false

0001114925

0001114925

2025-02-06

2025-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 6, 2025

LANTRONIX,

INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-16027 |

|

33-0362767 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

48

Discovery, Suite

250

Irvine, California 92618 |

| (Address of Principal Executive Offices, including zip code) |

| |

|

|

|

|

| Registrant’s telephone number, including area code: (949) 453-3990 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

LTRX |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of Securities Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition. |

On February 6, 2025, Lantronix, Inc., a Delaware

corporation (the “Company”), issued a press release setting forth the Company’s financial results for its second fiscal

quarter ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information furnished under this Item 2.02,

including Exhibit 99.1, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended.

In addition, on February 6, 2025, the Company

posted on its website at www.lantronix.com a transcript of management’s prepared remarks for the Company’s second quarter

fiscal 2025 investor conference call and audio webcast, scheduled for 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time) on February 6, 2025.

The information furnished under this Item 2.02,

including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as shall be expressly set forth by specific reference in such filing.

| Item 7.01. | Regulation FD Disclosure. |

The information disclosed in Item 2.02 of this

Current Report on Form 8-K is incorporated by reference into this Item 7.01.

The information furnished pursuant to this Item

7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing

under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

The following exhibits are filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

LANTRONIX, INC. |

| |

|

|

| |

By: |

|

/s/ Brent Stringham |

| |

|

|

Brent Stringham Chief Financial Officer |

Date: February 6, 2025

Exhibit 99.1

Lantronix Reports

Results for Second Quarter of Fiscal 2025

| · | Second Quarter Net Revenue of $31.2 Million |

| · | Second Quarter GAAP EPS of ($0.06) |

| · | Second Quarter Non-GAAP EPS of $0.04 |

IRVINE, Calif., Feb. 6, 2025 – Lantronix

Inc. (NASDAQ: LTRX), a global leader of compute and connectivity for the Internet of Things (IoT) solutions enabling Artificial Intelligence

(AI) Edge Intelligence, today reported results for its second quarter of fiscal 2025.

Net revenue totaled $31.2 million, near the midpoint of the guidance

range provided for the quarter.

GAAP EPS of ($0.06), compared to ($0.07) in the prior year and $(0.07)

in the prior quarter.

Non-GAAP EPS of $0.04, compared to $0.08 in the prior year and $0.06

in the prior quarter.

“Lantronix has the key assets in Compute and Connect to

drive Edge Intelligence, and the company remains focused on three key vertical markets: Enterprise; Smart Cities including critical

infrastructure; and Transportation,” said President and CEO Saleel Awsare. “We are actively advancing Edge AI solutions,

integrating the recently acquired IoT assets from Netcomm, and positioning Lantronix for exciting future growth.”

Business Outlook

For the third fiscal quarter of 2025, the company expects revenue in

a range of $27.0 million to $31.0 million and non-GAAP EPS of $0.01 to $0.05 per share.

Conference Call and Webcast

Management will host an investor conference call and audio webcast

on Thursday, Feb. 6, 2025, at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time) to discuss its results for the second quarter of fiscal

2025 that ended Dec. 31, 2024. To access the live conference call, investors should dial 1-844-802-2442 (US) or 1-412-317-5135 (international)

and indicate that they are participating in the Lantronix Q2 FY 2025 call. The webcast will be available simultaneously via the investor

relations section of the company’s website.

Investors can access a replay of the conference call starting at approximately

7:00 p.m. Pacific Time on Feb. 6, 2025, at the Lantronix

website. A telephonic replay will also be available through Feb. 13, 2025, by dialing 1-877-344-7529 (US) or 1-412-317-0088 (international)

or Canada toll-free at 1-855-669-9658 and entering passcode 3433776.

About Lantronix

Lantronix Inc. is a global leader of compute and connectivity IoT solutions

that target high-growth markets, including Smart Cities, Enterprise and Transportation. Lantronix’s products and services empower

companies to succeed in the growing IoT markets by delivering customizable solutions that enable AI Edge Intelligence. Lantronix’s

advanced solutions include Intelligent Substations infrastructure, Infotainment systems and Video Surveillance, supplemented with advanced

Out-of-Band Management (OOB) for Cloud and Edge Computing.

For more information, visit the Lantronix

website.

