UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-38588

OPERA LIMITED

Vitaminveien 4,

0485 Oslo, Norway

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

Opera Limited |

|

|

|

Date: August 22, 2024 |

By: |

/s/ James Yahui Zhou |

|

Name: |

James Yahui Zhou |

|

Title: |

Chairman of the Board and Chief Executive Officer |

Exhibit 99.1

Opera Reports Second Quarter 2024 Results Ahead of Expectations, Raises Full-Year Outlook Again

Revenue grew 17% year-over-year to $109.7 million, and exceeded the guidance range

Adjusted EBITDA of $26.6 million, a 24% margin, also exceeded the guidance range

Product lineup further strengthened with Opera One launched on iOS along with rapid innovation across platforms

Company increases both revenue and adjusted EBITDA guidance for the year, now at 17% year-over-year growth at a 24% adjusted EBITDA margin at the midpoints

OSLO, Norway, August 22, 2024 – Opera Limited (NASDAQ: OPRA), one of the world’s major browser developers and a leading internet consumer brand, today announced financial results for the quarter ended June 30, 2024.

Second Quarter and First Half 2024 Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

|

(In thousands, except percentages and per share amounts) |

|

2023 |

|

|

2024 |

|

|

% change |

|

|

2023 |

|

|

2024 |

|

|

% change |

|

Revenue |

|

$ |

94,134 |

|

|

$ |

109,734 |

|

|

|

17 |

% |

|

$ |

181,185 |

|

|

$ |

211,605 |

|

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

13,537 |

|

|

$ |

19,303 |

|

|

|

43 |

% |

|

$ |

29,015 |

|

|

$ |

34,142 |

|

|

|

18 |

% |

Net income margin |

|

|

14 |

% |

|

|

18 |

% |

|

|

|

|

|

16 |

% |

|

|

16 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (1) |

|

$ |

20,466 |

|

|

$ |

26,606 |

|

|

|

30 |

% |

|

$ |

42,204 |

|

|

$ |

51,519 |

|

|

|

22 |

% |

Adjusted EBITDA margin |

|

|

22 |

% |

|

|

24 |

% |

|

|

|

|

|

23 |

% |

|

|

24 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per ADS (2) |

|

$ |

0.15 |

|

|

$ |

0.22 |

|

|

|

46 |

% |

|

$ |

0.32 |

|

|

$ |

0.38 |

|

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash flow from operating activities |

|

$ |

15,517 |

|

|

$ |

17,416 |

|

|

|

12 |

% |

|

$ |

41,244 |

|

|

$ |

48,438 |

|

|

|

17 |

% |

As percent of adjusted EBITDA |

|

|

76 |

% |

|

|

65 |

% |

|

|

|

|

|

98 |

% |

|

|

94 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow from operations (1) |

|

$ |

13,216 |

|

|

$ |

13,525 |

|

|

|

2 |

% |

|

$ |

36,533 |

|

|

$ |

21,815 |

|

|

|

(40 |

%) |

As percent of adjusted EBITDA |

|

|

65 |

% |

|

|

51 |

% |

|

|

|

|

|

87 |

% |

|

|

42 |

% |

|

|

|

_______________

(1)See the sections below titled “Non-IFRS Financial Measures” and “Reconciliations of Non-IFRS Financial Measures” for explanations and reconciliations of non-IFRS financial measures.

(2)Opera Limited has American depositary shares (ADSs) listed on the Nasdaq Global Select Market, each representing two ordinary shares.

“Our continued momentum is underpinned by a record strong and rapidly evolving product lineup that attracts users with high monetization potential, combined with our ability to drive targeted and high purchase-intent traffic directly to an expanding partnership base. In sum, this led to both revenue and profitability exceeding expectations for the quarter,” said co-CEO Lin Song.

“Continued innovation on the product front in the form of refreshed browsers such as Opera One for iOS, and on the feature front with our evolving Aria browser AI, combined with a highly scalable revenue model, point to continued growth in the second half of the year,” continued Mr. Song.

Second Quarter 2024 and Recent Business Highlights

•Solid monetization performance of our browsers, along with continuing growth of our Opera Ads platform and our ability to deliver targeted, high purchase intent traffic to our advertising partners, resulted in advertising revenue growing 20% year-over-year to $64.6 million, or 59% of total revenue.

