UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☑ |

Definitive Proxy Statement |

|

¨ |

Definitive Additional Materials |

|

¨ |

Soliciting Material Pursuant to §240.14a-12 |

PORTAGE FINTECH ACQUISITION CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

¨ |

Fee paid previously with preliminary materials. |

|

¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PORTAGE FINTECH ACQUISITION CORPORATION

A Cayman Islands Exempted Company

(Company Number 373033)

3109 W 50th St, #207

Minneapolis, MN 55410

NOTICE OF EXTRAORDINARY

GENERAL MEETING

To Be Held at 10:00 A.M. Eastern Time on October 11, 2023

TO THE SHAREHOLDERS OF PORTAGE FINTECH ACQUISITION CORPORATION:

You are hereby invited

to attend the extraordinary general meeting (the “Meeting”) of Portage Fintech Acquisition Corporation (“we,”

“us,” “our” or the “Company”) to be held at 10:00 A.M. Eastern Time on October

11, 2023 at the offices of Faegre Drinker Biddle & Reath LLP located at 90 South Seventh Street, 2200 Wells Fargo Center, Minneapolis,

Minnesota 55402, United States of America, or at such other time, on such other date and at such other place to which the meeting may

be postponed or adjourned.

Shareholders are permitted

to attend the Meeting in person at our offices. The accompanying proxy statement (the “Proxy Statement”) is first being mailed

to shareholders of the Company on or about September 22, 2023. The sole purpose of the Meeting is to consider and vote upon the following

proposals:

| |

● |

a proposal to approve, as a special resolution, the change of name of the Company from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III” (the “Name Change” and, such proposal, the “Name Change Proposal”); |

| |

|

|

| |

● |

a proposal, as a special resolution, to amend and restate the Company’s amended and restated memorandum and articles of association (the “Articles”) in the form set forth in Annex A to the accompanying Proxy Statement (the “Articles Amendment” and, such proposal, the “Articles Amendment Proposal”); and |

| |

|

|

| |

● |

a proposal to approve, as an ordinary resolution, the adjournment of the Meeting to a later date or dates or indefinitely, if necessary or convenient, either (x) to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the foregoing proposal or (y) if our board determines before the Meeting that it is not necessary or no longer desirable to proceed with the other proposal (the “Adjournment Proposal”). |

The Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal are more fully described in the accompanying Proxy Statement.

The Adjournment Proposal, if adopted, will allow our Board to adjourn the Meeting to a later date or dates or indefinitely, if necessary or convenient, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the foregoing proposal. Notwithstanding the order of the resolutions on the notice to the Meeting, the Adjournment Proposal may be presented first to our shareholders if, based on the tabulated vote collected at the time of the Meeting, there are insufficient votes for, or otherwise in connection with, the Name Change Proposal or the Articles Amendment Proposal. If put forth at the Meeting, the Adjournment Proposal will be the first and only proposal voted on and the Name Change Proposal and the Articles Amendment Proposal will not be submitted to the shareholders for a vote.

The approval of the Name Change Proposal and the Articles Amendment Proposal each requires a special resolution under Cayman Islands law, being the affirmative vote of shareholders representing a majority of not less than two-thirds of the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

The approval of the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, being a simple majority of the votes cast by shareholders representing the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

Our Board has fixed the close of business on September 14, 2023 as the record date for determining the shareholders entitled to receive notice of and vote at the Meeting and any adjournment thereof. Only holders of record of the ordinary shares on that date are entitled to have their votes counted at the Meeting or any adjournment thereof.

After careful consideration of all relevant factors, our Board has determined that the Name Change Proposal, the Articles Amendment Proposal and, if presented, the Adjournment Proposal are advisable and recommends that you vote or give instruction to vote “FOR” such proposals.

Under our Articles, no other business may be transacted at the Meeting.

Enclosed is the Proxy Statement containing detailed information concerning the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal and the Meeting. Whether or not you plan to attend the Meeting, we urge you to read this material carefully and vote your ordinary shares.

September 22,

2023

| By Order of the Board of Directors |

/s/ Rick Gaenzle |

| |

Rick Gaenzle |

| |

Chief Executive Officer |

Your vote is important. If you are a shareholder of record, please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the Meeting. If you are a shareholder of record, you may also cast your vote in person at the Meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you may cast your vote in person at the Meeting by obtaining a proxy from your brokerage firm or bank. Your failure to vote or instruct your broker or bank how to vote will mean that your ordinary shares will not count towards the quorum requirement for the Meeting and will not be voted. An abstention or broker non-vote will be counted towards the quorum requirement but will not count as a vote cast at the Meeting.

Important Notice Regarding

the Availability of Proxy Materials for the Meeting to be held on October 11, 2023: This notice of Meeting and the accompanying Proxy

Statement are available at https://materials.proxyvote.com/G7185D.

PORTAGE FINTECH ACQUISITION CORPORATION

A Cayman Islands Exempted Company

(Company Number 373033)

3109 W 50th St, #207

Minneapolis, MN 55410

EXTRAORDINARY GENERAL

MEETING

TO BE HELD AT 10:00 A.M. EASTERN TIME ON OCTOBER 11, 2023

PROXY STATEMENT

The extraordinary general

meeting (the “Meeting”) of Portage Fintech Acquisition Corporation (“we,” “us,” “our”

or the “Company”) will be held at 10:00 A.M. Eastern Time on October 11, 2023, or at such other time, on such other date

and at such other place to which the meeting may be postponed or adjourned. You will be permitted to attend the Meeting in person at

the offices of Faegre Drinker Biddle & Reath LLP located at 90 South Seventh Street, 2200 Wells Fargo Center, Minneapolis, Minnesota

55402, United States of America. The sole purpose of the Meeting is to consider and vote upon the following proposals:

| |

● |

a proposal to approve, as a special resolution, the change of name of the Company from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III” (the “Name Change” and, such proposal, the “Name Change Proposal”); |

| |

|

|

| |

● |

a proposal, as a special resolution, to amend and restate the Company’s amended and restated memorandum and articles of association (the “Articles”) in the form set forth in Annex A to the accompanying Proxy Statement (the “Articles Amendment” and, such proposal, the “Articles Amendment Proposal”); and |

| |

|

|

| |

● |

a proposal to approve, as an ordinary resolution, the adjournment of the Meeting to a later date or dates or indefinitely, if necessary or convenient, either (x) to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any of the foregoing proposals or (y) if our board determines before the Meeting that it is not necessary or no longer desirable to proceed with the other proposal (the “Adjournment Proposal”). |

The Company’s initial sponsor was PFTA I LP, an Ontario limited partnership (the “Initial Sponsor”). On July 21, 2023, the Initial Sponsor sold a portion of the Class B ordinary shares it holds in the Company and Private Placement Warrants to Perception Capital Partners IIIA LLC, a Delaware limited liability company (the “Managing Sponsor”) (the “Transaction”), pursuant to a Securities Purchase Agreement dated July 12, 2023 (the “Purchase Agreement”). In connection with the Transaction, the Managing Sponsor and the Board have determined that it is in the best interests of the Company to change the name of the Company The purpose of the Name Change Proposal is to better reflect the Company’s new sponsor.

