FALSE000153104800015310482024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

Inari Medical, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39293 | | 45-2902923 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

6001 Oak Canyon, Suite 100 | | | | |

Irvine, California | | | | 92618 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

| | |

Registrant’s Telephone Number, Including Area Code: (877) 923-4747 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | |

Name of each exchange on which registered |

| Common stock, $0.001 par value | | NARI | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 28, 2024, Inari Medical, Inc. (the “Company”) issued a press release announcing financial results for the fourth quarter and year ended December 31, 2023. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | INARI MEDICAL, INC. |

| | | |

| Date: | February 28, 2024 | By: | /s/ Mitchell Hill |

| | | Mitchell Hill Chief Financial Officer |

Inari Medical Reports Fourth Quarter 2023 Financial Results

IRVINE, CALIFORNIA – February 28, 2024 (GLOBE NEWSWIRE) – Inari Medical, Inc. (NASDAQ: NARI) (“Inari”), a medical device company with a mission to treat and transform the lives of patients suffering from venous and other diseases, today reported financial results for its fourth quarter and full year ended December 31, 2023.

Fourth Quarter Financial and Recent Business Highlights

•Generated revenue of $132.1 million in Q4 of 2023, up 22.6% over the same quarter last year.

•GAAP operating loss was $9.3 million in Q4 of 2023, compared to a $5.9 million operating loss in the same quarter of last year.

•Non-GAAP operating loss was $0.3 million in Q4 of 2023, compared to a $5.9 million non-GAAP operating loss in the same quarter of last year.

•Closed LimFlow acquisition on November 15, 2023.

•Completed enrollment in the PEERLESS randomized controlled trial.

“Our solid fourth quarter performance was driven by strong underlying procedural growth and crisp execution across our three growth pillars led by our core VTE business, with meaningful contributions from emerging therapies and international geographies,” said Drew Hykes, CEO of Inari Medical. “We also closed on the acquisition of LimFlow in mid-November. In terms of clinical evidence generation, the completion of enrollment in PEERLESS, our first RCT, represents an important step forward in our commitment to generating the highest level of clinical evidence. Taken together, these efforts will result in the establishment of our therapy as the standard of care for VTE. With a strong VTE foundation and encouraging commercial traction across emerging therapies and international, we remain confident in our ability to generate sustainable growth for many years to come. Most importantly, we remain fully committed to advancing our mission of addressing major unmet needs for patients.”

Fourth Quarter 2023 Financial Results

Revenue was $132.1 million for the fourth quarter of 2023, up 22.6% compared to $107.8 million for the fourth quarter of 2022. The increase over the prior year quarter was driven primarily by increased adoption of our procedures, new products, and global commercial expansion.

Gross profit was $115.1 million for the fourth quarter of 2023, compared to $94.6 million for the fourth quarter of 2022. Gross margin was 87.1% for the fourth quarter of 2023, compared to 87.8% for the for the fourth quarter of 2022.

Operating expenses for the fourth quarter of 2023 were $124.4 million, compared to $100.5 million for the fourth quarter of 2022. The increase was mainly driven by transaction costs associated with the acquisition of LimFlow; personnel-related expenses, including commissions and stock-based compensation associated with increased headcount to fund the expansion of the commercial, research and development, clinical, and support organizations; sales and marketing related efforts; and amortization expense related to an intangible asset acquired in the LimFlow acquisition.

GAAP operating loss was $9.3 million in the fourth quarter of 2023, compared with a $5.9 million GAAP operating loss for the fourth quarter of 2022.

Non-GAAP operating loss was $0.3 million in the fourth quarter of 2023. The following items were excluded from the non-GAAP operating loss: acquisition-related costs of $7.7 million and acquired intangible asset amortization of $1.3 million. There were no non-GAAP adjustments related to the company’s operating loss for the fourth quarter of 2022.

Net loss was $4.7 million for the fourth quarter of 2023 and net loss per share was $0.08 on a weighted-average basic and diluted share count of 57.6 million, compared to a net loss of $5.8 million and a net loss per share of $0.11 on a weighted-average basic and diluted share count of 53.6 million, in the same period of the prior year.

Full Year 2023 Financial Results

Revenue was $493.6 million for the year ended December 31, 2023, up 28.7% compared to $383.5 million in the prior year. The increase over the prior period was driven primarily by continued U.S. and international commercial expansion, increased adoption of our procedures, and introduction of new products.

