Company Provides 2024 Results of Operations

16 April 2024 - 9:00PM

The Singing Machine Company, Inc. (“Singing Machine”) (NASDAQ:

MICS) – the worldwide leader in consumer karaoke

products, today announced its results of operations for the

nine-month period ended December 31, 2023. The Company has

historically reported on a March 31 fiscal year end and

transitioned to a December 31 fiscal year end with the Transition

Period Annual Report released today.

“We are pleased to provide a comprehensive

update on the Company’s financial results of operations,” commented

Gary Atkinson, CEO of the Singing Machine. “Overall, we saw a

broadly weakened retail environment for much of 2023, with the

Christmas retail season being marginally improved relative to the

2022 season. The backdrop of a potential recession, inflation and

high interest rates played a large role in overall retail

sentiment.”

“Despite these headwinds, we saw a number of

positive developments. We saw increased demand for our higher-end

products, particularly our WiFi enabled products that sold very

well. We also saw music subscription sales increase 35% year over

year. We saw real strength in our best, highest-margin offerings,

and this is where we intend to drive growth and profitability in

the future.”

“We see the karaoke market further separating

into two very distinct sub-markets. First, there are the

competitors that deliver technology-enabled, sophisticated products

that command a higher average sales price. Then there are the more

promotional, less-proprietary offerings that are price-driven. We

are systematically driving our product mix towards the higher-end,

higher-margin end of this spectrum.”

“Together with our strategic partners at

Stingray, we are focused on driving consumers to a best-in-class

product, coupled with an industry-leading content app. Our newest

version app has been rebuilt from the ground-up to support direct

integration into our karaoke devices, automotive infotainment

systems, and smart TVs. Our goal is to leverage Stingray’s

world-wide, industry-leading digital music library to extend our

karaoke hardware into more devices and more applications. Our

consumer strategy remains to leverage strong product placement

through our retail partners with a recurring revenue model that

leverages our brand, our market share, and our technology going

forward,” concluded Mr. Atkinson.

Results of operations are summarized as

follows:

- Revenues: Net

sales for the nine-month transition period ended December 31, 2023

were approximately $29.2 million, representing a decrease of

approximately $6.7 million (18.7%) from approximately $35.9 million

for the same period in 2022 (unaudited).

- We experienced a decrease in net

sales to four of our five major customers in the Transition Period

in 2023 as compared to the same period in 2022 (unaudited). The two

largest single declines in sales by customer were Amazon and Sam’s

Club. Sam’s Club elected to reduce the number of products it

carried during the Christmas retail season, whereas Amazon

experienced across the board decreases in all product lines.

- Among the Company’s top 5 accounts,

only Costco experienced significant growth, which was primarily

attributable to approximately $3.0 million in new business from new

business with Costco Canada.

- Gross Profits:

Gross profit for the Transition Period in 2023 was approximately

$6.2 million, or 21.2% of net sales, compared to approximately $8.4

million, or 23.5% of sales for the same period in 2022 (unaudited).

This represented a decrease of approximately $2.2 million or 26.6%.

- The overall decrease in net sales

accounted for approximately $1.6 million of the decrease.

- The remaining decrease in gross

profit margins was the result of a 2.3% percentage point decrease

in gross margins.

- The decrease was entirely due to an

approximate $1.8 million non-cash impairment to inventory recorded

during the Transition Period in 2023.

- Excluding the negative impact of

this impairment, gross margins improved to 27.4% for the nine-month

period ended December 31, 2023, as compared to 23.5% for the same

period in the prior year (unaudited).

- This improvement was largely

attributable to the increase in higher margin sales of newer

streaming technology karaoke machines as percentage of total

sales.

- Operating

Expenses: Total operating expenses were approximately

$12.3 million for the nine-months ended December 31, 2023, as

compared to approximately $10.0 million for the same period in the

prior year.

- The approximately $2.3 million

increase was primarily due to $0.9 million in increased advertising

expenses paid during the period. The Company took a more aggressive

approach to direct-to-consumer marketing in anticipation of a

challenging retail environment.

- The remaining $1.4 million increase

in operating expenses was almost entirely attributable to one-time,

non-recurring expenses. First, the Company spent $0.9 million on

the launch of its hospitality concept, which has been discontinued.

The Company also incurred $0.4 million in expenses related to the

closure and outsourcing of its logistics operations formerly in

Ontario, CA. Lastly, the Company also incurred $0.2 million in

one-time accounting expenses and $0.2 million in one-time

advertising expenses with its former parent, Ault Alliance.

- Excluding the expenses detailed

above, all other operating costs decreased $0.2 for the nine-months

ended December 31, 2023 due to strict cost control measures.

- Net Income: The

Company reported a net loss of $6. 4 million for the nine months

ended December 31, 2024, as compared to a net loss of $1.7 million

for the same period in the prior year.