•Search revenue grew 15% year-over-year, driven by our ongoing focus on users with the potential for the greatest monetization.

•Opera had 298 million monthly active users (MAUs), with continued growth in high-ARPU users in North America, Europe and Latin America, offset primarily by a decline of feature phone users in emerging markets.

•Annualized ARPU was $1.46, an increase of 25% versus the second quarter of 2023.

•The Opera GX gaming browser had 30 million MAUs across PC and mobile, up 27% year-over-year.

•Net cash flow from operating activities was $17.4 million, with a year-to-date conversion of adjusted EBITDA to operating cash flow of 94%. Opera had cash and cash equivalents of $104.4 million at quarter end.

•Opera declared a semi-annual dividend of $0.40 per ADS, representing a total dividend value of $35.4 million at the July record date. The cash distribution was $27.6 million, whereas the remaining $7.8 million was offset against our receivable from the sale of Star X, resulting in the receivable being fully settled.

Second Quarter 2024 Financial Results

All comparisons in this section are relative to the second quarter of 2023 unless otherwise stated.

Revenue increased by 17% to $109.7 million.

•Advertising revenue increased by 20% to $64.6 million.

•Search revenue increased by 15% to $44.5 million.

•Technology licensing and other revenue was $0.6 million.

Operating expenses increased by 9% to $89.1 million.

•Combined technology and platform fees, content cost and cost of inventory sold were $27.7 million, or 25% of revenue.

•Personnel expenses, including share-based compensation, totaled $19.8 million. Cash-based compensation expense was $17.8 million, a 7% increase year-over-year, whereas share-based compensation expense was $1.9 million. The share-based compensation expense includes equity awards granted by Opera’s majority shareholder to employees of Opera even though Opera does not have any obligation to settle the awards, and such awards do not lead to dilution for Opera shareholders.

•Marketing and distribution expenses were $29.0 million, an increase of 8%.

•Depreciation and amortization expenses were $4.0 million, a 20% increase driven by the recently deployed AI data cluster.

•All other operating expenses were $8.6 million, a 17% increase driven by increases in professional and cloud services.

Operating profit was $21.9 million, representing a 20% margin, compared to an operating profit of $12.5 million and a margin of 13% in the second quarter of 2023.

Net finance income was $0.2 million, a result of $0.8 million in net interest income, offset by foreign exchange loss of $0.6 million.

Income tax expense was $2.8 million, corresponding to an effective tax rate of 13%, or 11% of adjusted EBITDA.

Net income was $19.3 million, representing an 18% margin, compared to net income of $13.5 million and a margin of 14% in the second quarter of 2023.

Adjusted EBITDA was $26.6 million, representing a 24% margin, compared to adjusted EBITDA of $20.5 million, representing a 22% margin, in the second quarter of 2023.

Diluted earnings per ADS was $0.22. The diluted weighted average number of ordinary shares outstanding was 178.6 million in the quarter, corresponding to 89.3 million ADSs.

Net cash flow from operating activities was $17.4 million, or 65% of adjusted EBITDA, net of annual bonuses that were paid during the second quarter as opposed to within the first quarter in 2023. Free cash flow from operations was $13.5 million, or 51% of adjusted EBITDA.

Business Outlook

“We are very pleased to combine overperformance on revenue with strong cost discipline, adding to the overperformance of adjusted EBITDA. This demonstrates the health of our business and adds to our comfort in terms of our full-year trajectory, in turn allowing us to raise our guidance for both revenue and adjusted EBITDA,” said Frode Jacobsen, CFO.

“We are fortunate to be in a position where we can continue to invest in innovation and return cash to shareholders, while simultaneously growing both our revenue and our profits,” continued Mr. Jacobsen.

For the full year of 2024, we guide revenue to be in the range of $461 – 467 million, an increase of 17% over 2023 at the midpoint, and guide adjusted EBITDA to be in the range of $110 – 113 million, or a 24% margin at the midpoints.

For the third quarter of 2024, we guide revenue to be in the range of $119 – 121 million, or 17% year-over-year growth at the midpoint, and guide adjusted EBITDA to be in the range of $27.0 – 28.5 million, or a 23% margin at the midpoints.

