false

0001176309

0001176309

2025-01-21

2025-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 21, 2025

ORAMED PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

| delaware |

|

001-35813 |

|

98-0376008 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1185 Avenue of the Americas, Third Floor,

New York, New York |

|

10036 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

844-967-2633

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.012 |

|

ORMP |

|

The Nasdaq Capital Market,

Tel Aviv Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

Amendment to Senior Secured Promissory Note,

dated as of January 21, 2025

As previously disclosed, on

September 21, 2023, Oramed Pharmaceuticals Inc. (the “Company”) entered into and consummated the transactions contemplated

by a Securities Purchase Agreement (the “Scilex SPA”) with Scilex Holding Company (“Scilex”) and Acquiom Agency

Services LLC (the “Agent”). Pursuant to the Scilex SPA, in exchange for Scilex assuming certain outstanding obligations of

Sorrento Therapeutics, Inc., Scilex issued to the Company a Senior Secured Promissory Note due 18 months from the date of issuance in

the principal amount of $101,875,000 (the “Tranche A Note”), as well as certain warrants to purchase shares of common stock

of Scilex. To date, an aggregate of $94,200,000 of the original principal amount under Tranche A Note has been repaid or refinanced and

the remaining principal amount owed by Scilex to the Company is $7,675,000 under the Tranche A Note. The foregoing descriptions of the

Scilex SPA and the Tranche A Note and the transactions contemplated thereby are not complete and are subject to and qualified in their

entirety by reference to the copies of the Scilex SPA and the Tranche A Note attached as Exhibits 10.1 and 10.2 to the Company’s

Current Report on Form 8-K filed on September 26, 2023, and are incorporated herein by reference.

On January 21, 2025, the

Company, Scilex and SCLX Stock Acquisition JV LLC (“SCLX JV”) entered into an amendment to the Tranche A Note (the

“Amendment”) pursuant to which, among other things, the Company and Scilex agreed to extend the maturity date of the

Tranche A Note from March 21, 2025 to December 31, 2025 (the “Extended Maturity Date”), among certain other changes. Interest on the

Tranche A Note will continue to accrue and be due and payable on the Extended Maturity Date. In consideration for the extension,

SCLX JV agreed to transfer 3,250,000 shares of Scilex common stock, par value $0.0001 per share, held by SCLX JV to the Company.

In addition to the

extension of the maturity date, pursuant to the Amendment, the parties also agreed to amend the definition of “Cash Sweep

Financing” in the Tranche A Note to remove certain specific exclusions of indebtedness previously present in such definition,

and further agreed that prior to Payment in Full of the First Out Priority Obligations (each as defined in that certain Agreement

Among Holders (the “Agreement Among Holders”), dated as of October 8, 2024, between the Company and the other holders of

the Tranche B Notes (as defined below)), any prepayment required pursuant to Section 2(g) of the Tranche A Note may be waived in the

Company’s sole discretion and, in such case, the Company shall have the unilateral option to instead direct Scilex to prepay

the Last Out Holders (as defined in the Agreement Among Holders) and apply such amount to either, in the Company’s sole

discretion, (A) the outstanding principal amount of that certain Tranche B Senior Secured Convertible Note (the “Tranche B

Notes”), dated as of October 8, 2024 held by the Company or (B) the outstanding principal amount of all of the Tranche B Notes

in accordance with each Last Out Holder’s Last Out Pro Rata Share (as defined in the Agreement Among Holders) at such time. In

addition, the parties agreed to add an additional covenant to the Tranche A Note, preventing any increase in compensation or

additional incentive equity awards to any officer, director or member of senior management of Scilex or Scilex’s

subsidiaries while the Tranche A Note remains outstanding.

The foregoing summary of the

Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which

is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ORAMED PHARMACEUTICALS INC. |

| |

|

|

| |

By: |

/s/ Nadav Kidron |

| |

Name: |

Nadav Kidron |

| |

Title: |

President and CEO |

January 22, 2025

2

Exhibit 10.1

January

21, 2025

SCLX

Stock Acquisition JV

960

San Antonio Rd.

Palo

Alto, CA 94303

Attn:

Xiao Xu

And

Scilex

Holding Company

960

San Antonio Rd.