Discussion of Non-GAAP Financial Measures

Lantronix believes that the presentation of non-GAAP financial information,

when presented in conjunction with the corresponding GAAP measures, provides important supplemental information to management and investors

regarding financial and business trends relating to the company’s financial condition and results of operations. Management uses

the aforementioned non-GAAP measures to monitor and evaluate ongoing operating results and trends to gain an understanding of our comparative

operating performance. The non-GAAP financial measures disclosed by the company should not be considered a substitute for, or superior

to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations

of the non-GAAP financial measures to the financial measures calculated in accordance with GAAP should be carefully evaluated. The non-GAAP

financial measures used by the company may be calculated differently from, and therefore may not be comparable to, similarly titled measures

used by other companies. The company has provided reconciliations of the non-GAAP financial measures to the most directly comparable GAAP

financial measures.

Non-GAAP net income consists of net loss excluding (i) share-based

compensation and the employer portion of withholding taxes on stock grants, (ii) depreciation and amortization, (iii) interest income

(expense), (iv) other income (expense), (v) income tax provision (benefit), (vi) restructuring, severance and related charges, (vii) acquisition

related costs, (viii) impairment of long-lived assets, (ix) amortization of purchased intangibles, (x) amortization of manufacturing profit

in acquired inventory, (xi) fair value remeasurement of earnout consideration, and (xii) loss on extinguishment of debt.

Non-GAAP EPS is calculated by dividing non-GAAP net loss by non-GAAP

weighted-average shares outstanding (diluted). For purposes of calculating non-GAAP EPS, the calculation of GAAP weighted-average shares

outstanding (diluted) is adjusted to exclude share-based compensation, which for GAAP purposes is treated as proceeds assumed to be used

to repurchase shares under the GAAP treasury stock method.

Guidance on earnings per share growth is provided only on a non-GAAP

basis due to the inherent difficulty of forecasting the timing or amount of certain items that have been excluded from the forward-looking

non-GAAP measures, and a reconciliation to the comparable GAAP guidance has not been provided because certain factors that are materially

significant to Lantronix’s ability to estimate the excluded items are not accessible or estimable on a forward-looking basis without

unreasonable effort.

Forward-Looking Statements

This news release contains forward-looking statements,

including statements concerning our revenue and earnings expectations for the third fiscal quarter of 2025, the market opportunities offered

by the current shift towards edge computing and our positioning to capitalize on this trend, and our expectations regarding the benefits

of our acquisition of Netcomm Wireless Pty Ltd. and our cost reduction initiatives. These forward-looking statements are intended to qualify

for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. We have based our forward-looking

statements on our current expectations and projections about trends affecting our business and industry and other future events. Although

we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy.

Forward-looking statements are subject to substantial risks and uncertainties that could cause our results or experiences, or future business,

financial condition, results of operations or performance, to differ materially from our historical results or those expressed or implied

in any forward-looking statement contained in this news release. Other factors which could have a material adverse effect on our operations

and future prospects or which could cause actual results to differ materially from our expectations include, but are not limited to: the

effects of negative or worsening regional and worldwide economic conditions or market instability on our business, including effects on

purchasing decisions by our customers; our ability to mitigate any disruption in our and our suppliers’ and vendors’ supply

chains due to a pandemic or similar outbreak, wars and recent conflicts in Europe, Asia and the Middle East, hostilities in the Red Sea,

or other causes; our ability to successfully convert our backlog and current demand; the impact of a pandemic or similar outbreak

on our business, employees, customers, supply and distribution chains and the global economy; our ability to successfully implement our

acquisition strategy or integrate acquired companies; uncertainty as to the future profitability of acquired businesses, and delays in

the realization of, or the failure to realize, any accretion from acquisition transactions; acquiring, managing and integrating new operations,

businesses or assets, and the associated diversion of management attention or other related costs or difficulties; our ability to continue

to generate revenue from products sold into mature markets; our ability to develop, market, and sell new products; our ability to succeed

with our new software offerings; our use of AI may result in reputational, competitive or financial harm and liability; fluctuations in

our revenue due to the project-based timing of orders from certain customers; unpredictable timing of our revenues due to the lengthy

sales cycle for our products and services and potential delays in customer completion of projects; our ability to accurately forecast

