0000932696false00009326962025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

INSIGHT ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

_____________________________

| | | | | | | | | | | | | | | | | |

| Delaware | | 0-25092 | | 86-0766246 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

| 2701 East Insight Way, | | | | |

| Chandler, | Arizona | | | | 85286 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code:

(480) 333-3000

Not Applicable

(Former name or former address, if changed since last report)

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

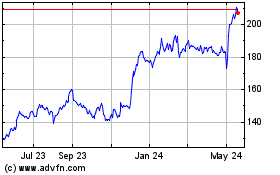

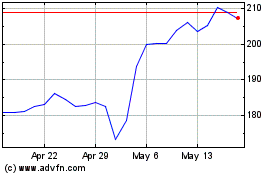

| Common stock, par value $0.01 | | NSIT | | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2025, Insight Enterprises, Inc. announced by press release its results of operations for the fourth quarter and full year ended December 31, 2024. A copy of the press release and accompanying investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein. The information disclosed under this Item 2.02, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | Insight Enterprises, Inc. |

| | | | |

| Date: | February 6, 2025 | By: | | /s/ Rachael A. Crump |

| | | | Rachael A. Crump |

| | | | Chief Accounting Officer |

| | | | | |

FOR IMMEDIATE RELEASE | NASDAQ: NSIT |

INSIGHT ENTERPRISES, INC. REPORTS

FOURTH QUARTER AND FULL YEAR RESULTS

CHANDLER, AZ – February 6, 2025 – Insight Enterprises, Inc. (NASDAQ: NSIT) (the “Company”) today reported financial results for the quarter and full year ended December 31, 2024. Highlights include:

•Gross profit increased 1% year over year to $439.6 million with gross margin expanding 170 basis points to a record 21.2% for the fourth quarter and gross profit increased 6% for the full year to $1.8 billion with gross margin expanding 210 basis points to a record 20.3%

•Insight Core services gross profit increased 12% year over year for the fourth quarter and increased 15% for the full year

•Cloud gross profit grew 3% year over year for the fourth quarter and increased 21% for the full year

•Consolidated net earnings decreased 59% to $37.0 million, year to year for the fourth quarter and decreased 11% to $249.7 million for the full year

•Adjusted earnings before interest, tax, depreciation and amortization (“EBITDA”) decreased 11% to $141.1 million, year to year for the fourth quarter but increased 4% to $543.5 million for the full year

•Diluted earnings per share of $0.99 decreased 59% year to year for the fourth quarter and diluted earnings per share of $6.55 decreased 13% for the full year

•Adjusted diluted earnings per share of $2.66 decreased 11% year to year for the fourth quarter and Adjusted diluted earnings per share of $9.68 was flat for the full year

•Cash flows provided by operating activities were $215.1 million for the fourth quarter and $632.8 million for the full year

In the fourth quarter of 2024, net sales decreased 7%, year to year, to $2.1 billion, while gross profit increased 1%, year over year, to $439.6 million. Gross margin expanded 170 basis points compared to the fourth quarter of 2023 to 21.2%. Earnings from operations of $64.7 million decreased 51% compared to $131.9 million in the fourth quarter of 2023. Adjusted earnings from operations of $129.4 million decreased 13%, year to year compared to $148.7 million in the fourth quarter of 2023. Consolidated net earnings were $37.0 million, or 1.8% of net sales, in the fourth quarter of 2024, and Adjusted consolidated net earnings were $91.1 million, or 4.4% of net sales. Diluted earnings per share for the quarter was $0.99, down 59%, year to year, and Adjusted diluted earnings per share was $2.66, down 11%, year to year.

For the full year 2024, net sales decreased 5%, year to year, to $8.7 billion, while gross profit increased 6%, year over year, to $1.8 billion. Gross margin expanded 210 basis points compared to the prior year to 20.3%. Earnings from operations of $388.6 million decreased 7% compared to $419.8 million in 2023. Adjusted earnings from operations of $502.4 million increased 2%, year over year compared to $492.1 million in 2023. Consolidated net earnings were $249.7 million, or 2.9% of net sales for the full year and Adjusted consolidated net earnings were $338.2 million, or 3.9% of net sales. Diluted earnings per share for the full year was $6.55, down 13%, year to year, and Adjusted diluted earnings per share was $9.68, flat, year to year.

“In 2024, clients continued to exercise caution due to the macroeconomic environment, which influenced their investment priorities and prolonged their decision-making. Still, Q4 met our expectations and we posted another record year of gross margin at 20.3% and cash flow from operations of $633 million,” stated Joyce Mullen, President and Chief Executive Officer. “We took critical steps forward with our offerings across key growth areas: cloud solutions and Insight Core services, and we continued building expertise and scale in other areas important to our clients, particularly in GCP, ServiceNow and AWS, augmenting our existing strength in Azure,” stated Mullen.

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

KEY HIGHLIGHTS

Results for the Quarter:

•Consolidated net sales for the fourth quarter of 2024 of $2.1 billion decreased 7%, year to year, when compared to the fourth quarter of 2023. Product net sales decreased 10%, year to year, while services net sales increased 3%, year over year.

•Net sales in North America decreased 5%, year to year, to $1.7 billion;

◦Product net sales decreased 6%, year to year, to $1.4 billion;

◦Services net sales increased 1%, year over year, to $321.3 million;

•Net sales in EMEA decreased 18%, year to year, to $319.8 million; and

•Net sales in APAC decreased 6%, year to year, to $52.1 million.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated net sales also decreased 7%, year to year, with decreases in net sales in North America, EMEA and APAC of 5%, 19% and 6%, year to year, respectively.

•Consolidated gross profit increased 1% compared to the fourth quarter of 2023 to $439.6 million, with consolidated gross margin expanding 170 basis points to 21.2% of net sales. Product gross profit decreased 1%, year to year, and services gross profit increased 3%, year over year. Cloud gross profit grew 3%, year over year, and Insight Core services gross profit increased 12%, year over year. By segment, gross profit:

•decreased 1% in North America, year to year, to $350.0 million (20.6% gross margin);

•increased 8% in EMEA, year over year, to $72.6 million (22.7% gross margin); and

•increased 13% in APAC, year over year, to $17.0 million (32.7% gross margin).

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated gross profit was also up 1%, year over year, with gross profit growth in EMEA and APAC of 7% and 13%, respectively, year over year, partially offset by a decrease in North America of 1%, year to year.

•Consolidated earnings from operations decreased 51% compared to the fourth quarter of 2023 to $64.7 million, or 3.1% of net sales. By segment, earnings from operations:

•decreased 55% in North America, year to year, to $52.4 million, or 3.1% of net sales;

•decreased 26% in EMEA, year to year, to $7.4 million, or 2.3% of net sales; and

•increased 7% in APAC, year over year, to $4.9 million, or 9.5% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated earnings from operations were also down 51%, year to year, with decreases in earnings from operations in North America and EMEA of 55% and 24%, respectively, year to year, partially offset by increased earnings from operations in APAC of 8%, year over year.

•Adjusted earnings from operations decreased 13% compared to the fourth quarter of 2023 at $129.4 million, or 6.2% of net sales. By segment, Adjusted earnings from operations:

•decreased 17% in North America, year to year, to $109.2 million, or 6.4% of net sales;

•increased 21% in EMEA, year over year, to $14.6 million, or 4.6% of net sales; and

•increased 16% in APAC, year over year, to $5.6 million, or 10.7% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, Adjusted consolidated earnings from operations decreased 13% compared to the fourth quarter of 2023, with a decrease in Adjusted earnings from operations in North America of 17%, year to year, partially offset by increased Adjusted earnings from operations in EMEA and APAC of 22% and 16%, respectively, year over year.

•Consolidated net earnings and diluted earnings per share for the fourth quarter of 2024 were $37.0 million and $0.99, respectively, at an effective tax rate of 29.2%.

