ProSomnus, Inc. (“the Company”) (NASDAQ: OSA), a pioneer in

precision medical devices for the treatment of Obstructive Sleep

Apnea (OSA), today announced the appointment of Brian Dow as Chief

Financial Officer, effective March 1, 2023.

Mr. Dow brings more than 28 years of experience

advancing privately-held and publicly-traded life science companies

with expertise executing equity and debt financings, M&A

transactions, and financial operations and accounting. Dow has

successfully taken three companies public, overseen multiple

mergers and acquisitions with a strategic focus on revenue growth,

expense management, product development and business

development.

“We are happy to welcome Brian to ProSomnus’s

leadership team during a time of great growth and our transition to

life as a public company,” said Len Liptak, Co-Founder and Chief

Executive Officer of ProSomnus. “As an expert in the financial

management of healthcare companies in the public and private

sector, Brian’s experience and vision will provide crucial counsel

as ProSomnus seeks to expand the availability and use of our

patient-preferred Oral Appliance Therapy devices.”

Brian Dow joined ProSomnus in March 2023 as

Chief Financial Officer with more than 28 years of financial,

accounting and operations experience with a focus on public and

emerging life sciences companies. From 2020 to 2023, Brian served

as Chief Financial Officer of Agendia, a $60-million global

molecular diagnostics company, where he was responsible for

developing and leading the company’s global financial operations,

including investor relations, and successfully raised over $100

million in equity and debt capital. Prior to that role, from 2015

to 2019, he was Chief Financial Officer & Senior Vice

President, Finance and Administration of Pulse Biosciences, a

medical technology company developing a novel energy-based tissue

treatment platform. In addition, Brian has held a series of

financial officer positions, including Vice President and Principal

Accounting Officer of Pacific Biosciences of California, a leading

provider of next generation genetic sequencing instruments, and

Chief Financial Officer of Northstar Neuroscience, Inc., a

development stage medical device company. Brian began his career as

a manager with Ernst and Young after earning his Bachelor of

Science degree in Management from the Georgia Institute of

Technology. Brian is also recognized as a licensed Certified Public

Accountant by the Washington State Board of Accountancy.

“ProSomnus is disrupting the

multi-billion-dollar Obstructive Sleep Apnea market by

significantly improving patient care with truly revolutionary and

clinically validated treatment alternatives. I see incredible

potential for our precision Oral Appliance Therapy devices to

become the standard of care for patients and providers worldwide,”

said Dow. “As evidenced by the Company’s delivery of over 187,500

devices to date, its NASDAQ debut during late 2022, the opening of

its new headquarters and expanded manufacturing center, and a

growing network of over 4,000 medical providers, ProSomnus is

poised for tremendous growth and I look forward to helping the

Company achieve its full potential.”

About ProSomnusProSomnus

(NASDAQ: OSA) precision intraoral medical devices offer effective,

economical, and patient preferred treatment for patients suffering

from Obstructive Sleep Apnea. ProSomnus is the first manufacturer

of mass-customized Precision Oral Appliance Therapy (OAT) devices

to treat OSA, which affects over 74 million people in North America

and is associated with serious comorbidities, including heart

failure, stroke, hypertension, morbid obesity, and type 2 diabetes.

ProSomnus’s patented, FDA-cleared devices are a less invasive and

more comfortable alternative to Continuous Positive Airway Pressure

(CPAP) therapy, and lead to more effective and patient-preferred

outcomes. A growing body of research, including studies published

by the Journal of Clinical Sleep Medicine and Military Medicine,

suggests ProSomnus’s Precision OAT devices are an effective

treatment for mild to moderate OSA. Additional clinical research

has shown that ProSomnus’s Precision OAT devices mitigate many of

the side effects associated with alternative treatments and improve

economics for payers and providers. With more than 187,500 devices

delivered, ProSomnus’s devices are the most prescribed Precision

OAT in the U.S. ProSomnus’s FDA-cleared devices are authorized by

the Department of Defense and the U.S. Army, and are often covered

by medical insurance, Medicare, and social health programs in key

international markets. To learn more, visit www.ProSomnus.com.

Important Notice Regarding

Forward-Looking StatementsThis Press Release contains

certain “forward-looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934,

both as amended. Statements that are not historical facts,

including statements about the parties’ perspectives and

expectations, are forward-looking statements. The words “expect,”

“believe,” “estimate,” “intend,” “plan” and similar expressions

indicate forward-looking statements. These forward-looking

statements are not guarantees of future performance and are subject

to various risks and uncertainties, assumptions (including

assumptions about general economic, market, industry and

operational factors), known or unknown, which could cause the

actual results to vary materially from those indicated or

anticipated.

