false

0001853580

0001853580

2024-02-06

2024-02-06

0001853580

PFTAU:UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnethirdOfOneRedeemableWarrantMember

2024-02-06

2024-02-06

0001853580

PFTAU:ClassOrdinarySharesIncludedAsPartOfUnitsMember

2024-02-06

2024-02-06

0001853580

PFTAU:RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2024

PERCEPTION CAPITAL CORP. III

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40639 |

|

98-1592069 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

3109 W 50th St, #207

Minneapolis,

MN |

|

55410 |

| (Address of principal executive offices) |

|

(Zip Coe) |

(212) 380-5605

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol: |

|

Name of Each Exchange on Which Registered: |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-third of one redeemable warrant |

|

PFTAU |

|

The NASDAQ Stock Market LLC |

| Class A ordinary shares included as part of the units |

|

PFTA |

|

The NASDAQ Stock Market LLC |

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

PFTAW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 7.01. |

Regulation FD Disclosure. |

On February 6, 2024, Perception Capital Corp. III (“Perception”) and RBio Energy Corporation, a Cayman Islands exempted company (“RBio Energy”), issued a joint press release announcing the execution by Perception and RBio Energy of a definitive business combination agreement, dated February 6, 2024 (the “Business Combination Agreement”), pursuant to which, among other things, RBio Energy’s ordinary shares are expected to be listed on the Nasdaq Stock Market LLC (“Nasdaq”). A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The foregoing (including the information presented in Exhibit 99.1) is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act. The submission of the information set forth in this Item 7.01 shall not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented in Exhibit 99.1 that is provided solely in connection with Regulation FD.

Additional Information and Where to Find It

In connection with the business combination agreement and the proposed business combination (the “Transaction”), Perception intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”), which will include a preliminary proxy statement/prospectus certain other related documents, which will be the proxy statement to be distributed to the stockholders of Perception in connection with Perception’s solicitation of proxies for the vote by its stockholders with respect to the proposed Transaction and other matters as may be described in the definitive proxy statement, as well as a prospectus relating to the offer and sale of the securities to be issued in the proposed Transaction. This Current Report on Form 8-K does not contain any information that should be considered by Perception’s stockholders concerning the proposed Transaction and is not intended to constitute the basis of any voting or investment decision in respect of the proposed Transaction or the securities of the combined company. The stockholders of Perception and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein filed in connection with the proposed Transaction, as these materials will contain important information about Perception, RBio Energy, the business combination agreement and the proposed Transaction. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Transaction will be mailed to stockholders of Perception as of a record date to be established for voting on the proposed Transaction. Stockholders of Perception will also be able to obtain copies of the Registration Statement, the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC's web site at www.sec.gov or by directing a request to: Perception Capital Corp. III, 767 5th Avenue, 15th Floor, New York, NY 10022, Attention: Investor Relations or by email at investors@perceptioncapitalpartners.com.

