false

--12-31

0000022701

0000022701

2024-09-23

2024-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (date of earliest event reported): September

23, 2024

Pineapple Energy Inc.

| |

(Exact

name of Registrant as Specified in its Charter) |

|

Minnesota

| |

(State Or Other Jurisdiction

Of Incorporation) |

|

| 001-31588 |

|

41-0957999 |

| (Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

10900

Red Circle Drive

Minnetonka,

MN

|

|

55343 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(952) 996-1674

| |

Registrant’s Telephone

Number, Including Area Code |

|

Securities

registered pursuant to Section 12(b) of the Act

| Title

of Each Class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common

Stock, par value, $.05 per share |

PEGY |

The

Nasdaq Stock Market, LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425

under the Securities Act |

| |

☐ |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| |

Item 1.01. |

Entry into a Material Definitive Agreement. |

As previously

disclosed, on July 22, 2024, Pineapple Energy Inc. (the “Company”) obtained bridge loan financing for working capital purposes

from Conduit Capital U.S. Holdings LLC (“Conduit”), an unaffiliated lender. On such date, Conduit loaned the principal sum

of $500,000 to the Company on an original issue (“OID”) basis of 20% and accordingly, Conduit advanced $400,000 to the Company

(the “Initial Conduit Loan”). The Initial Conduit Loan will accrue interest on the unpaid principal amount, without deduction

for the OID, at an annual rate of 20%. Commencing on October 21, 2024 through and including July 21, 2025 (the “Maturity Date”),

the Company may request that Conduit provide additional advances for working capital on identical terms, conditions and interest rate

as the Initial Conduit Loan on an OID basis, up to an aggregate principal sum of $500,000, and Conduit shall have the right, without commitment

or obligation to make such requested loan(s) by advancing 80% of the principal thereof. All such loans are secured by a pledge of all

of the Company’s assets. The agreement was evidenced by the Secured Credit Agreement, dated July 22, 2024, between the Company and

Conduit and the Secured Credit Note, dated July 22, 2024, between the Company and Conduit (the “Original Note”).

On September

9, 2024, the Company and Conduit entered into an Amended and Restated Convertible Secured Note (the “First Amended Note”)

which amended the Original Note, which provides for an additional principal advance of $120,000 (the “Second Advance”). The

First Amended Note also provides that Conduit may convert all or any portion of the Second Advance and all accrued but unpaid interest

thereon into a number of shares (the “Note Conversion Shares”) of the Company’s common stock, par value $0.05 per share

(the “Common Stock”), calculated as the total dollar amount to be converted divided by $0.45 (the “Conversion Price”).

On September

23, 2024, the Company and Conduit entered into a further amended and restated convertible secured credit note (the “Second Amended

Note”), which amends and restates the First Amended Note. Under the terms of the Second Amended Note, Conduit loaned an additional

principal sum of $380,000 to the Company (the “Third Advance”) on an OID basis of 20%. Additionally, pursuant to the Second

Amended Note, Conduit was granted a demand registration right, which is in addition to the piggyback registration rights set forth in

the First Amended Note, which registration rights are inclusive of all convertible shares issuable for the Second Advance and Third Advance,

if converted; however, all out of pocket costs and expenses incurred in connection with this demand registration right shall borne by

Conduit. The Third Advance, together with all accrued but unpaid interest thereon, are convertible into shares of Common Stock at the

Conversion Price.

A copy of Second

Amended Note, effective September 23, 2024, is annexed hereto as Exhibit 10.3.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant. |

The information

set forth above in Item 1.01 is hereby incorporated by reference into this Item 2.03.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On September 9, 2024, the Company filed with the Secretary of State of

the State of Minnesota the Certificate of Designation of Preferences, Rights and Limitations of Series C Preferred Stock (“Certificate

of Designation”), as more fully described in our Current Report on Form 8-K, dated September 9, 2024. On September 23, 2024, the

Company filed a certificate of correction to the Certificate of Designation solely to include a clarification to section 4 therein, which

is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

The following

exhibits are being filed with this Current Report on Form 8-K:

| Exhibit No. |

|

Description |

| |

|

|

| 3.1 |

|

Certificate of Correction to Certificate of Designation, dated September 23, 2024. |

| |

|

|

| 10.1 |

|

Secured Credit Note, dated July 22, 2024, between Pineapple Energy Inc. and Conduit Capital U.S. Holdings, LLC (incorporated by reference to Exhibit 10.2 of the Current Report on Form 8-K filed on July 26, 2024).

