UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Commission

File Number 001-39025

9F

Inc.

(Registrant’s name)

Room

1207, Building No. 5, 5 West Laiguangying Road

Chaoyang

District, Beijing 100012

People’s

Republic of China

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F

☒ Form 40-F ☐

9F

Inc. Reports First Half 2023 Unaudited Financial Results

BEIJING, CHINA — December 1, 2023 —

9F Inc. (“9F” or “the Company”) (NASDAQ: JFU), a global digital technology service company and online securities

and insurance brokerage service provider, today announced its unaudited financial results for the first half year ended June 30, 2023.

First

Half 2023 Financial Highlights

| |

● |

Total net revenues were RMB260.1 million (US$35.9 million), representing a decrease of 20.6% from RMB327.7 million in the first half of 2022. This was primarily due to the decrease in our technical services revenues resulting from the business contraction of our institutional partners, and the further scaling down of the provision of services for which upfront payments have been made in previous years, thereby resulting in a decrease of the amount of revenues recognized. |

| |

● |

Net loss was RMB135.7 million (US$18.7 million), up 5.7% from net loss of RMB128.4 million in the first half of 2022. Although our continued cost control efforts resulted in further decrease in total operating costs and expenses, due to the decrease in our net total revenues generated from our business operations, we recorded a slightly increased net loss for the first half of 2023. |

| |

● |

Adjusted net loss1 was RMB80.6 million (US$11.1 million), representing a 31.6% decrease from an adjusted net loss of RMB117.9 million in the first half of 2022. |

| |

● |

Cash and cash equivalents and term deposits remained

relatively stable at RMB2,615.2 million (US$360.7 million) as of June 30, 2023, compared with RMB2,665.7 million as of December 31, 2022.

The Company believes its cash position is sufficient to meet its operational needs and weather the challenges ahead.

Restricted cash was at RMB188.3 million (US$26.0million), representing a 5.2% decrease from RMB198.7 million as of December 31, 2022,

of which US$30.5 million were cash subject to temporary judicial freeze in connection with certain ongoing litigations, and US$157.8 million

were cash we received from investors under Internet Securities Services for Hong Kong and U.S. stock markets for their investment in securities. |

First

Half 2023 Financial Results

Total

net revenues were RMB260.1 million (US$35.9 million), representing a decrease of 20.6% from RMB327.7 million in the first half of

2022.

| ● | Sales

income revenues were RMB96.4 million (US$13.3 million) in the first half of 2023, representing

an increase of 9.5% from RMB88.0 million in the first half of 2022. After the significant

expansion of the Company’s e-commerce business line in late 2021, the Company has been

maintaining a relatively stable operation of the e-commerce business line. |

| |

● |

Technical services revenues were RMB147.9 million (US$20.4 million) in the first half of 2023, representing a decrease of 20.5% from RMB186.0 million in the first half of 2022. The decrease was primarily due to the decrease in demand of our technical services by our institutional partners because of the economic downturn. |

| |

● |

Post-origination services revenues were RMB0.9 million (US$0.1 million) in the first half of 2023, as compared to RMB28.7 million in the first half of 2022. Pursuant to industry-wide policy requirements, we ceased publishing information relating to new offerings of investment opportunities in fixed income products in late 2020 and the rights of investors in then existing loans underlying the fixed income products have been transferred to certain licensed asset management companies. We continued to provide certain services in connection with unpaid loans facilitated prior to the cessation of our online lending information intermediary services, and derive post-origination services revenues, which is expected to continue to decrease. |

| |

● |

Other revenues were RMB14.9 million (US$2.1 million) in the first half of 2023, representing a decrease of 40.2% from RMB24.9 million in the first half of 2022 primary resulting from the decrease in our wealth management services revenues, which was in turn mainly due to the weak performance of the Hong Kong stock market. |

| 1 | “Adjusted net income (loss)” is a non-GAAP financial measure.