•Adjusted consolidated net earnings and Adjusted diluted earnings per share for the fourth quarter of 2024 were $91.1 million and $2.66, respectively. Excluding the effects of fluctuating foreign currency exchange rates, Adjusted diluted earnings per share decreased 10%, year to year.

Results for the Year:

•Consolidated net sales of $8.7 billion for the full year of 2024 decreased 5%, year to year, when compared to the full year of 2023.

•Net sales in North America decreased 4%, year to year, to $7.1 billion;

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

◦Product net sales decreased 7%, year to year, to $5.8 billion;

◦Services net sales increased 7%, year over year, to $1.3 billion;

•Net sales in EMEA decreased 10%, year to year, to $1.4 billion; and

•Net sales in APAC increased 1%, year over year, to $233.0 million.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated net sales also decreased 5%, year to year, with declines in net sales in North America and EMEA of 4% and 11%, respectively, year to year, partially offset by an increase in net sales in APAC of 2%.

•Consolidated gross profit increased 6% compared to the full year of 2023 to $1.8 billion, with consolidated gross margin expanding 210 basis points to 20.3% of net sales. Product gross profit decreased 2%, year to year, and services gross profit increased 13%, year over year. Cloud gross profit grew 21%, year over year, and Insight core services gross profit increased 15%, year over year. By segment, gross profit:

•increased 4% in North America, year over year, to $1.4 billion (19.9% gross margin);

•increased 13% in EMEA, year over year, to $293.2 million (20.7% gross margin); and

•increased 11% in APAC, year over year, to $70.8 million (30.4% gross margin).

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated gross profit was also up 6%, year over year, with gross profit growth in North America, EMEA and APAC of 4%, 11% and 12%, respectively, year over year.

•Consolidated earnings from operations decreased 7% compared to the full year of 2023 to $388.6 million, or 4.5% of net sales. By segment, earnings from operations:

•decreased 12% in North America, year to year, to $319.1 million, or 4.5% of net sales;

•increased 21% in EMEA, year over year, to $46.2 million, or 3.3% of net sales; and

•increased 19% in APAC, year over year, to $23.3 million, or 10.0% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated earnings from operations were also down 7%, year to year, with a decrease in earnings from operations in North America of 12%, year to year, partially offset by increased earnings from operations in both EMEA and APAC of 20%, year over year.

•Adjusted earnings from operations increased 2% compared to the full year of 2023 to $502.4 million, or 5.8% of net sales. By segment, Adjusted earnings from operations:

•decreased 1% in North America, year to year, to $422.0 million, or 6.0% of net sales;

•increased 18% in EMEA, year over year, to $55.9 million, or 4.0% of net sales; and

•increased 21% in APAC, year over year, to $24.5 million, or 10.5% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, Adjusted consolidated earnings from operations were also up 2%, year over year, with increases in EMEA and APAC of 16% and 22%, respectively, year over year. Adjusted earnings from operations in North America remained flat.

•Consolidated net earnings and diluted earnings per share for the full year of 2024 were $249.7 million and $6.55, respectively, at an effective tax rate of 25.0%.

•Adjusted consolidated net earnings and Adjusted diluted earnings per share for the full year of 2024 were $338.2 million and $9.68, respectively. Excluding the effects of fluctuating foreign currency exchange rates, Adjusted diluted earnings per share was flat, year to year.

In discussing financial results for the three and twelve months ended months ended December 31, 2024 and 2023 in this press release, the Company refers to certain financial measures that are adjusted from the financial results prepared in accordance with United States generally accepted accounting principles (“GAAP”). When referring to non-GAAP measures, the Company refers to them as “Adjusted.” See “Use of Non-GAAP Financial Measures” for additional information. A tabular reconciliation of financial measures prepared in accordance with GAAP to the non-GAAP financial measures is included at the end of this press release.

In some instances, the Company refers to changes in net sales, gross profit, earnings from operations and Adjusted earnings from operations on a consolidated basis and in North America, EMEA and APAC excluding the effects of fluctuating foreign currency exchange rates. In addition, the Company refers to changes in Adjusted diluted earnings per share on a consolidated basis excluding the effects of fluctuating foreign currency exchange rates. These are also considered to be non-GAAP measures. The Company believes providing this information excluding the effects of fluctuating foreign currency exchange rates provides

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

valuable supplemental information to investors regarding its underlying business and results of operations, consistent with how the Company and its management evaluate the Company’s performance. In computing these changes and percentages, the Company compares the current year amount as translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period. The performance measures excluding the effects of fluctuating foreign currency exchange rates should not be considered a substitute for, or superior to, the measures of financial performance prepared in accordance with GAAP.

The tax effect of Adjusted amounts referenced herein were computed using the statutory tax rate for the taxing jurisdictions in the operating segment in which the related expenses were recorded, adjusted for the effects of valuation allowances on net operating losses in certain jurisdictions.

GUIDANCE

For the full year 2025, we expect Adjusted diluted earnings per share to be between $9.70 and $10.10. We expect to deliver low single-digits gross profit growth and expect that our gross margin will continue to be approximately 20%.

This outlook assumes:

•interest expense of $70 to $75 million;

•an effective tax rate of approximately 25% to 26% for the full year;

•capital expenditures of $35 to $40 million; and

•an average share count for the full year of 32.9 million shares, reflecting the net impact of settling our outstanding convertible senior notes (the “Convertible Notes”) in February 2025 and the associated warrants in 2025.

This outlook excludes acquisition-related intangibles amortization expense of approximately $74.3 million, assumes no acquisition or integration related expenses, transformation or severance and restructuring expenses, net, does not contemplate any impact of tariffs, and no significant change in our debt instruments, with the exception of the settlement of our Convertible Notes, and no significant change in the macroeconomic environment. Due to the inherent difficulty of forecasting some of these types of expenses, which impact net earnings, diluted earnings per share and selling and administrative expenses, the Company is unable to reasonably estimate the impact of such expenses, if any, to net earnings, diluted earnings per share and selling and administrative expenses. Accordingly, the Company is unable to provide a reconciliation of GAAP to non-GAAP diluted earnings per share for the full year 2025 forecast.

CONFERENCE CALL AND WEBCAST

The Company will host a conference call and live webcast today at 9:00 a.m. ET to discuss fourth quarter and full year 2024 results of operations. A live webcast of the conference call (in listen-only mode) will be available on the Company’s web site at http://investor.insight.com/, and a replay of the webcast will be available on the Company’s web site for a limited time following the call. To access the live conference call, please register in advance using the event link on the Company's web site. Upon registering, participants will receive dial-in information via email, as well as a unique registrant ID, event passcode, and detailed instructions regarding how to join the call.

USE OF NON-GAAP FINANCIAL MEASURES

The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration related expenses, (vi) gains and losses from revaluation of acquisition related earnout liabilities, (vii) certain third-party data center service outage related expenses and recoveries, and (viii) the tax effects of each of these items, as applicable. Transformation costs represent costs we are incurring to transform our business, to help us achieve our strategic objectives, including becoming a leading solutions integrator. The Company excludes these items when internally evaluating earnings from operations, tax expense, net earnings and diluted earnings per share for the Company and earnings from operations for each of the Company’s operating segments. Adjusted diluted earnings per share also includes the impact of the benefit from the note hedge where the Company’s average stock price for the fourth quarter of 2024 was in excess of $68.32, which is the initial conversion price of our Convertible Notes. Adjusted EBITDA excludes (i) interest expense, (ii) income tax expense, (iii) depreciation and amortization of property and equipment, (iv) amortization of

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

intangible assets, (v) severance and restructuring expenses, net, (vi) certain executive recruitment and hiring related expenses, (vii) transformation costs (viii) certain acquisition and integration related expenses, (ix) certain third-party data center service outage related expenses and recoveries, and (x) gains and losses from revaluation of acquisition related earnout liabilities. Adjusted return on invested capital (“ROIC”) excludes (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration related expenses, (vi) certain third-party data center service outage related expenses and recoveries, (vii) gains and losses from revaluation of acquisition related earnout liabilities, and (viii) the tax effects of each of these items, as applicable.

