Mercury Systems, Inc. (NASDAQ: MRCY, www.mrcy.com), reported

operating results for the second quarter of fiscal year 2025, ended

December 27, 2024.

“We delivered solid results in the second quarter

of fiscal 2025 that were once again in line with or ahead of our

expectations, and I’m optimistic about our ongoing efforts to

improve performance as we move through the fiscal year,” said Bill

Ballhaus, Mercury’s Chairman and CEO.

“In the quarter we secured bookings of $242.4

million, for a trailing-twelve-month book-to-bill of 1.12; revenue

of $223.1 million, up 13% year-over-year; adjusted EBITDA of $22.0

million and adjusted EBITDA margin of 9.9%, both up substantially

year-over-year; and record free cash flow of $81.9 million, up

$44.4 million year-over-year. These results reflect continued

progress in each of our four priority areas, highlighted by solid

execution across our broad portfolio of production and development

programs, a record backlog of $1.4 billion, reduced operating

expenses enabling increased positive operating leverage, and

continued progress on free cash flow drivers, with net working

capital down $114.9 million year-over-year.”

Second Quarter

Fiscal 2025 Results

Total Company second quarter fiscal 2025 revenues

were $223.1 million, compared to $197.5 million in the second

quarter of fiscal 2024.

Total bookings for the second quarter of fiscal

2025 were $242.4 million, yielding a book-to-bill ratio of 1.09 for

the quarter.

Total Company GAAP net loss and loss per share for

the second quarter of fiscal 2025 were $17.6 million, and $0.30,

respectively, compared to GAAP net loss and loss per share of $45.6

million, and $0.79, respectively, for the second quarter of fiscal

2024. Adjusted earnings (loss) per share (“adjusted EPS”) was $0.07

per share for the second quarter of fiscal 2025, compared to

$(0.42) per share in the second quarter of fiscal 2024.

Second quarter fiscal 2025 adjusted EBITDA for the

total Company was $22.0 million, compared to $(21.3) million for

the second quarter of fiscal 2024.

Cash flows provided by operating activities in the

second quarter of fiscal 2025 were $85.5 million, compared to $45.5

million in the second quarter of fiscal 2024. Free cash flow,

defined as cash flows from operating activities less capital

expenditures for property and equipment, was $81.9 million for the

second quarter of fiscal 2025 and $37.5 million for the second

quarter of fiscal 2024.

Backlog

Mercury’s total backlog at December 27, 2024 was

$1.4 billion, an approximate $80.0 million increase from a year

ago. Of the December 27, 2024 total backlog, $789.9 million

represents orders expected to be recognized as revenue within the

next 12 months.

Conference Call Information

Management will host a conference call and

simultaneous webcast at 5:00 p.m. ET on Tuesday, February 4,

2025, to discuss Mercury's quarterly financial results, business

highlights and outlook. In addition, Company representatives may

answer questions concerning business and financial developments and

trends, the Company's view on earnings forecasts, and other

business and financial matters affecting the Company, the responses

to which may contain information that has not been previously

disclosed.

To attend the conference call or webcast,

participants should register online at

ir.mrcy.com/events-presentations. Participants are requested to

register a day in advance or at a minimum 15 minutes before the

start of the call. A replay of the webcast will be available two

hours after the call and archived on the same web page for six

months.

Use of Non-GAAP Financial Measures

In addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, the Company

provides adjusted EBITDA, adjusted income, adjusted earnings per

share (“adjusted EPS”) and free cash flow, which are non-GAAP

financial measures. Adjusted EBITDA, adjusted income, and adjusted

EPS exclude certain non-cash and other specified charges. The

Company believes these non-GAAP financial measures are useful to

help investors understand its past financial performance and

prospects for the future. However, these non-GAAP measures should

not be considered in isolation or as a substitute for financial

information provided in accordance with GAAP. Management believes

these non-GAAP measures assist in providing a more complete

understanding of the Company’s underlying operational results and

trends, and management uses these measures along with the

corresponding GAAP financial measures to manage the Company’s

business, to evaluate its performance compared to prior periods and

the marketplace, and to establish operational goals. A

reconciliation of GAAP to non-GAAP financial results discussed in

this press release is contained in the attached exhibits.

