Republic Bancorp, Inc. (“Republic” or the “Company”) reported

fourth quarter 2024 net income and Diluted Earnings per Class A

Common Share (“Diluted EPS”) of $19.0 million and $0.98 per share.

Year-to-date net income was $101.4 million, an $11.0 million, or

12%, increase over 2023, resulting in return on average assets

(“ROA”) and return on average equity (“ROE”) of 1.47% and 10.50%

for 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250124606677/en/

Logan Pichel, President & CEO of Republic Bank & Trust

Company commented, “We are pleased to report another strong

performance for the fourth quarter, particularly within our Core

Bank, as its net income increased 11% over the fourth quarter of

2023. Our Core Bank includes the operations of our Traditional Bank

and Warehouse Lending, whose combined assets represent

approximately 90% of the Company’s total assets. The growth in our

Core Bank net income primarily resulted from a $7.0 million

increase in net interest income, which was driven by strong growth

in our net interest margin (“NIM”) from 3.40% for the fourth

quarter of 2023 to 3.64% for the fourth quarter of 2024. The growth

in our quarterly NIM reflected the success of a strong interest

rate risk management function, combined with solid growth in our

core deposits, and on-going pricing discipline for our new loan

originations.

In addition to our solid Core Bank net interest income, credit

quality continued to remain solid at the Core Bank. The Core Bank’s

net charge-offs to average loans was 0.02% for the fourth quarter,

while its period-end nonperforming loans to total loans was 0.44%

and its period-end delinquent loans to total loans was 0.20%. These

strong ratios helped contribute to a $1.6 million positive decline

in our Core Bank Provision(2) for loan losses from the fourth

quarter of 2023 to the fourth quarter of 2024.

Net income from our Republic Processing Group (“RPG”) declined

$2.4 million from the fourth quarter of 2023 to the fourth quarter

of 2024. While the Republic Credit Solutions (“RCS”) and Republic

Processing Solutions (“RPS”) components of RPG collectively

reported a $416,000, or 6%, increase in net income from the fourth

quarter of 2023 to the fourth quarter of 2024, Tax Refund Solutions

(“TRS”) reported a $2.8 million additional net loss for the same

time periods. As a result of the final performance of the December

2023 Early Season Refund Advances (“ERAs”) within TRS, we recorded

a larger Allowance(2) for these early season tax loans of $9.8

million during the fourth quarter of 2024 compared to $3.9 million

during the fourth quarter of 2023. Approximately $2.3 million of

the increase over the fourth quarter 2023 Allowance amount was due

to increased volume, with the remaining difference predominately

due to an increased loss estimate due to our experience from the

prior tax season.

Based on the prior tax season economics, during the fourth

quarter of 2024 we revised our agreement with our largest

third-party marketer-servicer for Refund Advances (“RAs”) and ERAs

for the current tax filing season beginning in December 2024. Under

this revised agreement:

- we received a loss cap guarantee specific to ERAs for the

current tax filing season;

- we will receive an enhanced fee specific to ERAs for the

current tax filing season; and

- we will receive a reduced fee applicable to in-season RAs for

the current tax filing season.

We are pleased with this new arrangement as we believe it

provides better alignment between the economics and the downside

risk to the Company. We estimate the revised contract will provide

approximately $2.8 million of additional fee income for the current

tax season of December 2024 through March 2025 compared to the

prior tax season of December 2023 through March 2024. The Company

earned approximately $1.4 million of this increased fee income

during the fourth quarter of 2024. We do not anticipate recording

any additional loss estimates for the December 2024 ERA

originations through this marketer-servicer as a result of the new

loss guarantee cap.

We continued to add additional on-balance-sheet liquidity during

the year with our Total Company period-end deposits, excluding

wholesale brokered deposits, growing by a net $157 million. Core

Bank period-end deposits, excluding wholesale brokered deposits,

represented $209 million of that net growth. Total Company

period-end loans increased by a net $200 million for the year, with

Warehouse comprising $211 million of that increase, RPG increasing

$38 million and the Traditional Bank declining $49 million. These

growth dynamics maintained our Total Company period-end

loan-to-deposit ratio at 104% as of December 31, 2023 and December

31, 2024.