On July 21, 2023, the Company held an extraordinary general meeting of shareholders (the “July EGM”). At the July EGM, the Company’s shareholders approved two proposals to amend the Articles. The first such proposal (the “Extension Amendment” and, such proposal, the “Extension Amendment Proposal”) sought to amend the Articles to extend the date by which the Company must (1) consummate a business combination, (2) cease its operations except for the purpose of winding up if it fails to complete a business combination, and (3) redeem all of the Company’s Class A ordinary shares sold in the Company’s IPO, from 24 months from the closing of the IPO to 36 months from the closing of the IPO or such earlier date as is determined by our board of directors (the “Board”) to be in the best interests of the Company. The second such proposal (the “Redemption Limitation Amendment” and such proposal, the “Redemption Limitation Amendment Proposal”) sought to eliminate from the Articles the limitation that the Company shall not redeem Class A ordinary shares sold in the IPO to the extent that such redemption would cause the Company’s net tangible assets to be less than $5,000,001.

The Company’s assets held in trust were held in a demand deposit account as of the date hereof and at December 31, 2022 assets held in the Trust Account were comprised substantially of investments in U.S. government securities. Demand deposit accounts and U.S. government securities are characterized as Level 1 investments within the fair value hierarchy under the Financial Accounting Standards Board Accounting Standards Codification subtopic 820, Fair Value Measurement. Gains and losses resulting from the change in fair value of assets held in Trust Account are included in interest income in the Company’s statements of operations. The estimated fair values of assets held in Trust Account are determined using available market information as of the date of the applicable financial statements.

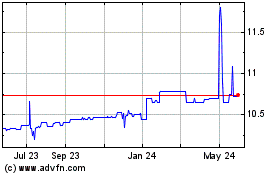

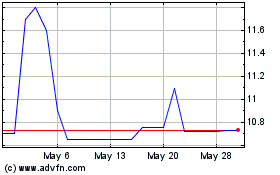

In connection with the

vote to approve the Extension Amendment Proposal, effective as of July 21, 2023, holders of 22,001,009 Class A ordinary shares exercised

their right to redeem their shares for cash at a redemption price of approximately $10.41 per share, for an aggregate redemption amount

of approximately $229.1 million. As a result, the amount in the Trust Account as of July 21, 2023 was approximately $40.7 million

and 3,910,370 Class A ordinary shares remained issued and outstanding. The closing price of the Class A ordinary shares on the Nasdaq

Stock Market LLC on September 20, 2023, the most recent practicable closing price prior to the mailing of this Proxy Statement, was $10.38

We cannot assure shareholders that they will be able to sell their shares in the open market, even if the market price per share is higher

than the redemption price stated above, as there may not be sufficient liquidity in our securities when such shareholders wish to sell

their shares.

Our Board has fixed the close of business on September 14, 2023 as the record date for determining our shareholders entitled to receive notice of and vote at the Meeting and any adjournment thereof. Only holders of record of the ordinary shares on that date are entitled to have their votes counted at the Meeting or any adjournment thereof. On the record date of the Meeting, there were 10,388,215 ordinary shares issued and outstanding, of which 6,477,845 are Class B ordinary shares, and 3,910,370 are Class A ordinary shares. The Class B ordinary shares carry voting rights in connection with the Name Change Proposal, the Articles Amendment Proposal and, if presented, the Adjournment Proposal, and we have been informed by our sponsors, which hold all 6,477,845 Class B ordinary shares, that they intend to vote in favor of the Name Change Proposal and the Articles Amendment Proposal.

This Proxy Statement contains important information about the Meeting and the proposals. Please read it carefully and vote your shares.

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and officers may also solicit proxies in person, by telephone or by other means of communication. These parties will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

This Proxy Statement is dated

September 22, 2023 and is first being mailed to shareholders on or about September 22, 2023.

QUESTIONS AND ANSWERS ABOUT THE MEETING

These Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully the entire document, including the annex to this Proxy Statement.

|

Q: |

Why am I receiving this Proxy Statement? |

|

A: |

We are a blank check company incorporated on March 17, 2021 as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities. On July 23, 2021, we consummated the Initial Public Offering from which we derived gross proceeds of $240,000,000. On August 5, 2021, the underwriters partially exercise the over-allotment option to purchase an additional 1,911,379 Units (as defined herein), from which we derived gross proceeds of $19,113,790, and forfeited the option to exercise the remaining 1,688,621 Units. A total of $259,113,790 of the net proceeds from the sale of the Units in the Initial Public Offering (including the over-allotment Units) and the sale of private placement warrants on July 23, 2021 and August 5, 2021 were placed in the Trust Account. On July 21, 2023, the Initial Sponsor sold a portion of its Class B ordinary shares and Private Placement Warrants to the Managing Sponsor, pursuant to the Purchase Agreement. Following the Transaction, our Board has determined that it is in the best interests of the Company to change the name of the Company from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III” and to amend and restate the Articles to reflect the change the name of the Company. |

|

Q: |

What is being voted on? |

|

A: |

You are being asked to vote on: |

| |

● |

a proposal to approve, as a special resolution, the change of name of the Company from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III” (the “Name Change” and, such proposal, the “Name Change Proposal”);

For more information, please see “The Name Change Proposal.” |

| |

|

|

| |

● |

a proposal, as a special resolution, to amend and restate the Company’s amended and restated memorandum and articles of association (the “Articles”) in the form set forth in Annex A to the accompanying Proxy Statement (the “Articles Amendment” and, such proposal, the “Articles Amendment Proposal”); and

For more information, please see “The Articles Amendment Proposal.” |

| |

|

|

| |

● |

a proposal to approve, as an ordinary resolution, the adjournment of the Meeting to a later date or dates or indefinitely, if necessary or convenient, either (x) to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any of the foregoing proposals or (y) if our board determines before the Meeting that it is not necessary or no longer desirable to proceed with the other proposal.

For more information, please see “The Adjournment Proposal.”

