Reborn Coffee Inc. (Nasdaq: REBN), (“Reborn”, or the “Company”), a

leading specialty coffee retailer in the US, has reported its

financial and operational results for the second quarter ended June

30, 2024.

Key Financial and Operational Highlights

-

Six months ending June 30, 2024 revenue increased 11.54% to $2.9

million.

-

Q2'24 company-operated store gross margins improved to 72.9%

compared to 65.3% for the same period in 2023.

-

Ended Q2'24 with 11 open locations, with 1 location in

development.

-

Q2'24 wholesale and online sales grew 633% to $0.2 million from

$24,320 in Q2’23.

Q2 2024 and Subsequent Events

-

Strategic joint venture with China's AI company Penglai Data Store

to Lead and develop master franchises in China, Hong Kong and

Macao.

-

Signed Memorandum of Understanding (“MOU”) to acquire Bbang Ssaem

Bakery, one of Korea's most iconic bakery brands to upgrade

footprint into the coffee and bakery sector, enhance offerings and

solidify position as a premier coffee & bakery franchise in the

US and South Korea.

-

Closed a master licensing deal that will facilitate Reborn Coffee's

dynamic entry into the vibrant United Arab Emirates (“UAE”) market,

with its first flagship location set to open in Dubai.

-

Launched on Amazon, expanding omni-channel strategy for e-commerce

growth, aiming to drive substantial revenue growth and capture a

wider online customer base.

-

Closed a Master License Agreement (“MLA”) with Shenyang Yongsheng

Seven Stars Tourism Development Co. that will establish Reborn

Coffee premier locations in Shenyang, the capital of Liaoning

Province. The Shenyang flagship store will, with its

all-encompassing brand center, lays the foundation for a broader

expansion across China.

-

Closed a Master License Agreement (“MLA”) with IAID Co., Ltd., a

visionary architectural and interior design consulting firm, and

unveiled a major global expansion for premium brand growth in China

and southeast Asia, including in-depth plan for opening first

flagship store in the Historic Art Museum Building in Guangzhou,

China.

-

Signed a Letter of Intent (“LOI”) to acquire a 55% majority stake

in Derin Lezzetler, a leading artisan snack and frozen bakery

producer based in Istanbul, Turkey, a strategic move in Reborn

Coffee's expansion into the health-conscious food market and its

plans to further penetrate the US, Europe, Middle East, and Asia

Pacific regions.

Management Commentary

"Despite challenges in the food and beverage

markets, including rising input costs, heightened consumer price

sensitivity, and increased capital costs, Reborn Coffee has

successfully optimized operating expenses while maintaining a

strong Average Unit Volume (“AUV”) comparable to previous periods,”

said Jay Kim, Chief Executive Officer of Reborn.

“During the second quarter, we were highly

focused on initiatives to diversify and expand our global

operations as we continue to grow revenues. New global partnerships

in Asia, Eastern Europe, and the Middle East have significantly

expanded our global footprint and diversified our operations. In

the US, our growing ecommerce presence fueled an impressive 633%

revenue growth in our wholesale and online segment, underscoring

our commitment to innovation and strategic expansion across all

markets.

"At our US company operated retail locations, we

continued to focus on driving sales and enhancing gross profit has

yielded impressive results. While we made the strategic decision to

close underperforming stores, our introduction of innovative new

products and targeted marketing initiatives have significantly

boosted performance. As a result, we achieved a 760 basis point

improvement in year-over-year store margins in the second quarter,

reaching an impressive 72.9%.

“To expand our brand in Asia, we most recently

announced an MLA with Shenyang Yongsheng Seven Stars Tourism

Development Co. that will establish Reborn Coffee premier locations

in Shenyang, the capital of Liaoning Province. The Shenyang

flagship store will, with its all-encompassing brand center, lays

the foundation for a broader expansion across China, reinforcing

Reborn Coffee's position in one of the world's fastest-growing

coffee markets.