Conference Call and Webcast Information

Opera’s management will host a conference call to discuss the second quarter 2024 financial results at 8:00 a.m. ET today. The live webcast of the conference call can be accessed at our investor relations website at investor.opera.com, along with the earnings press release and financial tables. Following the call, a replay will be available at the same website.

We also provide announcements regarding our financial performance and other matters, including SEC filings, press releases, slide presentations, business blogs and information on corporate governance, on our investor relations website at investor.opera.com.

Non-IFRS Financial Measures

We collect and analyze operating and financial data to evaluate the health of our business and assess our performance. In addition to revenue, net income (loss), net cash flow from operating activities and other financial measures under IFRS Accounting Standards, we use adjusted EBITDA, adjusted EBITDA margin and free cash flow from operations to evaluate our business. We use these non-IFRS financial measures for financial and operational decision-making and as means to evaluate period-to-period comparisons. We believe adjusted EBITDA and adjusted EBITDA margin provide meaningful supplemental information regarding our financial performance by excluding certain items that may not be indicative of recurring core business operating results, and that free cash flow from operations provides useful information regarding our liquidity, including ability to generate cash from business operations that is available for acquisitions and other investments, and for distributions to our shareholders.

We define adjusted EBITDA as net income (loss) excluding (i) profit (loss) from discontinued operations, (ii) income tax (expense) benefit, (iii) net finance income (expense), (iv) share of net income (loss) of equity-accounted investees, (v) impairment of equity-accounted investees, (vi) fair value gain (loss) on investments, (vii) depreciation and amortization, (viii) impairment of non-financial assets, (ix) share-based compensation expense, (x) non-recurring expenses, and (xi) other operating income. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue.

We define free cash flow from operations as net cash flows from (used in) operating activities less (i) purchases of fixed and intangible assets, (ii) development expenditure and (iii) payment of lease liabilities.

We believe adjusted EBITDA, adjusted EBITDA margin and free cash flow from operations are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business. However, these non-IFRS financial measures should not be considered substitutes for, or superior to, the financial information prepared and presented in accordance with IFRS Accounting Standards. Our calculations of adjusted EBITDA, adjusted EBITDA margin and free cash flow from operations may differ from similarly-titled non-IFRS measures, if any, reported by our peers. In addition, the non-IFRS financial measures may be limited in their usefulness because they do not present the full economic effects of certain items of income, expenses and cash flows. We compensate for these limitations by providing reconciliations of our non-IFRS financial measures to the most closely related financial measures in IFRS Accounting Standards. We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view adjusted EBITDA, adjusted EBITDA margin and free cash flow from operations in conjunction with net income (loss) and net cash flow from operating activities.

For reconciliations of these non-IFRS financial measures to the most directly comparable financial measures prepared in accordance with IFRS Accounting Standards, please see the section titled “Reconciliations of Non-IFRS Financial Measures” included at the end of this earnings press release.

Safe Harbor Statement

This press release contains statements of a forward-looking nature. These statements, including statements relating to the Company’s future financial and operating results, are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as “will,” “may,” “expect,” “believe,” “anticipate,” “intend,” “aim,” “estimate,” “seek,” “plan,” “potential,” “continue,” “ongoing,” “target,” “guidance,” “is/are likely to,” “future” and similar statements. Among other things, management’s quotations and the Business outlook section contain forward-looking statements. The Company may also make forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry in which it operates. Potential risks and uncertainties include, but are not limited to, those relating to: the duration and development of international conflicts, such as the war in Ukraine, and related economic sanctions, as well as resulting changes in consumer behaviors; the outcome of regulatory processes or litigation; the Company and its goals and strategies; expected development and launch, and market acceptance, of products and services; Company’s expectations regarding demand for and market acceptance of its brands, platforms and services; Company’s expectations regarding growth in its user base, user retention and level of engagement; changes in consumer behavior, for example from increased adoption of AI powered services; Company’s ability to attract, retain and monetize users; Company’s ability to continue to develop new technologies, products and services and/or upgrade its existing technologies, products and services; quarterly variations in Company’s operating results caused by factors beyond its control; and global macroeconomic conditions and their potential impact in the markets in which the Company has business. All information provided in this press release is as of the date hereof and is based on assumptions that the Company believes to be reasonable as of this date, and it undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated results. Further information regarding risks and uncertainties faced by Opera is included in the Company’s filings with the SEC, including its annual reports on Form 20-F.