Amended and Restated Convertible Secured Credit Note, dated September 9 2024, between Pineapple Energy Inc. and Conduit Capital U.S. Holdings, LLC (incorporated by reference to Exhibit 10.2 of the Current Report on Form 8-K filed on September 9, 2024).

|

| |

|

|

| 10.2 |

|

Second Amended and Restated Convertible Secured Credit Note, dated September 23, 2024, between Pineapple Energy Inc. and Conduit Capital U.S. Holdings, LLC. |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

|

|

SIGNATUREs

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

PINEAPPLE ENERGY INC. |

| |

|

| |

By: |

/s/ James Brennan |

| |

|

James Brennan

Chief Operating Officer |

| |

|

|

| Date: September 26, 2024 |

|

|

Exhibit 3.1

CERTIFICATE

OF CORRECTION

REGARDING

PINEAPPLE

energy inc.

Pursuant

to Minnesota Statute Section 5.16, the undersigned the interim Chief Executive Officer of Pineapple Energy Inc. hereby files this

Certificate of Correction with respect to the Pineapple Energy Inc. Certificate of Designation of Preferences, Rights and Limitations

of Series C Convertible Preferred Stock (the “Certificate of Designation”) originally filed with the Minnesota Secretary

of State on September 9, 2024. The correction is as follows:

| 1. | Section

4 of the Certificate of Designation states “on an as-converted basis as follows”

instead of “on an as-converted basis, subject to the beneficial ownership limitations

set forth in Section 5(d), as follows” which was in error. |

| 2. | Section

4 should read as follows: |

“Section

4. Voting Rights. Except as otherwise provided herein or as otherwise required by law, the Preferred Stock shall entitle

the holder thereof to vote exclusively with respect to the Reincorporation Proposal (and the Preferred Stock shall not be entitled

to vote on any other matter except to the extent required by law) together as a single class with the Common Stock on an as-converted

basis, subject to the beneficial ownership limitations set forth in Section 5(d), as follows: each share of the Preferred Stock

shall be entitled to such number of votes equal to the quotient obtained by dividing (i) the Stated Value by (ii) the Minimum

Price of the Common Stock immediately prior to the effective time of the Securities Exchange Agreements. As long as any shares

of Preferred Stock are outstanding, the Corporation shall not, without the affirmative vote of the Holders of a majority of the

then outstanding shares of the Preferred Stock (the “Required Holders”), (a) alter or change adversely the

powers, preferences or rights given to the Preferred Stock or alter or amend this Certificate of Designation, (b) authorize or

create any class of stock ranking as to redemption senior to the Preferred Stock, (c) amend its articles of incorporation or other

charter documents in any manner that adversely affects any rights of the Holders, (d) increase the number of authorized shares

of Preferred Stock, or (e) enter into any agreement with respect to any of the foregoing.”

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Correction this 21st day of September, 2024.

| |

/s/

Scott Maskin |

| |

Scott

Maskin |

| |

Interim

Chief Executive Officer |

Exhibit 10.2

THIS

NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “1933 ACT”), OR ANY STATE

SECURITIES LAWS AND MAY NOT BE OFFERED, SOLD, PLEDGED, ASSIGNED, OR OTHERWISE TRANSFERRED UNLESS A REGISTRATION STATEMENT WITH

RESPECT THERETO IS EFFECTIVE UNDER THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS OR BORROWER (AS DEFINED BELOW)

RECEIVES AN OPINION OF COUNSEL SATISFACTORY TO BORROWER THAT THIS NOTE MAY BE OFFERED, SOLD, PLEDGED, ASSIGNED, OR OTHERWISE TRANSFERRED

IN THE MANNER CONTEMPLATED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR APPLICABLE STATE SECURITIES

LAWS.

SECOND

AMENDED AND RESTATED CONVERTIBLE SECURED CREDIT NOTE

(Original

Issue Discount)

| Not

to Exceed the Principal Sum of $1,000,000.00 |

September

23, 2024 |

FOR

VALUE RECEIVED, Pineapple Energy, Inc., a corporation

having an office located at 171 Remington Boulevard, Ronkonkoma, New York 11779 and

its successors and assigns (the “Borrower”), promises to pay to the order of Conduit Capital U.S.

