Current Report Filing (8-k)

26 April 2023 - 6:28AM

Edgar (US Regulatory)

0001847607

false

0001847607

2023-04-19

2023-04-19

0001847607

RFACU:UnitsEachConsistingOfOneShareOfClassACommonStockOneRedeemableWarrantAndOneRightToReceiveOneTenthOfOneShareOfClassACommonStockMember

2023-04-19

2023-04-19

0001847607

us-gaap:CommonClassAMember

2023-04-19

2023-04-19

0001847607

us-gaap:WarrantMember

2023-04-19

2023-04-19

0001847607

RFACU:RightsEachRightReceivesOneTenthOfOneShareOfClassACommonStockMember

2023-04-19

2023-04-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT

OF 1934

Date of Report (Date of earliest event reported): April 19, 2023

RF Acquisition Corp.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41332 |

|

61-1991323 |

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

Tse Meng Ng

111 Somerset, #05-06

Singapore 238164

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: +65 6904 0766

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Units, each consisting of one share of Class A common stock, one redeemable warrant, and one right to receive one-tenth of one share of Class A

|

|

RFACU |

|

The Nasdaq Stock Market LLC |

| Share of Class A common stock, par value $0.0001 per share |

|

RFAC |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

RFACW |

|

The Nasdaq Stock Market LLC |

| Rights, each right receives one-tenth of one share of Class A common stock |

|

RFACR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

RF Acquisition Corp. (the “Company”)

received a delinquency notification letter (“Notice”) from the Listing Qualifications staff of the Nasdaq Stock Market

LLC (“Nasdaq”) on April 19, 2023 due to the Company’s non-compliance with Nasdaq Listing Rule 5250(c)(1) (the

“Rule”) as a result of the Company’s failure to timely file its Annual Report on Form 10-K for the fiscal year

ended December 31, 2022 (the “Form 10-K”). The Rule requires listed companies to timely file all required periodic

financial reports with the Securities and Exchange Commission (the “SEC”).

The Notice states that the Company has 60 calendar

days to submit to Nasdaq a plan to regain compliance with the Nasdaq Listing Rules. If Nasdaq accepts the Company’s plan, then Nasdaq

may grant the Company up to 180 calendar days from the prescribed due date for filing the Form 10-K or until October 16, 2023, to regain

compliance. If Nasdaq does not accept the Company’s plan, then the Company will have the opportunity to appeal that decision to

a Nasdaq Hearings Panel.

The Company requires additional time to prepare,

review and finalize its financial statements, and its auditors have not completed their audit of the financial statements. The Company

is continuing in its efforts to file the Form 10-K as soon as reasonably practicable.

The Notice has no immediate impact on the listing

of the Company’s Class A common stock, which will continue to trade on Nasdaq under the symbol “RFAC.”

As required under Nasdaq Listing Rule 5250(b)(2),

the Company issued a press release on April 25, 2023, announcing that it had received the Notice. A copy of this press release is attached

as Exhibit 99.1 to this Form 8-K.

Forward-Looking Statements

This Form 8-K contains forward-looking

statements, including statements about the financial condition, results of operations, earnings outlook and prospects of the Company.

In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,”

“believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,”

“forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict,” “should,” “would” and other similar words and expressions, but

the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements

are based on the current expectations of the Company’s management and are inherently subject to uncertainties and changes in circumstances

and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be

those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that

may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made with the SEC by the

Company.

| Item 9.01 |

Financial Statements and Exhibits. |

The following exhibit is filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| RF Acquisition Corp. |

|

| |

|

| By: |

/s/ Tse Meng Ng |

|

| Name: |

Tse Meng Ng |

|

| Title: |

Chief Executive Officer |

|

Dated: April 25, 2023

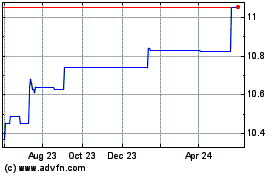

RF Acquisition (NASDAQ:RFACU)

Historical Stock Chart

From Dec 2024 to Jan 2025

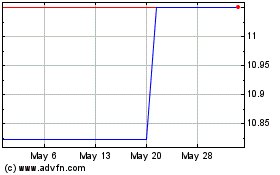

RF Acquisition (NASDAQ:RFACU)

Historical Stock Chart

From Jan 2024 to Jan 2025