FALSE00010904255321 Corporate Blvd.Baton RougeLouisiana70808225926-1000LAMAR ADVERTISING CO/NEW00010904252023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

____________________

LAMAR ADVERTISING COMPANY

(Exact name of registrants as specified in its charter)

____________________

| | | | | | | | | | | | | | |

| Delaware | | 001-36756 | | 47-0961620 |

(States or other jurisdictions of incorporation) | | (Commission File Numbers) | | (IRS Employer Identification Nos.) |

| | | | |

5321 Corporate Blvd., Baton Rouge, Louisiana 70808 (Address of principal executive offices and zip code) |

| | | | |

(225) 926-1000 (Registrants’ telephone number, including area code) |

| | | | |

N/A

(Former name or former address, if change since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Lamar Advertising Company securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.001 par value | | LAMR | | The NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, Lamar Advertising Company announced via press release its results for the quarter ended June 30, 2024. A copy of Lamar’s press release is hereby furnished to the Commission and incorporated by reference herein as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File - (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

Date: August 8, 2024 | LAMAR ADVERTISING COMPANY |

| | | |

| | By: | | /s/ Jay L. Johnson |

| | | | Jay L. Johnson |

| | | | Executive Vice President, Chief Financial Officer, and Treasurer |

5321 Corporate Boulevard

Baton Rouge, LA 70808

Lamar Advertising Company Announces

Second Quarter Ended June 30, 2024 Operating Results

Three Month Results

•Net revenue was $565.3 million

•Net income was $137.6 million

•Adjusted EBITDA was $271.6 million

Six Month Results

•Net revenue was $1.06 billion

•Net income was $216.1 million

•Adjusted EBITDA was $483.5 million

Baton Rouge, LA – August 8, 2024 - Lamar Advertising Company (the “Company” or “Lamar”) (Nasdaq: LAMR), a leading owner and operator of outdoor advertising and logo sign displays, announces the Company’s operating results for the second quarter ended June 30, 2024.

"We delivered solid revenue growth in the second quarter, buoyed by continued strong demand from local and regional advertisers,” Lamar chief executive Sean Reilly said. "The revenue gain, combined with continued discipline on expenses, allowed us to produce adjusted EBITDA growth of nearly 7% and diluted AFFO per share growth of 9.5%. Also, we continue to pace at the top end of our previously provided guidance of $7.75 to $7.90 for full year diluted AFFO per share.”

Second Quarter Highlights

•Net revenue increased 4.5%

•Adjusted EBITDA increased 6.9%

•Diluted AFFO per share increased 9.5%

Second Quarter Results

Lamar reported net revenues of $565.3 million for the second quarter of 2024 versus $541.1 million for the second quarter of 2023, a 4.5% increase. Operating income for the second quarter of 2024 increased $7.4 million to $184.2 million as compared to $176.8 million for the same period in 2023. Lamar recognized net income of $137.6 million for the second quarter of 2024 as compared to net income of $130.9 million for the same period in 2023, an increase of $6.7 million. Net income per diluted share was $1.34 and $1.28 for the three months ended June 30, 2024 and 2023, respectively.

Adjusted EBITDA for the second quarter of 2024 was $271.6 million versus $253.9 million for the second quarter of 2023, an increase of 6.9%.

Cash flow provided by operating activities was $256.3 million for the three months ended June 30, 2024 versus $198.2 million for the second quarter of 2023, an increase of $58.2 million. Free cash flow for the second quarter of 2024 was $203.5 million as compared to $159.2 million for the same period in 2023, a 27.8% increase.

For the second quarter of 2024, funds from operations, or FFO, was $209.3 million versus $200.6 million for the same period in 2023, an increase of 4.3%. Adjusted funds from operations, or AFFO, for the second quarter of 2024 was $213.5 million compared to $194.4 million for the same period in 2023, an increase of 9.8%. Diluted AFFO per share increased 9.5% to $2.08 for the three months ended June 30, 2024 as compared to $1.90 for the same period in 2023.