Holdings LLC, a Delaware limited liability company having an office located at 1451 Fort Cassin Road, Ferrisburg, Vermont

05456 (“Lender”) or at such other place as the holder hereof may from time to time designate in writing, in federal

funds immediately available in New York, all Loans (defined herein) made by Lender to Borrower hereunder in an amount not to exceed

the aggregate principal sum of One Million ($1,000,000.00) Dollars as indicated on the Grid Schedule attached hereto as

Annex 1, as same shall be amended from time to time subsequent to the date hereof, in accordance with the Credit Agreement

(defined herein). This Amended and Restated Convertible Secured Credit Note (this “Note”) amends and restates, in

its entirety, that certain Secured Credit Note by Borrower in favor of Lender dated July 24, 2024 in the principal sum (the “Principal

Sum”) of $1,000,000.00 United States Dollars (the “Original Note”), as such Original Note has

been amended and restated in its entirety by that certain Amended and Restated Secured Credit Note by Borrower in favor of Lender

dated September 9, 2024.

This

Note, as amended hereby, is the Secured Credit Note referred to in that certain Secured Credit Agreement dated July 24, 2024 between

Borrower and Lender (as the same may be amended, modified or supplemented from time to time, the “Credit Agreement”).

This Note is secured by that certain Security Agreement dated July 24, 2024 between the Borrower and Lender (the “Security

Agreement”). This Note is subject to the terms and provisions of that certain Subordination Agreement of even date herewith

among Borrower, Lender, Decathlon Specialty Finance, LLC, MBB Energy, LLC, and Hercules Capital, Inc. Certain capitalized terms

used in this Note which are not defined herein shall have the meanings ascribed to them in the Credit Agreement.

a. First

Advance. Lender advanced the principal sum of Five Hundred Thousand ($500,000.00) Dollars to Borrower on July 24, 2024,

in an amount equal to such principal sum minus the Original Issue Discount.

b. Second

Advance. On September 9, 2024, Lender advanced the additional principal sum of One Hundred

Twenty Thousand ($120,000.00) Dollars, in an amount equal to such principal sum minus

the Original Issue Discount.

c. Third

Advance. Not later than one (1) business day after the execution of this Note, Lender is advancing the additional principal

sum of Three Hundred Eighty Thousand ($380,000.00) Dollars to Borrower in an amount equal to such principal sum minus the

Original Issue Discount.

d. Original

Issue Discount. Notwithstanding any such deduction of the Original Issue Discount, Borrower is and shall remain liable to

pay (a) the full principal amount of all Loans, inclusive of the Original Issue Discount and without giving effect to such deduction,

and (b) interest, which shall accrue on the outstanding principal amount of such Loans, inclusive of the Original Issue Discount

and without giving effect to such deduction from and after the Maturity Date. All calculations of interest and fees in respect

of the Loans shall be calculated on the basis of their full stated principal sum. For the avoidance of doubt, the Original Issue

Discount is and shall be deemed to be a part of the aggregate outstanding principal sum due under this Note.

2. Interest

Rate. Each Loan shall bear interest on the unpaid principal amount thereof (without deduction for the Ordinary Issue Discount)

at an interest rate equal to Twenty Percent (20.0%) per annum; provided

that payment in full of the Repayment Amount, inclusive of the Original Issue Discount, on the Maturity Date satisfies the interest

accrual on the Loan from initial issuance to the Maturity Date. Upon the occurrence and during the continuance of an Event

of Default, the outstanding principal amount of the Loans hereunder shall bear interest payable on demand at a rate of interest

of five (5.0%) percent per annum in excess of the interest rate otherwise then in effect or, if less, the maximum lawful rate

of interest. Interest on each Loan shall be calculated on the basis year of 360 days and shall be payable for the actual days

elapsed.

3. Maturity.

On the Maturity Date, the entire outstanding Repayment Amount (including the Original Issue Discount)

shall be due and payable in full without any notice or demand whatsoever being required.

4. Application

of Payments. All payments received by Lender hereunder shall be applied first, to interest in accordance with the

Credit Agreement, second, to the unpaid principal amount of all Loans then outstanding (including the Original

Issue Discount), and third, to the payment of any fees, costs, expenses or charges then payable by Borrower to

Lender hereunder, under the Credit Agreement or under any other document executed and delivered by Borrower to Lender or the

holder hereof (or to either of their respective successors, assigns or Affiliates.

5. Event

of Default. Upon the occurrence of an Event of Default, Lender shall have the unconditional right, but not the obligation,

to accelerate and declare this Note to be forthwith due and payable without presentment, demand, protest or other notice of any

kind, all of which are hereby expressly waived.