Gross profit was $434.6 million for the full year of 2023, compared to $339.0 million for the prior year. Gross margin was 88.0% for the full year of 2023, compared to 88.4% for the prior year.

Operating expenses for the full year of 2023 were $448.6 million, compared to $367.1 million for the prior year. The increase was mainly driven by personnel-related expenses, including commissions and stock-based compensation associated with increased headcount to fund the expansion of the commercial, research and development, clinical, and support organizations.

GAAP operating loss was $14.0 million for the full year of 2023, compared with a $28.1 million GAAP operating loss in the prior year.

Non-GAAP operating loss was $2.4 million for the full year of 2023. The following items were excluded from the non-GAAP operating loss: acquisition-related costs of $10.4 million and acquired intangible asset amortization of $1.3 million. There were no non-GAAP adjustments related to the company’s full year 2022 operating loss.

Net loss was $1.6 million for the full year of 2023 and net loss per share was $0.03 on a weighted-average basic and diluted share count of 56.8 million, compared to a net loss of $29.3 million and net loss per share of $0.55 on a weighted-average basic and diluted share count of 52.8 million.

Full Year 2024 Revenue Guidance

•Inari expects full year 2024 revenue of $580 million to $595 million, reflecting growth of approximately 17.5% to 20.5% over 2023.

•The company still expects to reach sustained operating profitability in the first half of 2025.

Webcast and Conference Call Information

Inari Medical will host a conference call to discuss the fourth quarter and full year 2023 financial results and acquisition of LimFlow after market close on February 28, 2024 at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time. The conference call can be accessed live by dialing (844) 825-9789 for domestic callers or (412) 317-5180 for international callers. The live webinar and presentation may be accessed by visiting the Events Section of the Inari investor relations website at ir.inarimedical.com.

Use of Non-GAAP Financial Measures

This press release contains references to non-GAAP operating income (loss), which is considered a non-GAAP financial measure. This means that non-GAAP operating income (loss) is determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). As used by Inari, non-GAAP operating income (loss) excludes from GAAP operating income (loss) the following items: amortization of acquired intangible assets and acquisition-related costs. Beginning in the fourth quarter of 2023, we began presenting non-GAAP operating income (loss) to exclude these charges because we believe these charges are significantly impacted by the timing and valuation of acquisitions, such as our LimFlow acquisition in the fourth quarter of 2023. Our management believes the presentation of non-GAAP operating income (loss) is useful because it provides meaningful comparisons to prior periods and provides visibility to our underlying operating performance and an additional means to evaluate the cost and expense trends excluding the impact of these acquisition-related items, which are not related to our core business operations.

Our definition of non-GAAP operating income (loss) may differ from similarly titled measures used by others. Non-GAAP operating income (loss) should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. We encourage investors to review the reconciliation of non-GAAP operating income (loss) to GAAP operating income (loss), which has been provided in the financial statement tables included in this press release.

About Inari Medical, Inc.

Patients first. No small plans. Take care of each other. These are the guiding principles that form the ethos of Inari Medical. We are committed to improving lives in extraordinary ways by creating innovative solutions for both unmet and underserved health needs. In addition to our purpose-built solutions, we leverage our capabilities in education, clinical research, and program development to improve patient outcomes. We are passionate about our mission to establish our treatments as the standard of care for venous disease, including venous thromboembolism, chronic venous disease, and beyond. We are just getting started.

Forward Looking Statements

Statements in this press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to substantial risks and uncertainties. Forward-looking statements contained in this press release may be identified by the use of words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements include expectations regarding Inari’s core business, its ability to integrate LimFlow, expectations regarding future growth, Inari's ability to meet customers' needs, and timing for achieving sustained operating profitability, and are based on Inari’s current expectations, forecasts, and assumptions. Forward-looking statements are subject to inherent uncertainties, risks and assumptions that are difficult to predict, and actual outcomes and results could differ materially due to a number of factors. These and other risks and uncertainties include those described more fully in the section titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and elsewhere in its Annual Report on Form 10-K for the period ended December 31, 2023, and in Inari’s other reports filed with the U.S. Securities and Exchange Commission. Forward-looking statements contained in this announcement are based on information available to Inari as of the date hereof and are made only as of the date of this release. Inari undertakes no obligation to update such information except as required under applicable law. These forward-looking statements should not be relied upon as representing Inari’s views as of any date subsequent to the date of this press release. In light of the foregoing, investors

are urged not to rely on any forward-looking statement in reaching any conclusion or making any investment decision about any securities of Inari.

