Logan Ridge Finance Corporation (“Logan Ridge”, “LRFC”, “Company”,

“we”, “us” or “our”) (Nasdaq: LRFC) announced today its financial

results for the third quarter ended September 30, 2023.

Third Quarter 2023 Highlights

- Reported Net Investment Income

(“NII”) of $1.2 million, or $0.43 per share, which marks the

Company’s fifth consecutive quarter of positive NII, and an

increase of 13% over the prior quarter.

- Net Asset Value (“NAV”) decreased

to $34.78 per share as of September 30, 2023 from $35.68 per share

as of June 30, 2023.

- As of September 30, 2023, our

portfolio consisted of investments in 58 portfolio companies with a

fair value of approximately $187.1 million.

- There were no new portfolio

companies added to non-accrual status during the three months ended

September 30, 2023.

- The Company repurchased 17,384 of

its outstanding shares during the quarter ended September 30, 2023

for an aggregate cost of approximately $0.4 million under the share

repurchase program which resulted in $0.08 per share of NAV

accretion.

Subsequent Events

- On November 7, 2023, the Company’s

Board of Directors approved a fourth quarter distribution of $0.30

per share payable on November 30, 2023 to stockholders of record as

of November 20, 2023.

- Total distributions declared in

2023 (including the fourth quarter distribution) were $0.96 per

share.

Management CommentaryTed

Goldthorpe, Chief Executive Officer and President of LRFC, said,

“We are pleased to report another quarter of strong financial

performance for the third quarter of 2023 largely reflecting the

work we have done on both the left and right side of the balance

sheet, the benefits of higher rates and prudent underwriting.

Notably, I am incredibly pleased to report that total investment

income has increased by 38% and net investment income increased by

a substantial 534% compared to the third quarter of 2022, which was

the Company’s first quarter of positive NII since we took over

managing Logan Ridge.

Further, the strength of the Company’s financial

performance has once again allowed the Board of Directors to

approve another dividend increase. For the fourth quarter of 2023,

the Board has authorized a dividend of $0.30 per share, which

represents another meaningful increase from $0.26 per share

declared during the prior quarter, $0.22 per share declared during

the second quarter, and $0.18 per share declared during the first

quarter of this year when we reintroduced the regular dividend.

Looking forward, we continue to see attractive

opportunities throughout the market. Our pipeline remains strong,

and the platform remains well equipped to take advantage of current

market conditions.”

Selected Financial Information

- Total investment

income for the third quarter of 2023 increased by $1.4

million, to $5.2 million, compared to $3.8 million in the third

quarter of 2022.

- Total operating

expenses for the third quarter of 2023 increased by $0.4

million, to $4.0 million, compared to $3.6 million for the third

quarter of 2022.

- Net investment

income for the third quarter of 2023 was $1.2 million, as

compared to $0.2 million for the third quarter of 2022. The Company

reported net investment income of $1.0 million for the second

quarter of 2023.

- Net asset value as

of September 30, 2023 was $93.2 million, or $34.78 per share, as

compared to $96.2 million, or $35.68 per share, as of June 30,

2023.

- Cash and

cash equivalents as of September 30, 2023 were $5.1

million, as compared to $6.3 million as of June 30, 2023.

- The investment

portfolio as of September 30, 2023 consisted of

investments in 58 portfolio companies with a fair value of

approximately $187.1 million. This compares to 62 portfolio

companies with a fair value of approximately $206.6 million as of

June 30, 2023.

- Deployment was

strong, but it was offset by a few large exits at the end of the

quarter. During the third quarter of 2023, we made approximately

$6.1 million of investments and had approximately $23.2 million in

repayments and sales of investments, resulting in net repayments

and sales of approximately $17.1 million for the period.