In regards to our total year, we had many notable highlights for

the year. These highlights include the following:

- Increased Total Company Net Income for 2024 by $11.0 million,

or 12%, over 2023.

- Generated a one-year total return on our stock of 30.3% in 2024

versus a total return of 20.6% for the NASDAQ Bank Index during the

same period. Additionally, Republic generated a two-year total

return of 81.5% as of December 31, 2024 compared to the NASDAQ Bank

Index of 16.4% for the same period. We are very proud of the

recognition the market has given us through the performance of our

stock price.

- Continued to drive strong performance for the Total Company

through our diversified business model as three of our five

business segments reported an increase in net income for the year.

These increases included:

- Traditional Banking reported net income of $56.4 million for

the year, representing a $9.7 million, or 21%, increase in net

income over 2023.

- Warehouse Lending reported net income of $6.5 million for the

year, representing a $1.8 million, or 37%, increase in net income

over 2023.

- Republic Credit Solutions (“RCS”) reported net income of $23.5

million for 2024, representing a $5.2 million, or 28%, increase in

net income over 2023.

- Grew December 31, 2024 Traditional Bank period-end deposits,

excluding wholesale brokered deposits, 5% over December 31, 2023

period-end balances.

- Managed expenses prudently with Total Company non-interest

expenses increasing 1.7% from 2023, while our Core Bank noninterest

expenses increased just 0.7% for the same time period.

- Achieved a Total Company efficiency ratio, which measures the

amount of noninterest expense it takes to generate one dollar of

net revenue, of 52.68%, a 267-basis-point positive decrease from

the 55.35% result for 2023.

- Increased our 2024 Total Company operating leverage, which

measures the growth of revenue to the growth of noninterest

expense, by 5% over 2023.

- Maintained industry-strong credit quality with Core Bank net

charge-offs for the year of 0.05%.

- Our Net Promoter Score (“NPS”) increased from 38 in 1st quarter

2023 to 75 in 3rd quarter 2024. Our score of 75 is three times (3x)

the Banking Industry average. A score of 80 is considered World

Class, and we have our sights set on achieving this lofty

score.

2024 was a year in which we made continuous enhancements to our

client experiences, saw a marked improvement in our client

satisfaction scores, generated strong financial results, and

enjoyed tremendous stockholder returns. Without the strong support

of our shareholders, our clients and our associates, our success

would not be possible. We do not take this support for granted and

we will continue to do our absolute best to earn your loyalty each

and every day,” Pichel concluded.

The following table highlights Republic’s key metrics for the

three months ended December 31, 2024 and 2023. Additional financial

details, including segment-level data, are provided in the

financial supplement to this release. The attached digital version

of this release includes the financial supplement as an appendix.

The financial supplement may also be found as Exhibit 99.2 of the

Company’s Form 8-K filed with the SEC on January 24, 2025.

Total Company Financial

Performance Highlights

Three Months Ended Dec.

31,

$

%

Years Ended Dec. 31,

$

%

(dollars in thousands, except per share

data)

2024

2023

Change

Change

2024

2023

Change

Change

Income Before Income Tax Expense

$

23,050

$

23,519

$

(469

)

(2)

%

$

127,703

$

113,213

$

14,490

13

%

Net Income

19,016

19,659

(643

)

(3)

101,371

90,374

10,997

12

Diluted EPS

0.98

1.01

(0.03

)

(3)

5.21

4.62

0.59

13

Return on Average Assets ("ROA")

1.10

%

1.21

%

NA

(9)

1.47

%

1.44

%

NA

2

Return on Average Equity ("ROE")

7.63

8.68

NA

(12)

10.50

10.10

NA

4

NA – Not applicable

Results of Operations for the Fourth quarter of 2024 Compared

to the Fourth quarter of 2023

Core Bank(1)

Net income for the Core Bank was $17.6 million for the fourth

quarter of 2024, a $1.8 million, or 11%, increase over the $15.8

million for the fourth quarter of 2023. A solid increase in net

interest income combined with a minimal Provision, which was driven

by continued strong Core Bank credit quality, were both drivers for

the strong growth in net income for the quarter.