For more information on this non-GAAP financial measure, please see the section entitled “Use of Non-GAAP Financial Measures”

and the table captioned “Reconciliation of GAAP and Non-GAAP Results” set forth at the end of this press release. Adjusted

net income (loss) excludes the effect of share-based compensation expenses, impairment loss of investments, impairment of goodwill, impairment

loss of intangible asset and tax effect of adjustments. |

Total operating costs and expenses were

RMB374.5 million (US$51.6 million), representing a decrease of 24.5% from RMB496.3 million in the first half of 2022 primarily due to

(i) Sales and marketing expenses were RMB13.8 million (US$1.9 million) in the first half of 2023, representing a decrease of 63.3% from

RMB37.6 million in the first half of 2022. (ii) Origination and servicing expenses were RMB33.0 million (US$4.5 million) in the first

half of 2023, representing a decrease of 38.1% from RMB53.3 million in the first half of 2022 (iii) General and administrative expenses

were RMB149.0 million (US$20.5 million) in the first half of 2023, representing a decrease of 8.5% from RMB162.8 million in the first

half of 2022 and (iv) Provision for doubtful contract assets and receivables were RMB144.6 million (US$19.9 million) in the first half

of 2023, representing a decrease of 21.5%from RMB184.3 million in the first half of 2022 , as well as the cost of sales were RMB34.1 million

(US$4.7 million) in the first half of 2023, representing a decrease of 41.6% from RMB58.4 million in the first half of 2022.

Interest

income was RMB31.8 million (US$4.4 million) in the first half of 2023, compared with RMB31.7 million in the first half of 2022.

Income tax expense was RMB11.7 million

(US$1.6 million) in the first half of 2023, compared with RMB0.08 million in the first half of 2022. In the first half of 2023, the adjusted

pre-tax net income of certain of our subsidiaries increased significantly as compared to the first half of 2022, which in turn resulted

in the increase in our income tax expense.

Net loss was RMB135.7 million (US$18.7

million) in the first half of 2023, compared with net loss of RMB128.4 million in the first half of 2022.

Adjusted net loss2 was RMB80.6

million (US$11.1 million), compared with adjusted net loss of RMB117.9 million in the first half of 2022.

As

of June 30, 2023, the Company had cash and cash equivalents and term deposits of RMB2,615.2 million (US$360.7 million).

Use

of Non-GAAP Financial Measures

The

Company uses adjusted net income (loss), a non-GAAP financial measure, in evaluating its operating results and as a supplemental measure

to review and assess its financial and operational performance. The Company believes that adjusted net income (loss) provides useful

information about its core operating results, enhances the overall understanding of its past performance and future prospects and allows

for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making.

The Company also believes that adjusted net income (loss), which excludes the effect of share-based compensation expenses, impairment

loss of investments, impairment of goodwill, impairment loss of intangible asset and tax effect of adjustments, helps identify underlying

trends in its business and helps the Company’s management formulate business plans.

Adjusted

net income (loss) is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP. This non-GAAP financial measure has

limitations as an analytical tool, and when assessing the Company’s operating performance, cash flows or liquidity, investors should

not consider it in isolation, or as a substitute for net income (loss), cash flows provided by operating activities or other consolidated

statements of operation and cash flow data prepared in accordance with U.S. GAAP. Other companies, including peer companies in the industry,

may calculate this non-GAAP measure differently, which may reduce its usefulness as a comparative measure. The Company encourages investors

and others to review its financial information in its entirety and not rely on a single financial measure.

| 2 | “Adjusted

net income (loss)” is a non-GAAP financial measure. For more information on this non-GAAP financial measure, please see the section

of “Use of Non-GAAP Financial Measures” and the table captioned “Reconciliations of GAAP and Non-GAAP Results”

set forth at the end of this press release. Adjusted net income (loss) excludes the effect of share-based compensation expenses, impairment

loss of investments, impairment of goodwill, impairment loss of intangible asset and tax effect of adjustments. |

The

Company compensates for these limitations by reconciling the non-GAAP financial measure to the most directly comparable U.S. GAAP financial

measure, which should be considered when evaluating the Company’s performance. For more information on this non-GAAP financial

measure, please see the table captioned “Reconciliations of GAAP and Non-GAAP results” set forth at the end of this press

release.

Exchange

Rate Information

This

announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader.

Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.2513 to US$1.00, the rate in effect as of

June 30, 2023 as set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the

RMB or U.S. dollars amounts referred could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

The percentages stated are calculated based on RMB amounts.