About The Singing Machine

The Singing Machine Company, Inc. is the

worldwide leader in consumer karaoke products. Based in Fort

Lauderdale, Florida, and founded over forty years ago, the Company

designs and distributes the industry's widest assortment of at-home

and in-car karaoke entertainment products. Their portfolio is

marketed under both proprietary brands and popular licenses,

including Carpool Karaoke and Sesame Street. Singing Machine

products incorporate the latest technology and provide access to

over 100,000 songs for streaming through its mobile app and select

WiFi-capable products and is also developing the world’s first

globally available, fully integrated in-car karaoke system. The

Company also has a new philanthropic initiative, CARE-eoke by

Singing Machine, to focus on the social impact of karaoke for

children and adults of all ages who would benefit from singing.

Their products are sold in over 25,000 locations worldwide,

including Amazon, Costco, Sam’s Club, Target, and Walmart. To learn

more, go to www.singingmachine.com.

Investor Relations

Contact:investors@singingmachine.comwww.singingmachine.comwww.singingmachine.com/investors

The Singing Machine Company, Inc. and

SubsidiariesCONSOLIDATED BALANCE

SHEETS

|

|

|

December 31, 2023 |

|

|

March 31, 2023 |

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

6,703,000 |

|

|

$ |

2,895,000 |

|

|

Accounts receivable, net of allowances of $174,000 and $166,000,

respectively |

|

|

7,308,000 |

|

|

|

2,075,000 |

|

|

Accounts receivable related parties |

|

|

269,000 |

|

|

|

239,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Inventory |

|

|

6,871,000 |

|

|

|

9,085,000 |

|

|

Returns asset |

|

|

1,919,000 |

|

|

|

555,000 |

|

|

Prepaid expenses and other current assets |

|

|

136,000 |

|

|

|

351,000 |

|

|

Total Current Assets |

|

|

23,206,000 |

|

|

|

15,200,000 |

|

|

|

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

404,000 |

|

|

|

633,000 |

|

| Operating leases -

right of use assets |

|

|

3,926,000 |

|

|

|

561,000 |

|

| Other non-current

assets |

|

|

179,000 |

|

|

|

255,000 |

|

|

Total Assets |

|

$ |

27,715,000 |

|

|

$ |

16,649,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

7,616,000 |

|

|

$ |

1,769,000 |

|

|

Accrued expenses |

|

|

2,614,000 |

|

|

|

2,266,000 |

|

|

Refund due to customer |

|

|

1,743,000 |

|

|

|

- |

|

|

Customer prepayments |

|

|

687,000 |

|

|

|

583,000 |

|

|

Reserve for sales returns |

|

|

3,390,000 |

|

|

|

900,000 |

|

|

Other current liabilities |

|

|

75,000 |

|

|

|

99,000 |

|

|

Current portion of operating lease liabilities |

|

|

84,000 |

|

|

|

509,000 |

|

|

Total Current Liabilities |

|

|

16,209,000 |

|

|

|

6,126,000 |

|

| |

|

|

|

|

|

|

|

|

| Other liabilities, net

of current portion |

|

|

3,000 |

|

|

|

104,000 |

|

| Operating lease

liabilities, net of current portion |

|

|

3,925,000 |

|

|

|

88,000 |

|

|

Total Liabilities |

|

|

20,137,000 |

|

|

|

6,318,000 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value; 1,000,000 shares authorized; no

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock $0.01 par value; 100,000,000 shares authorized;

6,418,061 issued and outstanding at December 31, 2023 and 3,184,439

issued and 3,167,489 outstanding at March 31, 2023 |

|

|

64,000 |

|

|

|

32,000 |

|

|

Additional paid-in capital |

|

|

33,429,000 |

|

|

|

29,822,000 |

|

|

Subscriptions receivable |

|

|

- |

|

|

|

(6,000 |

) |

|

Accumulated deficit |

|

|

(25,915,000 |

) |

|

|

(19,517,000 |

) |

|

Total Shareholders’ Equity |

|

|

7,578,000 |

|

|

|

10,331,000 |

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

27,715,000 |

|

|

$ |

16,649,000 |

|

The Singing Machine Company, Inc. and

SubsidiariesCONSOLIDATED STATEMENTS OF

OPERATIONS

| |

|

Nine Months Ended |

|

|

Years Ended |

|

| |

|

December 31, 2023 |

|

|

March 31, 2023 |

|

|

March 31, 2022 |

|

| |

|

|

|

|

|

|

|

|

|

| Net

Sales |

|

$ |

29,198,000 |

|

|

$ |

39,299,000 |

|

|

$ |

47,512,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Goods

Sold |

|

|

23,008,000 |

|

|

|

30,090,000 |

|

|

|

36,697,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

Profit |

|

|

6,190,000 |

|

|

|

9,209,000 |

|

|

|

10,815,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

3,717,000 |

|

|

|

3,442,000 |

|

|

|

3,589,000 |

|

|

General and administrative expenses |

|

|

8,616,000 |

|

|

|

9,465,000 |

|

|

|

7,157,000 |

|

| Total Operating

Expenses |

|

|

12,333,000 |

|

|

|

12,907,000 |

|

|

|

10,746,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Income from

Operations |

|

|

(6,143,000 |

) |

|

|

(3,698,000 |

) |

|

|

69,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other (Expenses)