Mercury Systems – Innovation that

Matters®Mercury Systems is a technology company that

delivers mission-critical processing power to the edge, making

advanced technologies profoundly more accessible for today’s most

challenging aerospace and defense missions. The Mercury Processing

Platform allows customers to tap into innovative capabilities from

silicon to system scale, turning data into decisions on timelines

that matter. Mercury’s products and solutions are deployed in more

than 300 programs and across 35 countries, enabling a broad range

of applications in mission computing, sensor processing, command

and control, and communications. Mercury is headquartered in

Andover, Massachusetts, and has 23 locations worldwide. To learn

more, visit mrcy.com. (Nasdaq: MRCY)

Investors and others should note that we announce

material financial information using our website (www.mrcy.com),

SEC filings, press releases, public conference calls, webcasts, and

social media, including X (X.com/mrcy) and LinkedIn

(www.linkedin.com/company/mercury-systems). Therefore, we encourage

investors and others interested in Mercury to review the

information we post on the social media and other communication

channels listed on our website.

Forward-Looking Safe Harbor

Statement

This press release contains certain forward-looking

statements, as that term is defined in the Private Securities

Litigation Reform Act of 1995, including those relating to the

Company's focus on enhanced execution of the Company's strategic

plan under a refreshed Board and leadership team. You can identify

these statements by the words “may,” “will,” “could,” “should,”

“would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,”

“project,” “intend,” “likely,” “forecast,” “probable,” “potential,”

and similar expressions. These forward-looking statements involve

risks and uncertainties that could cause actual results to differ

materially from those projected or anticipated. Such risks and

uncertainties include, but are not limited to, continued funding of

defense programs, the timing and amounts of such funding, general

economic and business conditions, including unforeseen weakness in

the Company’s markets, effects of any U.S. federal government

shutdown or extended continuing resolution, effects of geopolitical

unrest and regional conflicts, competition, changes in technology

and methods of marketing, delays in or cost increases related to

completing development, engineering and manufacturing programs,

changes in customer order patterns, changes in product mix,

continued success in technological advances and delivering

technological innovations, changes in, or in the U.S. government’s

interpretation of, federal export control or procurement rules and

regulations, including tariffs, changes in, or in the

interpretation or enforcement of, environmental rules and

regulations, market acceptance of the Company's products, shortages

in or delays in receiving components, supply chain delays or

volatility for critical components, production delays or

unanticipated expenses including due to quality issues or

manufacturing execution issues, adherence to required manufacturing

standards, capacity underutilization, increases in scrap or

inventory write-offs, failure to achieve or maintain manufacturing

quality certifications, such as AS9100, the impact of supply chain

disruption, inflation and labor shortages, among other things, on

program execution and the resulting effect on customer

satisfaction, inability to fully realize the expected benefits from

acquisitions, restructurings, and operational efficiency

initiatives or delays in realizing such benefits, challenges in

integrating acquired businesses and achieving anticipated

synergies, effects of shareholder activism, increases in interest

rates, changes to industrial security and cyber-security

regulations and requirements and impacts from any cyber or insider

threat events, changes in tax rates or tax regulations, such as the

deductibility of internal research and development, changes to

interest rate swaps or other cash flow hedging arrangements,

changes to generally accepted accounting principles, difficulties

in retaining key employees and customers, litigation, including the

dispute arising with the former CEO over his resignation,

unanticipated costs under fixed-price service and system

integration engagements, and various other factors beyond our

control. These risks and uncertainties also include such additional

risk factors as are discussed in the Company's filings with the

U.S. Securities and Exchange Commission, including its Annual

Report on Form 10-K for the fiscal year ended June 28, 2024 and

subsequent Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. The Company cautions readers not to place undue reliance

upon any such forward-looking statements, which speak only as of

the date made. The Company undertakes no obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which such statement is made.

Contact:Tyler Hojo, CFA, Vice President of Investor

RelationsMercury Systems, Inc.978-967-3676

Mercury Systems and Innovation That Matters are

registered trademarks of Mercury Systems, Inc. Other product and

company names mentioned may be trademarks and/or registered

trademarks of their respective holders.