6. Usury

Savings Clause. Notwithstanding anything in to the contrary stated in this Note or the Credit Agreement, the obligation of

the Borrower to make payments of interest shall be subject to the limitation that payments of interest shall not be required to

be paid to Lender to the extent that the charging or receipt thereof would not be permissible under the law or laws applicable

to Lender limiting the rates of interest that may be charged or collected by Lender. If the provisions of this Note or the Credit

Agreement would at any time otherwise require payment by the Borrower to Lender of any amount of interest in excess of the maximum

amount then permitted by applicable law, the interest payments shall be reduced to the extent necessary so that Lender shall not

receive interest in excess of such maximum amount.

7. Time

of the essence. Time is of the essence as to all dates set forth herein; provided, however that whenever any payment to be

made under this Note shall be stated to be due on a day that is not a Business Day, such payment shall be made on the next succeeding

Business Day, and such extension of time shall in such case be included in the computations of payment of interest. “Business

Day” shall mean any day except a Saturday, Sunday or other day on which commercial banks are required or permitted to close

in the State of New York.

8. Borrower’s

Absolute Obligation. No provision of this Note or the Credit Agreement shall alter or impair the obligation of Borrower, which

is absolute and unconditional, to pay the principal of and interest due with respect to this Note at the place, at the respective

times, and in the currency herein prescribed.

9. Conversion

of this Note.

a. Conversion

Shares. Lender shall have the right, but not the obligation, at any time and from time-to-time so long as not less than an

amount equal to the principal sum of $500,000.00 (the “Convertible Amount”) remains unpaid under this Note, to convert

all or any portion of the outstanding Convertible Amount and all accrued but unpaid interest thereon into a number of shares (the

“Conversion Shares”) of the Borrower’s common stock (the “Common Stock”), calculated

as the total dollar amount to be converted divided by $0.45 (the “Conversion Price”).

i. For

the avoidance of doubt, the Convertible Amount is the sole portion of the Principal Sum that is subject to conversion herein.

ii. In

the event that Lender wishes to exercise the conversion rights set forth in this Section 9(a), the Lender shall give the Borrower

written notice (the “Conversion Notice”) of such conversion, which notice shall be effective on the date of

such Conversion Notice, if such Conversion Notice is received by the Borrower not later than 4:00 p.m. Eastern Time on such date

or, if such Conversion Notice is received by the Borrower after 4:00 p.m. Eastern Time on such date, then on the next succeeding

Business Day. The date on which such Conversion Notice is deemed to be effective is hereinafter referred to as the “Conversion

Date.”

b. Transfer

Agent. Not later than two (2) Business Days after any Conversion Date, the Borrower will cause the transfer agent for the

Common Stock to deliver to the Lender, a book-entry receipt evidencing the issuance of the Conversion Shares to the Lender and

containing a restrictive legend similar in tone and tenor to the legend on the first page of this Note.

c. No

Fractional Shares. Upon any conversion hereunder, the Borrower shall not issue fractions of any Conversion Shares, and the

aggregate number of Conversion Shares shall be rounded up or down to the nearest whole number.

d. Annotation

of Note. Not later than three (3) Business Days following the Conversion Date, the Borrower shall prepare and the Lender shall

acknowledge an annotated version of the Note and the Grid Schedule hereto reflecting the conversion and corresponding reduction

of the Principal Amount outstanding under this Note.

e. Adjustments.

i. If,

at any time while any portion of this Note remains outstanding, Borrower effectuates a stock split or reverse stock split of its

Common Stock or issues a dividend on Common Stock consisting of shares of Common Stock, the Conversion Price shall be equitably

adjusted to reflect such action. By way of illustration, and not in limitation, of the foregoing, (i) if Borrower effectuates

a 2:1 split of its Common Stock, thereafter, with respect to any conversion for which the Borrower issues shares after the record

date of such split, the Conversion Price shall be deemed to be one-half of what it had been immediately prior to such split; (ii)

if Borrower effectuates a 1:10 reverse split of its Common Stock, thereafter, with respect to any conversion for which Borrower

issues shares after the record date of such reverse split, the Conversion Price shall be deemed to be ten times what it had been

calculated to be immediately prior to such split; and (iii) if Borrower declares a stock dividend of one share of Common Stock

for every 10 shares outstanding, thereafter, with respect to any conversion for which Borrower issues shares after the record

date of such dividend, the Conversion Price shall be deemed to be such amount multiplied by a fraction, of which the numerator

is the number of shares (10 in the example) for which a dividend share will be issued and the denominator is such number of shares

plus the dividend share(s) issuable or issued thereon (11 in the example).