About Opera

Opera is a user-centric and innovative software company focused on enabling the best possible internet browsing experience across all devices. Hundreds of millions use the Opera web browsers for their unique and secure features on their mobile phones and desktop computers. Founded in 1995, and headquartered in Oslo, Norway, Opera is a public company listed on the Nasdaq stock exchange under the ticker symbol “OPRA”. Download the Opera web browser and access other Opera products from opera.com. Learn more about Opera at investor.opera.com.

Contacts

Investor relations:

Matthew Wolfson

investor-relations@opera.com

Media:

press-team@opera.com

Opera Limited

Consolidated Statement of Operations

(In thousands, except per share amounts, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Revenue |

|

$ |

94,134 |

|

|

$ |

109,734 |

|

|

$ |

181,185 |

|

|

$ |

211,605 |

|

Other operating income |

|

|

51 |

|

|

|

1,281 |

|

|

|

180 |

|

|

|

1,624 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Technology and platform fees |

|

|

(1,114 |

) |

|

|

(1,893 |

) |

|

|

(1,956 |

) |

|

|

(5,656 |

) |

Content cost |

|

|

(1,094 |

) |

|

|

(901 |

) |

|

|

(1,983 |

) |

|

|

(1,871 |

) |

Cost of inventory sold |

|

|

(20,357 |

) |

|

|

(24,862 |

) |

|

|

(35,523 |

) |

|

|

(44,147 |

) |

Personnel expenses including share-based compensation |

|

|

(21,370 |

) |

|

|

(19,780 |

) |

|

|

(41,423 |

) |

|

|

(38,705 |

) |

Marketing and distribution expenses |

|

|

(26,996 |

) |

|

|

(29,026 |

) |

|

|

(51,393 |

) |

|

|

(58,491 |

) |

Credit loss expense |

|

|

(47 |

) |

|

|

143 |

|

|

|

(2,446 |

) |

|

|

207 |

|

Depreciation and amortization |

|

|

(3,356 |

) |

|

|

(4,012 |

) |

|

|

(6,735 |

) |

|

|

(7,083 |

) |

Other operating expenses |

|

|

(7,315 |

) |

|

|

(8,741 |

) |

|

|

(13,422 |

) |

|

|

(15,965 |

) |

Total operating expenses |

|

|

(81,650 |

) |

|

|

(89,072 |

) |

|

|

(154,880 |

) |

|

|

(171,711 |

) |

Operating profit |

|

|

12,535 |

|

|

|

21,943 |

|

|

|

26,485 |

|

|

|

41,518 |

|

Net finance income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Finance income |

|

|

1,361 |

|

|

|

936 |

|

|

|

6,723 |

|

|

|

1,799 |

|

Finance expense |

|

|

(80 |

) |

|

|

(173 |

) |

|

|

(453 |

) |

|

|

(315 |

) |

Net foreign exchange gain (loss) |

|

|

869 |

|

|

|

(578 |

) |

|

|

676 |

|

|

|

(1,405 |

) |

Net finance income (expense) |

|

|

2,150 |

|

|

|

185 |

|

|

|

6,946 |

|

|

|

79 |

|

Income before income taxes |

|

|

14,684 |

|

|

|

22,128 |

|

|

|

33,431 |

|

|

|

41,596 |

|

Income tax expense |

|

|

(1,148 |

) |

|

|

(2,825 |

) |

|

|

(4,416 |

) |

|

|

(7,454 |

) |

Net income attributable to Opera shareholders |

|

$ |

13,537 |

|

|

$ |

19,303 |

|

|

$ |

29,015 |

|

|

$ |

34,142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per American depositary share (ADS): |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.15 |

|

|

$ |

0.22 |

|

|

$ |

0.32 |

|

|

$ |

0.39 |

|

Diluted |

|

$ |

0.15 |

|

|

$ |

0.22 |

|

|

$ |

0.32 |

|

|

$ |

0.38 |

|

Weighted-average number of ADSs outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

