LED Lighting and EV Charging Solutions Provider Orion Previews Q2’25 Results and Updates FY 2025 Outlook in Anticipation of LD Micro Investor Presentation Webcast Today at 8:30 a.m. PT

29 October 2024 - 10:57PM

Orion Energy Systems, Inc. (NASDAQ: OESX) (Orion

Lighting), a provider of energy-efficient LED lighting, electric

vehicle (EV) charging stations and maintenance services solutions,

today announced unaudited preliminary revenue results for its

fiscal 2025 second quarter (Q2’25) ended September 30, 2024, in

anticipation of its participation today at the LD Micro Main Event

XVII investor conference in Los Angeles. CEO Mike Jenkins and CFO

Per Brodin will provide an overview presentation at the conference

today at 8:30 a.m. PT / 11:30 a.m. ET (webcast details below) and

will also be available for in person investor meetings.

Orion plans to report its Q2’25 results and hold a conference

call on Wednesday, November 6th at 10.00 a.m. ET; call details will

be announced in advance.

Q2’25 PreviewOrion reported preliminary Q2’25

revenue of approximately $19.4M compared to $20.6M in Q2’24. Orion

also reported preliminary FY 2025 first six months revenue (6M’25)

of approximately $39.3M compared to $38.2M in 6M’24.

- EV charging solutions revenue rose 40%

to $4.7M compared to Q2’24, benefitting from Eversource Energy’s

“EV Make Ready” program contracts and additional work for Boston

Public Schools.

- LED lighting revenue declined

approximately 20% to $10.8M in Q2’25 vs. Q2’24, following the

completion of a large European retrofit project in Q1’25. This

project benefited the prior-year period versus no revenue in Q2’25.

Due to customer delays, several projects did not yet commence in

Q2’25 as anticipated but are expected to start in Q3’25 or Q4’25.

Orion maintains a robust pipeline in the automotive, retail,

technology, logistics/distribution, financial and public sectors,

from a mix of existing and new customers. In addition, Orion

recently secured a new 5-Year, $25M contract to supply LED lighting

fixtures for new store construction projects for its largest

customer, a major national retailer.

- Maintenance services revenue rose 5% to

$3.8M in Q2’25 compared to the year-ago quarter, delivering better

than expected performance following the Q1’25 revenue decrease that

resulted from the lapse of unprofitable customer contracts.

Maintenance services gross profit percentage rebounded 2,290 basis

points in Q2’25 from a negative margin in Q2’24.

- Orion ended the quarter with cash of

approximately $5.4M after a $1M debt repayment on the Company’s

bank facility in Q2’25.

FY 2025 Outlook UpdatePrincipally reflecting

project delays in the LED lighting business, Orion is revising its

FY’25 revenue outlook to growth of approximately 10% over FY 2024,

from its prior outlook of 10-15% growth, and it expects second half

revenue to be more heavily weighted to the fourth quarter. Orion

continues to expect solid growth in its EV charging business in

FY’25 and a decrease in maintenance services revenue principally

reflecting the roll-off of unprofitable legacy contracts. Orion

will provide more detail on its outlook when it reports Q2’25

results.

LD Micro Conference Details:Contact

(registration@ldmicro.com) to register for the event and to

schedule a meeting with Orion management.

| Orion Online Presentation Access |

|

Date/Time: |

Tuesday,

October 29th at 8:30 a.m. PT |

| URL: |

https://me24.sequireevents.com/ |

| |

|

About Orion Energy SystemsOrion provides energy

efficiency and clean tech solutions, including LED lighting and

controls, electrical vehicle (EV) charging solutions, and

maintenance services. Orion specializes in turnkey

design-through-installation solutions for large national customers

as well as projects through ESCO and distribution partners, with a

commitment to helping customers achieve their business and

environmental goals with healthy, safe and sustainable solutions

that reduce their carbon footprint and enhance business

performance.

Orion is committed to operating responsibly throughout all areas

of our organization. Learn more about our Sustainability and

Governance priorities, goals and progress here or visit our website

at www.orionlighting.com.