ii. In

case of any capital reorganization or of any reclassification of the capital of Borrower or in case of the consolidation or merger

of Borrower with or into any other company or of the sale of all or substantially all of the assets of Borrower, this Note shall,

after such capital reorganization, reclassification of capital, consolidation, merger or sale (“Equity Transaction”),

confer the right to convert into that number of shares or other securities or property of the Borrower or of the entity resulting

from such Equity Transaction or to which such sale shall be made, as the case may be, to which the holder of the shares deliverable

at the time of such Equity Transaction would have been entitled as a result of such Equity Transaction had the Note been converted

immediately prior thereto, and in any such case, if necessary, appropriate adjustments shall be made in the application of the

provisions set forth herein with respect to the rights and interest thereafter of the Lender to the end that the provisions set

forth herein shall thereafter correspondingly be made applicable as nearly as may reasonable be expected in relation to any shares

or other securities or property thereafter deliverable. The subdivision or consolidation of the shares at any time outstanding

into a greater or lesser number of shares (whether with or without par value) shall not be deemed to be a capital reorganization

or a reclassification of the capital of the Borrower for the purposes of this Section 9.

f. Covenants

regarding Common Stock. Borrower covenants and agrees that it shall at all times reserve and keep available out of its authorized

Common Stock solely for the purpose of issuing the Conversion Shares as provided in this Note, such number of shares of Common

Stock as shall then be issuable upon conversion of this Note as herein provided. In the event Borrower does not have a sufficient

number of shares of authorized Common Stock available for the issuance of any or all of the Conversion Shares, Borrower covenants

and agrees to take all steps necessary or desirable to effectuate the authorization of such Conversion Shares, including without

limitation amending its charter documents to increase the number of authorized shares of Common Stock. Borrower covenants and

agrees that all shares that may be issued upon conversion of this Note will, upon such issuance, be duly and validly issued, fully

paid and non-assessable, free of all liens and charges, and not subject to any preemptive rights.

| 10. | Piggyback

Registration Rights. |

a. Generally.

If Borrower determines to register any of its securities, other than a registration relating solely to employee benefit plans

or a registration relating solely to a corporate reorganization or other transaction on Form S-4, S-8 or similar forms that may

be promulgated in the future, then Borrower shall:

i. promptly

give written notice thereof to Lender on a date (the “Notice Date”) that is at least ten (10) days before filing any

such registration statement; and

ii. use

its commercially reasonable efforts to include in such registration (and any related qualification under blue sky laws or other

compliance), except as set forth in Section 10(b), and in any underwriting involved therein, all the Conversion Shares specified

in a written request made by Lender and received by Borrower within five (5) days after the Notice Date. Such written request

may specify all or a part of Lender’s Conversion Shares. If Lender decides not to include all of its Conversion Shares in

such registration statement, then Lender shall continue to have the right to include any Conversion Shares held by it any subsequent

registration statement or registration statements as may be filed by Borrower with respect to offerings of Borrower’s securities

upon the terms and conditions set forth herein.

b. Underwriting.

i. If

the registration for which Borrower gives notice is for a registered public offering involving an underwriting, then Borrower

shall so advise Lender as a part of the written notice given pursuant to Section 10(a)(i). In such event, the right of Lender

to registration pursuant to this Section 10 shall be conditioned upon Lender’s participation in such underwriting and the

inclusion of the Conversion Shares in the underwriting to the extent provided herein. Lender shall enter into a written underwriting

agreement in customary form with Borrower and the representative of the underwriter or underwriters selected by Borrower.

ii. Notwithstanding

any other provision of this Section 10, if the underwriters’ representative advises Borrower in good faith and in writing

(which notice Borrower, in turn, shall promptly provide to Lender) that marketing factors require a limitation on the number of

shares to be underwritten, then the representative may (subject to the limitations set forth below) exclude any or all Conversion

Shares from, or limit the number of Conversion Shares to be included in, the registration and underwriting. If Lender does not

agree to the terms of any such underwriting, then Lender shall be excluded from the underwriting by written notice from Borrower

or the underwriter. Any Conversion Shares excluded or withdrawn from such underwriting in accordance with the terms hereof shall

be withdrawn from such registration.

c. Right

to Terminate Piggyback Registration. Borrower shall have the right to terminate or withdraw any registration it has initiated,

to which this Section 10 is applicable, prior to the effectiveness of such registration, whether or not Lender elected to include

its Conversion Shares in such registration.

