Paychex Identifies Top Regulatory Issues for SMBs to Watch in 2025

12 December 2024 - 1:00AM

Business Wire

Tax policy, AI, and retirement among top

challenges for small- and mid-sized organizations

Paychex, Inc., a leading provider of integrated human capital

management software solutions for human resources, employee

benefits, insurance services, and payroll, today released its

annual list of top regulatory issues small- and medium-sized

businesses should be watching in 2025. Among them are taxes and tax

credits, retirement, paid leave, wage and hour developments, and

artificial intelligence and privacy.

“With a new administration entering the White House and many new

faces in other federal leadership positions starting in January, as

well as a breakneck pace of technological innovation across the

globe, 2025 is bound to be an impactful year for most businesses,”

said Kelee Delaney, director of compliance risk at Paychex.

“Keeping up and complying with changing laws is perennially a top

challenge for small businesses. Our annual list is designed to help

them focus on what is likely to have the most significant impact on

their business, their employees, and their bottom line.”

A team of in-house compliance and government relations experts

at Paychex continually monitors laws and regulations at federal,

state, and local levels to develop educational content for

customers and update Paychex Flex®, the company’s cloud-based SaaS

solution. The Paychex team has identified the following topics that

employers should watch closely in 2025:

- Taxes and Tax Credits: Many tax provisions contained in

the 2017 Tax Cuts and Jobs Act (TCJA) are scheduled to sunset at

the end of 2025, setting off a larger debate on the tax code.

Provisions that will sunset at the end of 2025 without

congressional action will include income tax withholding changes

and the pass-through qualified income tax deduction. Also likely to

be part of the larger discussion on tax policy are research and

development expensing, bonus depreciation, the corporate tax rate,

and more.

- Retirement: Effective January 1, 2025, with limited

exceptions, a provision under SECURE Act 2.0 will require employers

to auto-enroll employees in any new 401(k) or 403(b) workplace

retirement plan established after December 29, 2022. On the state

level, state-sponsored retirement programs continue to be on the

rise, with three expected to activate in 2025 (Minnesota, Missouri,

Nevada).

- Paid Leave: At the state and local levels across the

U.S., there are more than 40 jurisdictions with Paid Sick and Safe

Leave (PSSL) laws, and several more jurisdictions making PSSL

available in the next year, including Alaska, Missouri, and

Nebraska as a result of recently approved ballot measures.

Delaware, Maine, Maryland, and Minnesota will begin offering Paid

Family Leave benefits in 2026, joining nine other states plus the

District of Columbia who already offer these growing benefits.

Businesses should start preparing for these new requirements in

2025.

- Wage and Hour: A U.S. District Court in Texas vacated

the U.S. Department of Labor’s 2024 Final Overtime Rule, reverting

the minimum salary threshold of the standard executive,

administrative, and professional (EAP) and highly compensated

employee (HCE) exemptions back to the threshold amounts from the

2019 Overtime Rule. In addition, a total of nearly 70 minimum wage

increases at the state, local, and even industry-specific level are

scheduled to take effect January 1, 2025. Businesses should also

keep a close eye on state pay transparency laws going into effect

in the new year.

- AI and Privacy: With AI adoption and innovation

constantly evolving, businesses should pay close attention to

changes in regulation and legislation to help manage the

opportunities and risks that can come with using AI. Businesses

should anticipate a ramp-up of state-level AI regulations in 2025

to address hiring bias, threats to copyright protections, and

breaches of data privacy. In addition to those already in place,

eight new state-level laws are coming into effect between January

and October 2025 (Iowa, Delaware, Nebraska, New Hampshire, New

Jersey, Tennessee, Minnesota, and Maryland).

For more detailed information and helpful resources on each of

the top regulatory issues of 2025, visit Top Regulatory Issues of

2025: What Business Should Know and Prepare For.

This content is for informational purposes only, is not intended

to provide, and does not provide, legal, tax, or accounting advice.

Businesses should consult with a qualified attorney, accountant or

other professional based on their individual circumstances.

About Paychex Paychex, Inc. (Nasdaq: PAYX) is an

industry-leading HCM company delivering a full suite of technology

and advisory services in human resources, employee benefit

solutions, insurance, and payroll. The company serves over 745,000

customers in the U.S. and Europe and pays one out of every 12

American private sector employees. The more than 16,000 people at

Paychex are committed to helping businesses succeed and building

thriving communities where they work and live. Visit paychex.com to

learn more.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211977221/en/

Media Contacts Tracy Volkmann Manager, Public Relations

(585) 387-6705 tvolkmann@paychex.com @Paychex

Emily Walsh Highwire Public Relations Account Executive (914)

815-8846 paychex@highwirepr.com

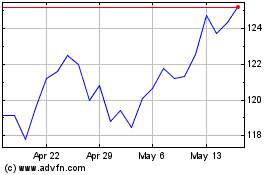

Paychex (NASDAQ:PAYX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Paychex (NASDAQ:PAYX)

Historical Stock Chart

From Dec 2023 to Dec 2024