future demand for our products; delays in qualifying revisions of existing products; constraints or delays in the supply of, or quality

control issues with, certain materials or components; difficulties associated with the delivery, quality or cost of our products from

our contract manufacturers or suppliers; risks related to the outsourcing of manufacturing and international operations; difficulties

associated with our distributors or resellers; intense competition in our industry and resultant downward price pressure; rises in inventory

levels and inventory obsolescence; undetected software or hardware errors or defects in our products; cybersecurity risks; our ability

to obtain appropriate industry certifications or approvals from governmental regulatory bodies; changes in applicable U.S. and foreign

government laws, regulations, and tariffs; our ability to protect patents and other proprietary rights and avoid infringement of others’

proprietary technology rights; issues relating to the stability of our financial and banking institutions and relationships; the level

of our indebtedness, our ability to service our indebtedness and the restrictions in our debt agreements; the impact of rising interest

rates; our ability to attract and retain qualified management; and any additional factors included in our Report on Form 10-K for the

fiscal year ended June 30, 2024, filed with the Securities and Exchange Commission (the “SEC”) on Sept. 9, 2024, including

in the section entitled “Risk Factors” in Item 1A of Part I of that report; in our Quarterly Report on Form 10-Q for the fiscal

quarter ended December 31, 2024, to be filed with the SEC on Feb. 7, 2025, including in the section entitled “Risk Factors”

in Item 1A of Part II of such report; and in our other public filings with the SEC. In addition, actual results may differ as a result

of additional risks and uncertainties of which we are currently unaware or which we do not currently view as material to our business.

For these reasons, investors are cautioned not to place undue reliance on any forward-looking statements. The forward-looking statements

we make speak only as of the date on which they are made. We expressly disclaim any intent or obligation to update any forward-looking

statements after the date hereof to conform such statements to actual results or to changes in our opinions or expectations, except as

required by applicable law or the rules of the Nasdaq Stock Market LLC. If we do update or correct any forward-looking statements, investors

should not conclude that we will make additional updates or corrections.

© 2025 Lantronix Inc. All rights reserved.

Lantronix is a registered trademark.

Lantronix Investor Relations Contact:

investors@lantronix.com

# # #

LANTRONIX, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | |

December 31, | | |

June 30, | |

| | |

2024 | | |

2024 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 19,210 | | |

$ | 26,237 | |

| Accounts receivable, net | |

| 30,472 | | |

| 31,279 | |

| Inventories, net | |

| 29,070 | | |

| 27,698 | |

| Contract manufacturers' receivables | |

| 3,473 | | |

| 1,401 | |

| Prepaid expenses and other current assets | |

| 3,329 | | |

| 2,335 | |

| Total current assets | |

| 85,554 | | |

| 88,950 | |

| Property and equipment, net | |

| 3,155 | | |

| 4,016 | |

| Goodwill | |

| 30,491 | | |

| 27,824 | |

| Intangible assets, net | |

| 4,910 | | |

| 5,251 | |

| Lease right-of-use assets | |

| 9,430 | | |

| 9,567 | |

| Other assets | |

| 683 | | |

| 600 | |

| Total assets | |

$ | 134,223 | | |

$ | 136,208 | |

| | |

| | | |

| | |

| Liabilities and stockholders' equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 15,975 | | |

