James River Announces Agreement to Sell Individual Risk Workers’ Compensation Renewal Rights to Amynta Group

26 September 2023 - 1:30AM

James River Group Holdings, Ltd. (“James River” or the “Company”)

(NASDAQ: JRVR) today announced that certain of its subsidiaries

have entered into an agreement to sell the renewal rights to their

Individual Risk Workers’ Compensation (“IRWC”) business to Amynta

Group (“Amynta”). The transaction includes the full operations of

the business, including underwriting, loss control and claims, and

transfer of the employees supporting the business. The IRWC

business produced $53 million of gross written premiums in 2022. It

will operate under Amynta Work Comp Solutions.

Frank D’Orazio, the Company’s Chief Executive

Officer, commented, “We are confident that Amynta’s scale and

expertise in workers’ compensation will provide the IRWC team with

a strong platform for future growth. This transaction is aligned

with our strategy to focus our resources on core businesses where

we have meaningful scale. We are excited to establish a

relationship with Amynta and look forward to partnering with them

on future business opportunities.”

Terry McCafferty, Specialty Admitted Insurance

Segment President and CEO, commented, “I am grateful for Paul

Kearns and the entire IRWC team for their years of dedicated

service to insureds and producers, as well as their contributions

to James River. I am excited for their future opportunities at

Amynta Work Comp Solutions.”

“The business brings a well-established team and

business profile dedicated to retail agents and wholesalers,

delivering strong solutions to the market. This acquisition is well

aligned with our workers’ comp portfolio, expanding our business

across targeted industries and establishing a strong presence in

the Southeast.” said Bob Schultz, Head of Insurance Programs at

Amynta Group. “We are excited to welcome the team to Amynta and to

support the business with additional investment and capacity,

enabling the team to continue providing outstanding service to its

distribution partners and insured clients.”

James River will not sell any insurance company

entities as part of the transaction. The transaction is subject to

customary closing conditions and is expected to close at the end of

the third quarter of 2023.

Forward-Looking Statements

This press release contains forward-looking

statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. In some cases, such forward-looking

statements may be identified by terms such as believe, expect,

seek, may, will, should, intend, project, anticipate, plan,

estimate, guidance or similar words. Forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those in the forward-looking statements.

Although it is not possible to identify all of these risks and

uncertainties, they include, among others, the following: the

failure to complete the transaction on anticipated terms and

timing; the inherent uncertainty of estimating reserves and the

possibility that incurred losses may be greater than our loss and

loss adjustment expense reserves; inaccurate estimates and

judgments in our risk management may expose us to greater risks

than intended; downgrades in the financial strength rating of our

regulated insurance subsidiaries impacting our ability to attract

and retain insurance and reinsurance business that our subsidiaries

write, our competitive position, and our financial condition; the

potential loss of key members of our management team or key

employees and our ability to attract and retain personnel; adverse

economic factors resulting in the sale of fewer policies than

expected or an increase in the frequency or severity of claims, or

both; the impact of a persistent high inflationary environment on

our reserves, the values of our investments and investment returns,

and our compensation expenses; exposure to credit risk, interest

rate risk and other market risk in our investment portfolio;

reliance on a select group of brokers and agents for a significant

portion of our business and the impact of our potential failure to

maintain such relationships; reliance on a select group of

customers for a significant portion of our business and the impact

of our potential failure to maintain, or decision to terminate,

such relationships; our ability to obtain reinsurance coverage at

prices and on terms that allow us to transfer risk, adequately

protect our company against financial loss and that supports our

growth plans; losses resulting from reinsurance counterparties

failing to pay us on reinsurance claims, insurance companies with

whom we have a fronting arrangement failing to pay us for claims,

or a former customer with whom we have an indemnification

arrangement failing to perform its reimbursement obligations, and

our potential inability to demand or maintain adequate collateral

to mitigate such risks; inadequacy of premiums we charge to

compensate us for our losses incurred; changes in laws or

government regulation, including tax or insurance law and

regulations; changes in U.S. tax laws and the interpretation of

certain provisions of Public Law No. 115-97, informally titled the

2017 Tax Cuts and Jobs Act (including associated regulations),

which may be retroactive and could have a significant effect on us

including, among other things, by potentially increasing our tax

rate, as well as on our shareholders; in the event we do not

qualify for the insurance company exception to the passive foreign

investment company (“PFIC”) rules and are therefore considered a

PFIC, there could be material adverse tax consequences to an

investor that is subject to U.S. federal income taxation; the

Company or any of its foreign subsidiaries becoming subject to U.S.

federal income taxation; a failure of any of the loss limitations

or exclusions we utilize to shield us from unanticipated financial

losses or legal exposures, or other liabilities; losses from

catastrophic events, such as natural disasters and terrorist acts,

which substantially exceed our expectations and/or exceed the

amount of reinsurance we have purchased to protect us from such

events; potential effects on our business of emerging claim and

coverage issues; the potential impact of internal or external

fraud, operational errors, systems malfunctions or cyber security

incidents; our ability to manage our growth effectively; failure to

maintain effective internal controls in accordance with the

Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley”); changes

in our financial condition, regulations or other factors that may

restrict our subsidiaries; ability to pay us dividends; and an

adverse result in any litigation or legal proceedings we are or may

become subject to. Additional information about these risks and

uncertainties, as well as others that may cause actual results to

differ materially from those in the forward-looking statements, is

contained in our filings with the U.S. Securities and Exchange

Commission ("SEC"), including our most recently filed Annual Report

on Form 10-K. These forward-looking statements speak only as of the

date of this release and the Company does not undertake any

obligation to update or revise any forward-looking information to

reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise.

About James River Group Holdings,

Ltd.James River Group Holdings, Ltd. is a Bermuda-based

insurance holding company that owns and operates a group of

specialty insurance and reinsurance companies. The Company operates

in three specialty property-casualty insurance and reinsurance

segments: Excess and Surplus Lines, Specialty Admitted Insurance

and Casualty Reinsurance. Each of the Company’s regulated insurance

subsidiaries are rated “A-” (Excellent) by A.M. Best Company. Visit

James River Group Holdings, Ltd. on the web at

www.jrvrgroup.com.

About AmyntaAmynta Group is a

premier insurance services company with more than $3.5 billion in

total managed premium and 2,000 associates across North America,

Europe, and Australia. An independent, customer-centered and

underwriting-focused company, Amynta serves leading carriers,

wholesalers, retail agencies, auto dealers, OEMs, and consumer

retailers with innovative insurance and warranty protection

solutions. For more information, please visit amyntagroup.com.

James River Investor

Contact:Brett ShirreffsSVP, Finance, Investments and

Investor Relations(919) 980-0524Investors@jrvrgroup.com

Amynta Media Contact:Brenna

Tetley(646) 887-9498Brenna.Tetley@amyntagroup.com

Amynta Mergers & Acquisitions

Contact:Chris Ezbiansky(646)

887-9495Chris.Ezbiansky@amyntagroup.com

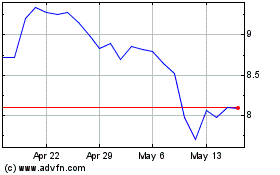

James River (NASDAQ:JRVR)

Historical Stock Chart

From Oct 2024 to Nov 2024

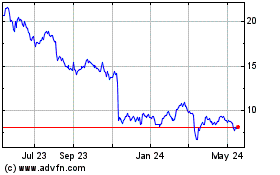

James River (NASDAQ:JRVR)

Historical Stock Chart

From Nov 2023 to Nov 2024