Acquisition-Adjusted Three Months Results

Acquisition-adjusted net revenue for the second quarter of 2024 increased 3.9% over acquisition-adjusted net revenue for the second quarter of 2023. Acquisition-adjusted EBITDA for the second quarter of 2024 increased 6.3% as compared to acquisition-adjusted EBITDA for the second quarter of 2023. Acquisition-adjusted net revenue and acquisition-adjusted EBITDA include adjustments to the 2023 period for acquisitions and divestitures for the same time frame as actually owned in

the 2024 period. See “Reconciliation of Reported Basis to Acquisition-Adjusted Results”, which provides reconciliations to GAAP for acquisition-adjusted measures.

Six Month Results

Lamar reported net revenues of $1.06 billion for the six months ended June 30, 2024 versus $1.01 billion for the six months ended June 30, 2023, a 5.0% increase. Operating income for the six months ended June 30, 2024 increased $13.2 million to $308.8 million as compared to $295.6 million for the same period in 2023. Lamar recognized net income of $216.1 million for the six months ended June 30, 2024 as compared to net income of $207.1 million for the same period in 2023, an increase of $9.0 million. Net income per diluted share was $2.10 and $2.02 for the six months ended June 30, 2024 and 2023, respectively.

Adjusted EBITDA for the six months ended June 30, 2024 was $483.5 million versus $451.9 million for the same period in 2023, an increase of 7.0%.

Cash flow provided by operating activities was $366.9 million for the six months ended June 30, 2024, an increase of $60.0 million as compared to the same period in 2023. Free cash flow for the six months ended June 30, 2024 was $342.2 million as compared to $272.5 million for the same period in 2023, a 25.6% increase.

For the six months ended June 30, 2024, funds from operations, or FFO, was $357.8 million versus $344.1 million for the same period in 2023, an increase of 4.0%. Adjusted funds from operations, or AFFO, for the six months ended June 30, 2024 was $371.8 million compared to $338.5 million for the same period in 2023, an increase of 9.8%. Diluted AFFO per share increased 9.3% to $3.63 for the six months ended June 30, 2024 as compared to $3.32 for the same period in 2023.

Liquidity

As of June 30, 2024, Lamar had $744.3 million in total liquidity that consisted of $666.4 million available for borrowing under its revolving senior credit facility and $77.9 million in cash and cash equivalents. There were $75.0 million in borrowings outstanding under the Company’s revolving credit facility and $250.0 million outstanding under the Accounts Receivable Securitization Program as of the same date.

Recent Developments

On July 31, 2024, Lamar Media paid in full its $350.0 million in Term A loans outstanding under our Senior Credit Facility. The Term A loans were repaid using a combination of borrowings under our revolving credit facility and cash on hand. Currently, the Company has $315.0 million in borrowings outstanding under the revolving credit facility.

On July 24, 2024, Lamar entered into an equity distribution or At-the-Market Offering agreement (the “ATM agreement”). Under the terms of the ATM Agreement, Lamar may, from time to time, issue and sell shares of its Class A common stock having an aggregate offering price of up to $400.0 million through the sales agents party to the ATM Agreement. The ATM Agreement replaces a prior equity distribution agreement with substantially similar terms between the Company and certain sales agents, which expired by its terms.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding sales trends. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected in these forward-looking statements. These risks and uncertainties include, among others: (1) our significant indebtedness; (2) the state of the economy and financial markets generally, and the effect of the broader economy on the demand for advertising; (3) the continued popularity of outdoor advertising as an advertising medium; (4) our need for and ability to obtain additional funding for operations, debt refinancing or acquisitions; (5) our ability to continue to qualify as a Real Estate Investment Trust (“REIT”) and maintain our status as a REIT; (6) the regulation of the outdoor advertising industry by federal, state and local governments; (7) the integration of companies and assets that we acquire and our ability to recognize cost savings or operating efficiencies as a result of these acquisitions; (8) changes in accounting principles, policies or guidelines; (9) changes in tax laws applicable to REITs or in the interpretation of those laws; (10) our ability to renew expiring contracts at favorable rates; (11) our ability to successfully implement our digital deployment strategy; and (12) the market for our Class A common stock. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023, as supplemented by any risk factors contained in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. We caution investors not to place undue reliance on the forward-looking statements contained in this

document. These statements speak only as of the date of this document, and we undertake no obligation to update or revise the statements, except as may be required by law.