$ | 10,347 | |

| Accrued payroll and related expenses | |

| 2,968 | | |

| 5,836 | |

| Current portion of long-term debt, net | |

| 3,056 | | |

| 3,002 | |

| Other current liabilities | |

| 11,436 | | |

| 10,971 | |

| Total current liabilities | |

| 33,435 | | |

| 30,156 | |

| Long-term debt, net | |

| 11,630 | | |

| 13,219 | |

| Other non-current liabilities | |

| 11,245 | | |

| 11,478 | |

| Total liabilities | |

| 56,310 | | |

| 54,853 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Common stock | |

| 4 | | |

| 4 | |

| Additional paid-in capital | |

| 305,433 | | |

| 304,001 | |

| Accumulated deficit | |

| (227,895 | ) | |

| (223,021 | ) |

| Accumulated other comprehensive income | |

| 371 | | |

| 371 | |

| Total stockholders' equity | |

| 77,913 | | |

| 81,355 | |

| Total liabilities and stockholders' equity | |

$ | 134,223 | | |

$ | 136,208 | |

LANTRONIX, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net revenue | |

$ | 31,161 | | |

$ | 34,423 | | |

$ | 37,038 | | |

$ | 65,584 | | |

$ | 70,069 | |

| Cost of revenue | |

| 17,877 | | |

| 19,948 | | |

| 22,007 | | |

| 37,825 | | |

| 40,941 | |

| Gross profit | |

| 13,284 | | |

| 14,475 | | |

| 15,031 | | |

| 27,759 | | |

| 29,128 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 8,811 | | |

| 9,467 | | |

| 10,224 | | |

| 18,278 | | |

| 19,394 | |

| Research and development | |

| 4,984 | | |

| 4,956 | | |

| 4,725 | | |

| 9,940 | | |

| 9,831 | |

| Restructuring, severance and related charges | |

| 193 | | |

| 900 | | |

| 530 | | |

| 1,093 | | |

| 550 | |

| Acquisition-related costs | |

| 208 | | |

| 29 | | |

| – | | |

| 237 | | |

| – | |

| Fair value remeasurement of earnout consideration | |

| – | | |

| – | | |

| – | | |

| – | | |

| (9 | ) |

| Amortization of intangible assets | |

| 1,248 | | |

| 1,251 | | |

| 1,310 | | |

| 2,499 | | |

| 2,694 | |

| Total operating expenses | |

| 15,444 | | |

| 16,603 | | |

| 16,789 | | |

| 32,047 | | |

| 32,460 | |

| Loss from operations | |

| (2,160 | ) | |

| (2,128 | ) | |

| (1,758 | ) | |

| (4,288 | ) | |

| (3,332 | ) |

| Interest expense, net | |

| (126 | ) | |

| (119 | ) | |

| (232 | ) | |

| (245 | ) | |

| (570 | ) |

| Other income (loss), net | |

| 8 | | |

| (37 | ) | |

| (23 | ) | |

| (29 | ) | |

| (4 | ) |

| Loss before income taxes | |

| (2,278 | ) | |

| (2,284 | ) | |

| (2,013 | ) | |

| (4,562 | ) | |

| (3,906 | ) |

| Provision for income taxes | |

| 94 | | |

| 218 | | |

| 580 | | |

| 312 | | |

| 573 | |

| Net loss | |

$ | (2,372 | ) | |

$ | (2,502 | ) | |

$ | (2,593 | ) | |

$ | (4,874 | ) | |

$ | (4,479 | ) |

| Net loss per share - basic and diluted | |

$ | (0.06 | ) | |

$ | (0.07 | ) | |

$ | (0.07 | ) | |

$ | (0.13 | ) | |

$ | (0.12 | ) |

| Weighted-average common shares - basic and diluted | |

| 38,631 | | |

| 38,024 | | |

| 37,354 | | |

| 38,330 | | |

| 37,170 | |

LANTRONIX, INC.

UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS

(In thousands, except per share data)

| | |

Three

Months Ended | | |

Six Months Ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December

31, | |

| | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| GAAP net loss | |

$ | (2,372 | ) | |

$ | (2,502 | ) | |

$ | (2,593 | ) | |

$ | (4,874 | ) | |

$ | (4,479 | ) |

| Non-GAAP adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 48 | | |

| 64 | | |

| 64 | | |

| 112 | | |

| 105 | |

| Employer portion of withholding taxes on stock grants | |

| 2 | | |

| 5 | | |

| 1 | | |

| 7 | | |

| 5 | |

| Amortization of manufacturing profit in acquired inventory | |

| – | | |

| – | | |

| 189 | | |

| – | | |

| 506 | |

| Depreciation and amortization | |

| 114 | | |

| 123 | | |

| 109 | | |

| 237 | | |

| 195 | |

| Total adjustments to cost of revenue | |

| 164 | | |

| 192 | | |

| 363 | | |

| 356 | | |

| 811 | |

| Selling, general and administrative: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 1,044 | | |