Pursuant to the Articles, a resolution put to the vote of the Meeting shall be decided on a poll in such manner as the chairman directs and the result of the poll shall be deemed to be the resolution of the Meeting. |

|

Q: |

Why is the Company proposing the Name Change Proposal and the Articles Amendment Proposal? |

|

A: |

The purpose of the Name Change Proposal and the Articles Amendment Proposal is to better reflect the Company’s new sponsor, the Managing Sponsor, following closing of the Transaction. |

|

Q: |

Why should I vote “FOR” the Name Change Proposal and the Articles Amendment Proposal? |

|

A: |

The Company is proposing the Name Change Proposal and the Articles Amendment Proposal to better reflect the Company’s new sponsor, the Managing Sponsor, following closing of the Transaction. We believe it is in the best interests of our shareholders to change the name of the Company accordingly, from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III”. |

Our Board recommends that you vote in favor of the Name Change Proposal and the Articles Amendment Proposal.

|

Q: |

Why should I vote “FOR” the Adjournment Proposal? |

|

A: |

If the Adjournment Proposal is put forth at the meeting and is not approved by our shareholders, our Board may not be able to adjourn the Meeting to a later date or dates or indefinitely, if necessary or convenient, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any of the foregoing proposals. |

If presented, our Board recommends that you vote in favor of the Adjournment Proposal.

|

Q: |

How do the Company insiders intend to vote their shares? |

|

A: |

As of the record date for this Meeting,

our Managing Sponsor owned 3,565,230 Class B ordinary shares. Such Class B ordinary shares represent approximately 55% of our issued

and outstanding ordinary shares. Additionally, our Initial Sponsor owns 2,757,615 Class

B ordinary shares. Such Class B ordinary shares represent approximately 43% of our issued and outstanding ordinary shares.

|

The Class B ordinary shares carry voting rights in connection with the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal and we have been informed by our sponsors that they intend to vote in favor of the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal.

In addition, our sponsors, directors, advisors or any of their affiliates may purchase Class A ordinary shares in privately negotiated transactions or in the open market prior to the Meeting. However, they have no current commitments, plans or intentions to engage in such transactions and have not formulated any terms or conditions for any such transactions. None of the funds in the Trust Account will be used to purchase Class A ordinary shares in such transactions. Any such purchases that are completed after the record date for the Meeting may include an agreement with a selling shareholder that such shareholder, for so long as it remains the record holder of the shares in question, will vote in favor of the Name Change Proposal and the Articles Amendment Proposal.

|

Q: |

What vote is required to adopt the Name Change Proposal and the Articles Amendment Proposal? |

| A: |

The approval of the Name Change Proposal and the Articles Amendment Proposal each requires a special resolution under Cayman Islands law, being the affirmative vote of shareholders representing a majority of not less than two-thirds of the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting. |

| Q: |

What vote is required to approve the Adjournment Proposal? |

|

A: |

The approval of the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, being a simple majority of the votes cast by shareholders representing the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting. |

|

Q: |

What if I do not want to vote “FOR” the Name Change Proposal or the Articles Amendment Proposal? |

|

A: |

If you do not want the Name Change Proposal or the Articles Amendment Proposal approved, you must vote “AGAINST” the proposals. |

Broker non-votes, abstentions or the failure to vote on the Name Change Proposal or the Articles Amendment Proposal will have no effect with respect to the approval of the Name Change Proposal or the Articles Amendment Proposal.

|

Q: |

How are the funds in the Trust Account currently being held? |

|

A: |

With respect to the regulation of special purpose acquisition companies (“SPACs”) like the Company, on March 30, 2022, the Securities and Exchange Commission (“SEC”) issued proposed rules (the “SPAC Rule Proposals”) relating to, among other items, disclosures in business combination transactions involving SPACs and private operating companies; the condensed financial statement requirements applicable to transactions involving shell companies; the use of projections by SPACs in SEC filings in connection with proposed business combination transactions; the potential liability of certain participants in proposed business combination transactions; and the extent to which SPACs could become subject to regulation under the Investment Company Act, as amended (the “Investment Company Act”), including a proposed rule that would provide SPACs a safe harbor from treatment as an investment company if they satisfy certain conditions that limit a SPAC’s duration, asset composition, business purpose and activities. |

With regard to the SEC’s investment company proposals included in the SPAC Rule Proposals, while the funds in the Trust Account have, since the Initial Public Offering, been held only within U.S. government securities within the meaning set forth in Section 2(a)(16) of the Investment Company Act, with a maturity of 185 days or less, or in an open-ended investment company that holds itself out as a money market fund meeting certain conditions of Rule 2a-7 of the Investment Company Act, as determined by the Company, to mitigate the risk of being viewed as operating an unregistered investment company (including pursuant to the subjective test of Section 3(a)(1)(A) of the Investment Company Act), we may, on or prior to the 24-month anniversary of the effective date of the registration statement relating to the Initial Public Offering, instruct Continental Stock Transfer & Trust Company, the trustee with respect to the Trust Account, to liquidate the U.S. government securities or money market funds held in the Trust Account and thereafter to hold all funds in the Trust Account in demand deposit accounts or certificates of deposit until the earlier of consummation of our initial business combination or liquidation, which may reduce the dollar amount that our Class A ordinary shareholders would receive upon any redemption or liquidation of the Company. Interest on the Trust Account is variable and is currently expected to be approximately 4% per annum.

|

Q: |

How do I change my vote? |

|

A: |

You may change your vote by sending a later dated, signed proxy card to the offices of Continental Stock Transfer & Trust Company, located at 1 State Street 30th Floor New York, NY 10004-1561, so that it is received prior to the Meeting or by attending the Meeting in person and voting. You also may revoke your proxy by sending a notice of revocation to the same address, which must be received by our Secretary prior to the Meeting. |

Please note, however, that if on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, custodian bank, or other nominee then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. If your shares are held in street name, and you wish to attend the Meeting and vote at the Meeting, you must bring to the Meeting a legal proxy from the broker, bank or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

|

Q: |

How are votes counted? |

|

A: |

Votes will be counted by the inspector of election appointed for the Meeting, who will separately count “FOR” and “AGAINST” votes, abstentions and broker non-votes. A Company shareholder’s failure to vote by proxy or to vote in person at the Meeting means that such shareholder’s ordinary shares will not count towards the quorum requirement for the Meeting and will not be voted. An abstention or broker non-vote will be counted towards the quorum requirement but will not count as a vote cast at the Meeting. |

The Name Change Proposal and the Articles Amendment Proposal must each be approved as a special resolution under the Cayman Islands Companies Act (as amended) and our Articles, being the affirmative vote of shareholders representing a majority of not less than two-thirds of the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

The approval of the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, being a simple majority of the votes cast by shareholders representing the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

Accordingly, if a valid quorum is otherwise established, abstentions and broker non-votes will have no effect on the outcome of any vote on the Name Change Proposal, the Articles Amendment Proposal or the Adjournment Proposal.

|

Q: |

If my shares are held in “street name,” will my broker automatically vote them for me? |

|

A: |

No. Under the rules of various national and regional securities exchanges, your broker, bank, or nominee cannot vote your shares with respect to non-discretionary matters unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank, or nominee. |

We believe all the proposals presented to the shareholders will be considered non-discretionary and therefore your broker, bank, or nominee cannot vote your shares without your instruction. Your bank, broker, or other nominee can vote your shares only if you provide instructions on how to vote. You should instruct your broker to vote your shares in accordance with directions you provide. If your shares are held by your broker as your nominee, which we refer to as being held in “street name,” you may need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares.