Use of Non-GAAP Financial Measures

The Company has presented the following measures that are not measures of performance under accounting principles generally accepted in the United States of America (“GAAP”): adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), free cash flow, funds from operations (“FFO”), adjusted funds from operations (“AFFO”), diluted AFFO per share, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense. Our management reviews our performance by focusing on these key performance indicators not prepared in conformity with GAAP. We believe these non-GAAP performance indicators are meaningful supplemental measures of our operating performance and should not be considered in isolation of, or as a substitute for their most directly comparable GAAP financial measures.

Our Non-GAAP financial measures are determined as follows:

•We define adjusted EBITDA as net income before income tax expense (benefit), interest expense (income), loss (gain) on extinguishment of debt and investments, equity in (earnings) loss of investee, stock-based compensation, depreciation and amortization, loss (gain) on disposition of assets and investments, transaction expenses and investments and capitalized contract fulfillment costs, net.

•Adjusted EBITDA margin is defined as adjusted EBITDA divided by net revenues.

•Free cash flow is defined as adjusted EBITDA less interest, net of interest income and amortization of deferred financing costs, current taxes, preferred stock dividends and total capital expenditures.

•We use the National Association of Real Estate Investment Trusts definition of FFO, which is defined as net income before (gain) loss from the sale or disposal of real estate assets and investments, net of tax, and real estate related depreciation and amortization and including adjustments to eliminate unconsolidated affiliates and non-controlling interest.

•We define AFFO as FFO before (i) straight-line income and expense; (ii) capitalized contract fulfillment costs, net; (iii) stock-based compensation expense; (iv) non-cash portion of tax expense (benefit); (v) non-real estate related depreciation and amortization; (vi) amortization of deferred financing costs; (vii) loss on extinguishment of debt; (viii) transaction expenses; (ix) non-recurring infrequent or unusual losses (gains); (x) less maintenance capital expenditures; and (xi) an adjustment for unconsolidated affiliates and non-controlling interest.

•Diluted AFFO per share is defined as AFFO divided by weighted average diluted common shares outstanding.

•Outdoor operating income is defined as operating income before corporate expenses, stock-based compensation, capitalized contract fulfillment costs, net, transaction expenses, depreciation and amortization and loss (gain) on disposition of assets.

•Acquisition-adjusted results adjusts our net revenue, direct and general and administrative expenses, outdoor operating income, corporate expense and EBITDA for the prior period by adding to, or subtracting from, the corresponding revenue or expense generated by the acquired or divested assets before our acquisition or divestiture of these assets for the same time frame that those assets were owned in the current period. In calculating acquisition-adjusted results, therefore, we include revenue and expenses generated by assets that we did not own in the prior period but acquired in the current period. We refer to the amount of pre-acquisition revenue and expense generated by or subtracted from the acquired assets during the prior period that corresponds with the current period in which we owned the assets (to the extent within the period to which this report relates) as “acquisition-adjusted results”.

•Acquisition-adjusted consolidated expense adjusts our total operating expense to remove the impact of stock-based compensation, depreciation and amortization, transaction expenses, capitalized contract fulfillment costs, net, and loss (gain) on disposition of assets and investments. The prior period is also adjusted to include the expense generated by the acquired or divested assets before our acquisition or divestiture of such assets for the same time frame that those assets were owned in the current period.