| 1,126 | | |

| 1,628 | | |

| 2,170 | | |

| 2,901 | |

| Employer portion of withholding taxes on stock grants | |

| 20 | | |

| 78 | | |

| 10 | | |

| 98 | | |

| 47 | |

| Depreciation and amortization | |

| 348 | | |

| 351 | | |

| 338 | | |

| 699 | | |

| 672 | |

| Total adjustments to selling, general and administrative | |

| 1,412 | | |

| 1,555 | | |

| 1,976 | | |

| 2,967 | | |

| 3,620 | |

| Research and development: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 421 | | |

| 410 | | |

| 484 | | |

| 831 | | |

| 912 | |

| Employer portion of withholding taxes on stock grants | |

| 2 | | |

| 19 | | |

| 5 | | |

| 21 | | |

| 18 | |

| Depreciation and amortization | |

| 111 | | |

| 69 | | |

| 52 | | |

| 180 | | |

| 160 | |

| Total adjustments to research and development | |

| 534 | | |

| 498 | | |

| 541 | | |

| 1,032 | | |

| 1,090 | |

| Restructuring, severance and related charges | |

| 193 | | |

| 900 | | |

| 530 | | |

| 1,093 | | |

| 550 | |

| Acquisition related costs | |

| 208 | | |

| 29 | | |

| – | | |

| 237 | | |

| – | |

| Fair value remeasurement of earnout consideration | |

| – | | |

| – | | |

| – | | |

| – | | |

| (9 | ) |

| Amortization of purchased intangible assets | |

| 1,248 | | |

| 1,251 | | |

| 1,310 | | |

| 2,499 | | |

| 2,694 | |

| Litigation settlement cost | |

| 158 | | |

| 40 | | |

| – | | |

| 198 | | |

| – | |

| Total non-GAAP adjustments to operating expenses | |

| 3,753 | | |

| 4,273 | | |

| 4,357 | | |

| 8,026 | | |

| 7,945 | |

| Interest expense, net | |

| 126 | | |

| 119 | | |

| 232 | | |

| 245 | | |

| 570 | |

| Other (income) expense, net | |

| (8 | ) | |

| 37 | | |

| 23 | | |

| 29 | | |

| 4 | |

| Provision for income taxes | |

| 94 | | |

| 218 | | |

| 580 | | |

| 312 | | |

| 573 | |

| Total non-GAAP adjustments | |

| 4,129 | | |

| 4,839 | | |

| 5,555 | | |

| 8,968 | | |

| 9,903 | |

| Non-GAAP net income | |

$ | 1,757 | | |

$ | 2,337 | | |

$ | 2,962 | | |

$ | 4,094 | | |

$ | 5,424 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per share - diluted | |

$ | 0.04 | | |

$ | 0.06 | | |

$ | 0.08 | | |

$ | 0.10 | | |

$ | 0.14 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Denominator for GAAP net income (loss) per share - diluted | |

| 38,631 | | |

| 38,024 | | |

| 37,354 | | |

| 38,330 | | |

| 37,170 | |

| Non-GAAP adjustment | |

| 953 | | |

| 1,257 | | |

| 1,228 | | |

| 901 | | |

| 938 | |

| Denominator for non-GAAP net income per share -

diluted | |

| 39,584 | | |

| 39,281 | | |

| 38,582 | | |

| 39,231 | | |

| 38,108 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP cost of revenue | |

$ | 17,877 | | |

$ | 19,948 | | |

$ | 22,007 | | |

$ | 37,825 | | |

$ | 40,941 | |

| Non-GAAP adjustments to cost of revenue | |

| (164 | ) | |

| (192 | ) | |

| (363 | ) | |

| (356 | ) | |

| (811 | ) |

| Non-GAAP cost of revenue | |

| 17,713 | | |

| 19,756 | | |

| 21,644 | | |

| 37,469 | | |

| 40,130 | |

| Non-GAAP gross profit | |

$ | 13,448 | | |

$ | 14,667 | | |

$ | 15,394 | | |

$ | 28,115 | | |

$ | 29,939 | |

| Non-GAAP gross margin | |

| 43.2% | | |

| 42.6% | | |

| 41.6% | | |

| 42.9% | | |

| 42.7% | |

LANTRONIX, INC.

