Filed

by Nocturne Acquisition Corporation

Pursuant

to Rule 425 under the Securities Act of 1933

and

deemed filed pursuant to Rule 14a-12

under

the Securities Exchange Act of 1934

Subject

Company: Nocturne Acquisition Corporation

Commission

File No.: 001-40259

Date:

October 24, 2023

Dear

Fellow Shareholders

Subject:

NASDAQ Listing Update

Cognos

Therapeutics, Inc. (“Cognos”) has made substantial progress toward our goal of becoming a publicly listed company on Nasdaq.

Over the past few weeks, we have achieved significant milestones, and I am pleased to share the latest developments with you.

On

October 5, 2023 Nocturne Acquisition Corporation (“Nocturne”) submitted a response to the initial comments provided by the

Securities and Exchange Commission (“SEC”) on the registration statement on Form S-4 (the “Registration Statement”)

submitted in September. Additionally, Nocturne has filed with the SEC a revised version of the investor presentation on the business

combination transaction (the “Business Combination”), and you can access it by visiting the following link:

Cognos

Business Combination Investor Presentation

In

parallel, we have submitted our Nasdaq listing application, commenced the PIPE capital raise roadshow in collaboration with Chardan,

and completed the setup of an investor portal on our website, which will go live once trading commences. We are also working with Continental

Stock Transfer & Trust Company to finalize the conversion of our common stock records into their system, paving the way for the transition

from private Cognos shares to publicly tradable shares of the combined company. Furthermore, we are excited to welcome Gilmartin Investor

Relations, who will enhance our website, increase our market and analyst exposure, facilitate investor conferences, and keep our investors

informed about Cognos' progress and the value proposition that we expect our technology and future products will bring to patients.

In

the coming week or so, we anticipate receiving feedback from the SEC regarding its review of the latest amendment to the Registration

Statement. We will act promptly to respond to the SEC’s feedback.

As

previously mentioned in my last update, several important tasks remain before the Business Combination can be consummated, after which

we can commence operations as a public company, including the following:

| ● | SEC

Effectiveness of Registration Statement: This step is vital in finalizing the Business

Combination with Nocturne and securing the listing of the combined company on Nasdaq as Cognos

Therapeutics Holdings, Inc. The Registration Statement is a required document for registering

securities to be issued in a public merger transaction. It provides detailed information

about the proposed transaction, risk factors, investor rights, and financial data about the

companies involved. |

| ● | Nocturne's

Shareholder Meeting: Nocturne currently holds approximately $20 million in a trust account

for the benefit of its public stockholders. Following SEC effectiveness, Nocturne will convene

a shareholder meeting in connection with which Nocturne shareholders will determine whether

to redeem their shares. |

After

the Registration Statement is declared effective, you will receive a form of proxy from Cognos for you to vote on approving the transaction

with Nocturne.

We

extend our heartfelt gratitude for your unwavering commitment to Cognos.

Forward-Looking

Statements

This

communication contains certain “forward-looking statements” within the meaning of the Securities Act and the Exchange Act.

Statements that are not historical facts, including statements about the Merger between Nocturne and Cognos, the Merger Agreement, the

transactions contemplated thereby and the parties’ perspectives and expectations, are forward-looking statements. The words “expect,”

“believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking

statements. These forward-looking statements are not guarantees of future performance and are subject to various risks, uncertainties

and assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could

cause the actual results to vary materially from those indicated or anticipated.

These

forward-looking statements are subject to a number of risks and uncertainties, including the risk that Cognos and Nocturne may be unable

to successfully or timely consummate the Merger, including as a result of any regulatory approvals that are not obtained, are delayed

or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Merger, that

approval by the stockholders of Cognos or Nocturne may not be obtained, that the Merger may not result in the benefits anticipated by

Nocturne and Cognos, as well as the risks discussed in Nocturne’s final prospectus dated March 30, 2021 under the heading “Risk

Factors,” and in other documents Nocturne has filed, or will file, with the SEC, including the registration statement, as amended,

on Form S-4/A, filed by Nocturne on October 4, 2023, in connection with the proposed initial business combination (the “Registration

Statement”), which includes a proxy statement/prospectus. If any of these risks materialize or underlying assumptions prove

incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional

risks that neither Nocturne nor Cognos presently know, or that Cognos or Nocturne currently believe are immaterial, that could also cause

actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Nocturne’s

and Cognos’ expectations, plans, or forecasts of future events and views as of the date of this communication. Nocturne and Cognos

anticipate that subsequent events and developments will cause Nocturne’s and Cognos’ assessments to change. Accordingly,

you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date

they were made, and Nocturne, Cognos and their affiliates undertake no obligation to update forward-looking statements to reflect events

or circumstances after the date they were made except as required by law or applicable regulation.

Additional

Information About the Business Combination and Where to Find It

A

full description of the terms of the Merger Agreement is provided in the preliminary Registration Statement, as amended, filed by Nocturne

on October 4, 2023, with the SEC, which includes a prospectus with respect to the combined company’s securities to be issued in

connection with the Merger and a proxy statement with respect to the stockholder meeting of Nocturne to vote on the Merger. The Registration

Statement filed by Nocturne on October 4, 2023 with the SEC is a preliminary

Registration

Statement and is subject to change. Nocturne urges its investors, stockholders and other interested persons to read the final Registration

Statement when available, as well as other documents filed with the SEC because these documents will contain important information about

Nocturne, Cognos and the Merger. After the Registration Statement is declared effective, the definitive proxy statement/prospectus

included in the Registration Statement will be mailed to stockholders of Nocturne as of a record date to be established for voting on

the proposed Merger. Stockholders are also able to obtain a copy of the Registration Statement, including the proxy statement/prospectus,

and other documents filed with the SEC without charge, by directing a request to Nocturne Acquisition Corporation, P.O Box 25739, Santa

Ana, CA 92799, Attention Thomas Ao. The preliminary and definitive proxy statement/prospectus included in the Registration Statement

can also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants

in the Solicitation

Nocturne,

Cognos and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Nocturne's

shareholders in connection with the proposed business combination. Information about Nocturne’s directors and executive officers

and their ownership of Nocturne’s securities is set forth in Nocturne’s filings with the SEC. Additional information regarding

the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained

by reading the Registration Statement when it becomes available. You may obtain free copies of these documents as described in the preceding

paragraph.

Non-Solicitation

This

communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Nocturne,

the combined company or Cognos, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Frank

Adell

Chief

Executive Officer

Cognos

Therapeutics, Inc

10/23/2023

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From Apr 2024 to May 2024

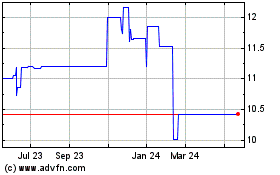

Nocturne Acquisition (NASDAQ:MBTCU)

Historical Stock Chart

From May 2023 to May 2024