PetVivo Holdings, Inc. (OTC: PETV, PETVW), a leading biomedical

company delivering innovative therapeutic medical devices for

equines and companion animals, reported results for the fiscal year

ended March 31, 2024. All comparisons are to the same year-ago

period unless otherwise noted. The company will hold a conference

call at 5:00 p.m. Eastern time today to discuss the results (see

dial-in information below).

Fiscal 2024 Financial Highlights

- Revenues up 6%

to $969,000, driven sales of the company’s lead veterinary medical

device, Spryng™ with OsteoCushion™ technology.

- Revenue growth

was driven largely by the company’s expanded distributor network,

with sales to distributors increasing 15% to $732,000.

- Gross profit

increased 6% to $740,000.

- Gross margin

improved 40 basis points to 76.3%.

Fiscal 2024 Operational Highlights

- Achieved

milestone of the distribution of Spryng to more than 700 Veterinary

Clinics across 50 States, and surpassed more than 6,000 syringes

distributed.

- Partnered with

Covetrus North America to market, sell and distribute Spryng™

throughout the U.S.

- Reported the

results of two clinical studies conducted by Inotiv, a

world-renowned independent clinical research organization, which

demonstrated the excellent safety profile of Spryng™ for cats and

dogs.

- Received two

notices of allowance from United States Patent and Trademark Office

for key patents covering proprietary biomaterials and corresponding

products, as well as the proprietary biocompatible protein-based

particles used in Spryng™.

- Appointed Garry

Lowenthal as chief financial officer, bringing to PetVivo more than

25 years of experience in operational and financial

management.

- Appointed

Spencer Breithaupt to the board of directors. He brings to the

board over 30 years of management and leadership experience in the

animal health industry, most recently with MWI Animal Health

(Amerisource Bergen), where he had held several positions on its

executive leadership team.

Management Commentary

“In fiscal 2024, we reported strong financial

and operational progress, including revenues up 6% to $969,000,”

commented PetVivo CEO, John Lai. “Our revenue growth was driven

largely by our expanded distributor network, with sales of Spryng™

by distributors up 15% to $732,000. This helped drive our gross

profit up 6% to $740,000, with our gross margins improving 40 basis

points to 76.3%.

“Also during the year, we developed clinical

data on the safety and efficacy of Spryng, increased distribution

through the addition of Covetrusm, expanded our efforts with MWI,

and increased market awareness of Spryng to veterinarians.

“We are excited about the final clinical results

from the cruciate ligament study on canines and the preliminary

clinical results from the osteoarthritis canine hip study which

were presented at the Veterinary Orthopedic Society conference

in February, 2024.

“The release of tolerance clinical results

involving the injection of Spryng into the joints of canines and

felines have confirmed the long-known understanding that Spryng is

a safe option for veterinarians who are addressing issues related

to osteoarthritis and other joint-related afflictions in companion

animals.

“We expect to use this clinical data to further

advance the use of Spryng by veterinarians in the management of

joint related afflictions, as well as raise veterinarian and

consumer awareness of the benefits of this life-enhancing

product.

“We are also taking several steps to position

the company for future success in fiscal 2025. We recently hired a

new VP of Sales as well as a new VP of Marketing to lead our sales

and marketing teams. We plan to add more sales and marketing

personnel to support our distribution relationship with MWI,

Covetrus and veterinary clinics.

“Looking ahead, we plan to further build out our

technical service teams and complete additional clinical studies in

equine, canine and feline companion animals. We also plan to

increase adoption of Spryng by key opinion leaders and increase

marketing awareness through trade shows and digital outreach.

“Our revenues are now ramping under global

distribution agreements and new key sales and marketing hires. We

have never been in a better position to address the enormous

opportunity we see in the $5.7 billion U.S. Animal Health Market—a

market that is projected to double to $11.3 billion by 2030.

“Helping to drive this market is the greater

affordability of pet care from pet health insurance, with the

number of pets insured in North America increasing by 20.9% last

year to more than 6 million. We believe all of these positive

factors have set the stage for strong growth for PetVivo over the

next year and beyond.”

Fiscal 2025 Revenue Outlook

For the fiscal full year of 2025, the company

anticipates net revenue of approximately $1.5 million to $2.0

million, which would represent growth of approximately 50% to 100%

over the prior year.

Fiscal 2024 Financial

Summary

Revenues in the fiscal full year of 2024

increased 6% to $969,000, primarily due to distribution channel

expansion.

Gross profit totaled $740,000 or 76.3% of

revenues as compared to $670,000 or 75.9% of revenues in fiscal

2023. The increase in gross margin was a result of a favorable

shift in product mix.