These non-GAAP measures are used by the Company and its management to evaluate financial performance against budgeted amounts, to calculate incentive compensation, to assist in forecasting future performance and to compare the Company’s results to those of the Company’s competitors. The Company believes that these non-GAAP financial measures are useful to investors because they allow for greater transparency, facilitate comparisons to prior periods and the Company’s competitors’ results and assist in forecasting performance for future periods. These non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non-GAAP financial measures presented by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

FINANCIAL SUMMARY TABLE

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | | | | | | | | | |

| | | | | | | | 2024 | | 2023 | | change | | 2024 | | 2023 | | change | | | | | | | | | | |

| Insight Enterprises, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 1,651,471 | | $ | 1,827,980 | | (10%) | | $ | 7,015,640 | | $ | 7,631,388 | | (8%) | | | | | | | | | | |

| Services | | | | | | | | $ | 421,194 | | $ | 408,031 | | 3% | | $ | 1,686,058 | | $ | 1,544,452 | | 9% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 2,072,665 | | $ | 2,236,011 | | (7%) | | $ | 8,701,698 | | $ | 9,175,840 | | (5%) | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 439,638 | | $ | 436,150 | | 1% | | $ | 1,766,016 | | $ | 1,669,525 | | 6% | | | | | | | | | | |

| Gross margin | | | | | | | | 21.2% | | 19.5% | | 170 bps | | 20.3% | | 18.2% | | 210 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 358,487 | | $ | 298,206 | | 20% | | $ | 1,343,151 | | $ | 1,236,243 | | 9% | | | | | | | | | | |

| Severance and restructuring expenses, net | | | | | | | | $ | 15,967 | | $ | 3,136 | | > 100% | | $ | 31,605 | | $ | 6,091 | | > 100% | | | | | | | | | | |

| Acquisition and integration related expenses | | | | | | | | $ | 510 | | $ | 2,947 | | (83%) | | $ | 2,676 | | $ | 7,396 | | (64%) | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 64,674 | | $ | 131,861 | | (51%) | | $ | 388,584 | | $ | 419,795 | | (7%) | | | | | | | | | | |

| Net earnings | | | | | | | | $ | 37,012 | | $ | 90,608 | | (59%) | | $ | 249,691 | | $ | 281,309 | | (11%) | | | | | | | | | | |

| Diluted earnings per share | | | | | | | | $ | 0.99 | | $ | 2.42 | | (59%) | | $ | 6.55 | | $ | 7.55 | | (13%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales Mix | | | | | | | | | | | | ** | | | | | | ** | | | | | | | | | | |

| Hardware | | | | | | | | 55 | % | | 51 | % | | (2%) | | 53 | % | | 55 | % | | (10%) | | | | | | | | | | |

| Software | | | | | | | | 25 | % | | 31 | % | | (23%) | | 28 | % | | 28 | % | | (4%) | | | | | | | | | | |

| Services | | | | | | | | 20 | % | | 18 | % | | 3% | | 19 | % | | 17 | % | | 9% | | | | | | | | | | |

| | | | | | | | 100 | % | | 100 | % | | (7%) | | 100 | % | | 100 | % | | (5%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| North America | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 1,379,530 | | $ | 1,471,761 | | (6%) | | $ | 5,759,744 | | $ | 6,167,512 | | (7%) | | | | | | | | | | |

| Services | | | | | | | | $ | 321,288 | | $ | 318,591 | | 1% | | $ | 1,294,836 | | $ | 1,214,842 | | 7% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 1,700,818 | | $ | 1,790,352 | | (5%) | | $ | 7,054,580 | | $ | 7,382,354 | | (4%) | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 349,987 | | $ | 353,812 | | (1%) | | $ | 1,401,994 | | $ | 1,345,955 | | 4% | | | | | | | | | | |

| Gross margin | | | | | | | | 20.6% | | 19.8% | | 80 bps | | 19.9% | | 18.2% | | 170 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 287,118 | | $ | 230,913 | | 24% | | $ | 1,058,184 | | $ | 976,172 | | 8% | | | | | | | | | | |

| Severance and restructuring expenses, net | | | | | | | | $ | 10,259 | | $ | 2,741 | | > 100% | | $ | 23,042 | | $ | 3,793 | | > 100% | | | | | | | | | | |

| Acquisition and integration related expenses | | | | | | | | $ | 214 | | $ | 2,781 | | (92%) | | $ | 1,700 | | $ | 3,908 | | (56%) | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 52,396 | | $ | 117,377 | | (55%) | | $ | 319,068 | | $ | 362,082 | | (12%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales Mix | | | | | | | | | | | | ** | | | | | | ** | | | | | | | | | | |

| Hardware | | | | | | | | 59 | % | | 57 | % | | (2%) | | 57 | % | | 61 | % | | (10%) | | | | | | | | | | |

| Software | | | | | | | | 22 | % | | 25 | % | | (17%) | | 25 | % | | 23 | % | | 3% | | | | | | | | | | |

| Services | | | | | | | | 19 | % | | 18 | % | | 1% | | 18 | % | | 16 | % | | 7% | | | | | | | | | | |

| | | | | | | | 100 | % | | 100 | % | | (5%) | | 100 | % | | 100 | % | | (4%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

FINANCIAL SUMMARY TABLE (CONTINUED)

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | | | | | | | | | |

| | | | | | | | 2024 | | 2023 | | change | | 2024 | | 2023 | | change | | | | | | | | | | |

| EMEA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 246,019 | | $ | 325,122 | | (24%) | | $ | 1,127,483 | | $ | 1,331,338 | | (15%) | | | | | | | | | | |

| Services | | | | | | | | $ | 73,758 | | $ | 65,406 | | 13% | | $ | 286,614 | | $ | 232,316 | | 23% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 319,777 | | $ | 390,528 | | (18%) | | $ | 1,414,097 | | $ | 1,563,654 | | (10%) | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 72,632 | | $ | 67,343 | | 8% | | $ | 293,188 | | $ | 259,987 | | 13% | | | | | | | | | | |

| Gross margin | | | | | | | | 22.7% | | 17.2% | | 550 bps | | 20.7% | | 16.6% | | 410 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 59,923 | | $ | 56,993 | | 5% | | $ | 238,300 | | $ | 216,246 | | 10% | | | | | | | | | | |

| Severance and restructuring expenses | | | | | | | | $ | 5,336 | | $ | 285 | | > 100% | | $ | 7,975 | | $ | 2,125 | | > 100% | | | | | | | | | | |

| Acquisition and integration related expenses | | | | | | | | $ | 17 | | $ | 166 | | (90%) | | $ | 695 | | $ | 3,488 | | (80%) | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 7,356 | | $ | 9,899 | | (26%) | | $ | 46,218 | | $ | 38,128 | | 21% | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales Mix | | | | | | | | | | | | ** | | | | | | ** | | | | | | | | | | |

| Hardware | | | | | | | | 36 | % | | 29 | % | | —% | | 36 | % | | 35 | % | | (8%) | | | | | | | | | | |

| Software | | | | | | | | 41 | % | | 54 | % | | (38%) | | 44 | % | | 50 | % | | (20%) | | | | | | | | | | |

| Services | | | | | | | | 23 | % | | 17 | % | | 13% | | 20 | % | | 15 | % | | 23% | | | | | | | | | | |

| | | | | | | | 100 | % | | 100 | % | | (18%) | | 100 | % | | 100 | % | | (10%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| APAC | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 25,922 | | $ | 31,097 | | (17%) | | $ | 128,413 | | $ | 132,538 | | (3%) | | | | | | | | | | |