|

MERCURY SYSTEMS, INC. |

|

|

UNAUDITED CONSOLIDATED BALANCE SHEETS |

|

|

(In thousands) |

|

|

|

| |

December 27, |

|

June 28, |

|

|

|

2024 |

|

|

|

2024 |

|

| |

|

|

|

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

242,565 |

|

|

$ |

180,521 |

|

|

Accounts receivable, net |

|

104,491 |

|

|

|

111,441 |

|

|

Unbilled receivables and costs in excess of billings, net |

|

278,657 |

|

|

|

304,029 |

|

|

Inventory |

|

344,415 |

|

|

|

335,300 |

|

|

Prepaid expenses and other current assets |

|

20,556 |

|

|

|

22,493 |

|

|

Total current assets |

|

990,684 |

|

|

|

953,784 |

|

| |

|

|

|

|

Property and equipment, net |

|

111,459 |

|

|

|

110,353 |

|

|

Goodwill |

|

938,093 |

|

|

|

938,093 |

|

|

Intangible assets, net |

|

226,142 |

|

|

|

250,512 |

|

|

Operating lease right-of-use assets, net |

|

56,525 |

|

|

|

60,860 |

|

|

Deferred tax asset |

|

71,712 |

|

|

|

58,612 |

|

|

Other non-current assets |

|

6,840 |

|

|

|

6,691 |

|

|

Total assets |

$ |

2,401,455 |

|

|

$ |

2,378,905 |

|

| |

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

64,778 |

|

|

$ |

81,068 |

|

|

Accrued expenses |

|

40,471 |

|

|

|

42,926 |

|

|

Accrued compensation |

|

32,015 |

|

|

|

36,398 |

|

|

Income taxes payable |

|

306 |

|

|

|

109 |

|

|

Deferred revenues and customer advances |

|

135,963 |

|

|

|

73,915 |

|

|

Total current liabilities |

|

273,533 |

|

|

|

234,416 |

|

| |

|

|

|

|

Income taxes payable |

|

7,713 |

|

|

|

7,713 |

|

|

Long-term debt |

|

591,500 |

|

|

|

591,500 |

|

|

Operating lease liabilities |

|

57,805 |

|

|

|

62,584 |

|

|

Other non-current liabilities |

|

10,628 |

|

|

|

9,917 |

|

|

Total liabilities |

|

941,179 |

|

|

|

906,130 |

|

| |

|

|

|

|

Shareholders’ equity: |

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

587 |

|

|

|

581 |

|

|

Additional paid-in capital |

|

1,266,926 |

|

|

|

1,242,402 |

|

|

Retained earnings |

|

184,695 |

|

|

|

219,799 |

|

|

Accumulated other comprehensive income |

|

8,068 |

|

|

|

9,993 |

|

|

Total shareholders’ equity |

|

1,460,276 |

|

|

|

1,472,775 |

|

|

Total liabilities and shareholders’ equity |

$ |

2,401,455 |

|

|

$ |

2,378,905 |

|

|

MERCURY SYSTEMS, INC. |

|

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

|

|

|

(In thousands, except per share data) |

| |

Second Quarters Ended |

|

Six Months Ended |

| |

December 27, 2024 |

|

December 29, 2023 |

|

December 27, 2024 |

|

December 29, 2023 |

|

Net revenues |

$ |

223,125 |

|

|

$ |

197,463 |

|

|

$ |

427,556 |

|

|

$ |

378,454 |

|

|

Cost of revenues(1) |

|

162,299 |

|

|

|

165,943 |

|

|

|

314,940 |

|

|

|

296,407 |

|

|

Gross margin |

|

60,826 |

|

|

|

31,520 |

|

|

|

112,616 |

|

|

|

82,047 |

|

| |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative(1) |

|

40,501 |

|

|

|

44,470 |

|

|

|

73,654 |

|

|

|

80,264 |

|

|

Research and development(1) |

|

21,368 |

|

|

|

28,476 |

|

|

|

39,751 |

|

|

|

60,348 |

|

|

Amortization of intangible assets |

|

11,154 |

|

|

|

12,270 |

|

|

|

22,389 |

|

|

|

24,817 |

|

|

Restructuring and other charges |

|

40 |

|

|

|

2 |

|

|

|

2,300 |

|

|