Adjusted EBITDA, FFO, AFFO, diluted AFFO per share, free cash flow, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense are not intended to replace other performance measures determined in accordance with GAAP. Free cash flow, FFO and AFFO do not represent cash flows from operating activities in accordance with GAAP and, therefore, these measures should not be considered indicative of cash flows from operating activities as a

measure of liquidity or of funds available to fund our cash needs, including our ability to make cash distributions. Adjusted EBITDA, free cash flow, FFO, AFFO, diluted AFFO per share, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense are presented as we believe each is a useful indicator of our current operating performance. Specifically, we believe that these metrics are useful to an investor in evaluating our operating performance because (1) each is a key measure used by our management team for purposes of decision making and for evaluating our core operating results; (2) adjusted EBITDA is widely used in the industry to measure operating performance as it excludes the impact of depreciation and amortization, which may vary significantly among companies, depending upon accounting methods and useful lives, particularly where acquisitions and non-operating factors are involved; (3) adjusted EBITDA, FFO, AFFO, diluted AFFO per share and acquisition-adjusted consolidated expense each provides investors with a meaningful measure for evaluating our period-over-period operating performance by eliminating items that are not operational in nature and reflect the impact on operations from trends in occupancy rates, operating costs, general and administrative expenses and interest costs; (4) acquisition-adjusted results is a supplement to enable investors to compare period-over-period results on a more consistent basis without the effects of acquisitions and divestitures, which reflects our core performance and organic growth (if any) during the period in which the assets were owned and managed by us; (5) free cash flow is an indicator of our ability to service debt and generate cash for acquisitions and other strategic investments; (6) outdoor operating income provides investors a measurement of our core results without the impact of fluctuations in stock-based compensation, depreciation and amortization and corporate expenses; and (7) each of our Non-GAAP measures provides investors with a measure for comparing our results of operations to those of other companies.

Our measurement of adjusted EBITDA, FFO, AFFO, diluted AFFO per share, free cash flow, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense may not, however, be fully comparable to similarly titled measures used by other companies. Reconciliations of adjusted EBITDA, FFO, AFFO, diluted AFFO per share, free cash flow, outdoor operating income, acquisition-adjusted results and acquisition-adjusted consolidated expense to the most directly comparable GAAP measures have been included herein.

Conference Call Information

A conference call will be held to discuss the Company’s operating results on Thursday, August 8, 2024 at 8:00 a.m. central time. Instructions for the conference call and Webcast are provided below:

Conference Call

| | | | | |

| All Callers: | 1-800-420-1271 or 1-785-424-1634 |

| Passcode: | 63104 |

| |

| Live Webcast: | www.lamar.com/About/Investors/Presentations |

| |

| Webcast Replay: | www.lamar.com/About/Investors/Presentations |

| Available through Thursday, August 15, 2024 at 11:59 p.m. eastern time |

| |

| Company Contact: | Buster Kantrow |

| Director of Investor Relations |

| (225) 926-1000 |

| bkantrow@lamar.com |

General Information

Founded in 1902, Lamar Advertising (Nasdaq: LAMR) is one of the largest outdoor advertising companies in North America, with over 360,000 displays across the United States and Canada. Lamar offers advertisers a variety of billboard, interstate logo, transit and airport advertising formats, helping both local businesses and national brands reach broad audiences every day. In addition to its more traditional out-of-home inventory, Lamar is proud to offer its customers the largest network of digital billboards in the United States with over 4,800 displays.

