Goal Acquisitions Corp. (Nasdaq: PUCK) today issued the following

open letter to its shareholders:

Dear Shareholders -

As you may know, Goal Acquisitions Corp. (Nasdaq: PUCK) (“Goal”

or “we”) has recently announced our entry into a business

combination with Digital Virgo Group (“Digital Virgo” or the

“Company”). Digital Virgo is a French corporation that is a global

hub for payment and monetization of digital content and services

that enables worldwide access to mobile content, entertainment, and

commerce—all payable on a phone bill using carrier billing

solutions, or alternative payment methods.

This is an opportune moment to combine with a strong and growing

global business that generates substantial recurring revenue,

having been consistently profitable for the last seven years.

Digital Virgo has generated positive EBITDA growth on strong

margins while creating tremendous market demand for the Company’s

mobile media, sports, entertainment, gaming, commerce, finance, and

other offerings, working with 140 telcos in 40+ countries. We are

excited about their consistent growth and the upside as we look to

bring Digital Virgo’s capabilities to the North American market. We

see Digital Virgo as a source for long-term returns, as well as a

leader in the space as mobile, entertainment, gaming, sports,

wagering, and commerce converge. Digital Virgo is poised to take

advantage of the future of digital content, where one destination

exists to meet customers’ mobile entertainment and commerce needs,

including payments, live events, travel, gaming, shopping, social

impact and more.

The Company itself offers an impact opportunity in global

markets as Digital Virgo provides access to digital services and

content to the unbanked and underbanked, where they otherwise would

not be able to participate. We intend to increase this impact,

including providing new ways for consumers to give and nonprofit

organizations to raise funds all through a seamless mobile

experience and phone bill payment.

Goal is comprised of seasoned board members and proven

business-builders who possess deep relationships in sports, media,

telecommunications, investments, brand building, and M&A, that

will stimulate Digital Virgo’s success in the U.S. market and

beyond. These relationships will help the Company develop new

partnerships, a critical element in leading the Company to more

rapid customer acquisition and premier content creation, enhancing

the platform and aiding revenue growth and profitability.

Similarly, the Digital Virgo team is exceptional. The Company’s

leadership has worked closely together for many years with the

founder previously navigating a 900M+ euro exit from a previous

company.

We have maintained disciplined diligence throughout our

process—our goals of identifying a quality company never wavering

as the markets continued to change. We know that investors are

always looking for opportunities with companies that have positive

cash flow, relevance, and growth potential, regardless of market

conditions. The Company itself is no stranger to down markets and

has a proven track record of financial success in a variety of

economic environments, with preliminary estimates for 2022 gross

revenue, net income, and adjusted EBITDA at 436 million euros (12%

YoY growth), 26 million euros (66% YoY), and 46 million euros (15%

YoY growth), respectively. In addition to financial success, the

Company also has an enviable M&A history, acquiring 15

companies in the last 14 years—while strengthening global

operations. Irrespective of this transaction or entry into North

America, Digital Virgo is on track to reach 70 million euros of

adjusted EBITDA by 2027.

As you know first-hand, prudent investors become even more

discerning when the market dips, and that’s exactly the approach

we’ve taken. After completing more than a year’s worth of due

diligence, we are highly confident in the quality of this proposed

business combination.

Existing Goal shareholders have received an extension proxy

requesting a vote in favor of a month-to-month extension, for up to

six months, in order for the Digital Virgo merger with Goal to

proceed forward to completion. The Goal sponsor team is

incentivizing holders to grant such extension by depositing the

lesser of (a) $0.05 per share for each public share of Company that

is not redeemed in connection with the Special Meeting and (b)

$258,750 per 30-day period. In addition, the proceeds held in

Goal’s trust account will continue to be invested in United States

government treasury bills with a maturity of 185 days or less or in

money market funds investing solely in U.S. Treasuries and meeting

certain conditions under Rule 2a-7 under the Investment Company Act

of 1940, as amended, as determined by the Company, or in an

interest bearing demand deposit account until the earlier of: (i)

the completion of its initial business combination and (ii) the

distribution of the trust account.

