UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 10-K

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

July 31, 2023

OR

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition

period from to

Commission file number 1-3647

J.W. MAYS,

INC.

(Exact Name of

Registrant as Specified in Its Charter)

|

New York

State or Other Jurisdiction of Incorporation or Organization

9 Bond Street,

Brooklyn, New York

Address of Principal Executive Offices |

|

11-1059070

I.R.S. Employer Identification No.

11201

Zip Code |

| Registrant’s telephone number, including area code 718 624-7400 |

Securities registered pursuant to Section 12(b)

of the Act:

Title of each class

Common Stock, $1 par value |

|

Trading Symbol(s)

MAYS |

|

Name of each exchange on which registered

NASDAQ |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405  of

this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III

of

this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III  of this Form 10-K or any amendment to this

Form 10-K. Yes o No x

of this Form 10-K or any amendment to this

Form 10-K. Yes o No x

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o |

|

Accelerated filer o |

|

Emerging growth company o |

| Non-accelerated filer o |

|

Smaller reporting company x |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements

of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market

value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity

was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently

completed second fiscal quarter.

Note.—If a determination

as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate

market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances,

provided that the assumptions are set forth in this Form.

The aggregate market value

of voting stock held by non-affiliates of the registrant was approximately $17,318,716 as of January 31, 2023 based on the average of

the bid and asked price of the stock reported for such date. For the purpose of the foregoing calculation, the shares of common stock

held by each officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded in that such

persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other

purposes.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the

Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a

court. Yes o No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares

outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

The number of shares outstanding

of the registrant’s common stock as of September 5, 2023 was 2,015,780.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following

documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated:

(1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b)

or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report

to security holders for fiscal year ended December 24, 1980).

| Document |

|

Part of Form 10-K

in which the Document

is incorporated |

| Annual Report to Shareholders for Fiscal Year Ended July 31, 2023 |

|

Parts I and II |

| Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders |

|

Part III |

J.W.

MAYS, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED JULY 31, 2023

TABLE

OF CONTENTS

PART

I

ITEM

1. BUSINESS.

J.W. Mays, Inc. (the “Company”

or “Registrant”) with executive offices at Nine Bond Street, Brooklyn, New York 11201, operates a number of commercial real

estate properties, which are described in Item 2 “Properties”. The Company’s business was founded in 1924 and incorporated

under the laws of the State of New York on July 6, 1927.

The Company has 30 employees

and has a contract, expiring November 30, 2025, with a union covering rates of pay, hours of employment and other conditions of employment

for approximately 27% of its employees. The Company considers that its labor relations with its employees and union are good.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form

10-K may contain forward-looking statements which include assumptions about future market conditions, operations and financial results.

These statements are based on current expectations and are subject to risks and uncertainties. They are made pursuant to safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. The Company’s actual results, performance or achievements in the future

could differ significantly from the results, performance or achievements discussed or implied in such forward-looking statements herein

and in prior U. S. Securities and Exchange Commission (“SEC”) filings by the Company. The Company assumes no obligation to

update these forward-looking statements or to advise of changes in the assumptions on which they were based.

Factors that could cause

or contribute to such differences include, but are not limited to, changes in the competitive environment of the Company, general economic

and business conditions, industry trends, changes in government rules and regulations and environmental rules and regulations. Statements

concerning interest rates and other financial instrument fair values and their estimated contribution to the Company’s future results

of operations are based upon market information as of a specific date. This market information is often a function of significant judgment

and estimation. Further, market interest rates are subject to potential significant volatility.

ITEM

1A. RISK FACTORS.

Risks Relating to Ownership Structure

The controlling shareholder

group may be able to vote its shares in favor of its interests that may not always coincide with the interests of shareholders not part

of such group. This risk may be counter-balanced to a degree by the actions of the Board of Directors whose composition is made up of

a majority of independent directors.

The controlling shareholder

group includes a corporation that owns a significant percentage of the Company’s common stock and which does business with the Company,

as further described in the Notes to the Consolidated Financial Statements. In theory, this could result in a conflict of interest; nevertheless,

the Company and its largest shareholder have put in place some controls to reduce the effects of any perceived conflict of interest.

Certain conflicts of interest

may be perceived by the relationship between the Company and its largest shareholder. Both entities have the same Chief Executive Officer,

and certain management personnel work for both entities. Nevertheless, the Company’s Board of Directors (“Board”) is

composed of a majority of independent directors. In 2005, in a case involving both entities, the Delaware Supreme Court in connection

with an attempt to obtain books and records of the Company through a proceeding against the Company’s significant shareholder, held

that the actions of the Company’s Board were proper.

Risks Related to Our Business

We are a part of the communities

in which we do business. Accordingly, like other businesses in our communities, we are subject to the following risks:

| |

• |

the continued threat of terrorism; |

| |

• |

economic downturns, both on a national and on local scales; |

| |

• |

loss of key personnel; |

| |

• |

the availability, if needed, of additional financing; |

| |

• |

the continued availability of insurance (in different types of policies) at reasonably acceptable rates; |

| |

• |

the general burdens of governmental regulation, at the Local, State and Federal levels; |

| |

• |

climate change; |

| |

• |

cyber security; and |

| |

• |

pandemics, such as COVID-19. |

Risks Related to Real Estate Operations

Our investment in property

development may be limited by increasing costs required to “fit up” property to be leased to tenants. Also, as the cost of

fitting up properties increases, we may be required to wait and forsake opportunities that would be revenue producing until such time

that we obtain the necessary financing of such ventures. This risk may be mitigated by obtaining lines of credit and other financing vehicles,

although such have significant limitations on the amounts that may be borrowed at any point in time.

We also may be subject to

environmental liability as an owner or operator of properties. Many of our properties are old and when we need to fit up a property for

a new tenant, we may find materials and the like that could be deemed to contain hazardous elements requiring remediation or encapsulation.

The impact of COVID-19 on

demand for commercial real estate rental space has been significant. As online retail operations continued to expand nationwide during

the pandemic, retailers are facing increased competition which reduces the need for the leasing of properties which is our business. Professionals

working remotely during the pandemic has resulted in tenants’ careful evaluation of office space needs and a decline in demand of

commercial office space rentals and increasing competition. The Company emphasizes retention of tenants over a long period of time which

helps in difficult economic conditions. The Company also aggressively markets available space to tenants including governmental agencies,

medical and educational institutions.

We try to lease our properties

to tenants with adequate finances, but as a result of recent business downturns, even formerly financially strong tenants may be at risk.

The Company mitigates risks of tenants with less than adequate finances by leasing our properties to multiple tenants where applicable

in order to diversify the tenant base.