Net Interest Income – Core Bank net interest income was $57.7

million for the fourth quarter of 2024, a $7.0 million, or 14%,

increase from the $50.6 million achieved during the fourth quarter

of 2023. The rise in net interest income for the quarter was driven

by period-over-period growth in average interest-earning assets and

a notable increase in the Core Bank’s NIM. The increase in the Core

Bank’s total dollars of net interest income represented the third

consecutive quarter-over-same-quarter-last-year increase following

two consecutive quarter-over-same-quarter-last-year declines for

the fourth quarter of 2023 and the first quarter of 2024.

The Core Bank’s NIM increased from 3.40% during the fourth

quarter of 2023 to 3.64% during the fourth quarter of 2024. This

increase represented the second consecutive rise in the Core Bank’s

quarter-over-same-quarter-last-year NIM. The increase in the Core

Bank’s NIM occurred as its yield on its interest earning assets

increased 25 basis points over the fourth quarter of 2023, while

its cost of funds increased only one basis point for the same time

periods.

Specific items of note impacting the Core Bank’s change in net

interest income and NIM between the fourth quarter of 2023 and the

fourth quarter of 2024 were as follows:

- Average outstanding Warehouse balances increased from $370

million during the fourth quarter of 2023 to $552 million for the

fourth quarter of 2024. Average committed Warehouse lines declined

from $1.0 billion to $942 million during these same periods, while

an up-tick in demand caused average usage rates for Warehouse lines

to increase from 37% during the fourth quarter of 2023 to 59% for

the fourth quarter of 2024.

- Traditional Bank average loans grew from $4.56 billion with a

weighted-average yield of 5.32% during the fourth quarter of 2023

to $4.57 billion with a weighted average yield of 5.57% during the

fourth quarter of 2024. Average Loans for the fourth quarter of

2024 were negatively impacted by the sale in early 2024 of $67

million of residential real estate loans, previously held for

investment.

- Average interest-earning cash was $584 million with a

weighted-average yield of 4.81% during the fourth quarter of 2024

compared to $201 million with a weighted-average yield of 5.45% for

the fourth quarter of 2023. During the first nine months of 2024,

the Company maintained higher cash balances due to the inverted

yield curve and the more attractive pricing for interest-earning

cash as compared to longer-term securities. While the yield curve

began to steepen during the fourth quarter of 2024, the Company

continued to maintain higher cash balances during the quarter, in

general, due to near-term funding requirements for tax loans

related to the upcoming first quarter 2025 tax season.

- Average investments were $595 million with a weighted-average

yield of 3.16% during the fourth quarter of 2024 compared to $769

million with a weighted-average yield of 3.02% for the fourth

quarter of 2023. As noted in the paragraph above, the Company

generally deployed its proceeds from maturing investments during

2024 into interest-earning cash for better yield and near-term

liquidity needs.

- As it relates to the Core Bank’s total dollar increase for its

cost of interest-bearing liabilities:

- The weighted-average cost of total interest-bearing deposits

increased from 2.36% during the fourth quarter of 2023 to 2.43% for

the fourth quarter of 2024, while average interest-bearing deposit

balances grew $410 million over the same periods. Included within

this growth in interest-bearing deposits was a $309 million

increase in the average balances for business and consumer money

market accounts, which generally paid premium rates.

- The average balance of FHLB borrowings increased from $357

million for the fourth quarter of 2023 to $371 million for the

fourth quarter of 2024, while the weighted-average cost of these

borrowings decreased from 4.62% to 4.34% for the same time periods.

The decrease in the overall weighted-average cost of FHLB

borrowings resulted from previous term-extension strategies

implemented earlier in 2024 to take advantage of the then-inverted

yield curve.

- Average noninterest-bearing deposits decreased $68 million from

the fourth quarter of 2023 to the fourth quarter of 2024. The

decline in noninterest-bearing deposits is an on-going trend dating

back to the fourth quarter of 2022, as the overall interest rate

environment combined with the competition for deposits continued to

make interest-bearing deposits a more attractive alternative for

consumer and business deposit accounts.

The following tables present by reportable segment the overall

changes in the Core Bank’s net interest income, net interest

margin, as well as average and period-end loan balances:

Net Interest Income

Net Interest Margin

(dollars in thousands)

Three Months Ended Dec.

31,

Three Months Ended Dec.