We look forward to your continued involvement in this investment

and the chance to realize strong returns, while leading a consumer

evolution in one-destination access for content, entertainment,

sports and commerce.

Our Goal team thanks you for your partnership and support so

far, and requests that you support our extension.

Looking ahead,

Alex Greystoke, Founder and Advisor Harvey Schiller, Chief

Executive Officer

About Goal Acquisitions

Goal Acquisitions Corp. is a blank check company formed for the

purpose of effecting a merger, share exchange, asset

acquisition, stock purchase, recapitalization, reorganization, or

other similar business combination with one or more business

entities. For more information visit www.goalacquisitions.com.

No Offer or Solicitation

This press release is for informational purposes only and does

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which the offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

No Assurances

There can be no assurance that the proposed Business Combination

will be completed, nor can there be any assurance, if the Business

Combination is completed, that the potential benefits of combining

the companies will be realized. The description of the Business

Combination contained herein is qualified in its entirety by

reference to the current definitive agreements relating to the

Business Combination, copies of which have been filed by Goal with

the SEC as an exhibit to a Current Report on Form 8-K on November

17, 2022.

Participants in the Solicitation

Goal and Digital Virgo and their respective directors and

executive officers may be considered participants in the

solicitation of proxies from Goal’s stockholders with respect to

the potential transaction described in this press release under the

rules of the SEC. Information about the directors and executive

officers of Goal and their ownership of Goal’s securities is set

forth in Goal’s Final Prospectus filed with the SEC on February 16,

2021. Additional information regarding the persons who may, under

the rules of the SEC, be deemed participants in the solicitation of

Goal’s stockholders in connection with the potential transaction

will be set forth in the preliminary and definitive proxy

statements when those are filed with the SEC. These documents are

available free of charge at the SEC’s website at www.sec.gov or by

directing a request to Goal Acquisitions Corp., Attention: William

T. Duffy, telephone: (888) 717-7678.

Additional Information about the Proposed Business

Combination and Where to Find It

Digital Virgo will submit with the SEC a Registration Statement

on Form F-4 (as may be amended, the “Registration Statement”),

which includes a preliminary proxy statement of Goal and a

prospectus in connection with the proposed Business Combination

involving Goal and Digital Virgo pursuant to the Business

Combination Agreement by and among the parties (the “Business

Combination Agreement”). STOCKHOLDERS OF GOAL AND OTHER INTERESTED

PERSONS ARE ADVISED TO READ, WHEN AVAILABLE, THE PRELIMINARY AND

DEFINITIVE PROXY STATEMENTS, ANY AMENDMENTS THERETO AS WELL AS ANY

OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC

IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION BECAUSE THESE

DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT GOAL, DIGITAL

VIRGO AND THE BUSINESS COMBINATION. THE DEFINITIVE PROXY STATEMENT

WILL BE MAILED TO STOCKHOLDERS OF GOAL AS OF A RECORD DATE TO BE

ESTABLISHED FOR VOTING ON THE BUSINESS COMBINATION. ONCE AVAILABLE,

STOCKHOLDERS OF GOAL WILL ALSO BE ABLE TO OBTAIN A COPY OF THE

PROXY STATEMENTS AND OTHER DOCUMENTS FILED WITH THE SEC WITHOUT

CHARGE, BY DIRECTING A REQUEST TO: GOAL ACQUISITIONS CORP.,

ATTENTION: WILLIAM T. DUFFY, TELEPHONE: (888) 717-7678 OR EMILIE

ROUSSELL: +33 1 82 50 50 00. THE PRELIMINARY AND DEFINITIVE PROXY

STATEMENTS, AND ANY OTHER RELEVANT DOCUMENTS, ONCE AVAILABLE, CAN

ALSO BE OBTAINED, WITHOUT CHARGE, AT THE SEC’S WEBSITE

(WWW.SEC.GOV).