Risks Related to our Investments

Excess cash and cash equivalents

may be invested from time to time. We seek to earn rates of return that will help us finance our business operations. These investments

may be subject to significant uncertainties and may not be successful for many reasons, including, but not limited to the following:

| |

• |

fluctuations in interest rates; |

| |

• |

worsening of general economic and market conditions; and |

| |

• |

adverse legal, financial and regulatory developments that may affect a particular business. |

Risk Factors Summary

These are some of the “Risk

Factors” that could affect the Company’s business. The Company endeavors to take actions and do business in a way that reduces

these “Risk Factors” or, at least, takes them into account when conducting its business. Nevertheless, some of these “Risk

Factors” cannot be avoided so that the Company must also take actions and do business that negates the adverse effects that these

may have on the Company.

ITEM

1B. UNRESOLVED STAFF COMMENTS.

There are no unresolved comments

from the staff of the U. S. Securities and Exchange Commission as of the date of this Annual Report on Form 10-K.

ITEM

2. PROPERTIES.

The table below sets forth

certain information as to each of the properties currently operated by the Company:

| Location |

|

Approximate

Square Feet |

| 1. |

Brooklyn, New York

Fulton Street at Bond Street |

|

380,000 |

|

| |

Livingston Street

Truck bays, passage facilities and tunnel-Schermerhorn Street |

|

17,000 |

|

| |

Building-Livingston Street |

|

10,500 |

|

| 2. |

Brooklyn, New York

Jowein building at Elm Place |

|

201,000 |

|

| 3. |

Jamaica, New York

Jamaica Avenue at 169th Street |

|

297,000 |

|

| 4. |

Fishkill, New York

Route 9 at Interstate Highway 84 |

|

203,000 |

|

| |

|

|

(located on

14.6 acres |

) |

| 5. |

Levittown, New York

Hempstead Turnpike |

|

10,000 |

|

| |

|

|

(located on 75,800 square feet of land |

) |

| 6. |

Massapequa, New York

Sunrise Highway |

|

133,400 |

|

| 7. |

Circleville, Ohio

Tarlton Road |

|

193,350 |

|

| |

|

|

(located on 11.6 acres |

) |

Properties are leased under

long-term leases for varying periods, the longest of which extends to 2073, and in most instances renewal options are included. Reference

is made to Notes 4 and 10 to the Consolidated Financial Statements contained in the 2023 Annual Report to Shareholders, incorporated herein

by reference. Properties owned and subject to mortgage are the Brooklyn Fulton Street at Bond Street and Fishkill buildings.

Fulton Street at Bond Street

90% of the property is owned by the Company

and the remaining 10% of the property is leased by the Company under five separate leases. Expiration dates are as follows: 12/8/2043

(1 lease) which lease currently has one thirty-year renewal option through 12/8/2073, 4/30/2031 (1 lease), and 4/30/2044 (3 leases).

The property is currently leased to twenty-five

tenants of which nine are retail tenants, three are fast food restaurants, ten occupy office space, three are dental or medical offices.

One tenant leased in excess of 10% of the rentable square footage; the tenant is a department store, occupying 20.60%.

In August 2022, a tenant who occupies 25,423

square feet of office space notified the Company of its intention to extend its lease for one year through September 30, 2023.

On October 4, 2022, a tenant who occupies

1,140 square feet of retail space agreed to terminate their lease effective October 31, 2022. In July 2023 another retail tenant took

occupancy of this space.

In December 2022, a tenant who occupies

5,167 square feet agreed to terminate the lease.

In February 2023, an office tenant who occupies

46,421 square feet agreed to terminate their lease effective March 31, 2023.

In June 2023, a retail tenant who occupies

63 square feet extended their lease an additional five years until June 30, 2028.

It is the intention of the Company to negotiate

the renewals of the expiring leases as they come due, providing the tenants maintain adequate finances.

| Occupancy |

|

Lease Expiration |

|

Rent |

|

Year

Ended |

|

Rate |

|

Year

Ended |

|

Number of

Leases |

|

Area

Sq. Ft. |

|

Annual

Rent |

|

Percentage of

Gross Annual Rent |

| 7/31/2019 |

|

75.65% |

|

7/31/2024 |

|

|

5 |

|

|

26,923 |

|

$ |

1,210,990 |

|

|

5.364 |

|

| 7/31/2020 |

|

70.07% |

|

7/31/2025 |

|

|

1 |

|

|

3,080 |

|

126,000 |

|

|

.558 |

|

| 7/31/2021 |

|

62.31% |

|

7/31/2026 |

|

|

2 |

|

|

15,261 |

|

735,522 |

|

|

3.258 |

|

| 7/31/2022 |

|

63.38% |

|

7/31/2027 |

|

|

3 |

|

|

3,558 |

|

156,431 |

|

|

.693 |

|

| 7/31/2023 |

|

59.51% |

|

7/31/2028 |

|

|

4 |

|

|

6,633 |

|

231,076 |

|

|

1.024 |

|

| |

|

|

|

7/31/2030 |

|

|

3 |

|

|

87,070 |

|

2,497,642 |

|

|

11.063 |

|

| |

|

|

|

7/31/2031 |

|

|

1 |

|

|

1,090 |

|

45,126 |

|

|

.200 |

|

| |

|

|

|

7/31/2032 |

|

|

5 |

|

|

49,268 |

|

2,080,043 |

|

|

9.213 |

|

| |

|

|

|

7/31/2033 |

|

|

1 |

|

|

1,140 |

|

16,499 |

|

|

.073 |

|

| |

|

|

|

|

|

|

25 |

|

|

194,023 |

|

$ |

7,099,329 |

|

|

31.446 |

|

The Company uses 17,810 square feet of available

space.

As of July 31, 2023 the federal tax basis

is $22,607,989 with accumulated depreciation of $14,453,318 for a net carrying value of $8,154,671. The lives taken for depreciation vary

between 15-40 years and the methods used are straight-line and declining balance.

The real estate taxes for this property

are $2,670,914 per year and the rate used is averaged at $11.135 per $100 of assessed valuation.

Livingston Street

The Company has a long-term lease with

the City of New York and another landlord for a garage at Livingston Street opposite the Company’s Brooklyn Fulton Street at Bond

Street Properties. The lease expires in 2043, with a renewal option to 2073. The garage includes truck bays and passage facilities through

a tunnel to the Properties. The truck bays, passage facilities and tunnel, total approximately 17,000 square feet. The lease also includes

a 20 x 75-foot land plot on which the Company constructed a building of six stories and basement annexed to the Properties.

| 2. | Brooklyn, New York—Jowein building at Elm Place |

The building is owned. The property is currently

leased to fourteen tenants of which one is a retail store, one is fast-food restaurant, two are for warehouse space and ten leases are

for office space. Three tenants leased in excess of 10% of the rentable square footage; each occupies office space of 15.64%, 11.74% and

11.44%, respectively.

Effective November 1, 2022, a tenant who

occupies 10,000 square feet agreed to terminate their lease.

In February 2023, an office tenant who occupies

3,300 square feet extended their lease an additional ten years until June 30, 2033. Also in February 2023, another office tenant who occupies

10,569 square feet extended their lease an additional year until March 31, 2024.