UNAUDITED NET REVENUES BY PRODUCT LINE AND REGION

(In thousands)

| | |

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, 2024 | | |

September 30, 2024 | | |

December 31, 2023 | | |

December 31, 2024 | | |

December 31, 2023 | |

| Embedded IoT Solutions | |

$ | 10,784 | | |

$ | 13,387 | | |

$ | 11,764 | | |

$ | 24,171 | | |

$ | 23,137 | |

| IoT System Solutions | |

| 18,592 | | |

| 18,759 | | |

| 23,022 | | |

| 37,351 | | |

| 42,058 | |

| Software & Services | |

| 1,785 | | |

| 2,277 | | |

| 2,252 | | |

| 4,062 | | |

| 4,874 | |

| | |

$ | 31,161 | | |

$ | 34,423 | | |

$ | 37,038 | | |

$ | 65,584 | | |

$ | 70,069 | |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, 2024 | | |

September 30, 2024 | | |

December 31, 2023 | | |

December 31, 2024 | | |

December 31, 2023 | |

| Americas | |

$ | 16,386 | | |

$ | 17,420 | | |

$ | 20,601 | | |

$ | 33,806 | | |

$ | 43,534 | |

| EMEA | |

| 9,036 | | |

| 10,484 | | |

| 12,886 | | |

| 19,520 | | |

| 19,477 | |

| Asia Pacific Japan | |

| 5,739 | | |

| 6,519 | | |

| 3,551 | | |

| 12,258 | | |

| 7,058 | |

| | |

$ | 31,161 | | |

$ | 34,423 | | |

$ | 37,038 | | |

$ | 65,584 | | |

$ | 70,069 | |

Exhibit 99.2

FYQ2’25

Combined CEO & CFO Script

Intro: Brent Stringham

Good afternoon and thank you for joining our quarterly earnings call.

Joining me on the call today is our President and Chief Executive Officer Saleel Awsare.

A “live” and archived webcast of today’s call will

be available on the company’s website. In addition, you can find the call-in details for the phone replay in today’s earnings

release.

During this call, management may make forward-looking statements which

involve risks and uncertainties that could cause our results to differ materially from management's current expectations.

We encourage you to review the cautionary statements and risk factors

contained in the earnings release, which was furnished to the SEC today and is available on our website, and in the Company’s SEC

filings such as its 10-K and 10-Qs. Lantronix undertakes no obligation to revise or update publicly any forward-looking statements to

reflect future events or circumstances.

Please refer to the news release and the financial information in the

investor relations section of our website for additional details that will supplement management’s commentary.

Furthermore, during the call, the company will discuss non-GAAP financial

measures. Today's earnings release, which is posted in the Investor Relations section of our website, describes the differences between

our non-GAAP and GAAP reporting and presents reconciliations for the non-GAAP financial measures that we use.

With that, I’ll now turn the call over to Saleel.

Saleel Awsare:

Thanks Brent, and thank you, everyone, for joining us on the call today.

We reported revenue of $31.2 million for the Second Quarter of Fiscal

2025 and our Non-GAAP EPS was 4 cents. Both metrics were solidly within the guidance range.

Brent Stringham, our newly appointed CFO, will be providing more details

on the Second Quarter financial results shortly.

On the call today, l would like to cover four topics briefly with you:

| 1. | An update on our Netcomm acquisition which closed in late December; |

| 2. | Expected growth of the Edge AI market and comments from CES in Las Vegas; |

| 3. | Our strengthening relationship and AI developments with Qualcomm; and |

| 4. | An update on our internal cost savings initiatives. |

First, we’re pleased with the strategic acquisition of Netcomm

for $6.5 million, which expands our Connect business with 4G & 5G gateways. The integration process is going well and we’re

working closely with supply chain partners to fill orders for their blue-chip customers. We recently met with several key customers

at CES including Vodaphone, Netcomm’s largest customer. We believe we’re off to a good start and are excited about the growth

prospects for the business. Australia and New Zealand present greenfield opportunities for us, and we’re exploring new cross-selling

opportunities for Lantronix.

To help us grow our Connect product offerings and integrate Netcomm’s

gateway line, we’ve hired Daniel Quant to head-up our Industrial IoT group. Daniel will play a pivotal role in integrating AI into

our new IoT devices and gateways for Industrial and Enterprise customers. With over 20 years of experience in Industrial IoT and wireless

communication, including his most recent role as VP & GM at Multi-Tech Systems in Minnesota, we are delighted to have him join the

team!