Forward-Looking Statements

The information in this press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words

such as “estimate,” “plan,” “project,” “forecast,” “intend,” “may,”

“will,” “expect,” “continue,” “should,” “would,” “anticipate,”

“believe,” “seek,” “target,” “predict,” “potential,” “seem,”

“future,” “outlook” or other similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters, but the absence of these words does not mean

that a statement is not forward-looking. These forward-looking

statements include, but are not limited to, (1) statements

regarding estimates and forecasts of financial and performance

metrics and projections of market opportunity and market share; (2)

references with respect to the anticipated benefits of the proposed

Business Combination and the projected future financial performance

of Goal and Digital Virgo’s operating companies following the

proposed Business Combination; (3) changes in the market for

Digital Virgo’s products and services and expansion plans and

opportunities; (4) Digital Virgo’s unit economics; (5) the sources

and uses of cash of the proposed Business Combination; (6) the

anticipated capitalization and enterprise value of the combined

company following the consummation of the proposed Business

Combination; (7) the projected technological developments of

Digital Virgo and its competitors; (8) anticipated short- and

long-term customer benefits; (9) current and future potential

commercial and customer relationships; (10) the ability to

manufacture efficiently at scale; (11) anticipated investments in

research and development and the effect of these investments and

timing related to commercial product launches; and (12)

expectations related to the terms and timing of the proposed

Business Combination. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of Digital Virgo’s and Goal’s

management and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by

any investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions. Many actual events and circumstances are

beyond the control of Digital Virgo and Goal. These forward-looking

statements are subject to a number of risks and uncertainties,

including the occurrence of any event, change or other

circumstances that could give rise to the termination of the

Business Combination Agreement; the risk that the Business

Combination disrupts current plans and operations as a result of

the announcement and consummation of the transactions described

herein; the inability to recognize the anticipated benefits of the

Business Combination; the lack of a third-party fairness opinion in

determining whether or not to pursue the proposed Business

Combination; the ability to obtain or maintain the listing of Goal

on The Nasdaq Stock Market, following the Business Combination,

including having the requisite number of shareholders; costs

related to the Business Combination; changes in domestic and

foreign business, market, financial, political and legal

conditions; risks relating to the uncertainty of certain projected

financial information with respect to Digital Virgo; Digital

Virgo’s ability to successfully and timely develop, manufacture,

sell and expand its technology and products, including implement

its growth strategy; Digital Virgo’s ability to adequately manage

any supply chain risks, including the purchase of a sufficient

supply of critical components incorporated into its product

offerings; risks relating to Digital Virgo’s operations and

business, including information technology and cybersecurity risks,

failure to adequately forecast supply and demand, loss of key

customers and deterioration in relationships between Digital Virgo

and its employees; Digital Virgo’s ability to successfully

collaborate with business partners; demand for Digital Virgo’s

current and future offerings; risks that orders that have been

placed for Digital Virgo’s products are cancelled or modified;

risks related to increased competition; risks relating to potential

disruption in the transportation and shipping infrastructure,

including trade policies and export controls; risks that Digital

Virgo is unable to secure or protect its intellectual property;