“We also announced a strategic partnership and

joint venture with a prominent China AI Database Company - Penglai

Data Store (Shenzhen), led by CEO Alex Guo, which develops the high

performance AI database software - HetuKV optimizing the AI

learning and training process for businesses. This collaboration

signifies the official launch of Reborn China, an innovative

venture poised to transform the coffee industry in China by

incorporating advanced AI technology into every new franchise in

the region. Reborn China will be responsible for managing the

recently acquired master license agreement in Guangzhou and will

also oversee all future master region licenses across China.

“During the quarter we closed an MLA in

partnership with Reborn UAE, led by CEO Mahmood Arjomand, will

facilitate our dynamic entry into the vibrant UAE market. Under

this agreement, we will collaborate to establish Reborn Coffee

outlets, a distribution center for the Middle East, and roasting

and warehouse facilities. The aim is to establish flagship stores

within one year, with Jumeirah, Dubai, as the first location.

Additionally, the plan includes opening 20 more stores across the

UAE to solidify our presence in the region.

“We also worked to add capabilities in the food

industry with an MOU to acquire Bbang Ssaem Bakery, one of Korea's

most iconic bakery brands. This strategic move will upgrade our

footprint into the coffee and bakery sector, enhancing offerings

and solidifying our position as a premier coffee and bakery

franchise. Additionally, the strong EBITDA generated by Bbang Ssaem

Bakery is expected to positively impact Reborn Coffee's financial

health, contributing to increased profitability and stability.

Additionally, we signed an LOI to acquire a 55% majority stake in

Derin Lezzetler, a leading artisan snack and frozen bakery producer

based in Istanbul, Turkey to expand into the health-conscious food

market. The company has developed a robust distribution network

that includes globally recognized brands such as Starbucks, Caffe

Nero, Gate Plus, Costa Coffee, Migros, Shell, Espressolab, and

Coffy, making its products available worldwide. The investment will

enable us to leverage Derin Lezzetler's established relationships

and expand its footprint in the global market and the US.

“Solidifying our presence in the ecommerce

space, we launched on Amazon, aiming to drive substantial revenue

growth and capture a wider online customer base. By launching on

Amazon, we can access millions of potential customers, utilize

advanced marketing tools to enhance brand presence and drive

traffic, ensure prompt and reliable delivery through Fulfillment by

Amazon (FBA), leverage data analytics to inform marketing

strategies and product development, and enhance our OMNI-channel

strategy by integrating our online and offline presence to provide

a seamless customer experience.

“Looking ahead, we continue to focus on

operational execution at our existing retail locations and online.

We are executing on strategic plans for new company-owned retail

locations in Southern California and new flagships in states such

as Texas, as well as global locations including South Korea,

Austria, Dubai and China with our partners. Taken together, we

continue to believe our existing retail locations, worldwide

expansion strategy, and acquisitions and investments, will empower

us to continue our momentum and build long term shareholder value,”

concluded Kim.

Anticipated Milestones

-

Open 4 flagship Reborn Café locations in the U.S., targeting cities

such as Miami, San Diego, Houston, and Kansas City.

-

Open up to 20 company-owned retail locations.

-

Open up to 20 Franchised locations nationwide.

-

Open 10+ overseas locations outside the U.S., targeting countries

such as South Korea, Malaysia, Dubai, China, Singapore, Thailand,

and the UK.

-

Open First Pet Friendly Indoor Café “Reborn N Pet Social” in city

of Pasadena, California.

-

Joint R&D projects with coffee farms in locations such as

Hawaii, Colombia, Ethiopia, Guatemala, and Brazil.

-

Expand B2B marketing to wholesale clubs and other major outlets and

expand ecommerce marketing with online initiatives by launching its

own Amazon marketplace.

-

Launch of Reborn Mobile App services.

-

Launch new Reborn-branded products such red tea bag packs and cold

brew cans.

Second Quarter 2024 Financial

Results

Revenues were $1.4 million for the three months

ended June 30, 2024, compared to $1.5 million for the comparable

period in 2023, representing a decrease of 9.6%. The decrease in

sales for the period was primarily due to the closure of

underperforming stores.