Investor Contact:

John Hsu, CFA

VP, Investor Relations

949-658-3889

IR@inarimedical.com

INARI MEDICAL, INC.

Consolidated Statements of Operations and Comprehensive Income (Loss)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Years ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 132,094 | | | $ | 107,771 | | | $ | 493,632 | | | $ | 383,471 | |

| Cost of goods sold | | 17,006 | | | 13,128 | | | 59,068 | | | 44,506 | |

| Gross profit | | 115,088 | | | 94,643 | | | 434,564 | | | 338,965 | |

| Operating expenses | | | | | | | | |

| Research and development | | 22,892 | | | 20,412 | | | 87,533 | | | 74,221 | |

| Selling, general and administrative | | 101,495 | | | 80,122 | | | 361,063 | | | 292,843 | |

| Total operating expenses | | 124,387 | | | 100,534 | | | 448,596 | | | 367,064 | |

| Loss from operations | | (9,299) | | | (5,891) | | | (14,032) | | | (28,099) | |

| Other income (expense) | | | | | | | | |

| Interest income | | 2,714 | | | 970 | | | 15,613 | | | 1,852 | |

| Interest expense | | (69) | | | (74) | | | (196) | | | (294) | |

| | | | | | | | |

| Other income | | 3,478 | | | 187 | | | 2,861 | | | 356 | |

| Total other income | | 6,123 | | | 1,083 | | | 18,278 | | | 1,914 | |

| (Loss) income before income taxes | | (3,176) | | | (4,808) | | | 4,246 | | | (26,185) | |

| Provision for income taxes | | 1,491 | | | 990 | | | 5,882 | | | 3,082 | |

| Net loss | | $ | (4,667) | | | $ | (5,798) | | | $ | (1,636) | | | $ | (29,267) | |

| Other comprehensive income (loss) | | | | | | | | |

| Foreign currency translation adjustments | | 10,002 | | | 222 | | | 9,864 | | | (592) | |

| Unrealized gain (loss) on available-for-sale debt securities | | 41 | | | 1,572 | | | (1,828) | | | 1,843 | |

| Total other comprehensive income | | 10,043 | | | 1,794 | | | 8,036 | | | 1,251 | |

| Comprehensive income (loss) | | $ | 5,376 | | | $ | (4,004) | | | $ | 6,400 | | | $ | (28,016) | |

| Net loss per share | | | | | | | | |

| Basic | | $ | (0.08) | | | $ | (0.11) | | | $ | (0.03) | | | $ | (0.55) | |

| Diluted | | $ | (0.08) | | | $ | (0.11) | | | $ | (0.03) | | | $ | (0.55) | |

| Weighted average common shares used to compute net loss per share | | | | | | | | |

| Basic | | 57,639,591 | | 53,610,347 | | 56,770,657 | | 52,837,674 |

| Diluted | | 57,639,591 | | 53,610,347 | | 56,770,657 | | 52,837,674 |

INARI MEDICAL, INC.

Consolidated Balance Sheets

(in thousands, except share data)

| | | | | | | | | | | | | | |

| | December 31,

2023 | | December 31,

2022 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 38,597 | | | $ | 60,222 | |

| Restricted cash | | 611 | | | — | |

| Short-term investments in debt securities | | 76,855 | | | 266,179 | |

| Accounts receivable, net | | 70,119 | | | 58,611 | |

| Inventories, net | | 42,900 | | | 32,581 | |

| Prepaid expenses and other current assets | | 6,481 | | | 5,312 | |

| Total current assets | | 235,563 | | | 422,905 | |

| Property and equipment, net | | 20,929 | | | 21,655 | |

| Operating lease right-of-use assets | | 48,407 | | | 50,703 | |

| Goodwill | | 214,335 | | | — | |

| Intangible assets | | 150,884 | | | — | |

| Deposits and other assets | | 4,117 | | | 8,889 | |

| Total assets | | $ | 674,235 | | | $ | 504,152 | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 10,577 | | | $ | 7,659 | |

