Interview With Laser Photonics Principal Financial Officer, Carlos Sardinas, Discussing Recently Announced Control Micro Systems Transaction

01 November 2024 - 10:00PM

Business Wire

The Company announced the signing of the asset

purchase agreement on 10/31/24

Laser Photonics Corporation (LPC) (NASDAQ: LASE), a leading

global developer of industrial laser systems for cleaning and other

material processing applications, today shared an interview with

Carlos Sardinas, VP of Finance for LPC, where he speaks on the

Company’s recently announced acquisition of the assets of Control

Micro Systems, Inc. (CMS). Key messages from the interview

included:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241101780450/en/

- LPC is diversifying into a new, recession-resistant vertical

with attractive growth characteristics;

- Due to financial challenges, the prior owner under-invested in

the business, particularly sales and marketing, and therefore, LPC

believes CMS’ products were under-monetized as well;

- CMS counts several of the top 20 largest global pharmaceutical

manufacturers as customers;

- LPC will combine the engineering and customer support talent

previously employed by CMS and LPC’s existing sales and marketing

programs with the goal of creating substantial synergies.

See below for a full transcript of the interview:

1. Please explain to investors what CMS does.

Sardinas: CMS specializes in developing custom precision laser

solutions for several markets; however, the business that was

especially attractive to us was their laser solutions for the

healthcare industry, specifically pharmaceutical drug delivery,

where they address two very attractive applications:

controlled-release tablet production and packaging compliance. With

its laser drilling systems, CMS has established itself as a

critical supplier for laser systems that create microscopic

apertures in tablets, allowing for precise control over drug

release rates.

2. Why were these assets especially attractive to LPC from a

business, technology and market perspective?

Sardinas: There are several reasons. First, this is a huge,

growing industry. According to Grandview Research, the broader

market for controlled-release pharmaceuticals was $49.5 billion in

2023 and is expected to grow at a CAGR of nearly 11% through 2030.

While the market for CMS’ laser systems that create precise holes

in the pharmaceuticals is a tiny fraction of this market, this

shows that the demand for these drug delivery methods will continue

to grow, and we believe CMS is well-positioned to capture this

growth.

Second, not only does this diversify our business into a new

growth market, but pharmaceuticals tend to be a recession-proof, or

at least highly recession-resistant industry, so we don’t expect to

see much cyclicality.

The third is synergies. We believe these assets were

significantly under-monetized and had become neglected after being

acquired in 2022. The acquiring Company was saddled with debt and

did not invest in growth initiatives like sales and marketing due

to its debt load. Despite this, CMS generated more revenue

(unaudited) than LPC did in 2023. We believe with the proper

investment in sales and marketing programs, an area of strength for

LPC, we can accelerate growth.

Finally, we see additional benefits as we acquired existing

customer programs with over $2 million in unbilled contracted

revenue that we can now turn into cash flow to reinvest in the

business. Also, while not technically part of the deal, we hired

most of the former CMS employees, who bring engineering and

customer support talent to LPC.

3. Who are CMS’ previous major customers?

Sardinas: CMS has several of the top 20 largest global

pharmaceutical manufacturers as its customers, including 2 in the

top 10. As we invest in sales and marketing, we hope to penetrate

these customers further while expanding this list in the coming

years.

4. What was the purchase price for the acquisition of

CMS?

Sardinas: We paid $1.05 million for the assets consisting of

$950,000 in cash and $100,000 in LPC stock.

5. Finally, what are the next steps following the

acquisition?

Sardinas: Laser Photonics is set to close the asset purchase

agreement over the next week. As we attain control of the assets

and develop our game plan, we will provide investors with relevant

updates. Thank you.

About Laser Photonics Corporation

Laser Photonics is a vertically integrated manufacturer and

R&D Center of Excellence for industrial laser technologies and

systems. Laser Photonics seeks to disrupt the $46 billion,

centuries-old sand and abrasives blasting markets, focusing on

surface cleaning, rust removal, corrosion control, de-painting and

other laser-based industrial applications. Laser Photonics’ new

generation of leading-edge laser blasting technologies and

equipment also addresses the numerous health, safety, environmental

and regulatory issues associated with old methods. As a result,

Laser Photonics has quickly gained a reputation as a leader in

industrial laser systems with a brand that stands for quality,

technology and product innovation. Currently, world-renowned and

Fortune 1000 manufacturers in the aerospace, automotive, defense,

energy, maritime, nuclear, and space industries are using Laser

Photonics’ unique-to-industry systems. For more information, visit

https://www.laserphotonics.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of applicable securities laws. These statements are

based on current expectations as of the date of this press release

and involve risks and uncertainties that may cause results and uses

of proceeds to differ materially from those indicated by these

forward-looking statements. We encourage readers to review the

“Risk Factors” in our Registration Statement for a comprehensive

understanding. Laser Photonics Corp. undertakes no obligation to

revise or update any forward-looking statements, except as required

by applicable laws or regulations, to reflect events or

circumstances after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241101780450/en/

Investor Relations Contact: Brian Siegel, IRC, MBA Senior

Managing Director Hayden IR (346) 396-8696 laser@haydenir.com

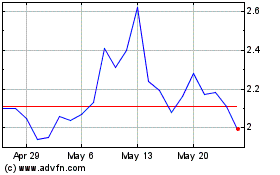

Laser Photonics (NASDAQ:LASE)

Historical Stock Chart

From Nov 2024 to Dec 2024

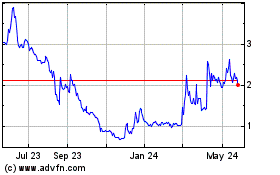

Laser Photonics (NASDAQ:LASE)

Historical Stock Chart

From Dec 2023 to Dec 2024