Palo

Alto, CA 94303

Attn:

Stephen Ma

VIA

EMAIL

RE:

Amendment to Senior Secured Promissory Note (this “Amendment”)

Ladies

and Gentlemen:

Reference

is made to (i) that certain Securities Purchase Agreement, dated as of September 21, 2023 (the “SPA”), between Scilex

Holding Company, a Delaware corporation (the “Company”), Oramed Pharmaceuticals Inc., a Delaware corporation (“Oramed”)

as the initial purchaser (the “Initial Purchaser”), and Acquiom Agency Services LLC, as Agent (“Agent”),

(ii) that certain Senior Secured Promissory Note, dated as of September 21, 2023 (as amended, modified or supplemented from time to time

prior to the date hereof, the “Note”), issued by Scilex to Oramed, as Holder (“Holder”), (iii)

that certain Amended and Restated Security Agreement, dated as of October 8, 2024 (the “Security Agreement”), among

the Company, SCLX Stock Acquisition JV LLC (“SCLX JV”) and the other

subsidiaries of the Company party thereto and the Agent, as (a) the collateral agent for the holders of the Note and all Additional Notes

(as defined in the Note), and their endorsees, transferees and assigns (collectively with the Agent, the “Secured Parties”)

and (b) as collateral agent for the holders of certain Tranche B Notes (as defined therein), (iv) that certain Tranche B Senior

Secured Convertible Note, dated as of October 8, 2024 (the “Tranche B Note” and together with the Tranche B Senior

Secured Convertible Notes, dated as of such date and held by each other holder thereof, the “Tranche B Notes”), issued

by Scilex to Oramed, and (v) all related Transaction Documents, as defined in the SPA. Capitalized

terms used but not defined herein are used with the respective meanings assigned to them in the SPA, the Note, or the Security Agreement,

as applicable; provided that, for purposes of Section 1(c) below, capitalized terms used but not defined herein are used with

the respective meanings assigned to them in that certain Agreement Among Holders, dated as of October 8, 2024, among the First Out Holders

(as defined therein), the Last Out Holders (as defined therein), the Agent, as collateral agent under the Note and the Tranche B Notes,

and each Additional Holder (as defined therein).

WHEREAS,

pursuant to Section 2(e) of the Note, the Company is required to repay the entire remaining principal balance of the Note on the Maturity

Date, which as of the date hereof is March 21, 2025 (the “Existing Maturity Date”);

WHEREAS,

the Company has requested that the undersigned Holder agree to extend the Maturity Date to December 31, 2025 (the “Extended

Maturity Date”);

WHEREAS,

each Holder of the Tranche B Notes, SCLX JV, the Company and the Agent entered into that certain Deferral and Consent under Tranche B

Senior Secured Convertible Note dated January 2, 2025 (collectively, the “Tranche B Deferral and Consent Letters”);

WHEREAS,

the payment deferrals in Section 1(b) of the Tranche B Deferral and Consent Letters require as one of the conditions thereof the extension

of the Maturity Date of the Note from the Existing Maturity Date to the Extended Maturity Date;

WHEREAS,

if the Maturity Date is not extended from the Existing Maturity Date to the Extended Maturity Date by January 31, 2025, the payment deferrals

in Section 1(b) of the Tranche B Deferral and Consent Letters shall not take effect, and the deferred payments thereunder shall immediately

become due and payable, and the failure to make any such payments on or prior to such date will constitute an immediate Event of Default

under the Tranche B Notes (the “Anticipated Events of Default”);

WHEREAS,

if an Event of Default occurs under the Tranche B Notes, the Holders of such Notes and the Agent (in its capacity as collateral agent

for such Holders) will be entitled to exercise certain secured creditor remedies pursuant to the Tranche B Notes and the other Transaction

Documents (as defined therein), including, without limitation by recourse against the assets of SCLX JV as a grantor under the Security

Agreement;

WHEREAS,

subject to and in consideration of the amendments set forth in Section 1 of this Amendment, SCLX JV has agreed to deliver contemporaneously

with the execution of this Amendment to the Holder by deposit/withdrawal at custodian with the Depository Trust Company an aggregate

of 3,250,000 fully paid, legend free and freely tradeable, shares of common stock, par value $0.0001 per share, of the Company (the “Relevant

Scilex Shares” and each a “Relevant Scilex Share”) held by SCLX JV;

WHEREAS,

the Holder and the Company have duly authorized the execution and delivery of this Amendment and have done all things necessary to make

this Amendment a valid and binding agreement in accordance with its terms.