89,897 |

|

|

|

88,458 |

|

|

|

89,841 |

|

|

|

88,455 |

|

Diluted |

|

|

91,313 |

|

|

|

89,315 |

|

|

|

91,203 |

|

|

|

89,303 |

|

Opera Limited

Consolidated Statement of Comprehensive Income

(In thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Net income |

|

$ |

13,537 |

|

|

$ |

19,303 |

|

|

$ |

29,015 |

|

|

$ |

34,142 |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Items that may be reclassified to the statement of operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Exchange differences on translation of foreign operations |

|

|

(1,219 |

) |

|

|

81 |

|

|

|

(1,167 |

) |

|

|

(165 |

) |

Other comprehensive income (loss) |

|

|

(1,219 |

) |

|

|

81 |

|

|

|

(1,167 |

) |

|

|

(165 |

) |

Total comprehensive income attributable to Opera shareholders |

|

$ |

12,318 |

|

|

$ |

19,384 |

|

|

$ |

27,848 |

|

|

$ |

33,978 |

|

Opera Limited

Consolidated Statement of Financial Position

(In thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

As of June 30, |

|

|

|

2023 |

|

|

2024 |

|

Assets: |

|

|

|

|

|

|

Property and equipment |

|

$ |

16,074 |

|

|

$ |

35,038 |

|

Goodwill |

|

|

429,856 |

|

|

|

429,794 |

|

Intangible assets |

|

|

99,070 |

|

|

|

99,278 |

|

Investment in OPay |

|

|

253,300 |

|

|

|

253,300 |

|

Other non-current investments and financial assets |

|

|

3,049 |

|

|

|

2,585 |

|

Deferred tax assets |

|

|

1,133 |

|

|

|

1,228 |

|

Total non-current assets |

|

|

802,482 |

|

|

|

821,224 |

|

Trade receivables |

|

|

69,382 |

|

|

|

65,580 |

|

Current receivables from sale of investments |

|

|

32,797 |

|

|

|

7,818 |

|

Other current receivables |

|

|

7,760 |

|

|

|

5,058 |

|

Prepayments |

|

|

4,660 |

|

|

|

3,869 |

|

Cash and cash equivalents |

|

|

93,863 |

|

|

|

104,356 |

|

Total current assets |

|

|

208,461 |

|

|

|

186,681 |

|

Total assets |

|

$ |

1,010,943 |

|

|

$ |

1,007,904 |

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Share capital |

|

$ |

18 |

|

|

$ |

18 |

|

Other paid in capital |

|

|

717,610 |

|

|

|

682,603 |

|

Treasury shares |

|

|

(238,815 |

) |

|

|

(238,815 |

) |

Retained earnings |

|

|

445,164 |

|

|

|

482,931 |

|

Foreign currency translation reserve |

|

|

(4,127 |

) |

|

|

(4,292 |

) |

Total equity attributable to Opera shareholders |

|

|

919,850 |

|

|

|

922,445 |

|

Liabilities: |

|

|

|

|

|

|

Non-current lease liabilities |

|

|

6,776 |

|

|

|

6,038 |

|

Deferred tax liabilities |

|

|

2,813 |

|

|

|

5,029 |

|

Other non-current liabilities |

|

|

94 |

|

|

|

47 |

|

Total non-current liabilities |

|

|

9,682 |

|

|

|

11,114 |

|

Trade and other payables |

|

|

52,247 |

|

|

|

52,992 |

|

Current lease liabilities |

|

|

3,770 |

|

|

|

3,641 |

|

Income tax payable |

|

|

1,838 |

|

|

|

3,502 |

|

Deferred revenue |

|

|

10,272 |

|

|

|

5,130 |

|

Other current liabilities |

|

|

13,285 |

|

|

|

9,081 |

|

Total current liabilities |

|

|

81,411 |

|

|

|

74,345 |

|

Total liabilities |

|

|

91,093 |

|

|

|

85,459 |

|

Total equity and liabilities |

|

$ |

1,010,943 |

|

|

$ |

1,007,904 |

|

Opera Limited

Consolidated Statement of Changes in Equity

(In thousands, except number of shares, unaudited)