| Services | | | | | | | | $ | 26,148 | | $ | 24,034 | | 9% | | $ | 104,608 | | $ | 97,294 | | 8% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 52,070 | | $ | 55,131 | | (6%) | | $ | 233,021 | | $ | 229,832 | | 1% | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 17,019 | | $ | 14,995 | | 13% | | $ | 70,834 | | $ | 63,583 | | 11% | | | | | | | | | | |

| Gross margin | | | | | | | | 32.7% | | 27.2% | | 550 bps | | 30.4% | | 27.7% | | 270 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 11,446 | | $ | 10,300 | | 11% | | $ | 46,667 | | $ | 43,825 | | 6% | | | | | | | | | | |

| Severance and restructuring expenses | | | | | | | | $ | 372 | | $ | 110 | | > 100% | | $ | 588 | | $ | 173 | | > 100% | | | | | | | | | | |

| Acquisition and integration related expenses | | | | | | | | $ | 279 | | $ | — | | * | | $ | 281 | | $ | — | | * | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 4,922 | | $ | 4,585 | | 7% | | $ | 23,298 | | $ | 19,585 | | 19% | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales Mix | | | | | | | | | | | | ** | | | | | | ** | | | | | | | | | | |

| Hardware | | | | | | | | 15 | % | | 18 | % | | (22%) | | 15 | % | | 19 | % | | (19)% | | | | | | | | | | |

| Software | | | | | | | | 35 | % | | 39 | % | | (14%) | | 40 | % | | 39 | % | | 5% | | | | | | | | | | |

| Services | | | | | | | | 50 | % | | 43 | % | | 9% | | 45 | % | | 42 | % | | 8% | | | | | | | | | | |

| | | | | | | | 100 | % | | 100 | % | | (6%) | | 100 | % | | 100 | % | | 1% | | | | | | | | | | |

* Percentage change not considered meaningful

** Change in sales mix represents growth/decline in category net sales on a U.S. dollar basis and does not exclude the effects of fluctuating foreign currency exchange rates

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

FORWARD-LOOKING INFORMATION

Certain statements in this release and the related conference call, webcast and presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, including those related to the impact of inflation and higher interest rates, the Company’s future financial performance and results of operations, including gross profit growth, Adjusted diluted earnings per share, gross margin, and Adjusted selling and administrative expenses, as well as the Company’s other key performance indicators, the Company’s anticipated effective tax rate, capital expenditures, and expected average share count, the Company’s expectations regarding cash flow, the Company’s plans and expectations relating to the settlement of the Convertible Notes and the related warrants, the Company’s expectations regarding supply constraints, future trends in the IT market, the Company’s business strategy and strategic initiatives, which are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. There can be no assurances that the results discussed by the forward-looking statements will be achieved, and actual results may differ materially from those set forth in the forward-looking statements. Some of the important factors that could cause the Company’s actual results to differ materially from those projected in any forward-looking statements include, but are not limited to, the following, which are discussed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings with the SEC:

•actions of our competitors, including manufacturers and publishers of products we sell;

•our reliance on our partners for product availability, competitive products to sell and marketing funds and purchasing incentives, which can and do change significantly in the amounts made available and in the requirements year over year;

•our ability to keep pace with rapidly evolving technological advances and the evolving competitive marketplace;

•general economic conditions, economic uncertainties and changes in geopolitical conditions, including the possibility of a recession or a decline in market activity as a result of the ongoing conflicts in Ukraine and Gaza;

•changes in the IT industry and/or rapid changes in technology;

•our ability to provide high quality services to our clients;

•our reliance on independent shipping companies;

•the risks associated with our international operations;

•supply constraints for products;

•natural disasters or other adverse occurrences, including public health issues such as pandemics or epidemics;

•disruptions in our IT systems and voice and data networks;

•cyberattacks, outages, or third-party breaches of data privacy as well as related breaches of government regulations;

•intellectual property infringement claims and challenges to our copyrights, patents, trademarks and trade names;

•potential liability and competitive risk based on the development, adoption, and use of Generative Artificial Intelligence;

•legal proceedings, client audits and failure to comply with laws and regulations;

•risks of termination, delays in payment, audits and investigations related to our public sector contracts;

•exposure to changes in, interpretations of, or enforcement trends related to tax rules and regulations;

•our potential to draw down a substantial amount of indebtedness;

•the Company is subject to counterparty risk with respect to certain hedge and warrant transactions entered into in connection with the issuance of the Convertible Notes;

•increased debt and interest expense and the possibility of decreased availability of funds under our financing facilities;

•possible significant fluctuations in our future operating results as well as seasonality and variability in client demands;

•potential contractual disputes with our clients and third-party suppliers;

•our dependence on certain key personnel and our ability to attract, train and retain skilled teammates;

•risks associated with the integration and operation of acquired businesses, including achievement of expected synergies and benefits; and

•future sales of the Company’s common stock or equity-linked securities in the public market could lower the market price for our common stock.

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

Additionally, there may be other risks that are otherwise described from time to time in the reports that the Company files with the SEC. Any forward-looking statements in this release, the related conference call, webcast and presentation speak only as of the date on which they are made and should be considered in light of various important factors, including the risks and uncertainties listed above, as well as others. The Company assumes no obligation to update, and, except as may be required by law, does not intend to update, any forward-looking statements. The Company does not endorse any projections regarding future performance that may be made by third parties.

| | | | | | | | |

| CONTACT: | JAMES MORGADO | |

| CHIEF FINANCIAL OFFICER | |

| TEL. 480.333.3251 | |

| EMAIL james.morgado@insight.com | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net sales: | | | | | | | | | | | |

| Products | $ | 1,651,471 | | | $ | 1,827,980 | | | $ | 7,015,640 | | | $ | 7,631,388 | | | | | |

| Services | 421,194 | | | 408,031 | | | 1,686,058 | | | 1,544,452 | | | | | |

| Total net sales | 2,072,665 | | | 2,236,011 | | | 8,701,698 | | | 9,175,840 | | | | | |

| Costs of goods sold: | | | | | | | | | | | |

| Products | 1,465,690 | | | 1,639,458 | | | 6,259,815 | | | 6,859,178 | | | | | |

| Services | 167,337 | | | 160,403 | | | 675,867 | | | 647,137 | | | | | |

| Total costs of goods sold | 1,633,027 | | | 1,799,861 | | | 6,935,682 | | | 7,506,315 | | | | | |

| Gross profit | 439,638 | | | 436,150 | | | 1,766,016 | | | 1,669,525 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Selling and administrative expenses | 358,487 | | | 298,206 | | | 1,343,151 | | | 1,236,243 | | | | | |

| Severance and restructuring expenses, net | 15,967 | | | 3,136 | | | 31,605 | | | 6,091 | | | | | |

| Acquisition and integration related expenses | 510 | | | 2,947 | | | 2,676 | | | 7,396 | | | | | |

| Earnings from operations | 64,674 | | | 131,861 | | | 388,584 | | | 419,795 | | | | | |