It is the intention of the Company to negotiate

the renewals of the expiring leases as they come due, providing the tenants maintain adequate finances.

| Occupancy |

|

Lease Expiration |

|

Rent |

|

Year

Ended |

|

Rate |

|

Year

Ended |

|

Number of

Leases |

|

Area

Sq. Ft. |

|

Annual

Rent |

|

Percentage of

Gross Annual Rent |

| 7/31/2019 |

|

85.14% |

|

7/31/2024 |

|

|

4 |

|

|

25,016 |

|

$ |

935,925 |

|

|

4.146 |

|

| 7/31/2020 |

|

73.22% |

|

7/31/2025 |

|

|

1 |

|

|

17,364 |

|

|

579,035 |

|

|

2.565 |

|

| 7/31/2021 |

|

72.54% |

|

7/31/2026 |

|

|

1 |

|

|

5,640 |

|

|

180,042 |

|

|

.797 |

|

| 7/31/2022 |

|

80.84% |

|

7/31/2027 |

|

|

1 |

|

|

500 |

|

|

54,530 |

|

|

.242 |

|

| 7/31/2023 |

|

83.46% |

|

7/31/2028 |

|

|

1 |

|

|

5,600 |

|

|

152,701 |

|

|

.676 |

|

| |

|

|

|

7/31/2030 |

|

|

1 |

|

|

31,438 |

|

|

981,386 |

|

|

4.347 |

|

| |

|

|

|

7/31/2033 |

|

|

1 |

|

|

3,300 |

|

|

89,760 |

|

|

.398 |

|

| |

|

|

|

7/31/2036 |

|

|

1 |

|

|

12,105 |

|

|

52,566 |

|

|

.233 |

|

| |

|

|

|

7/31/2037 |

|

|

2 |

|

|

41,028 |

|

|

1,898,972 |

|

|

8.411 |

|

| |

|

|

|

7/31/2059 |

|

|

1 |

|

|

19,437 |

|

|

161,173 |

|

|

.714 |

|

| |

|

|

|

|

|

|

14 |

|

|

161,428 |

|

$ |

5,086,090 |

|

|

22.529 |

|

As of July 31, 2023 the federal tax basis

is $7,550,837 with accumulated depreciation of $5,168,848 for a net carrying value of $2,381,989. The lives taken for depreciation vary

between 15-40 years and the methods used are straight-line and declining balance.

The real estate taxes for this property

are $816,733 per year and the rate used is averaged at $11.115 per $100 of assessed valuation.

| 3. | Jamaica, New York—Jamaica Avenue at 169th Street |

Building, improvements and land (“property”)

are leased from an affiliated company, principally owned by a director of the Company (“Landlord”). In July 2022, the Company

entered into an agreement with Landlord giving the Company four five-year option periods for a total of twenty years through May 31, 2050.

In April 2023, the Company exercised the first five-year option period, extending the lease expiration date to May 31, 2035.

Upon lease termination, all property included in operating lease right-of-use assets and leasehold improvements will be turned over to

the Landlord.

In August 2022, a tenant who occupies 38,109

square feet of office space notified the Company of its intention to extend its lease for one year through September 30, 2023.

In April 2023, a retail tenant who occupies

28,634 square feet extended their lease an additional ten years until February 28, 2034.

In May 2023, an office tenant who occupies

2,000 square feet at the Company’s Jamaica, New York property extended their lease an additional year until June 30, 2024.

The property is currently leased to ten

tenants: four are retail tenants and six occupy office space. Four tenants each occupy in excess of 10% of the rentable square footage:

two retail stores occupy 15.86% and 17.66%, respectively; and two office tenants occupy 14.22% and 12.83%, respectively.

It is the intention of the Company to negotiate

the renewals of the expiring leases as they come due, providing the tenants maintain adequate finances.

| Occupancy |

|

Lease Expiration |

|

Rent |

|

Year

Ended |

|

Rate |

|

Year

Ended |

|

Number of

Leases |

|

Area

Sq. Ft. |

|

Annual

Rent |

|

Percentage of

Gross Annual Rent |

| 7/31/2019 |

|

80.50% |

|

7/31/2024 |

|

|

4 |

|

|

104,404 |

|

$ |

2,900,639 |

|

|

12.848 |

|

| 7/31/2020 |

|

80.51% |

|

7/31/2025 |

|

|

1 |

|

|

147 |

|

|

24,000 |

|

|

.106 |

|

| 7/31/2021 |

|

80.41% |

|

7/31/2026 |

|

|

1 |

|

|

6,095 |

|

|

177,537 |

|

|

.786 |

|

| 7/31/2022 |

|

80.51% |

|

7/31/2027 |

|

|

1 |

|

|

505 |

|

|

34,800 |

|

|

.154 |

|

| 7/31/2023 |

|

80.58% |

|

7/31/2029 |

|

|

2 |

|

|

99,544 |

|

|

1,966,978 |

|

|

8.713 |

|

| |

|

|

|

7/31/2034 |

|

|

1 |

|

|

28,634 |

|

|

621,720 |

|

|

2.754 |

|

| |

|

|

|

|

|

|

10 |

|

|

239,329 |

|

$ |

5,725,674 |

|

|

25.361 |

|

Until the lease agreement terminates, the

Company remains solely entitled to tax depreciation and other tax deductions relating to the buildings, improvements and maintenance of

the property. As of July 31, 2023, the federal tax basis is $13,863,981 with accumulated depreciation of $9,889,906 for a net carrying

value of $3,974,075. The lives taken for depreciation vary between 15-40 years and the methods used are straight-line and declining balance.

The real estate taxes for this property

are $1,018,571 per year and the rate used is averaged at $11.137 per $100 of assessed valuation.

| 4. | Fishkill, New York—Route 9 at Interstate Highway 84 |

The Company owns the entire property. In

July 2019, the Company leased 47,000 square feet to a community college at its Fishkill, New York building, for a term of fifteen years

with two five-year option periods.

In August 2022, the Company leased 58,832

square feet at the Company’s Fishkill, New York building for use as storage space for six months which expired in February 2023.

There are approximately 156,000 square feet

of the building available for lease. There are plans to renovate vacant space upon the execution of future leases to tenants, although

no assurances can be made as to when or if such leases will be entered into.

| Occupancy |

|

Lease

Expiration |

|

Rent |

Year

Ended |

|

Rate |

|

Year

Ended |

|

Number of

Leases |

|

Area

Sq. Ft. |

|

Annual

Rent |

|

Percentage of

Gross Annual Rent |

| 7/31/2019 |

|

45.42% |

|

7/31/2036 |

|

|

1 |

|

|

47,000 |

|

$ |

992,301 |

|

|

4.395 |

|

| 7/31/2020 |

|

21.48% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2021 |

|

20.42% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2022 |

|

22.27% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2023 |

|

22.27% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of July 31, 2023 the federal tax basis

is $22,423,614 with accumulated depreciation of $15,861,531 for a net carrying value of $6,562,083. The lives taken for depreciation vary

between 15-40 years and the methods used are straight-line and declining balance.