|

Q: |

What is a quorum requirement? |

|

A: |

A quorum of our shareholders is necessary

to hold a valid Meeting. A quorum will be present at the Meeting if the holders of a majority of the issued and outstanding ordinary

shares entitled to vote at the Meeting are represented in person or by proxy. As of the record date for the Meeting, the holders of at

least 5,194,108 ordinary shares would be required to achieve a quorum.

|

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement but will not count as a vote cast at the Meeting. In the absence of a quorum, the chairman of the meeting has power to adjourn the Meeting.

|

Q: |

Who can vote at the Meeting? |

|

A: |

Only holders of record of our ordinary shares at the close of business on September 14, 2023 are entitled to have their vote counted at the Meeting and any adjournments thereof. On this record date, 10,388,215 ordinary shares were outstanding and entitled to vote. |

Shareholder of Record: Shares Registered in Your Name. If on the record date your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are a shareholder of record. As a shareholder of record, you may vote in person at the Meeting or vote by proxy. Whether or not you plan to attend the Meeting in person, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the Meeting unless you request and obtain a valid proxy from your broker or other agent.

|

Q: |

Does the Board recommend voting for the approval of the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal? |

|

A: |

Yes. After careful consideration of the terms and conditions of these proposals, our Board has determined that the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal are in the best interests of the Company and its shareholders. The Board recommends that our shareholders vote “FOR” the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal. |

|

Q: |

What interests do the Company’s Sponsor, directors, officers and advisors have in the approval of the proposals? |

|

A: |

Our Sponsor, directors, officers and advisors do not have any separate interests in the proposals. |

|

Q: |

Do I have dissenters’ or appraisal rights if I object to the Name Change Proposal or the Articles Amendment Proposal? |

|

A: |

Our shareholders do not have dissenters’ or appraisal rights in connection with the Name Change Proposal or the Articles Amendment Proposal under Cayman Islands law. |

|

Q: |

What do I need to do now? |

|

A: |

We urge you to read carefully and consider the information contained in this Proxy Statement, including the annex, and to consider how the proposals will affect you as a shareholder. You should then vote as soon as possible in accordance with the instructions provided in this Proxy Statement and on the enclosed proxy card. |

|

A: |

If you are a holder of record of our ordinary shares, you may vote in person at the Meeting or by submitting a proxy for the Meeting. |

Whether or not you plan to attend the Meeting in person, we urge you to vote by proxy to ensure your vote is counted. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. You may still attend the Meeting and vote in person if you have already voted by proxy.

If your ordinary shares are held in “street name” by a broker or other agent, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the Meeting unless you request and obtain a valid proxy from your broker or other agent.

|

Q: |

What should I do if I receive more than one set of voting materials? |

|

A: |

You may receive more than one set of voting materials, including multiple copies of this Proxy Statement and multiple proxy cards or voting instruction cards, if your shares are registered in more than one name or are registered in different accounts. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your shares. |

|

Q: |

Who is paying for this proxy solicitation? |

|

A: |

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and officers may also solicit proxies in person, by telephone or by other means of communication. These parties will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. |

|

Q: |

Who can help answer my questions? |

|

A: |

If you have questions about the proposals or if you need additional copies of the Proxy Statement or the enclosed proxy card you should contact Rick Gaenzle: |

Portage Fintech Acquisition Corporation

c/o Perception Capital Partners IIIA LLC

3109 W 50th St, #207

Minneapolis, Minnesota 55410

United States of America

If you have questions regarding the certification of your position or tendering your ordinary shares (and/or delivering your share certificate(s) (if any) and other redemption forms), please contact:

Continental Stock Transfer & Trust Company

1 State Street

30th Floor

New York, New York 10004

Attention: Francis Wolf

Email: fwolf@continentalstock.com

You may also obtain additional information about us from documents we file with the SEC by following the instructions in the section entitled “Where You Can Find More Information.”

FORWARD-LOOKING STATEMENTS

This Proxy Statement contains statements that are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding the Company’s financial position, business strategy and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. They involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by these statements. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Proxy Statement, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. When the Company discusses its strategies or plans, it is making projections, forecasts or forward-looking statements. Such statements are based on the beliefs of, as well as assumptions made by and information currently available to, the Company’s management. Actual results and shareholders’ value will be affected by a variety of risks and factors, including, without limitation, international, national and local economic conditions, merger, acquisition and business combination risks, financing risks, geo-political risks, acts of terror or war, and those risk factors described under “Item 1A. Risk Factors” of the Company’s Extraordinary Report on Form 10-K filed with the SEC on March 13, 2023, in this Proxy Statement and in other reports the Company files with the SEC. Many of the risks and factors that will determine these results and shareholders’ value are beyond the Company’s ability to control or predict.

All such forward-looking statements speak only as of the date of this Proxy Statement. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. All subsequent written or oral forward-looking statements attributable to us or persons acting on the Company’s behalf are qualified in their entirety by this “Forward-Looking Statements” section.

RISK FACTORS

You should consider carefully all of the risks described in our Extraordinary Report on Form 10-K filed with the SEC on March 13, 2023 and in the other reports we file with the SEC before making a decision to invest in our securities. Furthermore, if any of the following events occur, our business, financial condition and operating results may be materially adversely affected or we could face liquidation. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. The risks and uncertainties described in our Extraordinary Report on Form 10-K, our Quarterly Reports on Form 10-Q and below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business, financial condition and operating results or result in our liquidation.

If we were deemed to be an investment company for purposes of the Investment Company Act, we may be forced to abandon our efforts to complete an initial business combination and instead be required to liquidate the Company. To avoid that result, on or shortly prior to the 24-month anniversary of the effective date of the registration statement relating to the Initial Public Offering, we may liquidate securities held in the Trust Account and instead hold all funds in the Trust Account in demand deposit accounts or certificates of deposit, which may reduce the dollar amount our Class A ordinary shareholders would receive upon any redemption or liquidation of the Company. Interest on the Trust Account is variable and is currently expected to be approximately 4% per annum.

On March 30, 2022, the SEC issued the SPAC Rule Proposals, relating, among other things, to circumstances in which SPACs such as us could potentially be subject to the Investment Company Act and the regulations thereunder. The SPAC Rule Proposals would provide a safe harbor for such companies from the definition of “investment company” under Section 3(a)(1)(A) of the Investment Company Act, provided that a SPAC satisfies certain criteria. To comply with the duration limitation of the proposed safe harbor, a SPAC would have a limited time period to announce and complete a de-SPAC transaction. Specifically, to comply with the safe harbor, the SPAC Rule Proposals would require a SPAC to file a report on Form 8-K announcing that it has entered into an agreement with a target company for an initial business combination no later than 18 months after the effective date of the registration statement relating to the SPAC’s initial public offering. Such SPAC would then be required to complete its initial business combination no later than 24 months after the effective date of the registration statement relating to its initial public offering.