Company-operated store gross profit was $0.9

million for the three-month period ended June 30, 2024, compared to

$1.0 million for the comparable period in 2023. Q2'24

company-operated store gross margins improved to 72.9% compared to

65.3% for the same period in 2023.

Wholesale and online revenue for the second

quarter of 2024 was $0.2 million, an increase of 633% from $24,320

in the second quarter of 2023.

Total operating costs and expenses for the

three-month period ended June 30, 2024, were $2.7 million compared

to $2.7 million for the comparable period in 2023, a marginal

decline.

Net loss for the second quarter of 2024 was $1.3

million, compared to a net loss of $1.3 million for the second

quarter of 2023.

Net cash used in operating activities for the

six months ended June 30, 2024, was $2.9 million, compared to $2.3

million for the six months ended June 30, 2023.

Cash and cash equivalents totaled $0.6 million

as of June 30, 2024, compared to $0.2 million as of December 31,

2023.

About Reborn Coffee

Reborn Coffee, Inc. (NASDAQ: REBN) is focused on

serving high quality, specialty-roasted coffee at retail locations,

kiosks, and cafes. Reborn is an innovative company that strives for

constant improvement in the coffee experience through exploration

of new technology and premier service, guided by traditional

brewing techniques. Reborn believes they differentiate themselves

from other coffee roasters through innovative techniques, including

sourcing, washing, roasting, and brewing their coffee beans with a

balance of precision and craft. For more information, please visit

www.reborncoffee.com.

Forward-Looking Statements

All statements in this release that are not

based on historical fact are “forward-looking statements.” While

management has based any forward-looking statements included in

this release on its current expectations, the information on which

such expectations were based may change. Forward-looking statements

involve inherent risks and uncertainties which could cause actual

results to differ materially from those in the forward-looking

statements, as a result of various factors including those risks

and uncertainties described in the Risk Factors and Management’s

Discussion and Analysis of Financial Condition and Results of

Operations sections of our recent filings with the Securities and

Exchange Commission (“SEC”) including our Form 10-Q for the second

quarter of 2024, which can be found on the SEC’s website at

www.sec.gov. Such risks, uncertainties, and other factors include,

but are not limited to, the Company’s ability to continue as a

going concern as indicated in an explanatory paragraph in the

Company’s independent registered public accounting firm’s audit

report as a result of recurring net losses, among other things, the

Company’s ability to successfully open the additional locations

described herein as planned or at all, the Company’s ability to

expand its business both within and outside of California

(including as it relates to increasing sales and growing Average

Unit Volumes at our existing stores), the degree of customer

loyalty to our stores and products, the impact of COVID-19 on

consumer traffic and costs, the fluctuation of economic conditions,

competition and inflation. We urge you to consider those risks and

uncertainties in evaluating our forward-looking statements. We

caution readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date made.

The Company undertakes no obligation to update these statements for

revisions or changes after the date of this release, except as

required by law.