| Payroll-related accruals | | 48,706 | | | 38,955 | |

| Accrued expenses and other current liabilities | | 15,364 | | | 8,249 | |

| Operating lease liabilities, current portion | | 1,692 | | | 1,311 | |

| Total current liabilities | | 76,339 | | | 56,174 | |

| Operating lease liabilities, noncurrent portion | | 30,355 | | | 30,976 | |

| Deferred tax liability | | 36,231 | | | — | |

| Other long-term liability | | 66,400 | | | — | |

| Total liabilities | | 209,325 | | | 87,150 | |

| Commitments and contingencies | | | | |

| Stockholders' equity | | | | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized, no shares issued and outstanding as of December 31, 2023 and 2022 | | — | | | — | |

| Common stock, $0.001 par value, 300,000,000 shares authorized as of December 31, 2023 and 2022; 57,762,414 and 54,021,656 shares issued and outstanding as of December 31, 2023 and 2022, respectively | | 58 | | | 54 | |

| Additional paid in capital | | 504,453 | | | 462,949 | |

| Accumulated other comprehensive income | | 8,885 | | | 849 | |

| Accumulated deficit | | (48,486) | | | (46,850) | |

| Total stockholders' equity | | 464,910 | | | 417,002 | |

| Total liabilities and stockholders' equity | | $ | 674,235 | | | $ | 504,152 | |

INARI MEDICAL, INC.

Reconciliation of GAAP Operating Loss to Non-GAAP Operating Loss

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Years ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Operating loss | | $ | (9,299) | | | $ | (5,891) | | | $ | (14,032) | | | $ | (28,099) | |

Non-GAAP Adjustments: | | | | | | | | |

Amortization of acquired intangible assets | | 1,255 | | | — | | | 1,255 | | | — | |

Acquisition-related expense (a) | | 7,725 | | | — | | | 10,406 | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Non-GAAP Operating loss | | $ | (319) | | | $ | (5,891) | | | $ | (2,371) | | | $ | (28,099) | |

________________

(a) For three months ended December 31, 2023, acquisition related expenses included $6.0 million of transaction costs and $1.7 million of severance and integration related expenses. For the year ended December 31, 2023, acquisition related expenses included $8.7 million of transaction costs and $1.7 million of severance and integration related expenses.

Revenue Disaggregation

Commencing in the fourth quarter of 2023, we began presenting revenue bifurcated between VTE and Emerging Therapies. The following table presents the amount of revenue in VTE and Emerging Therapies recognized for the periods presented (in thousands, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Three Months Ended September 30, | | Three Months Ended June 30, | | Three Months Ended March 31, |

| | 2023 | | 2023 | | 2023 | | 2023 |

VTE | | $ | 126,671 | | | $ | 121,460 | | | $ | 114,086 | | | $ | 114,058 | |

Emerging Therapies | | 5,423 | | | 4,906 | | | 4,919 | | | 2,109 | |

Total Revenue | | $ | 132,094 | | | $ | 126,366 | | | $ | 119,005 | | | $ | 116,167 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Three Months Ended September 30, | | Three Months Ended June 30, | | Three Months Ended March 31, |

| | 2022 | | 2022 | | 2022 | | 2022 |

VTE | | $ | 105,978 | | | $ | 95,980 | | | $ | 92,721 | | | $ | 86,752 | |

Emerging Therapies | | 1,793 | | | 224 | | | 23 | | | — | |

| Total Revenue | | $ | 107,771 | | | $ | 96,204 | | | $ | 92,744 | | | $ | 86,752 | |

Cover

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

Inari Medical, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39293

|

| Entity Tax Identification Number |

45-2902923

|

| Entity Address, Address Line One |

6001 Oak Canyon

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Irvine

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92618

|

| City Area Code |

877

|

| Local Phone Number |

923-4747

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value

|

| Trading Symbol |

NARI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001531048

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

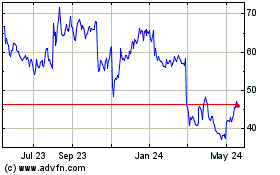

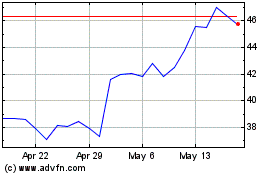

Inari Medical (NASDAQ:NARI)

Historical Stock Chart

From Apr 2024 to May 2024

Inari Medical (NASDAQ:NARI)

Historical Stock Chart

From May 2023 to May 2024