|

9,548 |

|

|

Acquisition costs and other related expenses |

|

178 |

|

|

|

231 |

|

|

|

355 |

|

|

|

1,200 |

|

|

Total operating expenses |

|

73,241 |

|

|

|

85,449 |

|

|

|

138,449 |

|

|

|

176,177 |

|

| |

|

|

|

|

|

|

|

|

Loss from operations |

|

(12,415 |

) |

|

|

(53,929 |

) |

|

|

(25,833 |

) |

|

|

(94,130 |

) |

| |

|

|

|

|

|

|

|

|

Interest income |

|

406 |

|

|

|

29 |

|

|

|

950 |

|

|

|

132 |

|

|

Interest expense |

|

(8,430 |

) |

|

|

(8,674 |

) |

|

|

(17,336 |

) |

|

|

(16,537 |

) |

|

Other expense, net |

|

(3,865 |

) |

|

|

(1,148 |

) |

|

|

(5,204 |

) |

|

|

(2,922 |

) |

| |

|

|

|

|

|

|

|

|

Loss before income tax benefit |

|

(24,304 |

) |

|

|

(63,722 |

) |

|

|

(47,423 |

) |

|

|

(113,457 |

) |

|

Income tax benefit |

|

(6,725 |

) |

|

|

(18,141 |

) |

|

|

(12,319 |

) |

|

|

(31,168 |

) |

|

Net loss |

$ |

(17,579 |

) |

|

$ |

(45,581 |

) |

|

$ |

(35,104 |

) |

|

$ |

(82,289 |

) |

| |

|

|

|

|

|

|

|

|

Basic net loss per share |

$ |

(0.30 |

) |

|

$ |

(0.79 |

) |

|

$ |

(0.60 |

) |

|

$ |

(1.44 |

) |

| |

|

|

|

|

|

|

|

|

Diluted net loss per share |

$ |

(0.30 |

) |

|

$ |

(0.79 |

) |

|

$ |

(0.60 |

) |

|

$ |

(1.44 |

) |

| |

|

|

|

|

|

|

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

58,561 |

|

|

|

57,424 |

|

|

|

58,454 |

|

|

|

57,314 |

|

|

Diluted |

|

58,561 |

|

|

|

57,424 |

|

|

|

58,454 |

|

|

|

57,314 |

|

| |

|

|

|

|

|

|

|

|

(1) Includes stock-based compensation expense, allocated as

follows: |

|

Cost of revenues |

$ |

(167 |

) |

|

$ |

4 |

|

|

$ |

(54 |

) |

|

$ |

820 |

|

|

Selling, general and administrative |

$ |

6,317 |

|

|

$ |

5,742 |

|

|

$ |

10,928 |

|

|

$ |

7,503 |

|

|

Research and development |

$ |

1,812 |

|

|

$ |

1,640 |

|

|

$ |

3,180 |

|

|

$ |

3,180 |

|

|

MERCURY SYSTEMS, INC. |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In thousands) |

| |

Second Quarters Ended |

|

Six Months Ended |

| |

December 27, 2024 |

|

December 29, 2023 |

|

December 27, 2024 |

|

December 29, 2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(17,579 |

) |

|

$ |

(45,581 |

) |

|

$ |

(35,104 |

) |

|

$ |

(82,289 |

) |

|

Depreciation and amortization |

|

20,922 |

|

|

|

22,193 |

|

|

|

42,142 |

|

|

|

44,885 |

|

|

Other non-cash items, net |

|

5,083 |

|

|

|

1,640 |

|

|

|

10,685 |

|

|

|

(2,011 |

) |

|

Cash settlement for termination of interest rate swap |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,403 |

|

|

Changes in operating assets and liabilities |

|

77,036 |

|

|

|

67,242 |

|

|

|

53,079 |

|

|

|

38,438 |

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

85,462 |

|

|

|

45,494 |

|

|

|

70,802 |

|

|

|

6,426 |

|

| |

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

$ |

(3,555 |

) |

|

$ |

(7,990 |

) |

|

$ |

(9,791 |

) |

|

$ |

(16,005 |

) |

|

Other investing activities |

|

1,900 |

|

|

|

— |

|

|

|

1,900 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

(1,655 |

) |

|

|

(7,990 |

) |

|

|

(7,891 |

) |

|

|

(16,005 |

) |

| |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Proceeds from employee stock plans |