d. Expenses

of Piggyback Registration. All expenses incurred in connection with any registration, qualification or compliance pursuant

to this Section 10 shall be borne by Borrower. All registration fees, underwriting discounts and selling commissions relating

to Conversion Shares so registered shall be borne by Lender.

e. Change

of Control. In the event of a change of control of the Borrower during the term hereof, the Lender (a) shall have the right

to convert and sell any Conversion Shares alongside any such transaction and (b) for any portion of the Note not converted the

outstanding balance of this Note shall be immediately payable and the Borrower shall repay in full any amounts due or outstanding

under this Note.

| 11. | Demand

Registration Rights. |

a. Lender’s

Right. Lender shall have the right, exercisable on one (1) occasion, to request that Borrower prepare and file a registration

statement under the 1933 Act covering the registration of all or any part of the Conversion Shares. In such event, Borrower shall

use its best efforts to effect such registration as soon as practicable, provided that Lender shall cooperate and assist Borrower

in connection with the preparation and filing of such registration statement.

b. Expenses

of Demand Registration. All out-of-pocket expenses incurred in connection with such registration shall be borne by Lender.

Such expenses include without limitation all filing fees and expenses; compliance and blue sky qualification of the Conversion

Shares; state and federal registration fees; underwriting discounts and selling broker commissions; and all legal, accounting

and other external professional fees and expenses incurred by Borrower in connection with such registration; provided that Lender

shall not be responsible for any expenses incurred by Borrower for wages, salaries or other expenses relating solely to its officers,

directors and employees with respect to such registration. Lender shall indemnify, defend and hold Borrower harmless from any

and all such expenses.

12. Prepayment.

Borrower shall prepay the Loans prior to Maturity in accordance with the Credit Agreement.

13. Waivers.

The Borrower and all endorsers of this Note waive presentment, diligence, demand, protest, and notice of any kind in connection

with this Note.

14. Governing

Laws. This Agreement and the performance hereunder will be governed in all respects by the laws of the State of New

York, without giving effect to principles of conflicts of laws or statutes. The parties agree that the sole and exclusive

jurisdiction and venue for any litigation arising from or relating to this Agreement or the subject matter hereof will be a

federal or state court located in Suffolk County in the State of New York. Each party knowingly and voluntarily submits to

personal jurisdiction over it in New York and to the exercise of jurisdiction over it by such court. Borrower knowingly and

voluntarily waives and agrees not to assert by way of motion, as a defense or otherwise in any such suit, action or

proceeding any claim that it is not personally subject to the jurisdiction of such federal or state courts, that the suit,

action or proceeding is brought in an inconvenient forum, that the venue of the suit, action or proceeding is improper, or

that this Note may not be litigated in or by such federal or state courts. BORROWER AND LENDER EACH HEREBY WAIVE ANY RIGHT IT

MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY ACTION OR PROCEEDING, AT LAW OR IN EQUITY, DIRECTLY OR INDIRECTLY ARISING OUT

OF, UNDER OR IN CONNECTION WITH THIS NOTE.

[signature

page follows]

[signature

page to Second Amended and Restated Secured Convertible Credit Note]

IN

WITNESS WHEREOF, the Borrower has caused this Note to be executed and delivered by its duly authorized officer, as of the

day and year and at the place first above written.

| |

PINEAPPLE ENERGY, INC. |

| |

|

|

| |

By:

|

/s/ James R. Brennan |

| |

|

Name:

James R. Brennan |

| |

|

Title:

Chief Operating Officer |

Lender

consents and agrees to the provisions of Section 10 and Section 11 of this Note:

CONDUIT

CAPITAL U.S. HOLDINGS LLC

By:

Pangaea Investments, LLC

| by:

|

/s/ Rober J. Zulkoski |

| |

Name:

Robert J. Zulkoski |

| |

Title:

Sole Member |

ANNEX

1

Grid

Schedule to Revolving Credit Note

between

Pineapple Energy, Inc. and Conduit Capital U.S. Holdings LLC

Date

of Loan

Disbursement |

Principal

Amount of

Loan |

Amount

of Principal

Repaid |

Notation

Made by |

| July

24, 2024 |

$500,000.00 |

-0- |

|

| |

|

|

|

| September

9, 2024 |

$120,000.00 |

-0- |

|

| |

|

|

|

| September

23, 2024 |

$380,000.00 |

-0- |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

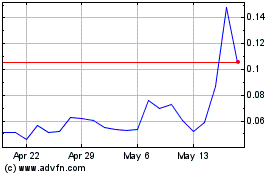

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Dec 2023 to Dec 2024