Non-operating expense (income): | | | | | | | | | | | |

| Interest expense, net | 14,660 | | | 9,358 | | | 58,036 | | | 41,124 | | | | | |

| Other (income) expense, net | (2,237) | | | 328 | | | (2,365) | | | 817 | | | | | |

| Earnings before income taxes | 52,251 | | | 122,175 | | | 332,913 | | | 377,854 | | | | | |

| Income tax expense | 15,239 | | | 31,567 | | | 83,222 | | | 96,545 | | | | | |

| Net earnings | $ | 37,012 | | | $ | 90,608 | | | $ | 249,691 | | | $ | 281,309 | | | | | |

| | | | | | | | | | | |

| Net earnings per share: | | | | | | | | | | | |

| Basic | $ | 1.17 | | | $ | 2.78 | | | $ | 7.73 | | | $ | 8.53 | | | | | |

| Diluted | $ | 0.99 | | | $ | 2.42 | | | $ | 6.55 | | | $ | 7.55 | | | | | |

| | | | | | | | | | | |

| Shares used in per share calculations: | | | | | | | | | | | |

| Basic | 31,769 | | | 32,583 | | | 32,286 | | | 32,991 | | | | | |

| Diluted | 37,212 | | | 37,513 | | | 38,136 | | | 37,241 | | | | | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 259,234 | | | $ | 268,730 | |

| Accounts receivable, net | 4,172,104 | | | 3,568,290 | |

| Inventories | 122,581 | | | 184,605 | |

| Contract assets, net | 81,980 | | | 120,518 | |

| Other current assets | 208,723 | | | 189,158 | |

| Total current assets | 4,844,622 | | | 4,331,301 | |

| | | |

| Long-term contract assets, net | 86,953 | | | 132,780 | |

| Property and equipment, net | 215,678 | | | 210,061 | |

| Goodwill | 893,516 | | | 684,345 | |

| Intangible assets, net | 426,493 | | | 369,687 | |

| Long-term accounts receivable | 845,943 | | | 412,666 | |

| Other assets | 135,373 | | | 145,510 | |

| $ | 7,448,578 | | | $ | 6,286,350 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable – trade | $ | 3,059,667 | | | $ | 2,255,183 | |

| Accounts payable – inventory financing facilities | 217,604 | | | 231,850 | |

| | | |

| Accrued expenses and other current liabilities | 512,052 | | | 538,346 | |

| Current portion of long-term debt | 332,879 | | | 348,004 | |

| Total current liabilities | 4,122,202 | | | 3,373,383 | |

| | | |

| | | |

| Long-term debt | 531,233 | | | 592,517 | |

| Deferred income taxes | 64,459 | | | 27,588 | |

| Long-term accounts payable | 799,546 | | | 353,794 | |

| Other liabilities | 160,527 | | | 203,335 | |

| 5,677,967 | | | 4,550,617 | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock | 318 | | | 326 | |

| Additional paid-in capital | 342,893 | | | 328,607 | |

| Retained earnings | 1,508,558 | | | 1,448,412 | |

Accumulated other comprehensive loss – foreign currency translation adjustments | (81,158) | | | (41,612) | |

| Total stockholders’ equity | 1,770,611 | | | 1,735,733 | |

| $ | 7,448,578 | | | $ | 6,286,350 | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net earnings | $ | 249,691 | | | $ | 281,309 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 98,137 | | | 62,476 | |

| Provision for losses on accounts receivable | 10,038 | | | 5,062 | |

| | | |

| Non-cash stock-based compensation | 33,971 | | | 28,951 | |

| Net change on revaluation of earnout liabilities | (7,848) | | | — | |

| Deferred income taxes | 8,296 | | | (13,080) | |

| Amortization of debt issuance costs | 5,591 | | | 4,870 | |

| Other adjustments | 1,054 | | | 234 | |

| Changes in assets and liabilities: | | | |

| Increase in accounts receivable | (656,092) | | | (11,892) | |

| Decrease in inventories | 54,439 | | | 75,729 | |

| Decrease (increase) in contract assets | 58,433 | | | (13,840) | |

| Increase in long-term accounts receivable | (454,887) | | | (126,850) | |

| Decrease in other assets | 16,199 | | | 34,061 | |

| Increase in accounts payable | 825,555 | | | 216,229 | |

| Increase in long-term accounts payable | 441,881 | | | 111,790 | |

| Decrease in accrued expenses and other liabilities | (51,613) | | | (35,518) | |

| Net cash provided by operating activities: | 632,845 | | | 619,531 | |

| Cash flows from investing activities: | | | |

| Proceeds from sale of assets | 13,751 | | | 15,515 | |

| Purchases of property and equipment | (46,782) | | | (39,252) | |

| Acquisitions, net of cash and cash equivalents acquired | (270,247) | | | (481,464) | |

| Net cash used in investing activities: | (303,278) | | | (505,201) | |

| Cash flows from financing activities: | | | |

| Borrowings on ABL revolving credit facility | 4,622,416 | | | 4,587,596 | |

| Repayments on ABL revolving credit facility | (5,176,546) | | | (4,288,036) | |

| Net repayments under inventory financing facilities | (13,577) | | | (70,408) | |

| Proceeds from issuance of senior unsecured notes | 500,000 | | | — | |

| Payment of debt issuance costs | (8,652) | | | — | |

| Repurchases of common stock | (200,020) | | | (217,108) | |

| Repayment of principal on the Convertible Notes | (16,895) | | | — | |

| Earnout and acquisition related payments | (20,286) | | | (15,615) | |

| Other payments | (7,711) | | | (13,141) | |

| Net cash used in financing activities: | (321,271) | | | (16,712) | |

| Foreign currency exchange effect on cash, cash equivalents and restricted cash balances | (17,614) | | | 7,449 | |

| (Decrease) increase in cash, cash equivalents and restricted cash | (9,318) | | | 105,067 | |

| Cash, cash equivalents and restricted cash at beginning of period | 270,785 | | | 165,718 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 261,467 | | | $ | 270,785 | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Adjusted Consolidated Earnings from Operations: | | | | | | | | | | | | |

| GAAP consolidated EFO | | $ | 64,674 | | $ | 131,861 | | $ | 388,584 | | $ | 419,795 | | | | |

| Amortization of intangible assets | | 18,597 | | 10,988 | | 69,581 | | 36,231 | | | | |

| Change in fair value of earnout liabilities | | 22,800 | | — | | (7,849) | | — | | | | |

| Other* | | 23,342 | | 5,823 | | 52,056 | | 36,101 | | | | |

| Adjusted non-GAAP consolidated EFO | | $ | 129,413 | | $ | 148,672 | | $ | 502,372 | | $ | 492,127 | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 3.1% | | 5.9% | | 4.5% | | 4.6% | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 6.2% | | 6.6% | | 5.8% | | 5.4% | | | | |

| | | | | | | | | | | | |

| Adjusted Consolidated Net Earnings: | | | | | | | | | | | | |

| GAAP consolidated net earnings | | $ | 37,012 | | $ | 90,608 | | $ | 249,691 | | $ | 281,309 | | | | |

| Amortization of intangible assets | | 18,597 | | 10,988 | | 69,581 | | 36,231 | | | | |

| | | | | | | | | | | | |

| Change in fair value of earnout liabilities | | 22,800 | | — | | (7,849) | — | — | | | | |

| Other* | | 23,342 | | 5,823 | | 52,056 | | 36,101 | | | | |

| Income taxes on non-GAAP adjustments | | (10,620) | | (4,287) | | (25,298) | | (18,016) | | | | |

| Adjusted non-GAAP consolidated net earnings | | $ | 91,131 | | $ | 103,132 | | $ | 338,181 | | $ | 335,625 | | | | |

| | | | | | | | | | | | |

| GAAP net earnings as a percentage of net sales | | 1.8% | | 4.1% | | 2.9% | | 3.1% | | | | |

| Adjusted non-GAAP net earnings as a percentage of net sales | | 4.4% | | 4.6% | | 3.9% | | 3.7% | | | | |

| | | | | | | | | | | | |

| Adjusted Diluted Earnings Per Share: | | | | | | | | | | | | |

| GAAP diluted EPS | | $ | 0.99 | | | $ | 2.42 | | | $ | 6.55 | | | $ | 7.55 | | | | | |

| Amortization of intangible assets | | 0.50 | | | 0.29 | | | 1.82 | | | 0.97 | | | | | |

| | | | | | | | | | | | |

| Change in fair value of earnout liabilities | | 0.61 | | | — | | | (0.21) | | | — | | | | | |

| Other | | 0.63 | | | 0.16 | | | 1.37 | | | 0.97 | | | | | |

| Income taxes on non-GAAP adjustments | | (0.29) | | | (0.11) | | | (0.66) | | | (0.48) | | | | | |

| Impact of benefit from note hedge | | 0.22 | | | 0.22 | | | 0.81 | | | 0.68 | | | | | |

| Adjusted non-GAAP diluted EPS | | $ | 2.66 | | | $ | 2.98 | | | $ | 9.68 | | | $ | 9.69 | | | | | |

| | | | | | | | | | | | |

| Shares used in diluted EPS calculation | | 37,212 | | 37,513 | | 38,136 | | 37,241 | | | | |