Participants in the Solicitation

Perception, RBio Energy and their respective directors, executive officers, other members of management and employees may be deemed participants in the solicitation of proxies from Perception's stockholders with respect to the proposed Transaction. Investors and securityholders may obtain more detailed information regarding the names and interests in the Transaction of the directors and officers of each of Perception and RBio Energy with respect to the proposed Transaction in the proxy statement/prospectus for the proposed Transaction when available and in Perception’s filings with the SEC.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed business combination. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This Current Report on Form 8-K, including the exhibit attached hereto, includes "forward-looking statements" within the meaning of the safe harbor for forward-looking statements provided by Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995 including, without limitation statements related to: the parties’ ability to close the proposed Transaction, including the ability of the companies to secure all required regulatory and shareholder approvals for the proposed Transaction, as applicable; the anticipated benefits of the proposed Transaction, including the potential amount of cash that may be available to RBio Energy’s shareholders upon consummation of the Transaction; sources and uses of cash from the Transaction; RBio Energy’s planned development of biorefinery assets and biomass and biogas power generation capacity and RBio Energy’s intent to build out an industry consolidation platform to acquire assets and invest capital for growth; the anticipated timing to close the Transaction; RBio Energy’s expectation that its shares of common stock will be accepted for listing on the Nasdaq Stock Market following the closing of the Transaction; the anticipated financial and business performance of RBio Energy; and RBio Energy’s anticipated future operating results. You are cautioned not to place undue reliance on these forward-looking statements, which are current only as of the date of this Current Report on Form 8-K. Each of these forward-looking statements involves risks and uncertainties. Important factors that could cause actual results to differ materially from those discussed or implied in the forward-looking statements include, but are not limited to: the risk that the Transaction may not be completed in a timely manner or at all; the risk that the Transaction may not be completed by Perception's business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Perception; the failure to obtain requisite approval for the Transaction or meet other closing conditions; the occurrence of any event, change or other circumstances that could give rise to the termination of the business combination agreement in respect of the Transaction; failure to achieve sufficient cash available (taking into account all available financing sources) following any redemptions of Perception’s public shareholders; failure to obtain the requisite approval of Perception’s shareholders; failure to meet relevant listing standards in connection with the consummation of the Transaction; failure to recognize the anticipated benefits of the Transaction, which may be affected by, among other things, competition, the ability of the combined entity to maintain relationships with customers and suppliers and strategic alliance third parties, and to retain its management and key employees; potential litigation relating to the proposed Transaction; changes to the proposed structure of the Transaction that may be required or appropriate as a result of the announcement and execution of the Transaction; unexpected costs and expenses related to the Transaction; estimates of the combined company’s financial performance being materially incorrect predictions; RBio Energy’s status as a newly formed company with no existing operations, and the potential that it is not able to successfully develop clean energy projects; inability to successfully integrate with the operations of RBio Energy or other factors; general economic or political conditions; negative economic conditions that could impact RBio Energy and the clean energy industry in general; reduction in demand for RBio Energy’s planned products; changes in the markets that RBio Energy targets or that the combined company intends to target; any change in laws applicable to Perception or RBio Energy or any regulatory or judicial interpretation thereof; and other factors, risks and uncertainties, including those to be included under the heading “Risk Factors” in the proxy statement/prospectus to be later filed with the SEC, and those disclosed in Perception's SEC filings, under the heading “Risk Factors,” including its Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 13, 2023, its subsequently filed Quarterly Reports on Form 10-Q and any other subsequent filings. All forward-looking statements are expressly qualified in their entirety by such factors. Neither Perception nor RBio Energy undertakes any duty to update any forward-looking statement except as required by law.

|

Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 7, 2024 |

PERCEPTION CAPITAL CORP. III |

| |

|

|

| |

By: |

/s/ Rick Gaenzle |

| |

Name: |

Rick Gaenzle |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

RBio Energy Corporation to Become a Public Company

through a Business Combination with Perception Capital Corp. III

Transaction expected to catalyze RBio Energy’s planned development of

biorefinery assets and biomass and biogas power generation capacity

RBio Energy to grow platform through expected acquisitions

Merger anticipated to close in second quarter 2024; combined company

anticipated to list on the Nasdaq Stock Market

ABERDEEN, WA and NEW YORK, NY, February 7, 2024 — RBio Energy Corporation, which plans to develop clean energy projects (“RBio Energy”) and Perception Capital Corp. III., a special purpose acquisition company (Nasdaq: PFTA, PFTAW and PFTAU) (“Perception”), today announced they have entered into a definitive business combination agreement that would result in RBio Energy becoming a publicly traded company (the “Transaction”). Perception currently has over $42 million of cash in the trust account established in connection with its initial public offering for the benefit

of its shareholders. Under the terms of the business combination agreement, the holders of the outstanding shares of RBio Energy will receive equity in Perception valued at approximately $350 million, subject to adjustments.

The boards of directors of both RBio Energy and Perception have unanimously approved the proposed Transaction, which is subject to customary closing conditions, including receipt of all regulatory

approvals, as well as the approval of the proposed Transaction by Perception’s shareholders. The closing of the Transaction is anticipated to occur in the second quarter of 2024 and RBio Energy is anticipated to list its securities on the Nasdaq Stock Market.

The Transaction is expected to catalyze RBio Energy’s planned development of biorefinery assets and biomass and biogas power generation capacity.

In addition, RBio Energy intends to build out an industry consolidation platform to acquire assets and invest capital for growth.