|

1,492 |

|

|

|

3,163 |

|

|

|

1,492 |

|

|

|

3,163 |

|

|

Borrowings under credit facilities |

|

— |

|

|

|

40,000 |

|

|

|

— |

|

|

|

105,000 |

|

|

Payments of deferred financing and offering costs |

|

— |

|

|

|

(1,931 |

) |

|

|

(2,249 |

) |

|

|

(1,931 |

) |

|

Payments for retirement of common stock |

|

— |

|

|

|

(15 |

) |

|

|

— |

|

|

|

(15 |

) |

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities |

|

1,492 |

|

|

|

41,217 |

|

|

|

(757 |

) |

|

|

106,217 |

|

| |

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(857 |

) |

|

|

556 |

|

|

|

(110 |

) |

|

|

445 |

|

| |

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents |

|

84,442 |

|

|

|

79,277 |

|

|

|

62,044 |

|

|

|

97,083 |

|

| |

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

158,123 |

|

|

|

89,369 |

|

|

|

180,521 |

|

|

|

71,563 |

|

| |

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

$ |

242,565 |

|

|

$ |

168,646 |

|

|

$ |

242,565 |

|

|

$ |

168,646 |

|

|

UNAUDITED SUPPLEMENTAL INFORMATION RECONCILIATION OF GAAP

TO NON-GAAP MEASURES |

|

(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA, a non-GAAP measure for reporting

financial performance, excludes the impact of certain items and,

therefore, has not been calculated in accordance with GAAP.

Management believes that exclusion of these items assists in

providing a more complete understanding of the Company’s underlying

results and trends, and management uses these measures along with

the corresponding GAAP financial measures to manage the Company’s

business, to evaluate its performance compared to prior periods and

the marketplace, and to establish operational goals. The

adjustments to calculate this non-GAAP financial measure, and the

basis for such adjustments, are outlined below:

Other non-operating adjustments. The Company

records other non-operating adjustments such as gains or losses on

foreign currency remeasurement, investments and fixed asset sales

or disposals among other adjustments. These adjustments may vary

from period to period without any direct correlation to underlying

operating performance.

Interest income and expense. The Company receives

interest income on investments and incurs interest expense on

loans, financing leases and other financing arrangements. These

amounts may vary from period to period due to changes in cash and

debt balances and interest rates driven by general market

conditions or other circumstances which may be outside of the

normal course of the Company’s operations.

Income taxes. The Company’s GAAP tax expense can

fluctuate materially from period to period due to tax adjustments

that are not directly related to underlying operating performance

or to the current period of operations.

Depreciation. The Company incurs depreciation

expense related to capital assets purchased to support the ongoing

operations of the business. These assets are recorded at cost or

fair value and are depreciated using the straight-line method over

the useful life of the asset. Purchases of such assets may vary

significantly from period to period and without any direct

correlation to underlying operating performance.

Amortization of intangible assets. The Company

incurs amortization of intangible assets primarily as a result of

acquired intangible assets such as backlog, customer relationships

and completed technologies but also due to licenses, patents and

other arrangements. These intangible assets are valued at the time

of acquisition or upon receipt of right to use the asset, amortized

over the requisite life and generally cannot be changed or

influenced by management after acquisition.

Restructuring and other charges. The Company incurs

restructuring and other charges in connection with management’s

decisions to undertake certain actions to realign operating

expenses through workforce reductions and the closure of certain

Company facilities, businesses and product lines. The Company’s

adjustments reflected in restructuring and other charges are

typically related to acquisitions and organizational redesign

programs initiated as part of discrete post-acquisition integration

activities. Management believes these items are non-routine and may

not be indicative of ongoing operating results.

Impairment of long-lived assets. The Company incurs

impairment charges of long-lived assets based on events that may or

may not be within the control of management. Management believes

these items are outside the normal operations of the Company’s

business and are not indicative of ongoing operating results.

Acquisition, financing and other third party costs.

The Company incurs transaction costs related to acquisition and

potential acquisition opportunities, such as legal, accounting, and

other third party advisory fees. The Company may also incur third

party costs, such as legal, banking, communications, proxy

solicitation, and other third party advisory fees in connection

with engagements by activist investors or unsolicited acquisition

offers. Although the Company may incur such third party costs and

other related charges and adjustments, it is not indicative that

any transaction will be consummated. Additionally, the Company

incurs unused revolver and bank fees associated with maintaining

its credit facility as well as non-cash financing expenses

associated with obtaining its credit facility. Management believes

these items are outside the normal operations of the Company’s

business and are not indicative of ongoing operating results.

Fair value adjustments from purchase accounting. As

a result of applying purchase accounting rules to acquired assets

and liabilities, certain fair value adjustments are recorded in the

opening balance sheet of acquired companies. These adjustments

are then reflected in the Company’s income statements in periods

subsequent to the acquisition. In addition, the impact of any

changes to originally recorded contingent consideration amounts are

reflected in the income statements in the period of the change.

Management believes these items are outside the normal operations

of the Company and are not indicative of ongoing operating

results.