LAMAR ADVERTISING COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenues | $ | 565,251 | | | $ | 541,137 | | | $ | 1,063,401 | | | $ | 1,012,469 | |

| Operating expenses (income) | | | | | | | |

| Direct advertising expenses | 183,455 | | | 172,543 | | | 359,284 | | | 340,301 | |

| General and administrative expenses | 84,334 | | | 88,309 | | | 167,429 | | | 169,191 | |

| Corporate expenses | 25,908 | | | 26,366 | | | 53,212 | | | 51,106 | |

| Stock-based compensation | 11,150 | | | 4,406 | | | 25,616 | | | 12,446 | |

| Capitalized contract fulfillment costs, net | (190) | | | (760) | | | (374) | | | (86) | |

| | | | | | | |

| Depreciation and amortization | 77,191 | | | 75,158 | | | 152,419 | | | 148,283 | |

| Gain on disposition of assets | (824) | | | (1,676) | | | (3,012) | | | (4,364) | |

| Total operating expense | 381,024 | | | 364,346 | | | 754,574 | | | 716,877 | |

| Operating income | 184,227 | | | 176,791 | | | 308,827 | | | 295,592 | |

| Other expense (income) | | | | | | | |

| | | | | | | |

| Interest income | (572) | | | (477) | | | (1,039) | | | (938) | |

| Interest expense | 44,337 | | | 43,649 | | | 88,824 | | | 85,093 | |

| Equity in (earnings) loss of investee | (4) | | | (449) | | | 555 | | | (627) | |

| 43,761 | | | 42,723 | | | 88,340 | | | 83,528 | |

| Income before income tax expense | 140,466 | | | 134,068 | | | 220,487 | | | 212,064 | |

| Income tax expense | 2,872 | | | 3,180 | | | 4,394 | | | 4,978 | |

| Net income | 137,594 | | | 130,888 | | | 216,093 | | | 207,086 | |

| Net income attributable to non-controlling interest | 228 | | | 268 | | | 503 | | | 425 | |

| Net income attributable to controlling interest | 137,366 | | | 130,620 | | | 215,590 | | | 206,661 | |

| Preferred stock dividends | 91 | | | 91 | | | 182 | | | 182 | |

| Net income applicable to common stock | $ | 137,275 | | | $ | 130,529 | | | $ | 215,408 | | | $ | 206,479 | |

| Earnings per share: | | | | | | | |

| Basic earnings per share | $ | 1.34 | | | $ | 1.28 | | | $ | 2.11 | | | $ | 2.03 | |

| Diluted earnings per share | $ | 1.34 | | | $ | 1.28 | | | $ | 2.10 | | | $ | 2.02 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 102,248,621 | | | 101,917,200 | | | 102,181,890 | | | 101,855,104 | |

| Diluted | 102,594,217 | | | 102,104,429 | | | 102,522,569 | | | 102,047,875 | |

| OTHER DATA | | | | | | | |

| Free Cash Flow Computation: | | | | | | | |

| Adjusted EBITDA | $ | 271,554 | | | $ | 253,919 | | | $ | 483,476 | | | $ | 451,871 | |

| Interest, net | (42,125) | | | (41,520) | | | (84,514) | | | (80,861) | |

| Current tax expense | (3,182) | | | (2,373) | | | (4,458) | | | (5,323) | |

| Preferred stock dividends | (91) | | | (91) | | | (182) | | | (182) | |

| Total capital expenditures | (22,648) | | | (50,722) | | | (52,130) | | | (93,007) | |

| Free cash flow | $ | 203,508 | | | $ | 159,213 | | | $ | 342,192 | | | $ | 272,498 | |

SUPPLEMENTAL SCHEDULES

SELECTED BALANCE SHEET AND CASH FLOW DATA

(IN THOUSANDS)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| (Unaudited) | | |

| Selected Balance Sheet Data: | | | |

| Cash and cash equivalents | $ | 77,932 | | | $ | 44,605 | |

| Working capital deficit | $ | (623,810) | | | $ | (340,711) | |

| Total assets | $ | 6,582,421 | | | $ | 6,563,622 | |

| Total debt, net of deferred financing costs (including current maturities) | $ | 3,349,177 | | | $ | 3,341,127 | |

| Total stockholders’ equity | $ | 1,198,409 | | | $ | 1,216,788 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (Unaudited) |

| Selected Cash Flow Data: | | | | | | | |

| Cash flows provided by operating activities | $ | 256,342 | | | $ | 198,162 | | | $ | 366,904 | | | $ | 306,874 | |

| Cash flows used in investing activities | $ | 31,645 | | | $ | 77,345 | | | $ | 76,661 | | | $ | 130,009 | |

| Cash flows used in financing activities | $ | 183,118 | | | $ | 106,626 | | | $ | 256,744 | | | $ | 181,781 | |