“We expect this Transaction to unlock a rich lineup of opportunities for RBio Energy,” said Richard Bassett, Chairman

and Chief Executive Officer of RBio Energy. “With strong private and public sector

support, including potential opportunities as a result of the Inflation Reduction Act, we look forward to building a clean, profitable, and viable bioenergy and biomaterials business.”

“We are excited about partnering with Richard and his talented team whom we’ve known for over 15 years,” said Scott Honour, Chairman of Perception.

Rick Gaenzle, Chief Executive Officer of Perception, added “Working with strong businesses run by strong operators is core to Perception’s strategy and Richard’s track record is proof of that.”

Tao Tan, President of Perception, added “Developing profitable and viable clean energy projects that create jobs and support

the energy transition is a win-win-win for our investors, our communities, and our

environment. We look forward to rolling up our sleeves to help make it happen.”

Advisors

Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC (“CCM”),

is serving as exclusive financial advisor and lead capital markets advisor to Perception. Greenberg Traurig LLP is serving as counsel to Perception.

About RBio Energy Corporation

RBio Energy is a newly-formed company based in Washington state, with the intent to develop, acquire, and consolidate biorefinery, biogas, and biomass assets. RBio Energy’s initial activities are expected to be focused on the Pacific Northwest of the United States.

About Perception Capital Corp. III

Perception is a special purpose acquisition company affiliated with Perception Capital

Partners IIIA LLC, a private and public equity investor.

Additional Information and Where to Find It

In connection with the business combination

agreement and the proposed Transaction, Perception intends to file with the Securities and Exchange Commission (the

“SEC”) a registration statement on Form S-4 (the “Registration Statement”), which will include a preliminary

proxy statement/prospectus certain other related documents, which will be both the proxy statement to be distributed to the

stockholders of Perception in connection with Perception’s solicitation of proxies for the vote by its stockholders with

respect to the proposed Transaction and other matters as may be described in the definitive proxy statement, as well as a prospectus

relating to the offer and sale of the securities to be issued in the proposed Transaction. This press release does not contain any

information that should be considered by Perception’s stockholders concerning the proposed Transaction and is not intended to

constitute the basis of any voting or investment decision in respect of the proposed Transaction or the securities of the combined

company. The stockholders of Perception and other interested persons are advised to read, when available, the preliminary proxy

statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and documents incorporated by

reference therein filed in connection with the proposed Transaction, as these materials will contain important information about

Perception, RBio Energy, the business combination agreement and the proposed Transaction. When available, the definitive proxy

statement/prospectus and other relevant materials for the proposed Transaction will be mailed to stockholders of Perception as of a

record date to be established for voting on the proposed Transaction. Stockholders of Perception will also be able to obtain copies

of the Registration Statement, the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other

documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s web

site at www.sec.gov or by directing a request to: Perception Capital Corp. III, 767 5th Avenue, 15th

Floor, New York, NY 10022, Attention: Investor Relations or by email at investors@perceptioncapitalpartners.com.

Participants in the Solicitation

Perception, RBio Energy and their respective directors, executive officers, other members of management and

employees may be deemed participants in the solicitation of proxies from Perception’s stockholders with respect to the proposed Transaction. Investors and securityholders may obtain more detailed information regarding the

names and interests in the Transaction of the directors and officers of each of Perception and RBio Energy with respect to the proposed Transaction in the proxy statement/prospectus for the proposed Transaction when available and in Perception’s filings with the SEC.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent, or authorization

with respect to any securities or in respect of the proposed Transaction. This press release shall also not constitute an offer to sell or the solicitation

of an offer to buy any securities, nor shall there be any sale of securities in any

states or jurisdictions in which such offer, solicitation, or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the

safe harbor for forward-looking statements provided by Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995 including, without limitation, statements related to: the parties’ ability to close the proposed Transaction, including the ability of the companies to secure all required regulatory and shareholder approvals for the proposed Transaction, as applicable; the anticipated benefits of the proposed Transaction, including the potential amount of cash that may be available to RBio Energy’s shareholders upon consummation of the Transaction; sources and uses of cash from the Transaction; RBio Energy’s planned development of biorefinery assets and biomass and biogas power generation capacity

and RBio Energy’s intent to build out an industry consolidation platform to acquire assets and invest

capital for growth; the anticipated timing to close the Transaction; RBio Energy’s expectation that its shares of common stock will be accepted for listing on the Nasdaq Stock Market following the closing of the Transaction; the anticipated financial and business performance of RBio Energy; and RBio Energy’s anticipated future operating results. You are cautioned not to place undue reliance on these forward-looking statements,