NOW,

THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the following is agreed:

Section 1 Amendment.

(a) Effective

as of the later of (i) time of execution and delivery of this Amendment and (ii) the time of the delivery to the Holder by deposit/withdrawal

at custodian with the Depository Trust Company of the Relevant Scilex Shares (the “Equity Consideration Payment”),

the undersigned Holder and the Company agree that the Note is hereby amended as follows (where applicable, language being inserted is

evidenced by bold and underline formatting (indicated textually in the same manner as the following example: bold

and underline formatting) and language being deleted is evidenced by strike-through formatting (indicated textually in the same

manner as the following example: strike-through formatting)):

(i) The

definition of “Cash Sweep Financing” in Section 1 of the Note is hereby amended and restated in its entirety as follows:

“Cash

Sweep Financing” means any Equity Issuance and any issuance or incurrence of Indebtedness or debt financing excluding the

Indebtedness referenced and subject to prepayment pursuant to Sections 2(g)(ii) and 2(g)(iii) (a)

any outstanding Indebtedness under the AR Facility, (b) any Equity Issuance undertaken by means of either of the ELOCs, (c) the Subordinated

Debt and (d) Acceptable Indebtedness (if any) (provided, that such exclusion shall apply only to the extent of such Indebtedness that

is not in excess of the thresholds applicable thereto as set forth in the definition of “Permitted Indebtedness” including,

for the avoidance of doubt, the AR Facility Cap, the Acceptable Indebtedness Cap and the Subordinated Debt Cap).

(ii) The

definition of “Maturity Date” as set forth in the second paragraph of the Note is hereby amended and restated to mean “December

31, 2025.”

(iii) The

following new Section 7(a)(xi) is hereby added to the Note:

“directly

or indirectly increase the compensation of (whether in the form of additional equity compensation, an increase in base salary, bonus

compensation or otherwise) or provide additional incentive equity awards to (including by changing or removing the vesting requirements

of previously granted stock options or warrants), in each case, any of the Company’s or any Subsidiary of the Company’s officers,

directors or members of senior management.”

(b) The

undersigned Holder and the Company hereby agree that, prior to Payment in Full of the First Out Priority Obligations, any prepayment

required pursuant to Section 2(g) of the Note (as amended hereby) may be waived in the sole discretion of the Holder and, in such case,

the Holder shall have the unilateral option to instead direct the Company to prepay the Last Out Holders and apply the amount that would

have been required to be prepaid to the Holder pursuant to Section 2(g) of the Note to either, in the Holder’s sole discretion,

(A) the outstanding principal amount of the Tranche B Notes held by the Holder or (B) the outstanding principal amount of all of the

Tranche B Notes in accordance with each Last Out Holder’s Last Out Pro Rata Share at such time and the Company hereby agrees to

comply with any such direction.

Section 2 Representations

and Warranties. In order to induce the Holder to enter into this Amendment, the Company hereby represents and warrants as of the

date hereof that:

(a) neither

it nor any other Person acting on its behalf has provided any of the undersigned Holder or its agents or counsel with any information

that constitutes or could reasonably be expected to constitute material, non-public information concerning the Company or any of its

Subsidiaries;

(b) the

Company has the full right, power and authority to enter into and execute this Amendment and to perform all its obligations hereunder

and under the Note and the Transaction Documents, as modified hereby;

(c) the

execution and delivery of this Amendment has been duly and validly authorized by all necessary action on the part of the Company, and

shall constitute the legal, valid and binding obligations of the Company enforceable against the Company in accordance with the terms

hereof, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other

Laws of general application affecting enforcement of creditors’ rights generally; and (ii) as limited by Laws relating to the availability

of specific performance, injunctive relief or other equitable remedies;

(d) neither

the execution and delivery of this Amendment, nor the taking of any actions contemplated hereby and the performance of the obligations

hereunder or the Transactions by the Company or any other Subsidiary, does or will, with or without the giving of notice, lapse of time

or both, (i) violate or constitute a default, event of default, or event creating a right of acceleration, termination or cancellation

of any obligation under any term or provision of any agreement, credit facility, debt or other instrument evidencing Company or Subsidiary