The

functional currency of certain of our subsidiaries is local currency (such as Hong Kong dollars) other than RMB or U.S. dollars. In preparing

our unaudited financial results contained in this announcement, (i) assets and liabilities are translated from such entity’s functional

currency to RMB using the exchange rates in effect on the balance sheet date, (ii) equity amounts are translated at historical exchange

rates, and (iii) revenues, expenses, gains and losses are translated using the average rates for the six months ended June 30, 2023.

Safe

Harbor Statement

This

press release contains forward-looking statements. These statements constitute “forward-looking” statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act

of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “target,”

“confident” and similar statements. Such statements are based upon management’s current expectations and current market,

regulatory and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all of

which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements involve risks, uncertainties

and other factors that could cause actual results to differ materially from those contained in any such statements. Potential risks and

uncertainties include, but are not limited to, uncertainties as to the Company’s ability to continue or to complete its ongoing

business transformation, its ability to attract and retain investors on its platform, its ability to apply for or obtain any license,

its ability to expand into any new market, its ability to compete effectively, its ability to comply with any applicable laws, regulations

and governmental policies in China or elsewhere, general economic conditions in China and elsewhere, and the Company’s ability

to meet the standards necessary to maintain listing of its ADSs on the Nasdaq, including its ability to cure any non-compliance with

the Nasdaq’s continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included

in the Company’s filings with the U.S. Securities and Exchange Commission. Neither track record nor past performance is indicative

of future results. 9F Inc. does not guarantee any specific outcome (including the outcome of its ongoing business transformation) or

profit.

All

information provided in this press release is as of the date of this press release, and subject to change without notice. 9F Inc. does

not undertake any obligation to update information contained herein as a result of new information, future events or otherwise, except

as required under applicable law.

For

investor and media enquiries, please contact:

In

China:

9F

Inc.

E-mail:

ir@9fbank.com.cn

9F

Inc.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(All

amounts in thousands, except for number of shares and per share data, or otherwise noted)

| | |

December 31,

2022 | | |

June 30,

2023 | | |

June 30,

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 2,433,279 | | |

| 2,178,145 | | |

| 300,380 | |

| Restricted cash | |

| 198,727 | | |

| 188,271 | | |

| 25,964 | |

| Term deposit | |

| 232,432 | | |

| 437,099 | | |

| 60,279 | |

| Investment in marketable securities | |

| 200,679 | | |

| 260,273 | | |

| 35,893 | |

| Accounts receivable, net | |

| 92,230 | | |

| 131,876 | | |

| 18,186 | |

| Other receivables, net | |

| 116,225 | | |

| 51,991 | | |

| 7,170 | |

| Loan receivables, net | |

| 146,177 | | |

| 37,213 | | |

| 5,131 | |

Amount due from related party | |

| — | | |

| 5,000 | | |

| 690 | |

| Prepaid expenses and other assets | |

| 222,736 | | |

| 211,854 | | |

| 29,217 | |

| Long-term investment, net | |

| 530,207 | | |

| 551,703 | | |

| 76,083 | |

| Operating lease right-of-use assets, net | |

| 8,659 | | |

| 16,360 | | |

| 2,256 | |

| Property, equipment and software, net | |

| 69,389 | | |

| 66,993 | | |

| 9,239 | |

| Goodwill, net | |

| 24,730 | | |

| 24,860 | | |

| 3,428 | |

| Intangible asset, net | |

| 35,135 | | |

| 33,007 | | |

| 4,552 | |

| Total assets | |

| 4,310,605 | | |

| 4,194,645 | | |

| 578,468 | |

| | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | |

| Deferred revenue | |

| 8,955 | | |

| 8,048 | | |

| 1,110 | |

| Payroll and welfare payable | |

| 15,745 | | |

| 3,901 | | |

| 538 | |

| Income tax payable | |

| 303,999 | | |

| 300,523 | | |

| 41,444 | |

| Accrued expenses and other liabilities | |

| 250,346 | | |

| 210,425 | | |

| 29,019 | |

| Operating lease liabilities | |

| 8,316 | | |

| 16,318 | | |

| 2,250 | |

| Amounts due to related parties | |

| 5,142 | | |

| 4,623 | | |

| 638 | |

| Deferred tax liabilities | |

| 7,126 | | |

| 6,652 | | |

| 917 | |

| Total liabilities | |

| 599,629 | | |

| 550,490 | | |

| 75,916 | |

| | |

| | | |

| | | |

| | |

| Shareholder’s equity | |

| | | |

| | | |

| | |

| Preferred shares (US$0.00001 par value; 20,000,000 shares authorized as of December 31, 2022 and June 30,2023; no shares issued and outstanding as of December 31, 2022 and June 30,2023) | |