Contacts

Investor Relations Contact:Chris TysonExecutive

Vice PresidentMZ North AmericaREBN@mzgroup.us

949-491-8235

Company Contact:Reborn Coffee,

Inc.ir@reborncoffee.com

|

Reborn Coffee, Inc. and

SubsidiariesUnaudited Condensed Consolidated

Balance Sheets |

| |

|

As of |

|

(Unaudited)June 30,

2024 |

|

|

December 31,2023 |

|

| |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

617,051 |

|

|

$ |

164,301 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $0

and $0, respectively |

|

|

67,225 |

|

|

|

56,938 |

|

|

Inventories, net |

|

|

267,934 |

|

|

|

185,061 |

|

|

Prepaid expense and other current assets |

|

|

704,960 |

|

|

|

359,124 |

|

|

Total current assets |

|

|

1,657,170 |

|

|

|

765,424 |

|

|

Property and equipment, net |

|

|

3,962,399 |

|

|

|

3,494,050 |

|

|

Operating lease right-of-use asset |

|

|

4,260,499 |

|

|

|

4,566,968 |

|

|

Other assets |

|

|

648,938 |

|

|

|

425,712 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

10,529,006 |

|

|

$ |

9,252,154 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

463,998 |

|

|

$ |

632,753 |

|

|

Accrued expenses and current liabilities |

|

|

665,197 |

|

|

|

611,290 |

|

|

Loans payable to financial institutions, current portion |

|

|

720,677 |

|

|

|

791,352 |

|

|

Loan payable to other |

|

|

792,775 |

|

|

|

609,027 |

|

|

Loan payable, emergency injury disaster loan (EIDL), current

portion |

|

|

30,060 |

|

|

|

30,060 |

|

|

Loan payable, payroll protection program (PPP), current

portion |

|

|

22,126 |

|

|

|

45,678 |

|

|

Operating lease liabilities, current portion |

|

|

1,016,649 |

|

|

|

1,003,753 |

|

|

Total current liabilities |

|

|

3,711,482 |

|

|

|

3,823,913 |

|

|

Loans payable to financial institutions, net of current

portion |

|

|

335,147 |

|

|

|

335,147 |

|

|

Loan payable, emergency injury disaster loan (EIDL), net of current

portion |

|

|

469,940 |

|

|

|

469,940 |

|

|

Loan payable, payroll protection program (PPP), net of current

portion |

|

|

51,595 |

|

|

|

51,595 |

|

|

Operating lease liabilities, net of current portion |

|

|

3,418,154 |

|

|

|

3,725,153 |

|

|

Total liabilities |

|

|

7,986,318 |

|

|

|

8,405,748 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Common Stock, $0.0001 par value, 40,000,000 shares authorized;

3,235,657 and 1,866,174 shares issued and outstanding at June 30,

2024 and December 31, 2023 |

|

|

324 |

|

|

|

187 |

|

|

Preferred Stock, $0.0001 par value, 1,000,000 shares authorized; no

shares issued and outstanding at June 30, 2024 and December 31,

2023 |

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

21,603,006 |

|

|

|

17,603,143 |

|

|

Accumulated deficit |

|

|

(19,064,080 |

) |

|

|

(16,756,924 |

) |

|

Accumulated other comprehensive income (loss) |

|

|

3,438 |

|

|

|

- |

|

|

Total stockholders’ equity |

|

|

2,542,688 |

|

|

|

846,406 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

10,529,006 |

|

|

$ |

9,252,154 |

|

|

Reborn Coffee, Inc. and

SubsidiariesUnaudited Condensed Consolidated

Statements of Operations |

|

|

|

|

|

(Unaudited)Six Months

EndedJune 30, |

|

|

(Unaudited)Three Months

EndedJune 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stores |

|

$ |

2,666,206 |

|

|

$ |

2,603,654 |

|

|

$ |

1,194,552 |

|

|

$ |

1,494,603 |

|

|

Wholesale and online |

|

|

224,757 |

|

|

|

37,590 |

|

|

|

178,349 |

|

|

|

24,320 |

|

|

Total net revenues |

|

|

2,890,963 |

|

|

|

2,641,244 |

|

|

|

1,372,901 |

|

|

|

1,518,923 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product, food and drink costs—stores |

