false

0001681206

0001681206

2024-08-13

2024-08-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): August

13, 2024

NI

Holdings, Inc.

(Exact name of registrant as specified in its charter)

| North Dakota |

|

001-37973 |

|

81-2683619 |

| (State or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1101 First Avenue North

Fargo, North Dakota

| (Address of principal executive offices) |

| |

| 58102 |

| (Zip code) |

| |

| (701) 298-4200 |

| (Registrant’s telephone number, including area code) |

| |

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Securities Exchange Act of 1934:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

NODK |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Explanatory Note

This Amendment No. 1 to Current Report on Form 8-K/A (the “Amendment”)

amends the Current Report on Form 8-K filed by NI Holdings, Inc. (the “Company”) on August 15, 2024 (the “Original Form

8-K”), which disclosed, among other things, the departure of Michael J. Alexander as Chief Executive and the appointment of Cindy

L. Launer, a member of the Company’s Board of Directors, as the Company’s Interim Chief Executive Officer effective August

26, 2024. At the time of the filing of the Original Form 8-K, the Company’s Board of Directors had not yet determined the terms

of Ms. Launer’s compensation in connection with her appointment as Interim Chief Executive Officer. The Company is filing this Amendment

to disclose (i) Ms. Launer’s compensation for her service as Interim Chief Executive Officer and (ii) the Company’s entry

into an employment agreement with Ms. Launer. No other changes have been made to the Original Form 8-K.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

As previously reported by the Company, on August 13, 2024, the Company

appointed Cindy L. Launer, a member of the Company’s Board of Directors, as the Company’s Interim Chief Executive Officer,

effective August 26, 2024. On August 20, 2024, the Company’s Board of Directors determined that Ms. Launer will receive a salary

of $100,000 per month, beginning September 1, 2024, for as long as she serves as Interim Chief Executive Officer. During her service as

Interim Chief Executive Officer, Ms. Launer will not receive compensation for her service as a member of the Board of Directors.

In connection with her appointment, the Company and Ms. Launer

entered into an employment agreement dated August 26, 2024, providing for the Company’s at-will employment of Ms. Launer as Interim Chief Executive

Officer, with a salary equal to $100,000 per month. The foregoing summary of the Employment Agreement does not purport to be

complete and is qualified in its entirety by reference to the full text of the Employment Agreement filed as Exhibit 10.1 to this

Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NI Holdings, Inc. |

| |

|

| |

|

| Date: August 26, 2024 |

By: |

/s/ Seth C. Daggett |

| |

|

Seth C. Daggett |

| |

|

Chief Financial Officer |

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS AGREEMENT (“Agreement”)

is made effective as of August 26, 2024 (the “Effective Date”), between NI Holdings, Inc., a North Dakota business

corporation, (the “Corporation”), NODAK Insurance Company, a North Dakota insurance company (the “Company”),

and Cindy L. Launer, an adult individual (“Executive”).

WITNESSETH:

WHEREAS, the Corporation, the Company, and

Executive desire to enter into an agreement providing for the terms of Executive’s employment with the Corporation and the Company.

AGREEMENT

NOW, THEREFORE, the parties hereto, intending

to be legally bound, agree as follows:

1. Employment. The Corporation and the Company employ Executive and Executive hereby accepts employment with the

Corporation and the Company, on the terms and conditions set forth in this Agreement.

2.

Duties of Employee. Executive shall serve as Interim President and Interim Chief Executive Officer of the Corporation

and the Company and shall report directly to the Board of Directors of the Corporation (the “Corporation Board”) and

the Company (the “Company Board” and collectively with the Corporation Board, the “Board”). Executive

shall submit such direct reports as are needed, from time to time, and shall be responsible for the day-to-day operations of the Corporation

and the Company and shall perform all reasonable duties assigned by the respective Board. Executive shall devote her full time, attention

and energies to the business of the Corporation and the Company during the Employment Period (as defined in Section 3 of this Agreement);

provided, however, that this Section 2 shall not be construed as preventing Executive from (a) engaging in activities incident

or necessary to personal investments, (b) acting as a member of the board of directors of any non-profit association or corporation,

or (c) being involved in any other business activity with the prior approval of the Corporation Board. Executive shall not engage

in any business or commercial activities, duties or pursuits which compete with the business or commercial activities of the Corporation

or the Company, nor may Executive serve as a director or officer or in any other capacity in a company which competes with the Corporation

or the Company.

3.

Term of Agreement.

(a)

Employment Period. This Agreement shall be for a period (the “Employment Period”) beginning on the Effective

Date and shall continue until terminated pursuant to the terms of this Agreement.

(b)

Employment At-Will. The Corporation and Executive acknowledge that Executive’s employment is and shall continue to

be “at will,” as defined under applicable law. This means that it is not for any specified period of time and can be terminated

by Executive or by the Corporation at any time, with or without advance notice, and for any or no particular reason or cause. It also

means that Executive’s job duties, title, responsibility and reporting level, work schedule, compensation, and benefits, as well

as the Corporation’s and the Company’s personnel policies and procedures, may be changed with prospective effect, with or

without notice, at any time in the sole discretion of the Corporation (subject to any ramification such changes may have under Section

4 of this Agreement).

4.