The real estate taxes for this property

are $135,702 per year and the rate used is averaged at $3.016 per $100 of assessed valuation.

| 5. | Levittown, New York—Hempstead Turnpike |

The Company owns the entire property. In

October 2006, the Company entered into a lease agreement with a restaurant. The restaurant constructed a new 10,000 square foot building,

which opened in May 2008. In September 2022, the restaurant extended its lease for an additional five years expiring May 3, 2028. Ownership

of the building reverts to the Company at the conclusion of the leasing arrangement, currently May 3, 2028.

| Occupancy |

|

Lease Expiration |

|

Rent |

|

Year

Ended |

|

Rate |

|

Year

Ended |

|

Number of

Leases |

|

Area

Sq. Ft. |

|

Annual

Rent |

|

Percentage of

Gross Annual Rent |

| 7/31/2019 |

|

100.00% |

|

7/31/2028 |

|

Building |

|

10,000 |

|

$ |

434,036 |

|

|

1.923 |

|

| 7/31/2020 |

|

100.00% |

|

|

|

Land |

|

75,800 |

|

|

|

|

|

|

|

| 7/31/2021 |

|

100.00% |

|

|

|

|

1 |

|

|

85,800 |

|

|

|

|

|

|

|

| 7/31/2022 |

|

100.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2023 |

|

100.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The real estate taxes for this property

are $188,232 per year and the rate used is averaged at $944.797 per $100 of assessed valuation.

| 6. | Massapequa, New York—Sunrise Highway |

The Company is the prime tenant of this

leasehold. The lease expired May 14, 2009, and there was one renewal option for twenty-one years, which the Company exercised in April

2008. The leasehold is currently subleased to two tenants; one tenant occupies 113,400 square feet of the property, and the other tenant

occupies 20,000 square feet of the property. The subleases expire in May 2030, with no renewal options.

| Occupancy |

|

Lease Expiration |

|

Rent |

|

Year

Ended |

|

Rate |

|

Year

Ended |

|

Number of

Leases |

|

Area

Sq. Ft. |

|

Annual

Rent |

|

Percentage of

Gross Annual Rent |

| 7/31/2019 |

|

85.01% |

|

7/31/2030 |

|

|

2 |

|

|

133,400 |

|

$ |

847,362 |

|

|

3.753 |

|

| 7/31/2020 |

|

85.01% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2021 |

|

93.75% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2022 |

|

100.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2023 |

|

100.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The real estate taxes for this property

are $244,620 per year and the rate used is averaged at $639.81 per $100 of assessed valuation.

The Company does not own this property.

Improvements to the property, if any, are made by tenants.

| 7. | Circleville, Ohio—Tarlton Road |

The Company owns the entire property. The

property is currently leased to two tenants. The tenants use these premises for warehouse and distribution facilities. In October 2013,

one tenant signed a lease agreement for a five-year period to occupy 48,000 square feet and in May 2015 signed a modification of lease

to occupy 72,000 square feet. In August 2016, this tenant signed a further modification of lease to occupy 84,000 square feet, which in

December 2020 was extended for an additional three years to expire October 31, 2024. The other tenant’s lease agreement was executed

in May 2015, for a five-year period effective June 1, 2015, and allows the tenant to have permanent space of 108,000 square feet. In April

2023, the tenant further extended the lease until May 31, 2026. Brokerage commissions were $88,841.

| Occupancy |

|

Lease Expiration |

|

Rent |

|

Year

Ended |

|

Rate |

|

Year

Ended |

|

Number of

Leases |

|

Area

Sq. Ft. |

|

Annual

Rent |

|

Percentage of

Gross Annual Rent |

| 7/31/2019 |

|

99.10% |

|

7/31/2025 |

|

|

1 |

|

|

84,000 |

|

$ |

368,982 |

|

|

1.634 |

|

| 7/31/2020 |

|

99.30% |

|

7/31/2026 |

|

|

1 |

|

|

108,000 |

|

|

512,956 |

|

|

2.272 |

|

| 7/31/2021 |

|

99.30% |

|

|

|

|

2 |

|

|

192,000 |

|

$ |

881,938 |

|

|

3.906 |

|

| 7/31/2022 |

|

99.30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7/31/2023 |

|

99.30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of July 31, 2023 the federal tax basis

is $4,493,846 with accumulated depreciation of $4,183,897 for a net carrying value of $309,949. The lives taken for depreciation vary

between 15-40 years and the methods used are straight-line and declining balance.

The real estate taxes for this property

are $38,300 per year and the rate used is averaged at $4.987 per $100 of assessed valuation.

In the opinion of management, all of the Company’s

properties are adequately covered by insurance.

See Note 8 to the Consolidated Financial Statements

contained in the 2023 Annual Report to Shareholders, which information is incorporated herein by reference, for information concerning

the tenants, the rental income from which equals 10% or more of the Company’s rental income.

Item

3. Legal Proceedings.

There are various lawsuits

and claims pending against the Company. It is the opinion of management that the resolution of these matters will not have a material

adverse effect on the Company’s Consolidated Financial Statements.

If the Company sells, transfers,

disposes of or demolishes 25 Elm Place, Brooklyn, New York, then the Company may be liable to create a condominium unit for the loading

dock. The necessity of creating the condominium unit and the cost of such condominium unit cannot be determined at this time.

ITEM

4. MINE SAFETY DISCLOSURES.

None

PART

II

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

COMMON

STOCK INFORMATION

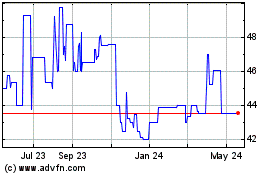

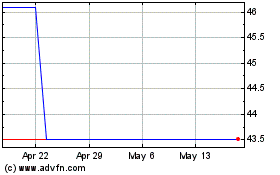

Effective November 8, 1999,

the Company’s common stock commenced trading on The Nasdaq Capital Market tier of The Nasdaq Stock Market under the Symbol: “Mays”.

Such shares were previously traded on The Nasdaq National Market. Effective August 1, 2006, NASDAQ became operational as an exchange in

NASDAQ-Listed Securities. It is now known as The NASDAQ Stock Market LLC.

On September 5, 2023, the

Company had approximately 800 shareholders of record.

RECENT

SALES OF UNREGISTERED SECURITIES

During the year ended July

31, 2023 we did not sell any unregistered securities.

RECENT

PURCHASES OF EQUITY SECURITIES

During the fourth quarter

of the year ended July 31, 2023, we did not repurchase any of our outstanding equity securities.

ITEM

6. SELECTED FINANCIAL DATA.

Not required.

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The information appearing

under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” on pages 22-26

of the Registrant’s 2023 Annual Report to Shareholders is incorporated herein by reference.

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not required.

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The Registrant’s Consolidated

Financial Statements, together with the report of Prager Metis CPAs, LLC, independent registered public accounting firm, dated October

23, 2023, appearing on pages 3 through 21 of the Registrant’s 2023 Annual Report to Shareholders is incorporated herein by reference.