- The debt investment

portfolio as of September 30, 2023 represented 82.0% of

the fair value of our total portfolio, with a weighted average

annualized yield of approximately 11.0% (excluding income from

non-accruals and collateralized loan obligations), compared to a

debt investment portfolio of approximately 82.2% with a weighted

average annualized yield of approximately 10.8% (excluding income

from non-accruals and collateralized loan obligations) as of June

30, 2023. As of September 30, 2023, 17.7% of the fair value of our

debt investment portfolio was bearing a fixed rate of interest,

compared to 16.8% of the fair value of our debt investment

portfolio as of June 30, 2023.

- No new

Non-Accruals: As of September 30, 2023, we had debt

investments in two portfolio companies on non-accrual status with

an amortized cost and fair value of $16.8 million and $10.6

million, respectively, representing 8.3% and 5.7% of the investment

portfolio’s amortized cost and fair value, respectively. As of June

30, 2023, we also had debt investments in two portfolio companies

on non-accrual status with an aggregate amortized cost and fair

value of $17.1 million and $11.1 million, respectively,

representing 7.8% and 5.3% of the investment portfolio’s amortized

cost and fair value, respectively.

- Our asset coverage

ratio as of September 30, 2023 was 191%.

Results of OperationsOperating

results for the three and nine months ended September 30, 2023 and

2022 were as follows (dollars in thousands):

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Total investment income |

|

$ |

5,162 |

|

|

$ |

3,748 |

|

|

$ |

15,762 |

|

|

$ |

10,389 |

|

| Total

expenses |

|

|

4,008 |

|

|

|

3,566 |

|

|

|

12,496 |

|

|

|

12,186 |

|

| Net

investment income (loss) |

|

|

1,154 |

|

|

|

182 |

|

|

|

3,266 |

|

|

|

(1,797 |

) |

| Net

realized (loss) gain on investments |

|

|

(95 |

) |

|

|

(5,192 |

) |

|

|

(3,963 |

) |

|

|

10,274 |

|

| Net

change in unrealized (depreciation) appreciation on

investments |

|

|

(3,010 |

) |

|

|

2,049 |

|

|

|

1,336 |

|

|

|

(17,330 |

) |

| Net

(decrease) increase in net assets resulting from operations |

|

$ |

(1,951 |

) |

|

$ |

(2,961 |

) |

|

$ |

639 |

|

|

$ |

(8,853 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income

The composition of our investment income for the

three and nine months ended September 30, 2023 and 2022 was as

follows (dollars in thousands):

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Interest income |

|

$ |

4,765 |

|

|

$ |

3,373 |

|

|

$ |

14,440 |

|

|

$ |

9,566 |

|

|

Payment-in-kind interest |

|

|

374 |

|

|

|

297 |

|

|

|

1,157 |

|

|

|

737 |

|

| Dividend

income |

|

|

14 |

|

|

|

— |

|

|

|

47 |

|

|

|

— |

|

| Other

income |

|

|

9 |

|

|

|

78 |

|

|

|

118 |

|

|

|

86 |

|

| Total

investment income |

|

$ |

5,162 |

|

|

$ |

3,748 |

|

|

$ |

15,762 |

|

|

$ |

10,389 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value of InvestmentsThe composition of our

investments as of September 30, 2023 and December 31, 2022 at

amortized cost and the fair value of investments was as follows

(dollars in thousands):