Employment Period Compensation, Benefits and Expenses.

(a)

Base Salary. For services performed by Executive under this Agreement, the Corporation shall pay Executive a base salary

during the Employment Period at the rate of $100,000 per month, minus applicable withholdings and deductions, payable at the same times

as salaries are payable to other executive employees of the Corporation (the “Monthly Base Salary”), beginning September

1, 2024 and ending on the last day of any full month of Executive’s employment as Interim Chief Executive Officer. If Executive’s

employment is terminated before the last day of a calendar month, Executive shall receive the full amount of the Monthly Base Salary with

respect to such period.

(b)

Vacations, Holidays, etc. During the term of this Agreement, Executive shall be entitled to vacation in accordance with

the policies as established from time to time by the Corporation. Executive shall also be entitled to all paid holidays, sick days and

personal days provided by the Corporation to regular full-time employees and senior executive officers.

(c)

Business Expenses. During the term of this Agreement, Executive shall be entitled to receive prompt reimbursement for all

customary and usual expenses incurred by her, which are properly accounted for, in accordance with the policies and procedures established

by the Corporation.

5.

Unauthorized Disclosure. During the term of her employment hereunder, or at any later time, Executive shall

not, without the written consent of the Corporation Board or a person authorized thereby (except as may be required pursuant to a subpoena

or other legal process), knowingly disclose to any person, other than an employee of the Company or the Corporation or a person to whom

disclosure is reasonably necessary or appropriate in connection with the performance by Executive of her duties as an executive of the

Company and the Corporation, any material confidential information obtained by her while in the employ of the Company and the Corporation

with respect to any of the Company’s, the Corporation’s or any of their subsidiaries’ services, products, improvements,

formulas, designs or styles, processes, customers, methods of business or any business practices the disclosure of which could be or

will be damaging to the Company or the Corporation; provided, however, that confidential information shall not include any information

known generally to the public (other than as a result of unauthorized disclosure by Executive or any person with the assistance, consent

or direction of Executive) or any information of a type not otherwise considered confidential by persons engaged in the same business

or a business similar to that conducted by the Company or the Corporation or any information that must be disclosed as required by law.

6.

Notices. Except as otherwise provided in this Agreement, any notice required or permitted to be given under

this Agreement shall be deemed properly given if in writing and if mailed by United States registered or certified mail, postage prepaid

with return receipt requested, to Executive’s address, in the case of notices to Executive, and to the principal executive office

of the Company, in the case of notice to the Company or the Corporation.

7.

Waiver. No provision of this Agreement may be modified, waived or discharged unless such waiver, modification

or discharge is agreed to in writing and signed by Executive and an executive officer of the Corporation and the Company specifically

designated by the respective Board or a Board member. No waiver by either party hereto at any time of any breach by the other party hereto

of, or compliance with, any condition or provision of this Agreement to be performed by such other party shall be deemed a waiver of

similar or dissimilar provisions or conditions at the same or at any prior or subsequent time.

8.

Assignment. This Agreement shall not be assignable by any party, except by the Company to any successor in interest

to its business.

9.

Entire Agreement. This Agreement contains the entire agreement of the parties relating to the subject matter

of this Agreement and supersedes and replaces any prior written or oral agreements between them respecting the within subject matter.

10.

Validity. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity

or enforceability of any other provision of this Agreement, which shall remain in full force and effect.

11.

Applicable Law. This Agreement shall be governed by and construed in accordance with the laws of the State of

North Dakota, without regard to its conflict of laws principles.

12.

Headings. The section headings of this Agreement are for convenience only and shall not control or affect the

meaning or construction or limit the scope or intent of any of the provisions of this Agreement.

13.

Application of Code Section 409A. Except as otherwise expressly provided herein,

to the extent any expense reimbursement or other in-kind benefit is determined to be subject to Code Section 409A, the amount of

any such expenses eligible for reimbursement or in-kind benefits in one calendar year shall not affect the expenses eligible for reimbursement

or in-kind benefits in any other taxable year (except under any lifetime limit applicable to expenses for medical care), in no event shall

any expenses be reimbursed or in-kind benefits be provided after the last day of the calendar year following the calendar year in which

Executive incurred such expenses or received such benefits, and in no event shall any right to reimbursement or in-kind benefits be subject

to liquidation or exchange for another benefit.

IN WITNESS WHEREOF, the parties have executed

this Agreement as of the Effective Date.

| |

NODAK INSURANCE COMPANY |

| |

|

| |

By: |

/s/ Eric Aasmundstad |

| |

Name: Eric Aasmundstad |

| |

Title: Director |

| |

|

| |

NI HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Eric Aasmundstad |

| |

Name: Eric Aasmundstad |

| |

Title: Chairman of the Board |

| |

|

| |

CINDY L. LAUNER |

| |

|

| |

/s/ Cindy L. Launer |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

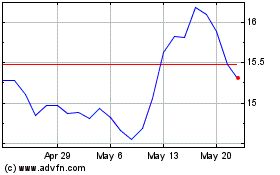

NI (NASDAQ:NODK)

Historical Stock Chart

From Dec 2024 to Jan 2025

NI (NASDAQ:NODK)

Historical Stock Chart

From Jan 2024 to Jan 2025