With the exception of the aforementioned information and the information incorporated by reference in Items 2 and 7 hereof, the 2023 Annual

Report to Shareholders is not to be deemed filed as part of this Form 10-K Annual Report.

ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

There are no disagreements

between the Company and its accountants relating to accounting or financial disclosures.

ITEM

9A. CONTROLS AND PROCEDURES.

(A)

EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES.

The Company’s management

reviewed the Company’s internal controls and procedures and the effectiveness of these controls. As of July 31, 2023, the Company

carried out an evaluation, under the supervision of, and with the participation of the Company’s management, including its Chief

Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s disclosure controls

and procedures pursuant to Rules 13a-14(c) and 15d-14(c) of the Securities Exchange Act of 1934. Based upon that evaluation, the Chief

Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures are effective in timely

alerting them to material information relating to the Company required to be included in its periodic SEC filings.

(B)

CHANGE TO INTERNAL CONTROLS OVER FINANCIAL REPORTING.

There was no change in the

Company’s internal controls over financial reporting or in other factors during the Company’s last fiscal quarter that materially

affected, or is reasonably likely to materially affect, the Company’s internal controls over financial reporting. There were no

significant deficiencies or material weaknesses noted, and therefore there were no corrective actions taken.

(C)

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING.

The Company’s management

is responsible for establishing and maintaining adequate internal control over financial reporting as such term is defined in Rule 13(a)-15(f).

Our internal control system has been designed to provide reasonable assurance to the Company’s management and its Board of Directors

regarding the preparation and fair presentation of published financial statements. All internal control systems, no matter how well designed,

have inherent limitations. Even those systems that have been determined to be effective can provide only reasonable assurance with respect

to financial statement preparation and presentation. The Company’s management assessed the effectiveness of our internal control

over financial reporting as of July 31, 2023. In making this assessment, the Company’s management used the criteria set forth by

the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control – Integrated Framework published in 2013.

Based on the Company’s assessments, we believe that, as of July 31, 2023, its internal control over financial reporting is effective

based on these criteria.

This Form 10-K Annual Report

does not include an attestation report of our independent registered public accounting firm regarding internal controls over financial

reporting. Management’s report was not subject to attestation by our independent registered public accounting firm pursuant to the

permanent exemption for smaller reporting company filers from the internal control audit requirement of Section 404(b) of the Sarbanes-Oxley

Act of 2002.

ITEM

9B. OTHER INFORMATION.

Reports on Form 8-K

- One report on Form 8-K was filed by the Company during the three months ended July 31, 2023.

Item reported - The Company

reported its financial results for the three and nine months ended April 30, 2023. Date of report filed - June 7, 2023.

ITEM

9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTION.

Not Applicable

PART

III

ITEM

10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The information relating

to directors of the Company is contained in the Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders and such information

is incorporated herein by reference.

Executive Officers of the Registrant

The following

information is furnished with respect to each Executive Officer of the Registrant (each of whose position is reviewed annually but

each of whom has a three-year employment agreement, effective August 1, 2011 and renewed August 1, 2014, August 1, 2017, August 1,

2020 and August 1, 2023). On October 3, 2023, Mr. Greenblatt tendered his resignation as Executive

Vice President and Chief Financial Officer of the Company effective December 31, 2023. He will continue to be subject to the terms and

conditions of his Employment Agreement with the Company through December 31, 2023.

| Name |

|

Age |

|

Business Experience During

the Past Five Years |

|

First Became

Such Officer

or Director |

| Lloyd J. Shulman |

|

81 |

|

President |

|

November, 1978 |

| |

|

|

|

Chairman of the Board, Chief Executive Officer and President |

|

November, 1996 |

| Mark S. Greenblatt |

|

69 |

|

Vice President |

|

August, 2000 |

| |

|

|

|

Chief Financial Officer and Treasurer |

|

August, 2003 |

| |

|

|

|

Director |

|

August, 2003 |

| Ward N. Lyke, Jr. |

|

72 |

|

Vice President |

|

February, 1984 |

| |

|

|

|

Assistant Treasurer |

|

August, 2003 |

| George Silva |

|

73 |

|

Vice President-Operations |

|

March, 1995 |

All of the above mentioned

officers have been appointed as such by the directors and have been employed as Executive Officers of the Company during the past five

years.

ITEM

11. EXECUTIVE COMPENSATION.

The information required

by this item appears under the heading “Compensation” in the Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders

and such information is incorporated herein by reference.

ITEM

12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The information required

by this item appears under the headings “Security Ownership of Certain Beneficial Owners and Management” and “Information

Concerning Nominees for Election as Directors” in the Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders and

such information is incorporated herein by reference.

ITEM

13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

The information required

by this item appears under the headings “Compensation”, “Certain Transactions,” and “Board Interlocks and

Insider Participation” in the Definitive Proxy Statement for the 2023 Annual Meeting of Shareholders and such information is incorporated

herein by reference.

ITEM

14. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

The following table sets

forth the fees paid by the Company (on a cash basis) to its independent registered public accounting firm, Prager Metis CPAS,

LLC, for the fiscal years 2023 and 2022.

| |

|

Fiscal

Year |

| |

|

2023 |

|

2022 |

| Audit

fees |

|

$ |

170,000 |

|

$ |

170,000 |

| Audit

related fees |

|

|

12,500 |

|

|

12,100 |

| Tax

fees |

|

|

45,000 |

|

|

45,000 |

| Total

Fees |

|

$ |

227,500 |

|

$ |

227,100 |

Audit Fees for fiscal year

2023 and fiscal year 2022 were for professional services rendered for the audits of the consolidated financial statements of the Company,

interim quarterly reviews of Form 10-Q information and assistance with the review of documents filed with the U. S. Securities and Exchange

Commission.

Audit related fees for fiscal

year 2023 and fiscal year 2022 consist of audits of real estate tax matters and consultations concerning financial accounting and reporting

standards.

Tax fees for fiscal year 2023

and fiscal year 2022 were for services related to tax compliance and preparation of federal, state and local corporate tax returns.

The officers of the Company

consult with, and receive the approval of, the Audit Committee before engaging accountants for any services.

PART

IV

ITEM

15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

The following documents are

filed as part of this report:

| 1. | The Consolidated Financial Statements and report of Prager Metis

CPAs, LLC, independent registered public accounting firm, dated October 19, 2023, set forth on pages 3 through 21 of the Company’s

2023 Annual Report to Shareholders. |

| 2. | See accompanying Index to the Company’s Consolidated Financial

Statements and Schedules. |

| (2) | Plan of acquisition, reorganization, arrangement, liquidation

or succession—not applicable. |

| (3) | Articles of incorporation and by-laws: |

| (i) | Certificate of Incorporation and certificate of amendment —

incorporated by reference. |

| (ii) | By-laws,

as amended — incorporated by reference. |

| (4) | Instruments defining the rights of security holders, including

indentures—see Exhibit above. |

| (9) | Voting trust agreement—not applicable. |

| (10) | Material contracts—(i) Retirement Plan and Trust, Summary

Plan Description —

incorporated by reference. |

| (ii) | Employment agreements — Employment Agreements with Messrs.