Litigation and settlement income and expense. The

Company periodically receives income and incurs expenses related to

pending claims and litigation and associated legal fees and

potential case settlements and/or judgments. Although the Company

may incur such costs and other related charges and adjustments, it

is not indicative of any particular outcome until the matter is

fully resolved. Management believes these items are outside the

normal operations of the Company’s business, often occur in periods

other than the period of activity, and are not indicative of

ongoing operating results. The Company periodically receives

warranty claims from customers and makes warranty claims towards

its vendors and supply chain. Management believes the expenses and

gains associated with these recurring warranty items are within the

normal operations and operating cycle of the Company’s business.

Therefore, management deems no adjustments are necessary unless

under extraordinary circumstances.

Stock-based and other non-cash compensation

expense. The Company incurs expense related to stock-based

compensation included in its GAAP presentation of cost of revenues,

selling, general and administrative expense and research and

development expense. The Company also incurs non-cash based

compensation in the form of pension related expenses and matching

contributions to its defined contribution plan. Although

stock-based and other non-cash compensation is an expense of the

Company and viewed as a form of compensation, these expenses vary

in amount from period to period, and are affected by market forces

that are difficult to predict and are not within the control of

management, such as the market price and volatility of the

Company’s shares, risk-free interest rates and the expected term

and forfeiture rates of the awards, as well as pension actuarial

assumptions. Management believes that exclusion of these expenses

allows comparisons of operating results to those of other

companies, both public, private or foreign, that disclose non-GAAP

financial measures that exclude stock-based compensation and other

non-cash compensation.

Mercury uses adjusted EBITDA as an important

indicator of the operating performance of its business. Management

excludes the above-described items from its internal forecasts and

models when establishing internal operating budgets, supplementing

the financial results and forecasts reported to the Company’s board

of directors, determining a portion of bonus compensation for

executive officers and other key employees based on operating

performance, evaluating short-term and long-term operating trends

in the Company’s operations, and allocating resources to various

initiatives and operational requirements. The Company believes that

adjusted EBITDA permits a comparative assessment of its operating

performance, relative to its performance based on its GAAP results,

while isolating the effects of charges that may vary from period to

period without direct correlation to underlying operating

performance. The Company believes that these non-GAAP financial

adjustments are useful to investors because they allow investors to

evaluate the effectiveness of the methodology and information used

by management in its financial and operational decision-making. The

Company believes that trends in its adjusted EBITDA are valuable

indicators of its operating performance.

Adjusted EBITDA is a non-GAAP financial measure and

should not be considered in isolation or as a substitute for

financial information provided in accordance with GAAP. This

non-GAAP financial measure may not be computed in the same manner

as similarly titled measures used by other companies. The Company

expects to continue to incur expenses similar to the adjusted

EBITDA financial adjustments described above, and investors should

not infer from the Company’s presentation of this non-GAAP

financial measure that these costs are unusual, infrequent or

non-recurring.

The following table reconciles the most directly

comparable GAAP financial measure to the non-GAAP financial

measure.

| |

Second Quarters Ended |

|

Six Months Ended |

| |

December 27, 2024 |

|

December 29, 2023 |

|

December 27, 2024 |

|

December 29, 2023 |

|

Net loss |

$ |

(17,579 |

) |

|

$ |

(45,581 |

) |

|

$ |

(35,104 |

) |

|

$ |

(82,289 |

) |

|

Other non-operating adjustments, net |

|

2,549 |

|

|

|

(1,042 |

) |

|

|

814 |

|

|

|

(311 |

) |

|

Interest expense, net |

|

8,024 |

|

|

|

8,645 |

|

|

|

16,386 |

|

|

|

16,405 |

|

|

Income tax benefit |

|

(6,725 |

) |

|

|

(18,141 |

) |

|

|

(12,319 |

) |

|

|

(31,168 |

) |

|

Depreciation |

|

9,768 |

|

|

|

9,923 |

|

|

|

19,753 |

|

|

|

20,068 |

|

|

Amortization of intangible assets |

|

11,154 |

|

|

|

12,270 |

|

|

|

22,389 |

|

|

|

24,817 |

|

|

Restructuring and other charges |

|

40 |

|

|

|

2 |

|

|

|

2,300 |

|

|

|

9,548 |

|

|

Impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Acquisition, financing and other third party costs |