Operating expenses increased 20% to $11.4

million compared to fiscal 2023. The increase in operating expenses

was due to increases in general and administrative expenses of $1.7

million and research and development of $272,000. The increase was

partially offset due to a decrease in sales and marketing of

$11,000.

Net loss totaled $11.0 million or $(0.78) per

basic and diluted share, as compared to a net loss of $8.7 million

or $(0.85) per basic and diluted share in the same year-ago

period.

Cash and cash equivalents totaled $87,000 at

March 31, 2024. Subsequent to the fiscal year end, the company

raised net proceeds of $1.8 million.

For a more detailed overview of the Company’s

financials, the PetVivo Holdings, Inc. Consolidated Statements of

Operations and Consolidated Balance Sheet are provided below.

Conference Call

PetVivo management will host a conference call

today to discuss these results, which will include a

question-and-answer period.

Date: Friday, June 28, 2024Time: 5:00 p.m. Eastern time (2:00

p.m. Pacific time)Toll-free dial-in number:

1-719-359-4580Conference ID: 845 8120 3778Passcode: 853545Webcast

(live and replay): here

A replay of the webcast will be available

through the same link following the conference call.

The conference call webcast is also available

via a link in the Investors section of the company’s website at

petvivo.com/investors.

If you require any assistance connecting to the

call, please contact CMA at 1-949-432-7566.

About PetVivo Holdings

PetVivo Holdings, Inc. (OTC: PETV, PETVW) is a

biomedical device company focused on the manufacturing,

commercialization and licensing of innovative medical devices and

therapeutics for companion animals. The company is pursuing a

strategy of developing and commercializing human therapies for the

treatment of companion animals in capital and time efficient ways.

A key component of this strategy is an accelerated timeline to

revenues for veterinary medical devices that can enter the market

much earlier than more stringently regulated human pharmaceuticals

and biologics.

PetVivo has developed a robust pipeline of

products for the medical treatment of animals and people, with a

portfolio of 21 patents that protect the company's biomaterials,

products, production processes and methods of use. The company’s

commercially launched flagship product, Spryng™ with OsteoCushion™

Technology, is a veterinarian-administered, intra-articular

injectable designed for the management of lameness and other joint

related afflictions, including osteoarthritis, in cats, dogs and

horses.

For more information about PetVivo and its

revolutionary Spryng with OsteoCushion Technology, email

info1@petvivo.com or visit petvivo.com or sprynghealth.com.

Disclosure Information

PetVivo uses and intends to continue to use its

Investor Relations website as a means of disclosing material

nonpublic information and for complying with its disclosure

obligations under Regulation FD. Accordingly, investors should

monitor the company’s Investor Relations website, in addition to

following the company’s press releases, SEC filings, public

conference calls, presentations and webcasts.

Forward-Looking commercial Statements

The foregoing information regarding PetVivo

Holdings, Inc. (the “Company”) may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

each as amended. Forward-looking statements include all statements

that do not relate solely to historical or current facts, including

without limitation the Company’s proposed development and

commercial timelines, and can be identified by the use of words

such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words.

Forward-looking statements are not guarantees of future actions or

performance. These forward-looking statements are based on

information currently available to the Company and its current

plans or expectations and are subject to a number of uncertainties

and risks that could significantly affect current plans. Risks

concerning the Company’s business are described in detail in the

Company’s Annual Report on Form 10-K for the year ended March 31,

2024 and other periodic and current reports filed with the

Securities and Exchange Commission. The Company is under no

obligation to, and expressly disclaims any such obligation to,

update or alter its forward-looking statements, whether as a result

of new information, future events or otherwise.

Company ContactJohn Lai,

CEOPetVivo Holdings, Inc.Email ContactTel (952) 405-6216

Investor ContactRonald Both or Grant StudeCMA

Investor RelationsTel (949) 432-7566Email contact

PETVIVO HOLDINGS,

INC.CONSOLIDATED BALANCE SHEETS

|

|

|

March 31, 2024 |

|

|

March 31, 2023 |

|

| Assets: |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

87,403 |

|

|

$ |

475,314 |

|

|

Accounts receivable, net of allowance for credit losses |

|

|

18,669 |

|

|

|

86,689 |

|

|

Inventory, net |

|

|

390,076 |

|

|

|

370,283 |

|

|

Prepaid expenses and other current assets |

|

|

545,512 |

|

|

|

491,694 |

|

|

Total Current Assets |

|

|

1,041,660 |

|

|

|

1,423,980 |

|

| |

|

|

|

|

|

|

|

|

| Property and Equipment,

net |

|

|

821,656 |

|

|

|

630,852 |

|

| |

|

|

|

|

|

|

|

|

| Other Assets: |

|

|

|

|

|

|

|

|

|

Operating lease right-of-use assets |

|

|

1,194,348 |

|

|

|

317,981 |

|

|

Patents and trademarks, net |

|

|

30,099 |

|

|

|

38,649 |

|

|

Security deposit |

|

|

27,490 |

|

|

|

27,490 |

|

|

Total Other Assets |

|

|

1,251,937 |

|

|

|

384,120 |

|

|

Total Assets |

|

$ |

3,115,253 |

|

|

$ |

2,438,952 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’