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on disposal of fixed assets |

|

|

44,000 |

|

|

|

- |

|

|

|

- |

|

|

Gain - related party |

|

|

- |

|

|

|

- |

|

|

|

11,000 |

|

|

Gain from extinguishment of PPP loan forgiveness |

|

|

- |

|

|

|

- |

|

|

|

448,000 |

|

|

Gain from Employee Retension Credit Program refund |

|

|

- |

|

|

|

704,000 |

|

|

|

- |

|

|

Gain from settlement of accounts payable |

|

|

- |

|

|

|

48,000 |

|

|

|

339,000 |

|

|

Loss from extinguishment of debt |

|

|

- |

|

|

|

(183,000 |

) |

|

|

- |

|

|

Interest expense |

|

|

(299,000 |

) |

|

|

(479,000 |

) |

|

|

(580,000 |

) |

| Total Other (Expenses)

Income, net |

|

|

(255,000 |

) |

|

|

90,000 |

|

|

|

218,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Income Before

Income Tax Benefit |

|

|

(6,398,000 |

) |

|

|

(3,608,000 |

) |

|

|

287,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income Tax Benefit

(Provision) |

|

|

- |

|

|

|

(1,030,000 |

) |

|

|

(57,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net (Loss)

Income |

|

$ |

(6,398,000 |

) |

|

$ |

(4,638,000 |

) |

|

$ |

230,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per Common

Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.32 |

) |

|

$ |

(1.65 |

) |

|

$ |

0.14 |

|

|

Diluted |

|

$ |

(1.32 |

) |

|

$ |

(1.65 |

) |

|

$ |

0.14 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Common and Common |

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent

Shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

4,864,540 |

|

|

|

2,811,872 |

|

|

|

1,614,506 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

4,864,540 |

|

|

|

2,811,872 |

|

|

|

1,623,397 |

|

The Singing Machine Company, Inc. and

SubsidiariesCONSOLIDATED STATEMENTS OF CASH

FLOWS

|

|

|

For the Nine Months Ended |

|

|

For the Fiscal Years Ended |

|

|

|

|

December 31, 2023 |

|

|

March 31, 2023 |

|

|

March 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(6,398,000 |

) |

|

$ |

(4,638,000 |

) |

|

$ |

230,000 |

|

|

Adjustments to reconcile net (loss) income to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