which are current only as of the date of this press release. Each of these forward-looking

statements involves risks and uncertainties. Important factors that could cause actual

results to differ materially from those discussed or implied in the forward-looking

statements include, but are not limited to: the risk that the Transaction may not be completed

in a timely manner or at all; the risk that the Transaction may not be completed by Perception’s business combination deadline and the potential failure to obtain an extension of

the business combination deadline if sought by Perception; the failure to obtain requisite approval for the Transaction or meet other closing conditions; the occurrence of any event, change or other circumstances

that could give rise to the termination of the business combination agreement in respect of the Transaction; failure to achieve sufficient cash available

(taking into account all available financing sources) following any redemptions of

Perception’s public shareholders; failure to obtain the requisite approval of Perception’s shareholders; failure to meet relevant listing standards in connection with the consummation of

the Transaction; failure to recognize the anticipated benefits of the Transaction,

which may be affected by, among other things, competition, the ability of the combined

entity to maintain relationships with customers and suppliers and strategic alliance

third parties, and to retain its management and key employees; potential litigation

relating to the proposed Transaction; changes to the proposed structure of the Transaction

that may be required or appropriate as a result of the announcement and execution

of the Transaction; unexpected costs and expenses related to the Transaction; estimates

of the combined company’s financial performance being materially incorrect predictions; RBio Energy’s status as a newly formed company with no existing operations, and the potential

that it is not able to successfully develop clean energy projects; inability to successfully integrate with the operations of RBio Energy or other factors; general economic or political conditions; negative economic conditions

that could impact RBio Energy and the clean energy industry in general; reduction in demand for RBio Energy’s planned products; changes in the markets that RBio Energy targets or that the combined company intends to target; any change in laws applicable

to Perception or RBio Energy or any regulatory or judicial interpretation thereof; and other factors, risks and

uncertainties, including those to be included under the heading “Risk Factors” in

the proxy statement/prospectus to be later filed with the SEC, and those disclosed in Perception’s SEC filings, under the heading “Risk Factors,” including its Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 13, 2023, its subsequently filed Quarterly Reports on Form 10-Q and any other subsequent filings. All forward-looking statements are expressly qualified in their

entirety by such factors. Neither Perception nor RBio Energy undertakes any duty to update any forward-looking statement except as required by law.

Contact

RBio Energy Corporation

Richard Bassett

Chairman and Chief Executive Officer

investors@rbioenergy.com

Perception Capital Corp. III

Rick Gaenzle

Chief Executive Officer

investors@perceptioncapitalpartners.com

###

v3.24.0.1

Cover

|

Feb. 06, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity File Number |

001-40639

|

| Entity Registrant Name |

PERCEPTION CAPITAL CORP. III

|

| Entity Central Index Key |

0001853580

|

| Entity Tax Identification Number |

98-1592069

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

3109 W 50th St

|

| Entity Address, Address Line Two |

#207

|

| Entity Address, City or Town |

Minneapolis

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55410

|

| City Area Code |

(212)

|

| Local Phone Number |

380-5605

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-third of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-third of one redeemable warrant

|

| Trading Symbol |

PFTAU

|

| Security Exchange Name |

NASDAQ

|

| Class A ordinary shares included as part of the units |

|

| Title of 12(b) Security |

Class A ordinary shares included as part of the units

|

| Trading Symbol |

PFTA

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50

|

| Trading Symbol |

PFTAW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PFTAU_UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnethirdOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PFTAU_ClassOrdinarySharesIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PFTAU_RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

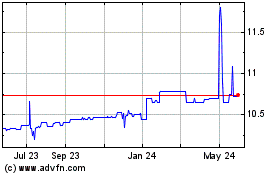

Perception Capital Corpo... (NASDAQ:PFTAU)

Historical Stock Chart

From Apr 2024 to May 2024

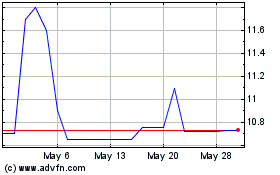

Perception Capital Corpo... (NASDAQ:PFTAU)

Historical Stock Chart

From May 2023 to May 2024