Impact of benefit from note hedge | | (3,011) | | (2,874) | | (3,205) | | (2,619) | | | | |

| Shares used in Adjusted non-GAAP diluted EPS calculation | | 34,201 | | 34,639 | | 34,931 | | 34,622 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Adjusted North America Earnings from Operations: | | | | | | | | | | | | |

| GAAP EFO from North America segment | | $ | 52,396 | | | $ | 117,377 | | | $ | 319,068 | | | $ | 362,082 | | | | | |

| Amortization of intangible assets | | 16,820 | | | 9,245 | | | 62,377 | | | 32,514 | | | | | |

| Change in fair value of earnout liabilities | | 22,800 | | | — | | | (1,419) | | | — | | | | | |

| Other* | | 17,198 | | | 5,122 | | | 41,951 | | | 29,763 | | | | | |

| Adjusted non-GAAP EFO from North America segment | | $ | 109,214 | | | $ | 131,744 | | | $ | 421,977 | | | $ | 424,359 | | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 3.1 | % | | 6.6 | % | | 4.5 | % | | 4.9 | % | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 6.4 | % | | 7.4 | % | | 6.0 | % | | 5.7 | % | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED)

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | | |

| Adjusted EMEA Earnings from Operations: | | | | | | | | | | | | |

| GAAP EFO from EMEA segment | | $ | 7,356 | | | $ | 9,899 | | | $ | 46,218 | | | $ | 38,128 | | | | | |

| Amortization of intangible assets | | 1,777 | | | 1,635 | | | 6,912 | | | 3,277 | | | | | |

| Change in fair value of earnout liabilities | | — | | | — | | | (6,430) | | | — | | | | | |

| Other | | 5,493 | | | 591 | | | 9,236 | | | 6,165 | | | | | |

| Adjusted non-GAAP EFO from EMEA segment | | $ | 14,626 | | | $ | 12,125 | | | $ | 55,936 | | | $ | 47,570 | | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 2.3 | % | | 2.5 | % | | 3.3 | % | | 2.4 | % | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 4.6 | % | | 3.1 | % | | 4.0 | % | | 3.0 | % | | | | |

| | | | | | | | | | | | |

| Adjusted APAC Earnings from Operations: | | | | | | | | | | | | |

| GAAP EFO from APAC segment | | $ | 4,922 | | | $ | 4,585 | | | $ | 23,298 | | | $ | 19,585 | | | | | |

| Amortization of intangible assets | | — | | | 108 | | | 292 | | | 440 | | | | | |

| Other | | 651 | | | 110 | | | 869 | | | 173 | | | | | |

| Adjusted non-GAAP EFO from APAC segment | | $ | 5,573 | | | $ | 4,803 | | | $ | 24,459 | | | $ | 20,198 | | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 9.5 | % | | 8.3 | % | | 10.0 | % | | 8.5 | % | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 10.7 | % | | 8.7 | % | | 10.5 | % | | 8.8 | % | | | | |

| | | | | | | | | | | | |

| Adjusted EBITDA: | | | | | | | | | | | | |

| GAAP consolidated net earnings | | $ | 37,012 | | $ | 90,608 | | $ | 249,691 | | $ | 281,309 | | | | |

| Interest expense | | 16,960 | | 11,958 | | 68,272 | | 48,576 | | | | |

| Income tax expense | | 15,239 | | 31,567 | | 83,222 | | 96,545 | | | | |

| Depreciation and amortization of property and equipment | | 7,183 | | 6,790 | | 28,556 | | 26,245 | | | | |

| Amortization of intangible assets | | 18,597 | | 10,988 | | 69,581 | | 36,231 | | | | |

| | | | | | | | | | | | |

| Change in fair value of earnout liabilities | | 22,800 | | — | | (7,849) | | — | | | | |

| Other* | | 23,342 | | 5,823 | | 52,056 | | 36,101 | | | | |

| Adjusted non-GAAP EBITDA | | $ | 141,133 | | $ | 157,734 | | $ | 543,529 | | $ | 525,007 | | | | |

| | | | | | | | | | | | |

| GAAP consolidated net earnings as a percentage of net sales | | 1.8% | | 4.1% | | 2.9% | | 3.1% | | | | |

| Adjusted non-GAAP EBITDA as a percentage of net sales | | 6.8% | | 7.1% | | 6.2% | | 5.7% | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Includes transformation costs of $5.4 million and $2.6 million for the three months ended December 31, 2024 and 2023, respectively and $18.4 million and $16.6 million for the twelve months ended December 31, 2024 and 2023, respectively. Includes certain third-party data center service outage expenses, net of recoveries of $1.3 million for the three months ended December 31, 2024 and recoveries in excess of expenses of $2.1 million for the twelve months ended December 31, 2024. Includes data center service outage related recoveries of $3.0 million for the three months ended December 31, 2023 and data center service outage related expenses, net of recoveries of $5.0 million for the twelve months ended December 31, 2023. Includes severance and restructuring expenses, net of $16.0 million and $31.6 million for the three and twelve months ended December 31, 2024, respectively. Includes severance and restructuring expenses, net of $3.1 million and $6.1 million for the three and twelve months ended December 31, 2023, respectively.

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED)

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2024 | | 2023 |

| Adjusted return on invested capital: | | | | |

| GAAP consolidated EFO | | $ | 388,584 | | | $ | 419,795 | |

| Amortization of intangible assets | | 69,581 | | | 36,231 | |

| Change in fair value of earnout liabilities | | (7,849) | | | — | |

Other5 | | 52,056 | | | 36,101 | |

| Adjusted non-GAAP consolidated EFO | | 502,372 | | | 492,127 | |

Income tax expense1 | | 130,617 | | | 127,953 | |

| Adjusted non-GAAP consolidated EFO, net of tax | | $ | 371,755 | | | $ | 364,174 | |

Average stockholders’ equity2 | | $ | 1,775,136 | | | $ | 1,628,480 | |

Average debt2 | | 953,619 | | | 690,402 | |

Average cash2 | | (296,166) | | | (209,674) | |

| Invested Capital | | $ | 2,432,589 | | | $ | 2,109,208 | |

| | | | |

Adjusted non-GAAP ROIC (from GAAP consolidated EFO)3 | | 11.82 | % | | 14.73 | % |

Adjusted non-GAAP ROIC (from non-GAAP consolidated EFO)4 | | 15.28 | % | | 17.27 | % |

1 Assumed tax rate of 26.0%.

2 Average of previous five quarters.

3 Computed as GAAP consolidated EFO, net of tax of $101,032 and $109,147 for the twelve months ended December 31, 2024 and 2023, respectively, divided by invested capital.

4 Computed as Adjusted non-GAAP consolidated EFO, net of tax, divided by invested capital.

5 Includes transformation costs of $18.4 million and $16.6 million for the twelve months ended December 31, 2024 and 2023, respectively. Includes certain third-party data center service outage related recoveries in excess of expenses of $2.1 million for the twelve months ended December 31, 2024. Includes certain third-party data center service outage related expenses, net of recoveries of $5.0 million for the twelve months ended December 31, 2023. Includes severance and restructuring expenses, net of $31.6 million and $6.1 million for the twelve months ended December 31, 2024 and 2023, respectively.