Equity: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

821,230 |

|

|

$ |

588,713 |

|

|

Accrued expenses |

|

|

243,030 |

|

|

|

779,882 |

|

|

Operating lease liability – current portion |

|

|

190,589 |

|

|

|

78,149 |

|

|

Notes payable and accrued interest-current portion |

|

|

157,521 |

|

|

|

6,936 |

|

|

Total Current Liabilities |

|

|

1,412,370 |

|

|

|

1,453,680 |

|

| Other Liabilities |

|

|

|

|

|

|

|

|

|

Operating lease liability (net of current portion) |

|

|

1,003,759 |

|

|

|

20,415 |

|

|

Note payable and accrued interest (net of current portion) |

|

|

13,171 |

|

|

|

239,832 |

|

|

Total Other Liabilities |

|

|

1,016,930 |

|

|

|

260,247 |

|

|

Total Liabilities |

|

|

2,429,300 |

|

|

|

1,713,927 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and Contingencies

(see Note 10) |

|

|

0 |

|

|

|

0 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Preferred stock, par value

$0.001 per share, 20,000,000 shares authorized, 0 and 0 shares

issued and outstanding at March 31, 2024 and March 31, 2023 |

|

|

- |

|

|

|

- |

|

| Common stock, par value $0.001

per share, 250,000,000 shares authorized, 17,058,620 and 10,950,220

shares issued and outstanding at March 31, 2024 and March 31, 2023,

respectively |

|

|

17,059 |

|

|

|

10,950 |

|

|

Common Stock to be Issued |

|

|

- |

|

|

|

137,500 |

|

|

Additional Paid-In Capital |

|

|

83,468,218 |

|

|

|

72,420,604 |

|

|

Accumulated Deficit |

|

|

(82,799,324 |

) |

|

|

(71,844,029 |

) |

|

Total Stockholders’ Equity |

|

|

685,953 |

|

|

|

725,025 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

3,115,253 |

|

|

$ |

2,438,952 |

|

PETVIVO HOLDINGS,

INC.CONSOLIDATED STATEMENTS OF

OPERATIONS

|

|

|

Year Ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Revenues |

|

$ |

968,706 |

|

|

$ |

917,162 |

|

| |

|

|

|

|

|

|

|

|

| Cost of

Sales |

|

|

229,180 |

|

|

|

221,036 |

|

|

Gross Profit |

|

|

739,526 |

|

|

|

696,126 |

|

| |

|

|

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Sales and Marketing |

|

|

3,399,666 |

|

|

|

3,410,277 |

|

|

Research and Development |

|

|

1,268,014 |

|

|

|

996,358 |

|

|

General and Administrative |

|

|

6,693,186 |

|

|

|

5,022,943 |

|

| |

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

|

11,360,866 |

|

|

|

9,429,578 |

|

| |

|

|

|

|

|

|

|

|

|

Operating Loss |

|

|

(10,621,340 |

) |

|

|

(8,733,452 |

) |

| |

|

|

|

|

|

|

|

|

| Other (Expense)

Income |

|

|

|

|

|

|

|

|

|

Loss on Extinguishment of Debt |

|

|

(534,366 |

) |

|

|

- |

|

|

Settlement Expense |

|

|

(180,000 |

) |

|

|

- |

|

|

Extinguishment of payables |

|

|

385,874 |

|

|

|

- |

|

|

Interest (Expense) Income |

|

|

(5,463 |

) |

|

|

15,844 |

|

|

Total Other (Expense) Income |

|

|

(333,955 |

) |

|

|

15,844 |

|

| |

|

|

|

|

|

|

|

|

|

Loss before taxes |

|

|

(10,955,295 |

) |

|

|

(8,717,608 |

) |

| |

|

|

|

|

|

|

|

|

|

Income Tax Provision |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(10,955,295 |

) |

|

$ |

(8,717,608 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Loss Per Share: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.78 |

) |

|

$ |

(0.85 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

13,969,754 |

|

|

|

10,222,994 |

|

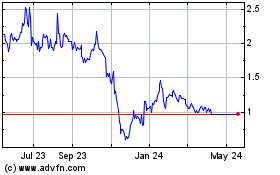

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Nov 2024 to Dec 2024

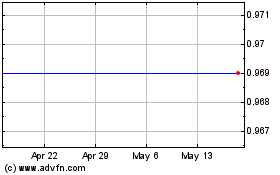

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Dec 2023 to Dec 2024