Shulman, Greenblatt, Lyke and Silva, each originally dated August 1, 2005, were incorporated by reference to Registrant’s Form

8-K dated August 1, 2005. Each of these Employment Agreements had been extended on multiple occasions, the most recent as of August 1,

2023, for three year periods. Each Employment Agreement dated as of August 1, 2023 and scheduled to end on July 31, 2026 is attached

as an Exhibit to this Form 10-K. On October 3, 2023, Mr. Greenblatt tendered his resignation as Executive

Vice President and Chief Financial Officer of the Company effective December 31, 2023. He will continue to be subject to the terms and

conditions of his Employment Agreement with the Company through December 31, 2023. |

| (11) | Statement re computation of per share earnings—not applicable. |

| (12) | Statement re computation of ratios—not applicable. |

| (14) | Code of ethics—not applicable. |

| (18) | Letter re change in accounting principles—not applicable. |

| (22) | Published report re matters submitted to vote of security holders—not

applicable. |

| (24) | Power of attorney—none. |

| (28) | Information from reports furnished to state insurance regulatory

authorities—not applicable. |

| (31) | Certifications pursuant to Section 302 of the Sarbanes-Oxley

Act of 2002. |

31.1—Chief Executive Officer

31.2—Chief Financial Officer

SIGNATURES

Pursuant to the requirements

of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

|

J.W. MAYS, INC. |

| |

|

|

(Registrant) |

| |

|

|

|

| October 19, 2023 |

|

By: |

LLOYD J. SHULMAN |

| |

|

|

Lloyd

J. Shulman |

| |

|

|

Chairman of the Board, |

| |

|

|

Chief Executive Officer and President |

| |

|

|

|

| October 19, 2023 |

|

By: |

MARK S. GREENBLATT |

| |

|

|

Mark

S. Greenblatt |

| |

|

|

Vice President, Chief Financial Officer

and Treasurer, Director |

| |

|

|

|

| October 19, 2023 |

|

By: |

WARD N. LYKE, JR. |

| |

|

|

Ward

N. Lyke, Jr. |

| |

|

|

Vice President |

| |

|

|

and Assistant Treasurer |

Pursuant to the requirements

of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant in the

capacities and on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| LLOYD J. SHULMAN |

|

Chairman of the Board, Chief Executive |

|

October 19, 2023 |

| Lloyd

J. Shulman |

|

Officer, and President |

|

|

| |

|

|

|

|

| MARK S. GREENBLATT |

|

Vice President, Chief Financial Officer |

|

October 19, 2023 |

| Mark

S. Greenblatt |

|

and Treasurer, Director |

|

|

| |

|

|

|

|

| JENNIFER L. CARUSO |

|

Director |

|

October 19, 2023 |

| Jennifer

L. Caruso |

|

|

|

|

| |

|

|

|

|

| ROBERT L. ECKER |

|

Director |

|

October 19, 2023 |

| Robert

L. Ecker |

|

|

|

|

| |

|

|

|

|

| STEVEN GURNEY-GOLDMAN |

|

Director |

|

October 19, 2023 |

| Steven

Gurney-Goldman |

|

|

|

|

| |

|

|

|

|

| JOHN J. PEARL |

|

Director |

|

October 19, 2023 |

| John

J. Pearl |

|

|

|

|

| |

|

|

|

|

| DEAN L. RYDER |

|

Director |

|

October 19, 2023 |

| Dean

L. Ryder |

|

|

|

|

INDEX

TO REGISTRANT’S FINANCIAL STATEMENTS AND SCHEDULES

Reference is made to the following

sections of the Registrant’s Annual Report to Shareholders for the fiscal year ended July 31, 2023, which are incorporated herein

by reference:

Report of Independent Registered

Public Accounting Firms (pages 20-21)

Consolidated Balance Sheets

(page 3)

Consolidated Statements of

Operations (page 4)

Consolidated Statement of

Changes in Shareholders’ Equity (page 5)

Consolidated Statements of

Cash Flows (page 6)

Notes to Consolidated Financial

Statements (pages 7-17)

Financial Statement Schedules

Real Estate and Accumulated

Depreciation (page 18)

Report of Management (page

19)

All other schedules for which

provision is made in the applicable regulations of the U. S. Securities and Exchange Commission are not required under the related instructions

or are inapplicable and, accordingly, are omitted.

The separate financial statements

and schedules of J.W. Mays, Inc. (not consolidated) are omitted because the Company is primarily an operating company and its subsidiaries

are wholly-owned.

EXHIBIT

INDEX TO FORM 10-K

| (2) | Plan of acquisition, reorganization, arrangement, liquidation

or succession—not applicable |

| (3) | (i) Certificate of incorporation and certificate of amendment

— incorporated by reference |

| (ii) | By-laws, as amended — incorporated by reference |

| (4) | Instruments defining the rights of security holders, including

indentures—see Exhibit (3) above |

| (9) | Voting trust agreement—not applicable |

| (10) | Material contracts—(i)

Retirement Plan and Trust, Summary

Plan Description —

incorporated by reference |

| (ii) | Employment agreements — Employment Agreements with Messrs.

Shulman, Greenblatt, Lyke and Silva, each originally dated August 1, 2005, were incorporated by reference to Registrant’s Form

8-K dated August 1, 2005. Each of these Employment Agreements had been extended on multiple occasions, the most recent as of August 1,

2023, for three year periods. Each Employment Agreement dated as of August 1, 2023 and scheduled to end on July 31, 2026 is attached

as an Exhibit to this Form 10-K. On October 3, 2023, Mr. Greenblatt tendered his resignation as Executive

Vice President and Chief Financial Officer of the Company effective December 31, 2023. He will continue to be subject to the terms and

conditions of his Employment Agreement with the Company through December 31, 2023. |

| (11) | Statement re computation of per share earnings—not applicable |

| (12) | Statement re computation of ratios—not applicable |

| (14) | Code of ethics—not applicable |

| (18) | Letter re change in accounting principles—not applicable |

| (22) | Published report re matters submitted to vote of security holders—not

applicable |

| (24) | Power of attorney—none |

| (28) | Information from reports furnished to state insurance regulatory

authorities—not applicable |

| (31) | Certifications Pursuant to Section 302 of the Sarbanes-Oxley

Act—1 and 2 |

31.1—Chief Executive Officer

31.2—Chief Financial Officer

EX-101.INS XBRL

INSTANCE DOCUMENT

EX-101.SCH

XBRL TAXONOMY EXTENSION SCHEMA

EX-101.PRE

XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE

EX-101.LAB

XBRL TAXONOMY EXTENSION LABEL LINKBASE

EX-101.CAL

XBRL TAXONOMY EXTENSION CALCULATION LINKBASE

EX-101.DEF

XBRL TAXONOMY EXTENSION DEFINITION LINKBASE

EXHIBIT 10 (ii)

EMPLOYMENT

AGREEMENT

AGREEMENT

made on the 1st day of August, 2023, which further modifies and extends the Employment Agreement originally made as of the 1st day of

August, 2008, which expired on July 31, 2011, as modified and extended by the Employment Agreement made as of the 1st day of August,

2011, which expired on July 31, 2014, as modified and extended by the Employment Agreement made as of the 1st day of August, 2014, which

expired on July 31, 2017, as modified and extended by the Employment Agreement made on the 22nd day of March, 2017 which expired on July

31, 2020, and as modified and extended by the Employment Agreement made on the 1st day of August, 2020, between J.W. Mays, Inc., a New

York corporation with offices and principal place of business located at 9 Bond Street, Brooklyn, New York 11201 (hereinafter called

the “Company”), and Lloyd J. Shulman (hereinafter called “Shulman” or “Employee”).