| — | | |

| — | | |

| — | |

| Class A ordinary shares(US$ 0.00001 par value; 460,000,000 shares authorized as of December 31, 2022 and June 30,2023; 170,161,275 and 174,304,260 shares issued and outstanding as of December 31,2022 and June 30, 2023,respectively) | |

| 1 | | |

| 1 | | |

| — | |

| Class B ordinary shares (US$ 0.00001 par value; 200,000,000 shares authorized as of December 31, 2022 and June 30,2023; 61,162,400 shares issued and outstanding as of December 31, 2022 and June 30,2023,respectively) | |

| 1 | | |

| 1 | | |

| — | |

| Additional paid-in capital | |

| 5,786,068 | | |

| 5,788,507 | | |

| 798,272 | |

| Statutory reserves | |

| 465,495 | | |

| 465,495 | | |

| 64,195 | |

| Deficit | |

| (2,686,354 | ) | |

| (2,820,888 | ) | |

| (389,018 | ) |

| Accumulated other comprehensive income | |

| 90,988 | | |

| 156,295 | | |

| 21,554 | |

| Total 9F Inc. shareholders’ equity | |

| 3,656,199 | | |

| 3,589,411 | | |

| 495,003 | |

| Non-controlling interest | |

| 54,777 | | |

| 54,744 | | |

| 7,549 | |

| Total shareholders’ equity | |

| 3,710,976 | | |

| 3,644,155 | | |

| 502,552 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’’ EQUITY | |

| 4,310,605 | | |

| 4,194,645 | | |

| 578,468 | |

9F

Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts

in thousands, except for number of shares and per share data, or otherwise noted)