There is currently uncertainty concerning the applicability of the Investment Company Act to a SPAC, including a company like ours, that has not entered into a definitive agreement within 18 months after the effective date of the registration statement relating to its initial public offering or that does not complete its initial business combination within 24 months after such date. We have not entered into a definitive business combination agreement within 18 months after the effective date of the registration statement relating to our initial public offering, and do not expect to complete our initial business combination within 24 months of such date. As a result, it is possible that a claim could be made that we have been operating as an unregistered investment company. If we were deemed to be an investment company for purposes of the Investment Company Act, we might be forced to abandon our efforts to complete an initial business combination and instead be required to liquidate. If we are required to liquidate, our investors would not be able to realize the benefits of owning stock in a successor operating business, including the potential appreciation in the value of our shares following such a transaction.

The funds in the Trust Account have, since the Initial Public Offering, been held only in U.S. government securities within the meaning set forth in Section 2(a)(16) of the Investment Company Act, with a maturity of 185 days or less, or in an open-ended investment company that holds itself out as a money market fund meeting certain conditions of Rule 2a-7 of the Investment Company Act, as determined by the Company. However, to mitigate the risk of us being deemed to have been operating as an unregistered investment company (including under the subjective test of Section 3(a)(1)(A) of the Investment Company Act, as amended), we may, on or shortly prior to the 24 month anniversary of the effective date of the registration statement relating to the Initial Public Offering, instruct Continental Stock Transfer & Trust Company, the trustee with respect to the Trust Account, to liquidate the U.S. government securities or money market funds held in the Trust Account and thereafter to hold all funds in the Trust Account in demand deposit accounts or certificates of deposit until the earlier of consummation of our initial business combination or liquidation, which may reduce the dollar amount our Class A ordinary shareholders would receive upon any redemption or liquidation of the Company. Interest on the Trust Account is variable and is currently expected to be approximately 4% per annum.

In addition, even prior to the 24-month anniversary of the effective date of the registration statement relating to the Initial Public Offering, we may be deemed to be an investment company. The longer that the funds in the Trust Account are held in short-term U.S. government securities or in money market funds invested exclusively in such securities, even prior to the 24-month anniversary, there is a greater risk that we may be considered an unregistered investment company, in which case we may be required to liquidate. Accordingly, we may determine, in our discretion, to liquidate the securities held in the Trust Account at any time, even prior to the 24-month anniversary, and instead hold all funds in the Trust Account as described above.

We may be subject to an excise tax under the Inflation Reduction Act of 2022 in connection with the redemption of our Class A ordinary shares after December 31, 2022.

The Inflation Reduction Act of 2022, enacted in August 2022, imposes a new U.S. federal 1% excise tax on certain repurchases (including redemptions) of stock by “covered corporations” occurring after December 31, 2022, with certain exceptions. This excise tax is imposed on the repurchasing corporation itself, not its shareholders from which shares are repurchased. Because we are a “blank check” Cayman Islands exempted company with no subsidiaries or previous merger or acquisition activity, we are not currently a “covered corporation” for this purpose. The amount of the excise tax is generally 1% of the fair market value of the shares repurchased at the time of the repurchase. However, for purposes of calculating the excise tax, repurchasing corporations are permitted to net the fair market value of certain new stock issuances against the fair market value of stock repurchases during the same taxable year. In addition, certain other exceptions apply to the excise tax. On December 27, 2022, the U.S. Department of the Treasury (the “Treasury”) issued a notice that it intends to publish proposed regulations addressing the application of the excise tax (the “Notice”). To provide taxpayers with interim guidance, the Notice describes certain rules upon which taxpayers are generally entitled to rely until publication of the proposed regulations, which the Treasury has stated it anticipates will be consistent with the guidance provided in the Notice.

Any redemption or other repurchase that occurs after December 31, 2022 in connection with a business combination that involves our combination with a U.S. entity and/or our re-domestication as a U.S. corporation may be subject to the excise tax. In the event of such a combination with a U.S. entity or re-domestication as a U.S. corporation, whether and to what extent we would be subject to the excise tax would depend on a number of factors, including (i) the fair market value of the redemptions and repurchases in connection with any such business combination, (ii) the amount of any stock issued in connection with the business combination, (iii) the status of the target (for example, whether the target is a domestic corporation) and the structure of any such business combination, (iv) the nature and amount of any “PIPE” or other equity issuances in connection with any such business combination (or otherwise issued not in connection with such business combination but issued within the same taxable year of the business combination) and (v) the content of regulations and other guidance from the Treasury. In addition, because the excise tax would be payable by us, and not by the redeeming holder, the mechanics of any required payment of the excise tax have not been determined. The foregoing could cause a reduction in our ability to complete a business combination or the cash available on hand to complete a business combination.

Any business combination may be subject to U.S. foreign investment regulations, which may impose conditions on or prevent the consummation of our initial business combination. Such conditions or limitations could also potentially make our Class A ordinary shares less attractive to investors or cause our future investments to be subject to U.S. foreign investment regulations.

Investments that involve the acquisition of, or investment in, a U.S. business by a non-U.S. investor may be subject to U.S. laws that regulate foreign investments in U.S. businesses and access by foreign persons to technology developed and produced in the United States. These laws include Section 721 of the Defense Production Act of 1950, as amended by the Foreign Investment Risk Review Modernization Act of 2018, and the regulations at 31 C.F.R. Parts 800 and 802, as amended, administered by the Committee on Foreign Investment in the United States (“CFIUS”).

Whether CFIUS has jurisdiction to review an acquisition or investment transaction depends on, among other factors, the nature and structure of the transaction, including the level of beneficial ownership interest and the nature of any information or governance rights involved. For example, investments that result in “control” of a “U.S. business” by a “foreign person” (in each case, as such terms are defined in 31 C.F.R. Part 800) always are subject to CFIUS jurisdiction. Significant CFIUS reform legislation, which was fully implemented through regulations that became effective in 2020, expanded the scope of CFIUS’s jurisdiction to investments that do not result in control of a U.S. business by a foreign person, but afford certain foreign investors certain information or governance rights in a U.S. business that has a nexus to “ critical technologies,” “ covered investment critical infrastructure,” and/or “ sensitive personal data” (in each case, as such terms are defined in 31 C.F.R. Part 800).

All of our sponsors’ managers and officers are U.S. citizens and all owners of our sponsors are also U.S. citizens. Our sponsors are not controlled by, and does not have substantial ties to, any “foreign person” such that a business combination would automatically be subject to CFIUS review. However, depending on the beneficial ownership of any prospective target company and the composition and governance rights of any PIPE investors in connection with a business combination, a business combination could result in investments that would be considered by CFIUS to be covered investments or a covered control transaction that CFIUS would have authority to review.