| As of September 30,

2023 |

|

Investments atAmortized Cost |

|

|

Amortized CostPercentage

ofTotal Portfolio |

|

|

Investments atFair Value |

|

|

Fair ValuePercentage

ofTotal Portfolio |

|

|

First Lien Debt |

|

$ |

128,979 |

|

|

|

63.6 |

% |

|

$ |

121,263 |

|

|

|

64.8 |

% |

| Second

Lien Debt |

|

|

8,784 |

|

|

|

4.3 |

% |

|

|

7,466 |

|

|

|

4.0 |

% |

|

Subordinated Debt |

|

|

26,573 |

|

|

|

13.1 |

% |

|

|

24,728 |

|

|

|

13.2 |

% |

|

Collateralized Loan Obligations |

|

|

2,327 |

|

|

|

1.2 |

% |

|

|

2,181 |

|

|

|

1.2 |

% |

| Joint

Venture |

|

|

481 |

|

|

|

0.2 |

% |

|

|

471 |

|

|

|

0.2 |

% |

|

Equity |

|

|

35,543 |

|

|

|

17.6 |

% |

|

|

30,990 |

|

|

|

16.6 |

% |

|

Total |

|

$ |

202,687 |

|

|

|

100.0 |

% |

|

$ |

187,099 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of December 31,

2022 |

|

Investments atAmortized Cost |

|

|

Amortized CostPercentage

ofTotal Portfolio |

|

|

Investments atFair Value |

|

|

Fair ValuePercentage

ofTotal Portfolio |

|

|

First Lien Debt |

|

$ |

143,047 |

|

|

|

64.9 |

% |

|

$ |

136,896 |

|

|

|

67.3 |

% |

| Second

Lien Debt |

|

|

8,283 |

|

|

|

3.8 |

% |

|

|

6,464 |

|

|

|

3.2 |

% |

|

Subordinated Debt |

|

|

26,571 |

|

|

|

12.0 |

% |

|

|

25,851 |

|

|

|

12.7 |

% |

|

Collateralized Loan Obligations |

|

|

6,185 |

|

|

|

2.8 |

% |

|

|

4,972 |

|

|

|

2.4 |

% |

| Joint

Venture |

|

|

414 |

|

|

|

0.2 |

% |

|

|

403 |

|

|

|

0.2 |

% |

|

Equity |

|

|

36,016 |

|

|

|

16.3 |

% |

|

|

29,006 |

|

|

|

14.2 |

% |

|

Total |

|

$ |

220,516 |

|

|

|

100.0 |

% |

|

$ |

203,592 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate Risk

Based on our September 30, 2023 consolidated

statements of assets and liabilities, the following table shows the

annual impact on net income (excluding the potential related

incentive fee impact) of base rate changes in interest rates

(considering interest rate floors for variable rate securities)

assuming no changes in our investment and borrowing structure

(dollars in thousands):

|

Basis Point Change |

Increase(decrease) in interest

income |

|

|

(Increase)decrease

ininterest expense |

|

|

Increase(decrease) in net

income |

|

|

Up 300 basis points |

$ |

3,935 |

|

|

$ |

(1,090 |

) |

|

$ |

2,845 |

|

| Up 200 basis points |

|

2,623 |

|

|

|

(727 |

) |

|

|

1,896 |

|

| Up 100 basis points |

|

1,312 |

|

|

|

(363 |

) |

|

|

949 |

|

| Down 100 basis points |

|

(1,312 |

) |

|

|

363 |

|

|

|

(949 |

) |

| Down 200 basis points |

|

(2,623 |

) |

|

|

727 |

|

|

|

(1,896 |

) |

| Down 300 basis points |

$ |

(3,873 |

) |

|

$ |

1,090 |

|

|

$ |

(2,783 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

Conference Call and Webcast

We will hold a conference call on Thursday,

November 9, 2023, at 5:00 p.m. Eastern Time to discuss third

quarter 2023 financial results. Stockholders, prospective

stockholders, and analysts are welcome to listen to the call or

attend the webcast.

To access the conference call, please dial (646)

307-1963 approximately 10 minutes prior to the start of the call

and use the conference ID 3976270. A replay of this conference call

will be available shortly after the live call through November

16th.

A live audio webcast of the conference call can

be accessed via the Internet, on a listen-only basis on our

Company’s website www.loganridgefinance.com in the Investor

Resources section under Events and Presentations. The webcast can

also be accessed by clicking the following link:

https://edge.media-server.com/mmc/p/vy93a7qf. The online archive of

the webcast will be available on the Company’s website shortly

after the call.

About Logan Ridge Finance

CorporationLogan Ridge Finance Corporation (Nasdaq: LRFC)

is a business development company that invests primarily in first

lien loans and, to a lesser extent, second lien loans and equity

securities issued by lower middle-market companies. The Company

invests in performing, well-established middle-market businesses

that operate across a wide range of industries. It employs

fundamental credit analysis, targeting investments in businesses

with relatively low levels of cyclicality and operating risk. For

more information, visit www.loganridgefinance.com.