SUPPLEMENTAL SCHEDULES

UNAUDITED RECONCILIATIONS OF NON-GAAP MEASURES

(IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Cash Flows Provided by Operating Activities to Free Cash Flow: | | | | | | | |

| Cash flows provided by operating activities | $ | 256,342 | | | $ | 198,162 | | | $ | 366,904 | | | $ | 306,874 | |

| Changes in operating assets and liabilities | (28,574) | | | 16,785 | | | 29,617 | | | 64,457 | |

| Total capital expenditures | (22,648) | | | (50,722) | | | (52,130) | | | (93,007) | |

| Preferred stock dividends | (91) | | | (91) | | | (182) | | | (182) | |

| Capitalized contract fulfillment costs, net | (190) | | | (760) | | | (374) | | | (86) | |

| | | | | | | |

| Other | (1,331) | | | (4,161) | | | (1,643) | | | (5,558) | |

| Free cash flow | $ | 203,508 | | | $ | 159,213 | | | $ | 342,192 | | | $ | 272,498 | |

| | | | | | | |

| Reconciliation of Net Income to Adjusted EBITDA: | | | | | | | |

| Net income | $ | 137,594 | | | $ | 130,888 | | | $ | 216,093 | | | $ | 207,086 | |

| | | | | | | |

| Interest income | (572) | | | (477) | | | (1,039) | | | (938) | |

| Interest expense | 44,337 | | | 43,649 | | | 88,824 | | | 85,093 | |

| Equity in loss (earnings) of investee | (4) | | | (449) | | | 555 | | | (627) | |

| Income tax expense | 2,872 | | | 3,180 | | | 4,394 | | | 4,978 | |

| Operating income | 184,227 | | | 176,791 | | | 308,827 | | | 295,592 | |

| Stock-based compensation | 11,150 | | | 4,406 | | | 25,616 | | | 12,446 | |

| Capitalized contract fulfillment costs, net | (190) | | | (760) | | | (374) | | | (86) | |

| | | | | | | |

| Depreciation and amortization | 77,191 | | | 75,158 | | | 152,419 | | | 148,283 | |

| Gain on disposition of assets | (824) | | | (1,676) | | | (3,012) | | | (4,364) | |

| Adjusted EBITDA | $ | 271,554 | | | $ | 253,919 | | | $ | 483,476 | | | $ | 451,871 | |

| | | | | | | |

| Capital expenditure detail by category: | | | | | | | |

| Billboards - traditional | $ | 3,865 | | | $ | 15,423 | | | $ | 11,013 | | | $ | 28,961 | |

| Billboards - digital | 11,195 | | | 24,109 | | | 24,608 | | | 41,541 | |

| Logo | 1,800 | | | 3,991 | | | 3,136 | | | 7,131 | |

| Transit | 1,034 | | | 670 | | | 1,385 | | | 1,389 | |

| Land and buildings | 2,364 | | | 3,517 | | | 4,680 | | | 7,691 | |

| Operating equipment | 2,390 | | | 3,012 | | | 7,308 | | | 6,294 | |

| Total capital expenditures | $ | 22,648 | | | $ | 50,722 | | | $ | 52,130 | | | $ | 93,007 | |