|

|

630,415 |

|

|

|

882,302 |

|

|

|

324,122 |

|

|

|

518,483 |

|

|

Cost of sales—wholesale and online |

|

|

154,021 |

|

|

|

16,464 |

|

|

|

78,944 |

|

|

|

10,652 |

|

|

General and administrative |

|

|

4,307,700 |

|

|

|

3,893,849 |

|

|

|

2,307,436 |

|

|

|

2,189,198 |

|

|

Total operating costs and expenses |

|

|

5,092,136 |

|

|

|

4,792,615 |

|

|

|

2,710,502 |

|

|

|

2,718,333 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(2,201,173 |

) |

|

|

(2,151,371 |

) |

|

|

(1,337,601 |

) |

|

|

(1,199,410 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

36,329 |

|

|

|

- |

|

|

|

28,520 |

|

|

|

- |

|

|

Interest expense |

|

|

(142,312 |

) |

|

|

(106,435 |

) |

|

|

(7,531 |

) |

|

|

(94,232 |

) |

|

Total other income (expense), net |

|

|

(105,983 |

) |

|

|

(106,435 |

) |

|

|

20,989 |

|

|

|

(94,232 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(2,307,156 |

) |

|

|

(2,257,806 |

) |

|

|

(1,316,612 |

) |

|

|

(1,293,642 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,307,156 |

) |

|

$ |

(2,257,806 |

) |

|

$ |

(1,316,612 |

) |

|

$ |

(1,293,642 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(1.05 |

) |

|

|

(1.37 |

) |

|

|

(0.48 |

) |

|

|

(0.78 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

2,200,037 |

|

|

|

1,652,034 |

|

|

|

2,746,605 |

|

|

|

1,654,698 |

|

|

Reborn Coffee, Inc. and

SubsidiariesUnaudited Consolidated Statements of

Cash Flows |

| |

|

For the Six Months Ended June 30, |

|

(unaudited)2024 |

|

|

(unaudited)2023 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,307,156 |

) |

|

$ |

(2,257,806 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Stock compensation |

|

|

- |

|

|

|

250,000 |

|

|

Operating lease |

|

|

12,367 |

|

|

|

27,222 |

|

|

Depreciation |

|

|

172,710 |

|

|

|

135,398 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(10,287 |

) |

|

|

(1,505 |

) |

|

Inventories |

|

|

(82,873 |

) |

|

|

7,501 |

|

|

Prepaid expense and other current assets |

|

|

(569,062 |

) |

|

|

(806,473 |

) |

|

Accounts payable |

|

|

(165,317 |

) |

|

|

206,102 |

|

|

Accrued expenses and current liabilities |

|

|

53,907 |

|

|

|

156,460 |

|

|

Net cash used in operating activities |

|

|

(2,895,711 |

) |

|

|

(2,283,101 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(641,060 |

) |

|

|

(4,417,782 |

) |

|

Net cash used in investing activities |

|

|

(641,060 |

) |

|

|

(4,417,782 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from line of credit |

|

|

4,000,000 |

|

|

|

974,027 |

|

|

Proceeds from loan payable to shareholders |

|

|

- |

|

|

|

- |

|

|

Proceeds from loan payable to financial institutions |

|

|

183,748 |

|

|

|

218,864 |

|

|

Repayments of borrowings from shareholder |

|

|

(100,000 |

) |

|

|

- |

|

|

Proceeds from loan payable, mortgage |

|

|

- |

|

|

|

2,850,000 |

|

|

Repayment of loan payable to financial institutions |

|

|

(70,675 |

) |

|

|

(23,551 |

) |

|

Repayment of loan payable, PPP |

|

|

(23,552 |

) |

|

|

- |

|

|

Net cash provided by financing activities |

|

|

3,989,521 |

|

|

|

4,019,340 |

|

|

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash |

|

|

452,750 |

|

|

|

(2,681,543 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash at beginning of period |

|

|

164,301 |

|

|

|

3,019,035 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash at end of period |

|

$ |

617,051 |

|

|

$ |

337,492 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of non-cash financing

activities: |

|

|

|

|

|

|

|

|

|

Issuance of common shares for compensation |

|

$ |

- |

|

|

$ |

250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

|

|

|

|

|

Cash paid during the years for: |

|

|

|

|

|

|

|

|

|

Lease liabilities |

|

$ |

704,608 |

|

|

$ |

546,389 |

|

|

Interest |

|

$ |

142,312 |

|

|

$ |

106,435 |

|

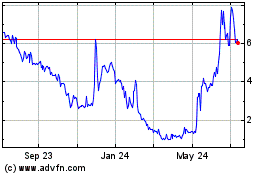

Reborn Coffee (NASDAQ:REBN)

Historical Stock Chart

From Dec 2024 to Jan 2025

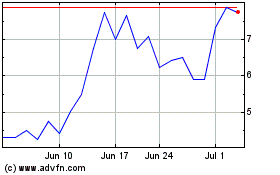

Reborn Coffee (NASDAQ:REBN)

Historical Stock Chart

From Jan 2024 to Jan 2025