To the extent that this occurs, CFIUS or another U.S. governmental agency could choose to review a business combination or past or proposed transactions involving new or existing foreign investors in the prospective target company, even if a filing with CFIUS is or was not required at the time of such transaction. Any review and approval of an investment or transaction by CFIUS may have outsized impacts on transaction certainty, timing, feasibility, and cost, among other things. CFIUS policies and agency practices are rapidly evolving, and in the event that CFIUS reviews a business combination or one or more proposed or existing investments by foreign investors in a prospective target company, there can be no assurances that such investors will be able to maintain, or proceed with, such investments on terms acceptable to the parties to a business combination or such investors. Among other things, CFIUS could seek to impose limitations or restrictions on, or prohibit, a business combination or investments by such investors. CFIUS could also order us to divest all or a portion of a target company if we had proceeded without first obtaining CFIUS clearance.

If CFIUS elects to review a business combination, the time necessary to complete such review of the business combination or a decision by CFIUS to prohibit the business combination could prevent us from completing a business combination prior to 24 months from the closing of the Initial Public Offering or the Extended Date, as applicable.

If we are not able to consummate a business combination within 24 months from the closing of the Initial Public Offering or by the Extended Date, as applicable, we will: (1) cease all operations except for the purpose of winding up; (2) as promptly as reasonably possible but not more than ten business days thereafter, redeem the Class A ordinary shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on the Trust Account and not previously released to the Company to pay income taxes, if any, (less up to $100,000 of interest to pay winding up and dissolution expenses), divided by the number of Class A ordinary shares then issued, which redemption will completely extinguish Class A ordinary shareholders’ rights as shareholders (including the right to receive further liquidation distributions, if any); and (3) as promptly as reasonably possible following such redemption, subject to the approval of our remaining shareholders and our Board, liquidate and dissolve, subject in the case of clauses (2) and (3), to our obligations under Cayman Islands law to provide for claims of creditors and in all cases subject to the other requirements of applicable law. There will also be no redemption rights or liquidating distributions with respect our warrants, which will expire worthless in the event of our winding up.

Nasdaq may delist our securities from trading on its exchange following shareholder redemptions in connection with such amendment, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions.

Our Class A ordinary shares and units are listed on Nasdaq. We are subject to compliance with Nasdaq’s continued listing requirements in order to maintain the listing of our securities on Nasdaq. Such continued listing requirements for our Class A ordinary shares include, among other things, the requirement to maintain at least 300 public holders and at least 500,000 publicly held shares.

We expect that if our Class A ordinary shares fails to meet Nasdaq’s continued listing requirements, our units will also fail to meet Nasdaq’s continued listing requirements for those securities. We cannot assure you that any of our Class A ordinary shares or units will be able to meet any of Nasdaq’s continued listing requirements following any stockholder redemptions of our Public Stock. If our securities do not meet Nasdaq’s continued listing requirements, Nasdaq may delist our securities from trading on its exchange. If Nasdaq delists any of our securities from trading on its exchange and we are not able to list such securities on another national securities exchange, we expect such securities could be quoted on an over-the-counter market. If this were to occur, we could face significant material adverse consequences, including:

| |

● |

a limited availability of market quotations for our securities; |

| |

● |

reduced liquidity for our securities; |

| |

● |

a determination that our Class A Ordinary Shares are a “penny stock” which will require brokers trading in our Class A Ordinary Shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| |

● |

a limited amount of news and analyst coverage; and |

| |

● |

a decreased ability to issue additional securities or obtain additional financing in the future. |

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as “covered securities.” Our Class A Ordinary Shares and units qualify as covered securities under such statute. Although the states are preempted from regulating the sale of covered securities, the federal statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. While we are not aware of a state having used these powers to prohibit or restrict the sale of securities issued by special purpose acquisition companies, certain state securities regulators view blank check companies unfavorably and might use these powers, or threaten to use these powers, to hinder the sale of securities of blank check companies in their states. Further, if we were no longer listed on Nasdaq, our securities would not qualify as covered securities under such statute and we would be subject to regulation in each state in which we offer our securities.

BACKGROUND

We are a blank check company incorporated on March 17, 2021 as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities.

On July 23, 2021, we consummated the Initial Public Offering of 24,000,000 units, each consisting of one Class A ordinary share, $0.0001 par value, and one-third of one redeemable warrant (the “Units”), at a price of $10.00 per Unit, generating gross proceeds of $240,000,000. Simultaneously with the closing of the Initial Public Offering, we consummated the sale of 6,333,334 private placement warrants to the Initial Sponsor (each, a “Private Placement Warrant” and collectively, the “Private Placement Warrants”) at a price of $1.50 per warrant, generating gross proceeds of $9,500,000. On August 5, 2021, the underwriters partially exercised their overallotment option to purchase 1,911,379 Units, at a price of $10.00 per Unit, generating gross proceeds of $19,113,790. Also on August 5, 2021, we consummated an additional sale of 254,850 private placement warrants to the Initial Sponsor at a price of $1.50 per warrant, generating gross proceeds of $382,275.

Following the Initial Public Offering and the sale of the private placement warrants, a total of $259,113,790 was placed in the Trust Account. The proceeds held in the Trust Account may be invested by the trustee only in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act, with a maturity of 185 days or less, or in any open-ended investment company that holds itself out as a money market fund meeting certain conditions of Rule 2a-7 of the Investment Company Act, as determined by the Company. As of June 26, 2023, funds held in the Trust Account totaled approximately $268,987,925.82, and were held in a money market fund invested in U.S. treasury bills. However, to mitigate the risk of being viewed as operating as an unregistered investment company (including pursuant to the subjective test of Section 3(a)(1)(A) of the Investment Company Act), we may, on or prior to the 24-month anniversary of the effective date of the registration statement relating to the Initial Public Offering, instruct Continental Stock Transfer & Trust Company, the trustee with respect to the Trust Account, to liquidate the U.S. government securities or money market funds held in the Trust Account and thereafter to hold all funds in the Trust Account in demand deposit accounts or certificates of deposit until the earlier of consummation of our initial business combination or liquidation, which may reduce the dollar amount our Class A ordinary shareholders would receive upon any redemption or liquidation of the Company. Interest on the Trust Account is variable and is currently expected to be approximately 4% per annum.

Our amended and restated memorandum and articles of association adopted on July 20, 2021 (the “Initial Articles”) provided that we had until July 23, 2023 to consummate an initial business combination. At the July EGM, amongst other matters, the shareholders approved amendments to the Initial Articles to extend the date by which we must complete an initial business combination to July 23, 2024 (the “Extension” and such date, the “Extended Date”). In connection with the July EGM, shareholders holding an aggregate of 22,001,009 shares of the Company’s Class A ordinary shares exercised their right to redeem their shares for approximately $10.41 per share of the funds held in the Company’s trust account (the “Trust Account”), leaving approximately $40.7 million in the Trust Account and 3,910,370 Class A ordinary shares outstanding after such redemption.