Safe Harbor

Statement Certain

matters discussed in this press release are "forward-looking

statements" intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of

1995. These forward-looking statements may generally be identified

as such because the context of such statements will include words

such as "anticipate," "believe," "could," "estimate," "expect,"

"intend," "may," "plan," "potential," "predict," "project,"

"should," "will," "would" or words of similar import. Similarly,

statements that describe our future outlook, plans, expectations,

objectives or goals are also forward-looking statements. Such

forward-looking statements are subject to certain risks and

uncertainties that could cause results to differ materially from

those expected, including, but not limited to, the following: (i)

our ability to manage and respond to ongoing increasing pressures

to reduce the selling price of our products driven largely by a

return to a more normalized supply chain and reduction in shipping

costs for our imported products, coupled with the related increase

in competition from foreign competitors; (ii) our ability to regain

and sustain our profitability and positive cash flows; (iii) our

ability to achieve our budgeted revenue expectations for fiscal

2025; (iv) our dependence on a limited number of key customers, and

the consequences of the loss of one or more key customers or

suppliers, including key contacts at such customers; (v) our

existing risk that liquidity and capital resources may not be

sufficient to allow us to fund or sustain our growth; (vi) our

ability to manage general economic, business and geopolitical

conditions, including the impacts of natural disasters, pandemics

and outbreaks of contagious diseases and other adverse public

health developments; (vii) our ability to successfully launch,

manage and maintain our refocused business strategy to successfully

bring to market new and innovative product and service offerings;

(viii) our ability to recruit, hire and retain talented individuals

in all disciplines of our company; (ix) price fluctuations

(including as a result of tariffs(, shortages or interruptions of

component supplies and raw materials used to manufacture our

products; (x) our risk of potential loss related to single or

focused exposure within our current customer base and product

offerings; (xi) our ability to maintain effective information

technology systems security measures and manage risks related to

cybersecurity; (xii) our ability to differentiate our products in a

highly competitive and converging market, expand our customer base

and gain market share; (xiii) our ability to manage and mitigate

downward pressure on the average selling prices of our products as

a result of competitive pressures in the light emitting diode

(“LED”) market; (xiv) our ability to manage our inventory and avoid

inventory obsolescence in a rapidly evolving LED market; (xv) our

increasing reliance on third parties for the manufacture and

development of products, product components, as well as the

provision of certain services; (xvi) our increasing emphasis on

selling more of our products through third party distributors and

sales agents, including our ability to attract and retain effective

third party distributors and sales agents to execute our sales

model; (xvii) our ability to develop and participate in new product

and technology offerings or applications in a cost effective and

timely manner; (xviii) our ability to maintain safe and secure

information technology systems; (xix) our ability to balance

customer demand and production capacity; (xx) our ability to

maintain an effective system of internal control over financial

reporting; (xxi) our ability to defend our patent portfolio and

license technology from third parties; (xxii) a reduction in the

price of electricity; (xxiii) the reduction or elimination of

investments in, or incentives to adopt, LED lighting or the

elimination of, or changes in, policies, incentives or rebates in

certain states or countries that encourage the use of LEDs over

some traditional lighting technologies; (xxiv) our failure to

comply with the covenants in our credit agreement; (xxv) the

electric vehicle (‘EV”) market and deliveries of passenger and

fleet vehicles may not grow as expected; (xxvi) incentives from

governments or utilities may not materialize or may be reduced,

which could reduce demand for EVs, or the portion of regulatory

credits that customers claim may increase, which would reduce our

revenue from such incentives; (xxvii) the cost to comply with, and

the effects of, any current and future industry and government

regulations, laws and policies; (xviii) potential warranty claims

in excess of our reserve estimates; and (xxix) the other risks

described in our filings with the Securities and Exchange

Commission. Shareholders, potential investors and other readers are

urged to consider these factors carefully in evaluating the

forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements made herein are made only as of the date of this press

release and we undertake no obligation to publicly update any

forward-looking statements, whether as a result of new information,

future events or otherwise. More detailed information about factors

that may affect our performance may be found in our filings with

the Securities and Exchange Commission, which are available at

http://www.sec.gov or at http://investor.oriones.com in the

Investor Relations section of our Website.

Engage with

UsX: @OrionLighting and

@OrionLightingIRStockTwits: @OESX_IR

|

Investor Relations Contacts |

|

|

Per Brodin, CFO |

William Jones; David Collins |

|

Orion Energy Systems, Inc. |

Catalyst IR |

|

pbrodin@oesx.com |

(212) 924-9800 or OESX@catalyst-ir.com |

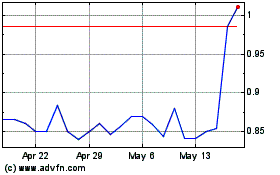

Orion Energy Systems (NASDAQ:OESX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Orion Energy Systems (NASDAQ:OESX)

Historical Stock Chart

From Jan 2024 to Jan 2025