WHEREAS,

Shulman has rendered distinguished and dedicated service to the Company for many years, currently serves as its President and his services

have continuing value to the Company; and

WHEREAS,

the Company desires to assure continuity of the services of Shulman as President by means of an Employment Agreement and Shulman is willing

to enter into such Agreement upon the terms and conditions hereinafter set forth; and

WHEREAS,

the protection of the Company’s Confidential Information (as defined hereinafter) is vital to the continued successful operation

of the Company’s business.

NOW,

THEREFORE, in consideration of the mutual covenants herein contained, it is agreed as follows:

1.

Nature of Services and Duties:

(A)

The Company hereby employs Shulman and Shulman accepts employment as the President of the Company.

(B)

Shulman shall devote his best efforts and substantially all of his business time to advance the interests of the Company, subject to

the control of the Board of Directors, and subject to and bound by all personnel and corporate policies and procedures applicable to

employees of the Company. At all times he shall be furnished office accommodations adequate for the performance of his duties and compatible

with his position as President of the Company.

2.

Term of Employment:

(A)

Shulman’s employment hereunder shall commence as of August 1, 2023 and shall end at the close of business on July 31, 2026, subject

to earlier termination as provided in this Agreement in the event of Shulman’s retirement or permanent disability (the “Term

of Employment”). Leave of absence for any period of time authorized by the Board of Directors of the Company shall not be deemed

an interruption, cessation or termination of the terms of Shulman’s employment.

(B)

Shulman may, at his option, elect to retire at any time upon at least ninety (90) days prior written notice to the Company.

(C)

Nothing in this Agreement shall prevent the Company from terminating the employment at any time for cause. The following events shall

constitute cause: (i) fraud, criminal conduct, misappropriation, embezzlement or the like; or (ii) willful misconduct of the Employee

in connection with the performance of his duties under this Agreement; or (iii) violation of any material provision of this Agreement.

3.

Compensation:

(A)

The Company agrees to compensate Shulman for his services, and Shulman agrees to accept as compensation for his services, during the

period of his employment hereunder or any renewal thereof, the sum of not less than Four Hundred Ten Thousand and 00/100 ($410,000.00)

Dollars per annum, payable in equal monthly or other installments in accordance with the general practice of the Company with respect

to Senior Executives. Shulman shall be entitled to such increases and additional payments as may be determined from time to time by the

Board of Directors in its discretion.

(B)

To the extent to which he may qualify, he shall, in addition, be entitled to participate in all plans now or hereafter adopted for Executives

or employees, including, but not limited to, pension, group insurance or medical plans, and in any other employee benefit plans, whether

similar to or different from any of the foregoing categories, offered or made available by the Company.

(C)

The Company shall reimburse Shulman upon submission of vouchers by him, for all out-of-pocket expenses for entertainment, travel, meals,

hotel accommodations and the like, incurred by him in the interest of the business of the Company.

(D)

The Company shall have the right, at its option, to allocate payment of Shulman’s compensation or expenses, or any part thereof,

among its subsidiaries or divisions, if any, to the extent applicable as its Board of Directors may from time to time direct.

4.

Restrictive Covenant:

(A)

Shulman acknowledges that: (i) due to the nature of his duties, he has and will continue to have access to and will acquire confidential

information relating to the business and operation of the Company: and (ii) Shulman’s expertise and background would enable him

to compete with the business of the Company, which is the ownership, control, development, management and operation of real property;

(B)

Shulman shall not at any time, either during or after his employment, directly or indirectly, divulge, disclose or communicate to any

person or entity, any non-public information affecting or relating to the business of the Company (the “Confidential Information”),

including without limitation the names and addresses of its tenants, sub-tenants and prospective or potential tenants, marketing information,

information regarding the nature and extent of its ownership interests in real property, leasing information, including, but not limited

to, rents, expiration dates, rights of renewal, or any other lease terms, costs and expenses of operation, income, its manner of operation,

its plans, its financial arrangements or condition, its policies and procedures, or contracts and other relationships with and information

regarding other individuals or entities, including, but not limited to employees and independent contractors, regardless of whether any

or all of the foregoing matters would be deemed confidential material or important, the parties stipulating that as between them such

information is confidential, important and gravely affects the successful conduct of the business of the Company and its goodwill and

that any breach of this Section is a material breach of this Agreement. Upon Shulman’s termination of employment, he shall immediately

deliver to the Company all of the Company’s Confidential Information and shall not retain in any copies of the Company’s

Confidential Information without the express prior written consent of the Company.

(C)

In consideration of the amounts paid and payable pursuant to this Agreement, and for other good and valuable consideration, the receipt

and sufficiency of which is hereby acknowledged, Shulman hereby agrees as follows:

1.

Except under and pursuant to this Agreement, or as otherwise consented to in writing by the Company from time to time, during the Term

of Employment, Shulman shall not at any time or place whatsoever, either directly or indirectly, engage or be interested as owner, stockholder,

partner, member director, officer, employee, independent contractor or otherwise, (either with or without compensation), in any person,

business or entity which is directly or indirectly in competition with the Company, or any of its subsidiaries. This provision shall

not be construed to prohibit investment by Shulman in publicly traded securities.

2.

During the twenty-four (24) month period immediately following the termination of Shulman’s employment, without regard to the reason

for such termination, Shulman shall not directly or indirectly, whether on Shulman’s own account or as an employee, partner, member,

manager, officer or director of, or consultant or independent contractor to, or holder of more than five (5%) percent of the equity interest

in any other entity, within a fifteen (15) mile radius of the then principal place of business of the Company, do any of the following:

(a)

enter into or engage in any business which is competitive with the Company’s Business.

(b)

induce any person employed by the Company, to join a corporation, partnership, joint venture, limited liability company or other entity

in any such capacity, directly or indirectly, if such business is competitive with that of the Company or if such business, or its successors

or assigns, competes with the Company or if such business, or its successors or assigns, solicits tenants of the Company.

(c)

employ, directly or indirectly, any of the Company’s Confidential Information in whole or in any material part.

(D)

For the purposes of this Agreement, a business will be deemed competitive with the Company’s Business if it engages in any manner

in the ownership, control, development, management and/or operation of real property.