For the six months ended June 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to Opera shareholders |

|

|

|

Number

of ADSs

outstanding |

|

|

Share

capital |

|

|

Other

paid in

capital |

|

|

Treasury

shares |

|

|

Retained

earnings |

|

|

Foreign

currency

translation

reserve |

|

|

Total

equity |

|

As of January 1, 2023 |

|

|

89,215,121 |

|

|

$ |

18 |

|

|

$ |

824,832 |

|

|

$ |

(206,514 |

) |

|

$ |

273,263 |

|

|

$ |

(3,385 |

) |

|

$ |

888,213 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

29,015 |

|

|

|

— |

|

|

|

29,015 |

|

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,167 |

) |

|

|

(1,167 |

) |

Share-based compensation, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,724 |

|

|

|

— |

|

|

|

9,724 |

|

Issuance of shares upon exercise of RSUs and options |

|

|

1,068,509 |

|

|

|

— |

|

|

|

— |

|

|

|

394 |

|

|

|

— |

|

|

|

— |

|

|

|

394 |

|

Dividends |

|

|

— |

|

|

|

— |

|

|

|

(107,222 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(107,222 |

) |

Acquisition of treasury shares |

|

|

(370,162 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,464 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,464 |

) |

As of June 30, 2023 |

|

|

89,913,468 |

|

|

$ |

18 |

|

|

$ |

717,610 |

|

|

$ |

(208,584 |

) |

|

$ |

312,001 |

|

|

$ |

(4,553 |

) |

|

$ |

816,493 |

|

For the six months ended June 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to Opera shareholders |

|

|

|

Number

of ADSs

outstanding |

|

|

Share

capital |

|

|

Other

paid in

capital |

|

|

Treasury

shares |

|

|

Retained

earnings |

|

|

Foreign

currency

translation

reserve |

|

|

Total

equity |

|

As of January 1, 2024 |

|

|

87,518,284 |

|

|

$ |

18 |

|

|

$ |

717,610 |

|

|

$ |

(238,815 |

) |

|

$ |

445,164 |

|

|

$ |

(4,127 |

) |

|

$ |

919,850 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

34,142 |

|

|

|

— |

|

|

|

34,142 |

|

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(165 |

) |

|

|

(165 |

) |

Share-based compensation, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,625 |

|

|

|

— |

|

|

|

3,625 |

|

Issuance of shares upon exercise of RSUs |

|

|

947,495 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Dividends |

|

|

— |

|

|

|

— |

|

|

|

(35,007 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(35,007 |

) |

As of June 30, 2024 |

|

|

88,465,779 |

|

|

$ |

18 |

|

|

$ |

682,603 |

|

|

$ |

(238,815 |

) |

|

$ |

482,931 |

|

|

$ |

(4,292 |

) |

|

$ |

922,445 |

|

Opera Limited

Consolidated Statement of Cash Flows

(In thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

$ |

14,684 |

|

|

$ |

22,128 |

|

|

$ |

33,431 |

|

|

$ |

41,596 |

|

Adjustments to reconcile income before income taxes to net cash flow from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