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2025 Insight Direct USA, Inc. All Rights Reserved. 1 Insight Enterprises, Inc. Fourth Quarter and Full Year 2024 Earnings Conference Call and Webcast

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 25 Disclosures ◦ Safe harbor statement This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 related to Insight’s plans and expectations. Statements that are not historical facts, including those related to our expectations about future financial results and the assumptions related thereto, our expectations regarding future expected trends in the IT market and our opportunities for growth, are forward-looking statements. These forward-looking statements are subject to assumptions, risks and uncertainties which could cause actual results or future events to differ materially from such statements. Insight Enterprises, Inc. (the "Company") undertakes no obligation to update publicly or revise any of the forward-looking statements, except as otherwise required by law. More detailed information about forward-looking statements and risk factors is included in today’s press release and discussed in the Company’s most recently filed periodic reports and subsequent filings with the Securities and Exchange Commission. ◦ Non-GAAP measures This presentation will reference certain non-GAAP financial information as ‘Adjusted’. A reconciliation of non-GAAP financial measures presented in this document to our actual GAAP results is attached to the back of this presentation and included in the press release issued today, which you may find on the Investor Relations section of our website at investor.insight.com. These non-GAAP measures are used by the Company and its management to evaluate financial performance against budgeted amounts, to calculate incentive compensation, to assist in forecasting future performance and to compare the Company’s results to those of the Company’s competitors. The Company believes that these non-GAAP financial measures are useful to investors because they allow for greater transparency, facilitate comparisons to prior periods and the Company’s competitors’ results and assist in forecasting performance for future periods. These non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non-GAAP financial measures presented by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. ◦ Constant currency In some instances, the Company refers to changes in net sales, gross profit, earnings from operations and Adjusted earnings from operations on a consolidated basis and in North America, EMEA and APAC excluding the effects of fluctuating foreign currency exchange rates. In addition, the Company refers to changes in Adjusted diluted earnings per share on a consolidated basis excluding the effects of fluctuating foreign currency exchange rates. These are also considered to be non-GAAP measures. The Company believes providing this information excluding the effects of fluctuating foreign currency exchange rates provides valuable supplemental information to investors regarding its underlying business and results of operations, consistent with how the Company and its management evaluate the Company’s performance. In computing these changes and percentages, the Company compares the current year amount as translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period.

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 35 Table of Contents ◦ Solutions Integrator Strategy ◦ Solutions at Work ◦ Awards and Recognitions ◦ Fourth Quarter and Full Year 2024 Highlights and Performance ◦ 2027 KPIs for Success ◦ 2025 Outlook ◦ Appendix

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 45 Put clients first We put our clients first, delivering essential value that contributes to their success and making us the partner they can't live without. Deliver differentiation Our combination of innovative and scalable solutions, exceptional talent and unique portfolio strategy gives us a differentiated advantage. Champion culture Our teammates and our culture are our biggest assets. We champion them to deliver the best. Put Clients First Deliver Differentiation Champion Our Culture Drive Profitable Growth Solutions Int grator ≠ Systems Integrator Reseller Distributor Our strategy is to become THE leading SOLUTIONS INTEGRATOR The pillars of our strategy are:

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 55 Our strategy is to become THE leading SOLUTIONS INTEGRATOR DRIVE PROFITABLE GROWTH We relentlessly pursue high performance, operational excellence and profitable growth. Put clients first We put our clients first, delivering essential value that contributes to their success and making us the partner they can't live without. Deliver differentiation Our combination of innovative and scalable solutions, exceptional technical talent and compelling portfolio strategy gives us a differentiated advantage. Champion our culture Our teammates and our culture are our biggest assets. We champion them to deliver the best.

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 65 The challenge: The results: • The consumer health division of a major pharmaceutical corporation needed to divest and stand up its organization • The client needed support establishing a strong security posture across numerous enterprise domains like apps, cloud, data and modern workplace tools • 4,000+ tickets supported • Reduced internal operational burdens • Reduced costs through optimization efforts • Improved security and scalability Key takeaways: To avoid disruption of operations or vulnerabilities in divestiture, this client is covering a wide range of its security needs with ongoing SECaaS growth. The Insight team helped the client architect and stand up its entire security practice from day one with far-reaching solutions: • Security as a Service (SECaaS) with a growing team of technicians supporting the client globally, 24/7/365 • Consolidated and updated security tools • Cloud app testing and identification of vulnerabilities for patching • Device and endpoint security, including antivirus management • Amplified data security, especially for sensitive information • Email security and spam filtering The solution: Building a Strong Posture from the Ground Up

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 75 The challenge: The results: • Cricket Australia oversees more than 7,000 weekly matches and major international events • The organization sought better ways to engage fans through real-time, personalized content and improve grassroots cricket experiences • Scaled workload capacity 4x while reducing operational costs by 50% compared to four years prior • Strengthened grassroots participation, with players using the PlayCricket app more likely to return the following season due to improved game experiences • Built stronger direct-to-fan relationships, increasing loyalty through personalized content, vertical video highlights, and targeted notifications • The client partnered with Insight and Microsoft to enhance fan engagement through AI-driven solutions • Launched the AI-powered insights feature on the Cricket Australia Live app, delivering dynamic matchday updates and personalized micro-storylines • Digitized grassroots cricket interactions with the PlayCricket app, offering features like live player notifications, AI-generated highlights, and personalized performance tracking • Created generative AI for tailored fan content, player profiles, and match reports • Adopted a cloud-based approach with Microsoft Azure, allowing dynamic scalability, cost efficiency, and real-time data processing The solution: Unlocking New Fan Experiences with AI

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 85 Awards • 2024 Best Large Employers • 2024 Canada's Best Employers • 2024 Best Employers for Diversity Sector Leaders No. 40 in Tech FORBES X World's Best Employers No. 37 in IT Newsweek • America's Greatest Workplaces for 2024 (5 stars) • America's Greatest Workplaces for Diversity for 2024 (5 stars) • America's Greatest Workplaces for Women (5 stars) • America's Greatest Workplaces for Parents & Families (4.5 stars) North America Great Place to Work International Great Place to Work No. 5 | Phoenix Business Journal's 2024 Best Places to Work (Extra-large companies) No. 8 | Arizona's Largest Corporate Volunteer Programs No. 46 | Arizona Largest Employers Columbus CEO Magazine Best of the Best Montreal's Top Employers Certified | U.S. No. 8 | Australia; Best in Tech No. 17 | Australia No. 28 | UK No. 31 | UK for Development No. 33 | UK for Women Hong Kong Best Workplace Certified | Australia, Austria, China, Hong Kong, India, Italy, New Zealand, Philippines, Singapore, Spain, UK

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 95 Industry and Partner Recognitions BROADCOM VMWARE | North America Cybersecurity Partner of the Year & Fastest Growth Partner of the Year X GITLAB | 2024 Americas Emerging Partner of the Year X HP | 2024 Canada Services Partner of the Year X INTEL | 2024 Solution Provider Marketing Partner of the Year X LENOVO | 2024 Infrastructure Solutions Groups National Partner of the Year (U.S. & Canada) X NETAPP | 2024 Keystone Partner of the Year X NVIDIA | 2024 Americas Software Partner of the Year X PURE STORAGE | Trailblazer of the Year X TREND MICRO | 2024 U.S. Enterprise Partner of the Year X VERITAS | 2024 Top Cloud Growth Partner of the Year • Surface Reseller Partner of the Year Award (North America) • 2024 Americas Surface Partner of the Year (U.S.) • Americas AI and Copilot Innovation Partner of the Year (Canada) • Microsoft 2024 Canada Surface Solutions Partner Excellence Award (Canada) • Americas • Americas Enterprise • Americas Customer Experience • U.S. Partner • Canada Defend and Protect 2024 Acquisition Partner of the Year 2024 Gartner Magic Quadrant™ for Software Asset Management Managed Services 2024 Cisco Partner of the Year Including Americas Partner of the Year • 2024 Global Sales Partner of the Year • 2024 Location-Based Services Partner of the Year

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 105 Q4/Full Year 2024 Performance (Changes against prior year period) Q4 2024 $125M +3% YoY CLOUD GROSS PROFIT Q4 2024 $78M +12% YoY INSIGHT CORE SERVICES GROSS PROFIT FY 2024 $484M +21% YoY FY 2024 $315M +15% YoY Note: We have updated our definition of cloud gross profit. Prior period cloud gross profit figures have been recast throughout this presentation to conform to our updated cloud gross profit definition. We have included a reconciliation of current and prior period cloud gross profit (previously reported amounts) to the recast cloud gross profit figures in slide 37 of this presentation. The Company does not intend to provide this reconciliation in its earnings materials in future periods. The update to cloud gross profit does not impact the Company’s compensation performance measure payout determinations under the 2024 Executive Compensation Program, as outlined in the Company’s 2024 Proxy Statement.