SUPPLEMENTAL SCHEDULES

UNAUDITED RECONCILIATIONS OF NON-GAAP MEASURES

(IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

Reconciliation of Reported Basis to Acquisition-Adjusted Results(a): | | | | | | | | | | | |

| Net revenue | $ | 565,251 | | | $ | 541,137 | | | 4.5 | % | | $ | 1,063,401 | | | $ | 1,012,469 | | | 5.0 | % |

| Acquisitions and divestitures | — | | | 2,723 | | | | | — | | | 4,417 | | | |

| Acquisition-adjusted net revenue | 565,251 | | | 543,860 | | | 3.9 | % | | 1,063,401 | | | 1,016,886 | | | 4.6 | % |

| Reported direct advertising and G&A expenses | 267,789 | | | 260,852 | | | 2.7 | % | | 526,713 | | | 509,492 | | | 3.4 | % |

| Acquisitions and divestitures | — | | | 1,056 | | | | | — | | | 1,648 | | | |

| Acquisition-adjusted direct advertising and G&A expenses | 267,789 | | | 261,908 | | | 2.2 | % | | 526,713 | | | 511,140 | | | 3.0 | % |

| Outdoor operating income | 297,462 | | | 280,285 | | | 6.1 | % | | 536,688 | | | 502,977 | | | 6.7 | % |

| Acquisition and divestitures | — | | | 1,667 | | | | | — | | | 2,769 | | | |

| Acquisition-adjusted outdoor operating income | 297,462 | | | 281,952 | | | 5.5 | % | | 536,688 | | | 505,746 | | | 6.1 | % |

| Reported corporate expense | 25,908 | | | 26,366 | | | (1.7) | % | | 53,212 | | | 51,106 | | | 4.1 | % |

| Acquisitions and divestitures | — | | | 66 | | | | | — | | | 132 | | | |

| Acquisition-adjusted corporate expenses | 25,908 | | | 26,432 | | | (2.0) | % | | 53,212 | | | 51,238 | | | 3.9 | % |

| Adjusted EBITDA | 271,554 | | | 253,919 | | | 6.9 | % | | 483,476 | | | 451,871 | | | 7.0 | % |

| Acquisitions and divestitures | — | | | 1,601 | | | | | — | | | 2,637 | | | |

| Acquisition-adjusted EBITDA | $ | 271,554 | | | $ | 255,520 | | | 6.3 | % | | $ | 483,476 | | | $ | 454,508 | | | 6.4 | % |

(a) Acquisition-adjusted net revenue, direct advertising and general and administrative expenses, outdoor operating income, corporate expenses and EBITDA include adjustments to 2023 for acquisitions and divestitures for the same time frame as actually owned in 2024.

SUPPLEMENTAL SCHEDULES

UNAUDITED RECONCILIATIONS OF NON-GAAP MEASURES

(IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Reconciliation of Net Income to Outdoor Operating Income: | | | | | | | | | | | |

| Net income | $ | 137,594 | | | $ | 130,888 | | | 5.1 | % | | $ | 216,093 | | | $ | 207,086 | | | 4.3 | % |

| | | | | | | | | | | |

| Interest expense, net | 43,765 | | | 43,172 | | | | | 87,785 | | | 84,155 | | | |

| Equity in loss (earnings) of investee | (4) | | | (449) | | | | | 555 | | | (627) | | | |

| Income tax expense | 2,872 | | | 3,180 | | | | | 4,394 | | | 4,978 | | | |

| Operating income | 184,227 | | | 176,791 | | | 4.2 | % | | 308,827 | | | 295,592 | | | 4.5 | % |

| Corporate expenses | 25,908 | | | 26,366 | | | | | 53,212 | | | 51,106 | | | |

| Stock-based compensation | 11,150 | | | 4,406 | | | | | 25,616 | | | 12,446 | | | |

| Capitalized contract fulfillment costs, net | (190) | | | (760) | | | | | (374) | | | (86) | | | |

| | | | | | | | | | | |

| Depreciation and amortization | 77,191 | | | 75,158 | | | | | 152,419 | | | 148,283 | | | |

| Gain on disposition of assets | (824) | | | (1,676) | | | | | (3,012) | | | (4,364) | | | |

| Outdoor operating income | $ | 297,462 | | | $ | 280,285 | | | 6.1 | % | | $ | 536,688 | | | $ | 502,977 | | | 6.7 | % |