|

1,109 |

|

|

|

860 |

|

|

|

3,440 |

|

|

|

2,192 |

|

|

Fair value adjustments from purchase accounting |

|

178 |

|

|

|

178 |

|

|

|

355 |

|

|

|

355 |

|

|

Litigation and settlement expense, net |

|

2,087 |

|

|

|

1,383 |

|

|

|

3,481 |

|

|

|

1,886 |

|

|

Stock-based and other non-cash compensation expense |

|

11,424 |

|

|

|

10,195 |

|

|

|

21,984 |

|

|

|

19,146 |

|

|

Adjusted EBITDA |

$ |

22,029 |

|

|

$ |

(21,308 |

) |

|

$ |

43,479 |

|

|

$ |

(19,351 |

) |

|

|

Free cash flow, a non-GAAP measure for reporting

cash flow, is defined as cash provided by operating activities less

capital expenditures for property and equipment, which includes

capitalized software development costs, and, therefore, has not

been calculated in accordance with GAAP. Management believes free

cash flow provides investors with an important perspective on cash

available for investment and acquisitions after making capital

investments required to support ongoing business operations and

long-term value creation. The Company believes that trends in its

free cash flow are valuable indicators of its operating performance

and liquidity.

Free cash flow is a non-GAAP financial measure and

should not be considered in isolation or as a substitute for

financial information provided in accordance with GAAP. This

non-GAAP financial measure may not be computed in the same manner

as similarly titled measures used by other companies. The Company

expects to continue to incur expenditures similar to the free cash

flow financial adjustment described above, and investors should not

infer from the Company’s presentation of this non-GAAP financial

measure that these expenditures reflect all of the Company's

obligations which require cash.

The following table reconciles the most directly

comparable GAAP financial measure to the non-GAAP financial

measure.

| |

Second Quarters Ended |

|

Six Months Ended |

| |

December 27, 2024 |

|

December 29, 2023 |

|

December 27, 2024 |

|

December 29, 2023 |

|

Net cash provided by operating activities |

$ |

85,462 |

|

|

$ |

45,494 |

|

|

$ |

70,802 |

|

|

$ |

6,426 |

|

|

Purchases of property and equipment |

|

(3,555 |

) |

|

|

(7,990 |

) |

|

|

(9,791 |

) |

|

|

(16,005 |

) |

|

Free cash flow |

$ |

81,907 |

|

|

$ |

37,504 |

|

|

$ |

61,011 |

|

|

$ |

(9,579 |

) |

|

UNAUDITED SUPPLEMENTAL INFORMATION RECONCILIATION OF GAAP

TO NON-GAAP MEASURES |

|

(In thousands, except per share data) |

| |

Adjusted income and adjusted earnings per share

(“adjusted EPS”) are non-GAAP measures for reporting financial

performance, exclude the impact of certain items and, therefore,

have not been calculated in accordance with GAAP. Management

believes that exclusion of these items assists in providing a more

complete understanding of the Company’s underlying results and

trends and allows for comparability with its peer company index and

industry. These non-GAAP financial measures may not be computed in

the same manner as similarly titled measures used by other

companies. The Company uses these measures along with the

corresponding GAAP financial measures to manage the Company’s

business and to evaluate its performance compared to prior periods

and the marketplace. The Company defines adjusted income as income

before other non-operating adjustments, amortization of intangible

assets, restructuring and other charges, impairment of long-lived

assets, acquisition, financing and other third party costs, fair

value adjustments from purchase accounting, litigation and

settlement income and expense, and stock-based and other non-cash

compensation expense. The impact to income taxes includes the

impact to the effective tax rate, current tax provision and

deferred tax provision(1). Adjusted EPS expresses adjusted income

on a per share basis using weighted average diluted shares

outstanding.

The following tables reconcile the most directly

comparable GAAP financial measures to the non-GAAP financial

measures.