On July 21, 2023, our Initial Sponsor sold a portion of its Class B ordinary shares and Private Placement Warrants to the Managing Sponsor, pursuant to the Purchase Agreement. On July 14, 2023, July 17, 2023, July 18, 2023 and July 19, 2023, the Company and the Initial Sponsor entered into non-redemption agreements (each, a “Non-Redemption Agreement”) with certain unaffiliated third parties (each, a “Holder,” and collectively, the “Holders”) in exchange for the Holder or Holders agreeing either not to request redemption in connection with the Extension (as defined below) or to reverse any previously submitted redemption demand in connection with the Extension with respect to an aggregate of 2,166,667 Class A ordinary shares, par value $0.0001 per share (the “Class A ordinary shares”), of the Company sold in its initial public offering (the “IPO”) at the extraordinary general meeting called by the Company to, among other things, approved the Extension. In consideration of the Non-Redemption Agreements, immediately prior to, and substantially concurrently with, the closing of an initial business combination, (i) the Managing Sponsor (or its designees or transferees) has agreed to surrender and forfeit to the Company for no consideration an aggregate of approximately 0.6 million shares of the Company’s Class B ordinary shares, par value $0.0001 per share, held by the Managing Sponsor (the “Forfeited Shares”) and (ii) the Company shall issue to the Holders a number of Class A ordinary shares equal to those underlying the Forfeited Shares.

On the record date of the

Meeting, there were 10,388,215 ordinary shares issued and outstanding, of which 6,477,845 were Class B ordinary shares, and 3,910,370

were Class A ordinary shares. The Class B ordinary shares carry voting rights in connection with the Name Change Proposal, the Articles

Amendment Proposal and the Adjournment Proposal, and we have been informed by our Managing Sponsor, which holds 3,565,230 Class B ordinary

shares, and our Initial Sponsor, which holds 2,757,615 Class B ordinary shares, that they

intend to vote in favor of the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal.

Our principal executive offices

are located at 3109 W 50th St, #207, Minneapolis, Minnesota, United States of America and our telephone number is (952) 456-5300.

THE NAME CHANGE PROPOSAL

The Name Change Proposal

We are proposing to change the name of the Company from “Portage Fintech Acquisition Corporation” to “ Perception Capital Corp. III”. On July 21, 2023, the Initial Sponsor sold a portion of its Class B ordinary shares and Private Placement Warrants to Perception Capital Partners IIIA LLC, the Managing Sponsor. The purpose of the Name Change Proposal is to better reflect the Company’s new sponsor as a result of the Transaction.

If the Name Change Proposal is Approved

Upon approval of the Name Change Proposal by the requisite number of votes, the name of the Company will be changed from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III”. The Company shall procure that all filings required to be made with the Registrar of Companies of the Cayman Islands in connection with the Name Change Proposal, which will be effective as of the date of the Meeting. Subsequent to the name change, we will remain a reporting company under the Exchange Act, and our Class A ordinary shares will remain publicly traded. The Company does not expect to change its trading symbol on the Nasdaq stock market.

If the Name Change Proposal Is Not Approved

Unless the Name Change Proposal is approved, the Company’s name will continue to be “Portage Fintech Acquisition Corporation”.

Vote Required for approval

The approval of the Name Amendment Proposal requires a special resolution under Cayman Islands law, being the affirmative vote of shareholders representing a majority of not less than two-thirds of the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

Resolution

The full text of the resolution to be voted upon is as follows:

“IT IS RESOLVED by special resolution that the name of the Company be changed from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III”.

Recommendation of the Board

Our Board unanimously recommends that our shareholders vote “FOR” the approval of the Name Change Proposal.

THE ARTICLES AMENDMENT PROPOSAL

The Articles Amendment Proposal

Subject to the approval of the Name Change Proposal, we are proposing to amend and restate the Company’s Articles to reflect the change of name of the Company from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III” in order to better reflect the Company’s new sponsor as a result of the Transaction.

If the Articles Amendment Proposal is Approved

Upon approval of the Articles Amendment Proposal by the requisite number of votes, our Articles will be amended and restated in the form set forth in Annex A hereto. The Company shall procure that all filings required to be made with the Registrar of Companies of the Cayman Islands in connection with the Articles Amendment Proposal, which will be effective as of the date of the Meeting.

If the Articles Amendment Proposal Is Not Approved

Unless the Articles Amendment Proposal is approved, the Company’s articles of association will continue to be the Articles.

Vote Required for approval

The approval of the Articles Amendment Proposal requires a special resolution under Cayman Islands law, being the affirmative vote of shareholders representing a majority of not less than two-thirds of the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

Resolution

The full text of the resolution to be voted upon is as follows:

“IT IS RESOLVED by special resolution that the existing Memorandum and Articles of Association of the Company be and are hereby replaced in their entirety with a new Memorandum and Articles of Association, a copy of which is annexed hereto.”

Recommendation of the Board

Our Board unanimously recommends that our shareholders vote “FOR” the approval of the Articles Amendment Proposal.

THE ADJOURNMENT PROPOSAL

Overview

The Adjournment Proposal, if adopted, will allow our Board to adjourn the Meeting to a later date or dates or indefinitely, if necessary or convenient, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Name Change Proposal and the Articles Amendment Proposal. In no event will our Board adjourn the Meeting for more than 30 days.

Consequences if the Adjournment Proposal is Not Approved

If the Adjournment Proposal is not approved by our shareholders, our Board may not be able to adjourn the Meeting to a later date or dates to permit further solicitation and vote of proxies or if our Board determines before the Meeting that it is not necessary or no longer desirable to proceed with the other proposal.

Resolution to be Voted Upon

The full text of the resolution to be proposed is as follows:

“RESOLVED, as an ordinary resolution, the adjournment of the Meeting to a later date or dates or indefinitely, if necessary or convenient, either (x) to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any of the foregoing proposal or (y) if our board determines before the Meeting that it is not necessary or no longer desirable to proceed with the other proposal, be confirmed, ratified and approved in all respects.”

Vote Required for approval

The Adjournment Proposal must be approved as an ordinary resolution under Cayman Islands law, being a simple majority of the votes cast by shareholders representing the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting. Abstentions and broker non-votes, while considered present for the purposes of establishing a quorum, will not count as a vote cast at the Meeting.

Recommendation of the Board

If presented, our Board unanimously recommends that our shareholders vote “FOR” the approval of the Adjournment Proposal.