SUPPLEMENTAL SCHEDULES

UNAUDITED RECONCILIATIONS OF NON-GAAP MEASURES

(IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Reconciliation of Total Operating Expense to Acquisition-Adjusted Consolidated Expense: | | | | | | | | | | | |

| Total operating expense | $ | 381,024 | | | $ | 364,346 | | | 4.6 | % | | $ | 754,574 | | | $ | 716,877 | | | 5.3 | % |

| Gain on disposition of assets | 824 | | | 1,676 | | | | | 3,012 | | | 4,364 | | | |

| Depreciation and amortization | (77,191) | | | (75,158) | | | | | (152,419) | | | (148,283) | | | |

| | | | | | | | | | | |

| Capitalized contract fulfillment costs, net | 190 | | | 760 | | | | | 374 | | | 86 | | | |

| Stock-based compensation | (11,150) | | | (4,406) | | | | | (25,616) | | | (12,446) | | | |

| Acquisitions and divestitures | — | | | 1,122 | | | | | — | | | 1,780 | | | |

| Acquisition-adjusted consolidated expense | $ | 293,697 | | | $ | 288,340 | | | 1.9 | % | | $ | 579,925 | | | $ | 562,378 | | | 3.1 | % |

SUPPLEMENTAL SCHEDULES

UNAUDITED REIT MEASURES

AND RECONCILIATIONS TO GAAP MEASURES

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Adjusted Funds from Operations: | | | | | | | |

| Net income | $ | 137,594 | | | $ | 130,888 | | | $ | 216,093 | | | $ | 207,086 | |

| Depreciation and amortization related to real estate | 72,393 | | | 72,056 | | | 144,122 | | | 142,406 | |

| Gain from sale or disposal of real estate, net of tax | (726) | | | (1,587) | | | (2,820) | | | (4,307) | |

| Adjustments for unconsolidated affiliates and non-controlling interest | 12 | | | (717) | | | 384 | | | (1,052) | |

| Funds from operations | $ | 209,273 | | | $ | 200,640 | | | $ | 357,779 | | | $ | 344,133 | |

| Straight-line expense | 794 | | | 1,383 | | | 2,067 | | | 2,340 | |

| Capitalized contract fulfillment costs, net | (190) | | | (760) | | | (374) | | | (86) | |

| Stock-based compensation expense | 11,150 | | | 4,406 | | | 25,616 | | | 12,446 | |

| Non-cash portion of tax provision | (310) | | | 807 | | | (64) | | | (345) | |

| Non-real estate related depreciation and amortization | 4,799 | | | 3,102 | | | 8,297 | | | 5,877 | |

| Amortization of deferred financing costs | 1,640 | | | 1,652 | | | 3,271 | | | 3,294 | |

| | | | | | | |

| | | | | | | |

| Capitalized expenditures-maintenance | (13,627) | | | (17,548) | | | (24,454) | | | (30,240) | |

| Adjustments for unconsolidated affiliates and non-controlling interest | (12) | | | 717 | | | (384) | | | 1,052 | |

| Adjusted funds from operations | $ | 213,517 | | | $ | 194,399 | | | $ | 371,754 | | | $ | 338,471 | |

| Divided by weighted average diluted common shares outstanding | 102,594,217 | | | 102,104,429 | | | 102,522,569 | | | 102,047,875 | |

| Diluted AFFO per share | $ | 2.08 | | | $ | 1.90 | | | $ | 3.63 | | | $ | 3.32 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

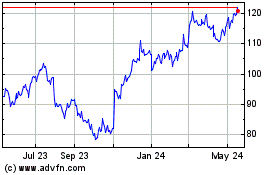

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Dec 2023 to Dec 2024