3,741 |

|

|

|

2,064 |

|

|

|

7,174 |

|

|

|

4,222 |

|

Depreciation and amortization |

|

|

3,356 |

|

|

|

4,012 |

|

|

|

6,735 |

|

|

|

7,083 |

|

Net finance (income) expense |

|

|

(2,150 |

) |

|

|

(185 |

) |

|

|

(6,946 |

) |

|

|

(79 |

) |

Other adjustments |

|

|

543 |

|

|

|

1,167 |

|

|

|

209 |

|

|

|

589 |

|

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

Change in trade and other receivables |

|

|

(3,852 |

) |

|

|

(1,759 |

) |

|

|

2,036 |

|

|

|

6,532 |

|

Change in prepayments |

|

|

(404 |

) |

|

|

1,227 |

|

|

|

(414 |

) |

|

|

1,324 |

|

Change in trade and other payables |

|

|

4,381 |

|

|

|

276 |

|

|

|

305 |

|

|

|

746 |

|

Change in deferred revenue |

|

|

(2,126 |

) |

|

|

(2,573 |

) |

|

|

3,850 |

|

|

|

(5,142 |

) |

Change in other liabilities |

|

|

744 |

|

|

|

(4,920 |

) |

|

|

(1,584 |

) |

|

|

(4,251 |

) |

Income taxes paid |

|

|

(3,397 |

) |

|

|

(4,019 |

) |

|

|

(3,552 |

) |

|

|

(4,182 |

) |

Net cash flow from operating activities |

|

|

15,517 |

|

|

|

17,416 |

|

|

|

41,244 |

|

|

|

48,438 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of equipment |

|

|

(219 |

) |

|

|

(1,232 |

) |

|

|

(537 |

) |

|

|

(21,466 |

) |

Development expenditure |

|

|

(1,048 |

) |

|

|

(1,729 |

) |

|

|

(2,114 |

) |

|

|

(3,120 |

) |

Sale of investments in unconsolidated entities |

|

|

— |

|

|

|

500 |

|

|

|

— |

|

|

|

500 |

|

Net sale of marketable securities |

|

|

— |

|

|

|

— |

|

|

|

23,414 |

|

|

|

— |

|

Interest received |

|

|

879 |

|

|

|

869 |

|

|

|

1,433 |

|

|

|

1,644 |

|

Net cash flow from (used in) investing activities |

|

|

(389 |

) |

|

|

(1,592 |

) |

|

|

22,194 |

|

|

|

(22,441 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of treasury shares |

|

|

— |

|

|

|

— |

|

|

|

(2,464 |

) |

|

|

— |

|

Dividends paid |

|

|

— |

|

|

|

— |

|

|

|

(12,273 |

) |

|

|

(9,874 |

) |

Proceeds from exercise of share options |

|

|

394 |

|

|

|

— |

|

|

|

394 |

|

|

|

— |

|

Repayment of borrowings |

|

|

(86 |

) |

|

|

111 |

|

|

|

(158 |

) |

|

|

— |

|

Payment of lease liabilities |

|

|

(1,034 |

) |

|

|

(930 |

) |

|

|

(2,059 |

) |

|

|

(2,038 |

) |

Interest paid |

|

|

(80 |

) |

|

|

(130 |

) |

|

|

(151 |

) |

|

|

(272 |

) |

Net cash flow used in financing activities |

|

|

(806 |

) |

|

|

(949 |

) |

|

|

(16,711 |

) |

|

|

(12,184 |

) |

Net change in cash and cash equivalents |

|

|

14,323 |

|

|

|

14,876 |

|

|

|

46,728 |

|

|

|

13,814 |

|

Cash and cash equivalents at beginning of period |

|

|

84,842 |

|

|

|

91,338 |

|

|

|

52,414 |

|

|

|

93,863 |

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

(1,010 |

) |

|

|

(1,858 |

) |

|

|

(987 |

) |

|

|

(3,320 |

) |

Cash and cash equivalents at end of period |

|

$ |

98,155 |

|

|

$ |

104,356 |

|

|

$ |

98,155 |

|

|

$ |

104,356 |

|

Opera Limited

Supplemental Financial Information

(In thousands, unaudited)

Revenue

The following table presents revenue disaggregated by type:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Advertising |

|

$ |

53,828 |

|

|

$ |

64,631 |

|

|

$ |

102,347 |

|

|

$ |

123,279 |

|

Search |

|

|

38,856 |

|

|

|

44,547 |

|

|

|

76,644 |

|

|

|

87,686 |

|

Technology licensing and other revenue |

|

|

1,450 |

|

|

|

556 |

|

|

|

2,194 |

|

|

|

640 |

|

Total revenue |

|

$ |

94,134 |

|

|

$ |

109,734 |

|

|

$ |

181,185 |

|

|

$ |

211,605 |

|

Personnel Expenses Including Share-based Compensation

The table below specifies personnel expenses including share-based compensation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Personnel expenses, excluding share-based compensation |

|

$ |

(16,744 |

) |

|

$ |

(17,848 |

) |

|

$ |

(32,260 |

) |

|

$ |

(34,163 |

) |

Share-based compensation expense for Opera-granted awards (1) |

|

|

(2,494 |

) |

|

|

(502 |

) |

|

|

(6,435 |

) |

|

|

(1,733 |

) |

Share-based compensation expense for parent-granted awards (2) |

|

|

(2,132 |

) |

|

|

(1,430 |

) |

|

|

(2,728 |

) |

|

|

(2,809 |

) |

Total personnel expenses including share-based compensation |

|

$ |

(21,370 |

) |

|

$ |

(19,780 |

) |

|

$ |

(41,423 |

) |

|

$ |

(38,705 |

) |

_______________

(1)The cost of social security contributions payable in connection with equity awards is presented as part of the share-based compensation expense.