About Mount Logan Capital Inc.

Mount Logan Capital Inc. is an alternative asset management company

that is focused on public and private debt securities in the North

American market. The Company seeks to source and actively manage

loans and other debt-like securities with credit-oriented

characteristics. The Company actively sources, evaluates,

underwrites, manages, monitors, and primarily invests in loans,

debt securities, and other credit-oriented instruments that present

attractive risk-adjusted returns and present low risk of principal

impairment through the credit cycle.

About BC Partners Advisors L.P. and BC

Partners CreditBC Partners is a leading international

investment firm with over $40 billion of assets under management in

private equity, private credit and real estate strategies.

Established in 1986, BC Partners has played an active role in

developing the European buyout market for three decades. Today, BC

Partners executives operate across markets as an integrated team

through the firm's offices in North America and Europe. Since

inception, BC Partners has completed 117 private equity investments

in companies with a total enterprise value of €149 billion and is

currently investing its eleventh private equity fund. For more

information, please visit www.bcpartners.com.

BC Partners Credit was launched in February 2017

and has pursued a strategy focused on identifying attractive credit

opportunities in any market environment and across sectors,

leveraging the deal sourcing and infrastructure made available from

BC Partners.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains “forward-looking”

statements. Forward-looking statements concern future circumstances

and results and other statements that are not historical facts and

are sometimes identified by the words “may,” “will,” “should,”

“potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,”

“estimate,” “overestimate,” “underestimate,” “believe,” “could,”

“project,” “predict,” “continue,” “target” or other similar words

or expressions. Forward-looking statements are based upon current

plans, estimates and expectations that are subject to risks,

uncertainties, and assumptions. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove to be incorrect, actual results may vary materially from

those indicated or anticipated by such forward-looking statements.

The inclusion of such statements should not be regarded as a

representation that such plans, estimates or expectations will be

achieved. Important factors that could cause actual results to

differ materially from such plans, estimates or expectations

include those risk factors detailed in the Company’s reports filed

with the Securities and Exchange Commission (“SEC”), including the

Company’s annual report on Form 10-K, quarterly reports on Form

10-Q, current reports on Form 8-K and other documents filed with

the SEC.

Any forward-looking statements speak only as of

the date of this communication. The Company does not undertake any

obligation to update any forward-looking statements, whether as a

result of new information or developments, future events or

otherwise, except as required by law. Readers are cautioned not to

place undue reliance on any of these forward-looking

statements.

For additional information, contact:

Logan Ridge Finance Corporation650 Madison Avenue, 23rd FloorNew

York, NY 10022

Jason Roos Chief Financial Officer Jason.Roos@bcpartners.com

(212) 891-5046

Lena Cati The Equity Group

Inc.lcati@equityny.com (212) 836-9611

Val FerraroThe Equity Group

Inc.vferraro@equityny.com (212) 836-9633

Logan Ridge Finance

CorporationConsolidated Statements of Assets and

Liabilities (in thousands, except share and per

share data)

