Northeast Bank Announces New Share Repurchase Program

21 April 2022 - 10:35PM

Northeast Bank (the “Bank”) (NASDAQ: NBN) announced today that its

Board of Directors has terminated its existing share repurchase

program and approved a new share repurchase program, which allows

for the repurchase of 1,000,000 shares of common stock, or up to

$40.0 million, representing approximately 13.1% of the Bank’s

common stock outstanding.

Repurchases under this program may be made in open market

transactions. The timing and actual number of shares repurchased

will depend on a variety of factors including price, corporate and

regulatory requirements, market conditions, and other corporate

liquidity requirements and priorities. The repurchase program does

not obligate the Bank to purchase any particular number of

shares.

The repurchase program may be suspended or terminated at any

time without prior notice, and it will expire April 13, 2023.

About Northeast Bank

Northeast Bank (NASDAQ: NBN) is a full-service bank

headquartered in Portland, Maine. We offer personal and business

banking services to the Maine market via eight branches. Our

National Lending Division purchases and originates commercial loans

on a nationwide basis. ableBanking, a division of Northeast Bank,

offers online savings products to consumers nationwide. Information

regarding Northeast Bank can be found at

www.northeastbank.com.

Forward-Looking Statements

Statements in this press release that are not historical facts

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and are intended to be

covered by the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Although the Bank believes that

these forward-looking statements are based on reasonable estimates

and assumptions, they are not guarantees of future performance and

are subject to known and unknown risks, uncertainties, and other

factors. You should not place undue reliance on our forward-looking

statements. You should exercise caution in interpreting and relying

on forward-looking statements because they are subject to

significant risks, uncertainties and other factors which are, in

some cases, beyond the Bank’s control. The Bank’s actual results

could differ materially from those projected in the forward-looking

statements as a result of, among other factors, the ongoing

negative impacts and disruptions of the ongoing COVID-19 pandemic

and measures taken to contain its spread on our employees,

customers, business operations, credit quality, financial position,

liquidity and results of operations; general business and economic

conditions on a national basis and in the local markets in which

the Bank operates, including changes which adversely affect

borrowers’ ability to service and repay our loans; changes in

customer behavior due to changing political, business and economic

conditions or legislative or regulatory initiatives; turbulence in

the capital and debt markets; changes in interest rates and real

estate values; increases in loan defaults and charge-off rates;

decreases in the value of securities and other assets, adequacy of

loan loss reserves, or deposit levels necessitating increased

borrowing to fund loans and investments; changing government

regulation; competitive pressures from other financial

institutions; operational risks including, but not limited to,

cybersecurity incidents, fraud, natural disasters and future

pandemics; the risk that the Bank may not be successful in the

implementation of its business strategy; the risk that intangibles

recorded in the Bank’s financial statements will become impaired;

changes in assumptions used in making such forward-looking

statements; and the other risks and uncertainties detailed in the

Bank’s Annual Report on Form 10-K and updated by our Quarterly

Reports on Form 10-Q and other filings submitted to the Federal

Deposit Insurance Corporation. These statements speak only as of

the date of this release and the Bank does not undertake any

obligation to update or revise any of these forward-looking

statements to reflect events or circumstances occurring after the

date of this communication or to reflect the occurrence of

unanticipated events.

| For More

Information: |

|

| Jean-Pierre Lapointe, Chief

Financial OfficerNortheast Bank, 27 Pearl Street, Portland, ME

04101 207.786.3245 ext. 3220www.northeastbank.com |

|

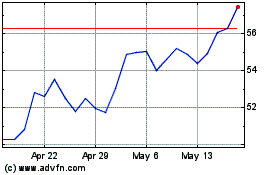

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Nov 2024 to Dec 2024

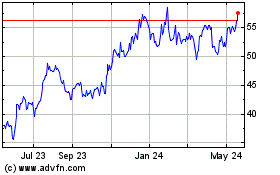

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Dec 2023 to Dec 2024