THE MEETING

Date, Time and Place. The Meeting will be held at 10:00 A.M. Eastern Time on October 11, 2023, or at such other time, on such other date and at such other place to which the meeting may be postponed or adjourned. You will be permitted to attend the Meeting in person at the offices of Faegre Drinker Biddle & Reath LLP located at 90 South Seventh Street, 2200 Wells Fargo Center, Minneapolis, Minnesota 55402, United States of America, or at such other time, on such other date and at such other place to which the meeting may be postponed or adjourned. The sole purpose of the Meeting is to consider and vote upon the following proposals.

Voting Power; Record Date. You will be entitled to vote or direct votes to be cast at the Meeting, if you owned the ordinary shares at the close of business on September 14, 2023, the record date for the Meeting. You will have one vote per proposal for each share of ordinary shares you owned at that time.

Votes Required. The approval of each of the Name Change Proposal and the Articles Amendment Proposal requires a special resolution under Cayman Islands law, being the affirmative vote of shareholders representing a majority of not less than two-thirds of the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting. The approval of the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, being a simple majority of the votes cast by shareholders representing the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting. Abstentions and broker non-votes, while considered present for the purposes of establishing a quorum, will not count as a vote cast at the Meeting.

On the record date of the Meeting, there were 10,388,215 ordinary shares issued and outstanding, of which 6,477,845 are Class B ordinary shares, and 3,910,370 are Class A ordinary shares. The Class B ordinary shares carry voting rights in connection with the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal, and we have been informed by our Managing Sponsor, which holds 3,565,230 Class B ordinary shares, and our Initial Sponsor, which holds 2,757,615 Class B ordinary shares that they intend to vote in favor of the Name Change Proposal, the Articles Amendment Proposal and the Adjournment Proposal.

If you do not want the Name Change Proposal or the Articles Amendment Proposal to be approved, you must vote “AGAINST” such proposal. If a valid quorum is otherwise established, broker non-votes, abstentions or the failure to vote on the Name Change Proposal, the Articles Amendment Proposal or the Adjournment Proposal will have no effect with respect to the approval of the Name Change Proposal, the Articles Amendment Proposal or the Adjournment Proposal.

Proxies; Board Solicitation; Proxy Solicitor. Your proxy is being solicited on behalf of our Board to approve the Name Change Proposal and the Articles Amendment Proposal and, if put forth at the Meeting, the Adjournment Proposal being presented to shareholders at the Meeting. No recommendation is being made as to whether you should elect to redeem your shares. Proxies may be solicited in person, by telephone or other means of communication. If you grant a proxy, you may still revoke your proxy and vote your shares in person at the Meeting. You may contact Rick Gaenzle:

Portage Fintech Acquisition

Corporation

c/o Perception Capital Partners

IIIA LLC

3109 W 50th St, #207

Minneapolis, Minnesota 55410

United States of America

(917) 673-8250

Required Vote

The approval of each of the Name Change Proposal and the Articles Amendment Proposal a requires a special resolution under Cayman Islands law, being the affirmative vote of shareholders representing a majority of not less than two-thirds of the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

The approval of the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, being a simple majority of the votes cast by shareholders representing the shareholders as, being entitled to do so, vote either in person or, where proxies are allowed, by proxy, at the Meeting.

In addition, our Sponsor, directors, officers, advisors or any of their affiliates may purchase Class A ordinary shares in privately negotiated transactions or in the open market prior to the Meeting. However, they have no current commitments, plans or intentions to engage in such transactions and have not formulated any terms or conditions for any such transactions. None of the funds in the Trust Account will be used to purchase Class A ordinary shares in such transactions. Any such purchases that are completed after the record date for the Meeting may include an agreement with a selling shareholder that such shareholder, for so long as it remains the record holder of the shares in question, will vote in favor of the Name Change Proposal and the Articles Amendment Proposal and/or will not exercise its redemption rights with respect to the shares so purchased. The purpose of such share purchases and other transactions would be to increase the likelihood that the resolutions to be put to the Meeting are approved by the requisite number of votes. In the event that such purchases do occur, the purchasers may seek to purchase shares from shareholders who would otherwise have voted against the Name Change Proposal and the Articles Amendment Proposal and/or elected to redeem their shares for a portion of the Trust Account. Any such privately negotiated purchases may be effected at purchase prices that are below or in excess of the per-share pro rata portion of the Trust Account.

The Board’s Reasons for the Name Change Proposal and the Articles Amendment Proposal and Its Recommendation

As discussed below, after careful consideration of all relevant factors, our Board has determined that each of the Name Change and the Articles Amendment is in the best interests of the Company and its shareholders. Our Board has approved and declared advisable adoption of the Name Change Proposal and the Articles Amendment Proposal and recommends that you vote “FOR” such proposal.

On July 21, 2023, the Initial Sponsor sold a portion of its Class B ordinary shares and Private Placement Warrants to the Managing Sponsor. As a result of the Transaction, we believe that it is in the best interests of our shareholders to change the name of the Company from “Portage Fintech Acquisition Corporation” to “Perception Capital Corp. III” to better reflect the Company’s new sponsor and to amend the Articles to reflect the proposed change of name of the Company.

After careful consideration of all relevant factors, our Board determined that each of the Name Change and the Articles Amendment is in the best interests of the Company and its shareholders.

Resolutions to be Voted Upon

The full text of the resolutions to be proposed in connection with the Name Change Proposal and the Articles Amendment Proposal are set out under “the Name Change Proposal” and “the Articles Amendment Proposal” herein.

Our Board unanimously recommends that our shareholders vote “FOR” the approval of the Name Change Proposal and the Articles Amendment Proposal.

BENEFICIAL OWNERSHIP OF SECURITIES

The following table sets

forth information regarding the beneficial ownership of the ordinary shares as of the record date, September 14, 2023, based on information

obtained from the persons named below, with respect to the beneficial ownership of ordinary shares, by:

| |

● |

each person known by us to be the beneficial owner of more than 5% of our issued and outstanding ordinary shares; |

| |

● |

each of our executive officers and directors that beneficially owns ordinary shares; and |

all our executive officers and directors as a group.

As of the record date, there were a total of 10,388,215 ordinary shares outstanding, of which 3,910,370 were Class A ordinary shares and 6,477,845 were Class B ordinary shares. Unless otherwise indicated, it is believed that all persons named in the table below have sole voting and investment power with respect to all ordinary shares beneficially owned by them. The table below does not include the shares of Class A ordinary shares underlying the private placement warrants held by our sponsors because these securities are not exercisable within 60 days of the date hereof.

| |

|

Class B ordinary shares |

|

|

Class A ordinary shares |

|

|

|

|

| Name and Address of Beneficial Owners(1) |

|

Number of

Shares Beneficially Owned |

|

|

Approximate Percentage of

Class(2) |

|

|

Number of

Shares Beneficially Owned |

|

|

Approximate Percentage of

Class |

|

|

Approximate Percentage of

Voting Control |

|

| Directors and Executive Officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Scott Honour |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Rick Gaenzle |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| R. Rudolph Reinfrank |