Such risks and uncertainties include, but are

not limited to: (i) the effect of the announcement or the business

combination on ProSomnus’s business relationships, operating

results and business generally; (ii) risks that the business

combination disrupts current plans and operations of ProSomnus;

(iii) the outcome of any legal proceedings that may be instituted

against ProSomnus or Purchaser related to the business combination;

(iv) changes in the competitive industries in which ProSomnus

operates, variations in operating performance across competitors,

changes in laws and regulations affecting ProSomnus’s business and

changes in the combined capital structure; (v) the ability to

implement business plans, forecasts and other expectations after

the completion of the business combination, and identify and

realize additional opportunities; (vi) the risk of downturns in the

market and ProSomnus’s industry including, but not limited to, as a

result of the COVID-19 pandemic; (vii) costs related to the

transaction and the failure to realize anticipated benefits of the

transaction or to realize estimated pro forma results and

underlying assumptions, including with respect to estimated

stockholder redemptions; (viii) the risk of potential future

significant dilution to stockholders resulting from lender

conversions under the convertible debt financing; and (ix) risks

and uncertainties related to ProSomnus’s business, including, but

not limited to, risks relating to the uncertainty of the projected

financial information with respect to ProSomnus; risks related to

ProSomnus’s limited operating history, the roll-out of ProSomnus’s

business and the timing of expected business milestones;

ProSomnus’s ability to implement its business plan and scale its

business, which includes the recruitment of healthcare

professionals to prescribe and dentists to deliver ProSomnus oral

devices; the understanding and adoption by dentists and other

healthcare professionals of ProSomnus oral devices for

mild-to-moderate OSA; expectations concerning the effectiveness of

OSA treatment using ProSomnus oral devices and the potential for

patient relapse after completion of treatment; the potential

financial benefits to dentists and other healthcare professionals

from treating patients with ProSomnus oral devices and using

ProSomnus’s monitoring tools; ProSomnus’s potential profit margin

from sales of ProSomnus oral devices; ProSomnus’s ability to

properly train dentists in the use of the ProSomnus oral devices

and other services it offers in their dental practices; ProSomnus’s

ability to formulate, implement and modify as necessary effective

sales, marketing, and strategic initiatives to drive revenue

growth; ProSomnus’s ability to expand internationally; the

viability of ProSomnus’s intellectual property and intellectual

property created in the future; acceptance by the marketplace of

the products and services that ProSomnus markets; government

regulations and ProSomnus’s ability to obtain applicable regulatory

approvals and comply with government regulations, including under

healthcare laws and the rules and regulations of the U.S. Food and

Drug Administration; and the extent of patient reimbursement by

medical insurance in the United States and internationally. A

further list and description of risks and uncertainties can be

found in Lakeshore’s initial public offering prospectus dated June

10, 2021 and in the Company’s quarterly reports on Form 10-Q and

annual reports on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) subsequent thereto and in the Registration

Statement on Form S-4 and proxy statement that has been filed with

the SEC by Lakeshore in connection with the business combination,

and other documents that the parties may file or furnish with the

SEC, which you are encouraged to read. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements. Forward-looking

statements relate only to the date they were made, and the Company

and its subsidiaries undertake no obligation to update

forward-looking statements to reflect events or circumstances after

the date they were made except as required by law or applicable

regulation.

Investor ContactMike CavanaughICR

WestwickePhone: +1.617.877.9641Email:

Mike.Cavanaugh@westwicke.com

Media ContactKyle EvansICR WestwickePhone:

+1.646.277.1295Email: Kyle.Evans@westwicke.com

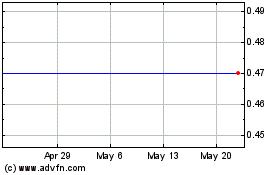

ProSomnus (NASDAQ:OSA)

Historical Stock Chart

From Dec 2024 to Jan 2025

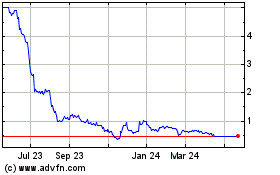

ProSomnus (NASDAQ:OSA)

Historical Stock Chart

From Jan 2024 to Jan 2025