(2)Kunlun, the ultimate parent of Opera, has granted equity awards to Opera employees as compensation for services provided to Opera. Opera does not have any obligation to settle the awards granted by Kunlun and such awards do not lead to dilution for Opera shareholders.

Other Operating Expenses

The following table specifies other operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Hosting |

|

$ |

(2,548 |

) |

|

$ |

(2,809 |

) |

|

$ |

(5,032 |

) |

|

$ |

(5,817 |

) |

Audit, legal and other advisory services |

|

|

(1,994 |

) |

|

|

(2,588 |

) |

|

|

(3,237 |

) |

|

|

(4,188 |

) |

Software license fees |

|

|

(914 |

) |

|

|

(1,211 |

) |

|

|

(1,467 |

) |

|

|

(2,452 |

) |

Rent and other office expenses |

|

|

(607 |

) |

|

|

(576 |

) |

|

|

(1,226 |

) |

|

|

(1,172 |

) |

Travel |

|

|

(442 |

) |

|

|

(517 |

) |

|

|

(870 |

) |

|

|

(947 |

) |

Other |

|

|

(809 |

) |

|

|

(1,042 |

) |

|

|

(1,589 |

) |

|

|

(1,390 |

) |

Total other operating expenses |

|

$ |

(7,315 |

) |

|

$ |

(8,741 |

) |

|

$ |

(13,422 |

) |

|

$ |

(15,965 |

) |

Opera Limited

Reconciliations of Non-IFRS Financial Measures

(In thousands, unaudited)

The following table is a reconciliation of net income to adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Net income |

|

$ |

13,537 |

|

|

$ |

19,303 |

|

|

$ |

29,015 |

|

|

$ |

34,142 |

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

1,148 |

|

|

|

2,825 |

|

|

|

4,416 |

|

|

|

7,454 |

|

Net finance (income) expense |

|

|

(2,150 |

) |

|

|

(185 |

) |

|

|

(6,946 |

) |

|

|

(79 |

) |

Depreciation and amortization |

|

|

3,356 |

|

|

|

4,012 |

|

|

|

6,735 |

|

|

|

7,083 |

|

Share-based compensation expense |

|

|

4,626 |

|

|

|

1,932 |

|

|

|

9,163 |

|

|

|

4,542 |

|

Other operating income |

|

|

(51 |

) |

|

|

(1,281 |

) |

|

|

(180 |

) |

|

|

(1,624 |

) |

Adjusted EBITDA |

|

$ |

20,466 |

|

|

$ |

26,606 |

|

|

$ |

42,204 |

|

|

$ |

51,519 |

|

The table below reconciles net cash flow from operating activities to free cash flow from operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Net cash flow from operating activities |

|

$ |

15,517 |

|

|

$ |

17,416 |

|

|

$ |

41,244 |

|

|

$ |

48,438 |

|

Deduct: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of equipment |

|

|

(219 |

) |

|

|

(1,232 |

) |

|

|

(537 |

) |

|

|

(21,466 |

) |

Development expenditure |

|

|

(1,048 |

) |

|

|

(1,729 |

) |

|

|

(2,114 |

) |

|

|

(3,120 |

) |

Payment of lease liabilities |

|

|

(1,034 |

) |

|

|

(930 |

) |

|

|

(2,059 |

) |

|

|

(2,038 |

) |

Free cash flow from operations |

|

$ |

13,216 |

|

|

$ |

13,525 |

|

|

$ |

36,533 |

|

|

$ |

21,815 |

|

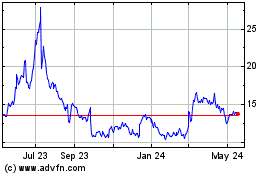

Opera (NASDAQ:OPRA)

Historical Stock Chart

From Nov 2024 to Dec 2024

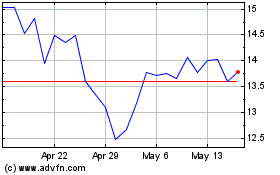

Opera (NASDAQ:OPRA)

Historical Stock Chart

From Dec 2023 to Dec 2024