Lake Shore Bancorp, Inc. (the “Company”) (NASDAQ: LSBK), the

holding company for Lake Shore Savings Bank (the “Bank”), announced

today that the Board of Directors of its parent mutual holding

company, Lake Shore, MHC, has adopted a Plan of Conversion and

Reorganization pursuant to which Lake Shore, MHC will undertake a

“second step” conversion from the mutual holding company structure

to the stock holding company structure. In connection with the

second step conversion, the Bank intends to seek regulatory

approval to convert its charter to a New York-chartered commercial

bank.

Lake Shore, MHC currently owns approximately

63.4% of the outstanding shares of common stock of the Company

which it acquired in connection with the reorganization of the Bank

into the mutual holding company structure and the related initial

public offering by the Company in 2006.

As a result of the proposed transaction, a new

stock holding company for the Bank (the “New Bank Holding

Company”), which will succeed the Company, and will offer for sale

shares of its common stock, representing Lake Shore, MHC’s

ownership interest in the Company, to depositors of the Bank in a

subscription offering and, if necessary, a community offering

and/or a syndicated community offering. Eligible account holders of

the Bank as of the close of business on December 31, 2023 have

first priority non-transferable subscription rights to subscribe

for shares of common stock of the New Bank Holding Company. The

total number of shares of common stock of the New Bank Holding

Company to be issued in the proposed stock offering will be based

on the aggregate pro forma market value of the common stock of the

New Bank Holding Company, as determined by an independent

appraisal. In addition, each share of common stock of the Company

owned by persons other than Lake Shore, MHC (the “minority

shareholders”) will be converted into and become the right to

receive a number of shares of common stock of the New Bank Holding

Company pursuant to an exchange ratio established at the completion

of the proposed transaction. The exchange ratio is designed to

preserve in the New Bank Holding Company the same aggregate

percentage ownership interest that the minority shareholders will

have in the Company immediately before the completion of the

proposed transaction, exclusive of the purchase of any additional

shares of common stock of the New Bank Holding Company by minority

shareholders in the stock offering and the effect of cash received

in lieu of issuance of fractional shares of common stock of the New

Bank Holding Company, and adjusted to reflect certain assets held

by Lake Shore, MHC.

The proposed transaction is expected to be

completed in the third quarter of 2025, subject to regulatory

approval, approval by the members of Lake Shore, MHC (i.e.,

depositors of the Bank), and approval by the shareholders of the

Company, including by a separate vote of approval by the Company’s

minority shareholders. Detailed information regarding the proposed

transaction, including the stock offering, will be sent to

shareholders of the Company and members of Lake Shore, MHC

following regulatory approval.

About Lake Shore

Lake Shore Bancorp, Inc. (NASDAQ Global Market:

LSBK) is the mid-tier holding company of Lake Shore Savings Bank, a

federally chartered, community-oriented financial institution

headquartered in Dunkirk, New York. The Bank has ten full-service

branch locations in Western New York, including four in Chautauqua

County and six in Erie County. The Bank offers a broad range of

retail and commercial lending and deposit services. The Company’s

common stock is traded on the NASDAQ Global Market as “LSBK”.

Additional information about the Company is available at

www.lakeshoresavings.com.

Safe-Harbor

This release contains certain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, that are based on current expectations,

estimates and projections about the Company’s and the Bank’s

industry, and management’s beliefs and assumptions. Words such as

anticipates, expects, intends, plans, believes, estimates and

variations of such words and expressions are intended to identify

forward-looking statements. Such statements reflect management’s

current views of future events and operations. These

forward-looking statements are based on information currently

available to the Company as of the date of this release. It is

important to note that these forward-looking statements are not

guarantees of future performance and involve and are subject to

significant risks, contingencies, and uncertainties, many of which

are difficult to predict and are generally beyond our control

including, but not limited to, that the proposed transaction may

not be timely completed, if at all, that required regulatory,

shareholder and member approvals are not timely received, if at

all, or that other customary closing conditions are not satisfied

in a timely manner, if at all, compliance with the Written

Agreement with the Federal Reserve Bank of Philadelphia, data loss

or other security breaches, including a breach of our operational

or security systems, policies or procedures, including

cyber-attacks on us or on our third party vendors or service

providers, economic conditions, the effect of changes in monetary

and fiscal policy, inflation, unanticipated changes in our

liquidity position, climate change, geopolitical conflicts, public

health issues, increased unemployment, deterioration in the credit

quality of the loan portfolio and/or the value of the collateral

securing repayment of loans, reduction in the value of investment

securities, the cost and ability to attract and retain key

employees, regulatory or legal developments, tax policy changes,

dividend policy changes and our ability to implement and execute

our business plan and strategy and expand our operations. These

factors should be considered in evaluating forward looking

statements and undue reliance should not be placed on such

statements, as our financial performance could differ materially

due to various risks or uncertainties. We do not undertake to

publicly update or revise our forward-looking statements if future

changes make it clear that any projected results expressed or

implied therein will not be realized.

Important Additional Information and Where to Find

It

Lake Shore Bancorp, Inc. will file with the

Securities and Exchange Commission (the “SEC”) a registration

statement on Form S-1 that will include a proxy statement of the

Company and a prospectus of Lake Shore Bancorp, Inc., as well as

other relevant documents concerning the proposed transaction.

SHAREHOLDERS OF THE COMPANY ARE URGED TO READ THE REGISTRATION

STATEMENT, THE PROXY STATEMENT, AND THE PROSPECTUS CAREFULLY WHEN

THESE DOCUMENTS BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS

FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

When filed, these documents and other documents relating to the

proposed transaction can be obtained free of charge from the SEC’s

website at www.sec.gov. Alternatively, these documents, when

available, can be obtained free-of-charge from the Company upon

written request to Lake Shore Bancorp, Inc., 31 East Fourth Street,

Dunkirk, New York 14048, Attention: Taylor M. Gilden, or by calling

(716) 366-4070 ext. 1065.

Participants in the Solicitation

The Company and its directors and its executive

officers may be deemed to be participants in the solicitation of

proxies with respect of the proposed transaction. Information

regarding the Company’s directors and executive officers is

available in its definitive proxy statement for its 2024 Annual

Meeting of Shareholders, filed with the SEC on April 11, 2024.

Other information regarding the participants in the proxy

solicitation will be contained in the proxy statement, the

prospectus, and other relevant materials filed with the SEC, as

described above.

This press release is neither an offer

to sell nor a solicitation of an offer to buy common stock. The

offer is made only by the prospectus when accompanied by a stock

order form. The shares of common stock to be offered for sale by

Lake Shore Bancorp, Inc. are not savings accounts or savings

deposits and are not insured by the Federal Deposit Insurance

Corporation or by any other government agency.

Source: Lake Shore Bancorp, Inc.Category: Financial

Investor Relations/Media ContactTaylor M.

GildenChief Financial Officer and TreasurerLake Shore Bancorp,

Inc.31 East Fourth StreetDunkirk, New York 14048(716) 366-4070 ext.

1065

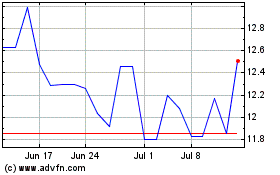

Lake Shore Bancorp (NASDAQ:LSBK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lake Shore Bancorp (NASDAQ:LSBK)

Historical Stock Chart

From Feb 2024 to Feb 2025