Indebtedness (after giving effect to any prior or concurrent consents or waivers under any such agreement, credit facility, debt or other

instrument to which the Company or such Subsidiary is a party or otherwise subject, copies of which consents or waivers have been furnished

by the Company to the Agent prior to the execution of this Amendment); or (ii) violate any rule, regulation, order, judgment, injunction,

decree or other restriction of any court or governmental authority to which the Company or a Subsidiary is subject (including federal

and state securities laws and regulations), or by which any property or asset of the Company or a Subsidiary is bound or affected;

(e) no

authorization, consent, approval, license, exemption of or filing or registration with any governmental authority, is or will be necessary

for the execution, delivery and performance by the Company of its obligations under this Amendment; and

(f) immediately

prior to and after giving effect to this Amendment, no Event of Default exists and is continuing on the date hereof and no Event of Default

could reasonably be expected to occur as a result of the Transactions.

Section 3 Affirmation.

(a) Except

as expressly amended pursuant to Section 1 hereof, the Company hereby expressly reaffirms, as of the date hereof, all of its covenants

and agreements contained in the Note and each Transaction Document and agrees that none of its covenants and agreements set forth in

the Note or any other Transaction Document shall be reduced or limited by the execution and delivery of this Amendment.

(b) The

Company (on behalf of itself and its Subsidiaries) hereby (i) affirms that each of the Liens granted in or pursuant to the Security Documents

are valid and subsisting, and (ii) agrees that this Amendment and all documents executed in connection herewith shall in no manner impair

or otherwise adversely affect any of the Liens granted in or pursuant to the Security Documents and such Liens continue unimpaired to

secure repayment of all Obligations in accordance with the Transaction Documents, whether heretofore or hereafter incurred.

Section 4 Miscellaneous.

(a) Section

headings in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for

any other purposes.

(b) This

Amendment may be executed with counterpart signature pages or in any number of counterparts, each of which shall be deemed to be an original,

but all such separate counterparts shall together constitute but one and the same agreement. In proving this Amendment or any other Transaction

Document in any judicial proceedings, it shall not be necessary to produce or account for more than one such counterpart signed by the

party against whom such enforcement is sought. Any signatures hereto delivered by electronic transmission shall be deemed an original

signature hereto.

(c) No

waiver or modification hereof or of any agreement referred to herein shall be binding or enforceable unless in writing and signed by

all of the parties hereto or thereto.

(d) From

and after the date on which this Amendment shall be effective, the term “Transaction Documents” in the Note and the other

Note Documents shall include, without limitation, this Amendment and any agreements, instruments and other documents executed and/or

delivered in connection herewith.

(e) The

terms and provisions of Section 9(d) (Governing Law) of the note are hereby incorporated

herein by reference and shall apply to this Amendment mutatitis mutandis as if fully set forth herein.

(f) Within

five (5) Business Days of the execution of this Amendment, the Company shall reimburse Proskauer Rose LLP (counsel to Oramed) (“Holder

Counsel”) for any fees incurred by them in connection with preparing and delivering this Amendment and the transactions contemplated

hereby.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, each of the undersigned have caused their respective signature page to this Amendment to be duly executed as

of the date first written above.

| |

ORAMED PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Nadav Kidron |

| |

Name: |

Nadav Kidron |

| |

Title: |

CEO |

| |

|

| |

SCILEX HOLDING COMPANY |

| |

|

| |

By: |

/s/ Jaisim Shah |

| |

Name: |

Jaisim Shah |

| |

Title: |

Chief Executive Officer and President |

| |

|

| |

SCLX Stock Acquisition JV LLC |

| |

|

| |

By: |

/s/ Xiao Xu |

| |

Name: |

Xiao Xu |

| |

Title: |

Sole Manager |

[Signature

Page to Amendment]

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

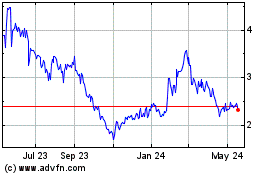

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

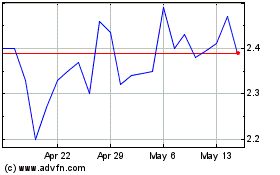

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Jan 2024 to Jan 2025