287,000 |

|

|

|

228,000 |

|

|

|

246,000 |

|

|

Amortization of deferred financing costs |

|

|

- |

|

|

|

47,000 |

|

|

|

45,000 |

|

|

Provision for estimated cost of returns |

|

|

(1,364,000 |

) |

|

|

128,000 |

|

|

|

(156,000 |

) |

|

Provision for inventory obsolesence |

|

|

1,798,000 |

|

|

|

536,000 |

|

|

|

(272,000 |

) |

|

Credit losses |

|

|

8,000 |

|

|

|

43,000 |

|

|

|

(16,000 |

) |

|

(Gain) loss from disposal of property and equipment |

|

|

(44,000 |

) |

|

|

3,000 |

|

|

|

4,000 |

|

|

Stock based compensation |

|

|

110,000 |

|

|

|

382,000 |

|

|

|

44,000 |

|

|

Amortization of right of use assets |

|

|

510,000 |

|

|

|

718,000 |

|

|

|

795,000 |

|

|

Change in net deferred tax assets |

|

|

- |

|

|

|

893,000 |

|

|

|

(5,000 |

) |

|

Loss on debt extinguishment |

|

|

- |

|

|

|

183,000 |

|

|

|

- |

|

|

Paycheck Protection Plan loan forgiveness |

|

|

- |

|

|

|

- |

|

|

|

(448,000 |

) |

|

Gain - related party |

|

|

- |

|

|

|

- |

|

|

|

(11,000 |

) |

|

Gain from extinguishment of accounts payable |

|

|

- |

|

|

|

(48,000 |

) |

|

|

(339,000 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(5,241,000 |

) |

|

|

667,000 |

|

|

|

(558,000 |

) |

|

Accounts receivable – related parties |

|

|

(30,000 |

) |

|

|

(87,000 |

) |

|

|

(64,000 |

) |

|

Due from banks |

|

|

- |

|

|

|

101,000 |

|

|

|

4,456,000 |

|

|

Inventories |

|

|

415,000 |

|

|

|

3,858,000 |

|

|

|

(8,244,000 |

) |

|

Prepaid expenses and other current assets |

|

|

215,000 |

|

|

|

78,000 |

|

|

|

(123,000 |

) |

|

Other non-current assets |

|

|

76,000 |

|

|

|

(38,000 |

) |

|

|

61,000 |

|

|

Accounts payable |

|

|

5,847,000 |

|

|

|

(3,511,000 |

) |

|

|

3,217,000 |

|

|

Accrued expenses |

|

|

348,000 |

|

|

|

533,000 |

|

|

|

77,000 |

|

|

Due to related parties |

|

|

- |

|

|

|

(63,000 |

) |

|

|

- |

|

|

Refunds due to customer |

|

|

1,743,000 |

|

|

|

- |

|

|

|

(139,000 |

) |

|

Prepaids from customers |

|

|

103,000 |

|

|

|

485,000 |

|

|

|

(47,000 |

) |

|

Reserve for sales returns |

|

|

2,490,000 |

|

|

|

(90,000 |

) |

|

|

30,000 |

|

|

Operating lease liabilities |

|

|

(462,000 |

) |

|

|

(738,000 |

) |

|

|

(795,000 |

) |

|

Net cash provided by (used in) operating activities |

|

|

411,000 |

|

|

|

(330,000 |

) |

|

|

(2,012,000 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(68,000 |

) |

|

|

(244,000 |

) |

|

|

(118,000 |

) |

|

Disposal of property and equipment |

|

|

54,000 |

|

|

|

- |

|

|

|

- |

|

|

Net cash used in investing activities |

|

|

(14,000 |

) |

|

|

(244,000 |

) |

|

|

(118,000 |

) |

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of stock, net of offering costs |

|

|

3,529,000 |

|

|

|

3,393,000 |

|

|

|

9,001,000 |

|

|

Payment of redemption and retirement of treasury stock |

|

|

- |

|

|

|

- |

|

|

|

(7,162,000 |

) |

|

Collection of subscriptions receivable |

|

|

6,000 |

|

|

|

- |

|

|

|

- |

|

|

Net (payment) proceeds from revolving lines of credit |

|

|

- |

|

|

|

(2,500,000 |

) |

|

|

2,435,000 |

|

|

Payment of subordinated note payable - Starlight Marketing

Development, Ltd. |

|

|

- |

|

|

|

(353,000 |

) |

|

|

(150,000 |

) |

|

Payment of deferred financing charges |

|

|

- |

|

|

|

(254,000 |

) |

|

|

(38,000 |

) |

|

Payment of early termination fees on revolving lines of credit |

|

|

- |

|

|

|

(183,000 |

) |

|

|

- |

|

|

Payments on installment notes |

|

|

(124,000 |

) |

|

|

(74,000 |

) |

|

|

(68,000 |

) |

|

Proceeds from exercise of stock options |

|

|

- |

|

|

|

- |

|

|

|

14,000 |

|

|

Proceeds from exercise of common stock warrants |

|

|

- |

|

|

|

990,000 |

|

|

|

- |

|

|

Proceeds from exercise of pre-funded warrants |

|

|

- |

|

|

|

168,000 |

|

|

|

- |

|

|

Payments on finance leases |

|

|

- |

|

|

|

(9,000 |

) |

|

|

(8,000 |

) |

|

Net cash provided by financing activities |

|

|

3,411,000 |

|

|

|

1,178,000 |

|

|

|

4,024,000 |

|

| Net change in

cash |

|

|

3,808,000 |

|

|

|

604,000 |

|

|

|

1,894,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash at beginning of

year |

|

|

2,895,000 |

|

|

|

2,291,000 |

|

|

|

397,000 |

|

| Cash at end of

period |

|

$ |

6,703,000 |

|

|

$ |

2,895,000 |

|

|

$ |

2,291,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

44,000 |

|

|

$ |

481,000 |

|

|

$ |

547,000 |

|

|

Cash paid for income taxes |

|

$ |

- |

|

|

$ |

34,000 |

|

|

$ |

- |

|

| Non-Cash investing and

financing cash flow information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equipment purchased under capital lease |

|

$ |

- |

|

|

$ |

55,000 |

|

|

$ |

24,000 |

|

|

Issuance of common stock and warrants for offering costs |

|

$ |

- |

|

|

$ |

244,000 |

|

|

$ |

548,000 |

|

|

Right of use assets exchanged for lease liabilities |

|

$ |

3,874,000 |

|

|

$ |

192,000 |

|

|

$ |

16,000 |

|

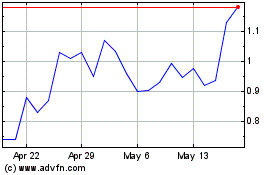

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Jan 2024 to Jan 2025