risks of product liability or regulatory lawsuits relating to

Digital Virgo’s products and services; risks that the

post-combination company experiences difficulties managing its

growth and expanding operations; the uncertain effects of the

COVID-19 pandemic and certain geopolitical developments; the

inability of the parties to successfully or timely consummate the

proposed Business Combination, including the risk that any required

shareholder or regulatory approvals are not obtained, are delayed

or are subject to unanticipated conditions that could adversely

affect the combined company or the expected benefits of the

proposed Business Combination; the outcome of any legal proceedings

that may be instituted against Digital Virgo or Goal or other

following announcement of the proposed Business Combination and

transactions contemplated thereby; the ability of Digital Virgo to

execute its business model, including market acceptance of its

planned products and services and achieving sufficient production

volumes at acceptable quality levels and prices; technological

improvements by Digital Virgo’s peers and competitors; and those

risk factors discussed in documents of Goal filed, or to be filed,

with the SEC. If any of these risks materialize or our assumptions

prove incorrect, actual results could differ materially from the

results implied by these forward-looking statements. There may be

additional risks that neither Goal nor Digital Virgo presently know

or that Goal and Digital Virgo currently believe are immaterial

that could also cause actual results to differ from those contained

in the forward-looking statements. In addition, forward-looking

statements reflect Goal’s and Digital Virgo’s expectations, plans

or forecasts of future events and views as of the date of this

press release. Goal and Digital Virgo anticipate that subsequent

events and developments will cause Goal’s and Digital Virgo’s

assessments to change. However, while Goal and Digital Virgo may

elect to update these forward-looking statements at some point in

the future, Goal and Digital Virgo specifically disclaim any

obligation to do so. Readers are referred to the most recent

reports filed with the SEC by Goal. Readers are cautioned not to

place undue reliance upon any forward-looking statements, which

speak only as of the date made, and we undertake no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise.

Non-IFRS Financial Matters

The projected financial information included in

this letter includes certain non-IFRS financial measures, including

Adjusted EBITDA. Digital Virgo’s management included these non-IFRS

financial measures because it believes they are useful in

evaluating Digital Virgo’s operating performance, as they are

similar to measures reported by Digital Virgo’s public competitors

and are regularly used by security analysts, institutional

investors, and other interested parties in analyzing operating

performance and prospects.

Digital Virgo defines Adjusted EBITDA as the

Recurring Operating Profit in accordance with IFRS (Operating

Profit excluding non-current costs and revenues) plus the

depreciation, amortization and impairment of non-current assets

excluding the depreciation charges for the right-of-use assets,

plus the stock-based compensation expenses (consumption of the fair

value of free shares and stock options granted to employees and

managers).

Digital Virgo defines non-IFRS gross profit as

revenue less cost of revenues. Non-IFRS gross margin is defined as

Digital Virgo’s non-IFRS gross profit divided by total revenues.

Digital Virgo’s management believes non-IFRS gross profit and

non-IFRS gross margin can provide a useful measure of Digital

Virgo’s core performance over time as they eliminate the impact of

non-cash expenses and allow a direct comparison of Digital Virgo’s

cash operations and ongoing operating performance between

periods.

Non-IFRS financial information is presented for

supplemental informational purposes only, has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for financial information presented in accordance with

IFRS. In addition, other companies, including companies in Digital

Virgo’s industry, may calculate similarly titled non-IFRS measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-IFRS financial measures as tools for comparison. Investors are

encouraged to review the related IFRS financial measures and the

reconciliation of these non-IFRS financial measures to their most

directly comparable IFRS financial measures, and not to rely on any

single financial measure to evaluate Digital Virgo’s business. A

reconciliation of non-IFRS measures is available in the Company’s

investor deck filed with the SEC as an exhibit to a current report

on Form 8-K on December 8, 2022.

Contacts

For inquiries regarding Digital Virgo, please

contact: www.digitalvirgo.com/contact.

Media

For Digital Virgo media inquiries, please contact Communications

Director Émilie Roussel:

press@digitalvirgo.com

For Goal Acquisitions media inquiries, please contact:

press@goalacquisitions.com

Investors

For investor inquiries at Digital Virgo, please contact:

ir@digitalvirgo.com

For investor inquiries at Goal Acquisitions, please contact:

info@goalacquisitions.com

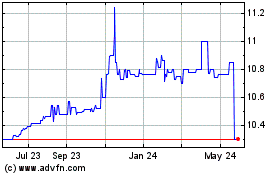

Goal Acquisition (NASDAQ:PUCK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Goal Acquisition (NASDAQ:PUCK)

Historical Stock Chart

From Dec 2023 to Dec 2024