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 115 Q4/Full Year 2024 Performance (continued) (Changes against prior year period) * See Appendix for reconciliation of non-GAAP measures ** For the twelve months ended December 31, 2024 Note: For cloud gross profit, refer to footnote in slide 10 and slide 37 Q4 2024 $2.1B -7% YoY NET SALES MARGINS Q4 2024 $440M +1% YoY GROSS PROFIT 57% services as a % of total gross profit and 27% cloud as a % of total gross profit** FY 2024 $8.7B -5% YoY FY 2024 $1.8B +6% YoY Q4 2024 FY 2024 GROSS MARGIN 20.3% +210 bps EFO MARGIN 4.5% -10 bps ADJUSTED EFO* MARGIN 5.8% +40 bps EARNINGS FROM OPERATIONS Q4 2024 $65M -51% YoY FY 2024 $389M -7% YoY ADJUSTED EARNINGS FROM OPERATIONS* Q4 2024 $129M -13% YoY GROSS MARGIN 21.2% +170 bps EFO MARGIN 3.1% -280 bps ADJUSTED EFO* MARGIN 6.2% -40 bps FY 2024 $502M +2% YoY

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 125 Q4/Full Year 2024 Performance (continued) (Changes against prior year period) * See Appendix for reconciliation of non-GAAP measures Q4 2024 $37M -59% YoY EARNINGS HEADCOUNT Skilled, certified consulting, and service delivery professionals NET EARNINGS DILUTED EARNINGS PER SHARE FY 2024 $250M -11% YoY Q4 2024 $0.99 -59% YoY FY 2024 $6.55 -13% YoY Q4 2024 $141M -11% YoY FY 2024 $544M +4% YoY CASH CONVERSION CYCLE 7 DAYS down 22 days ADJUSTED EBITDA* NET CASH FROM OPERATIONS $215M Q4 $633M FY24 Days sales outstanding (DSO) +38 days Days inventory outstanding (DIO) -2 days Days purchases outstanding (DPO) +(58) days Q4 2024 $2.66 -11% YoY FY 2024 $9.68 flat YoY ADJUSTED DILUTED EARNINGS PER SHARE* CASH FLOWS AND CASH CYCLE SERVICE DELIVERY SCALE 6,400+

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 135 Debt US Dollars in millions Description Net payments InfoCenter (May 2024) $265 NWT* (July 2024) $5 Total payments for acquisitions** $270 Total share repurchases $200 Cash from operations used $(546) Decease in total debt $(76) • Total debt balance at December 31, 2024 - $864.1 million • Total debt balance at December 31, 2023 - $940.5 million • YoY decrease in total debt of $76.4 million • Acquisitions and share repurchases - $470 million * Acquired entity in our EMEA segment ** Cash paid, net of cash and cash equivalents acquired (from Statement of Cash Flows)

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 145 2027 KPIs for Success KPIs 2024** 2-yr CAGR*** 2027 Cloud GP Growth 21% 24% 16% - 20% 5-year CAGR**** Core services GP Growth 15% 12% 16% - 20% 5-year CAGR**** Adjusted EBITDA Margin* 6.2% 6.5% - 7.0% Adjusted DEPS* Growth flat 3% 19% - 22% 5-year CAGR**** Adjusted ROIC* 15.3% >25% Adjusted free cash flow as % of Adjusted net earnings* 173% >90% * Adjusted non-GAAP basis excludes (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) certain third-party data center service outage related expenses and recoveries, (vii) gains and losses from revaluation of acquisition related earnout liabilities, and (viii) the tax effects of each of these items, as applicable. Due to the inherent difficulty of forecasting these adjustments, which impact net earnings, net earnings margin, diluted earnings per share, earnings from operations and net cash provided by operating activities as a percentage of net earnings, the Company is unable to reasonably estimate the impact of these adjustments, if any, to such GAAP measures. Accordingly, the Company is unable to provide a reconciliation for the 2027 forecast of GAAP to non-GAAP net earnings, diluted earnings per share, adjusted free cash flow as a percentage of adjusted net earnings, ROIC and EBITDA margin. See Appendix and elsewhere in this presentation for reconciliation of historical non-GAAP measures ** Growth baseline period is 2023. 2024 cloud GP growth is calculated based on 2023 recast cloud gross profit *** Growth is calculated as the 2-year CAGR from 2022 to 2024 **** CAGR baseline year is 2022 Note 1: Insight Core services is defined as services Insight delivers and manages Note 2: Adjusted free cash flow is defined as cash flow from operations minus capital expenditures Note 3: For cloud gross profit, refer to footnote in slide 10 and slide 37

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 155 Full Year 2025 Outlook Assumptions: As of February 6, 2025 Gross profit growth low single-digits Gross margin approximately 20% Adjusted diluted EPS* $9.70 - $10.10 Interest expense $70 - $75 million Effective tax rate 25% - 26% Capital expenditures $35 - $40 million Average share count 32.9 million Other Exclusions and Assumptions: • Average share count for the full year of 32.9 million shares reflects the net impact of settling our outstanding Convertible Notes in February 2025 and the associated warrants in 2025 • Excludes acquisition-related intangibles amortization expense of approximately $74.3 million (posted on website) • Assumes no acquisition or integration-related, transformation or severance and restructuring expenses, net, and does not contemplate any impact of tariffs • Assumes no significant change in our debt instruments, with the exception of the settlement of our Convertible Notes, or the macroeconomic environment * Adjusted diluted earnings per share excludes severance and restructuring expense, net and other unique items as well as amortization expense related to acquired intangibles. Due to the inherent difficulty of forecasting some of these types of expenses, which impact net earnings, diluted earnings per share and selling and administrative expenses, the Company is unable to reasonably estimate the impact of such expenses, if any, to net earnings, diluted earnings per share and selling and administrative expenses. Accordingly, the Company is unable to provide a reconciliation of GAAP to non-GAAP diluted earnings per share for the full year 2025 forecast

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2025 Insight Direct USA, Inc. All Rights Reserved. 16 Appendix

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 175 $2.1B NET SALES -7% YoY $440M GROSS PROFIT +1% YoY $8.7B* -5% YoY * For the twelve months ended December 31, 2024 $1.8B* +6% YoY $2.2B $2.4B $2.2B $2.1B $2.1B Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 $8.3B $9.4B $10.4B $9.2B $8.7B 2020 2021 2022 2023 2024 $436M $441M $453M $432M $440M Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 $1.3B $1.4B $1.6B $1.7B $1.8B 2020 2021 2022 2023 2024 19.5% 18.5% 21.0% 20.7% 21.2% 15.6% 15.3% 15.7% 18.2% 20.3% Gross Margin Trailing twelve months Trailing twelve months