31,

Reportable Segment

2024

2023

Change

2024

2023

Change

Traditional Banking

$

53,942

$

48,394

$

5,548

3.73

%

3.47

%

0.26

%

Warehouse Lending

3,718

2,251

1,467

2.68

2.41

0.27

Total Core Bank

$

57,660

$

50,645

$

7,015

3.64

3.40

0.24

Average Loan Balances

Period-End Loan

Balances

(dollars in thousands)

Three Months Ended Dec.

31,

Dec. 31,

Dec. 31,

Reportable Segment

2024

2023

$ Change

% Change

2024

2023

$ Change

% Change

Traditional Banking

$

4,569,224

$

4,560,572

$

8,652

0

%

$

4,569,179

$

4,618,569

$

(49,390

)

(1

)%

Warehouse Lending

552,856

370,169

182,687

49

550,760

339,723

211,037

62

Total Core Bank

$

5,122,080

$

4,930,741

$

191,339

4

$

5,119,939

$

4,958,292

$

161,647

3

Provision for Expected Credit Loss Expense – The Core Bank’s

Provision was a net charge of $367,000 for the fourth quarter of

2024 compared to a net charge of $2.0 million for the fourth

quarter of 2023.

The net charge of $367,000 for the fourth quarter of 2024 was

driven, primarily, by the following:

- The Core Bank recorded a net charge to the Provision of

$277,000 during the fourth quarter of 2024 related to net

charge-offs on loans and overdrafts.

- The Core Bank recorded a net charge to the Provision of

$270,000 during the fourth quarter of 2024 primarily related to the

nominal increase in Traditional Bank loan balances for the quarter

of $2 million.

- The Core Bank recorded a net credit to the Provision of

$112,000 resulting from general formula reserves applied to an $44

million decrease in outstanding Warehouse balances during the

quarter.

The net charge during the fourth quarter of 2023 was primarily

driven by the following:

- The Core Bank recorded a net charge to the Provision of $2.1

million during the fourth quarter of 2023 related to general

formula reserves applied to $123 million of Traditional Bank loan

growth for the fourth quarter of 2023.

- The Core Bank recorded a net credit to the Provision of

$296,000 resulting from general formula reserves applied to an $118

million decline in outstanding Warehouse balances for the fourth

quarter of 2023.

As a percentage of total loans, the Core Bank’s Allowance(2)

decreased 2 basis points from December 31, 2023 to December 31,

2024, driven by a change in loan mix toward loans with lower

overall reserve requirements. The table below provides a view of

the Company’s percentage of Allowance-to-total-loans by reportable

segment.

As of Dec. 31, 2024

As of Dec. 31, 2023

Year-over-Year Change

(dollars in thousands)

Allowance

Allowance

Allowance

Reportable Segment

Gross Loans

Allowance

to Loans

Gross Loans

Allowance

to Loans

to Loans

% Change

Traditional Bank

$

4,569,179

$

59,756

1.31

%

$

4,618,569

$

58,998

1.28

%

0.03

%

2

%

Warehouse Lending

550,760

1,374

0.25

339,723

847

0.25

—

—

Total Core Bank

5,119,939

61,130

1.19

4,958,292

59,845

1.21

(0.02

)

(2

)

Tax Refund Solutions

190,794

9,861

5.17

149,207

3,990

2.67

2.50

94

Republic Credit Solutions

128,733

20,987

16.30

132,362

18,295

13.82

2.48

18

Total Republic Processing Group

319,527

30,848

9.65

281,569

22,285

7.91

1.74

22

Total Company

$

5,439,466

$

91,978

1.69

%

$

5,239,861

$

82,130

1.57

%

0.12

%

8

%

ACLL Roll-Forward

Three Months Ended December

31,

2024

2023

(dollars in thousands)

Beginning

Charge-

Ending

Beginning

Charge-

Ending

Reportable Segment

Balance

Provision

offs

Recoveries

Balance

Balance

Provision

offs

Recoveries

Balance

Traditional Bank

$

59,549

$

484

$

(441

)

$

164

$

59,756

$

56,931

$

2,287

$

(449

)

$

229

$

58,998

Warehouse Lending

1,486

(112

)

—

—

1,374

1,143

(296

)

—

—

847

Total Core Bank

61,035

372

(441

)

164

61,130

58,074

1,991

(449

)

229

59,845

Tax Refund Solutions

1

7,701

—

2,159

9,861

1

2,937

—

1,052

3,990

Republic Credit Solutions

21,122

4,883

(5,357

)