Second, a recent Gartner report highlights a significant shift towards

Edge Computing. By 2025, 75% of data is expected to be captured at the edge of the network, up from 25% in 2018. Additionally, more than

50% of enterprise-generated data will be processed outside traditional data centers by 2028, compared to only 25% in 2018. This trend

represents a substantial market opportunity, with Edge AI and Machine Learning projected to become a $76 billion market by 2031.

Lantronix is strategically positioning itself to capitalize on this

mega-trend by focusing on Compute + Connect at the Edge. Through both organic growth and strategic acquisitions, Lantronix aims to be

the “Picks & Shovels” of the Edge AI build-out.

We provide the necessary hardware, software, and services to enable

Edge AI applications, helping customers deploy IoT Edge solutions more efficiently. We showcased our Edge Intelligence technology to our

key customers and partners at CES and received enthusiastic feedback.

Third, we continue to strengthen our strong collaboration with Qualcomm

on Edge Intelligence and some broader AI initiatives. For example, we are integrating Qualcomm’s “advanced AI frameworks”

into our Lantronix Edge AI systems to enhance modeling and real-time analytics.

We are positioned as one of Qualcomm’s key partners for Edge

AI, supporting their AI Hub program and their expansion into mid-tier and Enterprise customers. For example, new opportunities include

working on prototype solutions for banking institutions to test customer traffic analytics; working with an Electronics manufacturer for

quality control and predictive maintenance; and working with a large agricultural customer to explore real-time monitoring and maintenance

for advanced farming equipment.

While we invest in Edge AI solutions, we remain very focused on securing

new customers and Design Wins.

Several of note to share are:

| · | In Out of Band Management, we are shipping to a large Enterprise-ready AI

Datacenter business that is deploying our ‘Top of Rack’ solution including hardware, software and services that enable Out

of Band Management for remote configuration, fast recovery, and maintenance of the customer’s AI Cloud Servers. This is critical

for maintaining access to their assets at all times. |

| · | In Compute, we recently secured a design win with a US-based Drone Manufacturer.

We’re providing our production-ready computing modules that are embedded in the drones for short-range reconnaissance by the Military.

The system is TAA compliant. |

| · | In Connect, we’re building on our strong relationships with a leading

telecom provider to deliver gateways and routers to manufacturers of Critical Infrastructure assets, such as generators and power plants.

Our intelligent gateways allow customers to increase their operational readiness, reduce operating costs, and improve alerts & reporting. |

Finally, regarding the cost reduction initiatives we spoke about last

quarter, I’m pleased to report that we’re ‘on track’ and made good progress in the fiscal Second Quarter. These

initiatives are now substantially complete. Our process of consolidating our seven geographic locations down to four Centers of Excellence

is progressing, with:

| § | Taipei -- for Operations and Hardware; |

| § | Hyderabad -- for Software and Firmware; |

| § | Vancouver -- for Software and Qualcomm initiatives; and |

| § | Minneapolis -- for Operations & US-certified warehousing. |

We are making these changes to (i) better serve our customers; (ii)

help our future growth initiatives; and (iii) streamline our operations. In addition to the four Centers of Excellence, we are retaining

a small administrative head office in Irvine.

With that, I will now turn the call over to Brent to provide you with

the quarterly financial review.

Brent Stringham: Thank you, Saleel.

I will review the financial results and some business highlights for

our second quarter of fiscal year 2025 before commenting on our financial outlook for the third quarter of Fiscal 2025.

For FQ2 2025, we reported revenue of $31.2 million, which was near

the midpoint of our guidance range. This did not include any revenue from the acquisition of the Netcomm IoT products as the transaction

closed right at the end of the quarter. As expected, revenue was down sequentially from the prior quarter principally due to lower volume

from our largest automotive customer and slightly lower activity in our Enterprise vertical market.

On a year-over-year basis, revenue in FQ2 2025 was down approximately

$5.9 million, or 16 percent, as we saw lower activity in some of our out-of-band management and switch products.

GAAP gross margin was 42.6% in FQ2 2025 compared to 42.1% in the prior

quarter and 40.6% in the year ago quarter.