| |

Second Quarters Ended |

| |

December 27, 2024 |

|

December 29, 2023 |

|

Net loss and loss per share |

$ |

(17,579 |

) |

|

$ |

(0.30 |

) |

|

$ |

(45,581 |

) |

|

$ |

(0.79 |

) |

|

Other non-operating adjustments, net |

|

2,549 |

|

|

|

|

|

(1,042 |

) |

|

|

|

Amortization of intangible assets |

|

11,154 |

|

|

|

|

|

12,270 |

|

|

|

|

Restructuring and other charges |

|

40 |

|

|

|

|

|

2 |

|

|

|

|

Impairment of long-lived assets |

|

— |

|

|

|

|

|

— |

|

|

|

|

Acquisition, financing and other third party costs |

|

1,109 |

|

|

|

|

|

860 |

|

|

|

|

Fair value adjustments from purchase accounting |

|

178 |

|

|

|

|

|

178 |

|

|

|

|

Litigation and settlement expense, net |

|

2,087 |

|

|

|

|

|

1,383 |

|

|

|

|

Stock-based and other non-cash compensation expense |

|

11,424 |

|

|

|

|

|

10,195 |

|

|

|

|

Impact to income taxes(1) |

|

(7,022 |

) |

|

|

|

|

(2,446 |

) |

|

|

|

Adjusted income (loss) and adjusted earnings (loss) per

share(2) |

$ |

3,940 |

|

|

$ |

0.07 |

|

|

$ |

(24,181 |

) |

|

$ |

(0.42 |

) |

| |

|

|

|

|

|

|

|

|

Diluted weighted-average shares outstanding |

|

|

|

58,843 |

|

|

|

|

|

57,424 |

|

| |

|

|

|

|

|

|

|

| (1) Impact to

income taxes is calculated by recasting income before income taxes

to include the items involved in determining adjusted income and

recalculating the income tax provision using this adjusted income

from operations before income taxes. The recalculation also adjusts

for any discrete tax expense or benefit related to the items. |

|

(2) Adjusted earnings per share is calculated using diluted shares

whereas Net loss per share or Adjusted loss per share is calculated

using basic shares. There were no impact to the calculation of

adjusted earnings per share as a result of this for the second

quarters ended December 27, 2024 and December 29, 2023. |

| |

Six Months Ended |

| |

December 27, 2024 |

|

December 29, 2023 |

|

Net loss and loss per share |

$ |

(35,104 |

) |

|

$ |

(0.60 |

) |

|

$ |

(82,289 |

) |

|

$ |

(1.44 |

) |

|

Other non-operating adjustments, net |

|

814 |

|

|

|

|

|

(311 |

) |

|

|

|

Amortization of intangible assets |

|

22,389 |

|

|

|

|

|

24,817 |

|

|

|

|

Restructuring and other charges |

|

2,300 |

|

|

|

|

|

9,548 |

|

|

|

|

Impairment of long-lived assets |

|

— |

|

|

|

|

|

— |

|

|

|

|

Acquisition, financing and other third party costs |

|

3,440 |

|

|

|

|

|

2,192 |

|

|

|

|

Fair value adjustments from purchase accounting |

|

355 |

|

|

|

|

|

355 |

|

|

|

|

Litigation and settlement expense, net |

|

3,481 |

|

|

|

|

|

1,886 |

|

|

|

|

COVID related expenses |

|

— |

|

|

|

|

|

— |

|

|

|

|

Stock-based and other non-cash compensation expense |

|

21,984 |

|

|

|

|

|

19,146 |

|

|

|

|

Impact to income taxes(1) |

|

(13,275 |

) |

|

|

|

|

(13,204 |

) |

|

|

|

Adjusted income (loss) and adjusted earnings (loss) per

share(2) |

$ |

6,384 |

|

|

$ |

0.11 |

|

|

$ |

(37,860 |

) |

|

$ |

(0.66 |

) |

| |

|

|

|

|

|

|

|

|

Diluted weighted-average shares outstanding |

|

|

|

58,752 |

|

|

|

|

|

57,314 |

|

| |

|

|

|

|

|

|

|

| (1) Impact to

income taxes is calculated by recasting income before income taxes

to include the items involved in determining adjusted income and

recalculating the income tax provision using this adjusted income

from operations before income taxes. The recalculation also adjusts

for any discrete tax expense or benefit related to the items. |

|

(2) Adjusted earnings per share is calculated using diluted shares

whereas Net loss per share is calculated using basic shares. There

were no impact to the calculation of adjusted earnings per share as

a result of this for the six months ended December 27, 2024 and

December 29, 2023. |

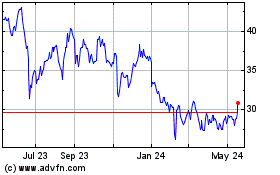

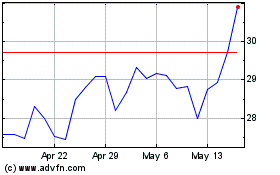

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Feb 2024 to Feb 2025