339

20,987

16,501

6,061

(4,453

)

186

18,295

Total Republic Processing Group

21,123

12,584

(5,357

)

2,498

30,848

16,502

8,998

(4,453

)

1,238

22,285

Total Company

$

82,158

$

12,956

$

(5,798

)

$

2,662

$

91,978

$

74,576

$

10,989

$

(4,902

)

$

1,467

$

82,130

The table below presents the Core Bank’s credit quality

metrics:

As of and for the:

Quarters Ended:

Years Ended:

Dec. 31,

Sep. 30,

Jun. 30,

Mar. 31,

Dec. 31,

Dec. 31,

Dec. 31,

Core Banking Credit Quality

Ratios

2024

2024

2024

2023

2024

2023

2022

Nonperforming loans to total loans

0.44

%

0.38

%

0.39

%

0.38

%

0.44

%

0.39

%

0.37

%

Nonperforming assets to total loans

(including OREO)

0.46

0.40

0.41

0.41

0.46

0.41

0.40

Delinquent loans* to total loans

0.20

0.19

0.18

0.15

0.20

0.16

0.14

Net charge-offs to average loans

0.02

0.14

0.02

0.01

0.05

0.01

0.00

(Quarterly rates annualized)

OREO = Other Real Estate Owned

*Loans 30-days-or-more past due at the

time the second contractual payment is past due.

Noninterest Income – Core Bank noninterest income slightly

decreased by $157,000 from $9.8 million in the fourth quarter of

2023 to $9.7 million for the fourth quarter of 2024, as nominal

increases related to mortgage banking income, BOLI income and

service charges on deposits were offset by declines in swap fees

and insurance captive income.

Noninterest Expense – The Core Bank’s noninterest expenses were

$45.8 million for the fourth quarter of 2024, an increase of $6.2

million, or 16%, over the fourth quarter of 2023. Notable line-item

variances within the noninterest expense category included:

- Salaries and benefits increased $4.6 million over the fourth

quarter of 2023. The fourth quarter of 2024 was negatively impacted

primarily by a $3.9 million swing in estimated bonus expenses as

the fourth quarter of 2023 contained a net credit of $342,000 for

bonus expense accruals, while the fourth quarter of 2024 contained

a net charge of $3.6 million.

The net credit during the fourth quarter of

2023 adjusted the liability for accrued bonuses to be in-line with

lower expected payouts related to the 2023 calendar year.

Conversely, the higher net charge during the fourth quarter of 2024

adjusted the liability for accrued bonuses to be in-line with

greater payouts related to the 2024 calendar year as the Company’s

second half results allowed it to reach higher full-year 2024

payout targets than previously projected earlier in the year.

Republic Processing Group(3)

RPG reported net income of $1.4 million for the fourth quarter

of 2024, a $2.4 million decrease from the $3.8 million for the

fourth quarter of 2023. RPG’s performance for the fourth quarter of

2024 compared to the fourth quarter of 2023, by operating segment,

was as follows:

Tax Refund Solutions

TRS experienced a net loss of $6.4 million during the fourth

quarter of 2024 compared to a net loss of $3.6 million for the

fourth quarter of 2023. The higher net loss at TRS for the fourth

quarter of 2024 was primarily driven by a higher estimated

Provision expense compared to the fourth quarter of 2023 for

ERAs.

Altogether, TRS originated $139 million of ERAs during the

fourth quarter of 2024 compared to $103 million originated during

the fourth quarter of 2023. The Company applied an estimated loss

rate of approximately 7.07% of total ERAs originated during the

fourth quarter of 2024 and an estimated loss rate of 3.81% of total

ERAs originated during the fourth quarter of 2023. The higher

Provision rate applied to ERAs during the fourth quarter of 2024

was based on a higher final loss rate realized during 2024 for the

ERAs that were originated during the fourth quarter of 2023. The

higher Provision for the quarter was partially offset by a $1.4

million increase in loan fee income for the ERA product comparing

the fourth quarter of 2024 to the fourth quarter of 2023.

Republic Payment

Solutions

Net income at RPS was $1.7 million for the fourth quarter of

2024, a $1.5 million decrease from the fourth quarter of 2023.