(E)

Shulman hereby agrees that, in the event of his breach of any of the covenants set forth in this Section 4, the Company shall be entitled

to obtain appropriate equitable relief, including, without limitation, a permanent injunction or similar court order enjoining Shulman

from violating any of such provisions, and that pending the hearing and the decision on the application for permanent equitable relief,

the Company shall be entitled to a temporary restraining order and a preliminary injunction, all at Shulman’s expense, including

reasonable attorney’s fees and disbursements, provided, however, no such remedy shall be construed to be the exclusive remedy of

the Company and any and all such remedies shall be held and construed to be cumulative and not exclusive of any rights or remedies, whether

at law or in equity, otherwise available under the terms of this Agreement, at common law, or under federal, state or local statutes,

rules and regulations.

(F)

Each provision contained in this Section 4 is intended to be independent of the others, and shall survive and shall remain binding and

enforceable, notwithstanding that any of the other provisions may be declared invalid, void or unenforceable and, in the case of the

geographical and time limitations, may be modified in geographical scope or duration by any court of competent jurisdiction to the extent

necessary to make such provision valid and enforceable.

(G)

The provisions of this Section 4 shall survive the termination of Shulman’s employment.

(H)

If any present or future statute of the State of New York provides protections or remedies relating to Confidential Information, which

are greater than the protections and remedies provided by this Agreement, then the Company shall also have the benefit of such additional

statutory protections and remedies.

(I)

The provisions of this Section 4 shall not apply to work of any kind performed by the Employee for any entity which is affiliated or

related to the Company, including, but not limited to Weinstein Enterprises, Inc.

5.

Disability:

(A)

If Shulman becomes permanently disabled (as defined herein) during the period of his employment, the Company may terminate his employment

on not less than three (3) months’ prior notice, but the Company shall nevertheless pay Shulman his compensation, as then in effect,

for the balance of his Term of Employment.

(B)

Shulman shall be deemed permanently disabled if either (i) he and the Company so agree, or (ii) after a period of ninety (90) days during

which Shulman is continuously unable, as a result of any physical or mental

ailment, to perform his major duties and responsibilities

as provided in Section 1, he is, either at his (or on his behalf) or the Company’s request, examined by New York University Medical

Center, New York, New York, or any successor organization, or by any other Hospital in the City of New York of comparable stature, mutually

agreed upon (hereinafter called the “Hospital”), and the Hospital certifies that, in the opinion of its Medical Examiners,

Shulman’s health is such that, for a period of ninety (90) days or more from that date, Shulman is and probably will be incapacitated,

physically or mentally, from performing, or that it would seriously impair his health to perform, his major duties and responsibilities

as provided in Section 1 hereof. If, for any reason, the Hospital cannot or refuses to pass on such question, such certificate may be

obtained from a majority of a Board of three (3) licensed physicians, members of the American Medical Association (New York City Division),

one (1) to be chosen by Shulman or on his behalf, one (1) by the Company, and the third (3rd) by the other two (2), if they

can agree thereon, otherwise by the then President of the New York State Medical Association. The certificate of two (2) of the said

physicians shall be final and binding upon both parties hereto.

6.

Assignability of This Agreement:

This

Agreement is personal and shall not be assignable by Shulman and its terms, covenants and conditions shall be binding upon and inure

to the benefit of the Company, or its successors and assigns.

7.

Interpretation of This Agreement:

This

Agreement shall be construed and enforced in accordance with, and governed by, the laws of the State of New York, applicable to agreements

made and to be performed in New York. This Agreement supersedes all prior Agreements and understandings relating to the subject matter

hereof, and this Agreement may not be modified or amended or any term or provision thereof waived or discharged except in writing signed

by the party against whom such amendment, modification, waiver or discharge is sought to be enforced. No waiver of any provision of this

Agreement shall be valid unless in writing and signed by the person or party to be charged.

The

headings of this Agreement are for purpose of reference only and shall not limit or otherwise affect the meaning thereof.

Whenever

the singular is used in this Agreement and when required by the context, the same shall include the plural.

This

Agreement may be executed in one or more counterparts each of which shall be deemed an original.

8.

Notices:

Any

notices that may, at any time, be required to be given hereunder shall mean written notice and be addressed by Registered or Certified

Mail as follows, unless a different address be furnished by Registered or Certified Mail to the other party:

| If

to the Company: |

at

9 Bond Street |

| |

Brooklyn,

NY 11201 |

| |

|

| If to

Shulman: |

at 961

Route 52 |

| |

Carmel,

NY 10512 |

IN

WITNESS WHEREOF, the Company has caused this Agreement to be signed by its President, attested by its Secretary and its corporate seal

affixed hereunto, and Shulman has affixed his hand and seal as of the date first above written.

| |

|

|

J.W.

Mays, Inc. |

| |

|

By: |

/s/

Mark Greenblatt |

| |

|

|

Mark Greenblatt,

Vice President |

| |

|

|

and Treasurer |

| |

|

|

|

| (SEAL) |

|

|

|

| ATTEST: |

|

|

|

| /s/

Salvatore Cappuzzo |

|

|

|

| Salvatore

Cappuzzo, Secretary |

|

|

/s/

Lloyd J. Shulman |

| |

|

|

Lloyd

J. Shulman |

EMPLOYMENT

AGREEMENT

AGREEMENT

made on the 1st day of August, 2023, which further modifies and extends the Employment Agreement originally made as of the 1st day of

August, 2008, which expired on July 31, 2011, as modified and extended by the Employment Agreement made as of the 1st day of August,

2011, which expired on July 31, 2014, as modified and extended by the Employment Agreement made as of the 1st day of August, 2014, which

expired on July 31, 2017, as modified and extended by the Employment Agreement made on the 22nd day of March, 2017 which expired on July

31, 2020, and as modified and extended by the Employment Agreement made on the 1st day of August, 2020, between J.W. Mays, Inc., a New

York corporation with offices and principal place of business located at 9 Bond Street, Brooklyn, New York 11201 (hereinafter called

the “Company”), and Mark Greenblatt (hereinafter called “Greenblatt” or “Employee”)

WHEREAS,

Greenblatt has rendered distinguished and dedicated service to the Company for many years, currently serves as a Vice President and Treasurer

and his services have continuing value to the Company; and

WHEREAS,

the Company desires to assure continuity of the services of Greenblatt as a Vice President and Treasurer by means of an Employment Agreement

and Greenblatt is willing to enter into such Agreement upon the terms and conditions hereinafter set forth; and

WHEREAS,

the protection of the Company’s Confidential Information (as defined hereinafter) is vital to the continued successful operation

of the Company’s business.

NOW,

THEREFORE, in consideration of the mutual covenants herein contained, it is agreed as follows:

1.

Nature of Services and Duties:

(A)

The Company hereby employs Greenblatt and Greenblatt accepts employment as a Vice President and Treasurer of the Company.

(B)

Greenblatt shall devote his best efforts and substantially all of his business time to advance the interests of the Company, subject

to the control of the Board of Directors, and subject to and bound by all personnel and corporate policies and procedures applicable