| |

|

As of September 30,2023 |

|

|

As of December 31,2022 |

|

| |

|

(unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| Investments at fair

value: |

|

|

|

|

|

|

|

Non-control/non-affiliate investments (amortized cost of $176,518

and $191,435, respectively) |

|

$ |

159,255 |

|

|

$ |

177,268 |

|

|

Affiliate investments (amortized cost of $26,169 and $29,081,

respectively) |

|

|

27,844 |

|

|

|

26,324 |

|

|

Total investments at fair value (amortized cost of $202,687 and

$220,516, respectively) |

|

|

187,099 |

|

|

|

203,592 |

|

| Cash and cash equivalents |

|

|

5,115 |

|

|

|

6,793 |

|

| Interest and dividend

receivable |

|

|

2,293 |

|

|

|

1,578 |

|

| Prepaid expenses |

|

|

2,381 |

|

|

|

2,682 |

|

| Other assets |

|

|

14 |

|

|

|

65 |

|

|

Total assets |

|

$ |

196,902 |

|

|

$ |

214,710 |

|

| LIABILITIES |

|

|

|

|

|

|

| 2026 Notes (net of deferred

financing costs and original issue discount of $1,147 and $1,421,

respectively) |

|

|

48,853 |

|

|

|

48,579 |

|

| 2032 Convertible Notes (net of

deferred financing costs and original issue discount of $1,029 and

$1,117, respectively) |

|

|

13,971 |

|

|

|

13,883 |

|

| KeyBank Credit Facility (net

of deferred financing costs of $1,068 and $1,322,

respectively) |

|

|

34,782 |

|

|

|

54,615 |

|

| Management and incentive fees

payable |

|

|

913 |

|

|

|

933 |

|

| Interest and financing fees

payable |

|

|

1,401 |

|

|

|

973 |

|

| Accounts payable and accrued

expenses |

|

|

1,460 |

|

|

|

722 |

|

| Payable for unsettled

trades |

|

|

2,314 |

|

|

|

— |

|

|

Total liabilities |

|

$ |

103,694 |

|

|

$ |

119,705 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| NET ASSETS |

|

|

|

|

|

|

| Common stock, par value $0.01,

100,000,000 common shares authorized, 2,679,812 and 2,711,068

common shares issued and outstanding, respectively |

|

$ |

27 |

|

|

$ |

27 |

|

| Additional paid in

capital |

|

|

190,384 |

|

|

|

191,038 |

|

| Total distributable loss |

|

|

(97,203 |

) |

|

|

(96,060 |

) |

|

Total net assets |

|

$ |

93,208 |

|

|

$ |

95,005 |

|

| Total liabilities and net

assets |

|

$ |

196,902 |

|

|

$ |

214,710 |

|

| Net asset value per share |

|

$ |

34.78 |

|

|

$ |

35.04 |

|

| |

|

|

|

|

|

|

|

|

Logan Ridge Finance

CorporationConsolidated Statements of

Operations (in thousands, except share and per

share data)

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| INVESTMENT INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-control/non-affiliate investments |

|

$ |

4,650 |

|

|

$ |

3,162 |

|

|

$ |

14,027 |

|

|

$ |

8,817 |

|

|

Affiliate investments |

|

|

115 |

|

|

|

176 |

|

|

|

413 |

|

|

|

521 |

|

|

Control investments |

|

|

— |

|

|

|

35 |

|

|

|

— |

|

|

|

228 |

|

|

Total interest income |

|

|

4,765 |

|

|

|

3,373 |

|

|

|

14,440 |

|

|

|

9,566 |

|

| Payment-in-kind interest and

dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-control/non-affiliate investments |

|

|

325 |

|

|

|

250 |

|

|

|

1,012 |

|

(1) |

|

597 |

|

|

Affiliate investments |

|

|

49 |

|

|

|

47 |

|

|

|

145 |

|

|

|

140 |

|

|

Total payment-in-kind interest and dividend income |

|

|

374 |

|

|

|

297 |

|

|

|

1,157 |

|

|

|

737 |

|

| Dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Affiliate investments |

|

|

14 |

|

|

|

— |

|

|

|

47 |

|

|

|

— |

|

|

Total dividend income |

|

|

14 |

|

|

|

— |

|

|

|

47 |

|

|

|

— |

|

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-control/non-affiliate investments |