| | |

Six Months Ended

June 30,

2022 | | |

Six Months

Ended

June 30,

2023 | | |

Six Months

Ended

June 30,

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Revenue: | |

| | |

| | |

| |

| Sales income | |

| 87,998 | | |

| 96,415 | | |

| 13,296 | |

| Cost of goods sold | |

| (58,377 | ) | |

| (34,131 | ) | |

| (4,707 | ) |

| Gross Profit | |

| 29,621 | | |

| 62,284 | | |

| 8,589 | |

| Technical services | |

| 185,993 | | |

| 147,873 | | |

| 20,393 | |

| Post-origination services | |

| 28,749 | | |

| 906 | | |

| 125 | |

Other | |

| 24,915 | | |

| 14,883 | | |

| 2,052 | |

| Total net revenues | |

| 327,655 | | |

| 260,077 | | |

| 35,866 | |

| | |

| | | |

| | | |

| | |

| Operating costs and expenses: | |

| | | |

| | | |

| | |

| Sales and marketing | |

| (37,619 | ) | |

| (13,797 | ) | |

| (1,903 | ) |

| Origination and servicing | |

| (53,335 | ) | |

| (32,953 | ) | |

| (4,544 | ) |

| General and administrative | |

| (162,753 | ) | |

| (148,983 | ) | |

| (20,546 | ) |

| Provision for doubtful contract assets and receivables | |

| (184,252 | ) | |

| (144,649 | ) | |

| (19,948 | ) |

| Total operating costs and expenses | |

| (496,336 | ) | |

| (374,513 | ) | |

| (51,648 | ) |

Operating (loss) | |

| (168,681 | ) | |

| (114,436 | ) | |

| (15,782 | ) |

| Interest income | |

| 31,728 | | |

| 31,792 | | |

| 4,384 | |

| Impairment loss of investments | |

| — | | |

| (26,923 | ) | |

| (3,713 | ) |

| Unrealized loss of investment in marketable securities | |

| (13,080 | ) | |

| (25,820 | ) | |

| (3,561 | ) |

| Other income (loss), net | |

| 8,767 | | |

| 1,323 | | |

| 184 | |

(Loss) before income tax expense and share of profit in

equity method investments | |

| (141,266 | ) | |

| (134,064 | ) | |

| (18,488 | ) |

| Income tax expense | |

| (84 | ) | |

| (11,714 | ) | |

| (1,615 | ) |

| Income in equity method investments, net | |

| 12,903 | | |

| 10,075 | | |

| 1,389 | |

| Net loss | |

| (128,447 | ) | |

| (135,703 | ) | |

| (18,714 | ) |

| | |

| | | |

| | | |

| | |

| Net loss attributed to the non-controlling interest shareholders | |

| 3,752 | | |

| 29 | | |

| 4 | |

| Net loss attributable to 9F Inc. ordinary shareholders | |

| (124,695 | ) | |

| (135,674 | ) | |

| (18,710 | ) |

| | |

| | | |

| | | |

| | |

| Net loss per ordinary share: | |

| | | |

| | | |

| | |

| Basic | |

| (0.55 | ) | |

| (0.58 | ) | |

| (0.08 | ) |

| Diluted | |

| (0.55 | ) | |

| (0.58 | ) | |

| (0.08 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares used in computing net loss per ordinary share | |

| | | |

| | | |

| | |

| Basic | |

| 231,660,130 | | |

| 234,934,057 | | |

| 234,934,057 | |

| Diluted | |

| 231,660,130 | | |

| 234,934,057 | | |

| 234,934,057 | |

9F

Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Amounts

in thousands, except for number of shares and per share data, or otherwise noted)

| | |

Six Months

Ended

June 30,

2022 | | |

Six Months

Ended

June 30,

2023 | | |

Six Months

Ended

June 30,

2023 | |

| | |

RMB | | |

RMB | | |

USD | |

| Net loss | |

| (128,447 | ) | |

| (135,703 | ) | |

| (18,714 | ) |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment, net of tax of nil | |

| 56,217 | | |

| 211,405 | | |

| 29,154 | |

| Total comprehensive loss | |

| (72,230 | ) | |

| 75,702 | | |

| 10,440 | |

| Total comprehensive income (loss) attributable to the non-controlling interest shareholders | |

| 3,752 | | |

| 29 | | |

| 4 | |

| Total comprehensive loss attributable to 9F Inc | |

| (68,478 | ) | |

| 75,731 | | |

| 10,444 | |

9F

Inc.

Reconciliations

of GAAP And Non-GAAP Results

(Amounts

in thousands, except for number of shares and per share data, or otherwise noted)

| | |

Six

Months

Ended

June 30,

2022 | | |

Six

Months

Ended

June 30,

2023 | | |

Six

Months

Ended

June 30,

2023 | |

| | |

RMB | | |

RMB | | |

USD | |

| Net loss | |

| (128,447 | ) | |

| (135,703 | ) | |

| (18,714 | ) |

| Add: | |

| | | |

| | | |

| | |

| Share-based compensation | |

| — | | |

| 2,331 | | |

| 321 | |

| Impairment loss of investments | |

| — | | |

| 26,923 | | |

| 3,713 | |

| Unrealized loss of investment in marketable securities | |

| 13,080 | | |

| 25,820 | | |

| 3,561 | |

| Less: Tax effect of adjustments | |

| (2,566 | ) | |

| — | | |

| — | |

| Non-GAAP Adjusted net loss | |

| (117,933 | ) | |

| (80,629 | ) | |

| (11,119 | ) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

9F

Inc. |

| |

|

| |

By: |

/s/

Lei Liu |

| |

Name: |

Lei

Liu |

| |

Title: |

Chief

Executive Officer |

| |

|

| Date:

December 1, 2023 |

|

8

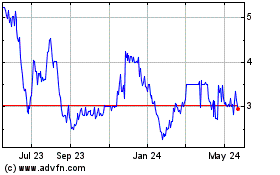

9F (NASDAQ:JFU)

Historical Stock Chart

From Dec 2024 to Jan 2025

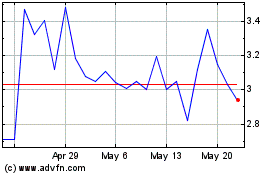

9F (NASDAQ:JFU)

Historical Stock Chart

From Jan 2024 to Jan 2025