Number 001-39025

9F Inc.

(Translation of registrant’s name into English)

Room 1607, Building No. 5, 5 West Laiguangying

Road

Chaoyang District, Beijing 100102

People's Republic of China

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F

x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

9F Inc. Enters into a Binding Term Sheet with

Potential Investors

This current report on Form 6-K was submitted in connection with

a binding term sheet 9F Inc. (the “Company”) entered into with two established Asian investors on June 7, 2021. Pursuant

to the term sheet, the potential investors have agreed to negotiate and potentially enter into definitive agreements with the Company

for the subscription of newly issued class A ordinary shares of the Company in a private placement transaction. The potential transaction

has an aggregate investment amount of approximately US$60 million, and the Company plans to use the proceeds from the potential transaction

for investments in licensed internet securities service companies and applications for securities service licenses and digital assets

management licenses in Singapore and in the United States. The completion of the potential transaction is subject to the parties’

execution of definitive agreements and customary closing conditions to be stipulated therein.

“The potential investors have rich experience in both investments

in internet companies and overseas securities investment and asset management services, and have in-depth insight into the relevant industries.

By integrating resources and offering their expertise, they can help us better develop our internet securities and digital asset management

businesses, and provide users with excellent digital brokerage service,” said Mr. Lei Liu, Chief Executive Officer of the Company.

Safe Harbor Statement

This Form 6-K contains forward-looking

statements. These statements constitute “forward-looking” statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements

can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” “target,” “confident” and similar statements.

Such statements are based upon management’s current expectations and current market, regulatory and operating conditions and relate

to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which

are beyond the Company’s control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual

results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited

to, uncertainties as to the Company’s ability to attract and retain borrowers and investors on its marketplace, its ability to increase

volume of loans facilitated through the Company’s marketplace, its ability to introduce new loan products and platform enhancements,

its ability to compete effectively, laws, regulations and governmental policies relating to the online consumer finance industry in China,

general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs

on the Nasdaq, including its ability to cure any non-compliance with the Nasdaq’s continued listing criteria. Further information

regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange

Commission. All information provided in this Form 6-K is as of the date of this Form 6-K, and 9F Inc. does not undertake any

obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under

applicable law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

9F Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Lei Liu

|

|

|

Name:

|

Lei Liu

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

Date: June 7, 2021

|

|

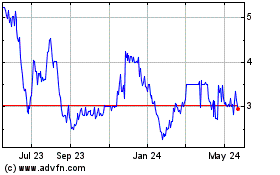

9F (NASDAQ:JFU)

Historical Stock Chart

From Dec 2024 to Jan 2025

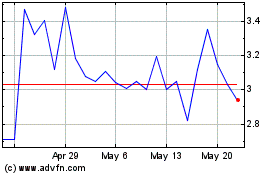

9F (NASDAQ:JFU)

Historical Stock Chart

From Jan 2024 to Jan 2025