Non-GAAP gross margin was 43.2% in FQ2 2025 compared to 42.6% in the

prior quarter and 41.6% in the year ago quarter.

The sequential improvement in gross margin reflects favorable product

mix toward higher-margin System Solution products.

GAAP operating expenses for FQ2 2025 were $15.4 million compared to

$16.8 million in the year-ago quarter and $16.6 million in the prior quarter.

Similarly, our non-GAAP Opex for FQ2 2025 was down by approximately

$700 thousand compared to the year-ago quarter, and down approximately $600 thousand sequentially, reflecting the progress we’re

making on cost reductions, which I will speak more about in a moment.

GAAP net loss was $2.4 million, or 6 cents per share, during FQ2 2025

compared to GAAP net loss of $2.6 million, or 7 cents per share, in the year ago quarter.

Non-GAAP net income was $1.8 million or 4 cents per share during FQ2

2025, compared to non-GAAP net income of $3.0 million, or 8 cents per share, in the year ago quarter.

Further to Saleel’s comments regarding our cost reduction initiatives,

activities to reduce our operating costs have been substantially completed as of last month in January.

We reported in the prior quarter that we expected these initiatives

to result in quarterly non-GAAP Opex in the range of $11.25 to $11.75 million, and on a full year basis, reduce Fiscal 2025 Opex by $4.5

million compared to Fiscal 2024. With the initiatives implemented to date, we are on track to deliver these cost reductions. Note this

quarterly Opex estimate did not include incremental costs attributable to the acquisition of the Netcomm IoT products, which we currently

expect to add approximately $300 to $400 thousand per quarter.

Turning to the balance sheet………

We ended FQ2 2025 with cash and cash equivalents of $19.2 million,

which includes the disbursement of $6.5 million in late December for the acquisition of the Netcomm IoT products. For the six-month period

ended December 31, 2024, we generated positive operating cash flow of $3.0 million.

Net inventories decreased slightly to $29.1 million as of FQ2 2025,

as compared to $29.5 million in the prior quarter.

Now for the outlook.

| · | For the Third Quarter of Fiscal 2025, we expect revenue to be in the range

of $27 to $31 million. We’re expecting sequentially lower revenue in FQ3 primarily reflecting a slower than anticipated rollout

by our large Smart Grid customer in Europe. |

| | | |

| · | We anticipate resuming shipments once the initial deployment is complete.

The revenue impact in FQ3 is partially offset by expected organic growth in Gateways, Routers, and Out of Band management. |

| | | |

| · | As a result, we’re expecting Non-GAAP EPS in the range of 1 cent to

5 cents per share in FQ3. |

On a general housekeeping note, when filing our Form 10-Q for the current

quarter, we also intend to file a Form S-3 registration statement which renews our existing shelf registration that recently expired.

This is consistent with the Company’s longstanding practice.

Saleel: Thanks Brent.

In conclusion, I believe Lantronix has the key assets in Compute &

Connect to drive Edge Intelligence.

We will continue to focus on three key verticals: (i) Enterprise; (ii)

Smart Cities, which includes critical infrastructure; and (iii) Transportation.

And as new reports indicate, more and more data traffic will be generated

at the Edge of the Network - - with a higher percentage of processing happening there because it’s secure, and it makes for fast

& efficient decision-making, rather than moving data back and forth to the Cloud. We’re very well positioned for this Mega-trend.

While we have experienced the effects of customer concentration, we

set our corporate strategy, focused the business, executed well operationally, while delivering consistent profitability.

We are driving ahead with Edge AI solutions, securing new design wins,

integrating the newly acquired assets from Netcomm, and positioning the company for exciting future growth.

With that, we complete our prepared remarks for today, so I’ll

now turn it over to the Operator to conduct our Q&A session.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

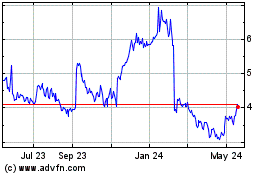

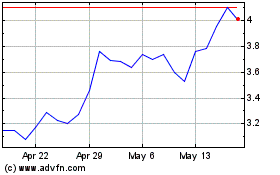

Lantronix (NASDAQ:LTRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lantronix (NASDAQ:LTRX)

Historical Stock Chart

From Feb 2024 to Feb 2025