Driving this decrease, RPS earned a lower yield of 4.39% for its

$357 million average of prepaid program balances for the fourth

quarter of 2024 compared to a yield of 5.10% for the $342 million

in average prepaid card balances for the fourth quarter of 2023. In

addition, net interest income at RPS was also negatively impacted

by a $1.1 million charge to interest expense for a revenue sharing

arrangement that began in January 2024.

Republic Credit

Solutions

Net income at RCS increased $1.9 million, or 44%, from $4.2

million for the fourth quarter of 2023 to $6.1 million for the

fourth quarter of 2024. The increase in RCS net income was

primarily due to an 18% growth in the average balances of its two

higher-yielding small dollar loan products, which contributed $1.9

million of additional net interest income to the overall segment.

In addition, Provision expense for these two products declined $1.2

million for the same periods primarily related to formula reserves

tied to spot balance growth for the quarters.

Republic Bancorp, Inc. (the “Company”) is the parent company of

Republic Bank & Trust Company (the “Bank”). The Bank currently

has 47 banking centers in communities within five metropolitan

statistical areas (“MSAs”) across five states: 22 banking centers

located within the Louisville MSA in Louisville, Prospect,

Shelbyville, and Shepherdsville in Kentucky, and Floyds Knobs,

Jeffersonville, and New Albany in Indiana; six banking centers

within the Lexington MSA in Georgetown and Lexington in Kentucky;

eight banking centers within the Cincinnati MSA in Cincinnati and

West Chester in Ohio, and Bellevue, Covington, Crestview Hills, and

Florence in Kentucky; seven banking centers within the Tampa MSA in

Largo, New Port Richey, St. Petersburg, Seminole, and Tampa in

Florida; and four banking centers within the Nashville MSA in

Franklin, Murfreesboro, Nashville and Spring Hill, Tennessee. In

addition, Republic Bank Finance has one loan production office in

St. Louis, Missouri. The Bank offers internet banking at

www.republicbank.com. The Company is headquartered in Louisville,

Kentucky, and as of December 31, 2024, had approximately $6.8

billion in total assets. The Company’s Class A Common Stock is

listed under the symbol “RBCAA” on the NASDAQ Global Select

Market.

Republic Bank. It’s just easier here. ®

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The forward-looking statements in the preceding paragraphs

are based on our current expectations and assumptions regarding our

business, the future impact to our balance sheet and income

statement resulting from changes in interest rates, the yield

curve, the ability to develop products and strategies in order to

meet the Company’s long-term strategic goals, future loan fees to

be earned, and future loan losses, related to ERAs and RAs

originated through the Company’s largest marketer-servicer within

TRS; the ability of the Company to enforce the loss cap guarantee

related to ERAs from its largest marketer-servicer within TRS; the

economy, and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Our actual results may differ materially from

those contemplated by forward-looking statements. We caution you

therefore against relying on any of these forward-looking

statements. They are neither statements of historical fact nor

guarantees or assurances of future performance. Actual results

could differ materially based upon factors disclosed from time to

time in the Company’s filings with the U.S. Securities and Exchange

Commission, including those factors set forth as “Risk Factors” in

the Company’s Annual Report on Form 10-K for the period ended

December 31, 2023. The Company undertakes no obligation to update

any forward-looking statements, except as required by applicable

law.

Footnotes:

(1)

“Core Bank” or “Core Banking” operations

consist of the Traditional Banking and Warehouse Lending

segments.

(2)

Provision – Provision for Expected Credit Loss Expense

Allowance – Allowance for Credit Losses on

Loans

(3)

Republic Processing Group operations

consist of the TRS, RPS, and RCS segments.

NM – Not meaningful

NA – Not applicable

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124606677/en/

Republic Bancorp, Inc. Kevin Sipes Executive Vice President

& Chief Financial Officer (502) 560-8628

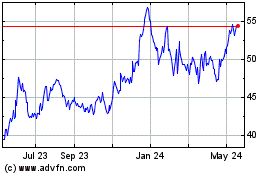

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Feb 2025 to Mar 2025

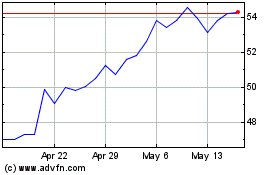

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Mar 2024 to Mar 2025