|

|

8 |

|

|

|

78 |

|

|

|

117 |

|

|

|

86 |

|

|

Affiliate investments |

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

Total other income |

|

|

9 |

|

|

|

78 |

|

|

|

118 |

|

|

|

86 |

|

|

Total investment income |

|

|

5,162 |

|

|

|

3,748 |

|

|

|

15,762 |

|

|

|

10,389 |

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and financing

expenses |

|

|

2,080 |

|

|

|

1,558 |

|

|

|

6,385 |

|

|

|

5,877 |

|

| Base management fee |

|

|

913 |

|

|

|

927 |

|

|

|

2,789 |

|

|

|

2,928 |

|

| Directors' expense |

|

|

135 |

|

|

|

135 |

|

|

|

405 |

|

|

|

358 |

|

| Administrative service

fees |

|

|

198 |

|

|

|

175 |

|

|

|

679 |

|

|

|

426 |

|

| General and administrative

expenses |

|

|

682 |

|

|

|

771 |

|

|

|

2,238 |

|

|

|

2,597 |

|

|

Total expenses |

|

|

4,008 |

|

|

|

3,566 |

|

|

|

12,496 |

|

|

|

12,186 |

|

|

NET INVESTMENT INCOME (LOSS) |

|

|

1,154 |

|

|

|

182 |

|

|

|

3,266 |

|

|

|

(1,797 |

) |

| REALIZED AND UNREALIZED (LOSS)

GAIN ON INVESTMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

| Net realized (loss) gain on

investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-control/non-affiliate investments |

|

|

(95 |

) |

|

|

23 |

|

|

|

(3,963 |

) |

|

|

15,489 |

|

|

Control investments |

|

|

— |

|

|

|

(5,215 |

) |

|

|

— |

|

|

|

(5,215 |

) |

|

Net realized (loss) gain on investments |

|

|

(95 |

) |

|

|

(5,192 |

) |

|

|

(3,963 |

) |

|

|

10,274 |

|

| Net change in unrealized

(depreciation) appreciation on investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-control/non-affiliate investments |

|

|

(2,356 |

) |

|

|

652 |

|

|

|

(3,096 |

) |

|

|

(16,993 |

) |

|

Affiliate investments |

|

|

(654 |

) |

|

|

(3,825 |

) |

|

|

4,432 |

|

|

|

(2,348 |

) |

|

Control investments |

|

|

— |

|

|

|

5,222 |

|

|

|

— |

|

|

|

2,011 |

|

|

Net change in unrealized (depreciation) appreciation on

investments |

|

|

(3,010 |

) |

|

|

2,049 |

|

|

|

1,336 |

|

|

|

(17,330 |

) |

|

Total net realized and change in unrealized loss on

investments |

|

|

(3,105 |

) |

|

|

(3,143 |

) |

|

|

(2,627 |

) |

|

|

(7,056 |

) |

| NET (DECREASE) INCREASE IN NET

ASSETS RESULTING FROM OPERATIONS |

|

$ |

(1,951 |

) |

|

$ |

(2,961 |

) |

|

$ |

639 |

|

|

$ |

(8,853 |

) |

| NET (DECREASE) INCREASE IN NET

ASSETS PER SHARE RESULTING FROM OPERATIONS – BASIC &

DILUTED |

|

$ |

(0.73 |

) |

|

$ |

(1.09 |

) |

|

$ |

0.24 |

|

|

$ |

(3.27 |

) |

| WEIGHTED AVERAGE COMMON STOCK

OUTSTANDING – BASIC & DILUTED |

|

|

2,688,826 |

|

|

|

2,711,068 |

|

|

|

2,701,133 |

|

|

|

2,711,068 |

|

| DISTRIBUTIONS PAID PER

SHARE |

|

$ |

0.26 |

|

|

$ |

— |

|

|

$ |

0.66 |

|

|

$ |

— |

|

(1) During the nine months

ended September 30, 2023, the Company received $0.2 million of

non-recurring fee income that was paid in-kind and included in this

financial statement line item.

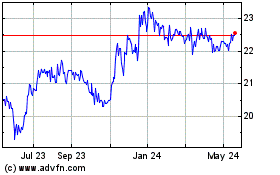

Logan Ridge Finance (NASDAQ:LRFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Logan Ridge Finance (NASDAQ:LRFC)

Historical Stock Chart

From Apr 2023 to Apr 2024